UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 13, 2014

Gevo, Inc.

(Exact Name

of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-35073 |

|

87-0747704 |

| (State or Other Jurisdiction

of Incorporation) |

|

Commission

File Number |

|

(I.R.S. Employer

Identification Number) |

345 Inverness Drive South, Building C, Suite 310, Englewood, CO 80112

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (303) 858-8358

N/A

(Former Name, or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On August 13, 2014, Gevo, Inc. (the

“Company”) issued a press release announcing the Company’s second quarter 2014 financial results. A copy of this press release entitled “Gevo Reports Second Quarter 2014 Financial Results” is furnished as Exhibit 99.1 to

this Current Report on Form 8-K and is incorporated herein by reference.

As previously announced, on August 13, 2014, the Company held a conference

call to discuss the Company’s second quarter 2014 financial results. A copy of the conference call transcript is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated

herein by reference. This transcript has been edited to facilitate the understanding of the information communicated during the conference call.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

|

|

| 99.1 |

|

Press release, dated August 13, 2014, entitled “Gevo Reports Second Quarter 2014 Financial Results”. |

|

|

| 99.2 |

|

Transcript of earnings conference call held on August 13, 2014. |

The information contained herein and in the accompanying exhibits shall not be incorporated by reference into any filing of

the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing. The information in this report, including the exhibits

hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| Gevo, Inc. |

|

|

| By: |

|

/s/ Mike Willis |

|

|

Mike Willis |

|

|

Chief Financial Officer |

Date: August 18, 2014

Exhibit 99.1

|

|

|

|

|

|

|

345 Inverness Drive South |

|

T 305-858-8358 |

| |

Building C, Suite 310 |

|

F 303-858-8431 |

| |

Englewood, CO 80112 |

|

gevo.com |

| |

|

|

|

For Immediate Release

Gevo Reports Second Quarter 2014 Financial Results

Luverne plant commences Side-by-Side production

| |

• |

|

Ended the second quarter with cash and cash equivalents of $5.9 million |

| |

• |

|

Luverne plant producing both isobutanol and ethanol in Side-by-Side operational mode (SBS) |

| |

• |

|

Closed an $18 million public offering of common stock and warrants |

| |

• |

|

Shipped renewable para-xylene to Toray Industries, Inc. (Toray) |

ENGLEWOOD, Colo. – August 13, 2014

- Gevo, Inc. (NASDAQ: GEVO) today announced its financial results for the three months ended June 30, 2014 and provided an update on recent corporate highlights.

Luverne Update

In the beginning of June, Gevo commenced

the co-production of isobutanol and ethanol, with one fermenter dedicated to isobutanol production and three fermenters dedicated to ethanol production.

Key results achieved thus far include:

| |

• |

|

Producing isobutanol in a commercial-scale one million liter fermenter; |

| |

• |

|

Producing ethanol at a run rate of approximately 1.5 million gallons per month (exceeding our goal of 1.25 million gallons per month); |

| |

• |

|

Generating revenue of more than $3 million per month at Luverne; and |

| |

• |

|

No yeast cross-contamination between the isobutanol and ethanol systems. |

“We are very pleased with the

progress of the plant under the SBS. Isobutanol yields have reached >90% of target based on starch content, and isobutanol batch cash costs have decreased by >25%, with a clear path towards targeted economic rates. Operating all the

assets of the plant has allowed us to achieve 100% recycle streams, while consistently producing sterile mash, controlling infections and growing isobutanol producing yeast. For the first time, we also sold IDGs®, the animal feed that is a co-product of our isobutanol production,” said Dr. Patrick Gruber, Gevo’s CEO.

The targeted next steps at the plant are:

| |

• |

|

Complete the final phase of capital for the SBS by installing distillation equipment which we believe will enable increased production of isobutanol; |

| |

• |

|

Begin to sell isobutanol into the solvents and specialty gasoline blendstock markets; |

| |

• |

|

Continue to convert our isobutanol into hydrocarbons at our demo plant located at the South Hampton Resources, Inc. facility (Hydrocarbons Plant) and sell our bio-jet and iso-octane products; and |

| |

• |

|

Achieve EBITDA breakeven at the Luverne plant which we project to occur by the end of 2014. |

“By

installing the additional distillation equipment at Luverne, we expect to be able to achieve production levels of 50-100 thousand gallons of isobutanol per month by the end of 2014. As we continue to learn and optimize the isobutanol production

process, we believe we can ultimately increase our production rate to approximately 2-3 million gallons of isobutanol per annum under the SBS, while we are running at an annual production rate of approximately 18 million gallons of

ethanol. With the much improved cash flow profile of the plant and the United States District Court’s decision to stay the trial relating to U.S. Patent Nos. 7,851,188 and 7,993,889, Gevo’s overall corporate burn is expected to decrease

significantly going forward,” continued Gruber.

Other Recent Highlights

On August 5, 2014, Gevo closed an underwritten public offering of 30,000,000 shares of common stock and warrants to purchase an additional 15,000,000

shares of common stock. The warrants have an exercise price of $0.85 per share, will be exercisable from the date of original issuance and will expire on August 5, 2019. The shares of common stock and the warrants were sold together as common

stock units but were immediately separable and issued separately. The gross proceeds to Gevo from this offering were approximately $18 million, not including any future proceeds from the exercise of the warrants. Gevo currently intends to use the

net proceeds from the offering, excluding any future proceeds from the exercise of the warrants, to fund capital to complete the side-by-side configuration of its Luverne facility, to fund working capital and for other general corporate purposes.

In May, Gevo sold para-xylene (PX) derived from its renewable isobutanol to Toray, one of the world’s leading producers of fibers, plastics, films,

and chemicals. PX is a primary raw material for the manufacture of bio-polyester (PET). PET has the largest global market share of all synthetic fibers and is also used in plastic bottles, films, and as a polymer for many other applications. The PX

was sold under a previously announced offtake agreement with Toray. Toray also provided funding

assistance for the construction of Gevo’s PX demo plant at the Hydrocarbons Plant, where Gevo also produces other products such as renewable jet fuel and renewable iso-octane. Toray expects

to produce fibers, yarns, and films from Gevo’s PX, for scale-up evaluation and market development purposes.

In July, 2014, the United States

District Court decided to stay the patent litigation involving U.S. Patent Nos. 7,851,188 and 7,993,889 that was scheduled to begin on July 21, 2014. We expect that this decision will significantly decrease our legal costs for the foreseeable

future.

