UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

Amendment No. 2

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

VOIS INC.

(Exact name of registrant as specified in its

charter)

|

Florida

|

|

95-4855709

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

3525 Del Mar Heights Rd. #802, San Diego, CA

|

|

92130

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

VOIS Inc. 2009 Equity Compensation Plan (as

amended)

(Full title of the plan)

Mr. Kerry Driscoll

Chief Executive Officer

VOIS Inc.

3525 Del Mar Heights Rd. #802

San Diego, CA 92130

(Name and address of agent for service)

(858) 481-0423

(Telephone number, including area code, of agent

for service)

Copy to:

John P. Cleary, Esq.

Procopio Cory Hargreaves & Savitch LLP

12544 High Bluff Drive, Suite 300

San Diego, California 92130

(619) 515-3221

_______________________________

Indicate by check mark whether the registrant

is a large accelerated filed, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company in Rule 12b-2 of

the Exchange Act.

|

Large Accelerated filer

o

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

x

|

CALCULATION OF REGISTRATION FEE

Title of securities to be

registered

|

|

Amount to be

registered

(1)

|

|

Proposed

maximum offering

price per share

(2)

|

|

Proposed

maximum

aggregate offering

price

(2)

|

|

Amount of

registration

fee

(3)

|

|

Common stock, par value $0.001 per share (Reserved for issuance under the VOIS Inc. 2009 Equity Compensation Plan (the “2009 Plan”)

|

|

185,000,000

|

|

$

0.0003

|

|

$

55,000

|

|

$

7.502

|

(1)

This Amendment No. 1 to Registration

Statement on Form S-8 covers 185,000,000

additional shares of Common Stock, $0.001 par value per share (“Common Stock”)

of VOIS Inc., a Florida corporation (“Registrant”), available for issuance pursuant to awards under the 2009 Plan.

The Registrant previously registered 5,000,000 shares of Common Stock issuable pursuant to stock options and other equity-based

compensation awards under the 2009 Plan, on Form S-8 (Registration No. 333-159895) filed with the Securities Exchange Commission

(the “Commission”) on June 11, 2009. The Registrant thereafter registered an additional 45,000,000 shares of Common

Stock under the 2009 Plan on Form S-8 (Registration No. 333-185249) filed with the Commission on December 3, 2012. The Registrant

thereafter registered an additional 50,000,000 shares of Common Stock under the 2009 Plan on Form S-8 (Registration No. 333-187223)

filed with the Commission on March 13, 2013. Pursuant to Rule 416(c) of the Securities Act of 1933, as amended (the “Securities

Act”), this registration statement shall also cover any additional shares of Common Stock of the Registrant which become

issuable under the 2009 Plan by reason of any stock dividend, stock split, recapitalization or other similar transaction effected

without the receipt of consideration that results in an increase in the number of the Registrant’s outstanding shares of

Common Stock.

(2)

Estimated solely for purposes

of calculating the registration fee pursuant to Rule 457(c) of the Securities Act based on the average of the high and low sale

price of the registrant’s common stock as reported on the OTC Bulletin Board on September 3, 2013.

(3)

Represents the Proposed Maximum

Aggregate Offering Price multiplied by $.00013640.

EXPLANATORY NOTE

This Amendment No. 1 to Registration Statement

on Form S-8 (the “Registration Statement”) is being filed by VOIS Inc. (the “Company”) in accordance with

the requirements of Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”), in order to increase

the number of shares of Common Stock, $0.001 par value per share, issuable on a registered basis pursuant to stock options and

other equity-based compensation awards that may have been or may be granted under the Company’s 2009 Equity Compensation

Plan, pursuant to General Instruction E on Form S-8 –

Registration of Additional Securities

. Such number of shares

is being increased by 185,000,000, from 100,000,000 to 285,000,000. The earlier Registration Statement on Form S-8 (Registration

No. 333-159895) filed with the Securities Exchange Commission (the “Commission”) on June 11, 2009, the earlier Registration

Statement on Form S-8 (Registration No. 333-185249) filed with the Commission on December 3, 2012, and the earlier Registration

Statement on Form S-8 (Registration No. 333-187223) filed with the Commission on March 13, 2013, are each incorporated herein by

this reference. This incorporation by reference is made under General Instruction E to Form S-9 in respect of the registration

of additional securities of the same class as other securities for which there has been filed a Registration Statement on Form

S-8 relating to the same employee benefit plan.

This Registration Statement contains the form

of reoffer prospectus in accordance with Part I of Form S-3 relating to 71,250,000 shares of the Company’s Common Stock,

which are reofferings and resales of up to an aggregate of 71,250,000 shares of our common stock, issuable upon exercise of options

under our 2009 Equity Compensation Plan. The reoffer prospectus may be used for reoffer and resales of restricted securities (as

such term is defined in General Instruction C to Form S-8) acquired pursuant to each of the plans.

We have withdrawn our previous Post-Effective

Amendment No. 1 to Registration Statement on Form S-8 which was filed on September 9, 2013 (Registration No. 333-187223), inasmuch

as it was incorrectly filed as a Post-Effective Amendment. We have also withdrawn our Amendment No. 1 to Registration Statement

on Form S-8 (Registration No. 333-187223) which was filed on August 6, 2014, which was incorrectly filed after the filing of our

Form RW relating to the Post-Effective Amendment No. 1 to Registration Statement on Form S-8 which was filed on September 9, 2013

(Registration No. 333-187223). In order to correct the Form RW filing we made, we have filed a Form RW WD. This filing is made

to correct the incorrect filings made on September 9, 2013, and August 6, 2014. Although this filing shows that we are registering

185,000,000 shares, that amount must be reduced by the amount of the shares of our common stock which have been already issued

pursuant to the Post-Effective Amendment No. 1 to Registration Statement on Form S-8 which was filed on September 9, 2013 (Registration

No. 333-187223). Other than the deletion of the reference to the filing made on September 9, 2013, as being a Post-Effective Amendment,

and the reference to Amendment No. 2 to Registration Statement on Form S-8 as being Amendment No. 2, no changes have been made

to the filing made on September 9, 2013, or August 6, 2014 (Registration No. 333-187223).

This filing is also made pursuant to Rule 429

of the Securities Act of 1933, as amended.

Part

I

Item 1. Plan Information.

The documents containing the information specified

in Item 1 will be sent or given to participants in the VOIS Inc. 2009 Equity Compensation Plan, as specified by Rule 428(b)(1)

of the Securities Act of 1933, as amended (the “Securities Act”). Such documents are not required to be and are not

filed with the Securities and Exchange Commission (the “SEC”) either as part of this Registration Statement or as prospectuses

or prospectus supplements pursuant to Rule 424. These documents and the documents incorporated by reference in this Registration

Statement pursuant to Item 3 of Part II of this Form S-8, taken together, constitute a prospectus that meets the requirements of

Section 10(a) of the Securities Act.

Item 2. Registrant Information and Employee Plan Annual Information.

