UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)

Plug Power

Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(title of Class of Securities)

72919P

(CUSIP Number)

|

|

|

| Sylvain Tongas

L’Air Liquide S.A.

75, Quai d’Orsay

75321 Paris

France +33 1 40 62 53

36 |

|

Jeffrey E. Cohen

Baker & McKenzie LLP

452 Fifth Avenue New

York, NY 10018 (212) 626-4936 |

(Name, Address and Telephone Number of Persons Authorized to Receive Notices and Communications)

August 26, 2014

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), (f) or (g), check the following box. ¨

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See rule 13d-7 for other

parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosure provided in a prior cover page. |

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON Air Liquide Investissements d’Avenir et de

Démonstration |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION France |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

5,593,918 |

| |

8 |

|

SHARED VOTING POWER

None |

| |

9 |

|

SOLE DISPOSITIVE POWER

5,593,918 |

| |

10 |

|

SHARED DISPOSITIVE POWER

None |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,593,918 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 11 3.3% (1) |

| 14 |

|

TYPE OF REPORTING PERSON

CO |

| (1) |

Calculated in accordance with Rule 13d-3(d)(1)(i), based on 167,345,074 shares of the Common Stock, par value $.01 per share, of Plug Power Inc. outstanding as of August 7, 2014, as reported in Plug Power

Inc.’s Form 10-Q dated August 14, 2014. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON L’Air Liquide S.A. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION France |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

5,593,918 |

| |

8 |

|

SHARED VOTING POWER

None |

| |

9 |

|

SOLE DISPOSITIVE POWER

5,593,918 |

| |

10 |

|

SHARED DISPOSITIVE POWER

None |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,593,918 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 11 3.3% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

CO |

| (2) |

Calculated in accordance with Rule 13d-3(d)(1)(i), based on 167,345,074 shares of the Common Stock, par value $.01 per share, of Plug Power Inc. outstanding as of August 7, 2014, as reported in Plug Power

Inc.’s Form 10-Q dated August 14, 2014. |

The Statement on Schedule 13D filed March 19, 2014 (the “Statement”), filed by Air Liquide

Investissements d’Avenir et de Demonstration, a corporation existing under the laws of France (“ALIAD”) and L’Air Liquide S.A., a corporation existing under the laws of France, relating to the common stock, $0.01 par value (the

“Common Stock”), of Plug Power, Inc., a Delaware corporation (the “Issuer”), is hereby amended with respect to the items set forth below in this Amendment No. 1. Capitalized terms used herein without definition have the same

meanings as those ascribed to them in the Statement.

| Item 2. |

Identity and Background. |

Beatrice Majnoni D’Intignano is no longer serving on the Board of

L’Air Liquide S.A.

The following additional persons now serve on the Board of L’Air Liquide S.A.:

|

|

|

|

|

|

|

|

| Name |

|

Position |

|

Principal occupation (other than within L’Air Liquide SA) |

|

|

|

| Sin-Leng LOW |

|

member of the Board |

|

Senior Advisor of Sembcorp Development Ltd. - Business address: #03-01 179 360 Sembcorp, 30 Hill Street, Singapore. |

|

|

|

| Annette WINKLER |

|

member of the Board |

|

Vice-President of Daimler AG, Chief Executive Officer of Smart - Business address: Villa Kayser - Ulbacher Strasse 7 70329 Stuttgart. |

| Item 3. |

Source and Amount of Funds or Other Consideration. |

The shares of Common Stock sold by ALIAD as

described in this Amendment No. 1 were acquired upon the conversion, on August 26, 2014, of 5200 shares of the Issuer’s Series C Redeemable Convertible Preferred Stock (the “Series C Preferred Stock”) acquired by ALIAD on

March 8, 2013 into 5,521,676 shares of the Issuer’s Common Stock. ALIAD acquired the Series C Preferred Stock using internal capital of the Air Liquide group.

| Item 4. |

Purpose of Transaction. |

ALIAD acquired the Issuer’s Series C Preferred Stock as an investment and

in order to support the business of the Issuer. As a result of both the improvement of the financial condition of the Issuer and market conditions, ALIAD determined to dispose of a portion of its holdings at a time that ALIAD considers favorable.

