UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month: August, 2014

Commission File Number

AGNICO EAGLE MINES LIMITED

(Translation of registrant’s name into English)

145 King Street East, Suite 400, Toronto, Ontario M5C 2Y7

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)( 1): o

Note: Regulation S-T Rule 101 (b)( 1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

EXHIBITS

|

Exhibit No. |

|

Exhibit Description |

|

99.1 |

|

Press Release dated August 25, 2014 providing the Corporation’s update on its summer 2014 exploration activities at the new IVR project near Meadowbank mine in Nunavut. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

AGNICO EAGLE MINES LIMITED |

|

|

(Registrant) |

|

|

|

|

|

|

|

Date: August 27, 2014 |

By: |

/s/ R. Gregory Laing |

|

|

|

R. Gregory Laing |

|

|

|

General Counsel, Sr. Vice President, Legal and Corporate Secretary |

|

|

|

2

Exhibit 99.1

|

Stock Symbol: |

AEM (NYSE and TSX) |

|

|

|

|

For further information: |

Investor Relations |

|

|

(416) 947-1212 |

MORE ENCOURAGING RESULTS FROM IVR PROJECT NEAR MEADOWBANK; ADDITIONAL DRILL RIGS AND NEW EXPLORATION CAMP MOBILIZED

Toronto (August 25, 2014) — Agnico Eagle Mines Limited (NYSE:AEM, TSX:AEM) (“Agnico Eagle” or the “Company”) is pleased to provide an update on its summer 2014 exploration activities at the new IVR project, located 50 kilometres northwest of the Meadowbank mine in Nunavut. The Company last reported results from this project in a news release dated July 30, 2014. Highlights include:

· Continuing expansion of IVR discovery — Exploration drilling in July and August has expanded the scope of the mineralization at the IVR property, which has now reached four zones. Since the beginning of the project a total of 102 drill holes (18,702 metres) have been completed (2013-2014). In the R zone, the best intercept in this period was 5.6 grams per tonne (“g/t”) gold (capped) over 12.8 metres estimated true width including 11.7 g/t gold (capped) over 4.6 metres.

· New Whale Tail zone discovery — The best intercepts from this period in the Whale Tail zone include 5.5 g/t gold (capped) over 19.8 metres estimated true width including 7.1 g/t gold (capped) over 9.6 metres estimated true width, 8.1 g/t gold (capped) over 21.6 metres estimated true width including 27.3 g/t gold (capped) over 4.5 metres and 7.2 g/t gold (capped) over 7.5 metres estimated true width at 289 metres vertical depth.

· Gold-bearing boulders discovered — A 600 metre long boulder field containing large blocks of quartz vein material (locally with sulphides and visible gold) has been located approximately 3.5 kilometres west of the main IVR area. A drill rig has been mobilized to test this target area.

· Second phase of drilling is underway — An estimated 20,000 metre drill program is expected to be completed by mid-September.

“The new IVR discovery has yielded some very exciting results for Agnico Eagle this summer,” said Sean Boyd, President and Chief Executive Officer. “We are particularly interested in the project because of its proximity to our Meadowbank mine and mill, which is currently our best cash flow generator”, added Mr. Boyd.

IVR Project — 2014 Drilling Expands New Mineralized Zones

The 408-square-kilometre IVR property is located within Inuit Owned Land and a 100% interest was acquired in April 2013 subject to a mineral exploration agreement with Nunavut Tunngavik Incorporated. The property is located approximately 50 kilometres northwest of the Meadowbank mine in Nunavut.

Agnico Eagle’s recent work has revealed the potential for multiple mineralized zones within a 2-kilometre-wide northeast-southwest corridor that can be traced along strike for at least 10 kilometres. Based on the current information, all four structures are open in all directions including at depth.

Exploration drilling in July and August 2014 on the IVR property has resulted in significant expansion of the Whale Tail zone, which is now recognized over a strike length of more than 1,000 metres (and remains open in all directions), and the discovery of boulders containing visible gold at more than 3.5 kilometres west of the current drilling area.

The most recent intercept in the “I” zone is hole IVR14-050 that returned 7.6 g/t gold over 3.3 metres at 37 metres depth.

In the “R” zone, hole IVR14-057 encountered a wide intercept of 5.6 g/t gold over 12.8 metres at 159 metres depth including 11.7 g/t gold over 4.6 metres at 164 metres depth.

