SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of the report (Date of earliest event reported): August 1, 2014

CHURCH & DWIGHT CO., INC.

(Exact Name of Registrant as Specified in its Charter)

| |

|

|

|

|

|

Delaware

|

|

1-10585

|

|

13-4996950

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

|

500 Charles Ewing Boulevard, Ewing, New Jersey

|

|

08628

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (609) 806-1200

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240. 14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

ITEM 2.02. Results of Operations and Financial Condition.

On August 1, 2014, Church & Dwight Co., Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2014 and providing additional information. This press release is furnished herewith as Exhibit 99.1 pursuant to this Item 2.02.

ITEM 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| |

|

|

|

|

|

|

| |

|

|

99.1

|

|

Church & Dwight Co., Inc. press release, dated August 1, 2014

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

CHURCH & DWIGHT CO., INC.

|

| |

|

|

|

|

|

Date:

|

|

|

|

|

|

By:

|

|

|

| |

|

|

|

|

|

Name:

|

|

Matthew T. Farrell

|

| |

|

|

|

|

|

Title:

|

|

Executive Vice President Finance and Chief Financial Officer

|

Church & Dwight Co., Inc.

News Release

Contact:

Rick Dierker

VP, Corporate Finance

609-806-1900

CHURCH & DWIGHT REPORTS SECOND QUARTER 2014 RESULTS

REAFFIRMS 2014 OUTLOOK OF 7 - 9% EPS GROWTH

2014 Second Quarter Results

· Organic sales growth of 3.0%

· Higher marketing spending at 14%

· EPS $0.65 exceeded management outlook

· $175MM accelerated share repurchase

|

· Organic sales growth of approximately 3%

· Continuing to invest to drive new product launches

· EPS growth of 7 - 9%

· Record cash from operations, in excess of $525MM

|

EWING, NJ, AUGUST 1, 2014 – Church & Dwight Co., Inc. (NYSE:CHD) today announced second quarter 2014 reported earnings per share of $0.65 per share, exceeding management’s outlook ($0.61).

Second quarter 2014 reported net sales increased $20.7 million to $808.3 million. Organic sales growth for second quarter 2014 was 3.0%. These results were driven by volume growth of 3.6%, partially offset by 0.6% negative price/mix.

James R. Craigie, Chairman and Chief Executive Officer, commented, “We are pleased with the sales and earnings growth despite continued weak U.S. consumer demand and fierce competition. As promised, we launched innovative new products in every one of our major categories and in three new categories in the first part of the year. The results to date are very promising, as three of our four megabrands hit record shares in the second quarter.”

Second Quarter Review

Consumer Domestic net sales were $598.9 million, a $4.4 million or 0.7% increase over the prior year second quarter sales. Second quarter organic sales also increased by 0.7%, primarily due to sales of our recently introduced ARM & HAMMER CLUMP & SEAL cat litter, and OXICLEAN liquid laundry detergent, and higher sales of ARM & HAMMER liquid laundry detergent and VITAFUSION vitamins, partially offset by lower sales of XTRA laundry detergent and ARM & HAMMER unit dose laundry detergent. Volume growth contributed approximately 1.5% to organic sales, partially offset by 0.8% unfavorable product mix and pricing.

Consumer International net sales were $136.6 million, a $3.9 million or 2.9% increase compared to the prior year second quarter sales. Organic sales increased 3.9%, which primarily reflects increased sales in the UK and France. Volume increased 4.7%, partially offset by 0.8% unfavorable product mix and pricing.

Specialty Products net sales were $72.8 million, a $12.4 million or 20.5% increase from the prior year second quarter sales. Second quarter organic sales increased by 22.9%. The animal nutrition business drove a 20.9% volume increase, and favorable mix and pricing contributed 2.0%. The animal nutrition business’s strong performance is primarily related to the health of the U.S. dairy industry, which is experiencing record high milk prices.

Gross margin contracted 50 basis points to 44.1% in the second quarter compared to 44.6% in the prior year second quarter. The gross margin contraction was driven primarily by increased coupon redemption, trade spending, and higher commodity costs, partially offset by our productivity programs.

