UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): September 3, 2014

PLUG POWER

INC.

(Exact name of registrant as specified in charter)

|

|

|

|

|

| Delaware |

|

1-34392 |

|

22-3672377 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

968 Albany Shaker Road, Latham, New York 12110

(Address of Principal Executive Offices) (Zip Code)

(518) 782-7700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers

(c) Appointment of Christopher T. Hutter as Chief Financial Officer of Plug Power Inc.

On September 4, 2014, Plug Power Inc. (the “Company”) announced that Christopher T. Hutter has been appointed as the Chief Financial Officer of

the Company, effective November 6, 2014.

The Company and Mr. Hutter entered into an Executive Employment Agreement, dated September 3,

2014 (the “Employment Agreement”), with a one year term which commences on November 6, 2014 and which renews automatically. Pursuant to the terms of the Employment Agreement, Mr. Hutter receives an annual base salary of $400,000,

is eligible to receive incentive compensation as determined by the Compensation Committee (the “Compensation Committee”) of the Board of Directors (the “Board”) of the Company and is entitled to participate in and receive

benefits under all of the Company’s employee benefit plans. The Employment Agreement also provides that if, within twelve months after a “Change in Control,” as defined in the Employment Agreement, the Company terminates

Mr. Hutter’s employment without “Cause,” as defined in the Employment Agreement, then he shall be entitled to (a) receive a payment equal to the sum of (1) his average annual base salary over the three fiscal years

prior to his termination (or his annual base salary for the fiscal year immediately preceding to the Change in Control, if higher) plus (2) his average annual incentive bonus over the three fiscal years prior to the Change in Control (or his

annual incentive bonus for the fiscal year immediately preceding to the Change in Control, if higher), (b) continued vesting of his stock options and other stock-based awards for twelve months following the termination date as if he had

remained an active employee and (c) receive benefits, including health and life insurance for twelve months following his termination. The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its

entirety by reference to the Employment Agreement, a copy of which is attached as Exhibit 99.2 hereto and is hereby incorporated into this report by reference.

On September 3, 2014, as inducement to accept the Company’s offer of employment, the Company approved an option grant to Mr. Hutter, effective

as of November 6, 2014. The option grant is for the purchase of an aggregate of 250,000 shares of Common Stock of the Company at a per share price equal to the closing price of the Company’s common stock on the NASDAQ Capital Market on

November 6, 2014, has a term of 10 years and is subject to a 3 year vesting schedule, with one third of the shares vesting on each of the first, second and third anniversary of November 6, 2014. The Compensation Committee and the Board

approved the option grant on September 3, 2014, and September 3, 2014, respectively. In connection with the option grant, it is anticipated that the Company and Mr. Hutter will enter into a Non-Qualified Stock Option Agreement on or

about November 6, 2014.

Mr. Hutter, age 47, served as Chief Financial Officer and Executive Vice President of PowerSecure International, Inc.,

an energy products and services company, from 2007 to 2014. Previously, Mr. Hutter served as National Vice President of Finance, Treasurer, Investors Relations and Assistant Secretary of ADVO, Inc., an advertising and marketing firm, from 1993

to 2007.

A copy of the Company’s press release announcing Mr. Hutter’s appointment as the Chief Financial

Officer of the Company is filed herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit

Number |

|

Title |

|

|

| 99.1 |

|

Press Release of Plug Power Inc. dated September 4, 2014 |

|

|

| 99.2 |

|

Executive Employment Agreement, by and between the Company and Christopher T. Hutter, dated September 3, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

PLUG POWER INC. |

|

|

|

|

| Date: September 4, 2014 |

|

|

|

By: |

|

/s/ Andrew Marsh |

|

|

|

|

|

|

Andrew Marsh |

|

|

|

|

|

|

Chief Executive Officer |

Exhibit 99.1

|

|

|

|

|

News Release |

PLUG POWER NAMES CHRIS HUTTER CHIEF FINANCIAL OFFICER

Energy industry veteran brings extensive strategic, financial and operational experience to facilitate growth and scale business

LATHAM, N.Y. – September 4, 2014 – Plug Power Inc. (NASDAQ: PLUG), announced today that Chris Hutter has been appointed Chief Financial Officer

(CFO), effective November 6, 2014. Mr. Hutter will take over responsibilities for Mr. Dave Waldek who has served at Plug Power as interim CFO since April of 2013.

Mr. Hutter has extensive experience growing businesses profitably, and comes to Plug Power with the skills needed to guide and propel Plug Power’s

sales and financial momentum. He brings 20 years of experience managing financial growth strategies of publicly traded companies to Plug Power. Most recently, he was Executive Vice President and CFO of PowerSecure International, Inc. (NYSE: POWR), a

$270 million energy products and services company. Under his financial leadership, PowerSecure tripled in size through sales growth and acquisitions. Mr. Hutter’s experience as an executive in the energy sector will quickly add value to

Plug Power with industry-specific analysis and investor knowledge.

Prior to PowerSecure International, Mr. Hutter served as National Vice President

of Finance, Treasurer, Investor Relations and Assistant Secretary at ADVO, Inc., a $1.5 billion advertising and marketing firm. Mr. Hutter held various financial positions over his 14 years with ADVO, a company which grew an attractive,

one-of-a-kind business platform that was acquired for a healthy premium by Valassis Communications in 2007.

