UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 4, 2014

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

000-51446 |

|

02-0636095 |

|

(State of Incorporation) |

|

(Commission File Number) |

|

(IRS employer identification no.) |

|

121 South 17th Street |

|

|

|

Mattoon, Illinois |

|

61938-3987 |

|

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: (217) 235-3311

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

Consolidated Communications Holdings, Inc. (the “Company”) hereby furnishes the following unaudited pro forma condensed combined financial statements that the Company has prepared to reflect the proposed combination of the Company and Enventis Corporation and the cost of financing such acquisition. These unaudited pro forma condensed combined financial statements are attached hereto as Exhibit 99.1 and incorporated into this Item 7.01 by reference.

The information in this Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

Safe Harbor

The Securities and Exchange Commission (“SEC”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. Certain statements in this Current Report on Form 8-K are forward-looking statements and are made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These forward-looking statements reflect, among other things, our current expectations, plans, strategies, and anticipated financial results. There are a number of risks, uncertainties, and conditions that may cause our actual results to differ materially from those expressed or implied by these forward-looking statements. These risks and uncertainties include our ability to complete the acquisition of Enventis and successfully integrate Enventis’ operations and realize the synergies from the acquisition, as well as a number of factors related to our business and that of Enventis, including economic and financial market conditions generally and economic conditions in the Company’s and Enventis’ service areas; various risks to shareholders of not receiving dividends and risks to the Company’s ability to pursue growth opportunities if the Company continues to pay dividends according to the current dividend policy; various risks to the price and volatility of the Company’s common stock; changes in the valuation of pension plan assets; the substantial amount of debt and the Company’s ability to repay or refinance it or incur additional debt in the future; the Company’s need for a significant amount of cash to service and repay the debt and to pay dividends on the common stock; restrictions contained in the debt agreements that limit the discretion of management in operating the business; regulatory changes, including changes to subsidies, rapid development and introduction of new technologies and intense competition in the telecommunications industry; risks associated with the Company’s possible pursuit of acquisitions; system failures; losses of large customers or government contracts; risks associated with the rights-of-way for the network; disruptions in the relationship with third party vendors; losses of key management personnel and the inability to attract and retain highly qualified management and personnel in the future; changes in the extensive governmental legislation and regulations governing telecommunications providers and the provision of telecommunications services; telecommunications carriers disputing and/or avoiding their obligations to pay network access charges for use of the Company’s and Enventis’ network; high costs of regulatory compliance; the competitive impact of legislation and regulatory changes in the telecommunications industry; and liability and compliance costs regarding environmental regulations. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements are discussed in more detail in the Company’s and Enventis’ filings with the Securities and Exchange Commission, including their reports on Form 10-K and Form 10-Q.

2

Many of these circumstances are beyond our ability to control or predict. Moreover, forward-looking statements necessarily involve assumptions on our part. These forward-looking statements generally are identified by the words “believe”, “expect”, “anticipate”, “estimate”, “project”, “intend”, “plan”, “should”, “may”, “will”, “would”, “will be”, “will continue” or similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company and its subsidiaries to be different from those expressed or implied in the forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements that appear throughout this Current Report on Form 8-K. Furthermore, forward-looking statements speak only as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the Securities and Exchange Commission, we disclaim any intention or obligation to update or revise publicly any forward-looking statements. You should not place undue reliance on forward-looking statements.

Proxy Statement/Prospectus

This material is not a substitute for the joint proxy statement/prospectus the Company and Enventis filed with the Securities and Exchange Commission on August 8, 2014, which, as amended, was declared effective on August 22, 2014. Investors in the Company or Enventis are urged to read the joint proxy statement/prospectus, which contains important information, including detailed risk factors. The joint proxy statement/prospectus is, and other documents which will be filed by the Company and Enventis with the Securities and Exchange Commission will be, available free of charge at the Securities and Exchange Commission’s website, www.sec.gov, or by directing a request to Consolidated Communications, 121 South 17th Street, Mattoon, IL 61938, Attention: Investor Relations; or to Enventis Corporation, P.O. Box 3248, Mankato, MN 56002, Attention: Investor Relations. The definitive joint proxy statement/prospectus was first mailed to the Company’s stockholders and Enventis’ shareholders on August 28, 2014.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

Proxy Solicitation

The Company and Enventis, and certain of their respective directors, executive officers and other members of management and employees are participants in the solicitation of proxies in connection with the proposed transactions. Information about the directors and executive officers of the Company is set forth in the joint proxy statement/prospectus. Information about the directors and executive officers of Enventis is set forth in its proxy statement for its 2014 annual meeting of shareholders. Investors may obtain additional information regarding the interests of such participants in the proposed transactions by reading the definitive joint proxy statement/prospectus for such proposed transactions.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

