|

|

UNITED STATES |

|

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, D.C. 20549 |

|

|

|

|

|

|

|

SCHEDULE 13D/A |

|

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

(Name of Issuer)

Class A Ordinary Shares, par value US$0.01 per share

(Title of Class of Securities)

(CUSIP Number)

Kelvin Wing Kee Lau

Perfect World Co., Ltd.

Perfect World Plaza, Tower 306

86 Beiyuan Road, Chaoyang District

Beijing 100101, People’s Republic of China

Telephone: +86 10 5780-5700

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

with a copy to:

Jeffrey J. Sun, Esq.

Orrick, Herrington & Sutcliffe LLP

47th Floor, Park Place, 1601 Nanjing Road West

Shanghai 200040

People’s Republic of China

Telephone: +86 21 6109 7000

September 1, 2014

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

** This CUSIP applies to the American Depositary Shares, evidenced by American Depositary Receipts, each representing two Class A ordinary shares.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 81941U105 |

|

1 |

|

Name of Reporting Person

Perfect World Co., Ltd. |

|

2 |

|

Check the Appropriate Box if a Member of a Group

(a) o (b) x |

|

3 |

|

SEC Use Only |

|

4 |

|

Source of Funds

WC |

|

5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): o |

|

6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

30,326,005(1) |

|

8 |

Shared Voting Power

0 |

|

9 |

Sole Dispositive Power

30,326,005 (1) |

|

10 |

Shared Dispositive Power

0 |

|

11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

30,326,005 (1) |

|

12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares o |

|

13 |

|

Percent of Class Represented by Amount in Row (11)

16.2% (2) |

|

14 |

|

Type of Reporting Person

CO |

|

|

|

|

|

|

(1) |

Representing 30,326,005 Class A ordinary shares of the Issuer held by Perfect World Co., Ltd. |

|

|

|

|

(2) |

percentage calculated based on total Class A ordinary shares of the Issuer outstanding as of August 31, 2014. As of August 31, 2014, 187,395,237 Class A ordinary shares (including Class A ordinary shares represented by American Depositary Shares) and 349,801,719 Class B ordinary shares were outstanding. |

2

INTRODUCTION

This statement on Schedule 13D/A (the “Statement”) amends the Schedule 13D previously filed by Perfect World Co., Ltd. (the “Reporting Person”) with the SEC on April 24, 2014, as amended and supplemented by the Amendment No. 1 filed by the Reporting Person on April 28, 2014 and the Amendment No. 2 filed by the Reporting Person on May 19, 2014 (the “Original 13D”) with respect to Shanda Games Limited (the “Issuer”). Except as amended and supplemented herein, the information set forth in the Original 13D remains unchanged. Capitalized terms used herein without definition have meanings assigned thereto in the Original 13D.

Item 4. Purpose of Transaction:

Item 4 is hereby amended and restated as follows:

On January 27, 2014, Shanda Interactive Entertainment Limited (“Shanda Interactive”) and Primavera Capital (Cayman) Fund I L.P. (the “Primavera,” together with Shanda Interactive, the “Consortium” and each member in the Consortium, a “Consortium Member”) entered into a consortium agreement (the “Consortium Agreement”). Under the Consortium Agreement, the Consortium Members agreed, among other things, (i) to jointly deliver a preliminary non-binding proposal (the “Proposal”) to the board of directors of the Issuer (the “Board”) to acquire the Issuer in a going private transaction (the “Transaction”), (ii) to deal exclusively with each other with respect to the Transaction until the earlier of (x) 9 months after the date thereof, and (y) termination of the Consortium Agreement by all Consortium Members, (iii) to use their reasonable efforts and cooperate in good faith to arrange debt financing to support the Transaction, and (iv) to cooperate and proceed in good faith to negotiate and consummate the Transaction.

On April 18, 2014, SDG and the Reporting Person entered into the PW Share Purchase Agreement pursuant to which SDG agreed to sell, and the Reporting Person agreed to purchase, 30,326,005 Class A Ordinary Shares (the “PW Purchase Shares”) at US$3.2975 per Class A Ordinary Share (the “PW Purchase Price”) subject to the terms and conditions thereof. Pursuant to the PW Share Purchase Agreement, if (i) a going-private transaction occurs within one year of the closing date of the sale of PW Purchase Shares where the Reporting Person is part of the buyer consortium and the price per share in the going-private transaction (the “Going-private Price”) is higher than the PW Purchase Price, or (ii) a going-private transaction occurs within one year of the closing date of the sale of PW Purchase Shares where the Reporting Person is not part of the buyer consortium solely due to its own decision or election without SDG’s written consent and the Going-private Price is higher than the PW Purchase Price, the Reporting Person shall pay SDG the shortfall between the PW Purchase Price and the Going-private Price with respect to all PW Purchase Shares. Pursuant to the PW Share Purchase Agreement, if a going-private transaction is not consummated within one year of the closing date of the sale of PW Purchase Shares solely due to SDG’s failure to vote in favor of such going-private transaction, SDG shall pay to the Reporting Person an amount equal to the PW Purchase Price in exchange for the PW Purchase Shares. The purchase and sale of the PW Purchase Shares was completed on May 16, 2014.

Concurrently with the execution of the PW Share Purchase Agreement, Shanda Interactive, Primavera and the Reporting Person entered into an adherence agreement (the “PW Adherence Agreement”), pursuant to which the Reporting Person became a party to the Consortium Agreement and joined the Consortium.

On September 1, 2014, the Reporting Person, Shanghai Buyout Fund L.P. (the “Purchaser”) and Primavera Capital (Cayman) Fund I L.P. entered into a share purchase agreement (the “New Purchase Agreement”), pursuant to which the Reporting Person agreed to sell, and the Purchaser agreed to purchase, 30,326,005 Class A Ordinary Shares (the “PW Sales Shares”) at US$3.45 per Class A Ordinary Share (the “PW Sale Price”) subject to the terms and conditions thereof.

3

Concurrently with the execution of the New Purchase Agreement, the Reporting Person and certain other parties executed a consortium withdrawal notice (the “Notice”) and a consent and release (the “Consent”), pursuant to which the Reporting Person ceased to be a party to the Consortium Agreement and the Consortium, and all remaining obligations of the Reporting Person and its affiliates under the PW Share Purchase Agreement shall automatically terminate. As a result, the Reporting Person shall no longer be liable to any other withdrawing party or any remaining party to the Consortium Agreement under or in relation to such agreement, prior to, on or after September 1, 2014, and the Reporting Person shall be released, waived and discharged from any and all actions, causes of action, suits, or any other claims of similar kind or nature, arising out of or relating to the PW Share Purchase Agreement, upon the consummation of the transactions contemplated by the New Purchase Agreement.

