UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 21, 2014

THE TORO COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-8649 |

|

41-0580470 |

|

(State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

|

8111 Lyndale Avenue South

Bloomington, Minnesota

(Address of principal executive offices) |

|

55420

(Zip Code) |

Registrant’s telephone number, including area code: (952) 888-8801

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 2 — Financial Information

Item 2.02 Results of Operations and Financial Condition.

On August 21, 2014, The Toro Company announced its earnings for the three and nine months ended August 1, 2014.

Attached to this Current Report on Form 8-K as Exhibit 99.1 is a copy of The Toro Company’s press release in connection with the announcement. The information in this Item 2.02, including the exhibit attached hereto, is furnished pursuant to Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

2

Section 9 — Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press release dated August 21, 2014 (furnished herewith). |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

THE TORO COMPANY |

|

|

(Registrant) |

|

|

|

|

|

Date: August 21, 2014 |

By |

/s/ Renee J. Peterson |

|

|

Renee J. Peterson |

|

|

Vice President, Treasurer and

Chief Financial Officer |

4

EXHIBIT INDEX

|

EXHIBIT NUMBER |

|

DESCRIPTION |

|

99.1 |

|

Press release dated August 21, 2014 (furnished herewith). |

5

Exhibit 99.1

Investor Relations

Amy Dahl

Managing Director, Corporate Communications and Investor Relations

(952) 887-8917, amy.dahl@toro.com

Media Relations

Branden Happel

Senior Manager, Public Relations

(952) 887-8930, branden.happel@toro.com

For Immediate Release

The Toro Company Reports Record Third Quarter Results

· Third quarter sales increase 11.3 percent to a record $567.5 million driven by strong retail demand for both professional and residential products

· Quarterly net earnings per share increase 28 percent to a record $0.87

· Company is well-positioned to achieve Destination 2014 goals as it launches its second century

BLOOMINGTON, Minn. (August 21, 2014) — The Toro Company (NYSE: TTC) today reported net earnings of $50 million, or $0.87 per share, on a net sales increase of 11.3 percent to $567.5 million for the third quarter of fiscal 2014. In the comparable fiscal 2013 quarter, the company delivered net earnings of $40.1 million, or $0.68 per share, on net sales of $509.9 million.

For the first nine months, Toro reported net earnings of $163 million, or $2.82 per share, on a net sales increase of 6 percent to $1.759 billion. In the comparable fiscal 2013 period, the company posted net earnings of $149.9 million, or $2.53 per share, on net sales of $1.659 billion.

“Our team is especially proud to deliver record results and double-digit sales and earnings growth for the third quarter in which we also celebrated our Centennial milestone,” said Michael J. Hoffman, Toro’s chairman and chief executive officer. “After successfully managing through the challenges of a late spring, our quarterly results benefited from favorable summer growing conditions in key markets that, similar to last year, helped drive retail sales across most of our businesses. Shipments of golf equipment and irrigation products increased on strong retail demand for our innovative product offerings. In addition, we returned to a more normal quarterly flow for channel purchases of professional equipment subject to Tier 4 emission standards. Landscape contractor customers continued to invest in turf maintenance equipment, which also helped drive sales. On the residential side of our business, early demand for snow products increased as channel partners began to prepare for the anticipated strong retail pre-season.”

“We are optimistic as we enter the final quarter of our fiscal year and Destination 2014 journey,” said Hoffman. “With our Centennial on July 10, 2014, we officially launched the company’s second century. Looking ahead, we will continue to focus on the key things that have driven our past performance: developing innovative products, serving our customers and executing in the marketplace. We will keep a close eye on both retail demand and field inventory levels and make adjustments as necessary. We also will continue to seek opportunities across the enterprise to improve productivity and leverage expenses. Of course, we remain mindful of the things outside of our control, such as unfavorable weather or economic conditions, that could create potential challenges for our customers.

-more-

That said, a strong snow pre-season and continued productivity gains, somewhat offset by product mix, should drive solid fourth quarter revenue and earnings results. As such, today we are changing our full-year outlook.”

