Current Report Filing (8-k)

July 29 2014 - 1:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

| |

|

|

| Date of Report (Date of Earliest Event Reported): |

|

July 24, 2014

|

JBI, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

| Nevada |

000-52444 |

90-0822950 |

| |

|

|

(State or other jurisdiction |

(Commission |

(I.R.S. Employer |

| of incorporation) |

File Number) |

Identification No.) |

| |

|

|

| 20 Iroquois Street, Niagara Falls, NY |

|

14303 |

| (Address of principal executive offices) |

|

(Zip Code) |

| |

|

|

| Registrant’s telephone number, including area code: |

|

716-278-0015 |

N/A

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 4 – MATTERS RELATED TO ACCOUNTANTS AND FINANCIAL

STATEMENTS

Item 4.01 Changes in Registrant’s Certifying Accountant.

(a) Prior Independent Registered

Public Accounting Firm

MNP LLP was

previously the principal accountants for JBI, Inc. (the “Company”). On July 24, 2014, MNP LLP was informed of its dismissal

and that David Brooks Associates CPA’s, P.A. (“Brooks”) had been engaged as principal accountants for the Company.

The decision to change accountants was authorized by the Board of Directors, as described in item (b) below.

During the

two fiscal years ended December 31, 2013 (the most recent audited financial statements filed by the Company), and the subsequent

period through July 24, 2014, there were no: (1) disagreements with MNP LLP on any matter of accounting principles or practices,

financial statement disclosure, or auditing scope or procedures, which disagreements if not resolved to their satisfaction would

have caused them to make reference in connection with their opinion to the subject matter of the disagreement, or (2) reportable

events, except that MNP LLP advised the Company of the following material weakness:

Financial Expertise of the Audit Committee

/ Board of Directors Composition

As at December 31, 2013 we are aware that the

Company's Board of Directors consists of two members, Richard Heddle (Non-Independent) and Phillip Bradley (Independent). As such,

the Board is not derived of a voting majority of independent directors. Subsequent to December 31, 2012, the Company disbanded

the Audit Committee and the current Board of Directors was to perform the duties of the Audit Committee. Based on this investors

may form an opinion that the Audit Committee lacks the appropriate financial expertise to accomplish effective governance. We are

aware that the Board is currently operating under a mandate to improve the structure of the Board and the Audit Committee by attracting

new members. In doing so, the Company should ensure that it's Audit Committee has the appropriate financial background, as described

in the Audit Committee Charter, especially among the independent members, and should ensure that such background is adequately

explained in public information.

The audit

reports of MNP LLP on the consolidated financial statements of the Company as of and for the years ended December 31, 2013 and

2012 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit

scope or accounting principles, except as follows:

MNP LLP’s report on the consolidated

financial statements of the Company as of and for the years ended December 31, 2013 and 2012, contained a separate paragraph stating

that: “The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going

concern. As discussed in Note 1, the Company has experienced negative cash flows from operations since inception and has accumulated

a significant deficit which raises substantial doubt about its ability to continue as a going concern. Management’s plans

regarding these matters are also described in Note 1. The consolidated financial statements do not include any adjustments that

might result from the outcome of this uncertainty”.

We have requested that MNP LLP furnish us with

a letter addressed to the Securities and Exchange Commission stating whether or not it agrees with the above statements. A copy

of such letter is attached as Exhibit 16 hereto.

(b) New Independent Registered

Public Accounting Firm

On July 24,

2014, the Board of Directors of the Company authorized the engagement of Brooks as the Company’s independent registered public

accounting firm for purposes of performing an audit of the Company’s financial statements for the fiscal years ended December

31, 2014. The Company entered into an engagement letter with Brooks on July 24, 2014.

During the

two fiscal years ended December 31, 2013, and the subsequent period through July 24, 2014, the Company did not consult with Brooks

regarding (i) the application of accounting principles to a specific completed or contemplated transaction, or the type of audit

opinion that might be rendered on the Company’s consolidated financial statements, and no written report or oral advice was

provided by Brooks that was an important factor considered by the Company in reaching a decision as to the accounting, auditing

or financial reporting issue or (ii) any matter that was either the subject of a disagreement or reportable event, as each term

is defined in Item 304(a)(1)(iv) or Item 304(a)(1)(v) of Regulation S-K.

SECTION 9 –

FINANCIAL STATEMENT AND EXHIBITS

Item 9.01 Financial

Statements and Exhibits.

(c) Exhibits.

| |

Number |

Documents |

| |

|

|

| |

16 |

Letter from MNP LLP to the Securities and Exchange Commission dated July 29, 2014. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

JBI, INC. |

|

| |

|

|

| July 29, 2014 |

By: |

/s/ Richard Heddle |

| |

|

Name: Richard Heddle |

| |

|

Title: Chief Executive Officer |

EXHIBIT INDEX

Exhibit No. Description

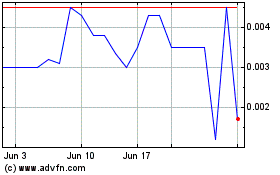

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

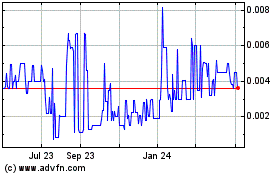

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Apr 2023 to Apr 2024