Mr. Hutter’s demonstrated skills,

coupled with the already successful management team at Plug Power, positions the Company to accelerate the growth of the business beyond 2014. Over his tenure, Mr. Hutter has developed a proven strategy revolving around disciplined planning,

forecasting and business review process, resulting in strong balance sheets, excellent bank relations and enhanced shareholder relationships. Mr. Hutter is a critical addition and will be a significant influence on Plug Power’s ability to

profitably scale the business today and continue substantial growth in the coming years.

“Chris has displayed the proven qualifications to

positively expedite Plug Power’s growth,” said Andy Marsh, CEO of Plug Power. “The addition of Chris to Plug Power’s developing management team adds an additional level of strength as we invest in prepping the business to handle

larger levels of success. On behalf of the whole Plug Power team, I’d like to welcome Chris to Plug Power.”

“The energy industry is very

dynamic and I’m excited by the unique growth opportunities that lie ahead for Plug Power. Plug Power has clearly established itself as the leader in the hydrogen fuel cell space, proving itself as the frontrunner in the material handling power

market,” Mr. Hutter said. “I look forward to being a significant contributor to helping Plug Power become a global powerhouse in the fuel cell industry.”

Mr. Hutter graduated magna cum laude graduate from Case Western Reserve University. Additionally, he holds an MBA from Duke University’s Fuqua

School of Business.

About Plug Power Inc.

The

architects of modern fuel cell technology, Plug Power is revolutionizing the industry with cost-effective power solutions that increase productivity, lower operating costs and reduce carbon footprints. Long-standing relationships with industry

leaders, including Walmart, Sysco, Procter & Gamble, and Mercedes-Benz, forged the path for Plug Power’s innovative GenKey hydrogen and fuel cell system solutions. With more than 5,000 GenDrive units deployed to material handling

customers, accumulating over 20 million hours of runtime, Plug Power manufactures tomorrow’s incumbent power solutions today. Additional information about Plug Power is available at www.plugpower.com.

###

Safe Harbor Statement

This communication contains

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks and uncertainties about Plug Power Inc. (“PLUG”), including but not limited to statements

about PLUG’s forecast of financial performance, order bookings, business model, strategy and growth opportunities. You are cautioned that such statements should not be read as a guarantee of future performance or results, and will not

necessarily be accurate indications of the times at, or by which, such performance or results will have been achieved. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from

those expressed in these statements. In particular, the risks and uncertainties include, among other things, the risk that we continue to incur losses and might never achieve or maintain profitability; the risk that we will need to raise additional

capital to fund our operations and such capital may not be available to us; the risk that our lack of extensive experience in manufacturing and marketing products may impact our ability to manufacture and market products on a profitable and

large-scale commercial basis; the risk that unit orders will not ship, be installed and/or converted to revenue, in whole or in part; the risk that pending orders may not convert to purchase orders, in whole or in part; the risk that a loss of one

or more of our major customers could result in a material adverse effect on our financial condition; the risk that a sale of a significant number of shares of stock could depress the market price of our common stock; the risk that negative publicity

related to our business or stock could result in a negative impact on our stock value and profitability; the risk of potential losses related to any product liability claims or contract disputes; the risk of loss related to an inability to maintain

an effective system of internal controls or key personnel; the risks related to use of flammable fuels in our products; the cost and timing of developing, marketing and selling our products and our ability to raise the necessary capital to fund such

costs; the ability to achieve the forecasted gross margin on the sale of our products; the risk that our actual net cash used for operating expenses may exceed the projected net cash for operating expenses; the cost and availability of fuel and

fueling infrastructures for our products; market acceptance of our products, including GenDrive systems; the volatility of our stock price; our ability to establish and maintain relationships with third parties with respect to product development,

manufacturing, distribution and servicing and the supply of key product components; the cost and availability of components and parts for our products; our ability to develop commercially viable products; our ability to reduce product and

manufacturing costs; our ability to successfully expand our product lines; our ability to successfully expand internationally; our ability to improve system reliability for our GenDrive systems; competitive factors, such as price competition and

competition from other traditional and alternative energy companies; our ability to protect our intellectual property; the cost of complying with current and future federal, state and international governmental regulations; risks associated with

potential future acquisitions; and other risks and uncertainties referenced in our public filings with the Securities and Exchange Commission. For additional disclosure regarding these and other risks faced by PLUG, see disclosures contained in

PLUG’s public filings with the Securities and Exchange Commission (the “SEC”) including, the “Risk Factors” section of PLUG’s Annual Report on Form 10-K for the year ended December 31, 2013. You should consider

these factors in evaluating the forward-looking statements included in this presentation and not place undue reliance on such statements. The forward-looking statements are made as of the date hereof, and PLUG undertakes no obligation to update such

statements as a result of new information.

Media and Investor Relations Contact:

Teal Vivacqua

Plug Power Inc.

Phone: 518.738.0269

Exhibit 99.2

EXECUTIVE EMPLOYMENT AGREEMENT

This Employment Agreement (“Agreement”) is made as of the 3rd day of September, 2014, between Plug Power Inc., a Delaware

corporation (the “Company”), and Christopher T. Hutter (the “Executive”).