We will provide to each Recipient a written

statement advising it of the availability of documents incorporated by reference in Item 3 of Part II of this Registration Statement

and of documents required to be delivered pursuant to Rule 428(b) under the Securities Act without charge and upon written or oral

notice by contacting:

Kerry Driscoll

Chief Executive Officer

3525 Del Mar Heights Rd. #802

San Diego, California 92130

(858) 481-0423

Information required by Part I to be contained

in section 10(a) prospectus is omitted from the registration statement in accordance with Rule 428 under the Securities Act of

1933, and Note to Part I of Form S-8.

REOFFER PROSPECTUS

The date of this prospectus is September 9,

2013

VOIS INC.

3525 Del Mar Heights Rd. #802

San Diego, CA 92130

185,000,000 Shares of Common Stock

This reoffer prospectus relates to 185,000,000

shares of our common stock, par value $0.001 per share, that may be offered and resold from time to time by the selling shareholders

identified in this prospectus (the “Selling Shareholders”) for their own account. The shares included in this prospectus

include shares issued or to be issued to the Selling Shareholders pursuant to our 2009 Equity Compensation Plan, as amended (the

“Plan”). It is anticipated that the Selling Shareholders will offer common shares for sale at prevailing prices on

the Over-the-Counter Bulletin Board on the date of sale. We will receive no part of the proceeds from sales made under this reoffer

prospectus. The Selling Shareholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in

connection with the registration and offering and not borne by the Selling Shareholders will be borne by us.

The Plan authorizes the issuance of up to 285,000,000

shares of our common stock to officers, directors, employees and consultants of the Company. This reoffer prospectus has been prepared

for the purposes of registering the common shares under the Securities Act to allow for future sales by the Selling Shareholders

on a continuous or delayed basis to the public without restriction.

The Selling Shareholders and any brokers executing

selling orders on their behalf may be deemed to be “underwriters” within the meaning of the Securities Act, in which

event commissions received by such brokers may be deemed to be underwriting commissions under the Securities Act.

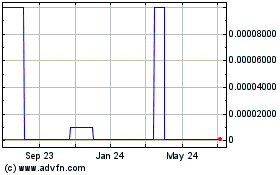

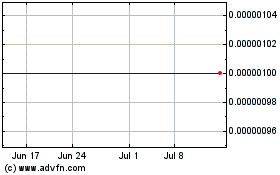

Our common stock is traded on the Over-the-Counter

Bulletin Board under the symbol “VOIS”. On September 3, 2013, the closing price of our common stock on such market

was $0.0003 per share.

Investing in our common stock involves risks.

See “Risk Factors” on page 7 of this reoffer prospectus. These are speculative securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF

THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

September 9, 2013

TABLE OF CONTENTS

|

|

|

Page

|

|

|

|

|

|

Prospectus Summary

|

|

4

|

|

|

|

|

|

Risk Factors

|

|

8

|

|

|

|

|

|

Cautionary Note Regarding Forward-Looking Statements

|

|

11

|

|

|

|

|

|

Use of Proceeds

|

|

11

|

|

|

|

|

|

Selling Shareholders

|

|

11

|

|

|

|

|

|

Plan of Distribution

|

|

12

|

|

|

|

|

|

Legal Matters

|

|

14

|

|

|

|

|

|

Experts

|

|

16

|

|

|

|

|

|

Interest of Named Experts and Counsel

|

|

16

|

|

|

|

|

|

Disclosure of Commission Position on Indemnification for Securities Act Liabilities

|

|

16

|

|

|

|

|

|

Additional Information Available to You

|

|

16

|

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION

OR TO MAKE ANY REPRESENTATIONS, OTHER THAN THOSE CONTAINED IN THIS PROSPECTUS, IN CONNECTION WITH THE OFFERING MADE HEREBY, AND,

IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY OR ANY OTHER

PERSON. NEITHER THE DELIVERY OF THIS PROSPECTUS NOR ANY SALE MADE HEREUNDER SHALL UNDER ANY CIRCUMSTANCES CREATE ANY IMPLICATION

THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE HEREOF. THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER

TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITIES OFFERED HEREBY BY ANYONE IN ANY JURISDICTION IN WHICH SUCH OFFER OR

SOLICITATION IS NOT AUTHORIZED OR IN WHICH THE PERSON MAKING SUCH OFFER OR SOLICITATION IS NOT QUALIFIED TO DO SO OR TO ANYONE

TO WHOM IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION.

PROSPECTUS SUMMARY

Our Company

Our focus is to develop software and certain

related hardware. Our software applications that we are developing use a wireless EEG headset, which is designed to read brainwaves

and allow the user to interact with a computer via our software. We are also developing a proprietary micro electro encephalograph,

or EEG, wireless headset that may, if we are successful, allow interaction with our software applications that we are developing.

The hardware we are developing is a BCI (brain

computer interface) device, which is an EEG headset that, if we are successful in our development work, may be used to interpret

electrical signals produced by the brain. We believe that the EEG headset may be the smallest in the world. If we are successful

in our development efforts, and if product testing can be successfully completed, it may be used to communicate with mobile smart

phones as well as personal computers, or PCs. We have received, on a preliminary basis, prototypes from our manufacturing sub-contractor

in Asia and, if our financial and market circumstances allow, and depending on the outcome of our efforts to raise additional capital,

we may make arrangements for our manufacturing sub-contractor to begin manufacturing of the product. We cannot assure you that

we will successfully complete testing or that market conditions or our financial resources will be sufficient to undertake these

and other steps that we anticipate will be necessary. The development of software and hardware by any small company, including

us, carries significant risks and uncertainties that are beyond our control. As a result, we cannot assure that we will successfully

market and sell our planned products or, if we are able to do so, that we can achieve sales volume levels that will allow us to

cover our fixed costs.

Finally, and if market conditions and our financial

circumstances allow, we anticipate that we may develop thought-controlled applications to communicate with our planned EEG headset

and, if we are successful in these efforts, we may add additional applications thereafter. In that connection we may, if these

efforts are successful, initiate one or more mobile device applications, or apps, store which will be designed to allow outside

developers to participate in a revenue sharing program for the thought-controlled applications they develop.

Our products fall under two categories: software

and hardware.

Software

On December 18, 2012, we entered into a

License Agreement with Mind Technologies, Inc. (“Mind Technologies”) whereby Mind Technologies granted the

Company a non-exclusive license to use, operate, market make, have made, offer to sell, sell, have sold and otherwise

transfer and commercially exploit Mind Technologies’ three thought-controlled software applications, which are

currently available to consumers. These completed applications have been tested by our Scientific Advisory Board as well

focus groups, including persons with disabilities such as amyotrophic lateral sclerosis, or ALS, which is also known as Lou

Gehrig’s disease. The applications have all passed beta testing and completed for commercialization to the public. The

three completed applications are sold online, direct to consumers and delivered via email as a download for their PC. Mind

Mouse and Master Mind are currently sold at $99, while the basic application of Think Tac Toe is sold for $49. These

applications have been available for purchase as a software download through

www.MindTechnologiesInc.com

and will be

available as of November 1

st

, 2012 through The Company’s website www.MindSolutionsCorp.com.