Financial Highlights

Revenues for the

second quarter of 2014 were $7.7 million compared to $1.9 million in the same period in 2013. The increase in revenue during 2014 is primarily a result of the production and sale of ethanol and distiller’s grains of $5.5 million following the

transition of the Luverne plant to the SBS.

During the second quarter of 2014, hydrocarbon revenues increased by $1.4 million, primarily due to the

shipment of bio-PX to Toray in May for which we recognized $1.5 million of revenue, including $1.0 million relating to a payment we received from Toray in 2012 for the design and construction of our bio-PX demo plant. We also continued to generate

revenue during the second quarter of 2014 associated with our ongoing research agreements.

Our cost of goods sold increased by $4.7 million during the

three months ended June 30, 2014, as compared to the same quarter in 2013, due primarily to the increased production activity at the Luverne plant under the SBS.

Research and development expense decreased by $2.2 million during the three months ended June 30, 2014, as compared to the same quarter in 2013, due

primarily to a $1.2 million decrease in expenses at the Hydrocarbons Plant. In the second quarter of 2013, we incurred expenses associated with the building of the bio-PX reactor at the Hydrocarbons Plant under our agreement with Toray, which was

substantially completed in the third quarter of 2013. Research and development expense also decreased in as a result of a $0.8 million decrease in salaries and consultant expenses.

Selling, general and administrative expense decreased $1.4 million during the three months ended June 30, 2014, as compared to the same quarter in 2013,

due primarily to a reduction in compensation-related expenses.

Interest expense increased to $5.8 million during the three months ended June 30,

2014 primarily due to one-time debt issuance costs of $3.2 million associated with the Whitebox financing in May.

The company reported a non-cash gain of $2.8 million during the second quarter of 2014 related to changes in the

fair value of derivative warrant liability and embedded derivatives contained in the convertible notes issued in 2012 (2012 Notes). We reported a $2.0 million gain during the second quarter of 2013 associated with changes in the fair value of the

embedded derivatives contained in the 2012 Notes. The company did not have any holders of 2012 Notes opt to convert their note holdings into shares of Gevo common stock during the three months ended June 30, 2014.

The company also reported a non-cash loss of $5.1 million during the second quarter of 2014 related to a change in the fair value of the convertible notes

issued in the second quarter of 2014 to Whitebox (Whitebox Notes).

The net loss for the second quarter of 2014 was $17.2 million compared to $15.2

million during the same period in 2013.

Webcast and Conference Call Information

Hosting today’s conference call at 4:30 p.m. EST (2:30 p.m. MST) will be Dr. Patrick Gruber, Chief Executive Officer, and Mike Willis, Chief

Financial Officer. They will review the company’s financial results for the three months ended June 30, 2014 and provide an update on recent corporate highlights.

To participate in the conference call, please dial 1 (800) 708-4540 (inside the U.S.) or 1 (847) 619-6397 (outside the U.S.) and reference the

access code 37684059. The presentation will be available via a live webcast at: http://edge.media-server.com/m/p/tyq6zx89/lan/en.

A replay of the

call and webcast will be available two hours after the conference call ends on August 13, 2014. To access the replay, please dial 1-888-843-7419 (inside the US) or 1-630-652-3042 (outside the US) and reference the access code 37684059. The

archived webcast will be available until Midnight EDT on September 12, 2014 in the Investor Relations section of Gevo’s website at www.gevo.com.

About Gevo

Gevo is a leading renewable technology,

chemical products, and next generation biofuels company. Gevo’s underlying technology uses a combination of synthetic biology, metabolic engineering, chemistry and chemical engineering to focus primarily on the production and sale of

isobutanol, as well as related products from renewable feedstocks. Gevo’s strategy is to

commercialize biobased alternatives to petroleum-based products to allow for the optimization of fermentation facilities’ assets, with the ultimate goal of maximizing cash flows from the

operation of those assets. Gevo produces isobutanol, ethanol and high-value animal feed at its first fermentation plant in Luverne, MN. Gevo has also developed technology to produce hydrocarbon products from renewable alcohols. Gevo currently

operates its first biorefinery in Silsbee, TX, in collaboration with South Hampton Resources Inc., to produce renewable jet fuel, octane, and ingredients for plastics like polyester. Gevo has a marquee list of partners including The Coca-Cola

Company, Toray Industries Inc., Total SA and LANXESS, Inc., an affiliate of LANXESS Corporation, among others. Gevo is committed to a sustainable bio-based economy that meets society’s needs for plentiful food and clean air and water. For more

information, visit www.gevo.com.

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995. These forward-looking statements include statements that are not purely statements of historical fact, and can sometimes be identified by our use of terms such as “intend,” “expect,” “plan,”

“estimate,” “future,” “strive” and similar words. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the management of Gevo and are subject to significant

risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and the company undertakes no obligation to update or

revise these statements, whether as a result of new information, future events or otherwise. Although the company believes that the expectations reflected in these forward-looking statements are reasonable, these statements involve many risks and

uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For a further discussion of risks and uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks relating to the business of Gevo in general, see the risk disclosures in the Annual Report on Form 10-K of Gevo for the year ended December 31, 2013 and in subsequent reports on

Form 10-Q and Form 8-K and other filings made with the Securities Exchange Commission by Gevo.

Non-GAAP Financial Information

Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis. On a non-GAAP basis, financial measures exclude

non-cash items such as stock-based compensation. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and

financial planning purposes. These non-GAAP financial measures also facilitate management’s internal comparisons to Gevo’s historical performance as well as comparisons to the operating results of other companies. In addition, Gevo

believes these non-GAAP financial measures are useful to investors because they allow for greater transparency into the indicators used by management as a basis for its financial and operational decision making. Non-GAAP information is not prepared

under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Gevo’s operating performance. A reconciliation between GAAP and non-GAAP

financial information is provided in the financial statement tables below.

Gevo, Inc.