WHEREAS, the Executive and the Company have

determined to enter into an agreement related to the employment of Executive by the Company which shall have a commencement date of November 6, 2014 (the “Commencement Date”);

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the

receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

1. Employment. The term of this Agreement

shall extend from the Commencement Date until the first anniversary of the Commencement Date; provided, however, that the term of this Agreement shall automatically be extended for one additional year on the anniversary of the Commencement Date and

on each anniversary thereafter unless, not less than ninety (90) days prior to each such date, either party shall have given notice to the other that it does not wish to extend this Agreement; provided, further, that if a Change in Control

occurs during the original or extended term of this Agreement, the term of this Agreement shall continue in effect for a period of not less than twelve (12) months beyond the month in which the Change in Control occurred. The term of this

Agreement shall also terminate upon any Date of Termination (as defined in Section 4) and may be referred to herein as the “Term.”

2. Position and Duties. During the Term, the Executive shall serve as the Chief Financial Officer and Senior Vice President of the

Company, and shall have responsibilities and duties consistent with his position and such other responsibilities and duties as may from time to time be prescribed by the Chairman of the Board of Directors of the Company (the “Board”), the

Chief Executive Officer of the Company (the “CEO”) or other authorized executives, provided that such responsibilities and duties are consistent with the Executive’s position or other positions that he may hold from time to time. The

Executive shall devote his full working time and efforts to the business and affairs of the Company. Notwithstanding the foregoing, the Executive may serve on other boards of directors with the approval of the Board, or engage in religious,

charitable or other community activities as long as such services and activities are disclosed to the Board and do not materially interfere with the Executive’s performance of his duties to the Company as provided in this Agreement.

3. Compensation and Related Matters.

(a) Base Salary. The Executive’s initial annual base salary shall be $400,000.00. The Executive’s base salary shall be

redetermined annually by the Compensation Committee of the Board. The base salary in effect at any given time is referred to herein as “Base Salary.” The Base Salary shall be payable in substantially equal weekly installments.

(b) Incentive Compensation. The Executive shall be eligible to receive cash incentive

compensation as determined by Compensation Committee of the Board from time to time.

(c) Expenses. The Executive shall be entitled

to receive prompt reimbursement for all reasonable expenses incurred by him in performing services hereunder during the Term, in accordance with the policies and procedures then in effect and established by the Company for its senior executive

officers.

(d) Other Benefits. During the Term, the Executive shall be entitled to continue to participate in or receive benefits

under all of the Company’s Employee Benefit Plans in effect on the date hereof, or under plans or arrangements that provide the Executive with benefits at least substantially equivalent to those provided under such Employee Benefit Plans. As

used herein, the term “Employee Benefit Plans” includes, without limitation, each retirement plan; stock option plan; life insurance plan; medical insurance plan; disability plan; and health and accident plan or arrangement established and

maintained by the Company on the date hereof for employees of the same status within the hierarchy of the Company. During the Term, the Executive shall be entitled to participate in or receive benefits under any employee benefit plan or arrangement

which may, in the future, be made available by the Company to its executives and key management employees, subject to and on a basis consistent with the terms, conditions and overall administration of such plan or arrangement. Any payments or

benefits payable to the Executive under a plan or arrangement referred to in this Section 3(d) in respect of any calendar year during which the Executive is employed by the Company for less than the whole of such year shall, unless otherwise

provided in the applicable plan or arrangement, be prorated in accordance with the number of days in such calendar year during which he is so employed. Should any such payments or benefits accrue on a fiscal (rather than calendar) year, then the

proration in the preceding sentence shall be on the basis of a fiscal year rather than calendar year.

(e) Vacations. The Executive

shall be entitled to 160 hours of paid vacation in each calendar year, which shall be accrued monthly during the calendar year. The Executive shall also be entitled to all paid holidays given by the Company to its executives.

4. Termination. The Executive’s employment hereunder may be terminated without any breach of this Agreement under the following

circumstances:

(a) Death. The Executive’s employment hereunder shall automatically terminate upon his death.

(b) Disability. The Company may terminate the Executive’s employment if he is disabled and unable to perform the essential

functions of the Executive’s then existing position or positions under this Agreement with or without reasonable accommodation for a period of 180 days (which need not be consecutive) in any 12-month period. If any question shall arise as to

whether during any period the Executive is disabled so as to be unable to perform the essential functions of the Executive’s then existing position or positions with or without reasonable accommodation, the Executive may, and at the request of

the Company shall, submit to the Company a certification in reasonable detail by a physician selected by the Company to whom the Executive or the Executive’s guardian has no reasonable objection as to

2

whether the Executive is so disabled or how long such disability is expected to continue, and such certification shall for the purposes of this Agreement be conclusive of the issue. The Executive

shall cooperate with any reasonable request of the physician in connection with such certification. If such question shall arise and the Executive shall fail to submit such certification, the Company’s determination of such issue shall be

binding on the Executive. Nothing in this Section 4(b) shall be construed to waive the Executive’s rights, if any, under existing law including, without limitation, the Family and Medical Leave Act of 1993, 29 U.S.C. §2601 et

seq. and the Americans with Disabilities Act, 42 U.S.C. §12101 et seq.

