UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 26, 2014

SunPower Corporation

(Exact name of registrant as specified in its charter)

001-34166

(Commission File Number)

|

| |

Delaware | 94-3008969 |

(State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

77 Rio Robles, San Jose, California 95134

(Address of principal executive offices, with zip code)

(408) 240-5500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 1.01. | Entry into a Material Definitive Agreement. |

First Amendment to Revolving Credit Agreement

On August 26, 2014, SunPower Corporation (“SunPower”) and its subsidiaries SunPower Corporation, Systems; SunPower North America LLC; and SunPower Capital, LLC entered into the First Amendment (the “Amendment”) to the Revolving Credit Agreement with Credit Agricole Corporate and Investment Bank, as “Administrative Agent,” and the other lenders party thereto, dated as of July 3, 2013 (as amended from time to time, the “Agreement”).

The Amendment extends the maturity date of the Agreement from July 3, 2016 to August 26, 2019. The Amendment also revises the definition of “EBITDA,” which, among other things, is used in connection with calculating certain financial covenants in the Agreement. The revised definition of EBITDA includes amounts from certain utility and commercial transactions whereby SunPower or a subsidiary receives cash proceeds from the direct or indirect sale of a portion of its interests in a project entity to a non-affiliate (as defined in the Agreement), which proceeds might otherwise be required to be deferred under applicable U.S. GAAP rules.

|

| |

Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information provided in Item 1.01 of this report is incorporated herein by reference.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

|

| |

Exhibit No. | Description |

| |

10.1 | First Amendment to Revolving Credit Agreement, dated August 26, 2014, by and among SunPower Corporation, its subsidiaries SunPower Corporation, Systems; SunPower North America LLC; and SunPower Capital, LLC, and Credit Agricole Corporate and Investment Bank and the other lenders party thereto. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | |

| SUNPOWER CORPORATION |

| | |

August 28, 2014 | By: | /S/ CHARLES D. BOYNTON |

| Name: | Charles D. Boynton |

| Title: | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

| |

10.1 | First Amendment to Revolving Credit Agreement, dated August 26, 2014, by and among SunPower Corporation, its subsidiaries SunPower Corporation, Systems; SunPower North America LLC; and SunPower Capital, LLC, and Credit Agricole Corporate and Investment Bank and the other lenders party thereto. |

EXHIBIT 10.1

FIRST AMENDMENT TO REVOLVING CREDIT AGREEMENT

This First Amendment to Revolving Credit Agreement (this “Amendment”), is entered into as of August 26, 2014, by and among SunPower Corporation, a Delaware corporation (the “Borrower”), SunPower Corporation, Systems, a Delaware corporation, SunPower North America, LLC, a Delaware limited liability company, and SunPower Capital, LLC, a Delaware limited liability company (collectively, the “Subsidiary Guarantors” and together with the Borrower, the “Loan Parties”), Credit Agricole Corporate and Investment Bank, as administrative agent for the Lenders (in such capacity, the “Agent”), and the Lenders listed on the signature pages hereof (the “Lenders”).

RECITALS

A. The Borrower, the Agent and the Lenders are parties to that certain Revolving Credit Agreement, dated as of July 3, 2013 (as amended pursuant this Amendment and as it may be further amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”), pursuant to which the Lenders have provided a revolving credit facility to the Borrower. Each capitalized term used herein, that is not defined herein, shall have the meaning ascribed thereto in the Credit Agreement.

B. The Borrower has notified the Agent and the Lenders of its request to amend the Credit Agreement as set forth below in order to (i) extend the Revolving Credit Maturity Date, and (ii) amend the definition of EBITDA, but otherwise have the Credit Agreement remain in full force and effect.

C. In accordance with section 9.02(b) (Waivers; Amendments) of the Credit Agreement, the Borrower and all the Lenders have agreed to amend the Credit Agreement, in accordance with the terms, and subject to the conditions, set forth herein.