No. |

|

Description |

|

99.1 |

|

Unaudited Pro Forma Condensed Combined Financial Statements |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: September 4, 2014 |

|

|

|

Consolidated Communications Holdings, Inc. |

|

|

|

|

|

|

|

|

|

By: |

/s/ Steven L. Childers |

|

|

|

Name: Steven L. Childers |

|

|

|

Title: Chief Financial Officer |

4

EXHIBIT INDEX

|

No. |

|

Description |

|

99.1 |

|

Unaudited Pro Forma Condensed Combined Financial Statements |

5

Exhibit 99.1

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

The following unaudited pro forma condensed combined financial statements (“pro forma financial statements”) have been prepared to reflect a business combination whereby Sky Merger Sub Inc., a Minnesota corporation and a wholly-owned subsidiary of Consolidated Communications Holdings, Inc., a Delaware corporation (“Consolidated”), will merge with and into Enventis Corporation, a Minnesota corporation (“Enventis”), with Enventis as the surviving entity (the “Proposed Acquisition”), based on the acquisition method of accounting, with Consolidated treated as the acquirer. The pro forma financial statements utilize the historical consolidated financial statements of Consolidated and Enventis, which are included in Consolidated’s Annual Report on Form 10-K for the year ended December 31, 2013, Consolidated’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, Consolidated’s Quarterly Report on Form 10-Q for the quarter ended June, 2014, Enventis’ Annual Report on Form 10-K for the year ended December 31, 2013, Enventis’ Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 and Enventis’ Quarterly Report on Form 10-Q for the quarter ended June, 2014 (collectively, the “Reports”). The historical consolidated financial statements have been adjusted to give effect to pro forma events that are directly attributable to the Proposed Acquisition and factually supportable and, in the case of the statement of income, that are expected to have a continuing impact. The unaudited pro forma condensed combined statements of income, which have been prepared for the six and twelve months ended June 30, 2014 and the year ended December 31, 2013, give effect to the Proposed Acquisition as if it had occurred on January 1, 2013. The unaudited pro forma condensed combined balance sheet has been prepared as of June 30, 2014 and gives effect to the Proposed Acquisition as if it had occurred on that date.

As of September 4, 2014, Consolidated has not finalized the detailed valuation studies necessary to arrive at the required fair value of the Enventis assets to be acquired and the liabilities to be assumed. As indicated in Note 1 to the pro forma financial statements, Consolidated has made certain pro forma adjustments to the historical book values of the assets and liabilities of Enventis to reflect certain preliminary estimates of the fair value of the net assets acquired, with the excess of the estimated purchase price over the estimated fair values of Enventis’ acquired assets and assumed liabilities recorded as goodwill. Actual results are expected to differ from these preliminary estimates once Consolidated has determined the final purchase price for Enventis and completed the valuation studies necessary to finalize the acquisition accounting. There can be no assurances that such finalization of the valuation studies will not result in material changes. Consolidated performed a preliminary assessment of accounting policies and financial statement presentation which has identified certain adjustments necessary to conform information in Enventis’ historical financial statements to Consolidated’s accounting policies and presentation. The review of the accounting policies and presentation is not yet complete and additional policy differences may be identified when completed.

These pro forma financial statements should be read in conjunction with the historical consolidated financial statements and accompanying notes of Consolidated and Enventis included in the Reports.

The pro forma financial statements are not intended to represent or be indicative of the consolidated results of operations or financial condition of the combined company that would have been reported had the Proposed Acquisition been completed as of the dates presented and should not be taken as representative of the future consolidated results of operations or financial condition of the combined company.

The pro forma financial statements do not include the realization of future cost savings or synergies or restructuring charges that are expected to result from Consolidated’s acquisition of Enventis.

1

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

FOR THE SIX MONTHS ENDED JUNE 30, 2014

(amounts in thousands, except per share amounts)

|

|

|

Consolidated

Communications |

|

Enventis

Corporation |

|

Pro Forma

Adjustments |

|

Note 4 |

|

Pro Forma

Combined |

|

|

Operating revenues |

|

$ |

300,684 |

|

$ |

93,963 |

|

$ |

— |

|

|

|

$ |

394,647 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (exclusive of depreciation and amortization) |

|

177,770 |

|

70,186 |

|

(1,811 |

) |

(b) |

|

246,145 |

|

|

Depreciation and amortization |

|

71,547 |

|

15,090 |

|

(2,614 |

) |

(c) |

|

84,023 |

|

|

Total operating expenses |

|

249,317 |

|

85,276 |

|

(4,425 |

) |

|

|

330,168 |

|

|

Operating income |

|

51,367 |

|

8,687 |

|

4,425 |

|

|

|

64,479 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

(39,559 |

) |

(1,962 |

) |

(1,695 |

) |

(d) |

|

(43,216 |

) |

|

Investment income |

|

17,649 |

|

— |

|

— |

|

|

|

17,649 |

|

|

Other, net |

|

(1,155 |

) |

— |

|

— |

|

|

|

(1,155 |

) |

|

Income before income taxes |

|

28,302 |

|

6,725 |

|

2,730 |

|

|

|

37,757 |

|

|

Income tax expense |

|

9,993 |

|

2,741 |

|

1,065 |

|

(e) |

|

13,799 |

|

|

Net income |

|

18,309 |

|

3,984 |

|

1,665 |

|

|

|

23,958 |

|

|

Less: net income attributable to noncontrolling interest |

|

178 |

|

— |

|

— |

|

|

|

178 |

|

|

Net income attributable to common stockholders |

|

$ |

18,131 |

|

$ |

3,984 |

|

$ |

1,665 |

|

|

|

$ |

23,780 |

|

|

Net income per common share attributable to common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share—basic |

|

$ |

0.45 |

|

$ |

0.29 |

|

n/a |

|

|

|

$ |

0.47 |

|

|

Net income per common share—diluted |

|

$ |

0.45 |

|

$ |

0.29 |

|

n/a |

|

|

|

$ |

0.47 |

|

|

Shares of common stock used to calculate earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

