UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 29, 2014

C.H. ROBINSON WORLDWIDE, INC.

(Exact name of registrant as specified in its charter)

Commission

File Number: 000-23189

|

|

|

| Delaware |

|

41-1883630 |

| (State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

14701 Charlson Road, Eden Prairie, MN 55347

(Address of principal executive offices, including zip code)

(952) 937-8500

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

The following information is being “furnished” in accordance with General Instruction B.2 of Form 8-K and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in

any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Furnished herewith as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein are the text of C.H. Robinson Worldwide,

Inc.’s announcement regarding its financial results for the quarter ended June 30, 2014 and its earnings conference call slides.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| 99.1 |

|

Press Release dated July 29, 2014 of C.H. Robinson Worldwide, Inc. |

|

|

| 99.2 |

|

Earnings conference call slides dated July 30, 2014. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| C.H. ROBINSON WORLDWIDE, INC. |

|

|

| By: |

|

/s/ Christopher Gerst |

|

|

Christopher Gerst Assistant General Counsel and

Assistant Corporate Secretary |

Date: July 29, 2014

EXHIBIT INDEX

|

|

|

| 99.1 |

|

Press Release dated July 29, 2014 of C.H. Robinson Worldwide, Inc. |

|

|

| 99.2 |

|

Earnings conference call slides dated July 30, 2014. |

Exhibit 99.1

C.H. Robinson Worldwide, Inc.

14701 Charlson Road

Eden Prairie, Minnesota 55347

Chad Lindbloom, chief financial

officer (952) 937-7779

Tim Gagnon, director, investor relations (952) 683-5007

FOR IMMEDIATE RELEASE

C.H. ROBINSON REPORTS SECOND

QUARTER RESULTS

MINNEAPOLIS, July 29, 2014 – C.H. Robinson Worldwide, Inc. (“C.H. Robinson”) (NASDAQ: CHRW), today reported

financial results for the quarter ended June 30, 2014. Summarized financial results for the quarter ended June 30 are as follows (dollars in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

% change |

|

|

2014 |

|

|

2013 |

|

|

% change |

|

| Total revenues |

|

$ |

3,502,918 |

|

|

$ |

3,288,262 |

|

|

|

6.5 |

% |

|

$ |

6,645,503 |

|

|

$ |

6,282,529 |

|

|

|

5.8 |

% |

| Net revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transportation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Truckload |

