UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) August

14, 2014

|

VAPOR CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

3001 Griffin Road, Dania Beach, Florida

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (888) 766-5351

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On

August 14, 2014, Vapor Corp. (the “Company”) announced its financial and operating results for the quarter and

six months ended June 30, 2014 in the press release furnished herewith as Exhibit 99.1 and incorporated herein by

reference.

The information in this Report, including the Exhibit, is being furnished pursuant to Item 2.02 of Form 8-K and General Instruction B.2 thereunder. Such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press

Release of Vapor Corp. dated August 14, 2014

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

VAPOR CORP.

|

|

|

|

|

Date:

August 14, 2014

|

By:

|

/s/ Harlan Press

|

|

|

Name: Harlan Press

|

|

|

Title: Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press

Release of Vapor Corp. dated August 14, 2014

|

EXHIBIT 99.1

Investor Contacts:

Jeffrey Goldberger / Garth Russell

KCSA Strategic Communications

jgoldberger@kcsa.com / grussell@kcsa.com

(212)-896-1249 / (212)-896-1250

Vapor Corp. Reports Second Quarter 2014 Results

DANIA BEACH, Fla – (August 14, 2014) – Vapor Corp. (NASDAQCM: VPCO; “Vapor”, the “Company”), a leading U.S. based electronic cigarette and vaporizer company whose brands include Krave®, VaporX®, Hookah Stix®, Alternacig®, and Fifty-One®, today announced its financial and operating results for the quarter and six months ended June 30, 2014.

Recent Company Highlights:

|

●

|

Entered into an asset purchase agreement, as amended, to acquire International Vapor Group, Inc. and certain of its subsidiaries’ (collectively, “IVG”), online, wholesale and retail operations, which is expected to close no later than September 30, 2014.

|

|

o

|

Signed 9 real estate leases as of August 7, 2014 for new retail stores that will be added to the retail operations of IVG that Vapor acquires at the closing of the acquisition.

|

|

●

|

Launched a new line of vaporizers and premium USA-made e-Liquids with advanced technology, enhanced performance, and longer battery life in anticipation of increasing demand for vaporizer products.

|

|

●

|

Recently debuted a first of its kind infomercial showcasing our electronic vaporizers to drive sales in the explosive vaporizer market.

|

|

●

|

Uplisted to the NASDAQ Capital Market.

|

Jeff Holman, Chairman, President and CEO of Vapor, commented, “During the second quarter, we were affected by certain one-time internal and external events that impacted Vapor Corp.’s ability to achieve its quarterly sales objectives. This included an inventory overhang from our rebranding efforts for Krave®, the conclusion of our Alternacig electronic cigarette infomercial offering and the redirection of our direct marketing campaign towards Vaporizers. Also, similar to our industry peers, competition continues to intensify in the electronic cigarette market, which is further amplified by the market shift towards vaporizers. As a result, total revenue for the second quarter decreased slightly by 1.7% to $6.1 million compared to the prior year quarter.”

“We believe that we are effectively managing our product mix amid the shift towards vaporizers, which has been increasingly taking market share from e-cigs as consumers’ tastes mature. We are well along in the process of properly transitioning a portion of our portfolio to better align ourselves with evolving market demand. For example, we recently launched a direct marketing campaign featuring the first ever vaporizer infomercial, which will help us gain further traction and spur growth in this product category.”

“We are also excited about the pending acquisition of IVG’s online, wholesale and retail operations, which is expected to close in the third quarter. Under the terms of our agreement, we have already purchased and infused capital to develop nine additional retail stores, which will contribute to our total retail sales for vaporizers,” continued Mr. Holman.

Mr. Holman concluded, “As we’ve demonstrated, Vapor Corp. remains nimble and well positioned to capitalize on the existing e-cig market and to further penetrate the vaporizer market. Given our strategic investments in these categories, we are confident that Vapor Corp. can take advantage of the explosive $2.5 billion e-cig and vaporizer industry and achieve future growth in 2014 and beyond.”

Results of Operations for the Three Months Ended June 30, 2014

Net sales for the quarter ended June 30, 2014 were approximately $6.1 million compared with approximately $6.2 million during the same period last year.