39,877 |

|

13,619 |

|

(3,343 |

) |

(f) |

|

50,153 |

|

|

Diluted |

|

39,877 |

|

13,679 |

|

(3,403 |

) |

(f) |

|

50,153 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

2

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

FOR THE LAST TWELVE MONTHS ENDED JUNE 30, 2014

(amounts in thousands, except per share amounts)

|

|

|

Consolidated

Communications |

|

Enventis

Corporation |

|

Pro Forma

Adjustments |

|

Note 4 |

|

Pro Forma

Combined |

|

|

Operating revenues |

|

$ |

599,413 |

|

$ |

187,253 |

|

$ |

— |

|

|

|

$ |

786,666 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (exclusive of depreciation and amortization) |

|

358,391 |

|

139,660 |

|

(1,811 |

) |

(b) |

|

496,240 |

|

|

Depreciation and amortization |

|

141,271 |

|

30,151 |

|

(5,199 |

) |

(c) |

|

166,223 |

|

|

Total operating expenses |

|

499,662 |

|

169,811 |

|

(7,010 |

) |

|

|

662,463 |

|

|

Operating income |

|

99,751 |

|

17,442 |

|

7,010 |

|

|

|

124,203 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

(80,029 |

) |

(4,307 |

) |

(3,046 |

) |

(d) |

|

(87,382 |

) |

|

Loss on extinguishment of debt |

|

(7,657 |

) |

— |

|

— |

|

|

|

(7,657 |

) |

|

Investment income |

|

37,867 |

|

— |

|

— |

|

|

|

37,867 |

|

|

Other, net |

|

(1,586 |

) |

— |

|

— |

|

|

|

(1,586 |

) |

|

Income before income taxes |

|

48,346 |

|

13,135 |

|

3,963 |

|

|

|

65,444 |

|

|

Income tax expense |

|

16,491 |

|

5,366 |

|

1,546 |

|

(e) |

|

23,403 |

|

|

Income from continuing operations |

|

31,855 |

|

7,769 |

|

2,418 |

|

|

|

42,042 |

|

|

Less: net income attributable to noncontrolling interest |

|

315 |

|

— |

|

— |

|

|

|

315 |

|

|

Income from continuing operations attributable to common stockholders |

|

$ |

31,540 |

|

$ |

7,769 |

|

$ |

2,418 |

|

|

|

$ |

41,727 |

|

|

Income from continuing operations per common share attributable to common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations—basic |

|

$ |

0.79 |

|

$ |

0.57 |

|

n/a |

|

|

|

$ |

0.83 |

|

|

Income from continuing operations—diluted |

|

$ |

0.79 |

|

$ |

0.57 |

|

n/a |

|

|

|

$ |

0.83 |

|

|

Shares of common stock used to calculate earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

39,825 |

|

13,585 |

|

(3,309 |

) |

(f) |

|

50,101 |

|

|

Diluted |

|

39,825 |

|

13,643 |

|

(3,367 |

) |

(f) |

|

50,101 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

3

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

FOR THE YEAR ENDED DECEMBER 31, 2013

(amounts in thousands, except per share amounts)

|

|

|

Consolidated

Communications |

|

Enventis

Corporation |

|

Pro Forma

Adjustments |

|

Note 4 |

|

Pro Forma

Combined |

|

|

Operating revenues |

|

$ |

601,577 |

|

$ |

189,200 |

|

$ |

— |

|

|

|

$ |

790,777 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (exclusive of depreciation and amortization) |

|

358,642 |

|

142,260 |

|

— |

|

|

|

500,902 |

|

|

Depreciation and amortization |

|

139,274 |

|

29,322 |

|

(4,370 |

) |

(c) |

|

164,226 |

|

|

Total operating expenses |

|

497,916 |

|

171,582 |

|

(4,370 |

) |

|

|

665,128 |

|

|

Operating income |

|

103,661 |

|

17,618 |

|

4,370 |

|

|

|

125,649 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

(85,767 |

) |

(4,600 |

) |

(2,752 |

) |

(d) |

|

(93,119 |

) |

|

Loss on extinguishment of debt |

|

(7,657 |

) |

— |

|

(9,634 |

) |

(d) |

|

(17,291 |

) |

|

Investment income |

|

37,695 |

|

— |

|

— |

|

|

|

37,695 |

|

|

Other, net |

|

(456 |

) |

— |

|

— |

|

|

|

(456 |

) |

|

Income before income taxes |

|

47,476 |

|

13,018 |

|

(8,016 |

) |

|

|

52,478 |

|

|

Income tax expense |

|

17,512 |

|

5,286 |

|

(3,126 |

) |

(e) |

|

19,672 |

|

|

Income from continuing operations |

|

29,964 |

|

7,732 |

|

(4,890 |

) |

|

|

32,806 |

|

|

Less: net income attributable to noncontrolling interest |

|

330 |

|

— |

|

— |

|

|

|

330 |

|

|

Income from continuing operations attributable to common stockholders |

|

$ |

29,634 |

|

$ |

7,732 |

|

$ |

(4,890 |

) |

|

|

$ |

32,476 |

|

|

Income from continuing operations per common share attributable to common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations—basic |

|

$ |

0.73 |

|

$ |

0.57 |

|

n/a |

|

|

|

$ |

0.65 |

|

|

Income from continuing operations—diluted |

|

$ |

0.73 |

|

$ |

0.57 |

|

n/a |

|

|

|

$ |

0.65 |

|

|

Shares of common stock used to calculate earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

