UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): August 15, 2014

LAS VEGAS SANDS CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| NEVADA |

|

001-32373

|

|

27-0099920

|

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 3355 LAS VEGAS BOULEVARD SOUTH

LAS VEGAS, NEVADA |

|

89109 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (702) 414-1000

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the

appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

| ¨ |

Written Communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

On August 15, 2014, Sands China Ltd. (“SCL”), a subsidiary of Las Vegas Sands Corp. with ordinary shares listed on The

Stock Exchange of Hong Kong Limited (the “SEHK”), filed its interim results in respect of the six month period ended June 30, 2014 (the “Interim Results Announcement”) with the SEHK. The Interim Results Announcement is

furnished as Exhibit 99.1 to this Form 8-K.

The information in this Form 8-K and Exhibit 99.1 attached hereto shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly

set forth by specific reference in any such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| 99.1 |

|

Interim Results Announcement of Sands China Ltd., dated August 15, 2014. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report on Form 8-K to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: August 15, 2014

|

|

|

| LAS VEGAS SANDS CORP. |

|

|

| By: |

|

/s/ Ira H. Raphaelson |

| Name: |

|

Ira H. Raphaelson |

| Title: |

|

Executive Vice President and Global General Counsel |

3

INDEX TO EXHIBITS

99.1 Interim Results Announcement of Sands China Ltd., dated August 15, 2014.

4

Exhibit

99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no

responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the

contents of this announcement.

(Incorporated in the Cayman Islands with limited liability)

(Stock Code: 1928)

ANNOUNCEMENT OF INTERIM RESULTS FOR THE SIX MONTHS ENDED JUNE 30, 2014

1. FINANCIAL HIGHLIGHTS

We generated an all-time

half year record of US$1,737.4 million (HK$13,467.1 million) of adjusted EBITDA, an increase of 35.7% compared to US$1,280.1 million (HK$9,931.3 million) in the first half of 2013.

Total net revenues for the Group increased 24.7% to US$5,075.3 million (HK$39,340.2 million) in the first half of 2014,

compared to US$4,070.3 million (HK$31,578.2 million) in the first half of 2013.

Profit for the Group increased

45.7% to US$1,370.4 million (HK$10,622.4 million) in the first half of 2014, compared to US$940.5 million (HK$7,296.6 million) in the first half of 2013.

Capitalized terms used but not defined herein shall have the meanings ascribed to them in our 2013 Annual Report.

2. MANAGEMENT DISCUSSION AND ANALYSIS

RESULTS OF

OPERATIONS

The Board of Directors (the “Board”) of Sands China Ltd. (“we” or our

“Company”) is pleased to announce the unaudited consolidated results of the Company and its subsidiaries (the “Group”) for the six months ended June 30, 2014 compared to the six months ended June 30, 2013.

Note: The translation of US$ amounts into HK$ amounts has been made at the rate of US$1.00 to HK$7.7513 (six months ended

June 30, 2013: US$1.00 to HK$7.7582) for the purposes of illustration only.

1

Net

Revenues

Our net revenues consisted of the following:

Six months ended June 30,

2014 2013 Percent change

(US$ in millions, except

percentages)

Casino 4,571.5 3,650.7 25.2%

Rooms 164.9 136.1 21.2%

Mall 147.9 119.6 23.7%

Food and beverage 84.1

69.2 21.5%

Convention, ferry, retail and other 106.9 94.7 12.9%

Total net revenues 5,075.3 4,070.3 24.7%

Net revenues were US$5,075.3 million for the six months ended June 30, 2014, an increase of US$1,005.0 million, or 24.7%, compared to US$4,070.3 million for the six months ended

June 30, 2013. Net revenues increased in all the segments, mainly driven by market growth as well as increase in visitation resulting from efforts in marketing and management’s focus on driving the high-margin mass market gaming segment,

while continuing to provide luxury amenities and high service levels to our VIP and premium players.

Our net

casino revenues for the six months ended June 30, 2014 were US$4,571.5 million, an increase of US$920.8 million, or 25.2%, compared to US$3,650.7 million for the six months ended June 30, 2013. The growth was primarily attributable to an

increase of US$419.6 million at The Venetian Macao and US$391.5 million at Sands Cotai Central driven by an increase in volume in our mass market segment, as well as ramp-up in premium mass segment.

2

The

following table summarizes the results of our casino activity:

Six months ended June 30,

2014 2013 Change

(US$ in millions, except percentages and points)

