UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2014 (July 25, 2014)

Owens & Minor, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Virginia |

|

1-9810 |

|

54-1701843 |

| (State or other jurisdiction

of incorporation |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 9120 Lockwood Blvd., Mechanicsville, Virginia |

|

23116 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (804) 723-7000

Not applicable

(former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On July 28, 2014, Owens & Minor, Inc. (the “Company”) issued a press release regarding its financial results for the

second quarter ended June 30, 2014. The Company is furnishing the press release attached hereto as Exhibit 99.1 pursuant to Item 2.02 of Form 8-K. In accordance with General Instruction B.2 of Form 8-K, the information in this

Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

On July 28, 2014, the Company announced that its Board of Directors has appointed James L. Bierman as

President & Chief Executive Officer effective September 1, 2014. Mr. Bierman currently serves as President & Chief Operating Officer of the Company. Current Chairman & Chief Executive Officer, Craig R. Smith, will continue

with the Company in the role of Executive Chairman effective September 1, 2014.

The Board of Directors also elected Mr. Bierman as a

director of the Company, effective September 1, 2014, to serve until the 2015 Annual Meeting of Shareholders and until his successor is duly elected and qualified.

Mr. Bierman, age 61, joined the Company in June 2007 as Senior Vice President, Chief Financial Officer and was promoted to Executive Vice

President & Chief Financial Officer in April 2011, to Executive Vice President & Chief Operating Officer in March 2012 and to President & Chief Operating Officer in August 2013. Mr. Bierman served as Executive Vice

President & Chief Financial Officer at Quintiles Transnational Corp. from 2001 to 2004, having joined Quintiles Transnational Corp. in 1998. From 1988 to 1998, he was a partner of Arthur Andersen LLP. Mr. Bierman currently serves on

the Board of Directors of Team Health Holdings, Inc. and formerly served on the Board of Directors of Quintiles Transnational Corp. and Pharma Services Holding, Inc.

As compensation for his services as President & Chief Executive Officer, effective September 1, 2014, Mr. Bierman will

receive an increase in his annual base salary from $700,000 to $850,000 and a special grant of $455,000 in value of shares of restricted stock which vest at the end of three years from the date of grant (in accordance with the Company’s

standard form grant agreement for such restricted stock awards) and $455,000 in value of performance shares tied to performance goals relating to international financial performance, acquisition integration and synergies, and core business results.

Mr. Bierman also will be eligible for a target annual incentive opportunity of 75% of his base salary.

Mr. Smith, age 63,

joined the Company in 1989 and has served as Chief Executive Officer since 2005 and Chairman since August 2013. As compensation for his services as Executive Chairman, Mr. Smith’s annual salary commencing September 1, 2014 will be

$750,000, and he will continue to participate in the Company’s benefit programs to which he is eligible as an executive officer. His participation in the Company’s 2014 Annual Incentive Plan will be prorated through September 1, 2014.

The press release announcing the foregoing management changes is included as Exhibit 99.2 to this Current Report on Form 8-K and is

incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On July 25, 2014, the Board of Directors amended the Bylaws of the Company, effective September 1, 2014, to increase the number of

directors constituting the Board of Directors from 10 to 11 in connection with the appointment of the new director as discussed in Item 5.02 above. The Amended and Restated Bylaws of the Company are included as Exhibit 3.1 to this Form 8-K and

incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

3.1 Amended and Restated Bylaws of the Company

99.1 Press Release issued by the Company on July 28, 2014 regarding Second Quarter Financial Results (furnished pursuant to

Item 2.02)

99.2 Press Release issued by the Company on July 28, 2014 regarding Management Changes

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

OWENS & MINOR, INC. |

|

|

|

| Date: July 29, 2014 |

|

By: |

|

/s/ Grace R. den Hartog |

|

|

|

|

Name: |

|

Grace R. den Hartog |

|

|

|

|

Title: |

|

Senior Vice President, General Counsel and Corporate Secretary |

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 3.1 |

|

Amended and Restated Bylaws of the Company |

|

|

| 99.1 |

|

Press Release issued by the Company on July 28, 2014 regarding Second Quarter Financial Results (furnished pursuant to Item 2.02) |

|

|

| 99.2 |

|

Press Release issued by the Company on July 28, 2014 regarding Management Changes |

Exhibit 3.1

AMENDED AND RESTATED

BYLAWS

OF

OWENS & MINOR, INC.

ARTICLE I

Meetings

of Shareholders

1.1 Places of Meetings. All meetings of the shareholders shall be held at such place, either within or

without the Commonwealth of Virginia, as from time to time may be fixed by the Board of Directors.

1.2 Annual Meetings. The annual

meeting of the shareholders, for the election of Directors and transaction of such other business as may come before the meeting, shall be held on such business day that is not earlier than the first day of March and not later than the last day of

May, or at such other time, as shall be fixed by the Board of Directors.

1.3 Special Meetings. A special meeting of the

shareholders for any purpose or purposes may be called at any time by the Chairman of the Board, the Chief Executive Officer, or by a majority of the Board of Directors. At a special meeting no business shall be transacted and no corporate action

shall be taken other than that stated in the notice of the meeting.

1.4 Notice of Meetings. Written or printed notice stating the

place, day and hour of every meeting of the shareholders and, in case of a special meeting, the purpose or purposes for which the meeting is called, shall be given not less than ten nor more than sixty days before the date of the meeting to each

shareholder of record entitled to vote at such meeting in any manner permitted by the Virginia Stock Corporation Act, including by electronic transmission (as defined therein). Such further notice shall be given as may be required by law, but

meetings may be held without notice if all the shareholders entitled to vote at the meeting are present in person or by proxy or if notice is waived in writing by those not present, either before or after the meeting.

1.5 Quorum. Any number of shareholders together holding at least a majority of the outstanding shares of capital stock entitled to vote

with respect to the business to be transacted, who shall be present in person or represented by proxy at any meeting duly called, shall constitute a quorum for the transaction of business. If less than a quorum shall be in attendance at the time for

which a meeting shall have been called, the meeting may be adjourned from time to time by the Chairman of the meeting or by a majority of the shareholders present or represented by proxy without notice other than by announcement at the meeting.

1.6 Voting. At any meeting of the shareholders each shareholder of a class entitled to vote on any matter coming before the meeting

shall, as to such matter, have one vote, in person or by proxy, for each share of capital stock of such class standing in his name on the books of the

Corporation on the date, not more than seventy days prior to such meeting, fixed by the Board of Directors as the record date for the purpose of determining shareholders entitled to vote. Every

proxy shall be executed in writing or by any means permitted by the Virginia Stock Corporation Act or other applicable law. In each case, such proxy must be authorized by the shareholder or by the shareholder’s duly authorized officer,

director, employee, agent or attorney-in-fact.

