Current Report Filing (8-k)

August 21 2014 - 5:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 15, 2014

| |

|

Innovative Food Holdings, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

| Florida |

0-9376 |

20-1167761 |

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

28411 Race Track Road, Bonita Springs, Florida

|

34135

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (239) 596-0204

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

As disclosed below, the registrant entered into an Agreement and Plan of Merger (the “Merger Agreement”) dated as of August 15, 2014 between itself, its wholly-owned subsidiary, FD Acquisition Corp., and The Fresh Diet, Inc., a Florida corporation (“FD”).

Item 2.01. Completion of Acquisition or Disposition of Assets.

Pursuant to the Merger Agreement, the registrant acquired FD through a reverse triangular merger as the registrant created a subsidiary corporation (FD Acquisition Corp) that merged with and into FD with FD being the surviving corporation and becoming a wholly-owned subsidiary of the registrant. FD is the nationwide leader in freshly prepared gourmet specialty meals, using the finest specialty, artisanal, direct from source ingredients, delivered daily, directly to consumers using The Fresh Diet® platform. The Fresh Diet’s platform includes a company managed and owned preparation and logistics infrastructure, including a comprehensive company owned network of same day and next day last mile food delivery capabilities. The purchase price consisted of 10,000,000 shares of the registrant’s common stock. The majority of FD’s current liabilities consist of approximately $5 million of deferred revenues and approximately $1.3 million in short term commercial loans and there are additional ordinary course of business expenses such as trade payables, payroll and sales taxes which varies from month to month. In addition, it has some long term obligations the bulk of which consist of interest free loans from FD’s shareholders in the amount of approximately $2.2 million which are not due for three years. Prior to the merger FD had purchased an immaterial amount of product from the registrant. It is anticipated that FD will operate as an independent subsidiary subject to oversight of its board of directors and the registrant’s President and CEO and that two of FD’s executive officers will be appointed to the registrant’s board of directors.

Item 3.02. Unregistered Sales of Equity Securities.

On August 18, 2014 we completed a round of financing of $1,435,000 through the sale of 1.435 million shares of our common stock at a price per share of $1.00. No warrants or other convertible securities were involved in the financing and the financing was completed by officers of the registrant without requiring the services of a placement agent. The financing was an exempt private placement under Regulation D with offers and sales made only to “accredited investors” without the use of public advertising.

Item 9.01 Financial Statements and Exhibits

The required financial statements with respect to the acquisition will be filed by amendment to this current Report on Form 8-K within 71 days of the date hereof.

|

(b)

|

Pro Forma Financial Information

|

Any required pro forma financial statements with respect to the acquisition will be filed by amendment to this current Report on Form 8-K within 71 days of the date hereof.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INNOVATIVE FOOD HOLDINGS, INC. |

|

| |

|

|

|

|

|

By:

|

/s/ Sam Klepfish |

|

| |

|

Sam Klepfish |

|

| |

|

CEO |

|

| |

|

|

|

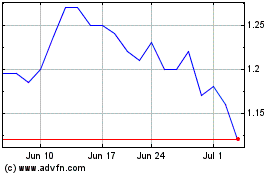

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

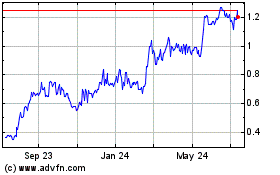

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Apr 2023 to Apr 2024