Marketing expense was $113.4 million in the second quarter, representing an increase of $9.7 million or 9.4% in comparison with the prior year second quarter. Marketing expense as a percentage of net sales was 14.0% in the second quarter, an increase of 80 basis points from the prior year second quarter.

Selling, general, and administrative expense (SG&A) was $104.8 million in the second quarter, a $2.0 million decrease from the prior year second quarter. In line with the Company’s strong focus on cost management, SG&A as a percentage of net sales was 13.0%, a 60 basis point decrease from the prior year second quarter.

Income from Operations was $138.2 million in the second quarter, a decrease of $2.3 million or 1.6% from the prior year second quarter. Operating income as a percentage of net sales was 17.1%, a 70 basis point decrease from the prior year second quarter, which was largely due to the marketing and trade investments behind new products.

The effective tax rate in the second quarter was 34.2%, compared to 34.5% in the second quarter of 2013. The Company expects the full year effective tax rate to be approximately 34%.

Operating Cash Flow

For the first six months of 2014, net cash from operating activities was $206.8 million, a $45.8 million increase from the prior year, reflecting improvement in working capital and the deferral of a $36 million payment relating to December 2012 estimated federal tax paid in the first quarter of 2013 as a result of Hurricane Sandy relief. Capital expenditures for the first six months were $17.1 million, a $3.0 million decrease from the prior year six months. The Company’s full year outlook is now $70 million for capital expenditures.

At June 30 2014, cash on hand was $197 million, while total debt was $803 million. The Company executed an accelerated share repurchase program totaling $175 million in the quarter. The Company does not anticipate making additional share purchases in 2014.

New Products

Mr. Craigie stated, “2014 is an exciting year for Church & Dwight as we have launched innovative new products on all of our major brands. In our core laundry additive category, OXICLEAN achieved a record 45.5% share in the second quarter of 2014, which is larger than the next four brands combined. In addition, we have extended the OXICLEAN brand into three additional categories: premium laundry detergent, dishwashing detergent and the bleach section. These new products helped to drive a 35% increase in consumption for the total OXICLEAN brand in the second quarter over the same period last year.

“We have also launched innovative new products across our other core businesses, including a new premium ARM & HAMMER CLUMP & SEAL cat litter, a new premium ARM & HAMMER TRULY RADIANT toothpaste, a new FIRST RESPONSE diagnostic kit business with “six days sooner” industry-leading technology, a new vitamin-plus line for our VITAFUSION brand, and new condoms, vibrators and lubricants under the TROJAN brand.

“We are pleased with the initial consumer acceptance of our innovative new products and the positive impact that they are having on both category growth and our share growth. For example, our new ARM & HAMMER CLUMP & SEAL cat litter has been a major success with consumers showing a double digit increase in sales and consumption that drove the total brand’s share up 2.5pts. to 19.3% in the second quarter to become the number two brand in the category. Most importantly, the new innovation drove category sales up over 7%, the strongest growth of any of our categories. This exemplifies our belief that innovation is the key antidote in reviving consumer demand in this challenging economy.”

Outlook for 2014

With regard to the outlook for the full year, Mr. Craigie said, “Despite continued weak U.S. consumer demand and fierce competition, we believe that we are positioned to deliver strong sales and earnings growth with our balanced portfolio of value and premium products, the launch of innovative new products across every one of our major categories and three new categories, aggressive productivity programs and tight management of overhead costs.

Mr. Craigie continued, “We are also pleased with the continued growth of our most recent acquisition, the gummy vitamin business. We achieved double digit consumption growth in the quarter and our sales growth outlook for the full year is approximately 10%, driven by significant distribution gains and adults switching from hard pills to our delicious tasting gummy vitamins.”