Our current software products are as follows:

MIND MOUSE - The thought-controlled software

application is designed to allow the user to navigate the computer, click and double click to open programs, compose email and

send with the power of their mind. The application can be used by anyone, but we believe it is especially beneficial to people

with disabilities that have problems with communicating.

MASTER MIND - This thought-controlled software

application is designed to allow the user to play existing PC games which are on the market with the power of their mind. Rather

than using a traditional keyboard, mouse or hand-held controller, the player controls the characters with their thoughts through

the use of a wireless headset that reads the player’s brainwaves. The user maps specific thoughts to create commands, which

are received via a Bluetooth wireless USB. Those commands cause the characters to run, shoot, jump or any other action used in

the game.

THINK-TAC-TOE - The thought-controlled version

of tic-tac-toe, allows the user to play against the computer using the power of their mind. The game provides the use of a gyroscope

to move right, left, up or down. Once the desired square is selected, the user concentrates to place an “X” or “O”

in the respective box. The game can be played entirely by cognitive thought, by thinking Right or Left or can utilize the gyroscope

to move from square to square.

Hardware

Our Micro EEG headset is currently in the development

phase with a completed, functioning prototype delivered and tested. The prototype has been tested positively on the majority of

Samsung Tablets and has received the communication and results our Scientific Advisory Board was expecting. The prototype has also

been tested anatomically on several subjects and has received the brain signals and electrical impulses we were seeking. From here,

we anticipate developing the software operating system, or SDK, to integrate the hardware with the software planning to be developed

by The Company’s development team as well as by outside developers seeking to participate on a revenue-sharing basis through

the planned APP store.

Our Micro EEG headset is designed to be the

smallest, lightest BCI device on the market. Our goal has been to create a user-friendly BCI that uses dry sensors in a way that

it does not stand out when worn and produces reliable, consistent results. While there are many uncertainties and variables beyond

our control in developing new products, if our market circumstances allow we anticipate that if we are successful in our development

efforts and provided that we can obtain sufficient amount of additional financing, we may release the headset in the near future.

Cognitive Thought Interactive Platform (CTIP)

Our CTIP employs unique, home based

infrastructure. This early stage development platform will allow the home to be operated by thoughts rather than actions. The

platform empowers users to control everyday applications with the power of their thoughts through powerful analytic software.

It empowers a stay at home parent to answer the telephone, turn on the lights, pre-heat the oven, start the washing machine,

dryer and, dish washer, turn on the television and change the channel all through their thoughts. The CTIP operates in a way

that can be programmed to fit any application. Household appliances will soon be created with software interfaces. An example

is the Apple iTouch and iPhone application that allows the user to control the volume and song selection on their computer

from across the room. Remote capacity to control one appliance such as a television is standard; however Apple has crossed to

multiple application interfaces. Combined with software interfaced appliance and our CTIP, we believe the household will be

operated by the power of the owners’ thoughts. Once placing on the headset the owner can turn on and off the lights by

simply thinking “lights turn on”. We plan to develop software for all household appliances.

|

•

|

Televisions

|

•

|

Lights

|

|

•

|

Ovens/Stoves

|

•

|

Telephones

|

|

•

|

Fax Machines

|

•

|

Fans

|

|

•

|

HVAC

|

•

|

Computers

|

|

•

|

Printers

|

•

|

Stereos

|

Our CTIP creates new possibilities for fun

efficient was to manage a household. The CTIP will be developed for each individual appliance and will be sold as separate applications

for the user. For each appliance a new application will be purchased from us. Subject to the availability of sufficient capital,

we will also expend resources and focus on the medical applications sector, focused on diagnostic software to address learning

impairments, sleep disorders, and severe clinical disorders.

Intellectual property

On December 18, 2012, we entered into a License

Agreement (the “License Agreement”) with Mind Technologies, Inc. (“Mind Technologies”) whereby Mind Technologies

granted the Company a non-exclusive license to use, operate, market make, have made, offer to sell, sell, have sold and otherwise

transfer and commercially exploit Mind Technologies’ three thought-controlled software applications, Mind Mouse, Master Mind

and Think-Tac-Toe, together with all trade names and documentation used in connection therewith (the “Licensed Products”).

The Licensed Products constitute neural processing software for thought-controlled technologies, allowing the user to interact

with computers, gaming devices and other machines through the power of the mind. The License Agreement was consummated pursuant

to a Letter of Intent by and between the Company and Mind Technologies on or about October 16, 2012.

Mind Technologies granted the license to the

Licensed Products to the Company in exchange for a one-time, advance license fee consisting of the issuance to Mind Technologies

of 7,000,000 shares of restricted Common Stock of the Company.

On April 30, 2013 the Company executed an asset

purchase agreement with Mind Technologies, whereby the Company purchased all the assets of Mind Technologies for 30,000,000 common

shares. The assets purchased were previously licensed from Mind Technologies as described previously. The cost basis of the assets

acquired is $86,033, with accumulated depreciation of $81,638, which resulted in a net asset balance of $4,395. The Company recorded

the excess consideration as additional paid in capital being it was a related party transaction. The former CEO of Mind Solutions,

Inc. is also the former CEO of Mind Technologies. The Company acquired all the assets involved with the former operations of Mind

Technologies which include the three thought-controlled software applications named Mind Mouse, Master Mind and Think-Tac-Toe.

These purchased assets constitute neural processing software for thought-controlled technologies, allowing the user to interact

with computers, gaming devices, and other machines through the power of the mind. Included in the purchase are all of Mind Technologies’

inventory, fixed assets, intellectual property, and an assignment of rights and assumption of obligations under Mind Technologies’

existing contracts.

The Company secures its hardware through

patents and trademark protection. The Company has completed a patent search, and filed a provisional patent with the USPTO

for a “Portable Brain Monitor Device”. The Company has since updated the filing within the 12 month grace period

allowed for amendments and improvements. The Company’s patent focuses on the anatomical location chosen to receive

electrical EEG signals when wearing the device, as well as the portable, mobile nature of the device. The Company has a

license from Emotiv Systems which grants us the right to develop software utilizing Emotiv’s Epoc headset and its

proprietary platform. This platform was used to create the three software applications completed by The Company which are

compatible with the Emotiv Epoc headset. The Licensing Agreement is valid for 10 years and allows the Licensee to develop

software compatible with the Epoc headset. Products developed by the Licensee can be sold and priced as the Licensee desires.

Consumers wishing to purchase the software applications developed for the Emotiv platform must purchase the Epoc headset from

www.Emotiv.com for $299 in order to operate the software applications purchased.

The Company utilizes up to six independent

contractors retained to develop our software applications. The complexity of the application and the time constraints will determine

how many software developers are utilized for a given project. While quality software developers cost approximately $90 per hour,

it is The Company’s view that quality control is more important than cost savings through outsourcing to less expensive developers,

such as those available overseas.