Descriptions of the Proposal, the Consortium Agreement, the PW Share Purchase Agreement, the PW Adherence Agreement, the New Purchase Agreement, the Notice and the Consent in this Statement are qualified in their entirety by reference to the Proposal, the Consortium Agreement, the PW Share Purchase Agreement, the PW Adherence Agreement, the New Purchase Agreement, the Notice and the Consent, which are filed hereto as Exhibits 7.01, 7.02, 7.03, 7.04, 7.05, 7.06 and 7.07, and incorporated herein by reference in their entirety.

Item 5. Interest in Securities of the Issuer:

Item 5 is hereby amended and restated as follows:

(a) – (b) The following disclosure assumes that there were a total of 187,395,237 Class A Ordinary Shares and 349,801,719 Class B Ordinary Shares outstanding as of August 31, 2014. Each Class A Ordinary Share is entitled to one vote per share and is not convertible into Class B Ordinary Shares. Each Class B Ordinary Share is entitled to 10 votes per share and is convertible at any time into one Class A Ordinary Share at the election of its holder. As of the date hereof, the Reporting Person holds 30,326,005 Class A Ordinary Shares, representing approximately 16.2% of the Class A Ordinary Shares of the Issuer outstanding as of September 1, 2014, or approximately 5.6% of the combined total outstanding shares (including Class A Ordinary Shares and Class B Ordinary Shares) of the Issuer.

(c) Except as set forth Items 3 and 4, to the best knowledge of the Reporting Person with respect to the persons named in response to Item 5(a), none of the persons named in response to Item 5(a) has effected any transactions in the shares of the Issuer during the past 60 days.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer:

Item 6 is hereby amended and restated as follows:

The descriptions of the principal terms of the Proposal, the Consortium Agreement, the PW Share Purchase Agreement, the PW Adherence Agreement, the New Purchase Agreement, the Notice and the Consent under Item 3 and 4 are incorporated herein by reference in their entirety.

4

Item 7. Material to be Filed as Exhibits:

|

Exhibit 7.01: |

|

Preliminary Proposal between Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.02 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

|

|

|

Exhibit 7.02: |

|

Consortium Agreement between Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.03 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

|

|

|

Exhibit 7.03: |

|

Share Purchase Agreement between Shanda SDG Investment Limited and Perfect World Co., Ltd. dated April 18, 2014 (incorporated herein by reference to Exhibit 7.05 to amendment No. 2 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 21, 2014). |

|

|

|

|

|

Exhibit 7.04: |

|

Adherence Agreement among Perfect World Co., Ltd., Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P., dated April 18, 2014 (incorporated herein by reference to Exhibit 7.06 to amendment No. 2 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 21, 2014). |

|

|

|

|

|

Exhibit 7.05: |

|

Share Purchase Agreement among Perfect World Co., Ltd., Primavera Capital (Cayman) Fund I L.P. and Shanghai Buyout Fund L.P., dated September 1, 2014. |

|

|

|

|

|

Exhibit 7.06: |

|

Withdrawal Notice executed by Perfect World Co., Ltd., FV Investment Holdings, and CAP IV Engagement Limited, and acknowledged and agreed by Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P., dated September 1, 2014. |

|

|

|

|

|

Exhibit 7.07: |

|

Consent and Release by and among Shanda SDG Investment Limited, Primavera Capital (Cayman) Fund I L.P. and Perfect World Co., Ltd., dated September 1, 2014. |

5

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

Dated: September 2, 2014

|

|

PERFECT WORLD CO., LTD. |

|

|

|

|

|

|

|

|

By: |

/s/ Robert Hong Xiao |

|

|

|

Name: Robert Hong Xiao |

|

|

|

Title: Chief Executive Officer |

6

INDEX TO EXHIBITS

|

Exhibit 7.01: |

|

Preliminary Proposal between Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.02 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

|

|

|

Exhibit 7.02: |

|

Consortium Agreement between Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.03 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

|

|

|

Exhibit 7.03: |

|

Share Purchase Agreement between Shanda SDG Investment Limited and Perfect World Co., Ltd. dated April 18, 2014 (incorporated herein by reference to Exhibit 7.05 to amendment No. 2 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 21, 2014). |

|

|

|

|

|

Exhibit 7.04: |

|

Adherence Agreement among Perfect World Co., Ltd., Shanda Interactive Entertainment Limited, Primavera Capital (Cayman) Fund I L.P., dated April 18, 2014 (incorporated herein by reference to Exhibit 7.06 to amendment No. 2 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 21, 2014). |

|

|

|

|

|

Exhibit 7.05: |

|

Share Purchase Agreement among Perfect World Co., Ltd., Primavera Capital (Cayman) Fund I L.P. and Shanghai Buyout Fund L.P., dated September 1, 2014. |

|

|

|

|

|

Exhibit 7.06: |

|

Withdrawal Notice executed by Perfect World Co., Ltd., FV Investment Holdings, and CAP IV Engagement Limited, and acknowledged and agreed by Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P., dated September 1, 2014. |

|

|

|

|

|

Exhibit 7.07: |

|

Consent and Release executed by Shanda SDG Investment Limited, Primavera Capital (Cayman) Fund I L.P. and Perfect World Co., Ltd., dated September 1, 2014. |

7

Exhibit 7.05

SHARE PURCHASE AGREEMENT

SHARE PURCHASE AGREEMENT, dated as of September 1, 2014 (this “Agreement”), by and among Primavera Capital (Cayman) Fund I L.P., a limited partnership organized under the laws of the Cayman Islands (“PV” and a “Seller”), Perfect World Co., Ltd., an exempted company incorporated under the laws of the Cayman Islands (“PW” and a “Seller”, and together with PV, the “Sellers”), and Shanghai Buyout Fund L.P. (上海并购股权投资基金合伙企业(有限合伙)), a limited partnership formed under the laws of the People’s Republic of China (together with any permitted transferee or assignee thereof under this Agreement, the “Purchaser”, together with the Sellers, each a “Party” and collectively, the “Parties”). Capitalized terms not otherwise defined shall have the meaning ascribed in Section 6.1 hereof.

