Current Report Filing (8-k)

September 02 2014 - 4:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 27, 2014

Blue Sphere Corporation

(Exact name of Registrant as specified in

its Charter)

| Nevada |

333-147716 |

98-0550257 |

|

(State or Other

Jurisdiction

of Incorporation or

Organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

35 Asuta St., P.O.B 857, Even Yehuda,

Israel 40500

(Address of Principal Executive Offices)

(Zip Code)

Registrant's telephone number, including

area code: 972-9-8917438

Not Applicable

(Former Name or Former Address, if Changed

since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

Between August 27,

2014 and September 2, 2014, we issued convertible promissory notes (the “Notes”) to accredited investors in an aggregate

principal amount of up to $580,000 for an aggregate purchase price of $275,000, with a Note in the principal amount of up to $350,000

subject to further funding of up to $240,000 in the discretion of the holder at any time in the future.

Notes in the

principal amount of $230,000 mature one-year from the date of issuance and a Note in the principal amount of up to $350,000

matures two years from the date of payment. The Notes accrue interest at rates ranging from 8% to 12% per annum and in an

event of default, the Notes bear interest at rates ranging from 12% to 18% per annum. The Notes may generally be converted

into shares of our common stock at conversion prices ranging from 37% to 42% discounts to our lowest trade or closing prices

during periods in proximity to the time of conversion except that in the case of Notes in the principal amount of up to

$450,000, an additional discount of up to 15% in the case of a DTC “chill” shall apply.

The Notes include customary

default provisions related to payment of principal and interest and bankruptcy or creditor assignment. In addition,

it shall constitute an event of default under certain of the Notes if we are delinquent in our filings with the Securities and

Exchange Commission, cease to be quoted on the OTCQB, our common stock is not DWAC eligible or if there is a change of control

event. In the event of an event of default the Notes may become immediately due and payable at premiums to the outstanding

principal. The Notes also provide that if shares issuable upon conversion of the Notes are not timely delivered in accordance with

the terms of the Notes then we shall be subject to certain cash penalties that increase proportionally to the duration of the delinquency.

The Note in the principal

amount of up to $350,000 may be prepaid interest free at any time during the first 90 days from issuance and may not be prepaid

thereafter and Notes in the principal amount of $230,000 may be prepaid at a premium to the outstanding principal or funded amount

during the first 180 days from issuance but may not be prepaid thereafter.

We paid aggregate commissions

of $7,500 to MD Global Partners, LLC and $4,000 to Carter Terry & Company (“Carter Terry”), registered broker-dealers,

in connection with the issuance of Notes in the aggregate principal of up to $480,000. In addition, Carter Terry is entitled to

a further amount of shares of our common stock equal to 4% of capital raised by them divided by the closing price of our common

stock on the date of close.

Additional covenants,

representations, and warranties between the parties are included in the Notes and any accompanying Securities Purchase Agreement

that was entered into.

The foregoing are summaries

of certain terms and agreements discussed herein. These summaries do not purport to be complete and are qualified in their entirety

by reference to the full text of any Securities Purchase Agreement and Notes, which will be filed as exhibits to our Form 10-K

for the year ending September 30, 2014.

The securities above

were offered and sold pursuant to an exemption from the registration requirements under Section 4(a)(2) of the Securities Act of

1933, as amended, and Rule 506 of Regulation D promulgated thereunder since, among other things, the transactions did not involve

a public offering and the securities were acquired for investment purposes only and not with a view to or for sale in connection

with any distribution thereof.

Item 2.03 Creation of a Direct Financial Obligation or an

Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01

is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01

is incorporated by reference into this Item 3.02.

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereto

duly authorized.

| |

Blue Sphere Corporation |

| |

|

| |

|

| |

|

| Dated: September 2, 2014 |

By: /s/ Shlomo Palas_____________ |

| |

Name: Shlomo Palas |

| |

Title: Chief Executive Officer |

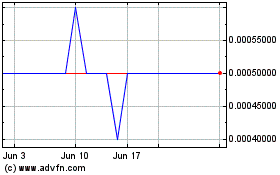

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

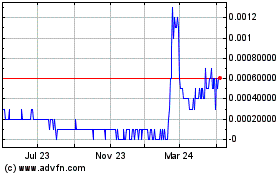

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Apr 2023 to Apr 2024