The Venetian Macao

Total net casino revenues 1,985.2 1,565.6 26.8%

Non-Rolling Chip drop 4,645.1 2,927.7 58.7%

Non-Rolling Chip win percentage 25.9% 30.0%(4.1)pts

Rolling Chip volume 27,645.2 23,508.9 17.6%

Rolling Chip win percentage 3.47% 3.49%(0.02)pts

Slot handle 2,798.3 2,341.2 19.5%

Slot hold percentage 5.0% 5.5%(0.5)pts

Sands

Cotai Central

Total net casino revenues 1,445.8 1,054.3 37.1%

Non-Rolling Chip drop 3,682.3 2,263.5 62.7%

Non-Rolling Chip win percentage 22.2% 21.8% 0.4pts

Rolling Chip volume 27,909.7 27,957.8(0.2)%

Rolling Chip win percentage 2.89% 2.71% 0.18pts

Slot handle 3,788.1 2,478.1 52.9%

Slot hold percentage 3.6% 3.9%(0.3)pts

The Plaza

Macao

Total net casino revenues 534.9 446.4 19.8%

Non-Rolling Chip drop 718.6 296.6 142.3%

Non-Rolling Chip win percentage 25.1% 32.3%(7.2)pts

Rolling Chip volume 14,841.6 19,424.4(23.6)%

Rolling Chip win percentage 3.42% 2.58% 0.84pts

Slot handle 460.2 366.4 25.6%

Slot hold percentage 5.1% 5.6%(0.5)pts

Sands

Macao

Total net casino revenues 605.7 584.4 3.6%

Non-Rolling Chip drop 2,173.2 1,586.1 37.0%

Non-Rolling Chip win percentage 17.7% 20.7%(3.0)pts

Rolling Chip volume 10,032.1 12,197.2(17.8)%

Rolling Chip win percentage 2.87% 2.69% 0.18pts

Slot handle 1,635.6 1,343.7 21.7%

Slot hold percentage 3.8% 3.9%(0.1)pts

Net room

revenues for the six months ended June 30, 2014 were US$164.9 million, an increase of US$28.8 million, or 21.2%, compared to US$136.1 million for the six months ended June 30, 2013. Sands Cotai Central and The Venetian Macao continued to

experience strong growth in both occupancy and ADR driven by strong demand.

3

The

following table summarizes our room activity. Information in this table takes into account rooms provided to customers on a complimentary basis.

Six months ended June 30,

2014 2013 Change

(US$, except percentages and points)

The Venetian Macao

Gross room revenues (in

millions) 126.6 105.5 20.0%

Occupancy rate 91.7% 89.5% 2.2pts

Average daily rate 265 229 15.7%

Revenue per available room 243 205 18.5%

Sands

Cotai Central

Gross room revenues (in millions) 152.7 94.2 62.1%

Occupancy rate 86.9% 69.0% 17.9pts

Average daily rate 173 148 16.9%

Revenue per

available room 150 102 47.1%

The Plaza Macao

Gross room revenues (in millions) 24.7 19.9 24.1%

Occupancy rate 86.4% 81.0% 5.4pts

Average daily

rate 419 361 16.1%

Revenue per available room 363 292 24.3%

Sands Macao

Gross room revenues (in millions) 12.8 12.0 6.7%

Occupancy rate 97.6% 94.9% 2.7pts

Average daily rate 254 244 4.1%

Revenue per

available room 248 232 6.9%

Net mall revenues for the six months ended June 30, 2014 were US$147.9

million, an increase of US$28.3 million, or 23.7%, compared to US$119.6 million for the six months ended June 30, 2013. The increase was primarily driven by higher base fees due to contract renewals and replacements, additional stores opened at

Shoppes at Venetian, and the opening of the third phase of Shoppes at Cotai Central in June 2014.

Net food and

beverage revenues for the six months ended June 30, 2014 were US$84.1 million, an increase of US$14.9 million, or 21.5%, compared to US$69.2 million for the six months ended June 30, 2013. The increase was primarily driven by stronger

business volume at most outlets due to increased property visitation.

Net convention, ferry, retail and other

revenues for the six months ended June 30, 2014 were US$106.9 million, an increase of US$12.2 million, or 12.9%, compared to US$94.7 million for the six months ended June 30, 2013. The increase was driven by the entertainment segment due

to shows with higher popularity, and convention and exhibition revenues from some major groups at Sands Cotai Central and The Venetian Macao.

4

Operating

Expenses

Operating expenses were US$3,655.4 million for the six months ended June 30, 2014, an increase

of US$565.4 million, or 18.3%, compared to US$3,090.0 million for the six months ended June 30, 2013. The increase in operating expenses was primarily attributed to the revenue growth at The Venetian Macao and Sands Cotai Central and a new

bonus program for non-management employees.

Adjusted EBITDA(1)

The following table summarizes information related to our segments:

Six months ended June 30,

2014 2013 Percent change

(US$ in millions, except

percentages)

The Venetian Macao 872.9 709.5 23.0%

Sands Cotai Central 513.0 277.0 85.2%

The Plaza Macao 180.8 115.2 56.9%

Sands Macao

173.0 184.4(6.2)%

Ferry and other operations(2.4)(6.1) 60.7%

Total adjusted EBITDA 1,737.4 1,280.1 35.7%

Adjusted EBITDA for the six months ended June 30, 2014 was US$1,737.4 million, an increase of US$457.3 million, or 35.7%, compared to US$1,280.1 million for the six months ended

June 30, 2013. This performance was driven by revenue increases in all of the business segments, as a result of growth in Non-Rolling Chip win and improvement in operational efficiencies at all properties. The management team continues to focus

on operational efficiencies throughout both gaming and non-gaming areas of the business, further improve adjusted EBITDA.

(1) Adjusted EBITDA is profit before share-based compensation, corporate expense, pre-opening expense, depreciation and amortization, net foreign exchange gains/(losses), gain/(loss) on

disposal of property and equipment and investment properties, fair value losses on financial assets at fair value through profit or loss, interest, loss on modification or early retirement of debt and income tax expense. Adjusted EBITDA is used by

management as the primary measure of operating performance of the Group’s properties and to compare the operating performance of the Group’s properties with that of its competitors. However, adjusted EBITDA should not be considered in

isolation; construed as an alternative to profit or operating profit; as an indicator of the Group’s IFRS operating performance, other combined operations or cash flow data; or as an alternative to cash flow as a measure of liquidity. Adjusted

EBITDA as presented by the Group may not be directly comparable to other similarly titled measures presented by other companies.

5

Interest

Expense

The following table summarizes information related to interest expense:

Six months ended June 30,

2014 2013 Percent change

(US$ in millions, except

percentages)

Interest and other finance costs 41.9 46.7(10.3)%

Less — capitalized interest(3.7)(2.7) 37.0%

Interest expense, net 38.2 44.0(13.2)%

Interest

expense, net of amounts capitalized, was US$38.2 million for the six months ended June 30, 2014, compared to US$44.0 million for the six months ended June 30, 2013. The decrease was primarily due to the decrease in interest and other

finance costs resulting primarily from a reduced interest rate after the Group amended the 2011 VML Credit Facility in March 2014, as described below.