W I T N E S S E T H :

WHEREAS, each Seller is the owner of the number of Class A Ordinary Shares of the Issuer set forth below its name on Schedule I hereto (with respect to each Seller, its “Sale Shares”); and

WHEREAS, each Seller intends to sell to the Purchaser, and the Purchaser intends to purchase from each Seller, all of such Seller’s right, title and interest in and pertaining to such Seller’s Sale Shares at the purchase price set forth below such Seller’s name on Schedule I hereto, all upon the terms and conditions hereinafter set forth;

WHEREAS, concurrently with the entry into this Agreement, the Purchaser is entering into a share purchase agreement with Shanda SDG Investment Limited to purchase additional shares of the Issuer;

NOW, THEREFORE, in consideration of the premises and the covenants hereinafter contained, it is agreed as follows:

1. PURCHASE AND SALE

1.1 Purchase and Sale. Subject to the terms and conditions set forth in this Agreement, the Purchaser agrees to purchase from each Seller, and each Seller agrees to sell, transfer and assign to the Purchaser, on the Closing Date, all of such Seller’s right, interest and title in the Sale Shares set forth below such Seller’s name on Schedule I hereto (including all dividends, distributions and other benefits attaching to the Shares) for the Purchase Price. On the Closing Date, the Purchaser shall pay the Purchase Price to each Seller by a wire transfer of immediately available funds in U.S. dollars into an account designated by such Seller.

1.2 The Closing.

(a) The closing of the purchase and sale of the Sale Shares and the other transactions contemplated hereby (the “Closing”) shall take place no later than the thirtieth (30th) calendar

day immediately after the date of this Agreement, or such other date as may be agreed by all Parties in writing (the “Closing Date”).

(b) At the Closing:

(i) each Seller shall deliver, or cause to be delivered, to the Purchaser (and with respect to clauses (C) and (D) below, shall use reasonable efforts to deliver, or cause to be delivered):

(A) the original stock certificates representing such Seller’s Sale Shares, if any;

(B) a share transfer form duly executed by such Seller in respect of such Seller’s Sale Shares in favor of the Purchaser;

(C) a certified copy of the updated register of members of the Issuer reflecting the Purchaser as the sole holder of such Seller’s Sale Shares;

(D) a new share certificate in the name of the Purchaser in respect of such Seller’s Sale Shares;

(E) all such other documents and instruments, if any, that are mutually determined by such Seller and the Purchaser to be necessary to effectuate the transactions contemplated by this Agreement; and

(ii) the Purchaser shall deliver, or cause to be delivered, to each Seller

(A) a wire transfer of immediately available funds into an account designated by such Seller in the amount of the Purchase Price; and

(B) all such other documents and instruments, if any, that are mutually determined by such Seller and the Purchaser to be necessary to effectuate the transactions contemplated by this Agreement.

(c) Unless otherwise agreed by the Sellers and the Purchaser, all actions at Closing are inter-dependent and will be deemed to take place simultaneously and no delivery or payment will be deemed to have been made until all deliveries and payments under this Agreement due to be made at Closing have been made.

2. PURCHASER’S REPRESENTATIONS AND WARRANTIES

The Purchaser makes the following representations and warranties to each of the Sellers, each and all of which shall be true and correct as of the date of this Agreement and the Closing Date:

2.1 Authority; Binding Effect. The Purchaser has the requisite corporate power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement has been duly and validly executed and delivered by the Purchaser and (assuming the due execution and delivery thereof by the Sellers) constitutes the legal, valid and binding obligation of the Purchaser, enforceable against the Purchaser in accordance with its terms.

2.2 No Conflicts. Except as would not have a material impact on the Purchaser’s ability to consummate the transactions contemplated by this Agreement, the execution and delivery of this Agreement and the consummation of the transactions contemplated herein and compliance by the Purchaser with its obligations hereunder do not, whether with or without the giving of notice or passage of time or both, conflict with or constitute a breach of, or default under, or result in the creation or imposition of any tax, lien, charge or encumbrance upon any property or assets of the Purchaser pursuant to any contract, indenture, mortgage, deed of trust, loan or credit agreement, note, license, lease or other agreement or instrument to which the Purchaser is a party or by which the Purchaser is bound, or to which any of the property or assets of the Purchaser is subject, nor does such action result in any violation of the provisions of Organizational Documents of the Purchaser or any applicable treaty, law, statute, rule, regulation, judgment, order, writ or decree of any government, government instrumentality or court, domestic or foreign, having jurisdiction over the Purchaser or any of its property or assets.

2.3 No Consents. No filing with, or consent, approval, authorization, order, registration, qualification or decree of, any court or governmental authority or agency, of any country or nation, is necessary or required for entry into this Agreement by the Purchaser or the performance by the Purchaser of its obligations hereunder.

2.4 Purchase for Investment. The Purchaser is acquiring the Sale Shares for investment for its own account and not with a view toward any resale or distribution thereof except in compliance with the Securities Act. The Purchaser does not presently have any contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participations to any person with respect to the Sale Shares. The Purchaser hereby acknowledges that the Sale Shares have not been registered pursuant to the Securities Act and may not be transferred in the absence of such registration thereunder or an exemption therefrom.

2.5 Purchaser Status. The Purchaser is either (i) not a U.S. Person (as defined in Rule 902 of Regulation S promulgated under the Securities Act) or (ii) an “accredited investor” within the meaning in Rule 501 of Regulation D promulgated under the Securities Act. Such Investor has the knowledge, sophistication and experience necessary to make an investment decision like that involved in the purchase of the Sale Shares and can bear the economic risk of its investment in the Sale Shares.

2.6 Access. The Purchaser has and had access to such reports, statements and announcements publicly released or published by the Issuer as shall have been reasonably necessary for the Purchaser to be capable of evaluating the merits and risks of the transactions contemplated by this Agreement. The Purchaser has such knowledge and experience in financial and business matters as to enable the Purchaser to make an informed decision with respect to the Purchaser’s purchase of the Sale Shares. The Purchaser is a sophisticated investor and has independently evaluated the merits of its decision to purchase the Sale Shares pursuant to this Agreement. In connection with such purchase, the Purchaser is not relying on the Seller or any of its affiliates or representatives (including any act, representation or warranty by the Seller or any of its affiliates or representatives) in any respect in making its decision to make such purchase except for such representations and warranties of the Seller made under Section 3 below.

3. SELLERS’ REPRESENTATIONS AND WARRANTIES

Each of the Sellers makes the following representations and warranties to the Purchaser (but only insofar as such representations and warranties relate to such Seller), each and all of which shall be true and correct as of the date of this Agreement and the Closing Date:

3.1 Authority; Binding Effect. The Seller has the requisite corporate power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement has been duly and validly executed and delivered by the Seller and (assuming the due execution and delivery thereof by the Purchaser) constitutes the legal, valid and binding obligations of the Seller, enforceable against the Seller in accordance with its terms.

3.2 Ownership and Transfer. The Seller has valid title to the Sale Shares set forth below its name on Schedule I hereto, free and clear of all security interests, claims, liens, equities or other encumbrances (collectively, “Liens”). Upon transfer, assignment and delivery of such Sale Shares and payment therefor in accordance with the terms of this Agreement, the Purchaser will acquire good and marketable title to such Sale Shares, free and clear of any and all Liens.