Condensed Consolidated Statements of Operations Information

(Unaudited, in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Revenue and cost of goods sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ethanol sales and related products, net |

|

$ |

5,522 |

|

|

$ |

— |

|

|

$ |

5,522 |

|

|

$ |

— |

|

| Hydrocarbon revenue |

|

|

2,018 |

|

|

|

573 |

|

|

|

2,648 |

|

|

|

1,312 |

|

| Grant and other revenue and corn sales |

|

|

181 |

|

|

|

1,286 |

|

|

|

454 |

|

|

|

4,090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

7,721 |

|

|

|

1,859 |

|

|

|

8,624 |

|

|

|

5,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

|

8,269 |

|

|

|

3,616 |

|

|

|

12,949 |

|

|

|

8,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross loss |

|

|

(548 |

) |

|

|

(1,757 |

) |

|

|

(4,325 |

) |

|

|

(2,717 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

3,586 |

|

|

|

5,828 |

|

|

|

7,691 |

|

|

|

10,804 |

|

| Selling, general and administrative and other |

|

|

4,898 |

|

|

|

6,279 |

|

|

|

9,938 |

|

|

|

13,229 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

8,484 |

|

|

|

12,107 |

|

|

|

17,629 |

|

|

|

24,033 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(9,032 |

) |

|

|

(13,864 |

) |

|

|

(21,954 |

) |

|

|

(26,750 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(2,609 |

) |

|

|

(2,312 |

) |

|

|

(4,210 |

) |

|

|

(5,588 |

) |

| Interest expense - debt issuance costs |

|

|

(3,185 |

) |

|

|

— |

|

|

|

(3,185 |

) |

|

|

— |

|

| Gain (Loss) from change in fair value of derivative warrant liability and embedded derivatives contained in 2012 Notes |

|

|

2,801 |

|

|

|

2,023 |

|

|

|

5,343 |

|

|

|

693 |

|

| Loss on conversion of 2012 Notes |

|

|

— |

|

|

|

(1,112 |

) |

|

|

— |

|

|

|

(2,038 |

) |

| Gain (Loss) from change in fair value of Whitebox Notes |

|

|

(5,129 |

) |

|

|

|

|

|

|

(5,129 |

) |

|

|

|

|

| Other income |

|

|

(2 |

) |

|

|

43 |

|

|

|

7 |

|

|

|

91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense |

|

|

(8,124 |

) |

|

|

(1,358 |

) |

|

|

(7,174 |

) |

|

|

(6,842 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(17,156 |

) |

|

$ |

(15,222 |

) |

|

$ |

(29,128 |

) |

|

$ |

(33,592 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share attributable to Gevo, Inc. common stockholders - basic and diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.43 |

) |

|

$ |

(0.80 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of common shares outstanding - basic and diluted |

|

|

67,969,811 |

|

|

|

43,371,992 |

|

|

|

67,865,844 |

|

|

|

43,371,992 |

|

Gevo, Inc.

Condensed Consolidated Balance Sheet Information

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2014 |

|

|

December 31,

2013 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

5,908 |

|

|

$ |

24,625 |

|

| Accounts receivable |

|

|

3,085 |

|

|

|

1,358 |

|

| Inventories |

|

|

4,243 |

|

|

|

3,581 |

|

| Prepaid expenses and other current assets |

|

|

935 |

|

|

|

1,163 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

14,171 |

|

|

|

30,727 |

|

|

|

|

| Property, plant and equipment, net |

|

|

83,704 |

|

|

|

83,475 |

|

| Deposits and other assets |

|

|

4,097 |

|

|

|

2,153 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

101,972 |

|

|

$ |

116,355 |

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable, accrued liabilities and other current liabilities |

|

$ |

8,195 |

|

|

$ |

13,030 |

|

| Derivative warrant liability |

|

|

4,687 |

|

|

|

7,243 |

|

| Current portion of secured debt, net |

|

|

268 |

|

|

|

788 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

13,150 |

|

|

|

21,061 |

|

| Long-term portion secured debt, net |

|

|

31,871 |

|

|

|

9,339 |

|

| 2012 Notes, net |

|

|

12,956 |

|

|

|

14,501 |

|

| Other long-term liabilities |

|

|

359 |

|

|

|

479 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

58,336 |

|

|

|

45,380 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

43,636 |

|

|

|

70,975 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

101,972 |

|

|

$ |

116,355 |

|

|

|

|

|

|

|

|

|

|

Gevo, Inc.

Condensed Consolidated Cash Flow Information

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

| Operating Activities |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(29,128 |

) |

|

$ |

(33,592 |

) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Non-cash expenses |

|

|

8,514 |

|

|

|

7,003 |

|

| Loss (gain) from change in fair value of derivatives |

|

|

(214 |

) |

|

|

(693 |

) |

| Loss on conversion of debt |

|

|

— |

|

|

|

2,038 |

|

| Changes from working capital |

|

|

(4,392 |

) |

|

|

6,057 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in operating activities |

|

|

(25,220 |

) |

|

|

(19,187 |

) |

|

|

|

| Investing Activities |

|

|

|

|

|

|

|

|

| Acquisitions of property, plant and equipment, net |

|

|

(3,837 |

) |

|

|

(2,758 |

) |

| Restricted cash - interest reserve |

|

|

(2,611 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(6,448 |

) |

|

|

(2,758 |

) |

|

|

|

| Financing Activities |

|

|

|

|

|

|

|

|

| Payments on secured debt |

|

|

(9,622 |

) |

|

|

(4,141 |

) |

| Proceeds from issuance of debt |

|

|

25,906 |

|

|

|

|

|

| Other financing activities |

|

|

(3,333 |

) |

|

|

(70 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

12,951 |

|

|

|

(4,211 |

) |

|

|

|

| Net decrease in cash and and cash equivalents |

|

|

(18,717 |

) |

|

|

(26,156 |

) |

|

|

|

| Cash and cash equivalents |

|

|

|

|

|

|

|

|

| Beginning of period |

|

|

24,625 |

|

|

|

66,744 |

|

|

|

|

|

|

|

|

|

|

| Ending of period |

|

$ |

5,908 |

|

|

$ |

40,588 |

|

|

|

|

|

|

|

|

|

|

Gevo, Inc.