(c) Termination by Company for Cause. At

any time during the Term, the Company may terminate the Executive’s employment hereunder for Cause. For purposes of this Agreement, “Cause” shall mean: (i) conduct by the Executive constituting a material act of misconduct in

connection with the performance of the Executive’s duties, including, without limitation, misappropriation of funds or property of the Company or any of its subsidiaries or affiliates other than the occasional, customary and de minimis use of

Company property for personal purposes; (ii) the commission by the Executive of (A) any felony; or (B) a misdemeanor involving moral turpitude, deceit, dishonesty or fraud; (iii) any conduct by the Executive that would reasonably

be expected to result in material injury or reputational harm to the Company or any of its subsidiaries and affiliates if the Executive were retained in the Executive’s position; (iv) continued non-performance by the Executive of the

Executive’s responsibilities hereunder (other than by reason of the Executive’s physical or mental illness, incapacity or disability) which has continued for more than thirty (30) days following written notice of such non-performance

from the Board; (v) a breach by the Executive of the Employee Patent, Confidential Information and Non-Compete Agreement dated September , 2014 between the Executive and the Company (the “Confidentiality

Agreement”); (vi) a material violation by the Executive of any of the Company’s written employment policies; or (vii) failure to cooperate with a bona fide internal investigation or an investigation by regulatory or law

enforcement authorities, after being instructed by the Company to cooperate, or the willful destruction or failure to preserve documents or other materials known to be relevant to such investigation or the inducement of others to fail to cooperate

or to produce documents or other materials in connection with such investigation.

(d) Termination Without Cause. At any time

during the Term, the Company may terminate the Executive’s employment hereunder without Cause. Any termination by the Company of the Executive’s employment under this Agreement which does not constitute a termination for Cause under

Section 4(c) or result from the death or disability of the Executive under Section 4(a) or (b) shall be deemed a termination without Cause.

(e) Termination by the Executive. At any time during the Term, the Executive may terminate his employment hereunder for any reason,

including but not limited to Good Reason. If the Executive provides notice to the Company under Section 1 that he elects to discontinue the extensions, such action shall be deemed a voluntary termination by the Executive and one without Good

Reason. For purposes of this Agreement, “Good Reason” shall mean that the Executive has complied with the “Good Reason Process” (hereinafter defined) following the occurrence of any of the following events after a Change in

Control: (i) a material diminution in the Executive’s responsibilities, authority or duties; (ii) a material diminution in the Executive’s Base Salary; (iii) a material change in the geographic location at which the

Executive provides

3

services to the Company; or (iv) the material breach of this Agreement by the Company. “Good Reason Process” shall mean that (i) the Executive reasonably determines in good

faith that a “Good Reason” condition has occurred; (ii) the Executive notifies the Company in writing of the occurrence of the Good Reason condition within sixty (60) days of the occurrence of such condition; (iii) the

Executive cooperates in good faith with the Company’s efforts, for a period not less than 30 days following such notice (the “Cure Period”), to remedy the condition; (iv) notwithstanding such efforts, the Good Reason condition

continues to exist; and (v) the Executive terminates his employment within sixty (60) days after the end of the Cure Period. If the Company cures the Good Reason condition during the Cure Period, Good Reason shall be deemed not to have

occurred.

(f) Notice of Termination. Except for termination as specified in Section 4(a), any termination of the

Executive’s employment by the Company or any such termination by the Executive shall be communicated by written Notice of Termination to the other party hereto. For purposes of this Agreement, a “Notice of Termination” shall mean a

notice which shall indicate the specific termination provision in this Agreement relied upon.

(g) Date of Termination. “Date

of Termination” shall mean: (i) if the Executive’s employment is terminated by his death, the date of his death; (ii) if the Executive’s employment is terminated by the Company for Cause under Section 4(c), the date on

which Notice of Termination is given; (iii) if the Executive’s employment is terminated by the Company under Section 4(b) or 4(d), thirty (30) days after the date on which a Notice of Termination is given; (iv) if the

Executive’s employment is terminated by the Executive under Section 4(e) without Good Reason, thirty (30) days after the date on which a Notice of Termination is given, and (v) if the Executive’s employment is terminated by

the Executive under Section 4(e) with Good Reason, the date on which a Notice of Termination is given after the end of the Cure Period. Notwithstanding the foregoing, in the event that the Executive gives a Notice of Termination to the Company,

the Company may unilaterally accelerate the Date of Termination and such acceleration shall not result in a termination by the Company for purposes of this Agreement.

5. Compensation Upon Termination.

(a) Termination Generally. If the Executive’s employment with the Company is terminated for any reason during the Term, the

Company shall pay or provide to the Executive (or to his authorized representative or estate) any earned but unpaid base salary, incentive compensation determined by the Board to be earned but not yet paid, unpaid expense reimbursements, accrued but

unused vacation and any vested benefits the Executive may have under the Company’s Employee Benefit Plans through the Date of Termination (the “Accrued Benefit”). The Executive shall not be entitled to receive any other termination

payments or benefits from the Company except as specifically provided in Section 5(b) or Section 6.