1.7 Inspectors. An appropriate number of inspectors for any meeting of shareholders

may be appointed by the Chairman of such meeting. Inspectors so appointed will open and close the polls, will receive and take charge of proxies and ballots, and will decide all questions as to the qualifications of voters, validity of proxies and

ballots, and the number of votes properly cast.

1.8 Nomination by Shareholders. Subject to any rights of holders of shares of the

Preferred Stock of the Corporation, if any, nominations for the election of directors shall be made by the Board of Directors or by any shareholder entitled to vote in elections of directors. However, any shareholder entitled to vote in the election

of directors may nominate one or more persons for election as directors only at an annual meeting and if written notice of such shareholders’ intent to make such nomination or nominations has been given, either by personal delivery or by United

States registered or certified mail, postage prepaid, to the Secretary of the Corporation not later than 120 days before the anniversary of the date of the Corporation’s immediately preceding annual meeting. In no event shall the public

announcement of an adjournment or postponement of an annual meeting or the fact that an annual meeting is held after the anniversary of the preceding annual meeting commence a new time period for the giving of a shareholder’s notice as

described above. Each notice shall set forth (i) the name and address of record of the shareholder who intends to make the nomination, the beneficial owner, if any, on whose behalf the nomination is made and of the person or persons to be

nominated, (ii) the class and number of shares of the Corporation that are owned by the shareholder and such beneficial owners, (iii) a representation that the shareholder is a holder of record of shares of the Corporation entitled to vote

at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, (iv) a description of all arrangements, understandings or relationships between the shareholder and each

nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder, (v) a description (including the names of any counterparties) of any agreement,

arrangement or understanding (including any derivative or short positions, profit interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the shareholder’s notice by, or on behalf

of, the shareholder and any other person on whose behalf the nomination is made, the effect or intent of which is to mitigate loss, manage risk or benefit resulting from share price changes of, or increase or decrease the voting power of the

shareholder or any other person on whose behalf the nomination is made with respect to, shares of stock of the Corporation, (vi) a description (including the names of any counterparties) of any agreement, arrangement or understanding with

respect to such nomination between or among the shareholder or any other person on whose behalf the nomination is made and any of its affiliates or associates, and any others acting in concert with any of the foregoing, (vii) a representation

that the shareholder will notify the

2

Corporation in writing of any changes to the information provided pursuant to clauses (iii), (v) and (vi) above that are in effect as of the record date for the relevant meeting

promptly following the later of the record date or the date notice of the record date is first publicly disclosed, and (viii) such other information regarding each nominee proposed by such shareholder as would be required to be disclosed in

solicitations of proxies for election of directors in an election contest, or is otherwise required to be disclosed, pursuant to applicable laws, had the nominee been nominated, or intended to be nominated, by the Board of Directors, and shall

include a consent signed by each such nominee to serve as a director of the Corporation if so elected. In the event that a shareholder attempts to nominate any person without complying with the procedures set forth in this Section 1.8, such

person shall not be nominated and shall not stand for election at such meeting. The Chairman of the Board of Directors shall have the power and duty to determine whether a nomination proposed to be brought before the meeting was made in accordance

with the procedures set forth in this Section 1.8 and, if any proposed nomination is not in compliance with this Section 1.8, to declare that such defective proposal shall be disregarded.

1.9 Business Proposed by a Shareholder. To be properly brought before a meeting of shareholders, business must be (i) specified in

the notice of meeting (or any supplement thereto) given by or at the direction of the Board of Directors, (ii) otherwise properly brought before the meeting by or at the direction of the Board of Directors or (iii) otherwise properly

brought before an annual meeting by a shareholder. In addition to any other applicable requirements, for business to be properly brought before an annual meeting by a shareholder, the shareholder must have given timely notice thereof in writing to

the Secretary of the Corporation. To be timely, a shareholder’s notice must be given, either by personal delivery or by United States registered or certified mail, postage prepaid, to the Secretary of the Corporation not later than 120 days

before the anniversary of the date of the Corporation’s immediately preceding annual meeting. In no event shall the public announcement of an adjournment or postponement of an annual meeting or the fact that an annual meeting is held after the

anniversary of the preceding annual meeting commence a new time period for the giving of a shareholder’s notice as described above. A shareholder’s notice to the Secretary shall set forth as to each matter the shareholder proposes to bring

before the meeting (i) a brief description of the business desired to be brought before the meeting, including the complete text of any resolutions to be presented at the meeting with respect to such business, and the reasons for conducting

such business at the meeting, (ii) the name and address of record of the shareholder proposing such business and the beneficial owner, if any, on whose behalf the proposal is made, (iii) the class and number of shares of the Corporation

that are owned by the shareholder and such beneficial owner, (iv) any material interest of the shareholder and such beneficial owner, in such business, (v) a description (including the names of any counterparties) of any agreement,

arrangement or understanding (including any derivative or short positions, profit interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the shareholder’s notice by, or on behalf

of, the shareholder and any other person on whose behalf the proposal is made, the effect or intent of which is to mitigate loss, manage risk or benefit resulting from share price changes of, or increase or decrease the voting power of the

shareholder or any other person on whose behalf the proposal is made with respect to, shares of stock of the

3

Corporation, (vi) a description (including the names of any counterparties) of any agreement, arrangement or understanding with respect to such business between or among the shareholder or

any other person on whose behalf the proposal is made and any of its affiliates or associates, and any others acting in concert with any of the foregoing, and (vii) a representation that the shareholder will notify the Corporation in writing of

any changes to the information provided pursuant to clauses (iii), (v) and (vi) above that are in effect as of the record date for the relevant meeting promptly following the later of the record date or the date notice of the record date

is first publicly disclosed. In the event that a shareholder attempts to bring business before a meeting without complying with the procedures set forth in this Section 1.9, such business shall not be transacted at such meeting. The Chairman of

the Board of Directors shall have the power and duty to determine whether any proposal to bring business before the meeting was made in accordance with the procedures set forth in this Section 1.9 and, if any business is not proposed in

compliance with this Section 1.9, to declare that such defective proposal shall be disregarded and that such proposed business shall not be transacted at such meeting.

ARTICLE II

Directors

2.1

General Powers. The property, affairs and business of the Corporation shall be managed under the direction of the Board of Directors, and, except as otherwise expressly provided by law, the Articles of Incorporation or these Bylaws, all of

the powers of the Corporation shall be vested in such Board.

2.2 Number of Directors. The number of Directors constituting the

Board of Directors shall be eleven (11).

2.3 Election and Removal of Directors; Quorum.

(a) Directors shall be elected at each annual meeting to serve until the next annual meeting of shareholders and until their successors are

elected.

(b) Any Director may be removed from office at a meeting called expressly for that purpose by the vote of shareholders holding

not less than a majority of the shares entitled to vote at an election of Directors.