Cost of goods sold in the second quarter of 2014 increased 22.1% to approximately $4.5 million, compared with approximately $3.7 million for the same quarter in the previous year, primarily due to the change in product mix to higher distributor and wholesaler sales, an inventory provision reducing the carrying value of certain products, and an increase in sales incentives to assist customers in selling off certain product lines as a result of our rebranding efforts.

Gross margins in the second quarter of 2014 decreased to 25.3% from 39.8%, year-over-year, as a result of the inventory provision associated with the rebranding of Krave, increase in sales incentives and the change in the product mix. However, gross margins increased 5.3 points from the first quarter of 2014, from 20.0% to 25.3%.

Selling, general and administrative expenses for the quarter ended June 30, 2014 increased by approximately 57.2% to $2.4 million, compared with $1.6 million from the same quarter in the prior year. The increase was primarily attributable to non-cash stock compensation expenses attributable to the consulting agreement with Knight Global Services, professional fees associated with the private placement of common stock completed in October 2013, uplisting to the NASDAQ Capital Market and costs incurred in connection with the acquisition of IVG’s operations.

Advertising expenses decreased approximately 12.2% to $0.8 million for the quarter ended June 30, 2014, compared with $0.9 million during the same quarter in 2013 due to decreases in Internet advertising and the television direct marketing campaign for Alternacig® brand, increased print advertising campaigns and participation in trade shows, and the initiation of several new marketing campaigns.

Operating loss was $1.7 million, compared with an operating income of $26,839 for the same quarter in the prior year, primarily attributable to non-cash stock compensation expenses attributable to the consulting agreement with Knight Global Services, professional fees associated with the private placement of common stock completed in October 2013, uplisting to the NASDAQ Capital Market and costs incurred in connection with the acquisition of IVG’s operations.

Interest expense for the quarters ended June 30, 2014 and 2013 was $29,182 and $76,899, respectively.

Income tax benefit for the quarter ended June 30, 2014 was $0.7 million compared to an income tax expense of $4,590 for the same period of 2013.

Net loss for the quarter ended June 30, 2014 was $1.1 million compared with a net loss of $54,650 for the quarter ended June 30, 2013.

At June 30, 2014, the Company had cash of $3.3 million compared to $6.6 million at December 31, 2013, a decrease of $3.3 million.

Results of Operation for the Six Months Ended June 30, 2014

Net sales for the six months ended June 30, 2014 were approximately $10.9 million compared with approximately $12.5 million during the same period last year, a decrease of 13.3%. The decline in revenue is primarily attributable to decreased sales from the television direct marketing campaign for the Alternacig® brand, decreased sales from on-line stores, inventory build leveling off and continued pipeline load from 2013, the increasing prevalence of vaporizers, tanks and open system vapor products that are marginalizing the e-cigarette category and the launches of new national competitors’ branded products during the second quarter of 2014.

Cost of goods sold in the six months ended June 30, 2014 increased 12.7% to approximately $8.4 million, compared with approximately $7.4 million for the same period in the previous year, primarily due to the change in product mix to higher distributor and wholesaler sales, which have lower gross margins than direct sales to consumers, an inventory provision to reduce the carrying value of certain rebranded products and an increase in sales incentives to assist customers in selling off certain rebranded product lines.

Gross margins decreased to 23.0% in the six months ended June 30, 2014, compared with 40.8% for the same period in 2013 as a result of the inventory provision, increase in sales incentives and the change in the product mix.

Selling, general and administrative expenses for the six months ended June 30, 2014 increased by approximately 65.0% to $5.2 million, compared with $3.2 million, from the same period in the prior year. The increase was primarily attributable to increases in non-cash stock compensation expense of $0.9 million dollars due to the consulting agreement with Knight Global Services, professional fees due to implementing corporate actions pursuant to the October 2013 private placement and costs incurred in connection with the acquisition of IVG’s operations.

Advertising expenses decreased approximately 34.1% to $1.1 million for the six months ended June 30, 2014, compared with $1.7 million during the same period in 2013 due to decreased Internet advertising and television direct marketing campaign for the Alternacig® brand, increased print advertising programs, participation at trade shows, and the initiation of several new marketing campaigns in which the Company sponsored several music campaigns and continued various other advertising campaigns.

Operating loss was $3.9 million, compared with an operating income of $0.2 million for the same period in the prior year.

Interest expense for the six months ended June 30, 2014 and 2013 was $57,616 and $143,409, respectively.