Non-GAAP Financial Information

(Unaudited, in

thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Gevo Development, LLC / Agri-Energy, LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

$ |

(3,053 |

) |

|

$ |

(2,960 |

) |

|

$ |

(8,121 |

) |

|

$ |

(5,433 |

) |

| Depreciation and amortization |

|

|

539 |

|

|

|

534 |

|

|

|

1,124 |

|

|

|

1,067 |

|

| Non-cash stock-based compensation |

|

|

30 |

|

|

|

46 |

|

|

|

30 |

|

|

|

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP loss from operations |

|

$ |

(2,484 |

) |

|

$ |

(2,380 |

) |

|

$ |

(6,967 |

) |

|

$ |

(4,320 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gevo, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

$ |

(5,979 |

) |

|

$ |

(10,904 |

) |

|

$ |

(13,833 |

) |

|

$ |

(21,317 |

) |

| Depreciation and amortization |

|

|

239 |

|

|

|

311 |

|

|

|

480 |

|

|

|

627 |

|

| Non-cash stock-based compensation |

|

|

607 |

|

|

|

993 |

|

|

|

607 |

|

|

|

993 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP loss from operations |

|

$ |

(5,133 |

) |

|

$ |

(9,600 |

) |

|

$ |

(12,746 |

) |

|

$ |

(19,697 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gevo Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

$ |

(9,032 |

) |

|

$ |

(13,864 |

) |

|

$ |

(21,954 |

) |

|

$ |

(26,750 |

) |

| Depreciation and amortization |

|

|

778 |

|

|

|

845 |

|

|

|

1,604 |

|

|

|

1,694 |

|

| Non-cash stock-based compensation |

|

|

637 |

|

|

|

1,039 |

|

|

|

637 |

|

|

|

1,039 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP loss from operations |

|

$ |

(7,617 |

) |

|

$ |

(11,980 |

) |

|

$ |

(19,713 |

) |

|

$ |

(24,017 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

###

|

|

|

| Media Contact: |

|

Investor Contact: |

| Robin Peak |

|

Mike Willis |

| Gevo, Inc. |

|

Gevo, Inc. |

| T: (720) 267-8632 |

|

T: (720) 267-8636 |

| rpeak@gevo.com |

|

mwillis@gevo.com |

Exhibit 99.2

Gevo, Inc.

Transcript

of Second Quarter 2014 Earnings Call

Mike Willis

Good afternoon and thank you for joining Gevo’s 2nd quarter 2014 conference call. I’m Mike Willis, Gevo’s CFO. With me today are Pat Gruber,

our CEO; and Brett Lund, our Chief Licensing Officer and General Counsel.

Earlier this afternoon we issued a press release, which outlines the topics

that we plan to discuss today. A copy of this release is available on our website at www.gevo.com.

I would like to remind our listeners that this

conference call is open to the media and we are providing a simultaneous webcast of this call to the public. A replay of our discussion will be available on our website later today.

On the call today and on this webcast, you will hear discussions of non-GAAP financial measures. Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information presented in accordance with GAAP. Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures is contained in the press release

distributed today, which is posted on our website.

We will also provide certain forward-looking statements about events and circumstances that have not

yet occurred, including projections of Gevo’s operating activities for 2014 and beyond. These statements are based on management’s current beliefs, expectations and assumptions and are subject to significant risks and uncertainty,

including those disclosed in Gevo’s most recent annual report on Form 10-K, which was filed with the SEC on April 14, 2014, and in subsequent reports and other filings made with the SEC by Gevo. Investors are cautioned not to place undue

reliance on any such forward-looking statements. Such forward-looking statements speak only as of today’s date and Gevo disclaims any obligation to update information contained in these forward-looking statements, whether as a result of new

information, future events or otherwise. Please refer to Gevo’s SEC filings for detailed discussions of the relevant risks and uncertainties.

On

today’s call, Pat, will begin with a review of our recent business developments. I will then review our financial results for the 2nd quarter of 2014. Following the presentation we will open the call up for questions.

I will now turn the call over to Pat.

Pat Gruber

Thank you for joining us on our call today. I believe we have turned a corner: our Side-by-Side operation of producing isobutanol with ethanol has solved many

of the operational problems we had encountered. We are finally in a position to get on with the business of isobutanol, producing and selling it at commercial scale. We also are in a position to give more specific guidance and will do so today.

First Luverne:

As we previously announced, we are in fact

operating Luverne in what we are calling Side-by-Side mode where we produce isobutanol and ethanol. Currently three of our fermenters are dedicated to ethanol and one is used for isobutanol. Recall that the reasons we went to Side-by-Side were

threefold:

1) The production of ethanol facilitates consistent grind and recycle streams. This is important because dry mills don’t have a

wastewater treatment plant and virtually all of the water used in the process needs to be recycled to the front of the plant for reuse. The recycle stream needs to be steady and consistent. Running ethanol keeps the streams and recycles all running

smoothly while we work on isobutanol. Instead of chasing down plant operability problems, we can just focus on isobutanol. That is just what we have done. Regarding recycles, we now are at 100% use of recycle water for isobutanol fermentation. That

is up from 90%. Also our techniques for managing infections seem to work well in Side-by-Side. We have had no cross contamination of our isobutanol and ethanol biocatalysts. We also have had no significant issues with extraneous bacteria infecting

our fermentations. I’m pleased with the results on this front.

2) Running Side-by-Side dramatically improves the utilization of the plant to

generate cash by utilizing all the fermentation assets. We believe that ethanol and animal feed profit will greatly assist us in covering the cost of the isobutanol implementation, with the goal of achieving profitability across both product lines

as we ramp up isobutanol.

3) We have several parties who are interesting in the Side-by-Side model. It is good to have a working version of it. There

seems to be good reason people are interested in our Side-by-Side business model. The good ethanol plants make money. However, it’s not obvious if and when the ethanol market will grow. Where will their growth come from? Isobutanol provides an

opportunity for adding a product line and production capacity, while they keep their ethanol running. They can expand the revenue and margin for their plant by adding isobutanol production lines. As previously discussed, we already have two

letters-of-intent (“LOI”s) for licensing a Side-by-Side isobutanol plant, and I expect we will add other partners to our licensee list, and I look forward to converting these LOIs to definitive agreements.

Now that the plant operability has improved, we are making progress on the isobutanol fermentation. We have been

consistently achieving high yields at greater than 90% of our target. This is good news. It means that our biocatalyst is converting carbohydrate to isobutanol very efficiently.

We are installing a relatively small distillation column at Luverne and should have it operating in the early

4th quarter. The purpose of this column is to debottleneck the isobutanol side of the plant. This is a straightforward engineering exercise, no bioprocessing involved. While we are installing that

distillation column we will continue to optimize the fermentation in our 1 million liter fermenter, with a particular view of driving out cost.

The

ethanol side of our plant has been running well. Producing ethanol at a run rate of approximately 1.5 million gallons per month (above our previous guidance of 1.25 million gallons per month). Operating at these rates, ethanol generates

revenue of more than $3 million per month at Luverne.