(c) Any vacancy occurring in the Board of Directors

may be filled by the affirmative vote of the majority of the remaining Directors though less than a quorum of the Board, and the term of office of any Director so elected shall expire at the next shareholders’ meeting at which directors are

elected.

(d) A majority of the number of Directors fixed by these Bylaws shall constitute a quorum for the transaction of business. The

act of a majority of Directors present at a meeting at which a quorum is present shall be the act of the Board of Directors. Less than a quorum may adjourn any meeting.

4

2.4 Meetings of Directors. An annual meeting of the Board of Directors shall be held as

soon as practicable after the adjournment of the annual meeting of shareholders at such place as the Board may designate. Other meetings of the Board of Directors shall be held at places within or without the Commonwealth of Virginia and at times

fixed by resolution of the Board, or upon call of the Chairman of the Board, the Chief Executive Officer or a majority of the Directors. The Secretary or officer performing the Secretary’s duties shall give not less than twenty-four hours’

notice by letter, electronic transmission (as defined in the Virginia Stock Corporation Act) or telephone (or in person) of all meetings of the Board of Directors, provided that notice need not be given of the annual meeting or of regular meetings

held at times and places fixed by resolution of the Board. Meetings may be held at any time without notice if all of the Directors are present, or if those not present waive notice in writing either before or after the meeting. The notice of

meetings of the Board need not state the purpose of the meeting.

2.5 Compensation. By resolution of the Board, Directors who are

not employed by the Corporation may receive reasonable Directors’ fees in the form of cash and/or equity based awards including additional amounts paid to chairs of committees and to members of committees that meet more frequently or for longer

periods of time.

2.6 Eligibility for Service as a Director. No person shall be appointed or be eligible for election to the Board

of Directors of the Corporation if such person, at the time of the prospective appointment or election, is more than 72 years of age.

2.7

Director Emeritus. The Board of Directors may from time to time elect one or more former directors as Directors Emeriti. Election as a Director Emeritus shall be in recognition of contributions during his or her tenure on the Board of

Directors and in appreciation for loyal and dedicated service. A Director Emeritus shall be elected for a term expiring on the date of the next annual meeting of the Board and will be recognized at the annual meeting. A Director Emeritus is an

honorary non-compensated position and not considered a “Director” for the purposes of these Bylaws or for any other purpose, including Section 16 under the Exchange Act. Therefore, Director Emeriti may attend Board meetings and

participate in other Board events only at the invitation of the Chairman.

5

ARTICLE III

Committees

3.1

Executive Committee. The Board of Directors, by resolution adopted by a majority of the number of Directors fixed by these Bylaws, may elect an Executive Committee which shall consist of not less than three Directors, including the Chief

Executive Officer (if the Chief Executive Officer is also a Director). When the Board of Directors is not in session, the Executive Committee shall have all power vested in the Board of Directors by law, by the Articles of Incorporation, or by these

Bylaws, provided that the Executive Committee shall not have power to (i) approve or recommend to shareholders action that the Virginia Stock Corporation Act requires to be approved by shareholders; (ii) fill vacancies on the Board or on

any of its committees; (iii) amend the Articles of Incorporation pursuant to §13.1-706 of the Virginia Stock Corporation Act; (iv) adopt, amend, or repeal the Bylaws; (v) approve a plan of merger not requiring shareholder

approval; (vi) authorize or approve a distribution, except according to a general formula or method prescribed by the Board of Directors; or (vii) authorize or approve the issuance or sale or contract for sale of shares, or determine the

designation and relative rights, preferences, and limitations of a class or series of shares, other than within limits specifically prescribed by the Board of Directors. The Executive Committee shall report at the next regular or special meeting of

the Board of Directors all action that the Executive Committee may have taken on behalf of the Board since the last regular or special meeting of the Board of Directors.

3.2 Other Committees. The Board of Directors, by resolution adopted by a majority of the number of Directors fixed by these Bylaws, may

establish such other standing or special committees of the Board as it may deem advisable, consisting of not less than two Directors; and the members, terms and authority of such committees shall be as set forth in the resolutions establishing the

same.

3.3 Meetings. Regular and special meetings of any Committee established pursuant to this Article may be called and held

subject to the same requirements with respect to time, place and notice as are specified in these Bylaws for regular and special meetings of the Board of Directors.

3.4 Quorum and Manner of Acting. A majority of the number of members of any Committee shall constitute a quorum for the transaction of

business at such meeting. The action of a majority of those members present at a Committee meeting at which a quorum is present shall constitute the act of the Committee.

3.5 Term of Office. Members of any Committee shall be elected as above provided and shall hold office until their successors are

elected by the Board of Directors or until such Committee is dissolved by the Board of Directors.

6

3.6 Resignation and Removal. Any member of a Committee may resign at any time by giving

written notice of his intention to do so to the Chief Executive Officer or the Secretary of the Corporation, or may be removed, with or without cause, at any time by such vote of the Board of Directors as would suffice for his election.

3.7 Vacancies. Any vacancy occurring in a Committee resulting from any cause whatever may be filled by a majority of the number of

Directors fixed by these Bylaws.

ARTICLE IV

Officers

4.1

Election of Officers: Terms. The officers of the Corporation shall consist of a Chief Executive Officer, a President, a Chief Financial Officer and a Secretary. Other officers, including a Chairman of the Board, one or more Vice Presidents

(whose seniority and titles, including Executive Vice Presidents and Senior Vice Presidents, may be specified by the Board of Directors), and assistant and subordinate officers, may from time to time be elected by the Board of Directors. All

officers shall hold office until the next annual meeting of the Board of Directors and until their successors are elected. Any two or more offices may be combined in and held by the same person, as the Board of Directors may determine.

4.2 Removal of Officers: Vacancies. Any officer of the Corporation may be removed summarily with or without cause, at any time, by the

Board of Directors. Vacancies may be filled by the Board of Directors.

4.3 Duties. The officers of the Corporation shall have such

duties as generally pertain to their offices, respectively, as well as such powers and duties as are prescribed by law or are hereinafter provided or as from time to time shall be conferred by the Board of Directors. The Board of Directors may

require any officer to give such bond for the faithful performance of his duties as the Board may see fit.

4.4 Duties of the Chief

Executive Officer. The Chief Executive Officer shall be either the Chairman of the Board or the President of the Corporation, as designated by the Board of Directors. Subject to the direction and control of the Board of Directors, the Chief

Executive Officer shall supervise and control the management of the Corporation, shall be primarily responsible for the implementation of policies of the Board of Directors and shall have such duties and authority as are normally incident to the

position of chief executive officer of a corporation and such other duties and authority as may be prescribed from time to time by the Board of Directors or as are provided elsewhere in these Bylaws. The Chief Executive Officer may sign and execute

in the name of the Corporation share certificates, deeds, mortgages, bonds, contracts or other instruments except in cases where the signing and execution thereof shall be expressly delegated by these Bylaws to some other officer or agent of the

Corporation or shall be required by law or otherwise to be signed or executed by some other officer of the Corporation.