|

$ |

305,561 |

|

|

$ |

264,335 |

|

|

|

15.6 |

% |

|

$ |

575,398 |

|

|

$ |

532,939 |

|

|

|

8.0 |

% |

| LTL |

|

|

67,376 |

|

|

|

60,711 |

|

|

|

11.0 |

% |

|

|

127,514 |

|

|

|

119,202 |

|

|

|

7.0 |

% |

| Intermodal |

|

|

10,863 |

|

|

|

9,920 |

|

|

|

9.5 |

% |

|

|

19,803 |

|

|

|

19,021 |

|

|

|

4.1 |

% |

| Ocean |

|

|

50,486 |

|

|

|

49,124 |

|

|

|

2.8 |

% |

|

|

94,098 |

|

|

|

91,612 |

|

|

|

2.7 |

% |

| Air |

|

|

21,747 |

|

|

|

20,202 |

|

|

|

7.6 |

% |

|

|

39,201 |

|

|

|

36,970 |

|

|

|

6.0 |

% |

| Customs |

|

|

10,312 |

|

|

|

9,769 |

|

|

|

5.6 |

% |

|

|

19,644 |

|

|

|

18,375 |

|

|

|

6.9 |

% |

| Other logistics services |

|

|

17,207 |

|

|

|

17,084 |

|

|

|

0.7 |

% |

|

|

35,773 |

|

|

|

34,278 |

|

|

|

4.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total transportation |

|

|

483,552 |

|

|

|

431,145 |

|

|

|

12.2 |

% |

|

|

911,431 |

|

|

|

852,397 |

|

|

|

6.9 |

% |

| Sourcing |

|

|

34,894 |

|

|

|

38,752 |

|

|

|

-10.0 |

% |

|

|

61,740 |

|

|

|

70,598 |

|

|

|

-12.5 |

% |

| Payment services |

|

|

2,591 |

|

|

|

2,705 |

|

|

|

-4.2 |

% |

|

|

5,101 |

|

|

|

5,329 |

|

|

|

-4.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net revenues |

|

|

521,037 |

|

|

|

472,602 |

|

|

|

10.2 |

% |

|

|

978,272 |

|

|

|

928,324 |

|

|

|

5.4 |

% |

| Operating expenses |

|

|

320,655 |

|

|

|

290,126 |

|

|

|

10.5 |

% |

|

|

620,919 |

|

|

|

577,142 |

|

|

|

7.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

200,382 |

|

|

|

182,476 |

|

|

|

9.8 |

% |

|

|

357,353 |

|

|

|

351,182 |

|

|

|

1.8 |

% |

| Net income |

|

$ |

118,596 |

|

|

$ |

111,872 |

|

|

|

6.0 |

% |

|

$ |

211,783 |

|

|

$ |

215,215 |

|

|

|

-1.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted EPS |

|

$ |

0.80 |

|

|

$ |

0.70 |

|

|

|

14.3 |

% |

|

$ |

1.43 |

|

|

$ |

1.34 |

|

|

|

6.7 |

% |

Our truckload net revenues increased 15.6 percent in the second quarter of 2014 compared to the second quarter of 2013. Our

truckload volumes increased approximately four percent in the second quarter of 2014 compared to the second quarter of 2013. Our North American truckload volumes increased approximately three percent. Our truckload net revenue margin increased in

the second quarter of 2014 compared to the second quarter of 2013, due primarily to increased rate per mile. In North America, excluding the estimated impacts of the change in fuel, our average truckload rate per mile charged to our customers

increased approximately ten percent in the second quarter of 2014 compared to the second quarter of 2013. In North America, our truckload transportation costs increased approximately nine percent, excluding the estimated impacts of the change in

fuel.

(more)

C.H. Robinson Worldwide, Inc.

July 29, 2014

Page

2

Our less-than-truckload (“LTL”) net revenues increased 11.0 percent in the second quarter of 2014

compared to the second quarter of 2013. The increase was driven by an eight percent increase in total shipments and a slight increase in net revenue margin.

Our intermodal net revenues increased 9.5 percent in the second quarter of 2014 compared to the second quarter of 2013. This increase was primarily driven by

improved purchased transportation costs, a change in business mix, and a volume increase of one percent. Intermodal volumes were adversely impacted by railroad service levels.

Our ocean transportation net revenues increased 2.8 percent in the second quarter of 2014 compared to the second quarter of 2013. This increase in net

revenues was primarily due to volume increases partially offset by a decrease in net revenue margin.

Our air transportation net revenues increased 7.6

percent in the second quarter of 2014 compared to the second quarter of 2013. This increase was primarily due to increased volumes and an increase in net revenue margin.

Our customs net revenues increased 5.6 percent in the second quarter of 2014 compared to the second quarter of 2013. This increase was primarily due to higher

transaction volumes.

Our other logistics services revenues increased 0.7 percent in the second quarter of 2014 compared to the second quarter of 2013.

This increase was primarily due to increases in transportation management services, partially offset by declines in other logistics services.

Sourcing

net revenues decreased 10.0 percent in the second quarter of 2014 compared to the second quarter of 2013. We continued to experience volume and net revenue declines from a large customer. We expect these declines with this large customer to continue

throughout 2014. Volumes were also negatively impacted by the west coast drought which affected product availability.

For the second quarter, operating

expenses increased 10.5 percent to $320.7 million in 2014 from $290.1 million in 2013. Operating expenses as a percentage of net revenues increased slightly to 61.5 percent in the second quarter of 2014 from 61.4 percent in the second quarter of

2013.

For the second quarter, personnel expenses increased 16.0 percent to $239.0 million in 2014 from $206.0 million. This was primarily due to an

increase in the expenses related to incentive plans that are designed to keep expenses variable with changes in net revenues and profitability and an increase in our average headcount of approximately four percent.

For the second quarter, other selling, general, and administrative expenses decreased 2.9 percent to $81.7 million in 2014 from $84.1 million in 2013. This

was due to a decrease in claims and travel expenses, partially offset by an increase in the provision for doubtful accounts. In the second quarter of 2013, we recorded a $5.0 million charge related to the settlement of a contingent auto liability

claim.

For the second quarter, interest and other expense was an expense of $6.3 million in 2014 compared to an expense of $589,000 in the second quarter

of 2013. This increase was primarily driven by the interest expense on our notes payable, issued during the third quarter of 2013 and used to fund the accelerated share repurchase agreements.

