SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 2, 2014

XPO

LOGISTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-32172 |

|

03-0450326 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

Five Greenwich Office Park

Greenwich, CT |

|

06831 |

(Address of principal

executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (855) 976-4636

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.01 Completion of Acquisition or Disposition of Assets.

On September 2, 2014 (the “Closing Date”), XPO Logistics, Inc., a Delaware Corporation (“XPO”),

completed the acquisition of New Breed Holding Company, a Delaware corporation (“New Breed”), pursuant to the terms of the Agreement and Plan of Merger, dated as of July 29, 2014 (the “Merger Agreement”), by

and among XPO, New Breed, Nexus Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of XPO (“Merger Sub”), and NB Representative, LLC, solely in its capacity as the representative for New Breed’s stockholders.

Under the terms of the Merger Agreement, Merger Sub merged with and into New Breed (the “Merger”) with New Breed surviving the Merger as a wholly owned subsidiary of XPO. The Merger was effective upon filing of a certificate of

merger with the Secretary of State of the State of Delaware on September 2, 2014 (the “Effective Time”).

At the

Effective Time, pursuant to the terms of the Merger Agreement, XPO paid an aggregate consideration of $615 million in cash (the “Closing Date Purchase Price”) to acquire New Breed on a

cash-free, debt-free basis, adjusted for an agreed-upon working capital balance as of the Closing Date.

The Closing Date Purchase Price was funded in part by the funds from XPO’s previously announced private placement of $500 million

aggregate principal amount of 7.875% senior notes due September 1, 2019 (the “Notes”). The private placement of the Notes was completed on August 25, 2014, and the proceeds had been held in escrow pending the completion of the

Merger.

This description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the

Merger Agreement, which is incorporated by reference to Exhibit 2.1.

Item 3.02 Unregistered Sales of Equity Securities

At the Effective Time, Louis DeJoy, Chief Executive Officer of New Breed, together with entities affiliated with Mr. DeJoy, purchased $30

million of XPO common stock at a per share purchase price in cash equal to (1) the closing price of XPO’s common stock on the New York Stock Exchange on July 29, 2014 with respect to 50% of such purchase and (2) the closing price

of XPO’s common stock on the New York Stock Exchange on the trading day immediately preceding the Closing Date with respect to the remaining 50% of such purchase. The XPO common stock issued to Mr. DeJoy and his affiliated entities was

issued pursuant to Section 4(a)(2) of the U.S. Securities Act of 1933, as amended, and Regulation D promulgated by the U.S. Securities and Exchange Commission thereunder.

Item 7.01 Regulation FD Disclosure.

On September 2, 2014, XPO issued a press release announcing the completion of the Merger. The full text of the press release is attached

hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

| (a) |

Financial Statements of Businesses Acquired. |

| (b) |

Pro Forma Financial Information. |

The financial statements and pro forma financial information

required to be filed under Item 9.01 of this Current Report on Form 8-K will be filed by amendment to this Current Report on Form 8-K no later than 75 days after the Closing Date.

|

|

|

| Exhibit |

|

Description of Document |

|

|

| 2.1 |

|

Agreement and Plan of Merger, dated as of July 29, 2014, by and among New Breed Holding Company, XPO Logistics, Inc., Nexus Merger Sub, Inc. and NB Representative, LLC, in its capacity as the Representative (Incorporated by

reference to Exhibit 2.1 to XPO’s current report on Form 8-K filed with the SEC on July 30, 2014 (File No. 001-32172)) |

|

|

| 99.1 |

|

XPO Logistics, Inc. Press Release, dated September 2, 2014 |

Forward Looking Statements

This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking

terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,”

“will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” or the negative of these terms or other

comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception

of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity,

performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference

include, but are not limited to, those discussed in XPO’s filings with the SEC and the following: economic conditions generally; competition; XPO’s ability to find suitable acquisition candidates and execute its acquisition strategy; the

expected impact of the acquisition of New Breed, including the expected impact on XPO’s results of operations; XPO’s ability to raise debt and equity capital; XPO’s ability to attract and retain key employees to

execute its growth strategy, including New Breed’s management team; litigation, including litigation related to alleged misclassification of independent contractors; the ability to develop

and implement a suitable information technology system; the ability to maintain positive relationships with XPO’s networks of third-party transportation providers; the ability to retain XPO’s and acquired companies’ largest customers;

XPO’s ability to successfully integrate New Breed and other acquired businesses and realize anticipated synergies and cost savings; rail and other network changes; weather and other service disruptions; and governmental regulation. All

forward-looking statements set forth in this report are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated will be realized or, even if substantially realized, that they will

have the expected consequences to, or effects on, XPO or its businesses or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and XPO undertakes no obligation to update forward-looking statements to

reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events except to the extent required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