7

4.5 Duties of the Chairman of the Board. The Board of Directors may, but need not, appoint

from among its members an officer designated as the Chairman of the Board. The Chairman of the Board shall, when present, preside over meetings of the Board of Directors and meetings of the shareholders, and shall have such other duties and

authority as may be prescribed from time to time by the Board of Directors or as are provided for elsewhere in these Bylaws.

4.6

Duties of the President. Subject to the direction and control of the Board of Directors and the Chief Executive Officer (if the President is not also the Chief Executive Officer), the President shall supervise and control the operations of

the Corporation and shall have such other duties as may be prescribed from time to time by the Board of Directors or the Chief Executive Officer (if the President is not also the Chief Executive Officer) or as are provided elsewhere in these Bylaws.

The President may sign and execute in the name of the Corporation share certificates, deeds, mortgages, bonds, contracts or other instruments except in cases where the signing and execution thereof shall be expressly delegated by the Board of

Directors or the Chief Executive Officer to some other officer or agent of the Corporation or shall be required by law or otherwise to be signed or executed by some other officer of the Corporation.

4.7 Duties of the Vice Presidents. Each Vice President (which term includes any Senior Executive Vice President, Executive Vice

President and Senior Vice President), if any, shall have such powers and duties as may from time to time be assigned to him by the Chief Executive Officer or the Board of Directors. Any Vice President may sign and execute in the name of the

Corporation deeds, mortgages, bonds, contracts or other instruments authorized by the Board of Directors, except where the signing and execution of such documents shall be expressly delegated by the Board of Directors or the Chief Executive Officer

to some other officer or agent of the Corporation or shall be required by law or otherwise to be signed or executed by some other officer of the Corporation.

4.8 Duties of the Chief Financial Officer. The Chief Financial Officer shall (i) be the chief financial officer of the Corporation

and have responsibility for all financial affairs of the Corporation, (ii) negotiate the terms of and procure capital required by the Corporation, (iii) be responsible for maintaining adequate financial accounts and records in accordance

with generally accepted accounting principles and applicable laws and regulations, (iv) be responsible for the Corporation’s internal control over financial reporting, (v) have charge of and be responsible for all funds, securities,

receipts and disbursements of the Corporation, (vi) deposit all monies and securities of the Corporation in such banks and depositories as shall be designated by the Board of Directors, and (vii) otherwise perform all duties incident to

the office of Chief Financial Officer and such other duties as from time to time may be assigned to him by the Board of Directors or the Chief Executive Officer. The Chief Financial Officer may sign and execute in the name of the Corporation share

certificates, deeds, mortgages, bonds, contracts or other instruments, except in cases where the signing and the execution thereof shall be expressly delegated by the Board of Directors or by these Bylaws to some other officer or agent of the

Corporation or shall be required by law or otherwise to be signed or executed by some other officer of the Corporation.

8

4.9 Duties of the Secretary. The Secretary shall act as secretary of all meetings of the

Board of Directors and shareholders of the Corporation. When requested, the Secretary shall also act as secretary of the meetings of the committees of the Board. The Secretary (i) shall keep and preserve the minutes of all such meetings in

permanent books; (ii) shall see that all notices required to be given by the Corporation are duly given and served; (iii) shall have custody of the seal of the Corporation and shall affix the seal or cause it to be affixed by facsimile or

otherwise to all share certificates of the Corporation and to all documents the execution of which on behalf of the Corporation under its corporate seal is required in accordance with law or the provisions of these Bylaws; (iv) shall have

custody of all deeds, leases, contracts and other important corporate documents; (v) shall have charge of the books, records and papers of the Corporation relating to its organization and management as a Corporation; (vi) shall see that

all reports, statements and other documents required by law (except tax returns) are properly filed; and (vii) shall in general perform all the duties incident to the office of Secretary and such other duties as from time to time may be

assigned to him by the Board of Directors or the Chief Executive Officer. The Secretary may sign and execute in the name of the Corporation share certificates, except in cases where the signing and the execution thereof shall be expressly delegated

by the Board of Directors or by these Bylaws to some other officer or agent of the Corporation or shall be required by law or otherwise to be signed or executed by some other officer of the Corporation.

4.10 Compensation. The Board of Directors shall have authority to fix the compensation of all officers of the Corporation.

ARTICLE V

Capital

Stock

5.1 Form. The shares of capital stock of the Corporation may be evidenced by certificates in forms prescribed by the

Board of Directors and executed in any manner permitted by law and stating thereon the information required by law. Alternatively, some or all of the shares of capital stock of the Corporation may be issued without certificates in which case, within

a reasonable time after issuance or transfer, the Corporation shall send or cause to be sent to the shareholder a written statement that shall include the information required by law to be set forth on certificates for shares of capital stock.

Transfer agents and/or registrars for one or more classes of shares of the Corporation may be appointed by the Board of Directors and may be required to countersign certificates representing shares of such class or classes. If any officer whose

signature or facsimile thereof shall have been used on a share certificate shall for any reason cease to be an officer of the Corporation and such certificate shall not then have been delivered by the Corporation, it may thereafter be issued and

delivered as though such person had not ceased to be an officer of the Corporation.

9

5.2 Lost, Destroyed and Mutilated Certificates. Holders of certificated shares of the

Corporation shall immediately notify the Corporation of any loss, destruction or mutilation of the certificate therefor, and the Board of Directors may in its discretion cause one or more new certificates or uncertificated shares for the same number

of shares in the aggregate to be issued to such shareholder upon the surrender of the mutilated certificate or upon satisfactory proof of such loss or destruction, and the deposit of a bond in such form and amount and with such surety as the Board

of Directors may require.

5.3 Transfer of Shares. The Board of Directors may make rules and regulations concerning the issue,

registration and transfer of shares and/or certificates representing the shares of the Corporation. The certificated shares of the Corporation shall be transferable or assignable only on the books of the Corporation by the holder in person or by

attorney on surrender of the duly endorsed certificate for such shares accompanied by written assignment, and, if sought to be transferred by attorney, accompanied by a written power of attorney to have the same transferred on the books of the

Corporation. Uncertificated shares shall be transferable or assignable only on the books of the Corporation upon proper instruction from the holder of such shares. The Corporation will recognize, however, the exclusive right of the person registered

on its books as the owner of shares to receive dividends or other distributions and to vote as such owner. To the extent that any provision of the Amended and Restated Rights Agreement between the Corporation and Bank of New York, as Rights Agent,

dated as of April 30, 2004, is deemed to constitute a restriction on the transfer of any securities of the Corporation, including, without limitation, the Rights, as defined therein, such restriction is hereby authorized by these Bylaws.