39,764 |

|

13,548 |

|

(3,272 |

) |

(f) |

|

50,040 |

|

|

Diluted |

|

39,764 |

|

13,606 |

|

(3,330 |

) |

(f) |

|

50,040 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

4

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

AS OF JUNE 30, 2014

(amounts in thousands, except per share amounts)

|

|

|

Consolidated

Communications |

|

Enventis

Corporation |

|

Pro Forma

Adjustments |

|

Note 5 |

|

Pro Forma

Combined |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,882 |

|

$ |

7,478 |

|

$ |

(10,325 |

) |

(b) |

|

$ |

2,035 |

|

|

Accounts receivable, net |

|

51,079 |

|

31,650 |

|

|

|

|

|

82,729 |

|

|

Inventories |

|

— |

|

1,043 |

|

(1,043 |

) |

(a) |

|

— |

|

|

Income tax receivable |

|

2,968 |

|

3,334 |

|

|

|

|

|

6,302 |

|

|

Deferred income taxes |

|

7,960 |

|

2,377 |

|

(145 |

) |

(f) |

|

10,192 |

|

|

Prepaid expenses and other current assets |

|

14,413 |

|

3,787 |

|

1,043 |

|

(a) |

|

19,243 |

|

|

Total current assets |

|

81,302 |

|

49,669 |

|

(10,470 |

) |

|

|

120,501 |

|

|

Property, plant and equipment, net |

|

866,982 |

|

178,069 |

|

2,359 |

|

(a) |

|

1,140,141 |

|

|

|

|

|

|

|

|

92,731 |

|

(c) |

|

|

|

|

Investments |

|

112,852 |

|

3,595 |

|

|

|

|

|

116,447 |

|

|

Intangible and other assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

603,446 |

|

29,028 |

|

131,517 |

|

(c) |

|

763,991 |

|

|

Other intangible assets, net |

|

35,248 |

|

3,827 |

|

24,373 |

|

(c) |

|

63,448 |

|

|

Deferred debt issuance costs, net and other assets |

|

20,687 |

|

6,435 |

|

(2,359 |

) |

(a) |

|

25,888 |

|

|

|

|

|

|

|

|

80 |

|

(c) |

|

|

|

|

|

|

|

|

|

|

1,045 |

|

(d) |

|

|

|

|

|

|

659,381 |

|

39,290 |

|

154,656 |

|

|

|

853,327 |

|

|

|

|

$ |

1,720,517 |

|

$ |

270,623 |

|

$ |

239,276 |

|

|

|

$ |

2,230,416 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

9,644 |

|

$ |

3,586 |

|

|

|

|

|

$ |

13,230 |

|

|

Extended term payable |

|

— |

|

13,068 |

|

|

|

|

|

13,068 |

|

|

Advance billings and deferred revenues |

|

23,153 |

|

5,202 |

|

|

|

|

|

28,355 |

|

|

Dividends payable |

|

15,607 |

|

— |

|

|

|

|

|

15,607 |

|

|

Accrued compensation |

|

19,016 |

|

— |

|

4,601 |

|

(a) |

|

23,617 |

|

|

Accrued expense |

|

36,189 |

|

11,201 |

|

(4,601 |

) |

(a) |

|

39,578 |

|

|

|

|

|

|

|

|

(3,211 |

) |

(b) |

|

|

|

|

Current portion of long-term debt and capital lease obligations |

|

9,796 |

|

1,504 |

|

(1,353 |

) |

(e) |

|

9,947 |

|

|

Current portion of derivative liability |

|

1,299 |

|

371 |

|

(371 |

) |

(c) |

|

1,299 |

|

|

Total current liabilities |

|

114,704 |

|

34,932 |

|

(4,935 |

) |

|

|

144,701 |

|

|

Long-term debt and capital lease obligations |

|

1,207,609 |

|

132,938 |

|

20,341 |

|

(e) |

|

1,360,888 |

|

|

Deferred income taxes |

|

179,589 |

|

37,445 |

|

45,825 |

|

(f) |

|

262,859 |

|

|

Pension and other post-retirement benefits |

|

65,885 |

|

12,357 |

|

|

|

|

|

78,242 |

|

|

Other liabilities and deferred revenues |

|

11,133 |

|

3,107 |

|

(317 |

) |

(c) |

|

13,923 |

|

|

Total stockholders’ equity |

|

141,597 |

|

49,844 |

|

(12,689 |

) |

(g) |

|

369,803 |

|

|

|

|

|

|

|

|

(9,634 |

) |

(g) |

|

|

|

|

|

|

|

|

|

|

200,685 |

|

(g) |

|

|

|

|

|

|

$ |

1,720,517 |

|

$ |

270,623 |

|

$ |

239,276 |

|

|

|

$ |

2,230,416 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

5

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(amounts in thousands, except per share amounts)