With regard to the Company’s 2014 outlook, Mr. Craigie said, “We are reaffirming our 2014 EPS range of 7 to 9% growth, despite unprecedented price competition in the laundry category. We continue to expect organic sales growth to be approximately 3%. Gross margin is expected to be approximately 75 bps lower than last year (the high-end of our previous 50 to 75 bps outlook) due to higher trade promotions to address the price competition and to support the launch of our new products. We continue to expect operating margin expansion from rigorous control of SG&A. We expect the second half of the year to drive the majority of our earnings growth, as the first half included a significant increase in slotting, couponing, trade promotions, and incremental marketing support for our new product launches. Specifically, we expect the fourth quarter will be a significant contributor to full year earnings growth behind SG&A leverage and strong organic growth. This earnings outlook does not include the benefit from any potential acquisitions, which we continue to aggressively pursue.”

Mr. Craigie concluded, “With regard to the third quarter, we expect organic sales growth of approximately 3% behind a strengthening consumer business. Gross margin is expected to contract by approximately 150 bps behind higher trade spending, coupon redemptions on our new products and more competitive pricing in the laundry category, as well as negative business mix. The Company expects earnings per share of approximately $0.80 – $0.82.”

Church & Dwight Co., Inc. will host a conference call to discuss second quarter 2014 results on August 1, 2014 at 10:00 a.m. (ET). To participate, dial in at 877-322-9846, access code: 68115477 (International: 631-291-4539, same access code: 68115477). A replay will be available two hours after the call at 855-859-2056 or 404-537-3406 (same access code: 68115477). You also can participate via webcast by visiting the Investor Relations section of the Company’s website at www.churchdwight.com.

Church & Dwight Co., Inc. manufactures and markets a wide range of personal care, household and specialty products under the ARM & HAMMER brand name and other well-known trademarks.

This release contains forward-looking statements relating to, among other things, the effect of product mix; the impact of acquisitions; earnings per share; reported net sales growth and organic sales growth; volume growth, including the effects of new products; gross margin; operating margin; marketing spending; commodity price increases; consumer spending; cost savings programs; marketing support; effective tax rate; share repurchases; net cash from operating activities; capital expenditures; competition; and customer response to new products. These statements represent the intentions, plans, expectations and beliefs of the Company, and are subject to risks, uncertainties and other factors, many of which are outside the Company’s control and could cause actual results to differ materially from such forward-looking statements. The uncertainties include assumptions as to market growth and consumer demand (including the effect of political and economic events on consumer demand), retailer actions in response to changes in consumer demand and the economy, raw material and energy prices, the financial condition of major customers and suppliers, interest rate and foreign currency exchange rate fluctuations, and changes in marketing and promotional spending. With regard to the new product introductions referred to in this release, there is particular uncertainty relating to trade, competitive and consumer reactions and retailer distribution. Other factors that could materially affect actual results include the outcome of contingencies, including litigation, pending regulatory proceedings, environmental matters and the acquisition or divestiture of assets. For a description of additional factors that could cause actual results to differ materially from the forward looking statements, please see the Company’s quarterly and annual reports filed with the SEC, including information in the Company’s annual report on Form 10-K in Item 1A, “Risk Factors”.

CHURCH & DWIGHT CO., INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Income (Unaudited)

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

(In millions, except per share data)