Profit for the Period

Profit for the six months

ended June 30, 2014 was US$1,370.4 million, an increase of US$429.9 million, or 45.7%, compared to US$940.5 million for the six months ended June 30, 2013.

LIQUIDITY AND CAPITAL RESOURCES

We fund our

operations through cash generated from our operations and our debt financing.

In March 2014, we amended our

2011 VML Credit Facility, which extended the maturity of US$2.39 billion in aggregate principal amount of the term loans under the facility to March 31, 2020 (the “Extended 2011 VML Term Facility”), and provided for revolving loan

commitments of US$2.0 billion (the “Extended 2011 VML Revolving Facility”). A portion of the revolving proceeds was used to pay down the US$819.7 million in aggregate principal balance of the 2011 VML Term Facility loans that were not

extended. Borrowings under the Extended 2011 VML Revolving Facility are being used to fund the development, construction and completion of Sands Cotai Central and The Parisian Macao, and for working capital requirements and general corporate

purposes. As at June 30, 2014, the Group had US$1.18 billion of available borrowing capacity under the Extended 2011 VML Revolving Facility.

As at June 30, 2014, we had cash and cash equivalents of US$1.51 billion, which was primarily generated from our operations.

6

Cash Flows

— Summary

Our cash flows consisted of the following:

Six months ended June 30,

2014 2013

(US$ in millions)

Net cash generated from operating activities 1,671.0 1,361.3

Net cash used in investing activities(418.4)(236.6)

Net cash used in financing activities(2,690.2)(1,430.1)

Net decrease in cash and cash equivalents(1,437.5)(305.5)

Cash and cash equivalents at beginning of period 2,943.4 1,948.4

Effect of exchange rate on cash and cash equivalents 1.9(3.9)

Cash and cash equivalents at end of period 1,507.8 1,639.0

Cash Flows — Operating Activities

We derive most of our operating cash flows from our casino, hotel and mall operations. Net cash generated from operating activities for the six months ended June 30, 2014 was

US$1,671.0 million, an increase of US$309.7 million, or 22.8%, compared to US$1,361.3 million for the six months ended June 30, 2013. The increase in net cash generated from operating activities was primarily due to the increase in our

operating results.

Cash Flows — Investing Activities

Net cash used in investing activities for the six months ended June 30, 2014 was US$418.4 million, and was primarily

attributable to capital expenditures for development projects as well as maintenance spending. Capital expenditures for the six months ended June 30, 2014, totaled US$428.0 million, including US$346.1 million for construction activities at

Sands Cotai Central and The Parisian Macao and US$81.9 million for our operations, mainly at The Venetian Macao, The Plaza Macao and Sands Macao.

Cash Flows — Financing Activities

For the

six months ended June 30, 2014, net cash used in financing activities was US$2,690.2 million, which was primarily attributable to US$2,600.9 million in dividend payments.

7

CAPITAL

EXPENDITURES

Capital expenditures were used primarily for new projects and to renovate, upgrade and

maintain existing properties. Set forth below is historical information on our capital

expenditures, excluding capitalized interest and construction payables:

Six months ended June 30,

2014 2013

(US$ in millions)

The Venetian Macao 44.2 44.2

Sands Cotai Central 156.5 123.4

The Plaza Macao

21.9 5.7

Sands Macao 14.8 9.7

Ferry and other operations 1.1 0.2

The Parisian

Macao 189.6 58.5

Total capital expenditures 428.0 241.7

Our capital expenditure plans are significant. In April 2012, September 2012 and January 2013, we opened the Conrad

and Holiday Inn tower, the first Sheraton tower and the second Sheraton tower, respectively, of Sands Cotai Central, which is part of our Cotai Strip development. We have begun construction activities on the remaining phase of the project, which

will include a fourth hotel and mixed-use tower, located on parcel 5, under the St. Regis brand. The total cost to complete the remaining phase of the project is expected to be approximately US$700 million.

We have commenced construction activities on The Parisian Macao, our integrated resort development on Parcel 3, but

stopped in June 2014, pending receipt of certain government approvals, which management has been informed are scheduled to be issued in October 2014. In the meantime, the Company is working to accelerate the permit approval process and, as with

projects of this nature, will continue to analyze options for both a full and phased opening of the facility in 2015. We have capitalized costs of US$595.9 million, including land, as at June 30, 2014. The Parisian Macao is targeted to open in

late 2015 and we expect the cost to design, develop and construct The Parisian Macao will be approximately US$2.7 billion, inclusive of land premium payments.

These investment plans are preliminary and subject to change based upon the execution of our business plan, the progress of our capital projects, market conditions and the outlook on

future business conditions.

8

CAPITAL

COMMITMENTS

Future commitments for property and equipment that are not recorded in the financial

statements herein are as follows:

June 30, December 31,

2014 2013

(US$ in millions)

Contracted but not provided for 1,836.5 1,227.4

Authorized but not contracted for 1,693.3 2,031.3

Total capital commitments 3,529.7 3,258.7

DIVIDENDS

On February 26, 2014, the Company paid an interim dividend of HK$0.87 (equivalent to US$0.112) per share and a special dividend of HK$0.77 (equivalent to US$0.099) per share for the

year ended December 31, 2013, amounting in aggregate to HK$13.23 billion (equivalent to US$1.71 billion), to Shareholders of record on February 14, 2014.

On May 30, 2014, the Shareholders approved a final dividend of HK$0.86 (equivalent to US$0.111) per share for the year ended December 31, 2013 to Shareholders of record on

June 9, 2014. This final dividend, amounting in aggregate to HK$6.94 billion (equivalent to US$894.4 million), was paid on June 30, 2014.