The company now expects revenue growth for fiscal 2014 to be about 6 percent, and net earnings per share to be about $2.94 to $2.96.

SEGMENT RESULTS

Professional

· Professional segment net sales for the third quarter totaled $384.7 million, up 11.9 percent from the comparable fiscal 2013 period. Sales of golf equipment and irrigation products increased on strong retail demand for our innovative product offerings, including our new INFINITY™ sprinklers. Sales also benefitted from the return to a more normal quarterly flow of channel purchases of equipment subject to Tier 4 emission standards, as compared to fiscal 2013 when sales were pulled from the third quarter to the first quarter in connection with the regulatory transition. Turf maintenance and ground engaging equipment sales were up due to continued demand by landscape contractors for our productivity enhancing products. In addition, global micro irrigation sales increased with continued demand for more efficient solutions for agriculture. For the first nine months, professional segment net sales were $1.209 billion, up 3.4 percent from the comparable fiscal 2013 period. Sales for the year-to-date period increased on strong retail demand for landscape maintenance equipment and increased demand for our micro irrigation, construction and rental products.

· Professional segment earnings for the third quarter totaled $74.8 million, up 23.7 percent from the comparable fiscal 2013 period. For the first nine months, professional segment earnings were $244.7 million, up 4.8 percent from the comparable fiscal 2013 period.

Residential

· Residential segment net sales for the third quarter totaled $175.7 million, up 13 percent from the comparable fiscal 2013 period. Sales of snow products were up due to increased early demand as channel partners began to prepare for the anticipated strong retail pre-season. Sales of our residential zero turn mowing products also grew on continued retail demand for these mowing platforms. For the first nine months, residential segment net sales were $533.7 million, up 11.7 percent from the comparable fiscal 2013 period. Sales for the year-to-date period increased on strong in-season and pre-season demand for our snow products, as well as increased channel and retail demand for our residential zero turn mowers.

· Residential segment earnings for the third quarter totaled $18.7 million, up 24.1 percent from the comparable fiscal 2013 period. For the first nine months, residential segment earnings were $60.7 million, up 16.9 percent from the comparable fiscal 2013 period.

OPERATING RESULTS

Gross margin for the third quarter was 35.6 percent, an increase of 70 basis points compared to the same fiscal 2013 period, primarily due to favorable product mix and realized pricing, somewhat offset by higher commodity costs. For the first nine months, gross margin was 35.8 percent, a decrease of 10 basis points, primarily due to higher commodity costs and unfavorable segment mix and currency exchange rates, somewhat offset by realized pricing.

Selling, general and administrative (SG&A) expense as a percent of sales for the third quarter was 22.9 percent, a decrease of 50 basis points compared to the same fiscal 2013 period. For the first

2

nine months, SG&A expense as a percent of sales was 22 percent, also a decrease of 50 basis points. For both periods, the decrease primarily was due to the leveraging of expenses over higher sales volumes.

Third quarter operating earnings as a percent of sales improved 120 basis points to 12.7 percent compared to the same fiscal 2013 period. For the first nine months, operating earnings as a percentage of sales improved 40 basis points to 13.8 percent.

The effective tax rate for the third quarter decreased to 29.4 percent from 30.5 percent in the comparable fiscal 2013 period primarily due to a one-time tax benefit. For the first nine months, the effective tax rate increased to 31.7 percent from 31 percent in the comparable fiscal 2013 period when the company benefited from the retroactive reinstatement of the Federal Research and Engineering Tax Credit in the first quarter of that fiscal year.

Accounts receivable at the end of the third quarter totaled $215.6 million, up 6.7 percent from the same fiscal 2013 period. Net inventories were $293.8 million, up 13.5 percent from the same period last year. Trade payables were $169 million, up 36 percent compared to the same fiscal 2013 period, primarily due to recent purchases in anticipation of product demand.

