Current Report Filing (8-k)

July 29 2014 - 3:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 28, 2014

CTS CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Indiana |

|

1-4639 |

|

35-0225010 |

|

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

1142 West Beardsley Ave.

Elkhart, Indiana |

|

46514 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (574) 523-3800

905 West Boulevard North, Elkhart, Indiana

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02 |

Results of Operations and Financial Condition. |

On July 28, 2014, CTS Corporation (the “Registrant”) issued a press release providing certain results for the quarterly period ended June 29, 2014 as more fully described in the press release. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being “furnished” to the Securities and Exchange Commission and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section. Furthermore, the information contained in Item 2.02 of this Current Report on Form 8-K shall not be deemed to be incorporated by reference into any filing made by the Registrant under the Securities Act of 1933 or the Exchange Act, except as set forth by specific reference in such filing.

|

Item 9.01 |

Financial Statements and Exhibits. |

|

(d) |

Exhibits. |

|

|

|

|

|

|

|

|

|

Exhibit No. |

|

Exhibit Description |

|

|

|

|

|

|

|

99.1 |

|

Press Release dated July 28, 2014. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CTS CORPORATION |

|

|

|

|

|

|

|

|

By: |

/s/ Robert J. Patton |

|

|

Name: |

Robert J. Patton |

|

|

Title: |

Vice President, General |

|

|

|

Counsel and Secretary |

|

|

|

|

|

|

|

|

Date: July 29, 2014 |

|

3

EXHIBIT INDEX

|

Exhibit No. |

|

Exhibit Description |

|

|

|

|

|

99.1 |

|

Press Release dated July 28, 2014. |

4

Exhibit 99.1

|

newsrelease |

|

|

|

CTS CORPORATION Elkhart, Indiana 46514 · 574-523-3800 |

|

|

|

|

July 28, 2014 |

FOR RELEASE: Immediately

CTS ANNOUNCES SECOND QUARTER 2014 RESULTS

Adjusted EPS of $0.25 despite sales softness

Continued progress on executing the strategic plan

Elkhart, IN. . .CTS Corporation (NYSE: CTS) today announced second quarter 2014 results:

· Revenues were $103.0 million, up 2.3% versus the first quarter of 2014; down 2.3% compared to the second quarter of 2013.

· GAAP earnings from continuing operations were $6.4 million, or $0.19 per diluted share, compared to a loss of $10.3 million, or $0.31 per diluted share, in second quarter of 2013.

· Adjusted EPS from continuing operations was $0.25 compared to $0.22 in the second quarter of 2013.

Sales of sensors and mechatronic products grew 3% year-over-year. Sales of electronic components declined 12% due mainly to softness in sales of frequency and HDD products. CTS received $89 million of new business wins in the second quarter. Year-to-date, CTS has won $225 million in new business.

“We are pleased with the earnings delivered in the second quarter despite the pressure on sales. During our transition, we continue to fine tune our product portfolio in 2014 and are addressing execution issues related to our electronic components products,” said Kieran O’Sullivan, CEO of CTS Corporation. “We remain confident in and committed to our strategy. We are making progress on improving our cost structure and expect to achieve substantial earnings growth in 2014.”

Management is adjusting its full-year 2014 guidance for sales due to the challenges with electronic components products. Sales for 2014 are expected to be in the range of $400 to $415 million. Adjusted earnings per diluted share are expected to be at the lower end of our guidance range of $0.96 and $1.02.

Conference Call

As previously announced, the Company has scheduled a conference call on Tuesday, July 29, 2014 at 11:00 a.m. (EDT). The dial-in number for the conference call is 888-359-3624 (719-325-2463, if calling from outside the U.S.). The conference I.D. number is 5350505. There will be a replay of the conference call from 2:00 p.m. (EDT) on Tuesday, July 29, 2014 through 2:00 p.m. (EDT) on Tuesday, August 5, 2014. The telephone number for the replay is 888-203-1112 (719-457-0820, if calling from outside the U.S.). The access code is 5350505. Also, please note that a live audio webcast of the conference call will be available and can be accessed directly from the website of CTS Corporation www.ctscorp.com.

About CTS

CTS is a leading designer and manufacturer of electronic components and sensors to OEMs in the automotive, communications, medical, defense and aerospace, industrial and computer markets. CTS manufactures products in North America, Europe and Asia. CTS’ stock is traded on the NYSE under the ticker symbol “CTS.”