Except as set forth in the third paragraph below, ALIAD does not have any present intention to effect additional dispositions of Common Stock, and the

filing persons do not have any plans or proposals which relate to, or could result in, any of the matters referred to in paragraphs (a) through (j), inclusive, of the instructions to Item 4 of Schedule 13D. The filing persons may, at any

time and from time to time, review or reconsider their position and/or change their purpose and/or formulate plans or proposals with respect thereto.

As

part of ALIAD’s continuing evaluation of, and preservation of the value of, its investment in the securities of the Issuer, ALIAD may in the future take such actions with respect to its investment in the Issuer as it deems appropriate and may,

from time to time, acquire additional Common Stock of the Issuer by conversion of the Series C Preferred Stock or otherwise, dispose of some or all of its Common Stock of the Issuer (including Common Stock acquired upon conversion of the Series C

Preferred Stock), and/or continue to hold the Common Stock of the Issuer and/or the Series C Preferred Stock. ALIAD’s determination whether to engage in any such transactions will depend on its consideration of various factors, including the

Issuer’s financial position and strategic direction, actions taken by the Issuer’s Board of Directors, the market price of the Common Stock, other investment opportunities available to ALIAD, conditions in the securities markets and

general economic and industry conditions. ALIAD will also consider the

impact of any future dispositions of Common Stock on its right to designate a Director to the Issuer’s Board, as described in Item 5 of the Statement as originally filed. ALIAD intends

to continue to sell shares of Common Stock received in payment of quarterly dividends on the Series C Preferred Stock pursuant to the Rule 10b5-1 Sales Trading Plan between ALIAD and Raymond James & Associates. (See Item 5 of the

Statement as originally filed.)

| Item 5. |

Interest in Securities of the Issuer. |

On August 26, 2014, ALIAD acquired 5,521,676 shares of

Common Stock by converting 5200 shares of Series C Preferred Stock. On August 26, 2014, ALIAD sold such 5,521,676 shares of Common Stock for $5.80 per share through Citigroup Global Markets Inc. pursuant to Rule 144.

On the date of this Schedule 13D (Amendment No. 1), ALIAD is the beneficial owner of 5,593,918 shares of the Issuer’s Common Stock, constituting

approximately 3.3% of the outstanding Common Stock, and 5,231 shares of the Issuer’s Series C Preferred Stock, constituting all of the outstanding Series C Preferred Stock. Of such 5,593,918 shares of Common Stock, 39,324 shares of Common Stock

are issued and outstanding and held directly by ALIAD, and 5,554,594 shares of Common Stock are issuable upon conversion at the current conversion price of 5,231 shares of Series C Preferred Stock, all of which shares are presently convertible. The

conversion price of the Series C Preferred Stock may decrease, and the number of shares of Common Stock issuable upon conversion of the Series C Preferred Stock may increase, through operation of the weighted average anti-dilution provisions of the

Series C Preferred Stock.

L’Air Liquide S.A. is the beneficial owner of all of the outstanding shares of capital stock of ALIAD and, accordingly,

may be considered the beneficial owner of the Issuer’s Common Stock and the Series C Preferred Stock held by ALIAD.

Except as set forth in this

Item 5, neither of the filing persons and, to their knowledge, none of their respective officers and directors, has effected any transactions in the Issuer’s Common Stock in the 60 days preceding the filing of this Schedule 13D (Amendment

No. 1).

SIGNATURES

After reasonable inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certify that the information set

forth in this statement is true, complete and correct.

Date: August 28, 2014

|

|

|

| AIR LIQUIDE INVESTISSEMENTS D’AVENIR ET DE DÉMONSTRATION |

|

|

| By: |

|

/s/ Pierre-Etienne Franc |

| Name: |

|

Pierre-Etienne Franc |

| Title: |

|

Directeur Général de la société |

|

| L’AIR LIQUIDE S.A. |

|

|

| By: |

|

/s/ Fabienne Lecorvaisier |

| Name: |

|

Fabienne Lecorvaisier |

| Title: |

|

Directeur Finance et Controle de Gestion |

|

|

Groupe |

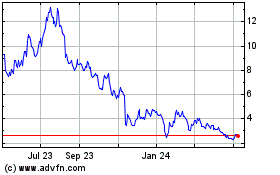

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

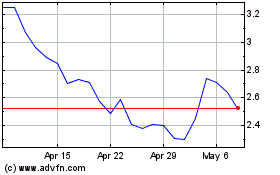

From Mar 2024 to Apr 2024

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Apr 2023 to Apr 2024