1. Description of the Transaction

On June 29, 2014, Consolidated Communications Holdings, Inc. (“Consolidated”), Sky Merger Sub Inc., a newly formed Minnesota corporation and wholly-owned subsidiary of Consolidated (“Merger Sub”), and Enventis Corporation, a Minnesota corporation (“Enventis”), entered into an Agreement and Plan of Merger (the “Merger Agreement”). The Merger Agreement provides for, among other things, a business combination whereby Merger Sub will merge with and into Enventis, with Enventis as the surviving entity (the “Proposed Acquisition”). As a result of the Proposed Acquisition, the separate corporate existence of Merger Sub will cease, and Enventis will continue as the surviving corporation and a wholly-owned subsidiary of Consolidated.

At the effective time of the Proposed Acquisition, each share of common stock, no par value, of Enventis issued and outstanding immediately prior to the effective time of the Proposed Acquisition will be converted into and become the right to receive 0.7402 shares of common stock, par value $0.01 per share, of Consolidated and cash in lieu of fractional shares, as set forth in the Merger Agreement.

The Proposed Acquisition is subject to various customary closing conditions, including, but not limited to, (i) approval by Consolidated’s stockholders and Enventis’ shareholders, (ii) the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (iii) specified federal and state regulatory approvals, (iv) the absence of any order, injunction, statute, rule, regulation or decree prohibiting, precluding, restraining, enjoining or making illegal the consummation of the Proposed Acquisition, (v) the material accuracy of the representations and warranties of each party, (vi) performance, in all material respects, of all obligations and compliance with, in all material respects, agreements and covenants to be performed or complied with by each party, (vii) declaration of effectiveness of the Registration Statement on Form S-4 to be filed by Consolidated, and (viii) the approval of the listing of additional shares of Consolidated common stock to be issued to Enventis’ shareholders.

Consolidated and Enventis have made customary representations, warranties and covenants in the Merger Agreement, including Enventis agreeing not to solicit alternative transactions or, subject to certain exceptions, enter into discussions concerning, or provide confidential information in connection with, an alternative transaction. The Merger Agreement contains certain termination rights for both Consolidated and Enventis, and further provides that, upon termination of the Merger Agreement under certain circumstances, Enventis may be obligated to pay Consolidated a termination fee of $8,449.

Consolidated will account for its acquisition of Enventis using the acquisition method of accounting. The pro forma adjustments reflect preliminary estimates of the fair value of the consideration transferred, the assets acquired and the liabilities assumed, which are expected to change upon finalization of appraisals and other valuation studies. The pro forma adjustments will be based on the fair value of the consideration transferred and the assets and liabilities that exist as of the effective time of the Proposed Acquisition. The final adjustments could be materially different from the pro forma adjustments presented herein.

The unaudited pro forma condensed combined statement of income includes certain accounting adjustments related to the Proposed Acquisition that are expected to have a continuing impact on the combined results, such as increased depreciation and amortization on the acquired tangible and intangible assets, increased interest expense on the debt expected to be incurred to complete the Proposed Acquisition, amortization of deferred financing fees incurred in connection with the new borrowings and the tax impact of these pro forma adjustments.

6

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(Continued)

(amounts in thousands, except per share amounts)

1. Description of the Transaction (Continued)

The unaudited pro forma condensed combined statements of income does not reflect certain adjustments that are expected to result from the Proposed Acquisition that may be significant, such as costs that may be incurred by Consolidated for integration and restructuring efforts, as well as payments under certain change in control agreements with Enventis employees, because they are considered to be of a non-recurring nature.

Upon completion of the Proposed Acquisition, various triggering events will have occurred which result in the payment of various change in control payments to certain Enventis employees. The estimated cash payments under these agreements will range from approximately $6,000 to $8,000. No adjustment has been included in the pro forma financial statements for these payments.

The summary pro forma financial information does not include the realization of future cost savings or synergies or restructuring charges that are expected to result from the Proposed Acquisition. The transaction is expected to generate annual operating synergies of approximately $14,000, which are expected to be achieved on a run-rate basis by the end of the second year after close. Consolidated also expects to incur merger and integration costs, excluding closing costs, of approximately $8,200 in operating expenses and $5,200 in capital expenditures over the first two years following the close. However, no assurance can be given with respect to the ultimate level of such synergies or costs or the timing of their realization.

2. Estimated Purchase Price

The following is the calculation of the preliminary estimate of the purchase price for the acquisition of Enventis:

|

Number of shares of Enventis common stock and equity awards outstanding at the effective time of the Merger(a) |

|

13,883 |

|

|

Exchange ratio |

|

0.7402 |

|

|

Number of shares of Consolidated common stock to be issued to holders of Enventis common stock |

|

10,276 |

|

|

Consolidated closing common stock price on August 29, 2014 |

|

$ |

24.38 |

|

|

Estimated stock value to be issued to Enventis shareholders(b) |

|

$ |

250,529 |

|

|

Cash consideration for vested stock options |

|

425 |

|

|

Repayment of Enventis debt |

|

134,255 |

|

|

Estimated purchase price |

|

$ |

385,209 |

|

(a) Based on the number of shares of Enventis stock and equity awards outstanding as of August 29, 2014.