Founded in 1905, C.H. Robinson Worldwide, Inc., is one of the largest non-asset based third party logistics companies in the world. C.H. Robinson is a global

provider of multimodal transportation services and logistics solutions, currently serving over 46,000 active customers through a network of 282 offices in North America, South America, Europe, and Asia. C.H. Robinson maintains one of the largest

networks of motor carrier capacity in North America and works with approximately 63,000 transportation providers worldwide.

(more)

C.H. Robinson Worldwide, Inc.

July 29, 2014

Page

3

Except for the historical information contained herein, the matters set forth in this release are

forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ

materially from our historical experience or our present expectations, including, but not limited to such factors as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our

services; competition and growth rates within the third party logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight, and changes in relationships with existing truck,

rail, ocean and air carriers; changes in our customer base due to possible consolidation among our customers; our ability to integrate the operations of acquired companies with our historic operations successfully; risks associated with litigation

and insurance coverage; risks associated with operations outside of the U.S.; risks associated with the potential impacts of changes in government regulations; risks associated with the produce industry, including food safety and contamination

issues; fuel prices and availability; the impact of war on the economy; and other risks and uncertainties detailed in our Annual and Quarterly Reports.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update such statement to reflect

events or circumstances arising after such date. All remarks made during our financial results conference call will be current at the time of the call and we undertake no obligation to update the replay.

Conference Call Information:

C.H. Robinson Worldwide

Second Quarter 2014 Earnings Conference Call

Wednesday, July 30, 2014 8:30 a.m. Eastern Time

The call will be limited to 60 minutes, including questions and answers. We invite call participants to submit questions in advance of the conference

call and we will respond to as many of the questions as we can in the time allowed. To submit your question(s)in advance of the call, please email tim.gagnon@chrobinson.com.

Presentation slides and a simultaneous live audio webcast of the conference call may be accessed through the Investor Relations link on C.H.

Robinson’s website at www.chrobinson.com.

To participate in the conference call by telephone, please call ten minutes early by dialing:

888-740-6137

International callers dial +1-913-312-1495

Callers should reference the conference ID, which is 5181255

Webcast replay available through Investor Relations link at www.chrobinson.com

Telephone audio replay available until 11:30 a.m. Eastern Time on August 6: 800-203-1112;

passcode: 5181255#

(more)

C.H. Robinson Worldwide, Inc.

July 29, 2014

Page

4

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

June 30, |

|

|

Six months ended

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transportation |

|

$ |

3,038,923 |

|

|

$ |

2,818,077 |

|

|

$ |

5,842,627 |

|

|

$ |

5,421,259 |

|

| Sourcing |

|

|

460,816 |

|

|

|

466,811 |

|

|

|

796,624 |

|

|

|

854,663 |

|

| Payment Services |

|

|

3,179 |

|

|

|

3,374 |

|

|

|

6,252 |

|

|

|

6,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

3,502,918 |

|

|

|

3,288,262 |

|

|

|

6,645,503 |

|

|

|

6,282,529 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased transportation and related services |

|

|

2,555,371 |

|

|

|

2,386,932 |

|

|

|

4,931,196 |

|

|

|

4,568,862 |

|

| Purchased products sourced for resale |

|

|

425,922 |

|

|

|

428,059 |

|

|

|

734,884 |

|

|

|

784,065 |

|

| Purchased payment services |

|

|

588 |

|

|

|

669 |

|

|

|

1,151 |

|

|

|

1,278 |

|

| Personnel expenses |

|

|

238,986 |

|

|

|

206,009 |

|

|

|

459,283 |

|

|

|

418,654 |

|

| Other selling, general, and administrative expenses |

|

|

81,669 |

|

|

|

84,117 |

|

|

|

161,636 |

|

|

|

158,488 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

3,302,536 |

|

|

|

3,105,786 |

|

|

|

6,288,150 |

|

|

|

5,931,347 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

200,382 |

|

|

|

182,476 |

|

|

|

357,353 |

|

|

|

351,182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and other expense |

|

|

(6,252 |

) |

|

|

(589 |

) |

|

|

(12,383 |

) |

|

|

(649 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before provision for income taxes |