(b) Termination by the

Company Without Cause. Except as provided in Section 6, if the Executive’s employment is terminated by the Company without Cause as provided in Section 4(d), then the Company shall, through the Date of Termination, pay the

Executive his Accrued Benefit. Except as provided in Section 6, if (i) the Executive’s employment is terminated by the Company without Cause as provided in Section 4(d), (ii) the

4

Executive signs a general release of claims in a form and manner satisfactory to the Company (the “Release”) within 21 days of the receipt of the Release and does not revoke such

Release during the seven-day revocation period, and (iii) the Executive complies with the Confidentiality Agreement, then

A. The Company shall pay the Executive an amount equal to the sum of 1.0 times the Executive’s Base Salary. Such amount

shall be paid out in a lump sum on the first payroll date after the Date of Termination or expiration of the seven-day revocation period for the Release, whichever is later.

B. As of the Date of Termination, all vested stock options held by the Executive shall be exercisable for twelve

(12) months following the Date of Termination; and any unvested stock options, restricted stock or other stock-based equity award will be immediately forfeited upon the Date of Termination.

C. Subject to the Executive’s copayment of premium amounts at the active employees’ rate, the Company shall pay its

share of the premiums for the Executive’s participation in the Company’s group health plans pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”) for a period of twelve (12) months

following the Date of Termination (the “Health Continuation Period”). The Executive may continue to participate in the Company’s group health plans after the Health Continuation Period at his own cost pursuant to COBRA.

6. Change in Control Payment. The provisions of this Section 6 set forth certain terms regarding the Executive’s rights and

obligations upon the occurrence of a Change in Control of the Company. These provisions are intended to assure and encourage in advance the Executive’s continued attention and dedication to his assigned duties and his objectivity during the

pendency and after the occurrence of any such event. These provisions shall apply in lieu of, and expressly supersede, the provisions of Section 5(b) regarding severance pay and benefits upon a termination of employment, if such termination of

employment occurs within 12 months after the occurrence of the first event constituting a Change in Control, provided that such first event occurs during the Term. These provisions shall terminate and be of no further force or effect beginning 12

months after the occurrence of a Change in Control.

(a) Change in Control. If (i) within twelve (12) months after a

Change in Control, the Executive’s employment is terminated by the Company without Cause as provided in Section 4(d) or the Executive terminates his employment for Good Reason as provided in Section 4(e), (ii) the Executive signs

the Release within twenty-one (21) days of the receipt of the Release and does not revoke the Release during the seven-day revocation period, and (iii) the Executive complies with the Confidentiality Agreement, then

A. The Company shall pay to the Executive an amount equal to the sum of (i) the Executive’s average annual base

salary over the three (3) fiscal years immediately prior to the Termination Date (or the Executive’s annual base salary in effect immediately prior to the Change in Control, if higher) and (ii) the Executive’s average annual

bonus over the three (3) fiscal years immediately

5

prior to the Change in Control (or the Executive’s annual bonus for the last fiscal year immediately prior to the Change in Control, if higher). Such amount shall be paid out in a lump sum

on the first payroll date after the Date of Termination or the expiration of the seven-day revocation period for the Release, whichever is later.

B. Notwithstanding anything to the contrary in any applicable option agreement or stock-based award agreement, on the

Termination Date the Executive shall vest in such portion of his stock options and other stock-based awards as he would have vested in if he had remained employed by the Company for twelve (12) months following the Termination Date.

C. Subject to the Executive’s copayment of premium amounts at the active employees’ rate, the Company shall pay its

share of the premiums for the Executive’s participation in the Company’s group health plans pursuant to COBRA for the Health Continuation Period. The Executive may continue to participate in the Company’s group health plans after the

Health Continuation Period at his own cost pursuant to COBRA.

D. The Company shall pay to the Executive all reasonable

legal and arbitration fees and expenses incurred by the Executive in obtaining or enforcing any right or benefit provided by this Agreement, except in cases involving frivolous or bad faith litigation.

(b) Additional Limitation.

(i) Anything in this Agreement to the contrary notwithstanding, in the event that any compensation, payment or distribution by

the Company to or for the benefit of the Executive, whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise (the “Severance Payments”), would be subject to the excise tax imposed by

Section 4999 of the Code, the following provisions shall apply:

A. If the Severance Payments, reduced by the sum of

(1) the Excise Tax and (2) the total of the Federal, state, and local income and employment taxes payable by the Executive on the amount of the Severance Payments which are in excess of the Threshold Amount, are greater than or equal to

the Threshold Amount, the Executive shall be entitled to the full benefits payable under this Agreement.

B. If the

Threshold Amount is less than (x) the Severance Payments, but greater than (y) the Severance Payments reduced by the sum of (1) the Excise Tax and (2) the total of the federal, state, and local income and employment taxes on the

amount of the Severance Payments which are in excess of the Threshold Amount, then the benefits payable under this Agreement shall be reduced (but not below zero) to the extent necessary so that the maximum Severance Payments shall not exceed the

Threshold Amount.

6

(ii) For the purposes of this Section 6(b), “Threshold Amount”

shall mean three times the Executive’s “base amount” within the meaning of Section 280G(b)(3) of the Code and the regulations promulgated thereunder less one dollar ($1.00); and “Excise Tax” shall mean the excise tax

imposed by Section 4999 of the Code, and any interest or penalties incurred by the Executive with respect to such excise tax.

