Ashland Inc. completes sale of Ashland Water Technologies to Clayton, Dubilier & Rice for approximately $1.8 billion

August 01 2014 - 7:00AM

August 1, 2014

COVINGTON, Ky. - Ashland Inc.

(NYSE: ASH) today said it has completed the previously announced

sale of Ashland Water Technologies to a fund managed by Clayton,

Dubilier & Rice (CD&R) in a transaction valued at

approximately $1.8 billion.

Net proceeds from the sale totaled

approximately $1.4 billion, which primarily will be used to return

capital to shareholders in the form of share repurchases.

With annual sales of $1.7 billion,

Water Technologies is a leading supplier of specialty chemicals and

services to the pulp and paper and industrial water markets.

"The sale of our water business allows Ashland to

focus on our core specialty chemicals business and to accelerate

return of capital to shareholders," said James J. O'Brien, Ashland

chairman and chief executive officer. "We believe this transaction,

when combined with our ongoing global restructuring, will help

position Ashland for EBITDA margins that rank among the top 25

percent of specialty chemical companies."

Citi acted as financial advisor, and Cravath,

Swaine & Moore LLP and Squire Patton Boggs LLP acted as legal

advisors to Ashland.

About

Ashland

Ashland Inc. (NYSE: ASH) is a global leader in providing specialty

chemical solutions to customers in a wide range of consumer and

industrial markets, including architectural coatings, automotive,

construction, energy, food and beverage, personal care and

pharmaceutical. Through our three commercial units - Ashland

Specialty Ingredients, Ashland Performance Materials and Valvoline

- we use good chemistry to make great things happen for customers

in more than 100 countries. Visit ashland.com to learn more.

- 0 -

C-ASH

Forward-Looking Statements

This news release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Ashland has identified

some of these forward-looking statements with words such as

"anticipates," "believes," "expects," "estimates," "may," "will,"

"should" and "intends" and the negatives of these words or other

comparable terminology. In addition, Ashland may from time to

time make forward-looking statements in its filings with the

Securities and Exchange Commission (SEC), news releases and other

written and oral communications. These forward-looking

statements are based on Ashland's expectations and assumptions, as

of the date such statements are made, regarding Ashland's future

operating performance and financial condition, the economy and

other future events or circumstances. Ashland's expectations

and assumptions include, without limitation, internal forecasts and

analyses of current and future market conditions and trends,

management plans and strategies, operating efficiencies and

economic conditions (such as prices, supply and demand, cost of raw

materials, and the ability to recover raw-material cost increases

through price increases), and risks and uncertainties associated

with the following: Ashland's substantial indebtedness (including

the possibility that such indebtedness and related restrictive

covenants may adversely affect Ashland's future cash flows, results

of operations, financial condition and its ability to repay debt);

the sale transactions involving Ashland Water Technologies and the

ASK joint venture and the potential sale transaction involving the

Elastomers division (including the possibility that Ashland may not

realize the anticipated benefits from such transactions or

potential transaction); the global restructuring program (including

the possibility that Ashland may not achieve the anticipated

revenue and earnings growth, cost reductions, and other expected

benefits from the program); Ashland's ability to generate

sufficient cash to finance its stock repurchase plans, severe

weather, natural disasters, and legal proceedings and claims

(including environmental and asbestos matters). Various risks

and uncertainties may cause actual results to differ materially

from those stated, projected or implied by any forward-looking

statements, including, without limitation, risks and uncertainties

affecting Ashland that are described in its most recent Form 10-K

(including Item 1A Risk Factors) filed with the SEC, which is

available on Ashland's website at http://investor.ashland.com or on

the SEC's website at www.sec.gov. Ashland believes its expectations

and assumptions are reasonable, but there can be no assurance that

the expectations reflected herein will be achieved. Unless

legally required, Ashland undertakes no obligation to update any

forward-looking statements made in this news release whether as a

result of new information, future events or otherwise.

FOR FURTHER

INFORMATION:

Investor Relations:

Jason

Thompson

+1 (859) 815-4454

jlthompson@ashland.com

Media Relations:

Gary

Rhodes

+1 (859)

815-3047

glrhodes@ashland.com

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Ashland Inc. via Globenewswire

HUG#1845686

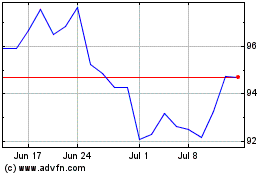

Ashland (NYSE:ASH)

Historical Stock Chart

From Mar 2024 to Apr 2024

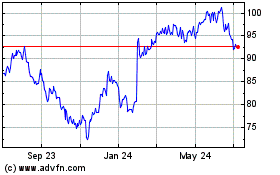

Ashland (NYSE:ASH)

Historical Stock Chart

From Apr 2023 to Apr 2024