The Board does not recommend the payment of an interim dividend for the six months ended June 30, 2014.

PLEDGE OF FIXED ASSETS

We have pledged a

substantial portion of our fixed assets to secure our loan facilities. As at June 30, 2014, we have pledged leasehold interests in land; buildings; building, land and leasehold improvements; furniture, fittings and equipment; construction in

progress; and vehicles with an aggregate net book value of approximately US$7.60 billion (December 31, 2013: US$7.04 billion).

9

CONTINGENT

LIABILITIES AND RISK FACTORS

The Group has contingent liabilities arising in the ordinary course of business.

Management has made estimates for potential litigation costs based upon consultation with legal counsel. Actual results could differ from these estimates; however, in the opinion of management, such litigation and claims will not have a material

adverse effect on our financial condition, results of operations or cash flows.

Under the land concession for

The Parisian Macao, we are required to complete the development by April 2016. The land concession for Sands Cotai Central contains a similar requirement, which was extended by the Macao Government in April 2014, that the development be completed by

December 2016. Should we determine that we are unable to complete The Parisian Macao or Sands Cotai Central by their respective deadlines, we would expect to apply for another extension from the Macao Government. If we are unable to meet the current

deadlines and the deadlines for either development are not extended, we could lose our land concessions for The Parisian Macao or Sands Cotai Central, which would prohibit us from operating any facilities developed under the respective land

concessions. As a result, the Group could record a charge for all or some portion of the US$595.9 million or US$4.37 billion in capitalized construction costs including land, as at June 30, 2014, related to The Parisian Macao and Sands Cotai

Central, respectively.

CAPITAL RISK MANAGEMENT

The Group’s primary objective when managing capital is to safeguard the Group’s ability to continue as a going

concern in order to provide returns for Shareholders and benefits for other stakeholders, by pricing products and services commensurately with the level of risk.

The capital structure of the Group consists of debt, which includes borrowings (including current and non-current borrowings as shown in note 12 to the condensed consolidated financial

statements), cash and cash equivalents, and equity attributable to Shareholders, comprising issued share capital and reserves.

10

The Group

actively and regularly reviews and manages its capital structure to maintain the net

debt-to-capital ratio

(gearing ratio) at an appropriate level based on its assessment of the current

risk and circumstances. This

ratio is calculated as net debt divided by total capital. Net debt is

calculated as interest bearing

borrowings, net of deferred financing costs, less cash and cash

equivalents and restricted cash and cash

equivalents. Total capital is calculated as equity, as

shown in the consolidated balance sheet, plus net debt.

June 30, December 31,

2014 2013

(US$ in millions,

except percentages)

Interest bearing borrowings, net of deferred financing costs 3,107.7 3,139.6

Less: cash and cash equivalents(1,507.8)(2,943.4)

restricted cash and cash equivalents(6.3)(5.7)

Net debt 1,593.7 190.5

Total equity 5,242.2

6,449.9

Total capital 6,835.9 6,640.4

Gearing ratio 23.3% 2.9%

The increase in the

gearing ratio during the six months ended June 30, 2014 was primarily due

to dividend payments of US$2.60

billion.

BUSINESS REVIEW AND PROSPECTS

Our business strategy is to continue to successfully execute our Cotai Strip developments and to leverage our integrated

resort business model to create Asia’s premier gaming, leisure and convention destination. The Company continues to execute on the strategies outlined in our 2013 Annual Report. These strategies have proven to be successful in the first half of

2014 and we are confident they will continue into the future.

Sands Cotai Central

Sands Cotai Central is located across the street from The Venetian Macao and The Plaza Macao. It is our largest integrated

resort on Cotai. Sands Cotai Central consists of three hotel towers including 636 five-star rooms and suites under the Conrad brand, 1,224 four-star rooms and suites under the Holiday Inn brand and 3,863 rooms and suites under the Sheraton brand. In

April 2012, we opened the Conrad and Holiday Inn tower, a variety of retail offerings, approximately 350,000 square feet of meeting space, several food and beverage establishments, along with the Himalaya casino and VIP gaming areas. In September

2012, we opened the first Sheraton tower featuring 1,796 rooms and suites, the Pacifica casino and additional retail, entertainment, dining and meeting facilities. In January 2013, we opened the second Sheraton tower featuring an additional 2,067

rooms and suites.

11

We have

begun construction activities on the remaining phase of the project, which will include a fourth hotel and mixed-use tower, located on parcel 5, under the St. Regis brand. The total cost to complete the remaining phase of the project is expected to

be approximately US$700 million.

The Parisian Macao

The Parisian Macao, which is currently expected to open in late 2015, is intended to include a gaming area (to be operated

under our gaming subconcession), a hotel with over 3,000 rooms and suites and retail, entertainment, dining and meeting facilities. We expect the cost to design, develop and construct The Parisian Macao will be approximately US$2.7 billion,

inclusive of land premium payments. We have commenced construction activities, but stopped in June 2014, pending receipt of certain government approvals, which management has been informed are scheduled to be issued in October 2014. In the meantime,

the Company is working to accelerate the permit approval process and, as with projects of this nature, will continue to analyze options for both a full and phased opening of the facility in 2015. We have capitalized construction costs of US$595.9

million for The Parisian Macao, including land, as at June 30, 2014.

3. CORPORATE GOVERNANCE

CORPORATE GOVERNANCE PRACTICES

Good corporate governance underpins the creation of Shareholder value and maintaining the highest standards of corporate governance is a core responsibility of the Board. An effective

system of corporate governance requires that our Board approves strategic direction, monitors performance, oversees effective risk management and leads the creation of the right culture across the organization. It also gives our investors confidence

that we are exercising our stewardship responsibilities with due skill and care.