5.4 Fixing Record Date. For the purpose of determining shareholders entitled to notice of or to vote at any meeting of shareholders or

any adjournment thereof, or entitled to receive payment of any dividend or other distribution, or in order to make a determination of shareholders for any other proper purpose, the Board of Directors may fix in advance a date as the record date for

any such determination of shareholders, such date in any case to be not more than seventy days prior to the date on which the particular action, requiring such determination of shareholders, is to be taken. If no record date is fixed for the

determination of shareholders entitled to notice of or to vote at a meeting of shareholders, or shareholders entitled to receive payment of a dividend or other distribution, the date on which notices of the meeting are mailed or the date on which

the resolution of the Board of Directors declaring such dividend or other distribution is adopted, as the case may be, shall be the record date for such determination of shareholders. When a determination of shareholders entitled to vote at any

meeting of shareholders has been made as provided in this section, such determination shall apply to any adjournment thereof unless the Board of Directors fixes a new record date, which it shall do if the meeting is adjourned to a date more than 120

days after the date fixed for the original meeting.

5.5 Control Share Acquisition Statute. Article 14.1 of the Virginia Stock

Corporation Act shall not apply to acquisitions of shares of capital stock of the Corporation.

10

ARTICLE VI

Miscellaneous Provisions

6.1 Seal. The seal of the Corporation shall consist of a circular design with the words “Owens & Minor, Inc.” around

the top margin thereof, “Richmond, Virginia” around the lower margin thereof and the word “Seal” in the center thereof.

6.2 Fiscal Year. The fiscal year of the Corporation shall end on such date and shall consist of such accounting periods as may be fixed

by the Board of Directors.

6.3 Checks, Notes and Drafts. Checks, notes, drafts and other orders for the payment of money shall be

signed by such persons as the Board of Directors from time to time may authorize. When the Board of Directors so authorizes, however, the signature of any such person may be a facsimile.

6.4 Amendment of Bylaws. Unless proscribed by the Articles of Incorporation, these Bylaws may be amended or altered at any meeting of

the Board of Directors by affirmative vote of a majority of the number of Directors fixed by these Bylaws. The shareholders entitled to vote in respect of the election of Directors, however, shall have the power to rescind, amend, alter or repeal

any Bylaws and, subject to the limitations set forth in the Virginia Stock Corporation Act, to enact Bylaws which, if expressly so provided, may not be amended, altered or repealed by the Board of Directors.

6.5 Voting of Shares Held. Unless otherwise provided by resolution of the Board of Directors or of the Executive Committee, if any, the

Chief Executive Officer may cast the vote which the Corporation may be entitled to cast as a shareholder or otherwise in any other corporation, any of whose securities may be held by the Corporation, at meetings of the holders of the shares or other

securities of such other corporation, or to consent in writing to any action by any such other corporation, or in lieu thereof, from time to time appoint an attorney or attorneys or agent or agents of the Corporation, in the name and on behalf of

the Corporation, to cast such votes or give such consents. The Chief Executive Officer shall instruct any person or persons so appointed as to the manner of casting such votes or giving such consent and may execute or cause to be executed on behalf

of the Corporation, and under its corporate seal or otherwise, such written proxies, consents, waivers or other instruments as may be necessary or proper.

ARTICLE VII

Emergency Bylaws

7.1 The Emergency Bylaws provided in this Article VII shall be operative during any emergency, notwithstanding any different provision in the

preceding Articles of these Bylaws or in the Articles of Incorporation of the Corporation or in the Virginia Stock Corporation Act (other

11

than those provisions relating to emergency bylaws). An emergency exists if a quorum of the Corporation’s Board of Directors cannot readily be assembled because of some catastrophic event.

To the extent not inconsistent with these Emergency Bylaws, the Bylaws provided in the preceding Articles shall remain in effect during such emergency and upon the termination of such emergency, the Emergency Bylaws shall cease to be operative

unless and until another such emergency shall occur.

7.2 During any such emergency:

(a) Any meeting of the Board of Directors may be called by any officer of the Corporation or by any Director. The notice thereof shall specify

the time and place of the meeting. To the extent feasible, notice shall be given in accord with Section 2.4 above, but notice may be given only to such of the Directors as it may be feasible to reach at the time, by such means as may be

feasible at the time, including publication or radio, and at a time less than twenty-four hours before the meeting if deemed necessary by the person giving notice. Notice shall be similarly given, to the extent feasible, to the other persons

referred to in (b) below.

(b) At any meeting of the Board of Directors, a quorum shall consist of a majority of the number of

Directors fixed at the time by these Bylaws. If the Directors present at any particular meeting shall be fewer than the number required for such quorum, other persons present as referred to below, to the number necessary to make up such quorum,

shall be deemed Directors for such particular meeting as determined by the following provisions and in the following order of priority:

(i) Vice-Presidents not already serving as Directors, in the order of their seniority of first election to such offices, or if two or more

shall have been first elected to such offices on the same day, in the order of their seniority in age;

(ii) All other officers of the

Corporation in the order of their seniority of first election to such offices, or if two or more shall have been first elected to such offices on the same day, in the order of their seniority in age; and

(iii) Any other persons that are designated on a list that shall have been approved by the Board of Directors before the emergency, such

persons to be taken in such order of priority and subject to such conditions as may be provided in the resolution approving the list.

(c)

The Board of Directors, during as well as before any such emergency, may provide, and from time to time modify, lines of succession in the event that during such an emergency any or all officers or agents of the Corporation shall for any reason be

rendered incapable of discharging their duties.

(d) The Board of Directors, during as well as before any such emergency, may, effective

in the emergency, change the principal office, or designate several alternative offices, or authorize the officers so to do.

12

7.3 No officer, Director or employee shall be liable for action taken in good faith in accordance

with these Emergency Bylaws.

7.4 These Emergency Bylaws shall be subject to repeal or change by further action of the Board of Directors

or by action of the shareholders, except that no such repeal or change shall modify the provisions of the next preceding paragraph with regard to action or inaction prior to the time of such repeal or change. Any such amendment of these Emergency

Bylaws may make any further or different provision that may be practical and necessary for the circumstances of the emergency.

Amended 7/25/2014

13

Exhibit 99.1

FOR IMMEDIATE RELEASE

July 28, 2014

Owens & Minor Releases 2nd Quarter 2014 Financial Results

Richmond, Va. — BUSINESS WIRE — July 28, 2014 — Owens & Minor, Inc. (NYSE:OMI) today reported financial results for the second

quarter ended June 30, 2014, including the following items:

| |

• |

|

Consolidated quarterly revenue was $2.31 billion, an increase of 3.1% |

| |

• |

|

Adjusted net income per diluted share was $0.40 for the quarter |

| |

• |

|

Owens & Minor announced plans to acquire Medical Action Industries Inc. during 2Q 2014 |

For the

quarter ended June 30, 2014, the company reported consolidated quarterly revenues of $2.31 billion, an increase of 3.1% over the second quarter of 2013. Quarterly net income was $19.9 million, or $0.32 per diluted share. Adjusted net income

(non-GAAP), excluding after-tax charges of $2.5 million for acquisition-related and $2.6 million for exit and realignment activities, was $25.0 million, or $0.40 per diluted share.