Competition

There are only two commercialized BCI Company’s

on the market currently: Emotiv and Neurosky. NeuroSky, Inc.

(www.neurosky.com

) - Considers itself the worldwide leader

in bringing biosensor technology to the consumer mass market. This competitor to the Epoc headset is a very basic and rudimentary

headset, which we have not found to be reliable for serious gamers or up to par to even consider for medical applications. The

technology is very basic and although works well as a toy, we have determined that it is not feasible to use for the applications

that we have developed and are developing. It is the technology behind Mattel’s Mindflex and Uncle Milton’s Star Wars

Force Trainer.

Mindflex by Mattel (www.mindflexgames.com)

– Toy based technology which is sold in toy stores such as Toys ‘r’ Us. Due to the simplicity of their technology,

they are more after the toy market as they cannot achieve the complexity required by gamers and the medical application market.

Uncle Milton’s Star Wars Force Trainer

(www.unclemilton.com/starwars) - A very rudimentary toy that shows the possibility of thought control but remains a simple technology

sold to the toy market.

Government regulation

The regulations associated with the Company’s

business will be SEC regulations and FTC regulations. SEC regulations will involve compliance in all areas related to the Company’s

publicly traded securities. The Company has retained competent SEC counsel to ensure filings are completed on time and that all

compliance issues are strictly followed. The products developed by the Company will be regulated by the FTC to ensure guidelines

on selling to consumers are strictly followed. The Company plans to sell their products throughout the world, so both U.S. Customs

and International Customs regulations will need to be strictly followed as well.

Employees

We currently have one full time employee and

rely on outside consultants. As we expand our business, we are anticipating adding employees in the areas of sales and marketing

and research and development. We do not expect to encounter any difficulties in hiring the necessary personnel.

Our history

We were incorporated in the State of Delaware

on May 19, 2000 initially under the name Medical Records by Net, Inc. In October 2000, we changed our name to Lifelink Online,

Inc., and in January 2001, we changed our name to MedStrong Corporation. In March 2001, the company name was changed to MedStrong

International Corporation. Prior management's efforts had been directed toward the development and implementation of a plan to

generate sufficient revenues in the medical information storage industry to cover all of its present and future costs and expenses.

We remained a development stage company, generating approximately $1,700 in cumulative revenues from our operations from inception

through December 31, 2006 and an accumulated deficit of approximately $3.7 million. We were considered a “shell” company

under Federal securities laws.

In February 2007, we acquired various

assets from VOIS Networking, Inc., a privately-held Florida corporation controlled by two of our former directors and

officers, Messrs. Gary Schultheis and Herbert Tabin, including furniture, fixtures and equipment as well as intangible assets

comprised of several website domain names (URLs), website and software development and applicable contracts relating thereto,

for a total purchase price of $24,044. Thereafter, we began developing a new line of business in connection with a Web 2.0

Internet social commerce networking site. In March 2007, the company’s name was changed to VOIS Inc.

Our historic operations

The Company’s focus has been to complete

the proprietary EEG headset as their primary goal. Once complete and ready for market, The Company plans to launch the product

with a marketing campaign. This will include social networking through sites like Facebook, Twitter and others. The Company also

plans to launch the product through industry trade shows such as the Consumer Electronics Show (CES).

The Company believes it is a much better strategy

to utilize marketing capital once The Company’s proprietary EEG headset is complete to sell along with completed software

applications, rather than sell the software completed for the Emotiv platform. This way, the Company realizes revenue from both

the hardware and software in comparison to selling only software and having the consumer purchase the EEG (Epoc) headset from Emotiv.

Executive Offices

Our executive offices are located at 3525 Del

Mar Heights Rd. #802, San Diego, CA 92130. Our telephone number is (858) 481-0423.

RISK FACTORS

Before you invest in our securities, you

should be aware that there are various risks. You should consider carefully these risk factors, together with all of the other

information included in this Current Report before you decide to purchase securities. If any of the following risks and uncertainties

develops into actual events, our business, financial condition or results of operations could be materially adversely affected

and you could lose your entire investment in our company.

We have only

a limited operating history, have not generated any revenues and have not operated profitably since inception. There are no assurances

we will ever generate revenues or profits

.

Our operations have

never been profitable, and it is expected that we will continue to incur operating losses in the future. For fiscal 2012 our operating

loss and net loss was $2,482,348. During fiscal 2012 cash used in operations was approximately $33,609, and at December 31, 2012

we had a working capital deficit of $806,194 and an accumulated deficit of approximately $30,819,609. For fiscal 2011 our operating

loss and net loss was $150,656. During fiscal 2011 cash used in operations was approximately $155,370, and at December 31, 2011

we had a working capital deficit of $302,201 and an accumulated deficit of approximately $296,390. For fiscal 2010 our operating

loss and net loss was $145,634. During fiscal 2010 cash used in operations was approximately $145,612, and at December 31, 2010

we had a working capital deficit of $146,296 and an accumulated deficit of $145,734. We did not generate any revenues in fiscal

2012 or fiscal 2011. There is no assurance that we will be able to fully implement our business model, generate any meaningful

revenues or operate profitably in the future. Our failure to generate substantial revenues and achieve profitable operations in

future periods will adversely affect our ability to continue as a going concern. If we should be unable to continue as a going

concern, you could lose all of your investment in our company.

We will need

additional financing which we may not be able to obtain on acceptable terms. If we cannot raise additional capital as needed, our

ability to execute our business plan and grow our company will be in jeopardy.

Capital is needed

not only to fund our ongoing operations and to pay our existing obligations, but capital is also necessary for the effective implementation

of our business plan. Our future capital requirements, however, depend on a number of factors, including our ability to internally

grow our revenues, manage our business and control our expenses. On December 31, 2012, we had cash on hand of $208. We will need

to raise significant additional capital

to fund the future

growth of our company, including advertising and marketing, continued investment in growing our user base and product development.

We do not have any firm commitments to provide capital and we anticipate that we will have certain difficulties raising capital

given the development stage of our company and the current uncertainties in the capital markets. Accordingly, we cannot assure

you that additional working capital will be available to us upon terms acceptable to us. If we do not raise funds as needed, our

ability to continue to implement our business model is in jeopardy and we may never be able to achieve profitable operations. In

that event, our ability to continue as a going concern is in jeopardy and you could lose all of your investment in our company.

Our auditors

have raised substantial doubts about our ability to continue as a going concern.

The report of our

independent registered public accounting firm on our financial statements at December 31, 2012 and for the year then ended raises

substantial doubts about our ability to continue as a going concern based on our losses since inception, available working capital

and shareholders’ deficiency

.