XPO LOGISTICS INC. |

|

|

|

| Date: September 2, 2014 |

|

|

|

/s/ Gordon E. Devens |

|

|

|

|

Gordon E. Devens Senior Vice President and

General Counsel |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description of Document |

|

|

| 2.1 |

|

Agreement and Plan of Merger, dated as of July 29, 2014, by and among New Breed Holding Company, XPO Logistics, Inc., Nexus Merger Sub, Inc. and NB Representative, LLC, in its capacity as the Representative (Incorporated by

reference to Exhibit 2.1 to XPO’s current report on Form 8-K filed with the SEC on July 30, 2014 (File No. 001-32172)) |

|

|

| 99.1 |

|

XPO Logistics, Inc. Press Release, dated September 2, 2014 |

Exhibit 99.1

XPO Logistics Completes Acquisition of New Breed

Becomes the preeminent U.S. provider of complex, technology-enabled contract

logistics for blue chip customers

Gains critical mass with total operations of 203 locations, 10,400 employees and

end-to-end supply chain solutions

Adds approximately $597 million of revenue and $77 million of adjusted EBITDA

to annual run rates

GREENWICH,

Conn. — September 2, 2014 — XPO Logistics, Inc. (NYSE: XPO) (“XPO” or the “company”) today announced that it has completed its previously announced acquisition of premium contract logistics provider New Breed

Holding Company (“New Breed”) for a cash purchase price of $615 million. The acquisition expands the company’s operations to 203 locations and approximately 10,400 employees.

The company financed the acquisition and related fees and expenses with the proceeds from its August 2014 private placement of $500 million of senior notes

and available cash on hand. Upon closing, New Breed’s former chief executive, Louis DeJoy, used $30 million of proceeds from the transaction to purchase restricted stock from the company. As chief executive of XPO’s new contract logistics

business, Mr. DeJoy will continue to lead the operations he has been instrumental in growing since 1983.

New Breed is the preeminent U.S. provider

of non-asset based, highly engineered contract logistics solutions for blue chip customers. Its services are concentrated in industries with high-growth outsourcing opportunities, including telecom/technology, retail/e-commerce, aerospace and

defense, medical equipment and select areas of manufacturing. The company plans to grow its contract logistics platform organically and through the addition of complementary acquisitions.

In July, the company raised its 2014 financial targets in light of the significant growth of its acquired operations and cold-starts, as reported, and its

agreement to acquire New Breed. The company expects to achieve an annual revenue run rate of more than $3 billion and an annual EBITDA run rate of at least $150 million by year-end.

Credit Suisse Securities (USA) LLC served as financial advisor to XPO Logistics, and Wachtell, Lipton, Rosen & Katz acted as legal advisor for the

transaction. Morgan Stanley & Co. LLC served as financial advisor to New Breed, and Willkie Farr & Gallagher LLP acted as legal advisor.

About XPO Logistics, Inc.

XPO Logistics, Inc. (NYSE: XPO) is one of the fastest growing providers of transportation logistics services in North America: the fourth largest freight

brokerage firm, the third largest provider of intermodal services, the largest provider of last mile logistics for heavy goods, the largest manager of expedited shipments, and the leading provider of premium contract logistics, with growing

positions in managed transportation, global freight forwarding and less-than-truckload brokerage. The company facilitates more than 31,000 deliveries a day throughout the U.S., Mexico and Canada.

XPO Logistics has 203 locations and approximately 10,400 employees. Its three business segments—freight brokerage, expedited transportation and freight

forwarding—utilize relationships with ground, rail, sea and air carriers to serve over 14,000 customers in the manufacturing, industrial, retail, commercial, life sciences and governmental sectors. The company has more than 3,600 trucks under

contract to its drayage, expedited and last mile subsidiaries, and has access to additional capacity through its relationships with over 27,000 other carriers. For more information: www.xpologistics.com

Forward-Looking Statements

This press release

includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact

are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,”

“could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,”

“goal,” “guidance,” “outlook,” “effort,” “target” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not

forward-looking.

These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our

perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties

and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking

statements. Factors that might cause or contribute to a material difference include, but are not limited to, those discussed in XPO’s filings with the SEC and the following: economic conditions generally; competition; XPO’s ability to find

suitable acquisition candidates and execute its acquisition strategy; the expected impact of the acquisition of New Breed, including the expected impact on XPO’s results of operations; the ability to realize anticipated synergies and cost

savings with respect to acquired companies; XPO’s ability to raise debt and equity capital; XPO’s ability to

attract and retain key employees to execute its growth strategy, including New Breed’s management team; litigation, including litigation related to alleged misclassification of independent

contractors; the ability to develop and implement a suitable information technology system; the ability to maintain positive relationships with XPO’s networks of third-party transportation providers; the ability to retain XPO’s and

acquired companies’ largest customers; XPO’s ability to successfully integrate New Breed and other acquired businesses; rail and other network changes; weather and other service disruptions; and governmental regulation. All forward-looking

statements set forth in this press release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated will be realized or, even if substantially realized, that they will have the

expected consequences to, or effects on, XPO or its businesses or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and XPO undertakes no obligation to update forward-looking statements to reflect

subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events except to the extent required by law.

Investor Contact:

XPO Logistics, Inc.

Tavio Headley, +1-203-930-1602

tavio.headley@xpologistics.com

Media Contacts:

Brunswick Group

Gemma Hart, Darren McDermott, +1-212-333-3810

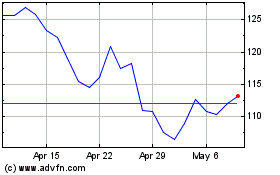

XPO (NYSE:XPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

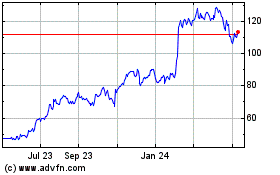

XPO (NYSE:XPO)

Historical Stock Chart

From Apr 2023 to Apr 2024