|

|

194,130 |

|

|

|

181,887 |

|

|

|

344,970 |

|

|

|

350,533 |

|

| Provision for income taxes |

|

|

75,534 |

|

|

|

70,015 |

|

|

|

133,187 |

|

|

|

135,318 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

118,596 |

|

|

$ |

111,872 |

|

|

$ |

211,783 |

|

|

$ |

215,215 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share (basic) |

|

$ |

0.80 |

|

|

$ |

0.70 |

|

|

$ |

1.43 |

|

|

$ |

1.34 |

|

| Net income per share (diluted) |

|

$ |

0.80 |

|

|

$ |

0.70 |

|

|

$ |

1.43 |

|

|

$ |

1.34 |

|

| Weighted average shares outstanding (basic) |

|

|

147,826 |

|

|

|

159,818 |

|

|

|

148,167 |

|

|

|

160,137 |

|

| Weighted average shares outstanding (diluted) |

|

|

147,974 |

|

|

|

159,917 |

|

|

|

148,293 |

|

|

|

160,198 |

|

(more)

C.H. Robinson Worldwide, Inc.

July 29, 2014

Page

5

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2014 |

|

|

December 31,

2013 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

144,215 |

|

|

$ |

162,047 |

|

| Receivables, net |

|

|

1,699,787 |

|

|

|

1,449,581 |

|

| Other current assets |

|

|

65,199 |

|

|

|

52,857 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,909,201 |

|

|

|

1,664,485 |

|

| Property and equipment, net |

|

|

160,268 |

|

|

|

160,703 |

|

| Intangible and other assets |

|

|

967,637 |

|

|

|

977,630 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

3,037,106 |

|

|

$ |

2,802,818 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders’ investment |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and outstanding checks |

|

$ |

876,113 |

|

|

$ |

755,007 |

|

| Accrued compensation |

|

|

78,917 |

|

|

|

85,247 |

|

| Accrued income taxes |

|

|

25,682 |

|

|

|

11,681 |

|

| Other accrued expenses |

|

|

50,286 |

|

|

|

43,046 |

|

| Current portion of debt |

|

|

400,000 |

|

|

|

375,000 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,430,998 |

|

|

|

1,269,981 |

|

| Noncurrent income taxes payable |

|

|

20,281 |

|

|

|

21,584 |

|

| Deferred tax liabilities |

|

|

75,502 |

|

|

|

70,618 |

|

| Long-term debt |

|

|

500,000 |

|

|

|

500,000 |

|

| Other long term liabilities |

|

|

224 |

|

|

|

911 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

2,027,005 |

|

|

|

1,863,094 |

|

| Total stockholders’ investment |

|

|

1,010,101 |

|

|

|

939,724 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ investment |

|

$ |

3,037,106 |

|

|

$ |

2,802,818 |

|

|

|

|

|

|

|

|

|

|

(more)

C.H. Robinson Worldwide, Inc.

July 29, 2014

Page

6

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(unaudited, in thousands, except operational data)

