UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 1)

Under the Securities Exchange Act of 1934

| SUPERNUS PHARMACEUTICALS, INC. |

| (Name of Issuer) |

| Common Stock, $0.001 par value per share |

| (Title of Class of Securities) |

| 868459108 |

| (CUSIP Number) |

| |

|

John Heard

c/o Abingworth Management Limited

Princes House

38 Jermyn Street

London, England SW1Y 6DN

+44 20 7534 1500 |

|

(Name, Address and Telephone

Number of Person

Authorized to Receive Notices and Communications) |

| |

| August 14, 2014 |

| (Date of Event Which Requires Filing of this Statement) |

| |

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [ ]

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out

for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover

page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP No. 868459108 |

| 1. Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only): |

| |

Abingworth Management Limited |

|

| |

|

|

| 2. Check the Appropriate Box if a Member of a Group (See Instructions): |

(a) [ ] |

|

| |

(b) [ X ] |

|

| |

|

|

| 3. SEC Use Only |

| 4. Source of Funds (See Instructions): WC (See Item 3) |

| |

|

|

| 5. Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e): [ ] |

| |

|

|

| 6. Citizenship or Place of Organization: England |

| |

|

|

| |

| |

Number of |

7. Sole Voting Power: |

0 |

|

| |

Shares Beneficially |

8. Shared Voting Power: |

3,277,869* |

|

| |

Owned by |

|

|

|

| |

Each Reporting |

9. Sole Dispositive Power: |

0 |

|

| |

Person With |

10. Shared Dispositive Power: |

3,277,869* |

|

| |

|

|

|

| 11. Aggregate Amount Beneficially Owned by Each Reporting Person: 3,277,869* |

| |

|

|

| 12. Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions): [ ] |

| |

|

|

| 13. Percent of Class Represented by Amount in Row (11): 7.6%* |

| |

|

|

| 14. Type of Reporting Person (See Instructions): CO |

| |

|

|

| |

|

|

|

|

|

|

|

|

* As of August 22, 2014, Abingworth Management Limited

(“AML”) may be deemed to beneficially own an aggregate of 3,277,869 shares of common stock, $0.001 par value

per share (“Common Stock”), of Supernus Pharmaceuticals, Inc. (the “Issuer”). The number

of shares reported above consists of (i) 3,250,007 shares of Common Stock held by Abingworth Bioventures IV LP (“ABV

IV”) and (ii) 27,862 shares of Common Stock held by Abingworth Bioventures IV Executives LP (“ABV IV Execs,”

and together with ABV IV, the “Abingworth Funds”). AML, as the investment manager to the Abingworth Funds,

may be deemed to beneficially own the 3,277,869 shares of Common Stock held by the Abingworth Funds.

Based on information disclosed by the Issuer in its

quarterly report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on August 12, 2014,

there were 42,921,376 shares of Common Stock issued and outstanding as of July 31, 2014. As a result of the foregoing, for purposes

of Reg. Section 240.13d-3, AML is deemed to beneficially own an aggregate of 3,277,869 shares of Common Stock, or 7.6% of the

shares of Common Stock deemed issued and outstanding as of August 22, 2014.

| CUSIP No. 868459108 |

| 1. Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only): |

| |

Abingworth Bioventures IV LP |

|

| |

|

|

| 2. Check the Appropriate Box if a Member of a Group (See Instructions): |

(a) [ ] |

|

| |

(b) [ X ] |

|

| |

|

|

| 3. SEC Use Only |

| 4. Source of Funds (See Instructions): WC (See Item 3) |

| |

|

|

| 5. Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e): [ ] |

| |

|

|

| 6. Citizenship or Place of Organization: England |

| |

|

|

| |

| |

Number of |

7. Sole Voting Power: |

0 |

|

| |

Shares Beneficially |

8. Shared Voting Power: |

3,250,007* |

|

| |

Owned by |

|

|

|

| |

Each Reporting |

9. Sole Dispositive Power: |

0 |

|

| |

Person With |

10. Shared Dispositive Power: |

3,250,007* |

|

| |

|

|

|

| 11. Aggregate Amount Beneficially Owned by Each Reporting Person: 3,250,007* |

| |

|

|

| 12. Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions): [ ] |

| |

|

|

| 13. Percent of Class Represented by Amount in Row (11): 7.6%* |

| |

|

|

| 14. Type of Reporting Person (See Instructions): PN |

| |

|

|

| |

|

|

|

|

|

|

|

|

* As of August 22, 2014, ABV IV may be deemed to beneficially

own an aggregate of 3,250,007 shares of Common Stock. Based on information disclosed by the Issuer in its quarterly report on

Form 10-Q filed with the SEC on August 12, 2014, there were 42,921,376 shares of Common Stock outstanding as of July 31, 2014.