Consolidated operating earnings for the second quarter of 2014 were $37.1 million, a decline of $12.9 million, when compared to the second quarter last year.

Adjusted consolidated operating earnings (non-GAAP) for the second quarter of 2014 were $44.7 million, or 1.94% of revenues, a decline of $6.0 million when compared to the year before.

“While second quarter results were impacted by many of the same trends that we saw earlier in the year, we are confident that the deliberate actions we

are taking to on-board new customers and realign our platforms and teams in the U.S. and Europe will drive performance in the second half of 2014,” said Craig R. Smith, chairman & chief executive officer of Owens & Minor.

“In the U.S., we continued to see growth among our larger healthcare provider customer accounts. In Europe, we continue to work on optimizing the network and improving operations, especially in the U.K. On the Domestic side, we are looking

forward to completing the Medical Action Industries acquisition, which will enable us to expand service offerings to our healthcare provider and manufacturer customers. We believe Owens & Minor remains well positioned to create sustainable

value for our shareholders.”

Acquisition Update

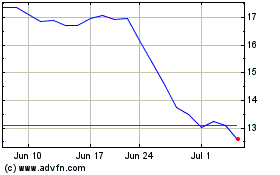

During the second quarter, Owens & Minor announced plans to acquire Medical Action Industries Inc. (Medical Action) (Nasdaq:MDCI), a leading producer

of surgical kits and procedure trays. The acquisition will enable an expansion of Owens & Minor’s capabilities in the global sourcing and production of kits, packs and trays for the healthcare market. Under terms of the definitive

agreement, Owens & Minor will acquire all outstanding shares of Medical Action Industries Inc. for $13.80 per share in cash, representing a total transaction value of approximately $208 million, including assumed debt, net of cash. Medical

Action reported $288 million in net sales from continuing operations for the fiscal year ended March 31, 2014, of which approximately 45% represented sales to Owens & Minor. The transaction, which is expected to close in the fourth

quarter of 2014, is subject to customary closing conditions, including Medical Action shareholder approval. Owens & Minor has been notified that the Federal Trade Commission has granted early termination of the waiting period under the

1

Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR) in connection with the proposed acquisition. Owens & Minor intends to finance the transaction with existing cash and available

borrowings under its revolving credit facility.

The acquisition of Medical Action is expected to be accretive to Owens & Minor’s adjusted

net income (non-GAAP) in 2015, including anticipated partial synergies in the first full year of ownership. Owens & Minor estimates annual pre-tax cost synergies of $10 to $12 million by the end of calendar year 2016, excluding potential

revenue synergies. Aside from transaction-related costs, which will be reported as acquisition-related and exit and realignment charges, the impact to Owens & Minor ’s 2014 adjusted net income per diluted share will be limited

primarily to the fourth quarter of 2014, and is not expected to be significant.

“This strategic acquisition, a highly complementary business, opens

up a new growth area for our company by allowing us to produce custom procedure trays and minor procedure kits for our provider and manufacturer customers,” said James L. Bierman, president & chief operating officer of Owens &

Minor. “It is a natural expansion of our strategy to provide customers more complete and cost-effective solutions globally. Combined with the steps we are taking to reduce costs and increase efficiencies, the continued focus on core

capabilities with customer-driven solutions that will allow us to remain at the forefront of connecting the world of medical products to the point-of-care.”

2014 Year-to-Date Results

For the six months

ended June 30, 2014, consolidated revenues were $4.56 billion, increased approximately $79.8 million, or 1.8%, when compared to the first six months of 2013. Net income for the first half of 2014 was $45.4 million, or $0.72 per diluted share.

For the year-to-date period, adjusted net income (non-GAAP), which excludes after-tax charges of $3.0 million for acquisition-related and $4.3 million for exit and realignment activities, was $52.7 million, or $0.84 per diluted share. Year-to-date

results include the first-quarter recovery of $5.3 million, resulting from the settlement of a direct purchaser anti-trust class action lawsuit, which was included in other operating income.

Consolidated operating earnings for the year-to-date period of 2014 were $83.4 million, or 1.83% of revenues, compared to operating earnings of $97.9 million

for the same period of 2013. Adjusted consolidated operating earnings for the year-to-date period were $94.2 million, or 2.07% of revenues, a decline of 17 basis points versus the first six months of 2013.

Asset Management

The balance of cash and cash

equivalents was $92 million at June 30, 2014. For the year-to-date period of 2014, the company reported cash provided by operating activities of approximately $73 million. Asset management metrics for the quarter were strong with consolidated

days sales outstanding (DSO) of 20.6 days as of June 30, 2014, compared to DSO of 20.8 days as of June 30, 2013. Consolidated inventory turns were 10.2 for the second quarter of 2014, comparable to inventory turns for the same period last

year.

Segment Results

Domestic segment

revenues for the second quarter of 2014 were $2.19 billion, an increase of 2% when compared to the prior year’s second quarter revenue of $2.14 billion. The increase in second quarter Domestic segment revenues resulted primarily from growth

among larger healthcare provider customer accounts, partially offset by declines in revenue from smaller provider customers. For the year-to-date period, Domestic segment revenues were $4.34 billion, an increase of approximately 1% when compared to

the same period last year.

2

For the second quarter of 2014, Domestic segment operating earnings were $48.3 million, or 2.21% of segment

revenues, a decline of approximately $2.9 million, when compared to the same period of 2013. For the year-to-date period, Domestic segment operating earnings were $101.1 million, or 2.33% of segment revenues, a decline of $3.1 million, when compared

to operating earnings for the same period in the prior year. For both the quarter and the year-to-date periods, the decline in Domestic segment operating earnings reflected lower benefits from supplier price changes, as well as lower margin on new

and renewed customer contracts. Offsetting these negative factors were cost benefits realized from ongoing strategic initiatives designed to improve productivity and efficiency.

The International segment contributed revenue of $118 million for the second quarter of 2014 and had an operating loss of $3.6 million. For the year-to-date

period, the International segment reported $226 million in revenues, and an operating loss of $6.8 million. For both the quarter and the year-to-date periods, the company attributed the International segment operating losses to operations in the

United Kingdom, including increased costs associated with integrating a significant new customer and reduced customer activity.

