Oncology arm of Pipeline Program expanded to

include three different approaches for antibody-based cancer

therapy

Compugen Ltd. (NASDAQ: CGEN) today reported financial results

for the second quarter ending June 30, 2014.

Dr. Anat Cohen-Dayag, Compugen’s President and CEO, stated,

"During the first six months of this year, our R&D efforts

focused primarily on advancing product candidates in our Pipeline

Program, diversifying the pipeline with additional target

candidates for antibody-based therapy, and extending our

capabilities to enable the validation and development of multiple

product candidates in parallel. Product candidates added to the

Pipeline Program since late last year include two additional

B7/CD28-like checkpoint candidates that increased the total number

of such discoveries by Compugen to eleven, five target candidates

for antibody-drug conjugate cancer therapy, and four

immune-modulatory targets candidates distinct from the B7/CD28

family of proteins.”

Dr. Cohen-Dayag continued, “Following these latest additions,

the oncology arm of our Pipeline Program now includes early stage

target candidates representing three different approaches for

antibody-based cancer treatment, all based on Compugen-discovered

targets. We believe that this achievement, which is unique in our

industry, provides an excellent example of the value of Compugen’s

long-term investment in establishing its broadly applicable

predictive discovery infrastructure.”

Dr. Cohen-Dayag concluded, "We are already beginning to see an

acceleration of positive experimental results with respect to our

Pipeline Program candidates. This, combined with the resulting

increase in both industry recognition of our discovery capabilities

and interest in our pipeline candidates, provides us with even

greater confidence of achieving our short-term objectives and

longer-term goals.”

Revenues for the second quarter of 2014 and six months ending

June 30, 2014 were $2.0 million and $4.1 million respectively,

compared with $22,000 and $184,000 for the comparable periods in

2013. These substantial increases from the prior year periods

resulted primarily from a milestone payment and the recognizable

portions of a non-refundable upfront payment in accordance with US

GAAP revenue recognition accounting, in each case pursuant to the

August 2013 collaboration and license agreement with Bayer Pharma

AG.

Cost of revenues for the second quarter of 2014 and the six

months ending June 30, 2014 were $0.9 million and $1.6 million

respectively, compared with $84,000 and $234,000 for the comparable

periods in 2013. These increases are largely the result of

increased research and development expenses attributed to our

current collaborations.

Research and development expenses, net, for the second quarter

of 2014 and the six months ending June 30, 2014 were $3.1 million

and $6.3 million respectively, compared with $3.4 million and $6.2

million for the comparable periods in 2013. Research and

development expenses do not include expenses incurred in support of

current collaborations which, as noted above, are accounted for as

cost of revenues.

Compugen’s net loss for the second quarter of 2014 was $2.3

million (after reflecting non-cash stock-based compensation of $0.7

million), or $0.05 per basic share, compared with a net loss of

$3.0 million (after reflecting non-cash stock-based compensation of

$0.7 million), or $0.08 per basic share, for the comparable period

in 2013. Compugen’s net loss for the first six months of 2014 was

$4.2 million (after reflecting non-cash stock-based compensation of

$1.6 million), or $0.09 per basic share, compared with a net loss

of $6.4 million (after reflecting non-cash stock-based compensation

of $1.4 million), or $0.17 per basic share, for the comparable

period in 2013. The reductions in net loss for the second quarter

and the first six months of 2014, compared with the comparable

periods in 2013, were attributable to increases in revenues

recognized for the quarter and the first six months, compared with

the comparable periods in 2013, partially off-set by increased

corporate expenses for such periods, primarily relating to research

and development.

As of June 30, 2014 and December 31, 2013, the liability related

to the "Research and development funding arrangements" amounted to

$13.1 million and $13.2 million respectively, in each case solely

relating to the accounting for the Baize research and development

funding arrangements signed in December 2011 and December 2010, as

amended. These noncash liability balances, which increase or

decrease based on changes in the market value of Compugen ordinary

shares, are primarily related to the estimated fair values of the

embedded derivative instruments resulting from the right of the

investor, under the amended agreement, to waive its right to

receive potential future payments in exchange for Compugen ordinary

shares.

As of June 30, 2014, cash, cash equivalents and short-term bank

deposits totaled $113.3 million compared with $46.8 million at

December 31, 2013. This increase of $66.5 million compared with

December 31, 2013 resulted primarily from net proceeds of $67.0

million from the Company's underwritten public offering of ordinary

shares completed in March 2014. With respect to calendar year 2014,

Compugen has budgeted total cash expenditures (without taking into

consideration actual to date or potential additional cash receipts)

of approximately $24 million.

Conference Call and Webcast InformationCompugen will hold

a conference call to discuss its second quarter 2014 results today,

August 6, 2014 at 10:00 a.m. EDT. To access the conference call,

please dial 1-888-281-1167 from the US or +972-3-918-0610

internationally. The call will also be available via live webcast

located at the following link. A replay of the conference call

will be available approximately two hours after the completion of

the live conference call. To access the replay, please dial

1-877-456-0009 from the US or +972-3-925-5925 internationally. The

replay will be available through August 8, 2014.