Most of the recent drilling activity has been focused on the newly discovered Whale Tail zone. Hole IVR14-054 intersected four apparently parallel zones grading respectively: 7.7 g/t gold over 6.5 metres at 52 metres below surface, 7.1 g/t gold over 9.6 metres at 104 metres below surface, 7.3 g/t gold over 5.4 metres at 115 metres below surface, and 3.1 g/t gold over 5.2 metres at 132 metres below surface. Across a 400 metre wide lake, Hole IVR14-058 intersected what is interpreted as the same structure 500 metres along strike to the northeast, grading 4.9 g/t gold over 16.7 metres at 109 metres depth including 8.1 g/t gold over 8.0 metres at 113 metres depth. 70 metres further to the east, hole IVR14-060 intersected 10.1 g/t gold over 3.8 metres at 86 metres depth.

More recently, one additional drill hole was added to the same section as drill hole IVR14-054 mentioned above to test the vertical continuity of the mineralization deeper in the same section. Hole IVR14-081 intersected 6.0 g/t gold over 23.7 metres at 122 metres depth including three higher grade intercepts of 7.0 g/t gold over 4.8 metres, 8.5 g/t gold over 5.7 metres and 8.3 g/t gold over 6.3 metres. Deeper in hole IVR14-081, another significant intercept returned 7.2 g/t gold over 7.5 metres at 289 vertical depth representing the deepest intercept so far on the project and demonstrating a good vertical continuity of the mineralization.

On the next section, 70 metres to the west of drill hole IVR14-054, hole IVR14-056 returned two intercepts grading 3.6 g/t gold over 9.0 metres at only 9 metres depth including 5.3 g/t gold over 4.5 metres and a second intercept of 7.3 g/t gold over 3.5 metres at 43 metres depth. On the next section, 70 metres to the west of drill hole IVR14-056, hole IVR14-079 returned an intercept grading 8.1 g/t gold over 21.6 metres

2

at only 35 metres depth including 27.3 g/t gold over 4.5 metres. The assays results of the lower part of drill hole IVR14-079 as well as all the other drill holes completed along strike to the west and at depth are still pending.

All intercepts reported for the IVR project show capped grades over estimated true widths, based on a preliminary geological interpretation. Additional information about these and other drill intersections are included in the table below, while the drill collars are located on the IVR project map. The drill collar coordinates table can be found in the Appendix of this news release.

[IVR Project]

Results from IVR project exploration drilling in 2013 and 2014

|

Drill hole |

|

Deposit |

|

From

(metres) |

|

To

(metres) |

|

Depth of

midpoint

below

surface

(metres) |

|

Estimated

true width

(metres) |

|

Gold grade

(g/t)

(uncapped) |

|

Gold grade

(g/t)