(b) Represents the product of the estimated number of shares of Consolidated common stock to be issued and the closing price of Consolidated common stock as of August 29, 2014. Pursuant to the terms of the Merger Agreement, the final purchase price will be based on the number of shares of Enventis common stock and equity awards outstanding and the price of Consolidated’s common stock as of the closing date of the Proposed Acquisition. Therefore, the estimated consideration expected to be transferred as reflected in these

7

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(Continued)

(amounts in thousands, except per share amounts)

2. Estimated Purchase Price (Continued)

unaudited pro forma condensed combined financial statements does not purport to represent what the actual consideration transferred will be when the Proposed Acquisition is completed. An increase or decrease by 10% in Consolidated’s common stock price as of the closing of business on August 29, 2014 ($24.38 per share) would increase or decrease the consideration expected to be transferred by approximately $25,100, which would be reflected in these unaudited pro forma condensed combined financial statements as an increase or decrease to goodwill.

3. Estimated Application of the Acquisition Method

The estimated fair value of the tangible and intangible assets acquired and liabilities assumed on a preliminary basis are as follows:

|

Assets: |

|

|

|

|

Accounts receivable |

|

$ |

31,650 |

|

|

Other current assets |

|

17,874 |

|

|

Property, plant and equipment |

|

270,800 |

|

|

Goodwill |

|

160,545 |

|

|

Customer relationships and tradenames |

|

28,200 |

|

|

Other assets |

|

7,801 |

|

|

Total assets |

|

516,870 |

|

|

Liabilities: |

|

|

|

|

Current liabilities |

|

33,208 |

|

|

Long-term debt, including current portion |

|

134,255 |

|

|

Deferred income taxes |

|

83,270 |

|

|

Pension and other postretirement obligations |

|

12,357 |

|

|

Other long-term liabilities |

|

2,826 |

|

|

Total liabilities |

|

265,916 |

|

|

Total Estimated Consideration |

|

$ |

250,954 |

|

For purposes of preparing the pro forma financial statements, the estimated fair value of the assets acquired and the liabilities assumed are based on preliminary estimates. The final amount recorded will be based on the estimated fair values at the completion of the Proposed Acquisition and could vary significantly from the pro forma amounts due to various factors, including but not limited to, changes in the share price of Consolidated’s common stock, the composition of Enventis’ assets, liabilities, outstanding equity ownership shares and changes in fair value assumptions prior to the completion of the Proposed Acquisition. Accordingly, the preliminary estimated fair values of the purchase price and the assets and liabilities recorded are subject to change pending additional information that may be developed by Consolidated and Enventis. Any changes to the initial estimates of the fair value of the acquired assets and assumed liabilities will be recorded as adjustments to those assets and liabilities and residual amounts will be allocated to goodwill.

8

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(Continued)

(amounts in thousands, except per share amounts)

4. Pro Forma Adjustments—Statements of Income

The following pro forma adjustments included in the unaudited pro forma condensed combined statements of income for the six and last twelve months ended June 30, 2014 and the year ended December 31, 2013 give effect to the Proposed Acquisition as if it had occurred on January 1, 2013:

(a) Accounting Policies and Presentation

In connection with the Proposed Acquisition, a preliminary review of the accounting policies and presentation of the financial statements of Enventis has been performed. Based on this review, no adjustments were necessary to conform the Enventis statements of income to the Consolidated accounting policies and presentation. The final results of the complete review of accounting policies and presentation may result in identifying differences that, when conformed, could have a material effect on the combined financial statements.

(b) Transaction Costs

The pro forma adjustment reflects the removal of transaction costs that were incurred by Consolidated and Enventis directly related to the Proposed Acquisition during the six and last twelve months ended June 30, 2014. These costs have been excluded from the unaudited pro forma condensed combined statements of income since they are considered to be of a non-recurring nature.

(c) Depreciation and Amortization

The pro forma adjustments to depreciation and amortization reflect the removal of the historical basis of depreciation and amortization for the Enventis assets and the increase in depreciation and amortization expense for property and equipment and finite-lived intangible assets acquired in the Proposed Acquisition, based on the estimated fair value of these assets in accordance with Statement of Financial Accounting Standards Board Accounting Standards Codification Topic 805, Business Combinations. The following table summarizes the pro forma adjustments to depreciation and amortization:

|

|

|

Six Months

Ended

June 30, 2014 |

|

Last

Twelve Months

Ended

June 30, 2014 |

|

Year Ended

December 31, 2013 |

|

|

Remove historical depreciation and amortization |

|

$ |

(15,090 |

) |

$ |

(30,151 |

) |

$ |

(29,322 |

) |

|

Record new depreciation and amortization |

|

12,476 |

|

24,952 |

|

24,952 |

|

|

|

|

$ |

(2,614 |

) |

$ |

(5,199 |

) |

$ |

(4,370 |

) |

(d) Interest Expense

The pro forma adjustments to interest expense, as summarized in the following table, reflect the removal of historical interest expense of Enventis, the removal of historical interest expense of Consolidated for the repayment of Existing Notes and the additional interest expense resulting from the new borrowings to finance the Proposed Acquisition, as described below. The pro forma adjustments are