Income tax benefit for the six months ended June 30, 2014 was $1.4 million compared to an income tax expense of $9,180 for the same period in 2013.

Net loss for the six months ended June 30, 2014 was $2.5 million compared with a net income of $68,894 for the same period in 2013, as a result of the items discussed above.

Conference Call Information

The Company’s management team will host a conference call today August 14, 2014 at 10:30 A.M. Eastern Time to discuss the Company’s historical financial and operating performance during the second quarter ended June 30, 2014. To listen to the call, please dial 1-888-539-3678 (US Toll Free) or 1-719-785-1753 (International) and enter the pin number 3679759 at least five minutes before the scheduled start time. Investors and other interested parties can also access the call in a “listen only” mode via webcast at the Company’s website, www.vapor-corp.com. Please allow extra time prior to the call to visit the site and download any necessary audio software.

A digital replay of the conference call will be available an hour after the completion of the live call through August 28, 2014 at 1-877-870-5176 (US Toll Free) or 1-858-384-5517 (International), pin number 3679759. The replay also will be available at the Company’s website for a limited time.

About Vapor Corp.

Vapor

Corp., a NASDAQ listed company, is a leading U.S. based electronic cigarette and vaporizer company, whose brands include

Krave®, VaporX®, Hookah Stix®, Alternacig® and Fifty-One®. We also design and develop private label

brands for some of our distribution customers. “Electronic cigarettes” or “e-cigarettes,” and “Vaporizers,”

are battery-powered products that enable users to inhale nicotine vapor without smoke, tar, ash or carbon monoxide. Vapor’s

electronic cigarettes, vaporizers and accessories are available online, through direct response to our television advertisements

and through retail locations throughout the United States. For more information on Vapor Corp. and its e-cigarette and vaporizer

brands, please visit us at www.vapor-corp.com.

Safe Harbor Statement

This press release contains certain forward-looking statements that are made pursuant to the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Words such as “expects,” “anticipates,” “plans,” “believes,” “scheduled,” “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These forward-looking statements concern Vapor’s operations, economic performance, financial condition and pending purchase of IVG’s e-commerce, wholesale and retail operations and are based largely on Vapor’s beliefs and expectations. These statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Vapor to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Certain of these factors and risks, as well as other risks and uncertainties are stated in Vapor’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and in Vapor’s subsequent filings with the U.S. Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Vapor assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

(Tables to Follow)