To ensure that we adhere to

high standards of corporate governance, we have developed our own corporate governance principles and guidelines that set out how corporate governance operates in practice within the Company. This is based on the policies, principles and practices

set out in the Corporate Governance Code (the “Code”) contained in Appendix 14 of the Listing Rules and draws on other best practices.

The Board is of the view that throughout the six months ended June 30, 2014, save as disclosed below, the Company fully complied with all the code provisions and certain recommended

best practices set out in the Code.

Code Provision E.1.2

Under code provision E.1.2 of the Code, the Chairman of the Board should attend the annual general meeting of the Company.

The Chairman of the Board was absent from the Company’s annual general meeting held on May 30, 2014 due to other business commitments.

12

MODEL CODE

FOR SECURITIES TRANSACTIONS

The Company has developed its own securities trading code for securities

transactions (the “Company Code”) by the Directors and relevant employees who are likely to be in possession of unpublished inside information of the Company on terms no less exacting than the Model Code for Securities Transactions by

Directors of Listed Issuers as set out in Appendix 10 of the Listing Rules (the “Model Code”). Following specific enquiry by the Company, all Directors have confirmed that they have complied with the Company Code and, therefore, with the

Model Code throughout the six months ended June 30, 2014 and to the date of this announcement.

BOARD AND

BOARD COMMITTEES COMPOSITION

Mr. Jeffrey Howard Schwartz resigned as a Non-Executive Director of the

Company with effect from May 30, 2014. Mr. Irwin Abe Siegel and Mr. Lau Wong William did not offer themselves for re-election as Non-Executive Directors of the Company at the annual general meeting of the Company on May 30, 2014.

Mr. Charles Daniel Forman and Mr. Robert Glen Goldstein were elected as Non-Executive Directors of

the Company at the annual general meeting held on May 30, 2014.

The Directors of the Company as at the

date of this announcement are:

Title Note

Executive Directors

Edward Matthew Tracy President and Appointed July 27, 2011

Chief Executive Officer

Toh Hup Hock Executive

Vice President and Appointed June 30, 2010

Chief Financial Officer

Non-Executive Directors

Sheldon Gary Adelson Chairman of the Board Appointed August 18, 2009

Michael Alan Leven Redesignated July 27, 2011

Charles Daniel Forman Elected May 30, 2014

Robert Glen Goldstein Elected May 30, 2014

Independent Non-Executive

Directors

Iain Ferguson Bruce Appointed

October 14, 2009

Chiang Yun Appointed October 14, 2009

David Muir Turnbull Appointed October 14, 2009

Victor Patrick Hoog Antink Appointed December 7, 2012

Steven Zygmunt Strasser Elected May 31, 2013

Alternate Director

David Alec Andrew Fleming

General Counsel, Company Appointed March 1, 2011

Secretary and alternate director

to Michael Alan Leven

13

The Board

has established four committees, being the Audit Committee, the Remuneration Committee, the Nomination Committee and the Sands China Capital Expenditure Committee. The table below details the membership and composition of each of the four

committees.

Sands China

Capital

Audit Remuneration Nomination Expenditure

Director Committee Committee Committee Committee

Sheldon Gary Adelson — — Chairman —

Edward Matthew Tracy — — — Member

Toh Hup Hock — — — —

Michael

Alan Leven — — — Chairman

Charles Daniel Forman — — — —

Robert Glen Goldstein — — — —

Iain Ferguson Bruce Member Member Member —

Chiang Yun Member — — —

David Muir Turnbull — Chairman Member —

Victor Patrick Hoog Antink Chairman Member — Member

Steven Zygmunt Strasser Member Member — —

AUDIT COMMITTEE REVIEW

The Audit Committee has reviewed the accounting policies adopted by the Group and the unaudited condensed consolidated financial statements for the six months ended June 30, 2014. All

of the Audit Committee members are Independent Non-Executive Directors, with Mr. Victor Patrick Hoog Antink (Chairman of the Audit Committee) and Mr. Iain Ferguson Bruce possessing the appropriate professional qualifications and accounting

and related financial management expertise.

PURCHASE, SALE OR REDEMPTION OF THE COMPANY’S LISTED SHARES

Neither the Company, nor any of its subsidiaries purchased, sold or redeemed any of the listed shares of the

Company during the six months ended June 30, 2014.

14

4.

FINANCIAL RESULTS

The financial information set out below in this announcement represents an extract from the

condensed consolidated financial statements, which is unaudited but has been reviewed by the Company’s independent auditor, Deloitte Touche Tohmatsu, in accordance with the International Standard on Review Engagements 2410 “Review of

Interim Financial Information Performed by the Independent Auditor of the Entity”, and by the Audit Committee.

CONSOLIDATED INCOME STATEMENT

Six months ended

June 30,

2014 2013

Note US$’000, except per share data

(Unaudited)

Net revenues 4 5,075,255 4,070,271

Gaming

tax(2,169,447)(1,777,301)

Employee benefit expenses(529,555)(440,988)

Depreciation and amortization(257,250)(246,276)

Gaming promoter/agency commissions(183,949)(178,766)

Inventories consumed(49,932)(40,610)

Other

expenses and losses 5(465,309)(406,105)

Operating profit 1,419,813 980,225

Interest income 9,489 5,230

Interest expense, net of amounts capitalized 6(38,193)(44,011)

Loss on modification or early retirement of debt 12(17,964) —

Profit before income tax 1,373,145 941,444

Income

tax expense 7(2,729)(949)

Profit for the period attributable to

equity holders of the Company 1,370,416 940,495

Earnings per share for profit attributable to

equity holders of the Company

— Basic 8 US16.99 cents US11.67 cents

—

Diluted 8 US16.98 cents US11.66 cents

15

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended June 30,

2014 2013

US$’000

(Unaudited)