Our financial statements do not include any adjustments that might result from the outcome

of this uncertainty. As described above, while we believe our current working capital is sufficient to sustain our current operations

for approximately two to three months, we will need to raise additional working capital for marketing expenses as well as product

development in order to continue to implement our business model. If our estimates as to the sufficiency of these funds is incorrect,

in addition to raising capital to fund the continued implementation of our business model we will also need to raise funds to pay

our operating expenses. If such funds are not available to us as needed, we may be forced to curtail our growth plans and our ability

to grow our company will be in jeopardy. In such event, we may not be able to continue as a going concern.

Historically

we have engaged in a number of related party transactions and our Board is not controlled by independent directors

.

From time to time

we have engaged in a number of material related party transactions with companies owned or controlled by our executive officers

and directors, including the purchase of assets believed on favorable terms to the company, which comprise our business, payment

of expenses on behalf of these entities and the sale of securities to these entities. These affiliated transactions may from time

to time result in a conflict of interest for our management. Because these transactions are not subject to the approval of our

shareholders, investors in our company are wholly reliant upon the judgment of our management in these related party transactions.

We have approximately $145,000 principal amount in debt which

we have not repaid and which is in default.

At December 31,

2012 we owed an aggregate of $145,000 principal amount under the terms of unsecured promissory notes which were due between

December 2002 and February 2003, together with accrued but unpaid interest of approximately $222,015. The outstanding notes

due to Messrs. Edward Spindel and Michael Spindel, which were issued at the time they were members of our Board of Directors,

remain past due. Messrs. Edward Spindel and Michael Spindel elected not to participate with the holders of other promissory

notes, including our executive officers, in the exchange of those notes for equity which occurred during January 2008. In

April 2008 we filed a complaint against Messrs. Edward Spindel and Michael Spindel alleging, in part, that during 2002 and

2003 while our company, which at that time known as Medstrong International, was under significant financial distress the

defendants caused the company to issue demand promissory notes charging excessive and/or usurious interest rates with the

knowledge that the company would be unable to repay the notes upon any demand. Subsequently, in February 2009 the defendants

filed a counterclaim. We have attended both a settlement conference with a magistrate judge and mediation which resulted in

an impasse. Although we initially continued to discuss a possible settlement these discussions did not result in a

settlement. We were originally set to begin trial on this matter on December 12, 2009. On November 13, 2009, the parties

attended a pretrial hearing to address legal issues related to our complaint and the defendants’ counterclaim. Based

upon questions posed by the Court and the argument of counsel, the Court struck the defense of usury and additionally

dismissed our complaint without prejudice, providing us 10 days to file an amended complaint. The defendants were also

provided 10 days to file an amended counterclaim. Based upon the rulings, the matter was then removed from the

Court’s December 2009 trial docket. We have decided that it is not cost effective or beneficial to pursue our

affirmative claims in this matter and have, accordingly, elected not to file an amended complaint. On July 19, 2010, the

counter–plaintiffs, Edward and Michael Spindel filed a motion for summary judgment. We filed a response in opposition

on August 5, 2010. The Spindels filed a reply on September 9, 2010. The court held a hearing on September 16, 2010 and at the

hearing granted summary judgment in favor of the Spindels. Final judgment was ordered on November 16, 2010 in the amount of

$287,266 plus post judgment interest. Attorney’s fees amounted to $172,304.

On December 6, 2010 we

filed an appeal to the judgment. On July 13, 2011 the United States Court of Appeals for the Eleventh Circuit issued an opinion

in favor of the Company. This Opinion was made final when the Court issued its mandate on August 15, 2011. This ruling effectively

reversed the Summary Judgment previously granted to the Spindels by the District Court on November 4, 2010 in the amount of $287,266.

In connection with these

proceedings, on August 7, 2013, the counter-plaintiff, Edward Spindel filed a Motion for Writ of Garnishment with the district

court with Bank of America, N.A. as the Garnishee. Bank of America, N.A. filed an answer to the Motion for Write of Garnishment

on August 9, 2013 and on August 12, 2013 the U.S. District Court, Southern District of Florida, West Palm Beach Division issued

a Notice of Garnishment which states that the counter-defendant, the Company, has 20 days to move to dissolve the Writ of Garnishment.

The outstanding notes

due to the defendants in the aggregate amount of $145,000, which are unsecured and were issued at the time they were members of

our Board of Directors, remain past due. The defendants elected not to participate with the holders of other promissory notes,

including our then executive officers, in the exchange of those notes for equity which occurred during January 2009. At December

31, 2012 our liabilities as reported in our financial statements incorporated by reference to this report reflect the principal

amount of the notes together with $222,015 in accrued interest and penalties.

Because our

operating history is limited and the revenue and income potential of our business and markets are unproven, we cannot predict whether

we will meet internal or external expectations of future performance.

We believe that our future

success depends on our ability to develop revenue from our operations, of which we have a very limited history. Accordingly, our

prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies with a limited

operating history. These risks include our ability to:

|

|

|

|

|

|

•

|

attract a large audience to our community;

|

|

|

•

|

increase awareness of our brand and attempt to build member loyalty;

|

|

|

•

|

attract buyers and sellers;

|

|

|

•

|

maintain and develop new, strategic relationships;

|

|

|

•

|

derive revenue from our members from premium based services;

|

|

|

•

|

respond effectively to competitive pressures and address the effects of strategic relationships or corporate combinations among our competitors; and

|

|

|

•

|

attract and retain qualified management and employees.

|

Our future success and

our ability to generate revenues depend on our ability to successfully deal with these risks, expenses and difficulties. Our management

has no experience in operating a company such as ours. There are no assurances we will be able to successfully overcome any of

these risks.

Our common stock

is currently quoted on the OTC Pink Sheets, but trading in the securities is limited, and trading in these securities is, or could

be, subject to the penny stock rules

.

Currently, our

common stock and certain of our warrants are quoted on the OTC Markets. The market for these securities is extremely limited

and there are no assurances an active market for either security will ever develop. Additionally, securities which trade at

less than $5.00 per share, such as our securities, are considered a “penny stock,” and subject to the

requirements of Rule 15g-9 under the Securities Exchange Act of 1934. Under this rule, broker/dealers who recommend

low-priced securities to persons other than established customers and accredited investors must satisfy special sales

practice requirements. SEC regulations also require additional disclosure in connection with any trades involving a

“penny stock,” including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining

the penny stock market and its associated risks. These requirements would severely limit the liquidity of our securities in

the secondary market because few broker or dealers are likely to undertake these compliance activities.

Provisions of

our Articles of Incorporation and Bylaws may delay or prevent a take-over which may not be in the best interests of our shareholders.

Provisions of our

Articles of Incorporation and Bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings

of our shareholders may be called, and may delay, defer or prevent a takeover attempt. In addition, certain provisions of the Florida

Business Corporations Act also may be deemed to have certain anti-takeover effects which include that control of shares acquired

in excess of certain specified thresholds will not possess any voting rights unless these voting rights are approved by a majority

of a corporation's disinterested shareholders.