About The Toro Company

The Toro Company (NYSE: TTC) is a leading worldwide provider of innovative turf, landscape, rental and construction equipment, and irrigation and outdoor lighting solutions. With sales of more than $2 billion in fiscal 2013, Toro’s global presence extends to more than 90 countries through strong relationships built on integrity and trust, constant innovation and a commitment to helping customers enrich the beauty, productivity and sustainability of the land. Since 1914, the company has built a tradition of excellence around a number of strong brands to help customers care for golf courses, sports fields, public green spaces, commercial and residential properties and agricultural fields. More information is available at www.thetorocompany.com.

3

LIVE CONFERENCE CALL

August 21, 2014 at 10:00 a.m. CDT

www.thetorocompany.com/invest

The Toro Company will conduct its earnings call and webcast for investors beginning at 10:00 a.m. CDT on August 21, 2014. The webcast will be available at www.streetevents.com or at www.thetorocompany.com/invest. Webcast participants will need to complete a brief registration form and should allocate extra time before the webcast begins to register and, if necessary, download and install audio software.

Forward-Looking Statements

This news release contains forward-looking statements, which are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations of future events, and often can be identified by words such as “expect,” “strive,” “looking ahead,” “outlook,” “guidance,” “forecast,” “goal,” “optimistic,” “anticipate,” “continue,” “plan,” “estimate,” “project,” “believe,” “should,” “could,” “will,” “would,” “possible,” “may,” “likely,” “intend,” and similar expressions or future dates. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or implied. Particular risks and uncertainties that may affect our operating results or financial position include: worldwide economic conditions, including slow or negative growth rates in global and domestic economies and weakened consumer confidence; disruption at our manufacturing or distribution facilities, including drug cartel-related violence affecting our maquiladora operations in Juarez, Mexico; fluctuations in the cost and availability of raw materials and components, including steel, engines, hydraulics and resins; the impact of abnormal weather patterns, including unfavorable weather conditions exacerbated by global climate change or otherwise; the impact of natural disasters and global pandemics; the level of growth or contraction in our key markets; government and municipal revenue, budget and spending levels; dependence on The Home Depot as a customer for our residential business; elimination of shelf space for our products at dealers or retailers; inventory adjustments or changes in purchasing patterns by our customers; our ability to develop and achieve market acceptance for new products; increased competition; the risks attendant to international operations and markets, including political, economic and/or social instability and tax policies in the countries in which we manufacture or sell our products; foreign currency exchange rate fluctuations; our relationships with our distribution channel partners, including the financial viability of our distributors and dealers; risks associated with acquisitions; management of our alliances or joint ventures, including Red Iron Acceptance, LLC; the costs and effects of enactment of, changes in and compliance with laws, regulations and standards, including those relating to consumer product safety, Tier 4 emissions requirements, conflict mineral disclosure, taxation, healthcare, and environmental, health and safety matters; unforeseen product quality problems; loss of or changes in executive management or key employees; interruption of our management information systems, including by unauthorized access, security breaches, cyber attacks or other disruptive events; the occurrence of litigation or claims, including those involving intellectual property or product liability matters; and other risks and uncertainties described in our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and other filings with the Securities and Exchange Commission. We undertake no obligation to update forward-looking statements made herein to reflect events or circumstances after the date hereof.

(Financial tables follow)

4

THE TORO COMPANY AND SUBSIDIARIES

Condensed Consolidated Statements of Earnings (Unaudited)

(Dollars and shares in thousands, except per-share data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