Profit for the period attributable to

equity holders

of the Company 1,370,416 940,495

Other comprehensive income/(loss), net of tax

Item that will not be reclassified subsequently to

profit or loss:

Currency translation differences 3,823(4,604)

Total comprehensive income for the period

attributable to equity holders of the Company 1,374,239 935,891

CONSOLIDATED BALANCE SHEET

June 30, December 31,

2014 2013

Note US$’000

(Unaudited)(Audited)

ASSETS

Non-current assets

Investment properties, net 910,193 891,230

Property and equipment, net 6,850,706 6,722,586

Intangible assets, net 22,023 20,147

Deferred income tax assets 58 195

Other assets,

net 31,329 32,561

Trade and other receivables and prepayments, net 16,765 15,392

Total non-current assets 7,831,074 7,682,111

Current assets

Inventories 13,561 13,361

Trade and other receivables and

prepayments, net 10 680,288 820,926

Financial

assets at fair value through

profit or loss — 15

Restricted cash and cash equivalents 6,255 5,663

Cash and cash equivalents 1,507,785 2,943,424

Total current assets 2,207,889 3,783,389

Total assets 10,038,963 11,465,500

16

June 30, December 31,

2014 2013

Note US$’000

(Unaudited)(Audited)

EQUITY

Capital and reserves attributable to

equity holders of the Company

Share capital 80,659 80,632

Reserves 5,161,587

6,369,250

Total equity 5,242,246 6,449,882

LIABILITIES

Non-current liabilities

Trade and other payables

11 69,477 59,618

Borrowings 12 3,186,855 3,022,903

Total non-current liabilities 3,256,332 3,082,521

Current liabilities

Trade and other payables 11

1,531,608 1,724,343

Current income tax liabilities 2,697 1,968

Borrowings 12 6,080 206,786

Total current liabilities 1,540,385 1,933,097

Total liabilities 4,796,717 5,015,618

Total equity and liabilities 10,038,963 11,465,500

Net current assets 667,504 1,850,292

Total assets less current liabilities 8,498,578 9,532,403

17

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of preparation

The unaudited condensed consolidated financial statements are presented in United States dollars (“US$”), unless

otherwise stated. The condensed consolidated financial statements were approved and authorized for issue by the Board of Directors of the Company on August 15, 2014.

The condensed consolidated financial statements for the six months ended June 30, 2014 have been prepared in accordance with International Accounting Standard (“IAS”) 34

“Interim Financial Reporting” issued by the International Accounting Standards Board (“IASB”) and the applicable disclosure requirements of Appendix 16 to the Listing Rules. They should be read in conjunction with the

Group’s annual financial statements for the year ended December 31, 2013, which were prepared in accordance with International Financial Reporting Standards (“IFRS”).

2. Significant accounting policies

The condensed consolidated financial statements have been prepared on the historical cost basis except for certain financial assets that are measured at fair value.

Except as described below, the accounting policies adopted and methods of computation used in the preparation of the

condensed consolidated financial statements for the six months ended June 30, 2014 are consistent with those adopted and as described in the Group’s annual financial statements for the year ended December 31, 2013.

During the period, there have been a number of new interpretation and amendments to standards that have come into effect,

which the Group has adopted at their respective effective dates. The adoption of these new interpretation and amendments to standards has no material impact on the results of operations and financial position of the Group.

The Group has not early adopted the new or revised standards, amendments and interpretation that have been issued, but are

not yet effective for the period. The Group has already commenced the assessment of the impact of the new or revised standards, amendments and interpretation to the Group, but is not yet in a position to state whether these would have a significant

impact on the results of operations and financial position of the Group.

18

3. Segment

information

Management has determined the operating segments based on the reports reviewed by a group of

senior management to make strategic decisions. The Group considers the business from a property and service perspective.

The Group’s principal operating and developmental activities occur in Macao, which is the sole geographic area in which the Group is domiciled. The Group reviews the results of

operations for each of its key operating segments, which are also the reportable segments: The Venetian Macao, Sands Cotai Central, The Plaza Macao, Sands Macao and ferry and other operations. The Group’s primary projects under development are

The Parisian Macao, the St. Regis tower (the remaining phase of Sands Cotai Central) and the Four Seasons apart-hotel.

Revenue comprises turnover from sale of goods and services in the ordinary course of the Group’s activities. The Venetian Macao, Sands Cotai Central, The Plaza Macao, Sands Macao and

The Parisian Macao, once in operation will, derive their revenue primarily from casino, hotel, mall, food and beverage, convention, retail and other sources. Ferry and other operations mainly derive their revenue from the sale of ferry tickets for

transportation between Hong Kong and Macao.

The Group’s segment information is as follows:

Six months ended June 30,

2014 2013

US$’000

(Unaudited)

Net revenues

The Venetian Macao 2,208,157

1,759,048

Sands Cotai Central 1,598,818 1,163,650

The Plaza Macao 596,369 495,830

Sands Macao 619,913 600,368

Ferry and other

operations 66,026 62,090

The Parisian Macao — —

Inter-segment revenues(14,028)(10,715)

5,075,255 4,070,271

19

Six months

ended June 30,

2014 2013

US$’000

(Unaudited)

Adjusted EBITDA (Note)

The Venetian Macao 872,850 709,504

Sands Cotai

Central 513,026 276,976

The Plaza Macao 180,844 115,248

Sands Macao 172,984 184,402

Ferry and other operations(2,354)(6,080)

The

Parisian Macao — —

1,737,350 1,280,050

Note: Adjusted EBITDA is profit before share-based compensation, corporate expense, pre-opening expense, depreciation and

amortization, net foreign exchange gains/(losses), gain/(loss) on disposal of property and equipment and investment properties, fair value losses on financial assets at fair value through profit or loss, interest, loss on modification or early

retirement of debt and income tax expense. Adjusted EBITDA is used by management as the primary measure of operating performance of the Group’s properties and to compare the operating performance of the Group’s properties with that of its

competitors. However, adjusted EBITDA should not be considered in isolation; construed as an alternative to profit or operating profit; as an indicator of the Group’s IFRS operating performance, other combined operations or cash flow data; or

as an alternative to cash flow as a measure of liquidity. Adjusted EBITDA as presented by the Group may not be directly comparable to other similarly titled measures presented by other companies.

