SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 25, 2014

|

PERMA-FIX ENVIRONMENTAL SERVICES, INC. |

|

(Exact name of registrant as specified in its charter) |

|

Delaware |

|

|

1-11596 |

|

|

58-1954497 |

|

|

(State or other

jurisdiction of

incorporation) |

|

|

(Commission File Number) |

|

|

(IRS Employer

Identification No.) |

|

|

8302 Dunwoody Place, Suite 250, Atlanta, Georgia |

|

30350 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (770) 587-9898

|

Not applicable |

|

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| __ | |

Written communications pursuant to Rule 425 under the Securities Act |

|

| __ | |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

|

| __ | |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

|

| __ | |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Section 1 – Registrant’s Business and Operations

Item 1.01. Entry into a Material Definitive Agreement.

On July 25, 2014 and July 28, 2014, Perma-Fix Environmental Services, Inc. (the “Company”) and certain of our subsidiaries entered into amendments to our Amended Loan Agreement (as defined below) with PNC Bank, National Association (“PNC”) as discussed under Item 2.03 below, which is incorporated herein by reference.

Section 2 – Financial Information

Item 2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off Balance Sheet Arrangement of a Registrant.

On July 25, 2014, the Company, and certain of our subsidiaries, entered into an amendment (the “July 25th Amendment”) with the lenders signatory thereto and PNC, as agent for such lenders, to our Amended and Restated Revolving Credit, Term Loan and Security Agreement (“Amended Loan Agreement”). The July 25th Amendment added the Company’s subsidiary, Perma-Fix of Canada, Inc., as a guarantor to the Amended Loan Agreement but did not alter the Company’s financial obligations thereunder. All other terms of the Amended Loan Agreement remain principally unchanged.

On July 28, 2014, the Company and certain of our subsidiaries, entered into another amendment to our Amended Loan Agreement (the “July 28th Amendment”) with the lenders signatory thereto and PNC, as agent for such lenders. The July 28th Amendment authorized the Company to sell our subsidiary, Schreiber, Yonley & Associates, Inc. (“SYA”), as discussed under Item 8.01 below, and it released a hold by PNC on $2,350,000 of the $3,850,000 of insurance settlement proceeds received by our subsidiary, Perma-Fix of South Georgia Inc. (“PFSG”). The PFSG insurance settlement was previously disclosed by the Company. The release of the insurance settlement proceeds will allow the Company to use $2,350,000 for working capital purposes, and PNC will retain a hold on the remaining $1,500,000 of such proceeds for up to the remainder of the term of the Amended Loan Agreement. All other terms of the Amended Loan Agreement remain principally unchanged.

Section 5 – Corporate Governance and Management

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Robert Schreiber, Jr. (“Schreiber”), the President of SYA and a named executive officer of the Company as a result of being a member of the executive management team of the Company, resigned from, or ceased holding, any positions with the Company or its subsidiaries, effectively immediately upon the closing of the sale of SYA by the Company, as discussed in Item 8.01 below. Following his resignation, Schreiber is and will no longer be a named executive officer of the Company or hold any offices with the Company or any of its subsidiaries.

Section 8 – Other Events

Item 8.01. Other Events.

On July 29, 2014, the Company completed the sale of SYA. In consideration of the sale of SYA, the purchaser paid approximately $1,300,000 and an estimated $60,000 working capital adjustment which is subject to adjustment within approximately 90 days of the closing date, in cash, to the Company at the closing, with $50,000 of such consideration being placed in escrow for a period of one year to cover any claims by the purchaser for indemnification for certain limited types of losses incurred by the purchaser following the closing. SYA is a professional engineering and environmental consulting services company and was in the Company’s Services Segment. In 2013, SYA had net revenues of $2,564,736 and a net loss of $621,288.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

|

4.1 |

Fifth Amendment to Amended and Restated Revolving Credit, Term Loan and Security Agreement dated July 25, 2014, by and among Perma-Fix Environmental Services, Inc., the lenders signatory thereto, and PNC Bank, National Association, as agent for such lenders. |

|

4.2 |

Sixth Amendment to Amended and Restated Revolving Credit, Term Loan and Security Agreement dated July 28, 2014, by and among Perma-Fix Environmental Services, Inc., the lenders signatory thereto, and PNC Bank, National Association, as agent for such lenders. |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 31, 2014

|

|

PERMA-FIX ENVIRONMENTAL SERVICES, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Ben Naccarato |