Further, our Articles

of Incorporation authorizes the issuance of up to 10,000,000 shares of preferred stock with such rights and preferences as may

be determined from time to time by our Board of Directors in their sole discretion. Our Board of Directors may, without shareholder

approval, issue series of preferred stock with dividends, liquidation, conversion, voting or other rights that could adversely

affect the voting power or other rights of the holders of our common stock.

Cautionary

Note Regarding Forward-Looking StatementS

We and our representatives may from time to

time make written or oral statements that are “forward-looking,” including statements contained in this prospectus

and other filings with the Securities and Exchange Commission, reports to our shareholders and news releases. All statements that

express expectations, estimates, forecasts or projections are forward-looking statements. In addition, other written or oral statements

which constitute forward-looking statements may be made by us or on our behalf. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,”

“forecasts,” “may,” “should,” variations of such words and similar expressions are intended

to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties,

and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed

or forecasted in or suggested by such forward-looking statements. Among the important factors on which such statements are based

are assumptions concerning our ability to obtain additional funding, our ability to compete against our competitors, our ability

to integrate our acquisitions and our ability to attract and retain key employees.

Use

of Proceeds

We will not receive any proceeds from the sale

of common shares by the Selling Shareholders pursuant to this prospectus. The Selling Shareholders will receive all proceeds from

the sales of these common shares, and they will pay any and all expenses incurred by them for brokerage, accounting or tax services

(or any other expenses incurred by them in disposing of their common shares).

Selling

Shareholders

The selling shareholders named in this prospectus

(the “Selling Shareholders”) are offering all of the 71,250,000 shares offered through this prospectus, all of which

are issued or to be issued under our 2009 Equity Compensation Plan, as amended (the “Plan”).

If, subsequent to the date of this reoffer

prospectus, we grant any further awards under the Plan to any eligible participants who are affiliates of our company (as defined

in Rule 405 under the Securities Act), Instruction C of Form S-8 requires that we supplement this reoffer prospectus with the names

of such affiliates and the amounts of securities to be reoffered by them as selling shareholders.

Beneficial ownership is determined

according to the rules of the Securities and Exchange Commission, and generally means that a person has beneficial ownership

of a security if he, she or it possesses sole or shared voting or investment power of that security. The percentages for each

Selling Shareholder are calculated based on 1,431,523,747 shares issued and outstanding as of August 29, 2013, plus any

additional shares that the Selling Shareholder is deemed to beneficially own as set forth in the table. The shares offered by

this prospectus shall be deemed to include shares offered by any pledgee, donee, transferee or other successor in interest of

any of the Selling Shareholders below, provided that this prospectus is amended or supplemented if required by applicable

law.

|

Name

|

Shares Beneficially Owned Prior to this Offering (1)

|

Number of Shares Being Offered

|

Shares Beneficially Owned Upon Completion of the Offering (1)

|

|

|

Number

|

Percent (2)

|

Number

|

Percent (3)

|

|

Kerry Driscoll (4)

|

204,000,000

|

14.3%

|

35,625,000

|

239,625,000

|

15.9%

|

|

Jeff Dashefsky (5)

|

8,080,000

|

.5%

|

43,705,000

|

36,455,000

|

2.4%

|

|

|

(1)

|

The number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any shares as to which the Selling Shareholder has sole or shared voting power or investment power and also any shares, which the Selling Shareholder has the right to acquire within 60 days.

|

|

|

(2)

|

Based upon 1,431,523,747 shares of common stock issued and outstanding as of the date of this prospectus.

|

|

|

(3)

|

Based upon 1,502,773,747 shares of common stock issued and outstanding, including the issuance of an aggregate of 71,250,000

to the individuals listed in the table above.

|

|

|

(4)

|

Mr. Driscoll is the Company’s Chief Executive Officer and sole member of the Board of Directors.

|

|

|

(5)

|

Mr. Dashefsky is the Company’s corporate Secretary.

|

PLAN OF DISTRIBUTION

Timing of Sales

Under our 2009 Equity Compensation Plan, as

amended, we are authorized to issue up to 285,000,000

shares of our common stock.

Subject to the foregoing, the Selling Shareholders

may offer and sell the shares covered by this prospectus at various times. The Selling Shareholders will act independently of our

company in making decisions with respect to the timing, manner and size of each sale.

No Known Agreements to Resell the Shares

To our knowledge, no Selling Shareholder has

any agreement or understanding, directly or indirectly, with any person to resell the common shares covered by this prospectus.

Offering Price

The sales price offered by the Selling Shareholders to the public

may be:

|

|

1.

|

the market price prevailing at the time of sale;

|

|

|

2.

|

a price related to such prevailing market price; or

|

|

|

3.

|

such other price as the Selling Shareholders determine from time to time.

|

Manner Of Sale

The common shares may be sold by means of one or more of the following

methods:

|

|

1.

|

a block trade in which the broker-dealer so engaged will attempt to sell the common shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

2.

|

purchases by a broker-dealer as principal and resale by that broker-dealer for its account pursuant to this prospectus;

|

|

|

3.

|

ordinary brokerage transactions in which the broker solicits purchasers;

|

|

|

4.

|

through options, swaps or derivatives;

|

|

|

5.

|

in transactions to cover short sales;

|

|

|

6.

|

privately negotiated transactions; or

|

|

|

7.

|

in a combination of any of the above methods.

|

The Selling Shareholders may sell their common

shares directly to purchasers or may use brokers, dealers, underwriters or agents to sell their common shares. Brokers or dealers

engaged by the Selling Shareholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions,

discounts or concessions from the Selling Shareholders, or, if any such broker-dealer acts as agent for the purchaser of common

shares, from the purchaser in amounts to be negotiated immediately prior to the sale. The compensation received by brokers or dealers

may, but is not expected to, exceed that which is customary for the types of transactions involved. Broker-dealers may agree with

a Selling Shareholder to sell a specified number of common shares at a stipulated price per common share, and, to the extent the

broker-dealer is unable to do so acting as agent for a Selling Shareholder, to purchase as principal any unsold common shares at

the price required to fulfill the broker-dealer commitment to the Selling Shareholder.

Broker-dealers who acquire common shares as

principal may thereafter resell the common shares from time to time in transactions, which may involve block transactions and sales

to and through other broker-dealers, including transactions of the nature described above, in the over-the-counter market or otherwise

at prices and on terms then prevailing at the time of sale, at prices then related to the then-current market price or in negotiated

transactions. In connection with resales of the common shares, broker-dealers may pay to or receive from the purchasers of shares

commissions as described above.

If our Selling Shareholders enter into arrangements

with brokers or dealers, as described above, we are obligated to file a post-effective amendment to this registration statement

disclosing such arrangements, including the names of any broker-dealers acting as underwriters.

The Selling Shareholders and any broker-dealers

or agents that participate with the Selling Shareholders in the sale of the common shares may be deemed to be “underwriters”

within the meaning of the Securities Act. In that event, any commissions received by broker-dealers or agents and any profit on

the resale of the common shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act.