(iii) The determination as to which of the alternative provisions of Section 6(b)(i) shall apply to the Executive shall be

made by a nationally recognized accounting firm selected by the Company (the “Accounting Firm”), which shall provide detailed supporting calculations both to the Company and the Executive within fifteen (15) business days of the Date

of Termination, if applicable, or at such earlier time as is reasonably requested by the Company or the Executive. For purposes of determining which of the alternative provisions of Section 6(b)(i) shall apply, the Executive shall be deemed to

pay federal income taxes at the highest marginal rate of federal income taxation applicable to individuals for the calendar year in which the determination is to be made, and state and local income taxes at the highest marginal rates of individual

taxation in the state and locality of the Executive’s residence on the Date of Termination, net of the maximum reduction in federal income taxes which could be obtained from deduction of such state and local taxes. Any determination by the

Accounting Firm shall be binding upon the Company and the Executive.

(c) Definitions. For purposes of this Section 6, the

following terms shall have the following meanings:

“Change in Control” shall be deemed to have occurred in any one of the

following events:

(i) any “person,” as such term is used in Sections 13(d) and 14(d) of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), (other than the Company, any of its subsidiaries, any trustee, fiduciary or other person or entity holding securities under any employee benefit plan or trust of the Company or any of its

subsidiaries, together with all Affiliates and Associates (as such terms are hereinafter defined) of such person), shall become the “beneficial owner” (as such term is defined in Rule 13d-3 of the Exchange Act), directly or indirectly, of

securities of the Company representing 25% or more of the then outstanding shares of common stock of the Company (the “Stock”) (other than as a result of an acquisition of securities directly from the Company); or

(ii) persons who, as of the effective date of this Agreement (the “Effective Date”), constitute the Company’s

Board of Directors (the “Incumbent Directors”) cease for any reason, including, without limitation, as a result of a tender offer, proxy contest, merger or similar transaction, to constitute at least a majority of the Board, provided that

any person becoming a director of the Company subsequent to the Effective Date shall be considered an Incumbent Director if such person’s election was approved by or such person was nominated for election by either (A) a vote of at least a

majority of the Incumbent Directors or (B) a vote of at least a majority of the Incumbent

7

Directors who are members of a nominating committee comprised, in the majority, of Incumbent Directors; but provided further, that any such person whose initial assumption of office is in

connection with an actual or threatened election contest relating to the election of members of the Board of Directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board, including by

reason of agreement intended to avoid or settle any such actual or threatened contest or solicitation, shall not be considered an Incumbent Director; or

(iii) Upon (A) the consummation of any consolidation or merger of the Company where the shareholders of the Company,

immediately prior to the consolidation or merger, did not, immediately after the consolidation or merger, beneficially own (as such term is defined in Rule 13d-3 of the Exchange Act), directly or indirectly, shares representing in the aggregate more

than 50% of the voting shares of the corporation issuing cash or securities in the consolidation or merger (or of its ultimate parent corporation, if any), (B) the consummation of any sale, lease, exchange or other transfer (in one transaction

or a series of transactions contemplated or arranged by any party as a single plan) of all or substantially all of the assets of the Company or (C) the completion of a liquidation or dissolution that has been approved by the stockholders of the

Company; or

(iv) For purposes of this Agreement, “Affiliate” and “Associate” shall have the respective

meanings ascribed to such terms in Rule 12b-2 of the Exchange Act, as in effect on the date of this Agreement; provided, however, that no person who is a director or officer of the Company shall be deemed an Affiliate or an Associate

of any other director or officer of the Company solely as a result of his position as director or officer of the Company.

Notwithstanding

the foregoing, a “Change in Control” shall not be deemed to have occurred for purposes of the foregoing clause (i) solely as the result of an acquisition of securities by the Company which, by reducing the number of shares of Stock

outstanding, increases the proportionate number of shares of Stock beneficially owned by any person to 25% or more of the shares of Stock then outstanding; provided, however, that if any such person shall at any time following such acquisition of

securities by the Company become the beneficial owner of any additional shares of Stock (other than pursuant to a stock split, stock dividend, or similar transaction) and such person immediately thereafter is the beneficial owner of 25% or more of

the shares of Stock then outstanding, then a “Change in Control” shall be deemed to have occurred for purposes of the foregoing clause (i), as applicable.

7. Section 409A.

(a) Anything in this Agreement to the contrary notwithstanding, if at the time of the Executive’s “separation from service”

within the meaning of Section 409A of the Code, the Company determines that the Executive is a “specified employee” within the meaning of Section 409A(a)(2)(B)(i) of the Code, and to the extent any payment or benefit that the

Executive becomes entitled to under this Agreement would be considered deferred compensation subject to the 20 percent additional tax imposed pursuant to Section 409A(a) of the Code as a result of the application of

Section 409A(a)(2)(B)(i) of the Code, then no such payment shall be payable and no such benefit shall be provided prior to the date that is the earlier of (A) six months and one day after the Executive’s separation from service, or

(B) the Executive’s death.

8

(b) All in-kind benefits provided and expenses eligible for reimbursement under this Agreement

shall be provided by the Company or incurred by the Executive during the time periods set forth in this Agreement. All reimbursements shall be paid as soon as administratively practicable, but in no event shall any reimbursement be paid after the

last day of the taxable year following the taxable year in which the expense was incurred. The amount of in-kind benefits provided or reimbursable expenses incurred in one taxable year shall not affect the in-kind benefits to be provided or the

expenses eligible for reimbursement in any other taxable year. Such right to reimbursement or in-kind benefits is not subject to liquidation or exchange for another benefit.