VAPOR CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| |

|

|

|

|

|

|

| |

|

For The Six Months Ended

|

|

|

For The Three Months Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES, NET

|

|

$ |

10,873,866 |

|

|

$ |

12,546,591 |

|

|

$ |

6,081,322 |

|

|

$ |

6,185,842 |

|

|

Cost of goods sold

|

|

|

8,374,522 |

|

|

|

7,430,415 |

|

|

|

4,542,594 |

|

|

|

3,721,609 |

|

|

GROSS PROFIT

|

|

|

2,499,344 |

|

|

|

5,116,176 |

|

|

|

1,538,728 |

|

|

|

2,464,233 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

5,211,742 |

|

|

|

3,159,455 |

|

|

|

2,442,018 |

|

|

|

1,553,357 |

|

|

Advertising

|

|

|

1,143,633 |

|

|

|

1,735,238 |

|

|

|

776,017 |

|

|

|

884,037 |

|

|

Total operating expenses

|

|

|

6,355,375 |

|

|

|

4,894,693 |

|

|

|

3,218,035 |

|

|

|

2,437,394 |

|

|

Operating (loss) income

|

|

|

(3,856,031 |

) |

|

|

221,483 |

|

|

|

(1,679,307 |

) |

|

|

26,839 |

|

|

Other expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

57,616 |

|

|

|

143,409 |

|

|

|

29,182 |

|

|

|

76,899 |

|

|

Total other expense

|

|

|

57,616 |

|

|

|

143,409 |

|

|

|

29,182 |

|

|

|

76,899 |

|

|

INCOME (LOSS) BEFORE INCOME TAX (BENEFIT) EXPENSE

|

|

|

(3,913,647 |

) |

|

|

78,074 |

|

|

|

(1,708,489 |

) |

|

|

(50,060 |

) |

|

Income tax (benefit) expense

|

|

|

(1,409,724 |

) |

|

|

9,180 |

|

|

|

(657,324 |

) |

|

|

4,590 |

|

|

NET (LOSS) INCOME

|

|

$ |

(2,503,923 |

) |

|

$ |

68,894 |

|

|

$ |

(1,051,165 |

) |

|

$ |

(54,650 |

) |

(LOSS) EARNINGS PER SHARE-BASIC

|

|

$ |

(0.15 |

) |

|

$ |

0.01 |

|

|

$ |

(0.06 |

) |

|

$ |

0.00 |

|

(LOSS) EARNINGS PER SHARE-DILUTED

|

|

$ |

(0.15 |

) |

|

$ |

0.01 |

|

|

$ |

(0.06 |

) |

|

$ |

0.00 |

|

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING-BASIC

|

|

|

16,312,563 |

|

|

|

12,046,259 |

|

|

|

16,377,674 |

|

|

|

12,053,591 |

|

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING-DILUTED

|

|

|

16,312,563 |

|

|

|

12,337,027 |

|

|

|

16,377,674 |

|

|

|

12,053,591 |

|

VAPOR CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

|

|

|

|

|

| |

June 30,

|

|

|

December 31,

|

|

| |

2014

|

|

|

2013

|

|

| |

(Unaudited)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

Cash

|

|

$ |

3,329,447 |

|

|

$ |

6,570,215 |

|

|

Due from merchant credit card processor, net of reserve for chargebacks of $2,500 and $2,500, respectively

|

|

|

114,747 |

|

|

|

205,974 |

|

|

Accounts receivable, net of allowance of $161,792 and $256,833, respectively

|

|

|

1,428,603 |

|

|

|

1,802,781 |

|

|

Inventories

|

|

|

3,572,800 |

|

|

|

3,321,898 |

|

|

Prepaid expenses and vendor deposits

|

|

|

1,178,514 |

|

|

|

1,201,040 |

|

|

Deferred tax asset, net

|

|

|

333,638 |

|

|

|

766,498 |

|

|

TOTAL CURRENT ASSETS

|

|

|

9,957,749 |

|

|

|

13,868,406 |

|

| |

|

|

|

|

|

|

|

|

|

Deferred tax asset, net

|

|

|

1,843,419 |

|

|

|

- |

|

|

Property and equipment, net of accumulated depreciation of $36,103 and $27,879, respectively

|

|

|

26,307 |

|

|

|

28,685 |

|

|

Other assets

|

|

|

97,943 |

|

|

|

65,284 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$ |

11,925,418 |

|

|

$ |

13,962,375 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

1,229,629 |

|

|

$ |

1,123,508 |

|

|

Accrued expenses

|

|

|

416,732 |

|

|

|

420,363 |

|

|

Term loan

|

|

|

109,617 |

|

|

|

478,847 |

|

|

Customer deposits

|

|

|

43,682 |

|

|

|

182,266 |

|

|

Income taxes payable

|

|

|

3,092 |

|

|

|

5,807 |

|

|

TOTAL CURRENT LIABILITIES

|

|

|

1,802,752 |

|

|

|

2,210,791 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.001 par value, 1,000,000 shares authorized, none issued

|

|

|

- |

|

|

|

- |

|

|

Common stock, $.001 par value, 50,000,000 shares authorized, 16,756,911 and 16,214,528 shares issued and 16,456,911 and 16,214,528 outstanding, respectively

|

|

|

16,757 |

|

|

|

16,214 |

|

|

Additional paid-in capital

|

|

|

13,989,486 |

|

|

|

13,115,024 |

|

|

Accumulated deficit

|

|

|

(3,883,577 |

) |

|

|

(1,379,654 |

) |

|

TOTAL STOCKHOLDERS’ EQUITY

|

|

|

10,122,666 |

|

|

|

11,751,584 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$ |

11,925,418 |

|

|

$ |

13,962,375 |

|

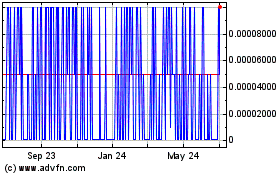

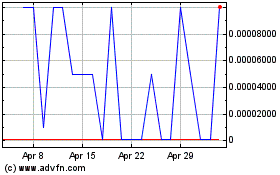

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024