2014 Outlook

Based on operating and financial results for the first half of 2014 and expectations for the remainder of the year, the company revised its

financial guidance for the year as follows:

For 2014, the company now expects revenue growth to exceed 2% and adjusted net income per diluted share to be

within a range of $1.80 to $1.90 for the year, excluding acquisition-related and exit and realignment activities.

The 2014 outlook is based on certain

assumptions that are subject to the risk factors discussed in the company’s filings with the Securities & Exchange Commission.

Investor Events

Owens & Minor is

scheduled to participate in investor conferences in second half of 2014; webcasts of the company’s formal presentations will be posted on the company’s corporate website:

| |

• |

|

R.W. Baird 2014 Healthcare Conference, New York – September 3, 2014 |

| |

• |

|

2014 Morgan Stanley Global Healthcare Conference, New York – September 8-10, 2014 |

| |

• |

|

2014 Credit Suisse Healthcare Conference, Phoenix – November 11-13, 2014 |

Investors Conference

Call & Supplemental Material

Conference Call: Owens & Minor will conduct a conference call for investors on Tuesday,

July 29, 2014, at 8:00 a.m. EDT. The access code for the conference call, international dial-in and replay is #70234446. Participants may access the call at 866-393-1604. The international dial-in number is 224-357-2191. Replay: A replay of the

call will be available for one week by dialing 855-859-2056. Webcast: A listen-only webcast of the call, along with supplemental information, will be available on www.owens-minor.com under “Investor Relations.”

Owens & Minor uses its website as a channel of distribution for material company information, including news releases, investor presentations and

financial information. This information is routinely posted and accessible under Investor Relations at

www.owens-minor.com.

Included with the press release financial tables are reconciliations of the differences between the non-GAAP financial measures presented in this news

release, which exclude acquisition-related and exit and realignment charges, and their most directly comparable GAAP financial measures.

3

Safe Harbor Statement

Except for historical information, the matters discussed in this press release may constitute forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from those projected. These risk factors are discussed in reports filed by the company with the Securities & Exchange Commission. All of this information is available at

www.owens-minor.com.

The company assumes no obligation,

and expressly disclaims any such obligation, to update or alter information, whether as a result of new information, future events, or otherwise.

Owens & Minor, Inc. (NYSE: OMI) is a leading healthcare logistics company dedicated to Connecting the World of Medical Products to

the Point of CareTM by providing vital supply chain services to healthcare providers and manufacturers of healthcare products. Owens & Minor provides logistics services across the

spectrum of medical products from disposable medical supplies to devices and implants. With logistics platforms strategically located in the United States and Europe, Owens & Minor serves markets where three quarters of global healthcare

spending occurs. Owens & Minor’s customers span the healthcare market from independent hospitals to large integrated healthcare networks, as well as group purchasing organizations, healthcare products manufacturers, and the federal

government. A FORTUNE 500 company, Owens & Minor is headquartered in Richmond, Virginia, and has annualized revenues exceeding $9 billion. For more information about Owens & Minor, visit the company website at

www.owens-minor.com.

|

|

|

| Contacts: |

|

Trudi Allcott, Director, Investor & Media Relations, 804-723-7555, truitt.allcott@owens-minor.com |

|

|

Chuck Graves, Director, Finance & Investor Relations, 804-723-7556, chuck.graves@owens-minor.com |

Source: Owens & Minor, Inc.

4

Owens & Minor, Inc.

Consolidated Statements of Income (unaudited)

(in

thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

| Net revenue |

|

$ |

2,305,858 |

|

|

$ |

2,236,077 |

|

| Cost of goods sold |

|

|

2,023,586 |

|

|

|

1,962,646 |

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

282,272 |

|

|

|

273,431 |

|

| Selling, general and administrative expenses |

|

|

225,838 |

|

|

|

212,548 |

|

| Acquisition-related and exit and realignment charges |

|

|

7,593 |

|

|

|

638 |

|

| Depreciation and amortization |

|

|

13,892 |

|

|

|

12,276 |

|

| Other operating income, net |

|

|

(2,152 |

) |

|

|

(2,081 |

) |

|

|

|

|

|

|

|

|

|

| Operating earnings |

|

|

37,101 |

|

|

|

50,050 |

|

| Interest expense, net |

|

|

3,342 |

|

|

|

3,248 |

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

33,759 |

|

|

|

46,802 |

|

| Income tax provision |

|

|

13,883 |

|

|

|

17,930 |

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

19,876 |

|

|

$ |

28,872 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.32 |

|

|

$ |

0.46 |

|

| Diluted |

|

$ |

0.32 |

|

|

$ |

0.46 |

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

| Net revenue |

|

$ |

4,562,239 |

|

|

$ |

4,482,461 |

|

| Cost of goods sold |

|

|

3,998,771 |

|

|

|

3,929,979 |

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

563,468 |

|

|

|

552,482 |

|

| Selling, general and administrative expenses |

|

|

451,448 |

|

|

|

430,269 |

|

| Acquisition-related and exit and realignment charges |

|

|

10,855 |

|

|

|

2,648 |

|

| Depreciation and amortization |

|

|

27,756 |

|

|

|

24,905 |

|

| Other operating income, net |

|

|

(9,978 |

) |

|

|

(3,274 |

) |

|

|

|

|

|

|

|

|

|

| Operating earnings |

|

|

83,387 |

|

|

|

97,934 |

|

| Interest expense, net |

|

|

6,589 |

|

|

|

6,446 |

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

76,798 |

|

|

|

91,488 |

|

| Income tax provision |

|

|

31,436 |

|

|

|

36,518 |

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

45,362 |

|

|

$ |

54,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.72 |

|

|

$ |

0.87 |

|

| Diluted |

|

$ |

0.72 |

|

|

$ |

0.87 |

|

Page 5

Owens & Minor, Inc.

Condensed Consolidated Balance Sheets (unaudited)

(in

thousands)

|

|

|

|

|

|

|

|

|

| |

|

June 30, 2014 |

|

|

December 31, 2013 |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

92,027 |

|

|

$ |

101,905 |

|

| Accounts and notes receivable, net |

|

|

545,179 |

|

|

|

572,854 |

|

| Merchandise inventories |

|

|

820,882 |

|

|

|

771,663 |

|

| Other current assets |

|

|

287,844 |

|

|

|

279,510 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,745,932 |

|

|

|

1,725,932 |

|

| Property and equipment, net |

|

|

207,140 |

|

|

|

191,961 |

|

| Goodwill, net |

|

|

275,975 |

|

|

|

275,439 |

|

| Intangible assets, net |

|

|

38,679 |

|

|

|

40,406 |

|

| Other assets, net |

|

|

96,085 |

|

|

|

90,304 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

2,363,811 |

|

|

$ |

2,324,042 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

698,648 |

|

|

$ |

643,872 |

|

| Accrued payroll and related liabilities |

|

|

29,691 |

|

|

|

23,296 |

|

| Deferred income taxes |

|

|

38,951 |

|

|

|

41,613 |

|

| Other current liabilities |

|

|

251,015 |

|

|

|

280,398 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,018,305 |

|

|

|

989,179 |

|

| Long-term debt, excluding current portion |

|

|

219,098 |

|

|

|

213,815 |

|

| Deferred income taxes |

|

|

42,080 |

|

|

|

43,727 |

|

| Other liabilities |

|

|

52,943 |

|

|

|

52,278 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

1,332,426 |

|

|

|

1,298,999 |

|

| Total equity |

|

|

1,031,385 |

|

|

|

1,025,043 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

$ |

2,363,811 |

|

|

$ |

2,324,042 |

|

|

|

|

|

|

|

|

|

|

Page 6

Owens & Minor, Inc.