3.3 Litigation. There is no legal proceeding pending or, to the knowledge of the Seller, threatened, against the Seller or to which the Seller is otherwise a party relating to this Agreement or the transactions contemplated hereby.

3.4 No Conflicts. The execution and delivery of this Agreement and the sale and delivery of such Seller’s Sale Shares by the Seller and the consummation of the transactions contemplated herein and compliance by the Seller with its obligations hereunder do not, whether with or without the giving of notice or passage of time or both, conflict with or constitute a breach of, or default under, or result in the creation or imposition of any tax, lien, charge or encumbrance upon such Sale Shares or any property or assets of the Seller pursuant to any contract, indenture, mortgage, deed of trust, loan or credit agreement, note, license, lease or any other agreement or instrument to which the Seller is a party or by which the Seller is bound, or to which any of the property or assets of the Seller is subject, nor does such action result in any violation of the provisions of Organizational Documents of the Seller or any applicable treaty, law, statute, rule, regulation, judgment, order, writ or decree of any government, government instrumentality or court, domestic or foreign, having jurisdiction over the Seller or any of its property or assets.

3.5 No Consents. No filing with, or consent, approval, authorization, order, registration, qualification or decree of, any court or governmental authority or agency, of any country or nation, is necessary or required for the performance by the Seller of its obligations hereunder, or in connection with the sale and delivery of such Seller’s Sale Shares hereunder or the consummation of the transactions contemplated by this Agreement.

4. CONDITIONS PRECEDENT

4.1 The obligations of each Seller under Sections 1.1 and 1.2(b)(i) hereof are subject to the following conditions:

(a) All of the representations and warranties of the Purchaser contained in Section 2 shall be true and correct in all material respects (other than the Purchaser’s representations and warranties set forth in Section 2.1 which shall be true and correct in all respects) on and as of the date hereof and on the Closing Date, and

(b) The Purchaser has performed all of its obligations contained in this Agreement (to be performed prior to the Closing) in all material respects.

4.2 The obligations of the Purchaser under Sections 1.1 and 1.2(b)(ii) hereof are subject to the following conditions:

(a) All of the representations and warranties of each Seller contained in Section 3 shall be true and correct in all material respects (other than the representations and warranties set forth in Sections 3.1 and 3.2 which shall be true and correct in all respects) on and as of the date hereof and on the Closing Date, and

(b) Each Seller has performed all of its obligations contained in this Agreement (to be performed prior to the Closing) in all material respects.

5. COVENANTS

5.1 Notification. Each party to this Agreement will notify the other parties as soon as reasonably practicable (but in any event prior to the Closing Date) in the event it comes to such party’s attention that any of such party’s representations or warranties set out in this Agreement has ceased to be true and accurate in any material respect or there has been any breach by such party of any of its agreements contained in this Agreement or any failure by such party to comply with any of its obligations contained in this Agreement.

5.2 Price Adjustment.

(a) If within 1 year of the Closing Date, (i) a Take-Private Transaction is consummated, (ii) the Take-Private Per Share Consideration is greater than the Per Share Consideration and (iii) the Purchaser is a member of the consortium acquiring control of the Issuer in the Take-Private Transaction, the Purchaser shall deliver, or cause to be delivered, within 7 Business Days after the consummation of the Take-Private Transaction, a wire transfer of immediately available funds into an account designated by each Seller in an amount for such Seller (the “Make-whole Payment”) equal to the product of (A) number of such Seller’s Sale Shares multiplied by (B) the result of (1) the Take-Private Per Share Consideration minus (2) the Per Share Consideration.

(b) If within 1 year of the Closing Date, (i) a Take-Private Transaction is consummated, (ii) the Take-Private Per Share Consideration is greater than the Per Share Consideration and (iii) the Purchaser is not a member of the consortium acquiring control of the Issuer in the Take-Private Transaction solely due to the Purchaser’s own decision or election not to participate in the Take-Private Transaction without the Sellers’ written consent, the Purchaser shall deliver, or cause to be delivered, within 7 Business Days after the consummation of the Take-Private Transaction, a wire transfer of immediately available funds into an account designated by each Seller the Make-whole Payment as calculated in accordance with Section 5.2(a) above.

5.3 Conversion to ADS. From and after the Consortium Agreement is terminated with respect to the Purchaser, at the request of the Purchaser, each Seller shall use reasonable efforts to cause the Issuer to cause, and cooperate with, the Depositary (as defined in the Deposit Agreement) to establish procedures enabling the deposit of such Seller’s Sale Shares with the Depositary in order to enable the Purchaser to hold its ownership interests in such Sale Shares in the form of ADSs in accordance with Section 3 of the Deposit Agreement.

5.4 Indemnification. Each Seller shall keep the Purchaser indemnified against any losses, liabilities, costs, claims, actions and demands (including any properly incurred expenses arising in connection therewith) which the Purchaser may incur, or which may be made against the Purchaser as a result of or in relation to any breach by such Seller of this Agreement or any misrepresentation in or breach of any of such Seller’s representations and warranties and such Seller shall reimburse the Purchaser for all properly incurred costs, charges and expenses which the Purchaser may pay or incur in connection with investigating, disputing or defending any such loss, liability, action or claim; provided that the representations and warranties of each Seller shall survive the Closing for 12 months.

5.5 SEC Filings. Each Party agrees, confirms and undertakes that promptly upon the signing of this Agreement and in any event within the time required by applicable law, such Party shall file a Form 13D (or an amendment to such Party’s existing Form 13D, as applicable) to announce the entry into this Agreement.

5.6 Dividends. The Parties agree that any Post-Closing Dividends are for the account of the Purchaser. If any Post-Closing Dividend is paid to a Seller, such Seller shall pay (within 7 Business Days of the receipt of the Post-Closing Dividend by the Seller) such Post-Closing Dividend to the Purchaser by a wire transfer of immediately available funds into an account designated by the Purchaser; provided that at the time of such transfer of the Post-Closing Dividend from the Seller to the Purchaser, the Purchaser shall have paid the Purchase Price in full (together with interest, if any, accrued thereon in accordance with Section 5.7).

5.7 Interest. Starting on the day after the Closing Date, for every calendar day after the Closing Date, simple interest will accrue at a rate equal to 5% per annum in excess of the prime rate published by Citibank N.A. from time to time, calculated based on a 360-day year on any amounts required to be paid under this Agreement by the Purchaser to a Seller at the Closing, but not actually paid by the Purchaser to the Seller on the Closing Date.

5.8 [Intentionally omitted]

5.9 Consortium. Each of the Sellers shall use its reasonable best efforts to cause the Purchaser to become a member of the consortium under the Consortium Agreement as soon as practically after the Closing.