Safe Harbor

This document contains statements that are, or may be deemed to be, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, any financial or other guidance, statements that reflect our current expectations concerning future results and events, and any other statements that are not based solely on historical fact. Forward-looking statements are based on management’s expectations, certain assumptions and currently available information. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof and are based on various assumptions as to future events, the occurrence of which necessarily are subject to uncertainties. These forward-looking statements are made subject to certain risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from those presented in the forward-looking statements. Examples of factors that may affect future operating results and financial condition include, but are not limited to: changes in the economy generally and in respect to the businesses in which CTS operates; unanticipated issues in integrating acquisitions; the results of actions to reposition our businesses; rapid technological change; general market conditions in the automotive, communications, and computer industries, as well as conditions in the industrial, defense and aerospace, and medical markets; reliance on key customers; unanticipated natural disasters or other events; the ability to protect our intellectual property; pricing pressures and demand for our products; and risks associated with our international operations, including trade and tariff barriers, exchange rates and political and geopolitical risks. Many of these, and other, risks and uncertainties are discussed in further detail in Item 1A. of the Annual Report on Form 10-K. We undertake no obligation to publicly update our forward-looking statements to reflect new information or events or circumstances that arise after the date hereof, including market or industry changes.

|

Contact: |

Ashish Agrawal, Vice President and Chief Financial Officer |

|

|

CTS Corporation, 1142 W. Beardsley Ave., Elkhart, IN 46514 |

|

|

Telephone 574-523-3800 |

CTS CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS (LOSS) - UNAUDITED

(In thousands, except per share amounts)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

June 29, |

|

June 30, |

|

June 29, |

|

June 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

102,980 |

|

$ |

105,381 |

|

$ |

203,686 |

|

$ |

203,443 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

69,157 |

|

72,981 |

|

139,248 |

|

144,257 |

|

|

Selling, general and administrative expenses |

|

15,813 |

|

17,157 |

|

29,454 |

|

34,833 |

|

|

Research and development expenses |

|

5,332 |

|

5,771 |

|

10,958 |

|

12,023 |

|

|

Restructuring charge |

|

2,733 |

|

7,029 |

|

3,236 |

|

7,206 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating earnings |

|

9,945 |

|

2,443 |

|

20,790 |

|

5,124 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

106 |

|

(612 |

) |

57 |

|

(1,105 |

) |

|

Other income (expense) |

|

(409 |

) |

398 |

|

(2,180 |

) |

(109 |

) |

|

Total other income (expense) |

|

(303 |

) |

(214 |

) |

(2,123 |

) |

(1,214 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from continuing operations before income taxes |

|

9,642 |

|

2,229 |

|

18,667 |

|

3,910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

3,281 |

|

12,482 |

|

7,226 |

|

11,176 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) from continuing operations |

|

6,361 |

|

(10,253 |

) |

11,441 |

|

(7,266 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations |

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations, net of tax |

|

— |

|

(1,082 |

) |

— |

|

(501 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) |

|

$ |

6,361 |

|

$ |

(11,335 |

) |

$ |

11,441 |

|

$ |

(7,767 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

0.19 |

|

$ |

(0.31 |

) |

$ |

0.34 |

|

$ |

(0.22 |

) |

|

Discontinued operations |

|

— |

|

(0.03 |

) |

— |

|

(0.01 |

) |

|

Net (loss) earnings attributable to CTS Corporation |

|

$ |

0.19 |

|

$ |

(0.34 |

) |

0.34 |

|

$ |

(0.23 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

0.19 |

|

$ |

(0.31 |

) |

0.33 |

|

$ |

(0.22 |

) |

|

Discontinued operations |

|

— |

|

(0.03 |

) |

— |

|

(0.01 |

) |

|

Net (loss) earnings attributable to CTS Corporation |

|

$ |

0.19 |

|

$ |

(0.34 |

) |

0.33 |

|

$ |

(0.23 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share |

|

$ |

0.040 |

|

$ |

0.035 |

|

$ |

0.080 |

|

$ |

0.070 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

33,741 |

|

33,589 |

|

33,725 |

|

33,556 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

34,208 |

|

33,589 |

|

34,244 |

|

33,556 |

|

CTS CORPORATION AND SUBSIDIARIES

OTHER SUPPLEMENTAL INFORMATION

Earnings / (Loss) per Share

The following table reconciles GAAP earnings per share to adjusted earnings per share for the Company:

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

June 29 |

|

June 30 |

|

June 29 |

|

June 30 |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP diluted earnings per share |

|

$ |

0.19 |

|

$ |

(0.34 |

) |

$ |

0.33 |

|

$ |

(0.23 |

) |

|

Discontinued operations |

|

— |

|

0.03 |

|

— |

|

0.01 |

|

|

Earnings per share from continuing operations |

|

$ |

0.19 |

|

$ |

(0.31 |

) |

$ |

0.33 |

|

$ |

(0.22 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Tax affected charges to reported diluted earnings / (loss) per share: |

|

|

|

|

|

|

|

|

|

|

Restructuring and related charges |

|

0.07 |

|

0.16 |

|

0.10 |

|

0.17 |

|

|

CEO transition costs |

|

— |

|

0.02 |

|

— |

|

0.03 |

|

|

Tax impact of cash repatriation |

|

— |

|

0.32 |

|

— |

|

0.32 |

|

|

Tax asset write-off related to restructuring |

|

(0.01 |

) |

0.03 |

|

0.01 |

|

0.03 |

|

|

Adjusted earnings per share |

|

$ |

0.25 |

|

$ |

0.22 |

|

$ |

0.44 |

|

$ |

0.33 |

|

Additional Information

The following table includes other financial information not presented in the preceding financial statements.

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

$ In thousands |

|

June 29 |

|

June 30 |

|

June 29 |

|

June 30 |

|

|

Expense |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Depreciation and Amortization |

|

$ |

4,153 |

|

$ |

5,470 |

|

$ |

8,401 |

|

$ |

11,356 |

|

|

Equity Based Compensation |

|

$ |

400 |

|

$ |

1,163 |

|

$ |

1,179 |

|

$ |

2,481 |

|

Non-GAAP Financial Measures

Adjusted earnings per share is a non-GAAP financial measure. The most directly comparable GAAP financial measure is diluted earnings per share.

CTS adjusts for these items because they are discrete events which have a significant impact on comparable GAAP financial measures and could distort an evaluation of our normal operating performance.

CTS uses an adjusted earnings per share measure to evaluate overall performance, establish plans and perform strategic analysis. Using this measure avoids distortion in the evaluation of operating results by eliminating the impact of events which are not related to normal operating performance. Because this measure is based on the exclusion or inclusion of specific items, they may not be comparable to measures used by other companies which have similar titles. CTS’ management compensates for this limitation when performing peer comparisons by evaluating both GAAP and non-GAAP financial measures reported by peer companies. CTS believes that this measure is useful to its management, investors and stakeholders in that it:

· provides a truer measure of CTS’ operating performance,

· reflects the results used by management in making decisions about the business, and

· helps review and project CTS’ performance over time.

We recommend that investors consider both actual and adjusted measures in evaluating the performance of CTS with peer companies.

CTS Corporation and Subsidiaries

Condensed Consolidated Balance Sheets - Unaudited

(In thousands of dollars)

|

|

|

June 29, |

|

December 31, |

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

127,230 |

|

$ |

124,368 |

|

|

Accounts receivable, net |

|

61,080 |

|

62,667 |

|

|

Inventories |

|

28,434 |

|

32,226 |

|

|

Other current assets |

|

18,828 |

|

17,008 |

|

|

Total current assets |

|

235,572 |

|

236,269 |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

74,430 |

|

74,869 |

|

|

Other assets |

|

169,629 |

|

169,127 |

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

479,631 |

|

$ |

480,265 |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

43,724 |

|

$ |

47,052 |

|

|

Accrued liabilities |

|

41,574 |

|

48,068 |

|

|

Total current liabilities |

|

85,298 |

|

95,120 |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

76,200 |

|

75,000 |

|

|

Other obligations |

|

12,888 |

|

13,416 |

|

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

305,245 |

|

296,729 |

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders’ Equity |

|

$ |

479,631 |

|

$ |

480,265 |

|

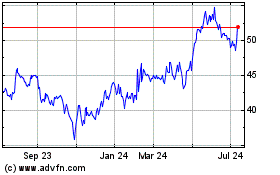

CTS (NYSE:CTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

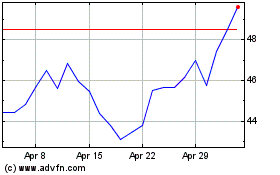

CTS (NYSE:CTS)

Historical Stock Chart

From Apr 2023 to Apr 2024