About CompugenCompugen is a leading drug discovery

company focused on therapeutic proteins and monoclonal antibodies

to address important unmet needs in the fields of immunology and

oncology. The Company utilizes a broad and continuously

growing integrated infrastructure of proprietary scientific

understandings and predictive platforms, algorithms, machine

learning systems and other computational biology capabilities for

the in silico (by computer) prediction and selection of

product candidates, which are then advanced in its Pipeline

Program. The Company's business model includes collaborations

covering the further development and commercialization of product

candidates at various stages from its Pipeline Program and various

forms of research and discovery agreements, in both cases providing

Compugen with potential milestone payments and royalties on product

sales or other forms of revenue sharing. Compugen’s wholly-owned

U.S. subsidiary located in South San Francisco is developing

monoclonal antibody therapeutic candidates against its novel drug

targets. For additional information, please visit Compugen's

corporate website at www.cgen.com.

Forward-Looking Statement DisclaimerThis press release

contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements related to the Company’ short and long-term objectives,

anticipated total cash uses for 2014 and product candidates added

to the Company’s Pipeline Program, including, without limitation,

B7/CD28 checkpoint proteins, targets for antibody-drug conjugate

cancer therapy and other immune-modulatory targets. Forward-looking

statements can be identified by the use of terminology such as

“may,” “expectations,” “approximately,” “further” and “potential”

and describe opinions about future events. These forward-looking

statements involve known and unknown risks and uncertainties that

may cause the actual results, performance or achievements of

Compugen to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Some of these risks and other factors

are discussed in the "Risk Factors" section of Compugen’s Annual

Report on Form 20-F for the year ended December 31, 2013 as filed

with the Securities and Exchange Commission, as well as other

documents that may be subsequently filed by Compugen from time to

time with the Securities and Exchange Commission. In addition, any

forward-looking statements represent Compugen’s views only as of

the date of this release and should not be relied upon as

representing its views as of any subsequent date. Compugen does not

assume any obligation to update any forward-looking statements

unless required by law.

COMPUGEN LTD. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(U.S. dollars in thousands, except for

share and per-share amounts)

Three Months EndedJune

30,

Six Months EndedJune

30,

2014Unaudited

2013Unaudited

2014Unaudited

2013Unaudited

Revenues 1,964 22 4,097 184 Cost of revenues

859 84 1,616

234

Gross profit (loss) 1,105

(62) 2,481

(50) Operating expenses Research

and development expenses, net 3,074 3,437 6,316 6,176 Marketing and

business development expenses 109 157 282 352 General and

administrative expenses

1,240 1,063

2,512 2,105 Total operating

expenses 4,423 4,657

9,110 8,633

Operating loss (3,318) (4,719) (6,629)

(8,683) Financing income, net

1,059

1,680 2,472 2,270 Net

loss before taxes (2,259) (3,039) (4,157)

(6,413) Taxes on income

(60) -

(60) - Net loss

(2,319) (3,039)

(4,217) (6,413)

Basic net loss per ordinary share (0.05) (0.08) (0.09)

(0.17) Weighted average number of ordinary shares used in computing

basic net loss per share 48,462,334 38,204,202 45,970,766

37,746,520 Diluted net loss per ordinary share (0.07) (0.09) (0.09)

(0.18) Weighted average number of ordinary shares used in computing

diluted net loss per share 49,796,012 40,221,504 45,970,766

39,140,651

COMPUGEN LTD. CONDENSED

CONSOLIDATED BALANCE SHEETS DATA

(U.S. dollars, in thousands)

June 30,2014(unaudited)

December 31,2013(audited)

ASSETS Current assets Cash, cash equivalents and

short-term bank deposits 113,259 46,766 Investment in Evogene 1,858

4,565 Trade receivable 1,140 - Other accounts receivable and

prepaid expenses

912 1,885 Total

current assets 117,169 53,216

Non-current investments Severance pay fund

2,256 2,129 Total non-current

investments 2,256 2,129

Non-current prepaid expenses 107

158 Property and equipment, net

2,009 1,208 Total assets

121,541 56,711 LIABILITIES AND

SHAREHOLDERS’ EQUITY Current liabilities Other accounts

payable, accrued expenses and trade payables 3,692 2,421 Deferred

revenues

3,121 5,318 Total current

liabilities 6,813 7,739

Non-current liabilities Research and development funding

arrangement 13,074 13,189 Deferred revenues 948 1,454 Accrued

severance pay

2,577 2,441 Total

non-current liabilities 16,599 17,084

Total shareholders’ equity 98,129

31,888 Total liabilities and shareholders’

equity 121,541 56,711

Compugen Ltd.Tsipi Haitovsky, Global Media

Liaison+972-52-598-9892tsipih@cgen.com

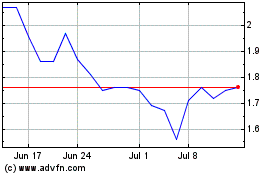

Compugen (NASDAQ:CGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

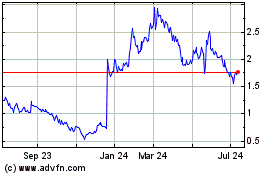

Compugen (NASDAQ:CGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024