UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 31, 2014

ARMOUR Residential REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

Maryland | 001-34766 | 26-1908763 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

|

| | |

3001 Ocean Drive, Suite 201 Vero Beach, Florida | | 32963 |

(Address of Principal Executive Offices) | | (Zip Code) |

(772) 617-4340

(Registrant’s Telephone Number, Including Area Code)

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[_] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On July 31, 2014, ARMOUR Residential REIT, Inc. (the “Company”) issued a press release announcing its financial results for the second fiscal quarter ended June 30, 2014. A copy of the press release is furnished as Exhibit 99.1 to this current report on Form 8-K.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

| |

Exhibit No. | Description |

99.1 | Press Release dated July 31, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 31, 2014

|

| | | |

| ARMOUR RESIDENTIAL REIT, INC. | |

| | | |

| By: | /s/ James R. Mountain | |

| Name: | James R. Mountain | |

| Title: | Chief Financial Officer | |

Exhibit Index

|

| |

Exhibit No. | Description |

99.1 | Press Release dated July 31, 2014 |

ARMOUR RESIDENTIAL REIT, INC. REPORTS Q2 2014 ANNUALIZED ROE OF 10.90% ON

CORE AND ESTIMATED TAXABLE REIT INCOME OF $50.9 MILLION

VERO BEACH, Fla. - July 31, 2014 -- ARMOUR Residential REIT, Inc. (NYSE: ARR, ARR PrA, and ARR PrB) (“ARMOUR” or the “Company”) today announced financial results for the quarter ended June 30, 2014.

Q2 2014 Highlights and Financial Information

| |

• | Core Income and estimated taxable Real Estate Investment Trust ("REIT") income of approximately $50.9 million or $0.13 per Common share, which represents a 10.90% return on stockholders' equity at the beginning of the quarter |

| |

• | Q2 2014 Generally Accepted Accounting Principles ("GAAP") net loss of approximately $(70.2) million or $(0.21) per Common share |

| |

• | Stockholders’ equity as of June 30, 2014 was approximately $2.0 billion or $4.90 per Common share |

| |

• | Ratio of debt to stockholders’ equity (“leverage”) of 7.90 to 1 as of June 30, 2014 |

| |

• | Liquidity as of June 30, 2014, consisting of cash and unpledged securities, of approximately $1.1 billion |

| |

• | Sales of Agency Securities in Q2 2014 totaled approximately $1.2 billion, completing the previously announced portfolio repositioning. The sales resulted in GAAP gains of approximately $11.2 million and tax capital losses of approximately $(314.9) million |

| |

• | Q2 2014 average yield on assets of 2.86% and average net interest margin of 1.46% |

| |

• | Q2 2014 annualized average principal repayment rate (CPR) of 5.12% |

| |

• | Stock outstanding as of June 30, 2014: |

Common - 357,189,085 shares

Series A Cumulative Redeemable Preferred - 2,180,572 shares

Series B Cumulative Redeemable Preferred - 5,650,000 shares

| |

• | Q2 2014 weighted average diluted Common shares were 357,111,170 |

| |

• | Additional updated information on the Company’s investment, financing and hedge positions can be found in ARMOUR Residential REIT, Inc.'s most recent “Company Update.” ARMOUR posts unaudited and unreviewed Company Updates each month on www.armourreit.com |

Q2 2014 Results

Core Income and Estimated Taxable REIT Income

Core Income for the quarter ended June 30, 2014, was approximately $50.9 million. “Core Income” represents a non-GAAP measure and is defined as net income excluding impairment losses, gains or losses on sales of securities and early termination of derivatives, unrealized gains or losses on derivatives and U.S. Treasury Securities and certain non-recurring expenses. Core Income may differ from GAAP net income, which includes the unrealized gains or losses of the Company’s derivative instruments and the gains or losses on Agency Securities and U.S. Treasury Securities.

Estimated taxable REIT income for the quarter ended June 30, 2014, was approximately $50.9 million. The Company distributes dividends based on its estimate of taxable earnings, not based on net income calculated in accordance with GAAP. Taxable REIT income and GAAP net income will generally differ primarily because of the non-taxable unrealized changes in the value of the Company’s derivatives, which the Company

ARMOUR Residential REIT, Inc. Reports Q2 2014 Annualized ROE of 10.90% on Core Income and Estimated Taxable REIT Income of $50.9 million

Page 2

July 31, 2014

uses as economic hedges, and other than temporary impairment of Agency Securities to be sold in later periods. These gains/losses on derivatives are included in GAAP net income, whereas valuation changes are

not included in taxable income. Additionally, capital losses realized for tax purposes will be carried forward to offset future capital gains. However, interest expense on U. S. Treasury Securities sold short, which was $4.3 million in Q2 2014, does reduce taxable income.