AGREEMENT

The parties to this Amendment, intending to be legally bound, hereby agree as follows:

1.Amendments to Credit Agreement. The Borrower and the Lenders agree to amend the Credit Agreement as set forth below:

a.Amendment of Defined Terms. The following defined terms in Section 1.01 (Defined Terms) of the Credit Agreement are hereby amended and restated in their entirety to read as follows:

““EBITDA” means, for any period, the total of the following calculated for the Borrower and its Subsidiaries (other than Project Finance Subsidiaries with obligations in respect of Project Indebtedness, excluding gains or losses attributable to noncontrolling interests) on a consolidated basis and without duplication, with each component thereof (other than clause (m)) determined in accordance with GAAP consistently applied by the Borrower for such period (except as otherwise required by GAAP): (a) consolidated net income attributable to stockholders; plus (b) any deduction for (or less any gain from) income or franchise taxes included in determining such consolidated net income; plus (c) interest expense deducted in determining such consolidated net income; plus (d) amortization and depreciation expense deducted in determining such consolidated net income; plus (e) any non-recurring charges and any non-cash charges resulting from application of GAAP insofar as GAAP requires a charge against earnings for the impairment of goodwill and other acquisition related charges to the extent deducted in determining such consolidated net income and not added back pursuant to another clause of this definition; plus (f) any non-cash expenses that arose in connection with the grant of equity or equity-based awards to officers, directors, employees and consultants of the Borrower and such Subsidiaries and were deducted in determining such consolidated net income; plus (g) non-cash restructuring charges; plus (h) non-cash charges related to negative mark-to-market valuation adjustments as may be required by GAAP from time to time; plus (i) non-cash charges arising from changes in GAAP occurring after the date hereof; less (j)(x) non-cash adjustments related to positive mark-to-market valuation adjustments as may be required by GAAP from time to time and (y) any non-recurring or extraordinary gains; less (k) other quarterly cash and non-cash adjustments that are deemed by the controller and chief financial officer of the Borrower not to be part of the normal course of business and not necessary to reflect the regular, ongoing operations of the Borrower and such Subsidiaries; plus (l) the aggregate cash proceeds received by Borrower and its Subsidiaries in connection with Sale and Lease Back Transactions permitted under Section 5.08 minus the aggregate cost value of building the projects sold pursuant to such Sale and Lease Back Transactions, plus (m) without duplication, (i) in case of any Utility and Commercial Transaction which results in the Borrower and its Subsidiaries owning, directly or indirectly, Equity Interests in a Transaction Subsidiary the accounts of which are not consolidated with (or will, pursuant to such Utility and Commercial Transaction, cease to be consolidated with) those of the Borrower in its consolidated financial statements in accordance with GAAP, the commercial value of such Transaction Subsidiary as of the date of such transaction (excluding the value of any Equity Interests retained by the Borrower or any of its Subsidiaries directly or indirectly in such Transaction Subsidiary as of such date), as adjusted to reflect the proportion of project capital sold, or (ii) in case of any Utility and Commercial Transaction which results in the Borrower and its Subsidiaries owning, directly or indirectly, Equity Interests in a Transaction Subsidiary the accounts of which will be consolidated with those of the Borrower in its consolidated financial statements in accordance with GAAP, the commercial value of such Transaction Subsidiary as of the date of such transaction multiplied by the percentage of the total Equity Interests in such Transaction Subsidiary sold pursuant to such transaction (it being understood and agreed that (1) any add-backs pursuant to this clause (m) shall be reasonably determined by the controller and the chief financial officer of the Borrower on a basis consistent with the methodology and

calculations set forth in the presentation materials provided to the Lenders prior to the First Amendment Effective Date and shall be described in reasonable detail in each applicable Compliance Certificate, (2) any add-back pursuant to this clause (m) shall be net of any prior add-backs pursuant to this clause (m) relating to the same Utility and Commercial Transaction, and (3) except for any adjustments and/or add-backs pursuant to clauses (m)(i) and (m)(ii) above, each Transaction Subsidiary and any Equity Interests retained (directly or indirectly) by the Borrower and its Subsidiaries therein shall be excluded from the calculation of EBITDA for all periods after the relevant Utility and Commercial Transaction). As used in this definition, “non-cash charge” shall mean that portion of any charge in respect of which no cash is paid during the applicable period (whether or not cash is paid with respect to such charge in a subsequent period).”