9

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(Continued)

(amounts in thousands, except per share amounts)

4. Pro Forma Adjustments—Statements of Income (Continued)

based on the amounts borrowed and the interest rates assumed to be in effect at the closing of the Proposed Acquisition.

|

|

|

Estimated

Principal

Outstanding |

|

Interest Rate |

|

Six Months

Ended

June 30, 2014 |

|

Last

Twelve Months

Ended

June 30, 2014 |

|

Year Ended

December 31, 2013 |

|

|

Removal of historical interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Enventis interest expense |

|

|

|

|

|

$ |

(1,962 |

) |

$ |

(4,282 |

) |

$ |

(4,594 |

) |

|

Consolidated repurchase of Existing Notes |

|

|

|

|

|

(2,556 |

) |

(5,112 |

) |

(5,112 |

) |

|

Amortization of debt issuance costs and discount related to the repurchase of Existing Notes |

|

|

|

|

|

(84 |

) |

(153 |

) |

(135 |

) |

|

Recording of new interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of senior notes |

|

$ |

200,000 |

|

6.00 |

% |

6,000 |

|

12,000 |

|

12,000 |

|

|

Amortization of debt issuance costs: |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of debt issuance costs on New Senior Notes |

|

|

|

|

|

297 |

|

593 |

|

593 |

|

|

Net adjustment to interest expense |

|

|

|

|

|

$ |

1,695 |

|

$ |

3,046 |

|

$ |

2,752 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

On June 29, 2014, concurrent with entering into the Merger Agreement, Consolidated entered into a Commitment Letter for a $140,000 senior unsecured bridge loan facility in order to fund the acquisition. In lieu of using the financing from the bridge loan facility, Consolidated is conducting this private placement offering.

Net proceeds from the issuance of the Notes offered hereby are expected to be used to finance the acquisition including the related fees and expenses, to repay the existing indebtedness of Enventis and to repay a portion of Consolidated’s existing $300,000 aggregate principal amount of 10.875% senior notes due 2020. Consolidated expects to repurchase $46,757 of its Existing Notes at a price of 117%, including premium and fees, of the principal amount for $55,000 resulting in a loss on the extinguishment of debt of $9,634, which includes the unamortized discount and deferred financing costs associated with the repurchased notes. If our efforts to repurchase a portion of our Existing Notes results in our use of less than $55,000 ($46,757 in principal and $8,243 in premium and fees) for the repurchase, any remaining funds up to $55,000 will be used to repay indebtedness under our credit agreement. The pro forma adjustments are based on the issuance of the new borrowings and the repurchase of the Existing Notes as if such events had occurred on January 1, 2013.

The pro forma adjustments are based on the issuance of the Notes offered hereby at an assumed weighted average interest rate of 6.00%. An increase or decrease of 1% in the assumed interest rate would

10

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(Continued)

(amounts in thousands, except per share amounts)

4. Pro Forma Adjustments—Statements of Income (Continued)

change pro forma interest expense for the six and last twelve months ended June 30, 2014 and year ended December 31, 2013 by $1,000, $2,000 and $2,000, respectively.

For all periods presented, pro forma interest expense includes the amortization of expected financing costs of $4,745 related to the issuance of the senior notes based on a term of 8 years.

(e) Income Tax Expense

The blended effective tax rate applied to the pro forma adjustments related to the Proposed Acquisition and related financing is 39% for the periods presented.

(f) Earnings Per Share

The pro forma adjustment reflects the change in outstanding shares to calculate basic and dilutive earnings per share based on the Proposed Acquisition:

|

|

|

Six Months

Ended

June 30, 2014 |

|

Last

Twelve Months

Ended

June 30, 2014 |

|

Year Ended

December 31, 2013 |

|

|

Shares Used in Basic Earnings Per Share |

|

|

|

|

|

|

|

|

Cancellation of Enventis shares |

|

(13,619 |

) |

(13,585 |

) |

(13,548 |

) |

|

Issuance of Consolidated shares |

|

10,276 |

|

10,276 |

|

10,276 |

|

|

|

|

(3,343 |

) |

(3,309 |

) |

(3,272 |

) |

|

Shares Used in Diluted Earnings Per Share |

|

|

|

|

|

|

|

|

Cancellation of Enventis shares |

|

(13,679 |

) |

(13,643 |

) |

(13,606 |

) |

|

Issuance of Consolidated shares |

|

10,276 |

|

10,276 |

|

10,276 |

|

|

|

|

(3,403 |

) |

(3,367 |

) |

(3,330 |

) |

5. Pro Forma Adjustments—Balance Sheet

The following are the pro forma adjustments included in the unaudited pro forma condensed combined balance sheet as of June 30, 2014 and give effect to the Proposed Acquisition as if it had occurred on that date:

(a) Accounting Policies and Presentation

In connection with the Proposed Acquisition, a preliminary review of the accounting policies and presentation of the financial statements of Enventis has been performed to conform to those of Consolidated. Based on this review, certain amounts included in Enventis’ historical balance sheet have been reclassified to conform to the Consolidated accounting policies and presentation. The pro forma adjustments reflect the reclassification of Enventis inventory to other current assets, materials and supplies from deferred debt finance costs, net and other assets to property, plant and equipment and the reclassification of accrued compensation from accrued expense.