August 1,

2014 |

|

August 2,

2013 |

|

August 1,

2014 |

|

August 2,

2013 |

|

|

Net sales |

|

$ |

567,540 |

|

$ |

509,918 |

|

$ |

1,758,551 |

|

$ |

1,659,065 |

|

|

Gross profit |

|

202,080 |

|

178,031 |

|

630,134 |

|

596,149 |

|

|

Gross profit percent |

|

35.6 |

% |

34.9 |

% |

35.8 |

% |

35.9 |

% |

|

Selling, general, and administrative expense |

|

130,043 |

|

119,451 |

|

386,620 |

|

373,894 |

|

|

Operating earnings |

|

72,037 |

|

58,580 |

|

243,514 |

|

222,255 |

|

|

Interest expense |

|

(3,629 |

) |

(3,909 |

) |

(11,065 |

) |

(12,307 |

) |

|

Other income, net |

|

2,390 |

|

2,982 |

|

6,220 |

|

7,420 |

|

|

Earnings before income taxes |

|

70,798 |

|

57,653 |

|

238,669 |

|

217,368 |

|

|

Provision for income taxes |

|

20,785 |

|

17,556 |

|

75,701 |

|

67,473 |

|

|

Net earnings |

|

$ |

50,013 |

|

$ |

40,097 |

|

$ |

162,968 |

|

$ |

149,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net earnings per share |

|

$ |

0.89 |

|

$ |

0.70 |

|

$ |

2.88 |

|

$ |

2.58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net earnings per share |

|

$ |

0.87 |

|

$ |

0.68 |

|

$ |

2.82 |

|

$ |

2.53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares of common stock outstanding – Basic |

|

55,965 |

|

57,653 |

|

56,494 |

|

58,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares of common stock outstanding – Diluted |

|

57,320 |

|

58,913 |

|

57,800 |

|

59,266 |

|

Segment Data (Unaudited)

(Dollars in thousands)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

Segment Net Sales |

|

August 1,

2014 |

|

August 2,

2013 |

|

August 1,

2014 |

|

August 2,

2013 |

|

|

Professional |

|

$ |

384,678 |

|

$ |

343,866 |

|

$ |

1,208,707 |

|

$ |

1,169,446 |

|

|

Residential |

|

175,717 |

|

155,452 |

|

533,664 |

|

477,789 |

|

|

Other |

|

7,145 |

|

10,600 |

|

16,180 |

|

11,830 |

|

|

Total * |

|

$ |

567,540 |

|

$ |

509,918 |

|

$ |

1,758,551 |

|

$ |

1,659,065 |

|

|

|

|

|

|

|

|

|

|

|

|

|

* Includes international sales of |

|

$ |

141,649 |

|

$ |

138,718 |

|

$ |

498,029 |

|

$ |

492,371 |

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

Segment Earnings (Loss) Before Income Taxes |

|

August 1,

2014 |

|

August 2,

2013 |

|

August 1,

2014 |

|

August 2,

2013 |

|

|

Professional |

|

$ |

74,835 |

|

$ |

60,508 |

|

$ |

244,665 |

|

$ |

233,521 |

|

|

Residential |

|

18,698 |

|

15,070 |

|

60,654 |

|

51,903 |

|

|

Other |

|

(22,735 |

) |

(17,925 |

) |

(66,650 |

) |

(68,056 |

) |

|

Total |

|

$ |

70,798 |

|

$ |

57,653 |

|

$ |

238,669 |

|

$ |

217,368 |

|

THE TORO COMPANY AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (Unaudited)

(Dollars in thousands)