““Revolving Credit Maturity Date” means the date falling 5 years after the First Amendment Effective Date.”

b. New Defined Terms. The following defined terms are hereby added, in alphabetical order, to Section 1.01 (Defined Terms) of the Credit Agreement:

“First Amendment” means the First Amendment to Revolving Credit Agreement relating to this Agreement dated on or about August 26, 2014, by and amount the Borrower, the Agent and the Lenders listed on the signature pages thereof.

“First Amendment Effective Date” means the “Effective Date” under and as defined in the First Amendment.

“Transaction Subsidiary” means, in respect of any Utility and Commercial Transaction, the Project Finance Subsidiary or entity which, but for a sale of its equity interests effected pursuant to an earlier Utility and Commercial Transaction, would qualify as a Project Finance Subsidiary, subject to such Utility and Commercial Transaction.

“Utility and Commercial Transaction” means any transaction or series of transactions consummated after the First Amendment Effective Date pursuant to which the Borrower or any of its Subsidiaries receives cash proceeds from the sale of a portion (but not all) of the Equity Interests in a Transaction Subsidiary that owns a utility and/or commercial development project; provided that (i) such sale is to one or more non-Affiliates of the Borrower and is consummated on arm’s-length terms, (ii) such Transaction Subsidiary has no outstanding Indebtedness other than Project Indebtedness, and (iii) no portion of the consideration payable to the Borrower and its Subsidiaries has been deferred, no future installment payments are due, and all such consideration has been paid in cash; and provided further that, solely for purposes of clause (i) above, it is expressly agreed that Total S.A. and its Affiliates (excluding the Borrower and its Subsidiaries) shall be deemed to be Non-Affiliates of the Borrower.

2.Representations and Warranties. Each Loan Party hereby represents and warrants, as of the date of this Amendment, that:

a.The representations and warranties in each Loan Document to which it is a party are true and correct in all material respects with the same effect as though made on and as of the date hereof, except to the extent such representations and warranties expressly relate to an earlier date, in which case they shall be true and correct in all material respects on and as of such earlier date; provided that, in each case, such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof;

b.The execution and delivery of this Amendment has been duly authorized by all necessary organizational action of such Loan Party. This Amendment has been duly executed and delivered by such Loan Party and is a legal, valid and binding obligation of such Loan Party, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency or similar laws affecting creditors’ rights generally and to general principles of equity;

c.The transactions contemplated by this Amendment (a) do not require any consent or approval of, registration or filing with, or any other action by, any Governmental Authority, except such as have been obtained or made and are in full force and effect, except to the extent that any such failure to obtain such consent or approval or to take any such action, would not reasonably be expected to result in a Material Adverse Effect, (b) will not violate any Requirement of Law applicable to such Loan Party, (c) will not violate or result in a default under any other material indenture, agreement or other instrument binding upon such Loan Party its assets, or give rise to a right thereunder to require any payment to be made by such Loan Party, and (d) will not result in the creation or imposition of any Lien on any asset of such Loan Party; and

d.No Event of Default, or event or condition that would constitute an Event of Default but for the requirement that notice be given or time elapse or both, has occurred and is continuing or would result after giving effect to this Agreement.