6. MISCELLANEOUS

6.1 Certain Definitions. For purposes of this Agreement, the following terms shall have the meanings specified in this Section 6.1:

“ADS” means the American Depositary Shares of the Issuer, each representing two Class A Ordinary Shares.

“ADS/Share Ratio” means such portion of ADSs that is equivalent to one Class A Ordinary Share if one ADS does not represent one Class A Ordinary Share, which for the avoidance of doubt is ½ as of the date hereof.

“Business Day” means any day except any Saturday, any Sunday, any day that is a federal legal holiday in the United States of America, a public holiday in the People’s Republic of China, Hong Kong, or the Cayman Islands, or any day on which banking institutions in the State of New York, the People’s Republic of China, Hong Kong, or the Cayman Islands are authorized or required by law or other governmental action to close.

“Class A Ordinary Shares” means ordinary shares, US$0.01 par value, of the Issuer.

“Consortium Agreement” means the Consortium Agreement, dated as of January 27, 2014, by and between Shanda Interactive Entertainment Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands and PV, to which several entities joined as party after the signing date thereof.

“Deposit Agreement” means the Deposit Agreement, dated as of September 24, 2009 by and among (i) the Issuer, (ii) JPMorgan Chase Bank, N.A. and (iii) all holders and beneficial owners of ADSs issued thereunder.

“Exchange Act” means the Securities Exchange Act of 1934 of the United States of America, as amended.

“Issuer” means Shanda Games Limited, a Cayman Islands exempted company.

“knowledge of” means, with respect to any person, the actual knowledge and constructive knowledge of such person.

“Organizational Documents” means, with respect to any person, the memorandum of association, articles of association, articles of incorporation, certificate of incorporation, bylaws and any charter, partnership agreements, joint venture agreements or other organizational documents of such entity and any amendments thereto.

“Per Share Consideration” means US$3.45.

“Post-Closing Dividend” means any dividend with respect to the Shares for which the record date is on or after the date of the Closing Date.

“Purchase Price” means, with respect to each Seller, the aggregate purchase price set forth below such Seller’s name on Schedule I hereto, which is equal to the Per Share Consideration multiplied by the number of Sale Shares set forth below such Seller’s name on Schedule I hereto.

“Securities Act” means the Securities Act of 1933 of the United States of America, as amended.

“Take-Private Per Share Consideration” means the consideration paid per ADS multiplied by the ADS/Share Ratio in a Take-Private Transaction.

“Take-Private Transaction” means an acquisition transaction pursuant to which the ADSs (and the underlying Class A Ordinary Shares) would be delisted from the NASDAQ Stock Market and deregistered under the Exchange Act.

6.2 Termination. This Agreement may be terminated prior to the Closing as follows:

(a) at the joint election of the Sellers on or after October 15, 2014 (the “Long Stop Date”), if the Closing shall not have occurred by the close of business on such date as a direct result of the breach by the Purchaser of its obligations hereunder; provided that the Purchaser shall remain liable for its breach after such termination;

(b) at the election of the Purchaser on or after the Long Stop Date, if the Closing shall not have occurred by the close of business on such date as a direct result of the breach by either of the Sellers of its obligations hereunder; provided that such Seller shall remain liable for its breach after such termination; or

(c) by mutual written consent of the Sellers and Purchaser.

6.3 Further Assurances. Each Seller and the Purchaser agree to execute and deliver such other documents or agreements and to take such other action as may be necessary or desirable for the implementation of this Agreement and the consummation of the transactions contemplated hereby.

6.4 Complete Agreement; Amendments; Waivers. This Agreement constitutes the complete agreement between the parties with respect to the subject matter hereof, supercedes any previous agreement or understanding between them relating hereto and may not be modified, altered or amended except as provided herein. This Agreement can be amended, supplemented or changed, and any provision hereof can be waived, only by written instrument making specific reference to this Agreement signed by the party against whom enforcement of any such amendment, supplement, modification or waiver is sought. No action taken pursuant to this Agreement shall be deemed to constitute a waiver by the party taking such action or compliance with any representation, warranty, covenant or agreement contained herein. The waiver by any party hereto of a breach of any provision of this Agreement shall not operate or be construed as a further or continuing waiver of such breach or as a waiver of any other or subsequent breach. No failure on the part of any party to exercise, and no delay in exercising, any right, power or remedy hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of such right, power or remedy by such party preclude any other or further exercise thereof or the exercise of any other right, power or remedy. All remedies hereunder are cumulative and are not exclusive of any other remedies provided by law.

6.5 Expenses. Each party hereto shall bear its own expenses incurred in connection with the negotiation and execution of this Agreement and each other document and instrument contemplated by this Agreement and the consummation of the transactions contemplated hereby and thereby.

6.6 Severability. If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by any rule of law or public policy, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic and legal substance of the transactions contemplated hereby is not affected in any manner materially adverse to any party. Upon such determination that any term or other provision is invalid, illegal or incapable of being enforced, the parties shall negotiate in good faith to modify this Agreement so as to effect the original intent of the parties as closely as possible in a mutually acceptable manner in order that the transactions be consummated as originally contemplated to the fullest extent possible.

6.7 Binding Effect; Assignment. This Agreement shall be binding upon and inure to the benefit of the parties and their respective heirs, successors and permitted assigns. Nothing in this Agreement shall create or be deemed to create any third party beneficiary rights in any person or entity not a party to this Agreement. No assignment of this Agreement or of any rights or obligations hereunder may be made by any party hereto (by operation of law or otherwise) without the prior written consent of the other parties hereto and any attempted assignment without the required consent shall be void; provided that, notwithstanding the foregoing, (i) Shanghai Buyout Fund L.P. (上海并购股权投资基金合伙企业(有限合伙)) may assign to an affiliate formed under the laws of the Cayman Islands, the British Virgin Islands or Hong Kong all of its rights, remedies, obligations or liabilities arising hereunder or by reason hereof, in which case such assignee shall execute and deliver to the Sellers an agreement to be bound by the terms of this Agreement and (ii) in connection with any assignment to such affiliate referenced in clause (i), Shanghai Buyout Fund L.P. (上海并购股权投资基金合伙企业(有限合伙)) hereby fully and unconditionally guarantees to the Seller, as primary obligor and not merely as a surety, the prompt and full discharge of all of the obligations of such affiliate as the “Purchaser” under this Agreement.

6.8 Governing Law. This Agreement shall be governed by, and construed and enforced in accordance with, the laws of the State of New York regardless of the laws that might otherwise govern under applicable principles of conflicts of laws thereof.