|

|

June 30, 2014

|

|

|

June 30, 2013

|

|

|

June 30, 2014

|

|

|

June 30, 2013

|

|

|

Net Sales

|

|

$ |

808.3 |

|

|

$ |

787.6 |

|

|

$ |

1,590.3 |

|

|

$ |

1,566.9 |

|

|

Cost of sales

|

|

|

451.9 |

|

|

|

436.6 |

|

|

|

894.5 |

|

|

|

865.8 |

|

|

Gross profit

|

|

|

356.4 |

|

|

|

351.0 |

|

|

|

695.8 |

|

|

|

701.1 |

|

|

Marketing expenses

|

|

|

113.4 |

|

|

|

103.7 |

|

|

|

201.2 |

|

|

|

182.6 |

|

|

Selling, general and administrative expenses

|

|

|

104.8 |

|

|

|

106.8 |

|

|

|

194.4 |

|

|

|

208.7 |

|

|

Income from Operations

|

|

|

138.2 |

|

|

|

140.5 |

|

|

|

300.2 |

|

|

|

309.8 |

|

|

Equity in earnings of affiliates

|

|

|

2.9 |

|

|

|

(1.1 |

) |

|

|

4.5 |

|

|

|

(0.5 |

) |

|

Other income (expense), net

|

|

|

(6.1 |

) |

|

|

(7.2 |

) |

|

|

(13.0 |

) |

|

|

(13.9 |

) |

|

Income before income taxes

|

|

|

135.0 |

|

|

|

132.2 |

|

|

|

291.7 |

|

|

|

295.4 |

|

|

Income taxes

|

|

|

46.2 |

|

|

|

45.6 |

|

|

|

100.3 |

|

|

|

101.1 |

|

|

Net Income

|

|

$ |

88.8 |

|

|

$ |

86.6 |

|

|

$ |

191.4 |

|

|

$ |

194.3 |

|

|

Net Income per share - Basic

|

|

$ |

0.66 |

|

|

$ |

0.62 |

|

|

$ |

1.40 |

|

|

$ |

1.40 |

|

|

Net Income per share - Diluted

|

|

$ |

0.65 |

|

|

$ |

0.61 |

|

|

$ |

1.38 |

|

|

$ |

1.38 |

|

|

Dividends per share

|

|

$ |

0.31 |

|

|

$ |

0.28 |

|

|

$ |

0.62 |

|

|

$ |

0.56 |

|

|

Weighted average shares outstanding - Basic

|

|

|

134.8 |

|

|

|

138.5 |

|

|

|

136.4 |

|

|

|

138.4 |

|

|

Weighted average shares outstanding - Diluted

|

|

|

137.3 |

|

|

|

141.1 |

|

|

|

138.9 |

|

|

|

141.0 |

|

CHURCH & DWIGHT CO., INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (Unaudited)

|

(Dollars in millions)

|

|

June 30, 2014

|

|

|

Dec. 31, 2013

|

|

|

Assets

|

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

|

$ |

196.9 |

|

|

$ |

496.9 |

|

|

Accounts Receivable

|

|

|

342.8 |

|

|

|

330.2 |

|

|

Inventories

|

|

|

271.0 |

|

|

|

250.5 |

|

|

Other Current Assets

|

|

|

53.7 |

|

|

|

38.2 |

|

|

Total Current Assets

|

|

|

864.4 |

|

|

|

1,115.8 |

|

|

Property, Plant and Equipment (Net)

|

|

|

585.7 |

|

|

|

594.1 |

|

|

Equity Investment in Affiliates

|

|

|

25.1 |

|

|

|

24.5 |

|

|

Tradenames and Other Intangibles

|

|

|

1,184.4 |

|

|

|

1,204.3 |

|

|

Goodwill

|

|

|

1,222.2 |

|

|

|

1,222.2 |

|

|

Other Long-Term Assets

|

|

|

106.3 |

|

|

|

98.8 |

|

|

Total Assets

|

|

$ |

3,988.1 |

|

|

$ |

4,259.7 |

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Short-Term Debt

|

|

$ |

153.1 |

|

|

$ |

153.8 |

|

|

Other Current Liabilities

|

|

|

492.3 |

|

|

|

497.4 |

|

|

Total Current Liabilities

|

|

|

645.4 |

|

|

|

651.2 |

|

|

Long-Term Debt

|

|

|

649.6 |

|

|

|

649.5 |

|

|

Other Long-Term Liabilities

|

|

|

673.2 |

|

|

|

659.0 |

|

|

Stockholders’ Equity

|

|

|

2,019.9 |

|

|

|

2,300.0 |

|

|

Total Liabilities and Stockholders’ Equity

|

|

$ |

3,988.1 |

|

|

$ |

4,259.7 |

|

CHURCH & DWIGHT CO., INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flow (Unaudited)

| |

|

Six Months Ended

|

|

|

(Dollars in millions)