GAAP Net (Loss)

For the purposes of computing GAAP net income (loss), the change in fair value of the Company’s derivatives is reflected in current period net income, while the change in fair value of its Agency Securities is reflected in its statement of comprehensive income. GAAP net loss for Q2 2014 was approximately $(70.2) million, including losses on security sales of approximately $(4.6) million.

Dividends

The Company paid dividends of $0.05 per Common share of record for each month of Q2 2014, resulting in payments to common stockholders of approximately $53.8 million. The Company also paid monthly dividends in Q2 2014 of $0.171875 per outstanding share of 8.250% Series A Cumulative Redeemable Preferred Stock and $0.1640625 per outstanding share of 7.875% Series B Cumulative Redeemable Preferred Stock, resulting in payments to preferred stockholders of an aggregate of approximately $3.9 million. The Company's taxable REIT income and dividend requirements to maintain REIT status are determined on an annual basis. Dividends in excess of taxable REIT income for the year will generally not be taxable to common stockholders. Our REIT dividend requirements are based on the amount of our ordinary taxable income. Realized capital losses do not affect the amount of the Company’s ordinary taxable income, but will generally be available to offset capital gains realized primarily through 2018.

Per Share Amounts

Per Common share amounts are net of applicable Preferred Stock dividends and liquidation preferences. The denominators used to calculate per Common share amounts for the quarter ended June 30, 2014, reflect, to the extent dilutive, the effects of 1.3 million unvested stock awards.

Portfolio

During Q2 2014, the Company sold approximately $1.2 billion of Agency Securities, resulting in GAAP gains of approximately $11.2 million and realized capital losses of approximately $(314.9) million for tax purposes. These sales completed the previously announced repositioning to move the portfolio from 30-year fixed rate Agency Securities and 25-year fixed rate Agency Securities to 15-year fixed rate Agency Securities and 20-year fixed rate Agency Securities. As of June 30, 2014, the Company’s portfolio consisted of Fannie Mae, Freddie Mac and Ginnie Mae mortgage securities, substantially all of which are fixed rate securities, and was valued at $17.0 billion. During Q2 2014, the annualized yield on average assets was 2.86%, and the annualized cost of funds on average liabilities (including realized cost of hedges) was 1.40%, resulting in a net interest spread of 1.46% for Q2 2014.

Portfolio Financing, Leverage and Interest Rate Hedges

As of June 30, 2014, the Company financed its portfolio with approximately $14.4 billion of net borrowings under repurchase agreements and $1.0 billion of obligations to return securities received as collateral (U.S. Treasury Securities sold short). The Company’s leverage ratio as of June 30, 2014, was 7.90 to 1. As of

ARMOUR Residential REIT, Inc. Reports Q2 2014 Annualized ROE of 10.90% on Core Income and Estimated Taxable REIT Income of $50.9 million

Page 3

July 31, 2014

June 30, 2014, the Company’s liquidity totaled approximately $1.1 billion, consisting of approximately $433.1 million of cash and equivalents, plus approximately $639.8 million of unpledged Agency Securities (including Agency Securities received as collateral).

As of June 30, 2014, the following information was available related to the Company’s interest rate risk and hedging activities: The Company’s repurchase agreements had a weighted-average maturity of approximately 58 days. The Company had a notional amount of approximately $10.0 billion of various maturities of interest rate swap contracts with a weighted average swap rate of 1.50%. The Company had a notional amount of approximately $5.3 billion of various maturities of swaptions with a weighted average swap rate of 2.94%. The Company had a notional amount of approximately $25.0 million of various maturities of Eurodollar futures contracts sold at a weighted average swap equivalent rate of 2.13%.

Clearing regulations adopted under the Dodd-Frank Act have increased the initial margin requirements for most types of interest rate swap contracts. The portfolio repositioning will allow the Company to manage the interest rate risk created by the differing maturity profiles of our assets and the liabilities with shorter tenor interest rate swap contracts and futures contracts that have smaller initial margin requirements.