6.9 Dispute Resolution.

(a) Subject to Section 6.9(b), any disputes, actions and proceedings against any Party or arising out of or in any way relating to this Agreement shall be submitted to the Hong Kong International Arbitration Centre (“HKIAC”) and resolved in accordance with the Arbitration Rules of HKIAC in force at the relevant time and as may be amended by this Section 6.9. The place of arbitration shall be Hong Kong. The official language of the arbitration shall be English and the tribunal shall consist of three arbitrators (each, an “Arbitrator”). The claimant(s), irrespective of number, shall nominate jointly one Arbitrator; the respondent(s), irrespective of number, shall nominate jointly one Arbitrator; and a third Arbitrator will be nominated jointly by the first two Arbitrators and shall serve as chairman of the Tribunal. In the event the claimant(s) or respondent(s) or the first two Arbitrators shall fail to nominate or agree the joint nomination of an Arbitrator or the third Arbitrator within the time limits specified by the Rules, such Arbitrator shall be appointed promptly by the HKIAC. The Tribunal shall have no authority to award punitive or other punitive-type damages. The award of the arbitration tribunal shall be final and binding upon the disputing parties. Any party to an award may apply to any court of competent jurisdiction for enforcement of such award and, for purposes of the enforcement of such award, the Parties irrevocably and unconditionally submit to the jurisdiction of any court of competent jurisdiction and waive any defenses to such enforcement based on lack of personal jurisdiction or inconvenient forum.

(b) Notwithstanding the foregoing, the Parties hereby consent to and agree that in addition to any recourse to arbitration as set out in this Section 6.9, any Party may, to the extent permitted under the laws of the jurisdiction where application is made, seek an interim injunction from a court or other authority with competent jurisdiction and, notwithstanding that this Agreement is governed by the laws of the State of New York, a court or authority hearing an application for injunctive relief may apply the procedural law of the jurisdiction where the court or other authority is located in determining whether to grant the interim injunction. For the avoidance of doubt, this Section 6.9(b) is only applicable to the seeking of interim injunctions and does not restrict the application of Section 6.9(a) in any way.

(c) Each Party acknowledges and agrees that the other Parties would be irreparably injured by a breach of this Agreement by it and that money damages alone are an inadequate remedy for actual or threatened breach of this Agreement. Accordingly, each Party shall be entitled to bring an action for specific performance and/or injunctive or other equitable relief (without posting a bond or other security) to enforce or prevent any violations of any provision of this Agreement, in addition to all other rights and remedies available at law or in equity to such Party, including the right to claim money damages for breach of any provision of this Agreement.

6.10 Notices. All notices and other communications under this Agreement shall be in writing and shall be deemed given when delivered personally, by international courier or by e-mail (with confirmation of receipt) to the parties at the following addresses (or to such other address as a party may have specified by notice given to the other party pursuant to this provision):

If to PV, to:

Primavera Capital Group

28/F, 28 Hennessy Road

Wanchai

Hong Kong

Attention: Jie Lian, Lawrence Wang

With a copy to (which shall not constitute notice):

Latham & Watkins

18/F, One Exchange Square

8 Connaught Place

Attention: Tim Gardner

If to PW, to:

Perfect World Co., Ltd.

Tower 306, 86 Beiyuan Road

Chaoyang District

Beijing 100101

Peoples Republic of China

Attention: Kelvin Wing Kee Lau

With a copy to (which shall not constitute notice):

Orrick, Herrington & Sutcliffe LLP

47/F, Park Place

1601 Nanjing Road West

Shanghai 200040

Attention: Jeffrey Sun

If to the Purchaser, to:

Shanghai Buyout Fund L.P. (上海并购股权投资基金合伙企业(有限合伙))

Room 2802, No. 689 Guangdong Road,

Huangpu District,

Shanghai, China

Attention: Jing Liu

6.11 Survival. All of the covenants and agreements of the parties in this Agreement shall survive the Closing.

6.12 Section and Other Headings. The section and other headings contained in this Agreement are for reference purposes only and shall not affect the meaning or interpretation of this Agreement.

6.13 Counterparts. This Agreement may be executed and delivered (including by facsimile transmission, e-mail of .pdf version or delivery of photographic copy via text message or WeChat) in one or more counterparts, all of which when executed and delivered shall be considered one and the same agreement.

[signature page follows]

IN WITNESS WHEREOF, each of the parties hereto has executed this Agreement as of the day and year first above written.

|

|

SELLERS: |

|

|

|

|

|

|

|

|

PRIMAVERA CAPITAL (CAYMAN) FUND I L.P. |

|

|

|

|

|

By: |

PRIMAVERA CAPITAL (CAYMAN) |

|

|

|

GP1 L.P., its General Partner |

|

|

|

|

|

By: |

PRIMAVERA (CAYMAN) GP1 LTD, its General Partner |

|

|

|

|

|

|

|

|

By: |

/s/ Jie Lian |

|

|

|

Name: |

Jie Lian |

|

|

|

Title: |

Partner |

|

|

|

|

|

|

|

|

PERFECT WORLD CO., LTD. |

|

|

|

|

|

|

|

|

By: |

/s/ Robert Hong Xiao |

|

|

|

Name: |

Robert Hong Xiao |

|

|

|

Title: |

Chief Executive Officer |

[Signature Page of Share Purchase Agreement]

IN WITNESS WHEREOF, each of the parties hereto has executed this Agreement as of the day and year first above written.

|

|

PURCHASER: |

|

|

|

|

|

SHANGHAI BUYOUT FUND L.P. (上海并购股权投资基金合伙企业(有限合伙)) |

|

|

|

|

|

|

|

|

BY: HAITONG M&A CAPITAL MANAGEMENT (SHANGHAI) CO., LTD. (海通并购资本管理(上海)有限公司), its general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Yanhua Yang |

|

|

|

Name: |

Yanhua Yang |

|

|

|

Title: |

Chairman of the Board |

[Signature Page of Share Purchase Agreement]

Schedule 1

PV

Sale Shares: 28,959,276 Class A Ordinary Shares

Purchase Price: $99,909,502.20

PW

Sale Shares: 30,326,005 Class A Ordinary Shares

Purchase Price: $104,624,717.25

Exhibit 7.06

WITHDRAWAL NOTICE

dated as of September 1, 2014

Shanda Interactive Entertainment Limited

8 Stevens Road

Singapore 257819

Attention: Ms. Han Li

Primavera Capital Group

28/F, 28 Hennessy Road

Wanchai

Hong Kong

Attention: Jie Lian, Lawrence Wang

Re: Withdrawal from the Consortium

Reference is made to the Consortium Agreement (as amended and supplemented, the “Agreement”) dated as of January 27, 2014 by and between Shanda Interactive Entertainment Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands (“Shanda Interactive”) and Primavera Capital (Cayman) Fund I L.P., a limited partnership organized under the laws of the Cayman Islands (“Primavera”), to which several entities joined as party after the signing date thereof. Capitalized terms used but not defined herein shall have the meanings ascribed to them under the Agreement.

