EDISON EQUITY RESEARCH - GLG LIFE TECH

August 25 2014 - 4:47PM

InvestorsHub NewsWire

Edison Investment Research:

Halozyme

Therapeutics - HyQvia got a favourable

vote

The positive vote (15 to one) by the FDA’s Blood Products Advisory

Committee (BPAC) for HyQvia should pave the way for its US approval

(Q3) and its launch by Baxter, the drug’s commercial partner.

Potential risk factors raised and extensively discussed by the FDA

at the panel meeting could result in some label restrictions, which

will be in line with the drug’s restricted approval in the EU. An

FDA approval would remove one near-term risk for Halozyme. The

panel vote, though positive, has only a small impact on Halozyme’s

valuation, which is now $1,448m, or $11.7 per basic share, vs

previously $1,445m, or $11.6 per basic share.

Halozyme Therapeutics focuses on development of

extracellular matrix-based drugs. Its rHuPH20-based delivery

platform has been used by partners, including Roche, Baxter and

Pfizer, to develop SC injection of IV drugs such as Herceptin,

Rituxan (Roche) and GAMMAGARD (Baxter). Its pipeline consists of

Hylenex, approved for hydration, PEGPH20 in Phase II trials for

pancreatic cancer, and HTI-501 in Phase II trials for

cellulite.

To view our full report, please click here: http://www.edisoninvestmentresearch.com/research/report/halozyme-therapeutics2

Click here to view all of Edison's Investment

Research's published reports.

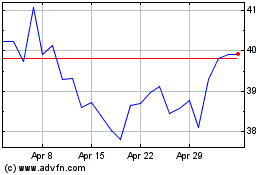

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

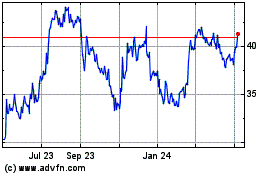

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Apr 2023 to Apr 2024