|

|

|

|

|

|

|

|

|

| |

|

Six months ended

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

| Operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

211,783 |

|

|

$ |

215,215 |

|

| Stock-based compensation |

|

|

16,423 |

|

|

|

9,885 |

|

| Depreciation and amortization |

|

|

29,349 |

|

|

|

27,952 |

|

| Provision for doubtful accounts |

|

|

11,128 |

|

|

|

5,635 |

|

| Deferred income taxes |

|

|

5,894 |

|

|

|

25,993 |

|

| Other |

|

|

(1,348 |

) |

|

|

143 |

|

| Changes in operating elements |

|

|

|

|

|

|

|

|

| Receivables |

|

|

(261,334 |

) |

|

|

(198,669 |

) |

| Prepaid expenses and other |

|

|

(14,214 |

) |

|

|

(12,146 |

) |

| Other non-current assets |

|

|

270 |

|

|

|

— |

|

| Accounts payable and outstanding checks |

|

|

121,109 |

|

|

|

100,481 |

|

| Accrued compensation and profit-sharing contribution |

|

|

(6,137 |

) |

|

|

(35,277 |

) |

| Accrued income taxes |

|

|

12,698 |

|

|

|

(69,631 |

) |

| Other accrued liabilities |

|

|

2,747 |

|

|

|

(11,310 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

128,368 |

|

|

|

58,271 |

|

| Investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(14,860 |

) |

|

|

(18,316 |

) |

| Purchases and development of software |

|

|

(3,964 |

) |

|

|

(4,261 |

) |

| Acquisitions, net of cash |

|

|

— |

|

|

|

19,126 |

|

| Other |

|

|

268 |

|

|

|

107 |

|

|

|

|

|

|

|

|

|

|

| Net cash used for investing activities |

|

|

(18,556 |

) |

|

|

(3,344 |

) |

| Financing activities: |

|

|

|

|

|

|

|

|

| Borrowings on line of credit |

|

|

2,435,000 |

|

|

|

2,134,023 |

|

| Repayments on line of credit |

|

|

(2,410,000 |

) |

|

|

(2,022,017 |

) |

| Payment of contingent purchase price |

|

|

— |

|

|

|

(927 |

) |

| Net repurchases of common stock |

|

|

(52,740 |

) |

|

|

(134,043 |

) |

| Excess tax benefit on stock-based compensation |

|

|

5,198 |

|

|

|

24,755 |

|

| Cash dividends |

|

|

(104,909 |

) |

|

|

(113,031 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used for financing activities |

|

|

(127,451 |

) |

|

|

(111,240 |

) |

| Effect of exchange rates on cash |

|

|

(193 |

) |

|

|

(3,689 |

) |

|

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

|

(17,832 |

) |

|

|

(60,002 |

) |

| Cash and cash equivalents, beginning of period |

|

|

162,047 |

|

|

|

210,019 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of period |

|

$ |

144,215 |

|

|

$ |

150,017 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of June 30, |

|

| |

|

2014 |

|

|

2013 |

|

| Operational Data: |

|

|

|

|

|

|

|

|

| Employees |

|

|

11,645 |

|

|

|

11,297 |

|

| Branches |

|

|

282 |

|

|

|

276 |

|

###

|

|

|

Earnings Conference Call –

Second Quarter 2014

July 30, 2014

John Wiehoff, Chairman & CEO

Chad Lindbloom, CFO

Tim Gagnon, Director, Investor Relations

Exhibit 99.2 |

|

|

| Safe

Harbor Statement Except for the historical information contained herein, the

matters set forth in this presentation and the accompanying earnings release

are forward-looking statements that represent our expectations, beliefs,

intentions or strategies concerning future events. These forward-looking

statements are subject to certain risks and uncertainties that could cause

actual results to differ materially from our historical experience or our

present expectations, including, but not limited to such factors as changes

in economic conditions, including uncertain consumer demand; changes in

market demand and pressures on the pricing for our services; competition and

growth rates within the third party logistics industry; freight levels and

increasing costs and availability of truck capacity or alternative means

of transporting freight,

and changes in relationships with existing truck, rail, ocean and air carriers;

changes in our customer base due to possible consolidation among our

customers; our ability to integrate the operations of acquired companies

with our historic operations successfully; risks associated with litigation

and insurance coverage; risks associated with

operations

outside

of

the

U.S.;

risks

associated

with

the

potential

impacts

of

changes in government regulations; risks associated with the produce industry,

including food safety and contamination issues; fuel prices and

availability; changes to our share repurchase activity; the impact of war on

the economy; and other risks and uncertainties detailed in our Annual and

Quarterly Reports. 2 |

|

|

|

Results Q2 2014

Three months ended June 30

in thousands, except per share amounts

•

Net

revenue

growth

in

the

second

quarter

was

primarily

driven

by

an

improvement in Truckload net revenue margin

•

Income from operations growth is comparable to net revenue growth

•

Net income growth is affected by the borrowings related to the 2013

accelerated share repurchases

•

2013/ 2014 share repurchases positively impacted EPS growth in the

second quarter

2014

2013

% Change

2014

2013

% Change

Total revenues

$3,502,918

$3,288,262

6.5%

$6,645,503

$6,282,529

5.8%

Total net revenues

$521,037

$472,602

10.2%

$978,272

$928,324

5.4%

Income from operations

$200,382

$182,476

9.8%

$357,353

$351,182

1.8%

Net income

$118,596

$111,872

6.0%

$211,783

$215,215

-1.6%

Earnings per share

(diluted)