|

|

|

|

Ben Naccarato |

|

|

|

|

Vice President and |

|

|

|

|

Chief Financial Officer |

|

3

Exhibit 4.1

Exhibit 4.2

SIXTH AMENDMENT TO AMENDED AND RESTATED REVOLVING CREDIT,

TERM LOAN AND SECURITY AGREEMENT

THIS SIXTH AMENDMENT TO AMENDED AND RESTATED REVOLVING CREDIT, TERM LOAN AND SECURITY AGREEMENT, dated as of 28, 2014 (this “Amendment”), relating to the Credit Agreement referenced below, is by and among PERMA-FIX ENVIRONMENTAL SERVICES, INC., a Delaware corporation (the “Borrower”), the lenders identified on the signature pages hereto (the “Lenders”), and PNC Bank, National Association, a national banking association, as agent for the Lenders (in such capacity, the “Agent”). Terms used herein but not otherwise defined herein shall have the meanings provided to such terms in the Credit Agreement.

W I T N E S S E T H

WHEREAS, a credit facility has been extended to the Borrower pursuant to the terms of that certain Amended and Restated Revolving Credit, Term Loan and Security Agreement dated as of October 31, 2011 (as amended and modified from time to time, the “Credit Agreement”) among the Borrower, the Lenders identified therein, and PNC Bank, National Association, as agent for the Lenders;

WHEREAS, the Borrower has requested certain modifications to the Credit Agreement;

WHEREAS, the Required Lenders have agreed to the requested modifications on the terms and conditions set forth herein;

NOW, THEREFORE, IN CONSIDERATION of the premises and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Amendment. The Credit Agreement is amended as set forth below:

(a) A new definition of “South Georgia Insurance Proceeds”) is added to Section 1.2 in correct alphabetical order to read as follows:

“ “South Georgia Insurance Proceeds” shall mean the $3,850,000 insurance proceeds from the fire at Borrower’s Perma-Fix of South Georgia, Inc.’s facility located at 1612 James P. Rodgers Circle, Valdosta, Georgia 31601.”

(b) The definition of “Guarantor” in Section 1.2 is amended to read as follows:

“ “Guarantor” shall mean the active Domestic Subsidiaries of Borrower (excluding limited liability companies and joint ventures not wholly owned by Borrower), Perma-Fix Northwest Richland, Inc., a Washington corporation, Safety and Ecology Corporation, a Nevada corporation, SEC Federal Services Corporation, a Nevada corporation, SEC Radcon Alliance, LLC, a Tennessee limited liability company (for as long as such entity remains inactive) and any other Person who may hereafter guarantee payment or performance of the whole or any part of the Obligations and “Guarantors” means collectively all such Persons.”

(c) Section 2.1(a) is amended to read as follows:

“(a) Amount of Revolving Advances

Subject to the terms and conditions set forth in this Agreement including Section 2.1(b), each Lender, severally and not jointly, will make Revolving Advances to Borrower in aggregate amounts outstanding at any time equal to such Lender’s Commitment Percentage of the lesser of (x) the Maximum Revolving Advance Amount less the aggregate Maximum Undrawn Amount of all outstanding Letters of Credit or (y) an amount equal to the sum of:

(i) an amount equal to the sum of (without duplication) (A) up to 85%, subject to the provisions of Section 2.1(b) hereof, of Acceptable Government Agency Receivables, (B) up to 50%, subject to the provision of Section 2.1(b) hereof, of Acceptable Unbilled Amounts, (C) up to 85%, subject to the provisions of Section 2.1(b) hereof, of Commercial Broker Receivables, and (D) up to 85%, subject to the provisions of Section 2.1(b) hereof, of Commercial Receivables (collectively, the “Advance Rates”); provided, however, that Foreign Receivables shall not constitute more than ten percent (10%) of Eligible Receivables at any time, minus

(ii) the aggregate Maximum Undrawn Amount of all outstanding Letters of Credit, minus

(iii) a $1,500,000 availability block established from a portion of the South Georgia Insurance Proceeds, minus

(iv) such reserves as Agent may in good faith reasonably deem proper and necessary from time to time.

The amount derived from the sum of (x) Sections 2.1(a)(y)(i) minus (y) Section 2.1 (a)(y)(ii), (iii) and (iv) at any time and from time to time shall be referred to as the “Formula Amount”. The Revolving Advances shall be evidenced by one or more secured promissory notes (collectively, the “Revolving Credit Note”) substantially in the form attached hereto as Exhibit 2.1(a).”