Consolidated Statements of Cash Flows (unaudited)

(in

thousands)

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

|

|

| Operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

45,362 |

|

|

$ |

54,970 |

|

| Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

27,756 |

|

|

|

24,905 |

|

| Share-based compensation expense |

|

|

4,190 |

|

|

|

3,449 |

|

| Provision for losses on accounts and notes receivable |

|

|

334 |

|

|

|

315 |

|

| Deferred income tax (benefit) expense |

|

|

(5,151 |

) |

|

|

5,777 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts and notes receivable |

|

|

28,477 |

|

|

|

1,789 |

|

| Merchandise inventories |

|

|

(48,575 |

) |

|

|

(31,176 |

) |

| Accounts payable |

|

|

54,922 |

|

|

|

191,406 |

|

| Net change in other assets and liabilities |

|

|

(32,765 |

) |

|

|

(69,462 |

) |

| Other, net |

|

|

(1,078 |

) |

|

|

(2,794 |

) |

|

|

|

|

|

|

|

|

|

| Cash provided by operating activities |

|

|

73,472 |

|

|

|

179,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

|

|

| Additions to property and equipment |

|

|

(25,657 |

) |

|

|

(16,221 |

) |

| Additions to computer software and intangible assets |

|

|

(13,166 |

) |

|

|

(14,826 |

) |

| Proceeds from sale of investment |

|

|

1,937 |

|

|

|

— |

|

| Proceeds from sale of property and equipment |

|

|

45 |

|

|

|

68 |

|

|

|

|

|

|

|

|

|

|

| Cash used for investing activities |

|

|

(36,841 |

) |

|

|

(30,979 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

|

|

|

| Cash dividends paid |

|

|

(31,564 |

) |

|

|

(30,411 |

) |

| Repurchases of common stock |

|

|

(9,448 |

) |

|

|

(8,297 |

) |

| Excess tax benefits related to share-based compensation |

|

|

444 |

|

|

|

550 |

|

| Proceeds from exercise of stock options |

|

|

1,180 |

|

|

|

4,195 |

|

| Purchase of noncontrolling interest |

|

|

(1,500 |

) |

|

|

— |

|

| Other, net |

|

|

(4,441 |

) |

|

|

(5,167 |

) |

|

|

|

|

|

|

|

|

|

| Cash used for financing activities |

|

|

(45,329 |

) |

|

|

(39,130 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

(1,180 |

) |

|

|

868 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in cash and cash equivalents |

|

|

(9,878 |

) |

|

|

109,938 |

|

| Cash and cash equivalents at beginning of period |

|

|

101,905 |

|

|

|

97,888 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

92,027 |

|

|

$ |

207,826 |

|

|

|

|

|

|

|

|

|

|

Page 7

Owens & Minor, Inc.

Financial Statistics and GAAP/Non-GAAP Reconciliations (unaudited)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

| (in thousands, except ratios and per share data) |

|

6/30/2014 |

|

|

3/31/2014 |

|

|

12/31/2013 |

|

|

9/30/2013 |

|

|

6/30/2013 |

|

|

|

|

|

|

|

| Consolidated operating results: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic |

|

$ |

2,187,535 |

|

|

$ |

2,148,915 |

|

|

$ |

2,213,949 |

|

|

$ |

2,175,663 |

|

|

$ |

2,143,691 |

|

| International |

|

|

118,323 |

|

|

|

107,465 |

|

|

|

104,575 |

|

|

|

94,884 |

|

|

|

92,386 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenue |

|

$ |

2,305,858 |

|

|

$ |

2,256,380 |

|

|

$ |

2,318,524 |

|

|

$ |

2,270,547 |

|

|

$ |

2,236,077 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

$ |

282,272 |

|

|

$ |

281,195 |

|

|

$ |

291,263 |

|

|

$ |

273,329 |

|

|

$ |

273,431 |

|

| Gross margin as a percent of revenue |

|

|

12.24 |

% |

|

|

12.46 |

% |

|

|

12.56 |

% |

|

|

12.04 |

% |

|

|

12.23 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SG&A expenses |

|

$ |

225,838 |

|

|

$ |

225,610 |

|

|

$ |

222,043 |

|

|

$ |

211,344 |

|

|

$ |

212,548 |

|

| SG&A expenses as a percent of revenue |

|

|

9.79 |

% |

|

|

10.00 |

% |

|

|

9.58 |

% |

|

|

9.31 |

% |

|

|

9.51 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating earnings, as reported (GAAP) |

|

$ |

37,101 |

|

|

$ |

46,284 |

|

|

$ |

50,934 |

|

|

$ |

49,215 |

|

|

$ |

50,050 |

|

| Acquisition-related and exit and realignment charges |

|

|

7,593 |

|

|

|

3,262 |

|

|

|

7,049 |

|

|

|

2,747 |

|

|

|

638 |

|

| Operating earnings, adjusted (Non-GAAP) |

|

$ |

44,694 |

|

|

$ |

49,546 |

|

|

$ |

57,983 |

|

|

$ |

51,962 |

|

|

$ |

50,688 |

|

| Operating earnings as a percent of revenue, adjusted (Non-GAAP) |

|

|

1.94 |

% |

|

|

2.20 |

% |

|

|

2.50 |

% |

|

|

2.29 |

% |

|

|

2.27 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income, as reported (GAAP) |

|

$ |

19,876 |

|

|

$ |

25,485 |

|

|

$ |

27,942 |

|

|

$ |

27,970 |

|

|

$ |

28,872 |

|

| Acquisition-related and exit and realignment charges, after-tax |

|

|

5,095 |

|

|

|

2,222 |

|

|

|

5,024 |

|

|

|

1,899 |

|

|

|

412 |

|

| Net income, adjusted (Non-GAAP) |

|

$ |

24,971 |

|

|

$ |

27,707 |

|

|

$ |

32,966 |

|

|

$ |

29,869 |

|

|

$ |

29,284 |

|

|

|

|

|

|

|

|