The correct way to think about our plant capacity is this:

Right now, we are set up to run 18 million gallons per year of ethanol. Once the distillation column is completed, and while we are running at an

18 million gallon per year ethanol run rate, we will target an isobutanol capacity of 150-200 thousand gallons per month, or roughly 2-3 million gallons of isobutanol capacity per year.

While our capacity by year end is expected to be about 2-3 million gallons per year of isobutanol, as I look as at how we are planning to ramp up

isobutanol production, I believe that our isobutanol run-rate by year end will be roughly about 50-100 thousand gallons per month. We will continue to push to the full isobutanol run rate as fast as possible in 2015, achieving the

150-200 thousand gallons per month while we run 18 million gallons per year of ethanol.

Note that until the distillation column is operating in

the 4th quarter, in other words, in the 3rd quarter of this year I expect our isobutanol capacity will be a bit variable, still in the tens of

thousands of gallons per month.

In 2015, we will have to make a decision to a) switch ethanol capacity to isobutanol, or b) add more isobutanol

fermentation capacity.

It’s also worth noting that we also have begun to sell iDGs™ in addition to DDGs. iDGs™ are the animal feed product

from isobutanol. Land ‘O Lakes/Purina has been a great partner on the animal feed.

Bottom line on the plant: We are making good progress. We expect

to see the plant at EBITDA breakeven by the end of the year while it produces isobutanol and ethanol. By the end of the year, we expect production of isobutanol to be reliable so we can sell isobutanol on a normal ongoing commercial basis. This is

good.

Our team is psyched up, we like having the plant operability issues behind us, and being able to focus on

isobutanol production. We all will like being in a position to supply isobutanol on a consistent, commercial basis.

Our commercial team continues to

develop market interest for isobutanol as a drop-in, as well as products derived from isobutanol such as jet fuel, paraxylene, and isooctane. Our objective is to maximize isobutanol value as both a drop-in material (fuels and chemicals) and as a

feedstock to produce other hydrocarbons (jet fuel, paraxylene, and isooctane). In both the drop-in and feedstock markets, Gevo has established partnerships and relationships that will achieve the objective of maximizing isobutanol value.

In the marine fuel market, isobutanol appears an attractive product that solves problems. Isobutanol is not miscible with water, has high energy, and is

renewable, so it appears to make for a very good marine fuel component. Marine engines appear to operate very well with isobutanol-blended fuels, as compared to marine fuels that contain ethanol. We have been working with both the US Coast Guard and

Mercury Marine performing long-term engine testing with 16% isobutanol blends. We have been working with Noble Mansfield, Gulf Hydrocarbon, and others to enable supply to the marine market.

In the chemical and solvent markets, we have been working with distributors who service high value uses of isobutanol for mining, oilfield applications, as

well as paints & coatings, and plastics. These specialty chemical applications for isobutanol appear to be very attractive.

Gevo continues to

produce jet fuel at South Hampton Resources in Silsbee, TX for supply to the Air Force, Army and Navy. This jet fuel is being specified by the Air Force, Army and Navy for blends of up to 50% bio-based fuel in the final blend. We expect

specification to be completed early next year, allowing us to seek larger contracts with the US Armed Forces. In addition, we expect the ASTM specification for alcohol-to-jet fuel (ATJ) to be completed in Q1 2015. This is expected to enable us to

seek contracts in the civilian aviation market.

Renewable PET or polyesters continue to be an interesting application for isobutanol. We have been

converting isobutanol to para-xylene at our demonstration plant at South Hampton Resources in Silsbee TX. Para-xylene is key raw material for making the plastic for bottles, packaging films, and fibers. The process to produce para-xylene from

isobutanol has been working well. We accomplished an important milestone in the second quarter of producing and delivering to Toray fully renewable paraxylene. Toray will use the bio-para-xylene to make bio-based polyester. Interest from our

partners in renewable para-xylene for use in PET remains strong.

So, we are continuing to make progress on the commercial front, interest in our products appear high, we need to

get on with supplying them. I’ll now turn it over to Mike Willis to discuss our financials.

Mike Willis

Thank you, Pat.

Gevo reported revenue in the 2nd quarter of

2014 of $7.7 million as compared to $1.9 million in the same period in 2013. The increase in revenue during 2014 is primarily a result of the production and sale of ethanol and distiller’s grains of $5.5 million following the transition of the

Luverne plant to Side-by-Side. Revenues also increased in the 2nd quarter of 2014 due to higher hydrocarbon revenues of $2 million. This increase was principally a result of the shipment of bio-para-xylene to Toray in May for which we recognized

$1.5 million of revenue, including $1 million relating to a payment we received from Toray in 2012 for the design and construction of our bio-para-xylene demo plant. We also generated revenue of $181 thousand during the 2nd quarter of 2014 from

ongoing research agreements.

Cost of goods sold increased to $8.3 million in the second quarter of 2014 versus $3.6 million in the same period in 2013,

due to the increased production activity at the Luverne plant under Side-by-Side.

R&D expense was $3.6 million in the 2nd quarter of 2014, compared

to $5.8 million reported in the 2nd quarter of 2013. Our R&D activities in the 2nd quarter of 2014 continued to be focused on the optimization of our technology to further enhance isobutanol production rates at Luverne, as well as

production-related activities at our hydrocarbons demo plant in Texas, where we produce our bio-jet, para-xylene and isooctane products. R&D expense decreased in the 2nd quarter of 2014 compared with the same period in 2013, due to a $1.2

million decrease in expenses at the hydrocarbons demo plant and a $0.8 million decrease in salaries and consultant expenses.

SG&A expense for the 2nd

quarter of 2014 decreased to $4.9 million compared to $6.3 million for the comparable quarter in 2013. Our 2nd quarter 2014 results continued to show the benefit of cost savings actions including decreases of $1.2 million in salary and

compensation-related expenses.

Within total operating expenses for the 2nd quarter of 2014 we reported approximately $0.6 million for non-cash stock

based compensation.

For the 2nd quarter of 2014, we reported a net loss from operations of $9 million, down from a loss from

operations of $13.9 million in the 2nd quarter of 2013.

Interest expense for the 2nd quarter of 2014 was $5.8 million compared to $2.3 million in the 2nd

quarter of 2013. The increase was primarily due to expensing $3.2 million of debt issuance costs related to the Whitebox financing we completed in May.