|

|

|

August 1,

2014 |

|

August 2,

2013 |

|

|

ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

177,894 |

|

$ |

161,180 |

|

|

Receivables, net |

|

215,595 |

|

202,148 |

|

|

Inventories, net |

|

293,761 |

|

258,929 |

|

|

Prepaid expenses and other current assets |

|

33,764 |

|

27,426 |

|

|

Deferred income taxes |

|

38,735 |

|

62,324 |

|

|

Total current assets |

|

759,749 |

|

712,007 |

|

|

|

|

|

|

|

|

|

Property, plant, and equipment, net |

|

202,828 |

|

179,943 |

|

|

Long-term deferred income taxes |

|

25,951 |

|

98 |

|

|

Goodwill and other assets, net |

|

139,299 |

|

139,082 |

|

|

Total assets |

|

$ |

1,127,827 |

|

$ |

1,031,130 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

140 |

|

$ |

— |

|

|

Short-term debt |

|

1,134 |

|

— |

|

|

Accounts payable |

|

168,956 |

|

124,244 |

|

|

Accrued liabilities |

|

289,519 |

|

284,702 |

|

|

Total current liabilities |

|

459,749 |

|

408,946 |

|

|

|

|

|

|

|

|

|

Long-term debt, less current portion |

|

223,800 |

|

223,528 |

|

|

Deferred revenue |

|

11,102 |

|

10,547 |

|

|

Deferred income taxes |

|

5,969 |

|

2,898 |

|

|

Other long-term liabilities |

|

14,474 |

|

6,592 |

|

|

Stockholders’ equity |

|

412,733 |

|

378,619 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

1,127,827 |

|

$ |

1,031,130 |

|

THE TORO COMPANY AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

(Dollars in thousands)

|

|

|

Nine Months Ended |

|

|

|

|

August 1,

2014 |

|

August 2,

2013 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net earnings |

|

$ |

162,968 |

|

$ |

149,895 |

|

|

Adjustments to reconcile net earnings to net cashprovided by operating activities: |

|

|

|

|

|

|

Noncash income from finance affiliate |

|

(5,598 |

) |

(5,658 |

) |

|

Provision for depreciation and amortization |

|

38,104 |

|

39,204 |

|

|

Stock-based compensation expense |

|

8,478 |

|

7,927 |

|

|

(Increase) decrease in deferred income taxes |

|

(43 |

) |

183 |

|

|

Other |

|

2 |

|

28 |

|

|

Changes in operating assets and liabilities, net of effect of acquisition: |

|

|

|

|

|

|

Receivables, net |

|

(59,774 |

) |

(56,762 |

) |

|

Inventories, net |

|

(53,716 |

) |

(12,048 |

) |

|

Prepaid expenses and other assets |

|

1,167 |

|

(1,539 |

) |

|

Accounts payable, accrued liabilities, deferred revenue, andother long-term liabilities |

|

72,625 |

|

36,910 |

|

|

Net cash provided by operating activities |

|

164,213 |

|

158,140 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of property, plant, and equipment |

|

(53,228 |

) |

(34,390 |

) |

|

Proceeds from asset disposals |

|

161 |

|

344 |

|

|

Distributions from finance affiliate, net |

|

2,324 |

|

2,977 |

|

|

Acquisition, net of cash acquired |

|

(715 |

) |

— |

|

|

Net cash used in investing activities |

|

(51,458 |

) |

(31,069 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Increase in (repayments of) short-term debt |

|

300 |

|

(415 |

) |

|

Increase in (repayments of) long-term debt |

|

18 |

|

(1,769 |

) |

|

Excess tax benefits from stock-based awards |

|

8,536 |

|

5,196 |

|

|

Proceeds from exercise of stock options |

|

6,813 |

|

8,146 |

|

|

Purchases of Toro common stock |

|

(100,507 |

) |

(76,003 |

) |

|

Dividends paid on Toro common stock |

|

(33,871 |

) |

(24,453 |

) |

|

Net cash used in financing activities |

|

(118,711 |

) |

(89,298 |

) |

|

|

|

|

|

|

|

|

Effect of exchange rates on cash and cash equivalents |

|

857 |

|

(2,449 |

) |

|

|

|

|

|

|

|

|

Net (decrease) increase in cash and cash equivalents |

|

(5,099 |

) |

35,324 |

|

|

Cash and cash equivalents as of the beginning of the period |

|

182,993 |

|

125,856 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents as of the end of the period |

|

$ |

177,894 |

|

$ |

161,180 |

|

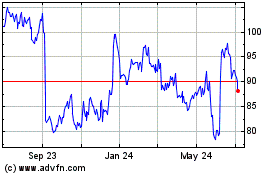

Toro (NYSE:TTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

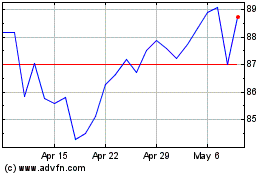

Toro (NYSE:TTC)

Historical Stock Chart

From Apr 2023 to Apr 2024