Sales Pursuant to Rule 144

Any common shares covered by this prospectus

which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than pursuant to this prospectus.

Regulation M

The Selling Shareholders must comply with the

requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. In particular, we will advise

the Selling Shareholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of common shares

in the market and to the activities of the Selling Shareholders and their affiliates. Regulation M under the Exchange Act prohibits,

with certain exceptions, participants in a distribution from bidding for, or purchasing for an account in which the participant

has a beneficial interest, any of the securities that are the subject of the distribution.

Accordingly, during such times as a Selling

Shareholder may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter,

the Selling Shareholder must comply with applicable law and, among other things:

|

|

1.

|

may not engage in any stabilization activities in connection with our common stock;

|

|

|

2.

|

may not cover short sales by purchasing shares while the distribution is taking place; and

|

|

|

3.

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act.

|

In addition, we will make copies of this prospectus

available to the Selling Shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act.

Penny Stock Rules

The SEC has adopted regulations which generally

define “penny stock” to be any equity security that has a market price (as defined) of less than $5.00 per share or

an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules,

which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and

“institutional accredited investors.” The term “institutional accredited investor” refers generally to

those accredited investors who are not natural persons and fall into one of the categories of accredited investor specified in

subparagraphs (1), (2), (3), (7) or (8) of Rule 501 of Regulation D promulgated under the Securities Act, including institutions

with assets in excess of $5,000,000.

The penny stock rules require a broker-dealer,

prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document

in a form required by the Securities and Exchange Commission, obtain from the customer a signed and dated acknowledgement of receipt

of the disclosure document and to wait two business days before effecting the transaction. The risk disclosure document provides

information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide

the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson

in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account.

The bid and offer quotations, and the broker-dealer

and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction

and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require

that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written

determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to

the transaction.

These disclosure requirements may have the

effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules.

Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny

stock rules discourage investor interest in and limit the marketability of our common stock.

State Securities Laws

Under the securities laws of some states, the

common shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the

common shares may not be sold unless the shares have been registered or qualified for sale in the state or an exemption from registration

or qualification is available and is complied with.

Expenses of Registration

We are bearing all costs relating to the registration

of the common stock. These expenses are estimated to be $5,000, including, but not limited to, legal, accounting, printing and

mailing fees. The Selling Shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection

with any sale of the common stock.

LEGAL MATTERS

The validity of the common stock has been passed

upon by the Law Offices of Michael L. Corrigan, San Diego, California. On February 20, 2013, we received a correspondence from

a shareholder of the Company complaining about a decline in our price per share, and threatening to file a complaint. We responded

to his correspondence denying his inferences, and we have not heard further from the shareholder and, to our knowledge, the shareholder

has not filed any complaint.

On April 30, 2008 we filed a complaint against

two former members of our Board of Directors alleging breach of fiduciary duty, waste of corporate assets and unjust enrichment.

The complaint, styled

VOIS Inc., Plaintiff, vs. Edward Spindel and Michael Spindel, Defendants, Case No. CA012201XXXXMB, in

the Circuit Court for the 15th Judicial District in and for Palm Beach County, Florida,

alleges that during 2002 and 2003 while

the company, which at that time known as Medstrong International, was under significant financial distress the defendants caused

the company to issue demand promissory notes charging excessive and/or usurious interest rates with the knowledge that the company

would be unable to repay the notes upon any demand. The defendants, who are brothers, were members of the Medstrong International

Board of Directors until their resignations in April 2006.

The complaint further alleges that the defendants

engaged in a repeated systematic scheme to defraud our company by continuing to restructure the promissory notes while they were

members of the prior Board of Directors at such excessive and usurious interest rates that the defendants violated their fiduciary

duties and responsibilities and approved debt obligations that benefited them and not the company and that their wrongful actions

and omissions resulted in their unjust enrichment. We sought damages in excess of $968,000.

On June 18, 2009, the defendants removed the

lawsuit from Palm Beach Circuit Court (State) to the United States District Court for the Southern District of Florida (Federal).

Thereafter, the defendants sought to have the case transferred to the United States District Court in New York. On October 27,

2009, the judge denied the defendant’s Motion to Transfer. On October 28, 2009 the defendants filed their Answer and Defenses

to the Complaint. The defendants did not file a counterclaim at that time. On November 12, 2009, the Court entered a Scheduling

Order and a Notice of Trial for December 2009. On December 4, 2009, the Court selected a mediator. In February 2010, the defendants

changed law firms and sought leave from the Court to file a counterclaim. At that time, the defendants also served discovery in

the form of interrogatories, request for production and request for admission. The defendant’s counterclaim was filed on

February 17, 2010 and we filed our Answer on March 13, 2010. Over the course of the next several months we responded to the discovery

requests.

On November 13, 2009, the parties attended

a pretrial hearing to address legal issues related to our complaint and the defendants’ counterclaim. Based upon questions

posed by the Court and the argument of counsel, the Court struck the defense of usury and additionally dismissed our complaint

without prejudice, providing us 10 days to file an amended complaint. The defendants were also provided 10 days to file an Amended

counterclaim. Based upon the rulings, the matter was then removed from the Court’s December 2009 trial docket. We have decided

that it is not cost effective or beneficial to pursue our affirmative claims in this matter and have, accordingly, elected not

to file an amended complaint.

On July 19, 2010, the counter–plaintiffs,

Edward and Michael Spindel filed a motion for summary judgment. Vois Inc. filed a response in opposition on August 5, 2010. The

Spindels filed a reply on September 9, 2010. The court held a hearing on September 16, 2010 and at the hearing granted summary

judgment in favor of the Spindels. Final judgment was ordered on November 16, 2010 in the amount of $287,266 plus post judgment

interest. Attorney’s fees of $172,304 were also awarded.

On December 6, 2010 we filed an appeal to the judgment.

On July 13, 2011 the United States Court of

Appeals for the Eleventh Circuit issued an opinion in favor of the Company. This Opinion was made final when the Court issued the

mandate on August 15, 2011.This ruling effectively reversed the Summary Judgment previously granted to the Spindels by the District

Court on November 4, 2010 in the amount of $287,266.

In connection with these proceedings, on August

7, 2013, the counter-plaintiff, Edward Spindel filed a Motion for Writ of Garnishment with the district court with Bank of America,

N.A. as the Garnishee. Bank of America, N.A. filed an answer to the Motion for Write of Garnishment on August 9, 2013 and on August

12, 2013 the U.S. District Court, Southern District of Florida, West Palm Beach Division issued a Notice of Garnishment which states

that the counter-defendant, the Company, has 20 days to move to dissolve the Writ of Garnishment.

The outstanding notes due to the defendants

in the aggregate amount of $145,000, which are unsecured and were issued at the time they were members of our Board of Directors,

remain past due. The defendants elected not to participate with the holders of other promissory notes, including our then executive

officers, in the exchange of those notes for equity which occurred during January 2009. At December 31, 2012 our liabilities as

reported in our financial statements incorporated by reference to this report reflect the principal amount of the notes together

with $214,766 in accrued interest and penalties.