We reported a non-cash gain of $2.8 million during the second quarter of 2014 related to changes in the fair value of the derivative warrant liability and

embedded derivatives contained in the convertible notes issued in 2012. The company also reported a non-cash loss of $5.1 million during the second quarter of 2014 related to a change in the fair value of the convertible notes just issued in the

second quarter of 2014 to Whitebox.

For the 2nd quarter of 2014, we reported a net loss of $17.2 million, or a loss of $(0.25) per share based on a

weighted average shares outstanding of 67,969,811. This compares to a loss of $15.2 million in the 2nd quarter of 2013, or a loss of $(0.35) per share.

During the 2nd quarter there were no conversions of convertible notes, and at quarter-end we had 69,104,005 shares outstanding.

Cash on hand at June 30 was $5.9 million.

In May, we

closed a financing with Whitebox Advisors that resulted in gross proceeds of $25.9 million. The investment was made via a Term Loan that was exchangeable into convertible debentures. After taking into account debt issuance costs of $3.2 million, the

pay-down of the TriplePoint Capital loan by $9.3 million and the establishment of a restricted interest reserve account of $2.6 million, the net cash proceeds to Gevo of the Whitebox financing were approximately $10.8 million.

In June, Whitebox exchanged their entire Term Loan into the Convertible Debentures. Taking into account PIK interest, Whitebox exchanged their term loan into

$26.1 million of the convertible debentures. These debentures can be converted into common stock of the Company at a price equal to $1.1584 per share and carry a 10% coupon, of which, under certain circumstances, 5% is payable in cash and 5% is

payable in kind.

In conjunction with the Whitebox financing, we also restructured our debt with TriplePoint Capital. We used $9.3m of the proceeds from

the Whitebox financing to pay down TriplePoint’s debt, leaving a balance with TriplePoint of $1 million at June 30th, 2014, and which is now subordinated to the Whitebox debt. TriplePoint’s remaining debt will amortize over 36 months

and carries a coupon of 9%.

In August we also closed an underwritten public offering of 30,000,000 shares of common stock + warrants to

purchase an additional 15,000,000 shares of common stock. The warrants have an exercise price of $0.85 per share, and expire on August 5th, 2019. The shares of common stock and the warrants were sold together as common stock units but were

immediately separable and issued separately. The gross proceeds to Gevo from this offering were approximately $18 million; not including any future proceeds from the exercise of the warrants.

In terms of cash burn, we expect this to continue to decrease over the coming quarters, in particular due to our decision to transition Luverne to the

Side-by-Side configuration and the US District Court’s recent decision to stay the patent trial that was scheduled to begin in July. As a result of these changes and our ongoing corporate expense control measures, we continue to expect

Gevo’s quarterly cash burn to decline into the single-digit millions in the 2nd half of the year.

With that, I will now turn the call back to Pat.

Pat

Gruber

Thanks Mike. So what does the near-term future hold? I’d say I look forward to transitioning to our ongoing sales of isobutanol on a

“normal customer” basis. By becoming a regular supplier, we are committing to customers that we won’t let them down. I expect our commercial development people to continue to add customers for both isobutanol and its derivative

hydrocarbon products.

I like where we’re headed in terms of reducing our burn. I like getting the plant to EBITDA breakeven. I believe we are

turning the corner.

And with that, we’ll take questions.

Question-and-Answer Session

Operator

Thank you. (Operator Instructions) And we have

Mike Ritzenthaler from Piper Jaffray in line with questions. Please go ahead.

Mike Ritzenthaler - Piper Jaffray

Yeah. Good afternoon.

Pat Gruber - Chief

Executive Officer

Hey Ritz.

Mike

Ritzenthaler - Piper Jaffray

Would you be able to delineate the EBITDA or the gross margin per gallon of ethanol in the quarter? I’m

assuming that the gross loss stems from the fact that it was only a partial quarter of ethanol production?

Mike Willis - Chief Financial

Officer

So the target of the plant is breakeven by Q4. Our ‘cost of goods’ line represents most of the costs of the plant itself, other than a

small amount of Luverne’s G&A.

Mike Ritzenthaler - Piper Jaffray

Okay.

Mike Willis - Chief Financial Officer

So when you think about the plant becoming EBITDA breakeven in Q4, those costs of goods associated with ethanol sales, related products and isobutanol sales,

should net to effectively zero at that point in time.

Mike Ritzenthaler - Piper Jaffray

Yeah. Okay. That was the nature of my question. Thanks for clearing that up. On the cash bridge from the end of Q1: thanks for the commentary about how things

stepped from the Whitebox infusion to the end of Q2. I’m wondering if there is anything pro forma, you can provide us on the current cash situation, given the recent raise?

Mike Willis - Chief Financial Officer

I think the only thing we probably can say at this stage is that the current cash position takes us into 2015, but we are not going to be specific in terms of

how far into 2015.

Mike Ritzenthaler - Piper Jaffray

Yeah.

Mike Willis - Chief Financial Officer

We do have a good runway to basically do all the things that Pat described in his earlier statement, that we plan to do over the next couple of quarters.

Mike Ritzenthaler - Piper Jaffray

Sure. I guess,

one last for me on isobutanol cash costs. I know that Side-by-Side helped greatly in reducing the cash costs of producing isobutanol. I’m curious, basically how far is Gevo from achieving those kinds of commercial economics or will that happen

post distillation column and all that?

Pat Gruber - Chief Executive Officer

We need to get the distillation column installed; right now, there is a bottleneck in the plant. We have a mixed stream that we have to take care: a mixed

stream of ethanol and isobutanol, we have to take care of. So yes, we install the distillation column and then I can tell you we’re in a pretty good shape. Towards the end of the year, it will be good.

Mike Ritzenthaler - Piper Jaffray

All right.

Thanks very much.

Pat Gruber - Chief Executive Officer

Thanks Mike.

Operator

And we have Caleb Dorfman from Simmons & Company in line with questions. Please go ahead.

Caleb Dorfman - Simmons & Company

Good

afternoon.

Pat Gruber - Chief Executive Officer

Hi Caleb.

Caleb Dorfman - Simmons &

Company

So Pat, it seems like you have made some good progress on the isobutanol production. What are going to be the key trigger points that cause you

to think about ramping isobutanol production at the plant to 100% isobutanol?