(capped)* |

|

|

IVR14-050 |

|

I zone |

|

47.5 |

|

51.6 |

|

37 |

|

3.3 |

|

7.60 |

|

7.60 |

|

|

IVR14-051 |

|

R zone |

|

173.2 |

|

177.4 |

|

126 |

|

2.9 |

|

4.46 |

|

4.46 |

|

|

IVR14-054 |

|

Whale Tail |

|

61.8 |

|

69.0 |

|

52 |

|

6.5 |

|

7.70 |

|

7.70 |

|

|

and |

|

|

|

125.0 |

|

147.0 |

|

109 |

|

19.8 |

|

5.54 |

|

5.54 |

|

|

including |

|

|

|

125.0 |

|

135.7 |

|

104 |

|

9.6 |

|

7.06 |

|

7.06 |

|

|

including |

|

|

|

141.0 |

|

147.0 |

|

115 |

|

5.4 |

|

7.33 |

|

7.33 |

|

|

and |

|

|

|

161.7 |

|

167.5 |

|

132 |

|

5.2 |

|

3.11 |

|

3.11 |

|

|

IVR14-056 |

|

Whale Tail |

|

8.0 |

|

18.0 |

|

9 |

|

9.0 |

|

3.56 |

|

3.56 |

|

|

including |

|

|

|

13.0 |

|

18.0 |

|

11 |

|

4.5 |

|

5.32 |

|

5.32 |

|

|

and |

|

|

|

60.5 |

|

64.4 |

|

43 |

|

3.5 |

|

7.25 |

|

7.25 |

|

|

IVR14-057 |

|

R zone |

|

189.3 |

|

207.6 |

|

159 |

|

12.8 |

|

5.63 |

|

5.63 |

|

|

including |

|

|

|

201.0 |

|

207.6 |

|

164 |

|

4.6 |

|

11.68 |

|

11.68 |

|

|

IVR14-058 |

|

Whale Tail |

|

135.9 |

|

154.4 |

|

109 |

|

16.7 |

|

4.94 |

|

4.94 |

|

|

including |

|

|

|

145.5 |

|

154.4 |

|

113 |

|

8.0 |

|

8.12 |

|

8.12 |

|

|

IVR14-060 |

|

Whale Tail |

|

102.0 |

|

105.0 |

|

77 |

|

2.7 |

|

4.59 |

|

4.59 |

|

|

and |

|

|

|

113.6 |

|

117.8 |

|

86 |

|

3.8 |

|

10.06 |

|

10.06 |

|

|

IVR14-079 |

|

Whale Tail |

|

36.0 |

|

60.0 |

|

35 |

|

21.6 |

|

8.70 |

|

8.13 |

|

|

including |

|

|

|

36.0 |

|

40.0 |

|

27 |

|

3.6 |

|

6.31 |

|

6.31 |

|

|

including |

|

|

|

55.0 |

|

60.0 |

|

41 |

|

4.5 |

|

30.05 |

|

27.29 |

|

|

IVR14-081 |

|

Whale Tail |

|

135.7 |

|

162.0 |

|

122 |

|

23.7 |

|

5.99 |

|

5.99 |

|

|

including |

|

|

|

135.7 |

|

141.0 |

|

114 |

|

4.8 |

|

7.03 |

|

7.03 |

|

|

including |

|

|

|

143.0 |

|

149.3 |

|

117 |

|

5.7 |

|

8.54 |

|

8.54 |

|

|

including |

|

|

|

155.0 |

|

162.0 |

|

130 |

|

6.3 |

|

8.33 |

|

8.33 |

|

|

and |

|

|

|

347.3 |

|

358.0 |

|

289 |

|

7.5 |

|

7.18 |

|

7.18 |

|

|

including |

|

|

|

347.3 |

|

351.6 |

|

286 |

|

3.0 |

|

13.17 |

|

13.17 |

|

* Holes at IVR use a capping factor of 60 g/t gold.

3

The second phase 20,000 metre drilling program commenced in July and is expected to be completed by mid-September. An extension of the drilling program could be considered with the ongoing commissioning of a new 25 man exploration camp on site with the potential to expand to 60 men in 2015 if additional drilling activities are required.

Field work, including mapping and sampling, is currently underway focusing on the anomalies highlighted by the airborne VTEMplus Time-Domain electromagnetic survey conducted earlier this year. A total of 510 surface rock samples have been collected so far in an area of approximately 1,300 hectares, leading to the discovery of numerous quartz-arsenopyrite-galena bearing boulders (locally containing coarse free gold) from a location of approximately 3.5 kilometres west of the current drilling area. The blocky shape and large size of the boulders suggests they have not been transported far from their original location, an important discovery in a region lacking true exposed bedrock. Based on the nature of the boulders, the proximity of a significant electromagnetic conductor and our understanding of the glacial transport direction, a third drill rig has been mobilized to investigate this area.

The favourable corridor seems to extend over at least 10 kilometres as interpreted from the 10,000-hectares magnetic-electromagnetic survey of the area.

Agnico Eagle started collecting environmental baseline data in the IVR project area in the second half of 2014, as well as beginning the preliminary engineering for road design. Qualified fisheries, geochemical, terrestrial and archaeological consultants have begun to review available baseline data from public sources and design field programs to gather additional data. Field programs will collect fisheries, geochemical and terrestrial field data from the end of August through September 2014. This environmental baseline study could be used in future permitting for the IVR project.

4

About Agnico Eagle

Agnico Eagle is a senior Canadian gold mining company that has produced precious metals since 1957. Its nine mines are located in Canada, Finland and Mexico, with exploration and development activities in each of these regions as well as in the United States. The Company and its shareholders have full exposure to gold prices due to its long-standing policy of no forward gold sales. Agnico Eagle has declared a cash dividend every year since 1983.

Further Information

For further information regarding Agnico Eagle, contact Investor Relations at info@agnicoeagle.com or call (416) 947-1212

Forward-Looking Statements

The information in this news release has been prepared as at August 25, 2014. Certain statements contained in this document constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information under the provisions of Canadian provincial securities laws and are referred to herein as forward-looking statements. When used in this document, the words “anticipate”, “expect”, “estimate”, “forecast”, “will”, “planned”, and similar expressions are intended to identify forward-looking statements or information.