As a result of the foregoing, for purposes of Reg. Section 240.13d-3, ABV IV is deemed to beneficially own an aggregate of 3,250,007

shares of Common Stock, or 7.6% of the shares of Common Stock deemed issued and outstanding as of August 22, 2014. AML, as the

investment manager to ABV IV, may be deemed to beneficially own the 3,250,007 shares of Common Stock held by ABV IV.

| CUSIP No. 868459108 |

| 1. Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only): |

| |

Abingworth Bioventures IV Executives LP |

|

| |

|

|

| 2. Check the Appropriate Box if a Member of a Group (See Instructions): |

(a) [ ] |

|

| |

(b) [ X ] |

|

| |

|

|

| 3. SEC Use Only |

| 4. Source of Funds (See Instructions): WC (See Item 3) |

| |

|

|

| 5. Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e): [ ] |

| |

|

|

| 6. Citizenship or Place of Organization: Delaware |

| |

|

|

| |

| |

Number of |

7. Sole Voting Power: |

0 |

|

| |

Shares Beneficially |

8. Shared Voting Power: |

27,862* |

|

| |

Owned by |

|

|

|

| |

Each Reporting |

9. Sole Dispositive Power: |

0 |

|

| |

Person With |

10. Shared Dispositive Power: |

27,862* |

|

| |

|

|

|

| 11. Aggregate Amount Beneficially Owned by Each Reporting Person: 27,862* |

| |

|

|

| 12. Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions): [ ] |

| |

|

|

| 13. Percent of Class Represented by Amount in Row (11): 0.1%* |

| |

|

|

| 14. Type of Reporting Person (See Instructions): PN |

| |

|

|

| |

|

|

|

|

|

|

|

|

* As of August 22, 2014, ABV IV Execs may be deemed to beneficially own an aggregate of

27,862 shares of Common Stock. Based on information disclosed by the Issuer in its quarterly report on Form 10-Q filed with the

SEC on August 12, 2014, there were 42,921,376 shares of Common Stock outstanding as of July 31, 2014. As a result of the foregoing,

for purposes of Reg. Section 240.13d-3, ABV IV Execs is deemed to beneficially own an aggregate of 27,862 shares of Common Stock,

or 0.1% of the shares of Common Stock deemed issued and outstanding as of August 22, 2014. AML, as the investment manager to ABV

IV Execs, may be deemed to beneficially own the 27,862 shares of Common Stock held by ABV IV Execs.

Item 4. Purpose of Transaction

Item 4 is hereby amended and supplemented as follows:

Under the terms of a Stockholders’

Voting Agreement, dated December 22, 2005 (as amended to date, the “Voting Agreement”), by and among the Issuer,

the holders of Common Stock identified therein and the Investors identified therein, entered into in connection with the Private

Placement, the Abingworth Funds were entitled to elect one member of the Issuer’s board of directors for so long as the

Abingworth Funds owned any capital stock of the Issuer. The Voting Agreement terminated upon the consummation of the IPO and Abingworth

Funds’ designee to the board has since resigned from the Issuer’s board of directors.

Item 5. Interest in Securities of the Issuer

Item 5 is hereby amended and supplemented as follows:

(a) ABV IV is the owner of record

of 3,250,007 shares of Common Stock. ABV IV may be deemed to beneficially own approximately 7.6% of the Issuer’s outstanding

Common Stock. The foregoing beneficial ownership percentage is based upon a total of 42,921,376 shares of Common Stock issued and

outstanding as of July 31, 2014, as reported by the Issuer in its quarterly report on Form 10-Q filed with the SEC on August 12,

2014.

ABV IV Execs is the owner of record

of 27,862 shares of Common Stock. ABV IV Execs may be deemed to beneficially own approximately 0.1% of the Issuer’s outstanding

Common Stock. The foregoing beneficial ownership percentage is based upon a total of 42,921,376 shares of Common Stock issued and

outstanding as of July 31, 2014, as reported by the Issuer in its quarterly report on Form 10-Q filed with the SEC on August 12,

2014.

AML is not the owner of record of

any shares of Common Stock. AML may be deemed to beneficially own, in the aggregate, 3,277,869 shares of Common Stock held by the

Abingworth Funds, representing approximately 7.6% of the Issuer’s outstanding Common Stock. The foregoing beneficial ownership

percentage is based upon a total of 42,921,376 shares of Common Stock issued and outstanding as of July 31, 2014, as reported by

the Issuer in its quarterly report on Form 10-Q filed with the SEC on August 12, 2014.

(b) As set forth in the cover

sheets to this Amendment No. 1 to Schedule 13D, (i) ABV IV has shared voting and dispositive power with respect to the 3,250,007

shares of Common Stock held by ABV IV and has sole voting and dispositive power over none of the securities reported herein; (ii)

ABV IV Execs has shared voting and dispositive power with respect to the 27,862 shares of Common Stock held by ABV IV Execs and

has sole voting and dispositive power over none of the securities reported herein; and (iii) AML has shared voting and dispositive

power with respect to the 3,277,869 shares of Common Stock held by the Abingworth Funds and has sole voting and dispositive power

over none of the securities reported herein.