Pat Gruber - Chief Executive Officer

There are several things that we will consider. First of all, continuing to improve how good we are on isobutanol. We still have work to do: see it operate,

get the products in the market place, see how customers want the product and how fast they want to offtake it. Make sure that we understand everything: but still we will learn more about whether things might occur in the plant. I don’t expect

anything that’s unusual but we are going to think it through pretty carefully and make sure that we continue with our eyes wide open.

I would like

to get all the operability issues behind us. I guess the answer is: I don’t know the full set of criteria yet. It’s going to be a blend of economics, how can we make the most money, which mix of ethanol to isobutanol, which customers want

product, where, how, etc. There looks to be demand for it. So that doesn’t seem to be an issue. And then there is also the opportunity to expand the plant and there are people who have expressed interest in that side of things too. So I just

don’t know yet.

Caleb Dorfman - Simmons & Company

Okay. That’s helpful. Can you talk about the customer reception so far? Where will these initial volumes of isobutanol be shipped to? Are they ready to

take on more isobutanol now if you’re able to produce it?

Pat Gruber - Chief Executive Officer

The answer seems to be yes. There seems to be good progress there. People are waiting for us. Our commercial teams have done a good job of keeping people

engaged throughout. I think we did ourselves some credit there. We didn’t over-promise. We were very clear to them and transparent along the way, explaining where we were on the supply situation. We don’t want to be engaged in the

supplying until we’re sure that we can deliver. So now I think this 4th quarter we will be able to do those sorts of things.

Caleb Dorfman - Simmons & Company

What will it take for them to be ready to take a full offtake supply from Luverne if you switch to 100% isobutanol? How long would it take for them to be

ready to take that volume?

Pat Gruber - Chief Executive Officer

Mike and I are looking at each other.

Mike

Willis - Chief Financial Officer

Yes. It’s a difficult question to answer only because it won’t be until 2015 when we’re thinking

about that. So, in the near term, our mindset is on the volumes that Pat talked about in his earlier comments, getting up to the 150,000 to 200,000 gallons per month. And that’s where we’re focused right now, just making sure that

we’re maximizing the ASPs on that.

Once we are selling those types of volumes, we will then focus on all the things that Pat has talked about:

including trying to maximize the overall profitability of the plant, whether that would be a combination of isobutanol or ethanol, or all isobutanol.

Pat Gruber - Chief Executive Officer

So yes,

it’s a difficult question to answer right now. I mean, if you believe all the customers…if you believe them and we have to, because our customers are friends of ours. Then it seems to be that we could sell as much as we can make.

That’s what it looks like.

The reality always is that you have to do it; that you have to go do it, that’s the reality. So I think there is

some advantage of starting off the way we’re doing it where we’re going to have a limited supply at first. We have to go out and do the applications that are most valuable and expand them. I don’t want to dump isobutanol into the

marketplace too quickly. That is the overall goal.

Caleb Dorfman - Simmons & Company

That’s helpful. And I guess, final question. Do you have any updates on LOIs, maybe when you can actually — you can put that into something more

than just an LOI?

Pat Gruber - Chief Executive Officer

For the license agreements you mean?

Caleb Dorfman - Simmons & Company

Right.

Pat Gruber - Chief Executive Officer

Yeah. Mike?

Mike Willis - Chief Financial

Officer

We are pushing forward as quickly as possible. Our partners that we talked about in the past i.e. IGPC and Porta remain very interested in moving

forward with us. However, they’re both working on projects themselves, and that is taking up their limited bandwidth right now. But they still remain extremely excited by the opportunity. And so again, on our side, we’re pushing forward as

quickly as possible.

Caleb Dorfman - Simmons & Company

Thank you.

Operator

And your next question comes from Craig Irwin from Wedbush Securities. Please go ahead.

Craig Irwin - Wedbush Securities

Hi. Good

evening and thank you for taking my questions. The first thing I wanted to ask, can you confirm for us that the ethanol produced in the run is “RIN-able” that you can get an ethanol RIN on your production?

Pat Gruber - Chief Executive Officer

Yes.

Craig Irwin - Wedbush Securities

Great. Then

looking at the other manufacturers out there, most of them are sort of suggesting mid-$0.30s EBITDA per gallon crush on their facilities now. I know this is not a facility that was traditional ICM and not directly comparable given that it is a

little bit smaller than some of these other facilities, but do you think that you would likely have those economics? If you would have run at full utilization for ethanol, would you be similar to what would some of the other producers are describing

these days?

Mike Willis - Chief Financial Officer

Yes. I actually just asked our plant manager this exact same question. Now obviously, we burden the plant itself with additional costs associated with the

isobutanol part of the business. But if you factor that out and went back to what was the fixed cost base (labor base, et cetera) back in the days when it was just an ethanol plant, the number my plant manager described to me was probably in the

$0.30-range of EBITDA.

Craig Irwin - Wedbush Securities

Great, great. So when we would have run the numbers on the fourth quarter, give-or-take you said, EBITDA breakeven by the fourth quarter. That sort of

suggests that there was a negative contribution of about a $1.5 million on the isobutanol side. Can you maybe split out for us the approximate headcount or portion of headcount on the SG&A side, that’s really focused on isobutanol versus

ethanol, just so that we can understand the trajectory as we head into ‘15, if we do really see the strengthening environment like many of us actually expect.

Pat Gruber - Chief Executive Officer

I think the

answer to this is, no, we can’t put it out that way because we share resources across the plant, and so it’s parts of people and other costs there. It is about the way you are describing: we get to EBITDA breakeven by having the run rates

that I had described for ethanol and isobutanol. So they are like the minimum requirements, how to get the EBITDA breakeven at the overall plant. And as it goes up from there, it gets better.

Craig Irwin - Wedbush Securities

Great. And then

just to discuss, I know this question was raised early on the call but to discuss the concept of what would have you switch incremental capacity from isobutanol to ethanol. Obviously, you’ve done a tremendous amount of work developing the

market and developing the technology but would this be primarily a profit-driven decision or is this something where you would look to seed the market, as you’re able to produce these gallons, knowing that that scale will benefit you as sort of

a lagging factor?

Pat Gruber - Chief Executive Officer

I think you’re summing up well. So the way we look at it hitting the market: make sure that we have the growth opportunities with good margins.

That’s the most important thing we can do. That’s where we need to be focusing our attention. We should then be taking that input and then make that decision of “do we switch over to isobutanol from ethanol or do we work to add

capacity”? And the thing is we want the lowest cost business system to be able to win in the long run, that’s actually what we’re shooting for.