$0.80

$0.70

14.3%

$1.43

$1.34

6.7%

Weighted average shares

outstanding

147,974

159,917

-7.5%

148,293

160,198

-7.4%

Six months ended June 30

3 |

|

|

|

Transportation Results Q2 2014

•

Transportation net revenue margin improvement driven primarily by Truckload

results •

Second quarter net revenue margin is in the middle range of historical norms

2014

2013

% Change

Total revenues

$3,038,923

$2,818,077

7.8%

Total net revenues

$483,552

$431,145

12.2%

Net revenue margin

15.9%

15.3%

4.0%

Three months ended June 30

TRANSPORTATION in thousands

TRANSPORTATION NET REVENUE MARGIN PERCENTAGE

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Q1

17.8%

16.8%

17.4%

18.3%

20.2%

18.2%

22.6%

17.4%

17.2%

16.9%

16.2%

15.3%

Q2

15.9%

15.4%

16.3%

17.1%

17.9%

15.4%

20.6%

15.8%

16.2%

14.9%

15.3%

15.9%

Q3

16.0%

15.9%

16.3%

17.5%

18.0%

15.9%

19.8%

16.6%

16.4%

15.6%

14.9%

Q4

15.8%

16.0%

15.7%

18.3%

17.7%

19.0%

18.3%

17.6%

16.3%

15.8%

15.0%

Year

16.3%

16.0%

16.3%

17.8%

18.4%

17.0%

20.2%

16.8%

16.5%

15.8%

15.3%

2014

2013

% Change

$5,842,627

$5,421,259

7.8%

$911,431

$852,397

6.9%

15.6%

15.7%

-0.8%

Six months ended June 30

4 |

|

|

|

Truckload Results Q2 2014

2014

2013

% Change

$305,561

$264,335

15.6%

Three months ended June 30

TRUCKLOAD NET REVENUES in thousands

North America

Truckload

Year over year change

*Pricing and cost measures exclude the estimated impact

of the change in fuel

•

Total Truckload volumes grew approximately four percent in the second

quarter of 2014 when compared to the second quarter of 2013

•

A

change

in

our

mix

of

business

and

a

tight

capacity

environment

impacted

our price and cost per mile in the second quarter of 2014 when compared

to the second quarter of 2013

•

North America Truckload capacity availability stabilized in the second

quarter when compared to the first quarter, capacity remains tight

•

Added 2900 new carriers in the second quarter of 2014, this is on the high

end of historical performance

2014

2013

% Change

$575,398

$532,939

8.0%

Six months ended June 30

Quarter

YTD

Volume

3%

3%

Approximate pricing*

10%

10%

Approximate cost*

9%

11%

Net revenue margin

5 |

|

|

| LTL

Results Q2 2014 2014

2013

% Change

$67,376

$60,711

11.0%

Three months ended June 30

LTL NET REVENUES in thousands

LTL

Year over year change

•

Strong demand drove increased volume and net revenue growth

in the second quarter

•

LTL shipment size and length of haul increased in the second

quarter when compared to the second quarter of 2013

•

Driver shortages are impacting LTL capacity availability and

causing carriers to increase rates

2014

2013

% Change

$127,514

$119,202

7.0%

Six months ended June 30

Quarter

YTD

Volume

8%

8%

Pricing

Net revenue margin

6 |

|

|

|

Intermodal Results Q2 2014

•

Net revenue increase was primarily driven by improved

purchase transportation costs and a change in business mix

•

Intermodal volumes were negatively impacted by railroad

service levels

•

Rail service saw incremental improvement from the first quarter

of 2014, service levels are expected to remain a challenge into

the third and fourth quarters

2014

2013

% Change

$10,863

$9,920

9.5%

Three months ended June 30

INTERMODAL NET REVENUES in thousands

Year over year change

2014

2013

% Change

$19,803

$19,021

4.1%

Six months ended June 30

INTERMODAL

Quarter

YTD

Volume

1%

-2%

Pricing

Net revenue margin

7 |

|

|

|

Global Forwarding Results Q2 2014

Ocean, Air and Customs

2014

2013

% Change

Ocean

$50,486

$49,124

2.8%

Air

$21,747

$20,202

7.6%

Customs

$10,312

$9,769

5.6%

Three months ended June 30

NET REVENUES in thousands

Quarter

Volume

Pricing

Net revenue margin

OCEAN

Quarter

Volume

Pricing

Net revenue margin

AIR

Year over year change

Year over year change

•

Combined Global Forwarding services net revenues increased 4.4% in the

second quarter when compared to the second quarter of 2013

•

