Direxion Launches Three 2X Shares; AdvisorShares Debuts Active Dividend Fund

July 31 2014 - 9:00AM

ETFDB

This week, Wall Street digested the latest U.S. GDP data, which

came in at a seasonally adjusted annual rate of 4.0% in the second

quarter. For the first half of 2014, the economy managed to eke out

positive growth, expanding at a 0.9% pace [see How Well Do

Defensive ETFs Actually Work?].

On the earnings front, Lorillard, Phillips 66, Waste Management,

Reynolds American, and UPS reported worse-than-expected results,

while American Express, Pfizer and Merck managed to beat analyst

expectations.

In ETF news, Direxion launched three new 2x bull funds, while

AdvisorShares rolled out its new actively managed dividend

fund.

Behavioral Finance Behind New Dividend ETF

AdvisorShares debuted its Athena High Dividend ETF (DIVI),

which is actively managed by AthenaInvest Advisors, LLC. The

managers use a behavioral finance approach to identifying

securities for DIVI’s portfolio. Stocks are screened and selected

using the Portfolio Manager’s patented research. The research

measures behavioral factors of active equity fund investment

managers (strategy, consistency and conviction) and identifies

stocks that are held in the top relative weight positions of

their portfolios.The selected securities are then dividend

weighted.

Commenting on the new fund, Noah Hamman, chief executive of

AdvisorShares, stated: “The need for shareholder yield is well

known, however, most equity dividend funds focus on dividends first

and stock selection second. DIVI aims to provide high yield to

investors while taking a patented behavioral approach to stock

selection. We feel many investors are seeking high income with less

exposure to credit and interest rate risk, and DIVI looks to

provide an established investment approach to selecting stocks with

the additional benefits of a high yielding dividend income

strategy. We believe DIVI, with its active ETF structure, is

positioned to present a compelling single investment diversifier

for investors and advisors to consider.”

Three New Bull Shares

Direxion introduced three new 2x leveraged funds:

- Daily 7-10 Year Treasury Bull 2x Shares (SYTL) offers 200%

exposure to the NYSE 7-10 Year Treasury Bond Index, which is a

multiple-security fixed income index that aims to track the total

returns of the intermediate 7 to 10 year maturity range of the U.S.

Treasury bond market. The fund charges 0.60%.

- Small Cap Bull 2x Shares (SMLL) offers 200% exposure to the

Russell 2000 Index, which measures the performance of the

small-cap segment of the U.S. equity universe. The fund charges

0.60%.

- Daily Mid Cap Bull 2x Shares (MDLL) offers 200% exposure to the

S&P Mid Cap 400 Index, which measures the performance of

the mid-cap segment of the U.S. equity universe. The fund charges

an expense ratio of 0.60%.

Follow me on

Twitter @DPylypczak

Disclosure: No positions at time of

writing.

Click here to read the original article on ETFdb.com.

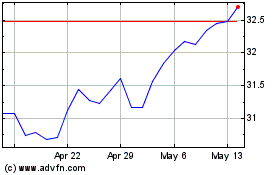

Franklin International C... (AMEX:DIVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

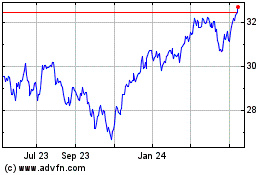

Franklin International C... (AMEX:DIVI)

Historical Stock Chart

From Apr 2023 to Apr 2024