3.Ratification and Confirmation of Loan Documents.

a.Except as expressly set forth herein, the execution, delivery, and performance of this Amendment shall not alter, modify, amend, or in any way affect any of the terms, conditions, obligations, covenants, or agreements contained in the Credit Agreement or any other Loan Document, and shall not shall not operate as a waiver of any right, power, or remedy of the Agent or any Lender under the Credit Agreement or any other Loan Document.

b.Each Loan Party hereby acknowledges that it has read this Amendment and consents to the terms hereof, and hereby confirms and agrees that, notwithstanding the effectiveness of this Amendment, the obligations of such Loan Party under the Loan Documents to which it is a party shall not be impaired or affected and such Loan Documents and all promissory notes and all other instruments, documents and agreements entered into by such Loan Party in connection with such Loan Documents are, and shall continue to be, in full force and effect and are hereby confirmed and ratified in all respects.

c.Each Subsidiary Guarantor further agrees that nothing in the Credit Agreement, this Amendment or any other Loan Document shall be deemed to require the consent of such Subsidiary Guarantor to any future amendment to the Credit Agreement.

4.Effectiveness. This Amendment shall become effective on the date first written above (the “Effective Date”) only upon satisfaction of the following conditions precedent on or prior to such date unless otherwise waived in writing by the Lenders:

a.The Agent (or its counsel) shall have received from each party hereto either (i) a counterpart of this Amendment signed on behalf of such party or (ii) written evidence satisfactory to the Agent (which may include facsimile or .pdf transmission of a signed signature page of this Amendment) that such party has signed a counterpart of this Amendment.

b.The representations and warranties of the Loan Parties set forth herein shall be true and correct in all material respects as of the Effective Date.

c.No Event of Default, or event or condition that would constitute an Event of Default but for the requirement that notice be given or time elapse or both, shall be continuing as of the Effective Date.

d.The Agent shall have received written opinions (addressed to the Agent and the Lenders and dated the Effective Date) of counsel to the Loan Parties with regard to matters of New York and Delaware law, in each case in form and substance reasonably satisfactory to the Agent.

e.The Agent shall have received (i) an officer’s certificate from each Loan Party, dated the Effective Date, certifying that (A) attached thereto are true, complete and correct copies of the certificate of incorporation and bylaws of such Loan Party (or certifying that there have been no changes to such documents since they were most recently delivered and certified to the Agent in connection with the Credit Agreement), (B) attached thereto is a true, complete and correct copy of the resolutions duly adopted by such Loan Party authorizing the execution, delivery and performance of this Amendment and that such resolutions have not been amended, modified, revoked or rescinded, and (C) such Loan Party is able to pay its debts as they become due and that no action has been taken by such Loan Party, its directors or officers in contemplation of the liquidation or dissolution of such Loan Party as of the Effective Date, and (ii) a good standing certificate for such Loan Party dated the Effective Date or a recent date prior to the Effective Date satisfactory to the Agent from such Loan Party’s jurisdiction of organization.

f.The Agent shall have received signature and incumbency certificates of the officers of each Loan Party executing this Amendment, each dated as of the Effective Date.

g.The Agent and the Lenders shall have received from the Borrower all fees required to be paid on or before the Effective Date, including an amendment fee paid to the Agent for the account of each Lender party hereto on a pro rata basis in accordance with such Lenders’ Revolving Credit Commitments as of the Effective Date, in an amount equal to 0.20% of such Lenders’ Revolving Credit Commitments as of the Effective Date.

h.Borrower shall have paid all reasonable and documented costs and expenses of the Agent (including the fees and expenses of Linklaters LLP as special counsel to the Lenders) in connection with the preparation, execution, delivery and administration of this Amendment.