|

|

June 30, 2014

|

|

|

June 30, 2013

|

|

| |

|

|

|

|

|

|

|

Net Income

|

|

$ |

191.4 |

|

|

$ |

194.3 |

|

| |

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

45.7 |

|

|

|

46.3 |

|

|

Deferred income taxes

|

|

|

8.9 |

|

|

|

5.6 |

|

|

Non cash compensation

|

|

|

12.8 |

|

|

|

12.3 |

|

|

Asset impairment charge and other asset write-offs

|

|

|

5.5 |

|

|

|

0.5 |

|

|

Other

|

|

|

(0.4 |

) |

|

|

5.8 |

|

| |

|

|

|

|

|

|

|

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(10.2 |

) |

|

|

(30.7 |

) |

|

Inventories

|

|

|

(18.8 |

) |

|

|

(13.6 |

) |

|

Other current assets

|

|

|

(13.8 |

) |

|

|

(19.2 |

) |

|

Accounts payable and accrued expenses

|

|

|

(11.1 |

) |

|

|

(4.7 |

) |

|

Income taxes payable

|

|

|

14.4 |

|

|

|

(27.6 |

) |

|

Excess tax benefit on stock options exercised

|

|

|

(12.4 |

) |

|

|

(8.2 |

) |

|

Other

|

|

|

(5.2 |

) |

|

|

0.2 |

|

|

Net cash from operating activities

|

|

|

206.8 |

|

|

|

161.0 |

|

| |

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

|

(17.1 |

) |

|

|

(20.1 |

) |

|

Investment in joint venture

|

|

|

(0.4 |

) |

|

|

(4.5 |

) |

|

Other

|

|

|

(0.5 |

) |

|

|

(1.1 |

) |

|

Net cash (used in) investing activities

|

|

|

(18.0 |

) |

|

|

(25.7 |

) |

| |

|

|

|

|

|

|

|

|

|

Net change in debt

|

|

|

(0.9 |

) |

|

|

(98.6 |

) |

|

Payment of cash dividends

|

|

|

(84.6 |

) |

|

|

(77.5 |

) |

|

Stock option related

|

|

|

30.3 |

|

|

|

20.9 |

|

|

Purchase of treasury stock

|

|

|

(435.0 |

) |

|

|

(50.0 |

) |

|

Lease incentive proceeds

|

|

─

|

|

|

|

10.9 |

|

|

Lease principal payments

|

|

|

(0.6 |

) |

|

|

(0.5 |

) |

|

Other

|

|

|

0.5 |

|

|

|

(0.3 |

) |

|

Net cash (used in) financing activities

|

|

|

(490.3 |

) |

|

|

(195.1 |

) |

| |

|

|

|

|

|

|

|

|

|

F/X impact on cash

|

|

|

1.5 |

|

|

|

(9.1 |

) |

| |

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents

|

|

$ |

(300.0 |

) |

|

$ |

(68.9 |

) |

| |

|

|

|

|

|

|

|

|

2014 and 2013 Product Line Net Sales

| |

|

Three Months Ended

|

|

|

Percent

|

|

| |

|

6/30/2014

|

|

|

6/30/2013

|

|

|

Change

|

|

| |

|

|

|

|

|

|

|

|

|

|

Household Products

|

|

$ |

355.2 |

|

|

$ |

354.0 |

|

|

|

0.3 |

% |

|

Personal Care Products

|

|

|

243.7 |

|

|

|

240.5 |

|

|

|

1.3 |

% |

|

Consumer Domestic

|

|

$ |

598.9 |

|

|

$ |

594.5 |

|

|

|

0.7 |

% |

|

Consumer International

|

|

|

136.6 |

|

|

|

132.7 |

|

|

|

2.9 |

% |

|

Total Consumer Net Sales

|

|

$ |

735.5 |

|

|

$ |

727.2 |

|

|

|

1.1 |

% |

|

Specialty Products Division

|

|

|

72.8 |

|

|

|

60.4 |

|

|

|

20.5 |

% |

|

Total Net Sales

|

|

$ |

808.3 |

|

|

$ |

787.6 |

|

|

|

2.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended

|

|

|

Percent

|

|

| |

|

6/30/2014

|

|

|

6/30/2013

|

|

|

Change

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Household Products