(d) A new sentence is added to the end of Section 4.11 to read as follows:

“Notwithstanding the foregoing, Borrower may retain $2,350,000 of the South Georgia insurance proceeds for working capital purposes.”

(e) Section 7.1(b) is amended to read as follows:

“(b) “Sell, lease, transfer or otherwise dispose of any of its properties or assets, except (i) dispositions of Inventory and Equipment to the extent expressly permitted by Section 4.3 and (ii) any other sales or dispositions expressly permitted by this Agreement and (iii) the sale of Schreiber, Yonley and Associates, Inc., one of the Guarantors.”

2. Release of Guarantor. The Agent and the Lenders hereby release Schreiber, Yonley and Associates, Inc. as a Guarantor under the Secured Subsidiaries Guaranty.

3. Conditions Precedent. This Amendment shall be effective as of the date hereof upon satisfaction of each of the following conditions precedent:

(a) the execution of this Amendment by the Borrower, the Required Lenders and the Agent; and

(b) receipt by the Agent of an amendment fee of $15,000;

4. Conditions Subsequent. Prior to September 28, 2014 or such later date as the Agent may determine, the Borrower shall deliver or shall cause to be delivered to the Agent (a) documents and other information requested by the Agent with respect to the new Domestic Subsidiary, Safety and Ecology Radcon Alliance, LLC, an entity organized in the State of Nevada, that will become a Guarantor, (b) an executed Agreement to be Bound by Guaranty with respect to Safety and Ecology Radcon Alliance, LLC and such other documents reasonably requested by the Agent to add Safety and Ecology Radcon Alliance, LLC as a Guarantor to the Credit Agreement and the Other Documents and (c) an executed Second Amendment to Pledge Agreement.

5. Clarification of Condition Subsequent in Fourth Amendment. Pursuant to the terms of the Fourth Amendment to Amended and Restated Revolving Credit, Term and Security Agreement dated as of April 14, 2014 the Borrower was required, as a condition subsequent, to deliver to the Agent prior to July 8, 2014 documents relating to Perma-Fix of Canada Inc. The Agent agreed to extend the date of such deliverables to July 25, 2014 and the required documents were delivered to Agent on that date.

6. Representations and Warranties. The Borrower hereby represents and warrants in connection herewith that as of the date hereof (after giving effect hereto) (i) the representations and warranties set forth in Article V of the Credit Agreement are true and correct in all material respects (except those which expressly relate to an earlier date), and (ii) no Default or Event of Default has occurred and is continuing under the Credit Agreement.

7. Acknowledgments, Affirmations and Agreements. The Borrower (i) acknowledges and consents to all of the terms and conditions of this Amendment and (ii) affirms all of its obligations under the Credit Agreement and the Other Documents.

8. Credit Agreement. Except as expressly modified hereby, all of the terms and provisions of the Credit Agreement remain in full force and effect.

9. Expenses. The Borrower agrees to pay all reasonable costs and expenses in connection with the preparation, execution and delivery of this Amendment, including the reasonable fees and expenses of the Agent’s legal counsel.

10. Counterparts. This Amendment may be executed in any number of counterparts, each of which when so executed and delivered shall be deemed an original. It shall not be necessary in making proof of this Amendment to produce or account for more than one such counterpart.

11. Governing Law. This Amendment shall be deemed to be a contract under, and shall for all purposes be construed in accordance with, the laws of the State of New York.

IN WITNESS WHEREOF, each of the parties hereto has caused a counterpart of this Amendment to be duly executed and delivered as of the date first above written.

| BORROWER: |

PERMA-FIX ENVIRONMENTAL

SERVICES, INC. |

| |

|

|

| |

By: |

/s/Ben Naccarato |

| |

Name: |

B. Naccarato |

| |

Title: |

CFO |

| AGENT AND LENDER: |

PNC BANK, NATIONAL ASSOCIATION,

in its capacity as Agent and as Lender |

| |

|

|

| |

By: |

/s/Alex Council |

| |

Name: |

Alex M. Council |

| |

Title: |

Vice President |

5

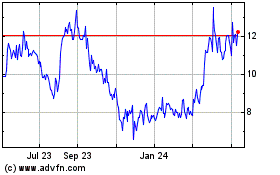

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Mar 2024 to Apr 2024

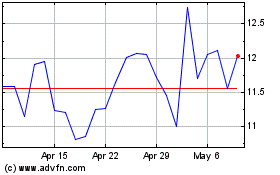

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Apr 2023 to Apr 2024