(c) The following table details

the transactions by the Reporting Persons, on behalf of the Abingworth Funds, in Common Stock during the period commencing sixty

(60) days prior to August 22, 2014:

| Date |

Price per Share |

Type of Transaction |

Number of Shares |

| 8/14/14 |

$9.2945(1) |

Open Market Sale |

73,016 |

| 8/15/14 |

$9.0549(2) |

Open Market Sale |

101,557 |

| 8/18/14 |

$9.0274(3) |

Open Market Sale |

105,501 |

| 8/19/14 |

$9.0098(4) |

Open Market Sale |

32,583 |

| 8/20/14 |

$9.0005(5) |

Open Market Sale |

5,544 |

| 8/21/14 |

$9.0067(6) |

Open Market Sale |

300 |

| 8/22/14 |

$9.0059(7) |

Open Market Sale |

15,318 |

Explanation of response:

1. The price reported in Item 5(c) is a weighted average

price. These shares were bought in multiple transactions at prices ranging from $9.25 to $9.37, inclusive. The Reporting Persons

undertake to provide to the staff of the SEC, upon request, full information regarding the number of shares bought at each separate

price within the range set forth in this footnote.

2. The price reported in Item 5(c) is a weighted average

price. These shares were bought in multiple transactions at prices ranging from $9.00 to $9.50, inclusive. The Reporting Persons

undertake to provide to the staff of the SEC, upon request, full information regarding the number of shares bought at each separate

price within the range set forth in this footnote.

3. The price reported in Item 5(c) is a weighted average

price. These shares were bought in multiple transactions at prices ranging from $9.00 to $9.21, inclusive. The Reporting Persons

undertake to provide to the staff of the SEC, upon request, full information regarding the number of shares bought at each separate

price within the range set forth in this footnote.

4. The price reported in Item 5(c) is a weighted average

price. These shares were bought in multiple transactions at prices ranging from $9.00 to $9.07, inclusive. The Reporting Persons

undertake to provide to the staff of the SEC, upon request, full information regarding the number of shares bought at each separate

price within the range set forth in this footnote.

5. The price reported in Item 5(c) is a weighted average

price. These shares were bought in multiple transactions at prices ranging from $9.00 to $9.01, inclusive. The Reporting Persons

undertake to provide to the staff of the SEC, upon request, full information regarding the number of shares bought at each separate

price within the range set forth in this footnote.

6. The price reported in Item 5(c) is a weighted average

price. These shares were bought in multiple transactions at prices ranging from $9.00 to $9.01, inclusive. The Reporting Persons

undertake to provide to the staff of the SEC, upon request, full information regarding the number of shares bought at each separate

price within the range set forth in this footnote.

7. The price reported in Item 5(c) is a weighted average

price. These shares were bought in multiple transactions at prices ranging from $9.00 to $9.03, inclusive. The Reporting Persons

undertake to provide to the staff of the SEC, upon request, full information regarding the number of shares bought at each separate

price within the range set forth in this footnote.

_________________________________

Except as set forth in this Schedule

13D, none of the persons identified in Item 2 of this Schedule 13D has engaged in any transaction in Shares, or securities convertible

for Shares, during the period commencing sixty (60) days prior to August 22, 2014.

(d) Each Abingworth Fund has the

right to receive dividends from, or proceeds from the sale of, the shares of Common Stock beneficially owned by it. The limited

partners or shareholders of each Abingworth Fund have the right to participate indirectly in the receipt of dividends from, or

proceeds from the sale of, the shares of Common Stock beneficially owned by it, in accordance with their respective ownership interests

in such Abingworth Fund.

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 22, 2014

| |

|

|

| |

Abingworth Management Limited |

|

| |

|

|

| |

By: Abingworth Management Limited, its Manager |

|

| |

|

|

| |

|

|

| |

By: |

/s/ John Heard |

|

| |

|

Name: John Heard |

|

| |

|

Title: Authorized Signatory |

|

| |

|

|

| |

|

|

| |

Abingworth Bioventures IV Executives LP |

|

| |

|

|

| |

By: Abingworth Management Limited, its Manager |

|

| |

|

|

| |

|

|

| |

By: |

/s/ John Heard |

|

| |

|

Name: John Heard |

|

| |

|

Title: Authorized Signatory |

|

| |

|

|

| |

|

|

| |

Abingworth Management Limited |

|

| |

|

|

| |

|

|

| |

By: |

/s/ John Heard |

|

| |

|

Name: John Heard |

|

| |

|

Title: Authorized Signatory |

|

| |

|

|

Attention: Intentional misstatements or omissions

of fact constitute

Federal criminal violations (See 18 U.S.C. 1001).

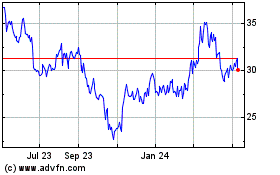

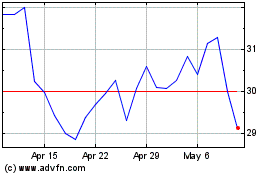

Supernus Pharmaceuticals (NASDAQ:SUPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Supernus Pharmaceuticals (NASDAQ:SUPN)

Historical Stock Chart

From Apr 2023 to Apr 2024