(c) To the extent that any payment or benefit described in this Agreement constitutes “non-qualified deferred compensation” under

Section 409A of the Code, and to the extent that such payment or benefit is payable upon the Executive’s termination of employment, then such payments or benefits shall be payable only upon the Executive’s “separation from

service.” The determination of whether and when a separation from service has occurred shall be made in accordance with the presumptions set forth in Treasury Regulation Section 1.409A-1(h).

(d) The parties intend that this Agreement will be administered in accordance with Section 409A of the Code. To the extent that any

provision of this Agreement is ambiguous as to its compliance with Section 409A of the Code, the provision shall be read in such a manner so that all payments hereunder comply with Section 409A of the Code. The parties agree that this

Agreement may be amended, as reasonably requested by either party, and as may be necessary to fully comply with Section 409A of the Code and all related rules and regulations in order to preserve the payments and benefits provided hereunder

without additional cost to either party.

(e) The Company makes no representation or warranty and shall have no liability to the Executive

or any other person if any provisions of this Agreement are determined to constitute deferred compensation subject to Section 409A of the Code but do not satisfy an exemption from, or the conditions of, such Section.

8. Covenants.

(a)

Confidentiality Agreement. The Executive acknowledges and agrees that the Confidentiality Agreement shall continue in effect as if set forth herein.

(b) Litigation and Regulatory Cooperation. During and after the Term, the Executive shall cooperate fully with the Company and all of

its subsidiaries and affiliates (including its and their outside counsel) in connection with the contemplation, prosecution and defense of all phases of existing, past and future claims or actions which relate to events or occurrences that

transpired while the Executive was employed by the Company. The Executive’s full cooperation in connection with such claims or actions shall include, but not be limited to, being available to meet with counsel to prepare for discovery or trial

and to act as a

9

witness on behalf of the Company at mutually convenient times. During and after the Term, the Executive also shall cooperate fully with the Company in connection with any investigation or review

of any federal, state or local regulatory authority as any such investigation or review relates to events or occurrences that transpired while the Executive was employed by the Company. The Company shall reimburse the Executive for any pre-approved

reasonable business travel expenses that are incurred in connection with the Executive’s performance of obligations pursuant to this Section 8(a) after receipt of appropriate documentation consistent with the Company’s business

expense reimbursement policy.

(c) Disparagement. During and after the Term, the Executive agrees not to make any disparaging

statements concerning the Company or any of its subsidiaries, affiliates or current or former officers, directors, shareholders, employees or agents (“Company Parties”). The Executive further agrees not to take any actions or conduct

himself in any way that would reasonably be expected to affect adversely the reputation or good will of the Company or any of the Company Parties. The Executive further agrees that he shall not voluntarily provide information to or otherwise

cooperate with any individual or entity that is contemplating or pursuing litigation against the Company or any of the Company Parties or that is undertaking any investigation or review of the Company’s or any of the Company Parties’

activities or practices; provided, however, that the Executive may participate in or otherwise assist in any investigation or inquiry conducted by the EEOC or the New York Division of Human Rights. These nondisparagement obligations shall not in any

way affect the Executive’s obligation to testify truthfully in any legal proceeding.

(d) Return of Property. As soon as

possible in connection with any termination of the Executive’s employment under this Agreement, the Executive shall return to the Company all Company property, including, without limitation, computer equipment, software, keys and access cards,

credit cards, files and any documents (including computerized data and any copies made of computer data or software) containing information concerning the Company, its business or its business relationships (in the latter two cases, actual or

prospective). The Executive shall also commit to deleting and finally purging any duplicates of files or documents that may contain Company information from any computer or other device that remains his property after any Date of Termination.

(e) Injunction. The Executive agrees that it would be difficult to measure any damages caused to the Company which might result from

any breach by the Executive of his obligations under this Agreement, and that in any event money damages would be an inadequate remedy for any such breach. Accordingly, subject to Section 9 of this Agreement, the Executive agrees that if the

Executive breaches, or proposes to breach, any provision of this Agreement, the Company shall be entitled, in addition to all other remedies that it may have, to an injunction or other appropriate equitable relief to restrain any such breach without

showing or proving any actual damage to the Company.

9. Settlement and Arbitration of Disputes. Any controversy or claim arising

out of or relating to this Agreement or the breach thereof shall be settled exclusively by arbitration in accordance with the laws of the State of New York by three arbitrators, one of whom shall be appointed by the Company, one by the Executive and

the third by the first two arbitrators. If the first two arbitrators cannot agree on the appointment of a third arbitrator, then the third arbitrator

10

shall be appointed by the American Arbitration Association in the City of Albany. Such arbitration shall be conducted in the City of Albany in accordance with the Employment Dispute Resolutions

Rules of the American Arbitration Association, except with respect to the selection of arbitrators which shall be as provided in this Section 9. Judgment upon the award rendered by the arbitrators may be entered in any court having jurisdiction

thereof. This Section 9 shall be specifically enforceable. Notwithstanding the foregoing, this Section 9 shall not preclude either party from pursuing a court action for the sole purpose of obtaining a temporary restraining order or a

preliminary injunction in circumstances in which such relief is appropriate; provided that any other relief shall be pursued through an arbitration proceeding pursuant to this Section 9.