Such statements include without limitation: estimates of mineral grades, the estimated timing regarding anticipated future exploration; and whether results thereof will expand gold reserves or resources. Such forward-looking statements reflect the Company’s views as at the date of this document and are subject to certain risks, uncertainties and assumptions, and undue reliance should not be placed on such statements and information. Many factors, known and unknown could cause the actual results to be materially different from those expressed or implied by such forward-looking statements and information. Such risks include, but are not limited to: the volatility of prices of gold and other metals; uncertainty of mineral grades; cost of exploration and development programs; governmental and environmental regulation; and the volatility of the Company’s stock price. The material factors and assumptions used in the preparation of the forward-looking statements and information contained herein, which may prove to be incorrect, include, but are not limited to, the assumptions set forth herein and in management’s discussion and analysis (“MD&A”) and the Company’s Annual Information Form (“AIF”) for the year ended December 31, 2013 filed with Canadian securities regulators and that are included in its Annual Report on Form 40-F for the year ended December 31, 2013 (“Form 40-F”) filed with the U.S. Securities and Exchange Commission (the “SEC”) as well as: that there are no significant disruptions affecting operations; that permitting and exploration at IVR proceeds on a basis consistent with current expectations and plans; that Agnico Eagle’s current estimates of mineral grades are accurate; and that there are no material delays in the timing for completion of the IVR exploration project.

5

For a more detailed discussion of such risks and other factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements contained in this document, see the Company’s AIF, MD&A and Form 40-F, as well as the Company’s other filings with the Canadian securities regulators and the SEC. The Company does not intend, and does not assume any obligation, to update these forward-looking statements and information. For a detailed breakdown of the Company’s reserve and resource position see the Company’s Annual Information Form or Form 40-F.

Guy Gosselin, Vice-President Exploration for Agnico Eagle Mines Limited, approved the scientific and technical information in this news release. Mr. Gosselin verified the data disclosed in this news release, including the sampling, analytical and testing data underlying the information. Verification included a review and validation of the applicable assay databases and reviews of assay certificates. Mr. Gosselin is a P.Eng. with the Ordre ingenieurs du Quebec, and is a qualified person as defined by NI 43-101.

6

Appendix: Selected drill collar coordinates

IVR Project exploration drill collar coordinates

|

|

|

Drill collar coordinates* |

|

|

Drill hole ID |

|

UTM North |

|

UTM East |

|

Elevation

(metres

above sea

level) |

|

Azimuth |

|

Dip

(degrees) |

|

Length

(metres) |

|

|

IVR14-050 |

|

7256676 |

|

606886 |

|

117 |

|

322 |

|

-50 |

|

210 |

|

|

IVR14-051 |

|

7256154 |

|

607079 |

|

115 |

|

320 |

|

-46 |

|

239 |

|

|

IVR14-054 |

|

7255369 |

|

606701 |

|

115 |

|

322 |

|

-55 |

|

229 |

|

|

IVR14-056 |

|

7255428 |

|

606569 |

|

114 |

|

322 |

|

-47 |

|

93 |

|

|

IVR14-057 |

|

7256281 |

|

606883 |

|

116 |

|

143 |

|

-50 |

|

249 |

|

|

IVR14-058 |

|

7255641 |

|

607060 |

|

115 |

|

330 |

|

-50 |

|

200 |

|

|

IVR14-060 |

|

7255723 |

|

607093 |

|

117 |

|

326 |

|

-48 |

|

156 |

|

|

IVR14-079 |

|

7255351 |

|

606547 |

|

117 |

|

323 |

|

-46 |

|

230 |

|

|

IVR14-081 |

|

7255301 |

|

606741 |

|

116 |

|

323 |

|

-59 |

|

411 |

|

* Coordinate System UTM Nad 83 zone 14

7

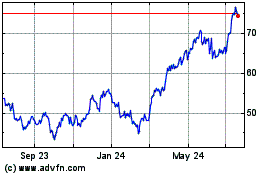

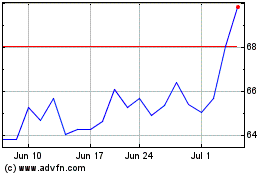

Agnico Eagle Mines (NYSE:AEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agnico Eagle Mines (NYSE:AEM)

Historical Stock Chart

From Apr 2023 to Apr 2024