Six months ended June 30,

2014 2013

US$’000

(Unaudited)

Depreciation and amortization

The Venetian Macao

75,027 69,519

Sands Cotai Central 137,572 129,469

The Plaza Macao 20,383 24,033

Sands Macao 17,339 16,178

Ferry and other

operations 6,929 7,077

The Parisian Macao — —

257,250 246,276

20

The

following is a reconciliation of adjusted EBITDA to profit for the period attributable to equity holders of the Company:

Six months ended June 30,

2014 2013

US$’000

(Unaudited)

Adjusted EBITDA 1,737,350 1,280,050

Share-based compensation granted to employees by

LVS and the Company, net of amounts capitalized(10,754)(5,427)

Corporate expense(29,292)(32,994)

Pre-opening expense(20,077)(7,394)

Depreciation

and amortization(257,250)(246,276)

Net foreign exchange gains/(losses) 1,237(4,697)

Loss on disposal of property and equipment and

investment properties(1,386)(2,986)

Fair value

losses on financial assets at fair value

through profit or loss(15)(51)

Operating profit 1,419,813 980,225

Interest income 9,489 5,230

Interest expense, net

of amounts capitalized(38,193)(44,011)

Loss on modification or early retirement of debt(17,964) —

Profit before income tax 1,373,145 941,444

Income tax expense(2,729)(949)

Profit for the period attributable to equity holders

of the Company 1,370,416 940,495

Six months ended

June 30,

2014 2013

US$’000

(Unaudited)

Capital expenditures

The Venetian Macao 44,150 44,195

Sands Cotai

Central 156,546 123,366

The Plaza Macao 21,850 5,668

Sands Macao 14,788 9,740

Ferry and other operations 1,092 205

The Parisian

Macao 189,563 58,486

427,989 241,660

21

June 30, December 31,

2014 2013

US$’000

(Unaudited)(Audited)

Total assets

The Venetian Macao 3,150,326

4,350,700

Sands Cotai Central 4,456,586 4,731,217

The Plaza Macao 1,155,903 1,295,093

Sands Macao 420,558 385,450

Ferry and other

operations 259,265 298,385

The Parisian Macao 596,325 404,655

10,038,963 11,465,500

June 30, December 31,

2014 2013

US$’000

(Unaudited)(Audited)

Total non-current assets

Held locally 7,653,064 7,497,681

Held in foreign countries 177,952 184,235

Deferred income tax assets 58 195

7,831,074 7,682,111

4. Net revenues

Six months ended June 30,

2014 2013

US$’000

(Unaudited)

Casino 4,571,491 3,650,660

Rooms 164,911 136,082

Mall

— Income from right of use 126,057 100,447

— Management fees and other 21,812 19,173

Food and beverage 84,061 69,193

Convention,

ferry, retail and other 106,923 94,716

5,075,255 4,070,271

22

5. Other

expenses and losses

Six months ended June 30,

2014 2013

US$’000

(Unaudited)

Utilities and operating supplies 107,519 108,502

Advertising and promotions 78,875 44,704

Contract

labor and services 59,630 45,385

Repairs and maintenance 30,957 26,437

Royalty fees 26,985 24,003

Management fees 26,888 20,350

Provision for

doubtful accounts 24,491 31,948

Operating lease payments 14,304 13,458

Suspension costs(1) 7,545 390

Loss on disposal of property and equipment and

investment properties 1,386 2,986

Auditor’s remuneration 884 996

Fair value

losses on financial assets at fair value

through profit or loss 15 51

Net foreign exchange (gains)/losses(1,237) 4,697

Other support services 63,363 49,013

Other

operating expenses 23,704 33,185

465,309 406,105

(1) Suspension costs are primarily comprised of fees paid to trade contractors and legal costs as a result of the project

suspension.

23

6.

Interest expense, net of amounts capitalized

Six months ended June 30,

2014 2013

US$’000

(Unaudited)

Bank borrowings 25,220 28,517

Amortization of deferred financing costs 10,874 12,132

Finance lease liabilities 3,072 4,057

Standby fee

and other financing costs 2,718 1,983

41,884 46,689

Less: interest capitalized(3,691)(2,678)

Interest expense, net of amounts capitalized 38,193 44,011

7. Income tax expense

Six months ended

June 30,

2014 2013

US$’000

(Unaudited)

Current income tax

Lump sum in lieu of Macao complementary tax

on

dividends 2,653 901

Other overseas taxes 74 141

Under/(over)provision in prior years

Macao complementary tax 2 —

Other overseas

taxes(132)(98)

Deferred income tax 132 5

Income tax expense 2,729 949

24

8.

Earnings per share

Basic earnings per share is calculated by dividing the profit for the period attributable

to equity holders of the Company by the weighted average number of ordinary shares in issue during the period.

Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. For the six months ended June 30, 2014, the Company has outstanding share options and restricted share units that will potentially dilute the ordinary shares.