10. Consent to Jurisdiction. To the extent that any court action is permitted consistent with or to enforce Section 9 of this

Agreement, the parties hereby consent to the jurisdiction of the Supreme Courts of New York State and the United States District Court for the Northern District of New York. Accordingly, with respect to any such court action, the Executive

(a) submits to the personal jurisdiction of such courts; (b) consents to service of process; and (c) waives any other requirement (whether imposed by statute, rule of court, or otherwise) with respect to personal jurisdiction or

service of process.

11. Integration. This Agreement constitutes the entire agreement and understanding between the parties with

respect to the subject matter hereof and supersedes all prior agreements between the parties concerning such subject matter, except the Confidentiality Agreement, which remains in full force and effect. The 2008 Employment Agreement has been

terminated and is no longer in effect.

12. Withholding. All payments made by the Company to the Executive under this Agreement

shall be net of any tax or other amounts required to be withheld by the Company under applicable law.

13. Successor to the

Executive. This Agreement shall inure to the benefit of and be enforceable by the Executive’s personal representatives, executors, administrators, heirs, distributees, devisees and legatees. In the event of the Executive’s death after

his termination of employment but prior to the completion by the Company of all payments due him under this Agreement, the Company shall continue such payments to the Executive’s beneficiary designated in writing to the Company prior to his

death (or to his estate, if the Executive fails to make such designation).

14. Enforceability. If any portion or provision of this

Agreement (including, without limitation, any portion or provision of any section of this Agreement) shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the remainder of this Agreement, or the

application of such portion or provision in circumstances other than those as to which it is so declared illegal or unenforceable, shall not be affected thereby, and each portion and provision of this Agreement shall be valid and enforceable to the

fullest extent permitted by law.

15. Waiver. No waiver of any provision hereof shall be effective unless made in writing and

signed by the waiving party. The failure of any party to require the performance of any term or obligation of this Agreement, or the waiver by any party of any breach of this Agreement, shall not prevent any subsequent enforcement of such term or

obligation or be deemed a waiver of any subsequent breach.

11

16. Notices. Any notices, requests, demands and other communications provided for by this

Agreement shall be sufficient if in writing and delivered in person or sent by a nationally recognized overnight courier service or by registered or certified mail, postage prepaid, return receipt requested, to the Executive at the last address the

Executive has filed in writing with the Company or, in the case of the Company, at its main offices, attention of the Board.

17.

Effect on Other Plans. Nothing in this Agreement shall be construed to limit the rights of the Executive under the Company’s benefit plans, programs or policies except (a) as otherwise provided herein, and (b) that the

Executive shall have no rights to any severance or similar benefits under any severance pay plan, policy or practice.

18.

Amendment. This Agreement may be amended or modified only by a written instrument signed by the Executive and by a duly authorized representative of the Company.

19. Governing Law. This is a New York contract and shall be construed under and be governed in all respects by the laws of the State of

New York, without giving effect to the conflict of laws principles of such State. With respect to any disputes concerning federal law, such disputes shall be determined in accordance with the law as it would be interpreted and applied by the United

States Court of Appeals for the Second Circuit.

20. Counterparts. This Agreement may be executed in any number of counterparts,

each of which when so executed and delivered shall be taken to be an original; but such counterparts shall together constitute one and the same document.

21. Successor to Company. The Company shall require any successor (whether direct or indirect, by purchase, merger, consolidation or

otherwise) to all or substantially all of the business or assets of the Company expressly to assume and agree to perform this Agreement to the same extent that the Company would be required to perform it if no succession had taken place. Failure of

the Company to obtain an assumption of this Agreement at or prior to the effectiveness of any succession shall be a breach of this Agreement and shall constitute Good Reason if the Executive elects to terminate employment.

22. Gender Neutral. Wherever used herein, a pronoun in the masculine gender shall be considered as including the feminine gender unless

the context clearly indicates otherwise.

23. Survival. The provisions of this Agreement shall survive the termination of this

Agreement and/or the termination of the Executive’s employment to the extent necessary to effectuate the terms contained herein.

12

IN WITNESS WHEREOF, the parties hereto have executed this Agreement effective on the date and

year first above written.

|

|

|

| PLUG POWER INC. |

|

|

| By: |

|

/s/ Andrew Marsh |

| Name: |

|

Andrew Marsh |

| Title: |

|

President & CEO |

|

| CHRISTOPHER T. HUTTER |

|

|

| By: |

|

/s/ Christopher T. Hutter |

| Name: |

|

Christopher T. Hutter |

| Title: |

|

Chief Financial Officer |

13

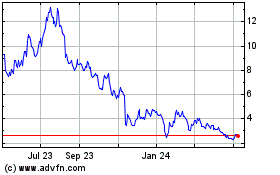

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Mar 2024 to Apr 2024

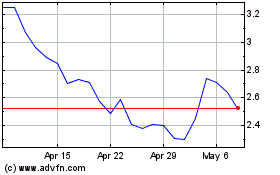

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Apr 2023 to Apr 2024