5.Miscellaneous. The Loan Parties acknowledge and agree that the representations and warranties set forth herein are material inducements to the Agent and the Lenders to deliver this Amendment. This Amendment shall be binding upon and inure to the benefit of and be enforceable by the parties hereto, and their respective permitted successors and assigns. This Amendment is a Loan Document. Henceforth, this Amendment and the Credit Agreement shall be read together as one document and the Credit Agreement shall be modified accordingly. No course of dealing on the part of the Agent, the Lenders or any of their respective officers, nor any failure or delay in the exercise of any right by the Agent or the Lenders, shall operate as a waiver thereof, and any single or partial exercise of any such right shall not preclude any later exercise of any such right. The failure at any time to require strict performance by the Loan Parties of any provision of the Loan Documents shall not affect any right of the Agent or the Lenders thereafter to demand strict compliance and performance. Any suspension or waiver of a right must be in writing signed by an officer of the Agent, and or the Lenders, as applicable. No other person or entity, other than the Agent and the Lenders, shall be entitled to claim any right or benefit hereunder, including, without limitation, the status of a third party beneficiary hereunder. This Amendment shall be governed by and construed in accordance with the laws of the State of New York without reference to conflicts of law rules. If any provision of this Amendment or any of the other Loan Documents shall be determined by a court of competent jurisdiction to be invalid, illegal or unenforceable, that portion shall be deemed severed therefrom, and the remaining parts shall remain in full force as though the invalid, illegal or unenforceable portion had never been a part thereof. This Amendment may be executed in any number of counterparts, including by electronic or facsimile transmission, each of which when so delivered shall be deemed an original, but all such counterparts taken together shall constitute but one and the same instrument.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the Loan Parties, the Agent and the Lenders have caused this Amendment to be executed as of the date first written above

|

| |

Borrower |

| |

SUNPOWER CORPORATION |

| |

By: | /S/ CHARLES D. BOYNTON |

Name: | Charles D. Boynton |

Title: | Executive Vice President, Chief Financial Officer and Assistant Secretary |

|

| |

Subsidiary Guarantors |

| |

SUNPOWER CORPORATION, SYSTEMS |

| |

By: | /S/ CHARLES D. BOYNTON |

Name: | Charles D. Boynton |

Title: | Chief Financial Officer |

|

| |

| |

SUNPOWER NORTH AMERICA, LLC |

| |

By: | /S/ CHARLES D. BOYNTON |

Name: | Charles D. Boynton |

Title: | Chief Financial Officer |

|

| |

| |

SUNPOWER CAPITAL, LLC |

| |

By: | /S/ MANDY YANG |

Name: | Mandy Yang |

Title: | Chief Financial Officer and Treasurer |

CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK, individually and as Agent

|

| | |

| | |

| By: | /S/ GARY HERZOG |

| Name: | Gary Herzog |

| Title: | Managing Director |

|

| | |

| | |

| By: | /S/ JEFF FERRELL |

| Name: | Jeff Ferrell |

| Title: | Managing Director |

|

| | |

| CITICORP NORTH AMERICA, INC., as a Lender |

| | |

| By: | /S/ SANDIP SEN |

| Name: | Sandip Sen |

| Title: | Vice President |

|

| | |

| DEUTSCHE BANK AG, NEW YORK BRANCH, as a Lender |

| | |

| By: | /S/ MARCUS M. TARKINGTON |

| Name: | Marcus M. Tarkington |

| Title: | Director |

|

| | |

| By: | /S/ LISA WONG |

| Name: | Lisa Wong |

| Title: | Vice President |

|

| | |

| HSBC BANK USA, NATIONAL ASSOCIATION, as a Lender |

| | |

| By: | /S/ THOMAS LO |

| Name: | Thomas Lo |

| Title: | Vice President |

|

| | |

| ROYAL BANK OF SCOTLAND PLC, as a Lender |

| | |

| By: | /S/ TYLER J. MCCARTHY |

| Name: | Tyler J. McCarthy |

| Title: | Director |

|

| | |

| SANTANDER BANK, N.A., as a Lender |

| | |

| By: | /S/ WILLIAM MAAG |

| Name: | William Maag |

| Title: | Managing Director |

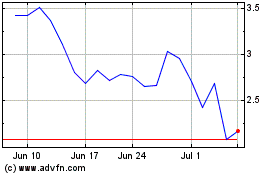

SunPower (NASDAQ:SPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

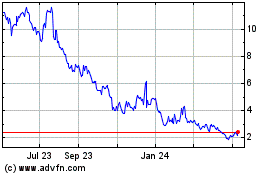

SunPower (NASDAQ:SPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024