The calculation of basic and diluted earnings per share is based on the following:

Six months ended June 30,

2014 2013

(Unaudited)

Profit attributable to equity holders of the Company

(US$’000) 1,370,416 940,495

Weighted average number of shares for basic earnings

per share (thousand shares) 8,064,183 8,056,146

Adjustments for share options and

restricted share units (thousand shares) 8,462 7,436

Weighted average number of shares for diluted

earnings per share (thousand shares) 8,072,645 8,063,582

Earnings per share, basic US16.99 cents US11.67 cents

Earnings per share, basic(i) HK131.69 cents HK90.54 cents

Earnings per share, diluted US16.98 cents US11.66 cents

Earnings per share, diluted(i) HK131.62 cents HK90.46 cents

(i) The translation of US$ amounts into HK$ amounts has been made at the rate of US$1.00 to HK$7.7513 (six months ended

June 30, 2013: US$1.00 to HK$7.7582). No representation is made that the HK$ amounts have been, could have been or could be converted into US$, or vice versa, at that rate, at any other rates or at all.

25

9.

Dividends

The Board does not recommend the payment of an interim dividend for the six months ended

June 30, 2014.

10. Trade receivables

The aging analysis of trade receivables, net of provision for doubtful accounts, is as follows:

June 30, December 31,

2014 2013

US$’000

(Unaudited)(Audited)

0–30 days 522,747 705,837

31–60 days

34,788 19,557

61–90 days 14,628 15,728

Over 90 days 30,739 23,274

602,902 764,396

Trade receivables mainly consist

of casino receivables. The Group generally does not charge interest for credit granted, but requires a personal check or other acceptable forms of security. In respect of gaming promoters, the receivables can be offset against the commission

payables and front money deposits made by the gaming promoters. Absent special approval, the credit period granted to selected premium and mass market players is typically 7–15 days, while for gaming promoters, the receivable is typically

repayable within one month following the granting of the credit subject to terms of the relevant credit agreement.

26

11. Trade

and other payables

June 30, December 31,

2014 2013

US$’000

(Unaudited)(Audited)

Trade payables 32,683 29,525

Outstanding chips and other casino liabilities 540,978 604,665

Other tax payables 317,521 419,574

Deposits

275,234 255,891

Construction payables and accruals 145,456 172,164

Accrued employee benefit expenses 121,369 132,340

Interest payables 33,344 31,797

Payables to

related companies — non-trade 3,057 12,201

Other payables and accruals 131,443 125,804

1,601,085 1,783,961

Less: non-current portion(69,477)(59,618)

Current

portion 1,531,608 1,724,343

The aging analysis of trade payables is as follows:

June 30, December 31,

2014 2013

US$’000

(Unaudited)(Audited)

0–30 days 19,816 18,086

31–60 days

6,895 8,892

61–90 days 4,596 1,297

Over 90 days 1,376 1,250

32,683 29,525

27

12.

Borrowings

June 30, December 31,

2014 2013

US$’000

(Unaudited)(Audited)

Non-current portion

Bank loans, secured 3,209,885 3,008,315

Finance

lease liabilities on leasehold interests in land,

secured 74,679 78,341

Other finance lease liabilities, secured 4,477 5,523

3,289,041 3,092,179

Less: deferred financing costs(102,186)(69,276)

3,186,855 3,022,903

Current portion

Bank loans, secured —

200,554

Finance lease liabilities on leasehold interests in land,

secured 3,657 3,845

Other finance lease liabilities, secured 2,423 2,387

6,080 206,786

Total borrowings 3,192,935

3,229,689

During March 2014, the Group amended its 2011 VML Credit Facility to, among other things, modify

certain financial covenants. In addition to the amendment, certain lenders extended the maturity of US$2.39 billion in aggregate principal amount of the 2011 VML Term Facility to March 31, 2020, and, together with new lenders, provided US$2.0

billion in aggregate principal amount of revolving loan commitments. A portion of the revolving proceeds was used to pay down the US$819.7 million in aggregate principal balance of the 2011 VML Term Facility loans that were not extended. The Group

recorded an US$18.0 million loss on modification or early retirement of debt during the six months ended June 30, 2014, in connection with the pay down and extension. Borrowings under the Extended 2011 VML Revolving Facility are being used to

fund the development, construction and completion of Sands Cotai Central and The Parisian Macao, and for working capital requirements and general corporate purposes. As at June 30, 2014, the Group had US$1.18 billion of available borrowing

capacity under the Extended 2011 VML Revolving Facility.

28

5.

PUBLICATION OF INTERIM RESULTS ON THE WEBSITES OF THE STOCK EXCHANGE AND THE COMPANY

This announcement is

published on the websites of the Stock Exchange (www.hkexnews.hk) and the Company (www.sandschinaltd.com). The interim report for the six months ended June 30, 2014 will be dispatched to Shareholders and published on the websites of the Stock

Exchange and the Company in due course.

By order of the Board

SANDS CHINA LTD. David Alec Andrew Fleming

Company Secretary

Macao, August 15, 2014

As at the date of this announcement, the directors of the Company are:

Executive Directors:

Edward Matthew Tracy Toh Hup Hock

Non-Executive

Directors:

Sheldon Gary Adelson

Michael Alan Leven (David Alec Andrew Fleming as his alternate)

Charles Daniel Forman Robert Glen Goldstein

Independent Non-Executive Directors:

Iain Ferguson Bruce Chiang Yun David Muir Turnbull Victor Patrick Hoog Antink Steven Zygmunt Strasser

This announcement is prepared in English and Chinese. In the case of inconsistency, please refer to the English version as it shall prevail.

29

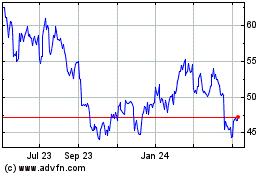

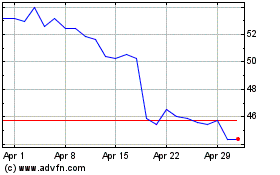

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024