Management Fee

The Company pays a management fee of 1.5% (per annum) of gross equity raised up to $1.0 billion and 0.75% (per annum) of gross equity raised above $1.0 billion. As of June 30, 2014, the effective management fee was 1.03% based on gross equity raised, net of stock buybacks and dividends in excess of annual taxable REIT income.

Regulation G Reconciliation

Taxable REIT income is calculated according to the requirements of the Internal Revenue Code (“the Code”) rather than GAAP. The Company plans to timely distribute at least 90% of its taxable REIT income in order to maintain its tax qualification as a REIT under the Code. The Company believes that taxable REIT income is useful to investors because taxable REIT income is directly related to the amount of dividends the Company is required to distribute in order to maintain its REIT tax qualification status. Core Income also excludes gains and losses on security sales. However, because taxable REIT income and Core Income are incomplete measures of the Company’s financial performance and involve differences from net income computed in accordance with GAAP, taxable REIT income and Core income should be considered as supplementary to, and not as a substitute for, the Company’s net income computed in accordance with GAAP as a measure of the Company’s financial performance.

ARMOUR Residential REIT, Inc. Reports Q2 2014 Annualized ROE of 10.90% on Core Income and Estimated Taxable REIT Income of $50.9 million

Page 4

July 31, 2014

The following table reconciles the Company’s results from operations to Core Income and estimated taxable REIT income for the quarter ended June 30, 2014

|

| | | | |

| | Quarter Ended

June 30, 2014 |

| | (in thousands) |

GAAP net loss | | $ | (70,190 | ) |

Book to tax differences: | | |

Changes in interest rate contracts | | 116,273 |

|

Loss on Security Sales | | 4,614 |

|

Amortization of deferred hedging gains | | 461 |

|

Net premium amortization differences | | (266 | ) |

Other | | 5 |

|

Core Income and estimated taxable REIT income | | $ | 50,897 |

|

Common Stock

The Company issued 17,191 shares of common stock during Q2 2014 under its dividend reinvestment plan at a weighted average price of $4.24 per share. As of June 30, 2014, there were 357,189,085 Common shares outstanding.

Preferred Stock

As of June 30, 2014, there were 2,180,572 shares of 8.250% Series A Cumulative Redeemable Preferred Stock and 5,650,000 shares of 7.875% Series B Cumulative Redeemable Preferred Stock outstanding.

ARMOUR Residential REIT, Inc.

ARMOUR is a Maryland corporation that invests primarily in fixed rate, hybrid adjustable rate and adjustable rate residential mortgage backed securities. These securities are issued or guaranteed by U.S. Government-sponsored entities and Ginnie Mae. ARMOUR is externally managed and advised by ARMOUR Residential Management LLC, an investment advisor registered with the Securities and Exchange Commission (“SEC”). ARMOUR Residential REIT, Inc. intends to qualify and has elected to be taxed as a REIT under the Code for U.S. federal income tax purposes.

Safe Harbor

This press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Additional information concerning these and other risk factors are contained in the Company's most recent filings with the SEC. All subsequent written and oral forward-looking statements concerning the Company are expressly qualified in their entirety by the cautionary statements above. The Company cautions readers not to place undue reliance upon any forward-

ARMOUR Residential REIT, Inc. Reports Q2 2014 Annualized ROE of 10.90% on Core Income and Estimated Taxable REIT Income of $50.9 million

Page 5

July 31, 2014

looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in their expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

Additional Information and Where to Find It

Investors, security holders and other interested persons may find additional information regarding the Company at the SEC’s Internet site at http://www.sec.gov/, or the Company website www.armourreit.com or by directing requests to: ARMOUR Residential REIT, Inc., 3001 Ocean Drive, Suite 201, Vero Beach, Florida 32963, Attention: Investor Relations.

CONTACT: investors@armourreit.com

James R. Mountain

Chief Financial Officer

ARMOUR Residential REIT, Inc.

(772) 617-4340

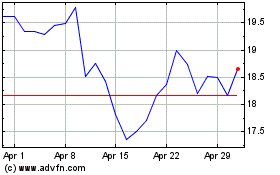

ARMOUR Residential REIT (NYSE:ARR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ARMOUR Residential REIT (NYSE:ARR)

Historical Stock Chart

From Apr 2023 to Apr 2024