It would be very easy for us to try to push everything over to isobutanol quickly. But if we have any hiccups

whatsoever, then that could be a problem. So I want to make sure that we have our act completely together before we do that. So it’s a question I can’t answer as to what we would do, how we would do it; but for sure, it would be profit

driven, in terms of how we think about it. We’ll try to maximize the profits. If isobutanol makes twice or three times as much margin of ethanol, that’s going to be a pretty powerful motivation to switch faster.

Craig Irwin - Wedbush Securities

Okay. And then

one last question if I may? So I know you’ve been really focused on isobutanol for a long time, just given the future potential. But over the last several years a number of the ethanol producers out there have made incremental changes to their

plants. Debottlenecking, increasing the throughput for things like production of corn oil, inedible corn oil for use, biodiesel production and other things, introducing micro grinding technology and some of the other small upgrades that can be done

to plants to really improve the economics.

Can you maybe frame out for us whether or not this is an opportunity for you and whether or not you have

anything yet in the capital budget to allow for this or if this is something that’s still in discussion?

Pat Gruber - Chief Executive

Officer

You mean if that’s available for us?

Craig Irwin - Wedbush Securities

Yes.

Pat Gruber - Chief Executive Officer

Yes. All of

those things that you listed, fit for us at Luverne. So yes, those things are all relevant for us to lower the cost at Luverne as well. And we just have not got around to it yet.

Mike Willis - Chief Financial Officer

But

specifically in the capital budget, the answer is, no. But we are considering all those initiatives. Yes, all those things benefit us. And Luverne is actually a very good economical plant, it resides in a great corn basis area and the farmers in

that region are really good. So we’re pretty well-positioned there; and yes, we can take incremental costs out of this plant.

Craig Irwin - Wedbush Securities

Great. It’s good to hear. That’s an opportunity. Thank you for taking my questions.

Pat Gruber - Chief Executive Officer

Yeah. You

bet.

Mike Willis - Chief Financial Officer

Thanks so much, Craig.

Operator

(Operator Instructions) And we have Jeff Osborne from Cowen in line with questions. Please go ahead.

Jeff Osborne - Cowen

Great. Good afternoon,

guys. A couple of quick questions from me: I was wondering on the Toray side you mentioned $1.5 million in revenue, but then you also alluded to a $1 million payment from something in a prior year. If I understand right, is it just a $0.5 million

for the production and $1 million was something else? Or maybe just explain that a bit further?

Mike Willis - Chief Financial Officer

Yes. No problem. So, yes, the off-take itself was $0.5 million. The $1 million was associated with funds they provided us in 2012 that effectively helped us

build the plant. There was a chance that if we hadn’t produced the para-xylene by a certain time and shipped to them, that we would have had to give them that $1 million back. So from 2012, it’s been sitting on our balance sheet as

deferred revenue. So we were able to recognize that revenue with this shipment.

Jeff Osborne - Cowen

Got you. Thanks for the clarification there. And then, I had a question on iDGs™ versus DDGs, is the protein content the same and hence the price per

pound similar for the two or how do we think about that, if you try to get granular on modeling the production above?

Pat Gruber - Chief Executive Officer

Yes. The actual, approximate protein analysis is identical between the two. And so, there is no material difference. As we start-up and continue to learn how

to run isobutanol and get the plant running on the iDGs™ side, in particular, these products won’t be perfect, the way that DDGs are perfect. So until we get good at running the isobutanol, I would put them in at a slight discount to DDGs.

Jeff Osborne - Cowen

Okay. As a rule of

thumb, how many IDGs™ per gallon of isobutanol have you folks produced, as it gets perfect.

Pat Gruber - Chief Executive Officer

I should know on top of head. How many IDGs™ do we produce per gallon of isobutanol?

Mike Willis - Chief Financial Officer

It

ultimately gets down to the same range as ethanol, which is in the 16.5 pounds per bushel range for both.

Pat Gruber - Chief Executive

Officer

Yeah. But the question is at 2 million to 3 million gallons of run rate capacity for isobutanol, whats that turn into for iDG™

volumes? — you might be calculating right now…

Mike Willis - Chief Financial Officer

Yes. Just a second.

Jeff Osborne - Cowen

As you guys get the calculator on that, maybe for you Pat: as you put in the distillation column, have you started that process? How long is that going to

take? And do you see any risk of ramping that up?

Pat Gruber - Chief Executive Officer

Yes, we’ve started getting the project implemented. It is going to take us probably into beginning of October and could take plus-or-minus a couple of

weeks. I don’t expect any issues in the implementation of our equipment installation.

In terms operating equipment, it’s really straightforward, so I don’t anticipate issues operating it

there. We have operated columns like this in the past. We have other columns in our plant. But we needed the existing distillation capacity for ethanol.

Jeff Osborne - Cowen

Got you. And two other

quick ones, I wonder if you were to go down the path of expanding the plant. What is your sense of what air permits that you will need to have and how long that would take to permit? So if you made the decision today to do that, where are you in

terms of permits and anything beyond financing, I guess, what would be the timeline?

Pat Gruber - Chief Executive Officer

I don’t have a good timeline. We have started to work on it internally though. We have started on it.

Jeff Osborne - Cowen

Okay. And then last

question, I may have missed this, but did you give the gallons of isobutanol either produced or sold in the quarter?

Pat Gruber - Chief

Executive Officer

No, we did not.

Jeff

Osborne - Cowen

Okay. Perfect. Thanks so much.

Mike Willis - Chief Financial Officer

And to

your earlier question: I believe it would be somewhere in the 15,000 tons of iDGs™, for that 2 million to 3 million gallon range of isobutanol.

Jeff Osborne - Cowen

All right. Thanks much

guys.

Operator

We have no further questions at

this time. I will now turn the call back over to Pat for final remarks.

Pat Gruber - Chief Executive Officer

Thank you all for joining us. I appreciate it and thank you for joining us on our call today. Bye-bye.

Operator

Thank you, ladies and gentlemen. This

concludes today’s conference. Thank you for participating and you may now disconnect.

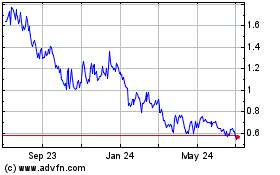

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

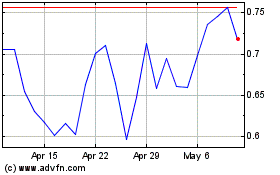

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024