11

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(Continued)

(amounts in thousands, except per share amounts)

5. Pro Forma Adjustments—Balance Sheet (Continued)

The final results of the complete review of accounting policies and presentation may result in additional differences. There can be no assurances that such finalization will not result in material differences.

(b) Cash

Pro forma adjustments to cash are the result of cash used to fund the acquisition of Enventis, estimated transaction costs and costs associated with entering into the new credit facilities. Following is a preliminary estimate of net cash used for the Proposed Acquisition:

|

Estimated transaction costs—Consolidated |

|

$ |

(8,200 |

) |

|

Estimated transaction costs—Enventis |

|

(6,300 |

) |

|

Deferred financing costs—bridge loan facility |

|

(1,400 |

) |

|

Deferred financing costs—senior notes issuance |

|

(4,745 |

) |

|

Cash portion of the purchase price |

|

(425 |

) |

|

Issuance of the Notes |

|

200,000 |

|

|

Repurchase of Existing Notes |

|

(55,000 |

) |

|

Retirement of Enventis debt |

|

(134,255 |

) |

|

Net cash used |

|

$ |

(10,325 |

) |

The estimated transaction costs of $14,500 expected to be incurred in connection with the Proposed Acquisition have not been assessed for deductibility for income tax purposes.

At June 30, 2014, deferred financing costs related to the bridge loan facility of $1,400 and transaction costs of $1,811 were incurred but unpaid and were included in the historical accrued expense in the unaudited pro forma condensed combined balance sheet.

(c) Fair Value Estimates

The pro forma adjustments reflect the preliminary estimated fair values for the net assets to be acquired. These estimates are preliminary and are subject to change upon completion of the valuation process.

|

Decrease in current assets |

|

$ |

(145 |

) |

|

Increase to property, plant and equipment |

|

92,731 |

|

|

Increase in customer relationships and tradenames |

|

24,373 |

|

|

Increase in other assets |

|

80 |

|

|

Decrease in current liabilities |

|

(371 |

) |

|

Decrease in other long term liabilities |

|

(317 |

) |

|

Increase in deferred income taxes |

|

45,825 |

|

|

|

|

|

|

|

Goodwill: |

|

|

|

|

Increase in goodwill |

|

$ |

160,545 |

|

|

Remove historical Enventis goodwill |

|

(29,028 |

) |

|

|

|

$ |

131,517 |

|

12

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(Continued)

(amounts in thousands, except per share amounts)

5. Pro Forma Adjustments—Balance Sheet (Continued)

(d) Deferred Financing Costs

The pro forma adjustments to deferred financing costs and other assets are as follows:

|

Removal of Enventis deferred financing costs |

|

$ |

(2,309 |

) |

|

Removal of costs associated with the repurchase of the Existing Notes |

|

(1,391 |

) |

|

New deferred financing costs associated with the senior notes |

|

4,745 |

|

|

|

|

$ |

1,045 |

|

(e) Debt

The pro forma adjustments to reflect the payment and incurrence of debt are as follows:

|

Non-current portion: |

|

|

|

|

Repayment of existing Enventis credit facility |

|

$ |

(132,902 |

) |

|

Repurchase of Existing Notes and removal of associated discount |

|

(46,757 |

) |

|

Issuance of senior notes |

|

200,000 |

|

|

Adjustment to non-current portion of long-term debt |

|

$ |

20,341 |

|

|

Current portion: |

|

|

|

|

Repayment of existing Enventis credit facility |

|

$ |

(1,353 |

) |

(f) Income Taxes

The pro forma adjustments reflect the income tax impact assuming a marginal combined state and federal tax rate of approximately 39% of the pro forma adjustments resulting from the Proposed Acquisition. The pro forma adjustments to current deferred tax assets and long-term deferred tax liabilities reflect the change in fair value of the net assets to be acquired.

(g) Stockholders’ Equity

The pro forma stockholders’ equity reflects the following adjustments:

|

Expected transactions costs of $14,500 less costs incurred to date of $1,811 |

|

$ |

(12,689 |

) |

|

Loss on extinguishment of debt related to the repurchase of the Existing Notes |

|

$ |

(9,634 |

) |

|

Equity issued to Enventis shareholders |

|

$ |

250,529 |

|

|

Elimination of historical Enventis shareholders’ equity |

|

(49,844 |

) |

|

|

|

$ |

200,685 |

|

13

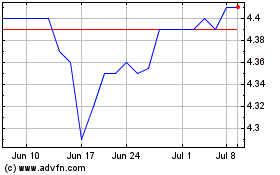

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

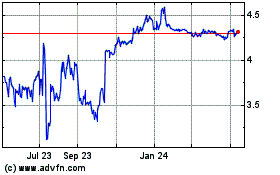

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Apr 2023 to Apr 2024