1. Each of Perfect World Co., Ltd., a company limited by shares incorporated and existing under the laws of the Cayman Islands (“Perfect World”), FV Investment Holdings, a company limited by shares incorporated and existing under the laws of the Cayman Islands (“FV Investment”), and CAP IV Engagement Limited, a company limited by shares incorporated and existing under the laws of Cayman Islands (“CAP IV”, together with Perfect World and FV Investment, the “Withdrawing Parties”) hereby withdraws from the Consortium. The withdrawal by the Withdrawing Parties from the Consortium (the “Withdrawal”) will become effective upon the counter-signing of this Withdrawal Notice by each of Shanda Interactive and Primavera (together, the “Remaining Parties”).

2. Upon the effectiveness of the Withdrawal, each Withdrawing Party shall cease to be a party to the Agreement and shall not be liable to any other Withdrawing Party or any Remaining Party under or in relation to the Agreement, whether in respect of actions taken by such Withdrawing Party prior to, on or after the date of this Withdrawal Notice; provided that the provisions of Section 6.2 (Confidentiality) of the Agreement shall remain in full force and effect and continue to bind the Withdrawing Parties.

3. Upon the effectiveness of the Withdrawal, each Remaining Party shall cease to be liable to any Withdrawing Party under or in relation to the Agreement, whether in respect of actions taken by such Remaining Party prior to, on or after the date of this Withdrawal Notice; provided that (i) the provisions of Section 6.2 (Confidentiality) of the Agreement shall remain in full force and effect and continue to bind the Remaining Parties and (ii) the Remaining Parties shall pay, on behalf of the Withdrawing Party, the reasonable fees, expenses and disbursements of advisors (including, for the avoidance of doubt, Clifford Chance, Commerce and Finance Law Offices, KPMG, Latham & Watkins, McKinsey & Company and Shin & Kim) incurred by the Withdrawing Party on behalf of and for the benefit of the Consortium between January 27, 2014 and the date hereof in connection with the Transaction and such fees, expenses and disbursements shall be deemed Consortium Transaction Expenses and be payable by the Remaining Parties upon consummation of the Transaction or at the time of termination of the Agreement, whichever comes earlier.

4. In consideration of the covenants, agreements and undertakings of the parties under this Withdrawal Notice, upon the effectiveness of this Withdrawal Notice, except for obligations remaining after the effectiveness of the Withdrawal as expressly stated herein, each Withdrawing Party, on behalf of itself and its present and former parents, subsidiaries, affiliates, officers, directors, shareholders, members, successors and assigns (collectively, “Withdrawing Party Releasors”) hereby releases, waives and forever discharges each Remaining Party and each of their respective present and former parents, subsidiaries, affiliates, employees, officers, directors, shareholders, members, agents, representatives, successors and assigns (collectively, “Remaining Party Releasees”) of and from any and all actions, causes of action, suits, losses, liabilities, rights, obligations, costs, expenses, claims, and demands, of every kind and nature whatsoever, whether now known or unknown, foreseen or unforeseen, matured or unmatured (collectively, “Claims”), which any of such Withdrawing Party Releasors ever had, now have, or may have against any of such Remaining Party Releasees by reason of any matter, cause, or thing whatsoever arising out of or relating to the Agreement.

5. In consideration of the covenants, agreements and undertakings of the parties under this Withdrawal Notice, upon the effectiveness of this Withdrawal Notice, except for obligations remaining after the effectiveness of the Withdrawal as expressly stated herein, each Remaining Party, on behalf of itself and its present and former parents, subsidiaries, affiliates, officers, directors, shareholders, members, successors and assigns (collectively, “Remaining Party Releasors”) hereby releases, waives and forever discharges each Withdrawing Party and each of their respective present and former parents, subsidiaries, affiliates, employees, officers, directors, shareholders, members, agents, representatives, successors and assigns (collectively, “Withdrawing Party Releasees”) of and from any and all Claims which any of such Remaining Party Releasors ever had, now have, or may have against any of such Withdrawing Party Releasees by reason of any matter, cause, or thing whatsoever arising out of or relating to the Agreement.

6. This Withdrawal Notice shall be governed by, and construed and enforced in accordance with, the laws of the State of New York regardless of the laws that might otherwise govern under applicable principles of conflicts of laws thereof.

7. This Withdrawal Notice may be executed and delivered (including by facsimile transmission, e-mail of .pdf version or delivery of photographic copy via text message or WeChat) in one or more counterparts, all of which when executed and delivered shall be considered one and the same agreement

[Signature Page follows]

2

IN WITNESS WHEREOF, the parties hereto have caused this withdrawal notice to be executed as of the date first written above by their respective duly authorized officers.

|

|

PERFECT WORLD CO., LTD. |

|

|

|

|

|

|

|

|

By: |

/s/ Robert Hong Xiao |

|

|

|

Name: Robert Hong Xiao |

|

|

|

Title: Chief Executive Officer |

[Signature Page to Withdrawal Notice]

IN WITNESS WHEREOF, the parties hereto have caused this withdrawal notice to be executed as of the date first written above by their respective duly authorized officers.

|

|

FV INVESTMENT HOLDINGS |

|

|

|

|

|

|

|

|

By: |

/s/ Tang Kui |

|

|

|

Name: Tang Kui |

|

|

|

Title: Director |

[Signature Page to Withdrawal Notice]

IN WITNESS WHEREOF, the parties hereto have caused this withdrawal notice to be executed as of the date first written above by their respective duly authorized officers.

|

|

CAP IV ENGAGEMENT LIMITED |

|

|

|

|

|

|

|

|

By: |

/s/ Eric Zhang |

|

|

|

Name: Eric Zhang |

|

|

|

Title: Managing Director |

[Signature Page to Withdrawal Notice]

Acknowledged and agreed:

|

|

SHANDA INTERACTIVE ENTERTAINMENT LIMITED |

|

|

|

|

|

|

|

|

By: |

/s/ Tianqiao Chen |

|

|

|

Name: Tianqiao Chen |

|

|

|

Title: Director |

|

|

|

|

|

|

|

|

Date: September 1, 2014 |

[Signature Page to Withdrawal Notice]

Acknowledged and agreed:

|

|

PRIMAVERA CAPITAL (CAYMAN) FUND I L.P. |

|

|

|

|

|

|

|

|

BY: PRIMAVERA CAPITAL (CAYMAN) GP1 L.P., ITS GENERAL PARTNER |

|

|

|

|

|

|

|

|

BY: PRIMAVERA (CAYMAN) GP1 LTD, ITS GENERAL PARTNER |

|

|

|

|

|

|

|

|

By: |

/s/ Lawrence Wang |

|

|

|

Name: Lawrence Wang |

|

|

|

Title: Authorized Signatory |

|

|

|

|

|

|

Date: September 1, 2014 |

[Signature Page to Withdrawal Notice]

Exhibit 7.07

CONSENT AND RELEASE

dated as of September 1, 2014

Reference is made to (i) that certain share purchase agreement dated as of January 27, 2014 (the “PV Share Purchase Agreement”) by and between Shanda SDG Investment Limited (the “Seller”) and Primavera Capital (Cayman) Fund I L.P. (“PV”) and (ii) that certain share purchase agreement dated as of April 18, 2014 (the “PW Share Purchase Agreement”) by and between the Seller and Perfect World Co., Ltd. (“PW”).