We were a defendant in two actions, each entitled

951 Yamato Acquisition Company, LLC versus VOIS Inc.

both as filed in December 2009 the Circuit Court of the 15th Judicial

Circuit in and for Palm Beach County, Florida under case numbers 502010CA040121XXXXMB and 502010CC19027XXXXBBRS, which are related

to the lease agreements for our former office space. A combined summary judgment was entered in April, 2010 against the Company

in the amount of $106,231. At December 31, 2012 our liabilities as reported in our financial statements incorporated by reference

to this report reflect the principal amount of the judgment together with $15,936 in accrued interest.

EXPERTS

The financial statements incorporated by reference

in the prospectus have been audited by each of Patrick Rodgers, an independent certified public accountant, and Michael F. Cronin,

an independent certified public accountant, to the extent and for the periods set forth in their respective reports included in

our 10-K for the year ended December 31, 2012, and are incorporated in reliance upon such report given upon the authority of said

individual as an expert in auditing and accounting. The financial statements incorporated by reference in the prospectus have been

audited by Sherb & Co., LLP, an independent registered public accounting firm, to the extent and for the periods set forth

in their report included in our 10-K for the year ended September 30, 2011, and are incorporated in reliance upon such report given

upon the authority of said firm as experts in auditing and accounting.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared

or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon

other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis or

had, or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in the registrant or any

of its parents or subsidiaries.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

Our directors and officers are indemnified

pursuant to our bylaws against amounts actually and necessarily incurred by them in connection with the defense of any action,

suit or proceeding in which they are a party by reason of being or having been directors or officers of the Company. Our certificate

of incorporation provides that none of our directors or officers shall be personally liable for damages for breach of any fiduciary

duty as a director or officer involving any act or omission of any such director or officer. Insofar as indemnification for liabilities

arising under the Securities Act of 1933, as amended, may be permitted to such directors, officers and controlling persons pursuant

to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such

indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification

against such liabilities, other than the payment by us of expenses incurred or paid by such director, officer or controlling person

in the successful defense of any action, suit or proceeding, is asserted by such director, officer or controlling person in connection

with the securities being registered, we will, unless in the opinion of counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act and will be governed by the final adjudication of such issue.

ADDITIONAL INFORMATION AVAILABLE TO YOU

This prospectus is part of a Registration Statement

on Form S-8 that we filed with the SEC. Certain information in the Registration Statement has been omitted from this prospectus

in accordance with the rules of the SEC. We file annual, quarterly and special reports, proxy statements and other information

with the SEC. You can inspect and copy the Registration Statement as well as reports, proxy statements and other information we

have filed with the SEC at the public reference room maintained by the SEC at 100 F Street N.E. Washington, D.C. 20549, You can

obtain copies from the public reference room of the SEC at 100 F Street N.E. Washington, D.C. 20549, upon payment of certain fees.

You can call the SEC at 1-800-732-0330 for further information about the public reference room. We are also required to file electronic

versions of these documents with the SEC, which may be accessed through the SEC’s World Wide Web site at http://www.sec.gov.

No dealer, salesperson or other person is authorized to give any information or to make any representations other than those contained

in this prospectus, and, if given or made, such information or representations must not be relied upon as having been authorized

by us. This prospectus does not constitute an offer to buy any security other than the securities offered by this prospectus, or

an offer to sell or a solicitation of an offer to buy any securities by any person in any jurisdiction where such offer or solicitation

is not authorized or is unlawful. Neither delivery of this prospectus nor any sale hereunder shall, under any circumstances, create

any implication that there has been no change in the affairs of our company since the date hereof.

PART II: INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The contents of the Registration

Statement on Form S-8 previously filed with the Securities and Exchange Commission (the “Commission”) on June 11, 2009

(File No. 333-159895) by VOIS Inc., a Florida corporation (the “Corporation” or “Registrant”), the Registration

Statement on Form S-8 previously filed with the Commission on December 3, 2012 (File No. 333-185249) and the Registration Statement

on Form S-8 previously filed with the Commission on March 13, 2013 (File No. 333-187223), are incorporated herein by reference.

In addition, the documents listed below and filed with the Commission are incorporated herein by reference.

|

•

|

The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, filed with the SEC on April 10, 2013, as amended by the Form 10-K/A filed with the SEC on April 18, 2013; the Registrant’s Annual Report on Form 10-K for the fiscal year ended September 30, 2012, filed with the SEC on January 15, 2013, as amended by the Form 10-K/A filed with the SEC on January 16, 2013, January 24, 2013 and January 28, 2013; the Registrant’s Annual Report on Form 10-K for the fiscal year ended September 30, 2011, filed with the SEC on December 6, 2011; and the Registrant’s Annual Report on Form 10-K for the fiscal year ended September 30, 2010, filed with the SEC on December 23, 2010.

|

|

•

|

The Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2013, filed with the SEC on August 7, 2013; the Registrant’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2013, filed with the SEC on May 15, 2013; the Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, filed with the SEC on August 9, 2012, the Registrant’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2012, filed with the SEC on May 22, 2012, and the Registrant’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2011, filed with the SEC on January 26, 2012.

|

|

•

|

The Registrant’s Form 8-K filed with the SEC on August 30, 2013.

|

|

•

|

The Registrant’s Form 8-K filed with the SEC on May 22, 2013.

|

|

•

|

The Registrant’s Form 8-K filed with the SEC on May 7, 2013.

|

|

•

|

The Registrant’s Form 8-K filed with the SEC on January 30, 2013.

|

|

•

|

The Registrant’s Form 8-K filed with the SEC on January 15, 2013.

|

|

•

|

The Registrant’s Form 8-K filed with the SEC on December 20, 2012.

|

|

•

|

The Registrant’s Form 8-K filed with the SEC on October 23, 2012.

|

All documents subsequently

filed by the registrant pursuant to Section 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended, prior

to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all

securities then remaining unsold, shall be deemed to be incorporated by reference in the registration statement and to be part

thereof from the date of filing of such documents. In no event, however, will any information that the Registrant discloses under

Item 2.02 or Item 7.01 of any Current Report on Form 8-K that the Registrant may from time to time furnish to the Commission be

incorporated by reference into, or otherwise become a part of, this Registration Statement. Any statement contained in any document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this

Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is

or is deemed to be incorporated by this reference herein modifies or supersedes such statement. Any such statement so modified

or superseded shall not be deemed to constitute a part of this Registration Statement, except as so modified or superseded.

You may access each of

these documents on the SEC’s website at www.sec.gov, or you may request a copy of these filings, at no cost, by writing or

calling us at the following address and telephone number:

Corporate Secretary

VOIS Inc.

3525 Del Mar Heights Rd. #802

San Diego, CA 92130

|

Item 4.

|

Description of Securities.

|

Not applicable.

|

Item 5.

|

Interests of Named Experts and Counsel.

|