|

|

$ |

707.7 |

|

|

$ |

712.8 |

|

|

|

-0.7 |

% |

|

Personal Care Products

|

|

|

484.5 |

|

|

|

472.7 |

|

|

|

2.5 |

% |

|

Consumer Domestic

|

|

$ |

1,192.2 |

|

|

$ |

1,185.5 |

|

|

|

0.6 |

% |

|

Consumer International

|

|

|

260.4 |

|

|

|

262.0 |

|

|

|

-0.6 |

% |

|

Total Consumer Net Sales

|

|

$ |

1,452.6 |

|

|

$ |

1,447.5 |

|

|

|

0.4 |

% |

|

Specialty Products Division

|

|

|

137.7 |

|

|

|

119.4 |

|

|

|

15.3 |

% |

|

Total Net Sales

|

|

$ |

1,590.3 |

|

|

$ |

1,566.9 |

|

|

|

1.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

The following discussion addresses the non-GAAP measures used in this press release and reconciliations of non-GAAP measures to the most directly comparable GAAP measures:

The following non-GAAP measures may not be the same as similar measures provided by other companies due to differences in methods of calculation and items and events being excluded.

Organic Sales Growth

The press release provides information regarding organic sales growth, namely net sales growth excluding the effect of divestitures and foreign exchange rate changes. Management believes that the presentation of organic sales growth is useful to investors because it enables them to assess, on a consistent basis, sales trends related to products that were marketed by the Company during the entirety of relevant periods and foreign exchange rate changes that are out of the control of, and do not reflect the performance of, management.

| |

Three Months Ended 6/30/2014

|

| |

|

|

|

|

|

|

|

|

|

| |

Total

|

|

Worldwide

|

|

Consumer

|

|

Consumer

|

|

Specialty

|

| |

Company

|

|

Consumer

|

|

Domestic

|

|

International

|

|

Products

|

| |

|

|

|

|

|

|

|

|

|

|

Reported Sales Growth

|

2.6%

|

|

1.1%

|

|

0.7%

|

|

2.9%

|

|

20.5%

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

FX

|

0.2%

|

|

0.1%

|

|

-

|

|

0.4%

|

|

1.0%

|

|

Divestitures/Other

|

0.2%

|

|

0.1%

|

|

-

|

|

0.6%

|

|

1.4%

|

| |

|

|

|

|

|

|

|

|

|

|

Organic Sales Growth

|

3.0%

|

|

1.3%

|

|

0.7%

|

|

3.9%

|

|

22.9%

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Six Months Ended 6/30/2014

|

| |

|

|

|

|

|

|

|

|

|

| |

Total

|

|

Worldwide

|

|

Consumer

|

|

Consumer

|

|

Specialty

|

| |

Company

|

|

Consumer

|

|

Domestic

|

|

International

|

|

Products

|

| |

|

|

|

|

|

|

|

|

|

|

Reported Sales Growth

|

1.5%

|

|

0.3%

|

|

0.6%

|

|

-0.6%

|

|

15.3%

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

FX

|

0.5%

|

|

0.4%

|

|

-

|

|

2.0%

|

|

1.6%

|

|

Divestitures/Other

|

0.1%

|

|

0.1%

|

|

-

|

|

0.5%

|

|

0.9%

|

| |

|

|

|

|

|

|

|

|

|

|

Organic Sales Growth

|

2.1%

|

|

0.8%

|

|

0.6%

|

|

1.9%

|

|

17.8%

|

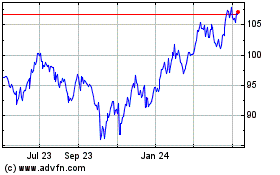

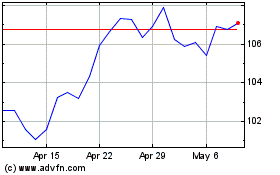

Church and Dwight (NYSE:CHD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Church and Dwight (NYSE:CHD)

Historical Stock Chart

From Apr 2023 to Apr 2024