Whereas, pursuant to the PV Share Purchase Agreement, Mage Capital Limited, a British Virgin Islands corporation and an indirect wholly-owned subsidiary of PV, purchased 28,959,276 Class A ordinary shares of Shanda Games Limited (the “PV Sale Shares”) from the Seller.

Whereas, pursuant to the PW Share Purchase Agreement, PW purchased 30,326,005 Class A ordinary shares of Shanda Games Limited (the “PW Sale Shares”) from the Seller.

Whereas, PV, PW and Shanghai Buyout Fund L.P. (上海并购股权投资基金合伙企业(有限合伙)), a limited partnership formed under the laws of the People’s Republic of China entered into a share purchase agreement (the “Haitong SPA”) dated as of September 1, 2014, pursuant to which PV intends to sell the PV Sale Shares, and PW intends to sell the PW Sale Shares, to Shanghai Buyout Fund L.P.

NOW, THEREFORE, in consideration of the premises set forth above and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Effective upon consummation of the transactions contemplated by the Haitong SPA, (i) all remaining obligations, whether actual or contingent, of PV and its affiliates under the PV Share Purchase Agreement, and PW and its affiliates under the PW Share Purchase Agreement, as applicable, shall automatically terminate; and (ii) all remaining obligations, whether actual or contingent, of the Seller and its affiliates under the PV Share Purchase Agreement and the PW Share Purchase Agreement shall automatically terminate.

2. In consideration of the covenants, agreements and undertakings of the parties under this Consent and Release, effective upon the consummation of the transactions contemplated by the Haitong SPA, the Seller, on behalf of itself and its present and former parents, subsidiaries, affiliates, officers, directors, shareholders, members, successors and assigns (collectively, “Seller Releasors”) hereby releases, waives and forever discharges PV, PW and each of their respective present and former parents, subsidiaries, affiliates, employees, officers, directors, shareholders, members, agents, representatives, successors and assigns (collectively, “ PV/PW Releasees”) of and from any and all actions, causes of action, suits, losses, liabilities, rights, obligations, costs, expenses, claims, and demands, of every kind and nature whatsoever, whether now known or unknown, foreseen or unforeseen, matured or unmatured (collectively, “Claims”), which any of such Seller Releasors ever had, now have, or may have against any of such PV/PW Releasees by reason of any matter, cause, or thing whatsoever arising out of or relating to the PV Share Purchase Agreement or the PW Share Purchase Agreement.

3. In consideration of the covenants, agreements and undertakings of the parties under this Consent and Release, effective upon the consummation of the transactions contemplated by the Haitong SPA, PV, on behalf of itself and its present and former parents, subsidiaries, affiliates, officers, directors, shareholders, members, successors and assigns (collectively, “PV Releasors”) hereby releases, waives and forever discharges the Seller and each of its present and former parents, subsidiaries, affiliates, employees, officers, directors, shareholders, members, agents, representatives, successors and assigns (collectively, “Seller Releasees”) of and from any and all Claims which any of such PV Releasors ever had, now have, or may have against any of such Seller Releasees by reason of any matter, cause, or thing whatsoever arising out of or relating to the PV Share Purchase Agreement.

4. In consideration of the covenants, agreements and undertakings of the parties under this Consent and Release, effective upon the consummation of the transactions contemplated by the Haitong SPA, PW, on behalf of itself and its present and former parents, subsidiaries, affiliates, officers, directors, shareholders, members, successors and assigns (collectively, “PW Releasors”) hereby releases, waives and forever discharges the Seller Releasees of and from any and all Claims which any of such PW Releasors ever had, now have, or may have against any of such Seller Releasees by reason of any matter, cause, or thing whatsoever arising out of or relating to the PW Share Purchase Agreement.

5. This Consent and Release shall be governed by, and construed and enforced in accordance with, the laws of the State of New York regardless of the laws that might otherwise govern under applicable principles of conflicts of laws thereof.

6. This Consent and Release may be executed and delivered (including by facsimile transmission, e-mail of .pdf version or delivery of photographic copy via text message or WeChat) in one or more counterparts, all of which when executed and delivered shall be considered one and the same agreement.

[Signature Page follows]

2

IN WITNESS WHEREOF, the parties hereto have caused this consent and release to be executed as of the date first written above by their respective duly authorized officers.

|

|

SHANDA SDG INVESTMENT LIMITED |

|

|

|

|

|

|

|

|

By: |

/s/ Tianqiao Chen |

|

|

|

Name: Tianqiao Chen |

|

|

|

Title: Director |

IN WITNESS WHEREOF, the parties hereto have caused this consent and release to be executed as of the date first written above by their respective duly authorized officers.

|

|

PRIMAVERA CAPITAL (CAYMAN) FUND I L.P. |

|

|

|

|

|

|

|

|

BY: PRIMAVERA CAPITAL (CAYMAN) GP1 L.P., ITS GENERAL PARTNER |

|

|

|

|

|

|

|

|

BY: PRIMAVERA (CAYMAN) GP1 LTD, ITS GENERAL PARTNER |

|

|

|

|

|

|

|

|

By: |

/s/ Lawrence Wang |

|

|

|

Name: Lawrence Wang |

|

|

|

Title: authorized signatory |

IN WITNESS WHEREOF, the parties hereto have caused this consent and release to be executed as of the date first written above by their respective duly authorized officers.

|

|

PERFECT WORLD CO., LTD. |

|

|

|

|

|

|

|

|

By: |

/s/ Robert Hong Xiao |

|

|

|

Name: Robert Hong Xiao |

|

|

|

Title: Chief Executive Officer |

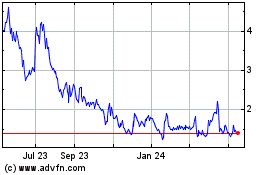

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Mar 2024 to Apr 2024

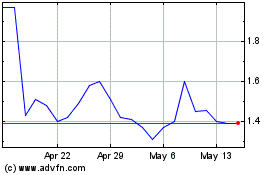

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Apr 2023 to Apr 2024