Second quarter volumes increased in the Ocean, Air and Customs service lines

while competitive pressures remain strong

•

The labor negotiations on the U. S. West Coast continue to create some

uncertainty for global and domestic shippers

2014

2013

% Change

$94,098

$91,612

2.7%

$39,201

$36,970

6.0%

$19,644

$18,375

6.9%

Year to Date

Year to Date

Six months ended June 30

8 |

|

|

|

Other Logistics Services Results Q2 2014

•

Other Logistics Services net revenues include transportation

management services, warehousing and small parcel

•

Increases in transportation management services were offset by

declines in the other services

2014

2013

% Change

$17,207

$17,084

0.7%

Three months ended June 30

NET REVENUES in thousands

2014

2013

% Change

$35,773

$34,278

4.4%

Six months ended June 30

9 |

|

|

|

10

Sourcing Results Q2 2014

•

Continued net revenue decreases from a large customer; we expect

this impact will continue through Q4 2014

•

Case volumes decreased 11 percent partially from the large

customer lost volume and the west coast drought impacting product

availability

•

Robinson Fresh launched in the second quarter creating one global

business brand for our Produce business

•

2014

2013

% Change

Total revenues

$460,816

$466,811

-1.3%

Total net revenues

$34,894

$38,752

-10.0%

Net revenue margin

7.6%

8.3%

-8.8%

Three months ended June 30

SOURCING NET REVENUES in thousands

2014

2013

% Change

$796,624

$854,663

-6.8%

$61,740

$70,598

-12.5%

7.8%

8.3%

-6.2%

Six months ended June 30 |

|

|

|

11

in thousands

Summarized Income Statement

•

Growth in personnel expense primarily the result of our variable

compensation plans that are driven by changes in net revenues

and profitability.

•

Quarter 2, 2013 selling, general and administrative includes a $5

million expense related to a contingent auto liability settlement

•

Increase in provision of doubtful accounts driven primarily by

growth in our accounts receivable balance

Three months ended June 30

2014

2013

% Change

Total revenues

$3,502,918

$3,288,262

6.5%

Total net revenues

521,037

472,602

10.2%

Personnel expenses

238,986

206,009

16.0%

Selling, general & admin

81,669

84,117

-2.9%

Total operating expenses

320,655

290,126

10.5%

Income from operations

$200,382

$182,476

9.8%

Percent of net revenue

38.5%

38.6%

-0.4%

2014

2013

% Change

$6,645,503

$6,282,529

5.8%

978,272

928,324

5.4%

459,283

418,654

9.7%

161,636

158,488

2.0%

620,919

577,142

7.6%

$357,353

$351,182

1.8%

36.5%

37.8%

-3.4%

Six months ended June 30 |

|

|

|

12

Three months ended June 30

June 30, 2014

Cash & investments

$144,215

Current assets

$1,909,201

Total assets

$3,037,106

Debt

$900,000

Current liabilities

$1,430,998

Stockholders’

investment

$1,010,101

CASH FLOW DATA

BALANCE SHEET DATA

Other Financial Information

in thousands

2014

2013

% Change

Net cash provided by operating activities

$113,928

$116,321

-2.1%

Capital expenditures, net

$6,229

$12,400

-49.8%

•

Strong cash flow quarter

•

Total debt balance $900 million

•

$500 million, 4.28% average coupon

•

$400 million drawn on revolver, 1.65%

current rate

•

Capital returned to shareholders during

the quarter

•

$52.5 million cash dividend

•

$51.4 million in share repurchase activity

•

844,900 shares

•

Average price $60.83 |

|

|

|

13

A look ahead

•

Cyclical and secular factors will continue to impact our quarterly

results

•

North America Truckload net revenue growth rate in July has been

similar to the second quarter driven by margin improvement with

minimal volume growth

•

We

continue

to

focus

on

growth

and

efficiency

initiatives

across

all

areas of our business

•

Investments continue in the areas of technology, global expansion

and talent development |

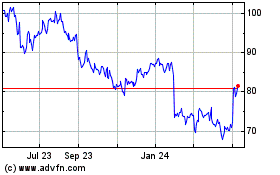

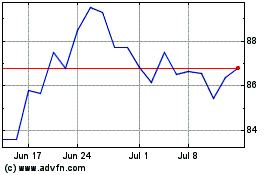

CH Robinson Worldwide (NASDAQ:CHRW)

Historical Stock Chart

From Mar 2024 to Apr 2024

CH Robinson Worldwide (NASDAQ:CHRW)

Historical Stock Chart

From Apr 2023 to Apr 2024