Current Report Filing (8-k)

August 14 2014 - 7:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest reported) August 12, 2014

Commission File Number 000-52727

ELRAY RESOURCES INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

98-0526438

|

|

State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization

|

|

Identification No.)

|

3651 Lindell Road, Suite D 131, Las Vegas, Nevada

|

|

89103

|

|

(Address of principal executive offices)

|

|

(Zip Code) |

Registrant’s telephone number, including area code: 917.775.9689

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 3.02 Unregistered Sales of Equity Securities.

Since the filing of its quarterly report on Form 10-Q for the period ended March 31, 2104, Elray Resources, Inc., a Nevada corporation (the “Company”), has sold a total of 9,449,082.

On January 23, 2014, the Company issued a Convertible Promissory Note in the principal amount of $2.8 million to Gold Globe Investments Limited, a BVI company (“GGI”) and issued a Convertible Promissory Note in the principal amount of $1.5 million to Virtual Technology Group LLC, a Nevada limited liability company (“VTG”). These Convertible Promissory Notes (the “Notes) were issued in consideration for the sale by GGI and VTG to the Company of certain proprietary assets, intellectual property and know pursuant to a written Asset Purchase Agreement dated January 16, 2014.

Pursuant to the terms of these convertible promissory notes, the holders have the right to convert any portion of the principal amount thereof at the average of the Company’s share closing price over the last 7 trading days prior to the holder’s election to convert. The holders also have the right to assign any portion of the Notes, or assign the shares to be issued upon any conversion of the Notes, to other parties.

During the month of August 2014, VTG provided notices of its election to convert a total of $240,000 of its Note into shares, which totaled 41,022,260 shares, to the following entities:

|

Name of Party to whom shares were issued Price

|

|

# of Shares

Issued

|

|

|

Conversion

Price

|

|

| |

|

|

|

|

|

|

|

VTG

|

|

|

6,603,774 |

|

|

$ |

0.01 |

|

|

Pancar Capital LLC

|

|

|

6,965,174 |

|

|

$ |

0.005743 |

|

|

Portspot Consultant Ltd.

|

|

|

8,928,571 |

|

|

$ |

0.0056 |

|

|

Robert Francis Edwin Burr

|

|

|

9,043,928 |

|

|

$ |

0.005529 |

|

|

Universal Technology Investments Limited

|

|

|

9,480,813 |

|

|

$ |

0.006329 |

|

During the month of August 2014, GGI provided notices of its election to convert a total of $225,000 of its Note into shares, which totaled 18,426,822 shares, to the following entities:

|

Name of Party to whom shares were issued Price

|

|

# of Shares

Issued

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

GGI

|

|

|

3,747,283 |

|

|

$ |

0.0095 |

|

|

Sarafese Holdings Limited

|

|

|

4,337,464 |

|

|

$ |

0.019986 |

|

|

MBD Holdings Limited

|

|

|

4,981,025 |

|

|

$ |

0.01506 |

|

|

Universal Development Enterprises N.V.

|

|

|

5,361,050 |

|

|

$ |

0.006523 |

|

On August 12, 2014 the Company issued 10,000,000 shares to Longma Holdings Limited at a price of $0.03 per share, for a total purchase price of $300,000, pursuant to a written Subscription Agreement dated June 10, 2014.

The Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended, for the issuance of the foregoing shares pursuant to Section 4(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other things, the transaction does not involve a public offering, the purchasers are “accredited investors” and/or qualified institutional buyers, the purchasers have access to information about the Company and its purchase, the purchasers will take the securities for investment and not resale, and the Company is taking appropriate measures to restrict the transfer of the securities.

SIGNATURES

Pursuant to the requirements of the Securities Exchange of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ELRAY RESOURCES INC. |

|

| |

|

|

|

|

Date: August 14, 2014

|

By:

|

/s/ Brian Goodman |

|

| |

Name: |

Brian Goodman |

|

| |

Title: |

President |

|

3

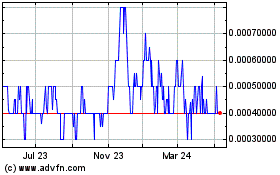

Elray Resources (PK) (USOTC:ELRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

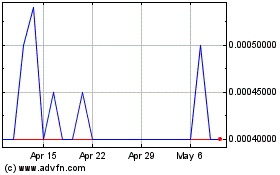

Elray Resources (PK) (USOTC:ELRA)

Historical Stock Chart

From Apr 2023 to Apr 2024