Owens & Minor, Inc. (NYSE:OMI) today reported financial

results for the second quarter ended June 30, 2014, including the

following items:

- Consolidated quarterly revenue was

$2.31 billion, an increase of 3.1%

- Adjusted net income per diluted share

was $0.40 for the quarter

- Owens & Minor announced plans to

acquire Medical Action Industries Inc. during 2Q 2014

For the quarter ended June 30, 2014, the company reported

consolidated quarterly revenues of $2.31 billion, an increase of

3.1% over the second quarter of 2013. Quarterly net income was

$19.9 million, or $0.32 per diluted share. Adjusted net income

(non-GAAP), excluding after-tax charges of $2.5 million for

acquisition-related and $2.6 million for exit and realignment

activities, was $25.0 million, or $0.40 per diluted share.

Consolidated operating earnings for the second quarter of 2014

were $37.1 million, a decline of $12.9 million, when compared to

the second quarter last year. Adjusted consolidated operating

earnings (non-GAAP) for the second quarter of 2014 were $44.7

million, or 1.94% of revenues, a decline of $6.0 million when

compared to the year before.

“While second quarter results were impacted by many of the same

trends that we saw earlier in the year, we are confident that the

deliberate actions we are taking to on-board new customers and

realign our platforms and teams in the U.S. and Europe will drive

performance in the second half of 2014,” said Craig R. Smith,

chairman & chief executive officer of Owens & Minor. “In

the U.S., we continued to see growth among our larger healthcare

provider customer accounts. In Europe, we continue to work on

optimizing the network and improving operations, especially in the

U.K. On the Domestic side, we are looking forward to completing the

Medical Action Industries acquisition, which will enable us to

expand service offerings to our healthcare provider and

manufacturer customers. We believe Owens & Minor remains well

positioned to create sustainable value for our shareholders.”

Acquisition Update

During the second quarter, Owens & Minor announced plans to

acquire Medical Action Industries Inc. (Medical Action)

(Nasdaq:MDCI), a leading producer of surgical kits and procedure

trays. The acquisition will enable an expansion of Owens &

Minor’s capabilities in the global sourcing and production of kits,

packs and trays for the healthcare market. Under terms of the

definitive agreement, Owens & Minor will acquire all

outstanding shares of Medical Action Industries Inc. for $13.80 per

share in cash, representing a total transaction value of

approximately $208 million, including assumed debt, net of cash.

Medical Action reported $288 million in net sales from continuing

operations for the fiscal year ended March 31, 2014, of which

approximately 45% represented sales to Owens & Minor. The

transaction, which is expected to close in the fourth quarter of

2014, is subject to customary closing conditions, including Medical

Action shareholder approval. Owens & Minor has been notified

that the Federal Trade Commission has granted early termination of

the waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976 (HSR) in connection with the proposed

acquisition. Owens & Minor intends to finance the transaction

with existing cash and available borrowings under its revolving

credit facility.

The acquisition of Medical Action is expected to be accretive to

Owens & Minor’s adjusted net income (non-GAAP) in 2015,

including anticipated partial synergies in the first full year of

ownership. Owens & Minor estimates annual pre-tax cost

synergies of $10 to $12 million by the end of calendar year 2016,

excluding potential revenue synergies. Aside from

transaction-related costs, which will be reported as

acquisition-related and exit and realignment charges, the impact to

Owens & Minor ’s 2014 adjusted net income per diluted share

will be limited primarily to the fourth quarter of 2014, and is not

expected to be significant.

“This strategic acquisition, a highly complementary business,

opens up a new growth area for our company by allowing us to

produce custom procedure trays and minor procedure kits for our

provider and manufacturer customers,” said James L. Bierman,

president & chief operating officer of Owens & Minor. “It

is a natural expansion of our strategy to provide customers more

complete and cost-effective solutions globally. Combined with the

steps we are taking to reduce costs and increase efficiencies, the

continued focus on core capabilities with customer-driven solutions

that will allow us to remain at the forefront of connecting the

world of medical products to the point-of-care.”

2014 Year-to-Date

Results

For the six months ended June 30, 2014, consolidated revenues

were $4.56 billion, increased approximately $79.8 million, or 1.8%,

when compared to the first six months of 2013. Net income for the

first half of 2014 was $45.4 million, or $0.72 per diluted share.

For the year-to-date period, adjusted net income (non-GAAP), which

excludes after-tax charges of $3.0 million for acquisition-related

and $4.3 million for exit and realignment activities, was $52.7

million, or $0.84 per diluted share. Year-to-date results include

the first-quarter recovery of $5.3 million, resulting from the

settlement of a direct purchaser anti-trust class action lawsuit,

which was included in other operating income.

Consolidated operating earnings for the year-to-date period of

2014 were $83.4 million, or 1.83% of revenues, compared to

operating earnings of $97.9 million for the same period of 2013.

Adjusted consolidated operating earnings for the year-to-date

period were $94.2 million, or 2.07% of revenues, a decline of 17

basis points versus the first six months of 2013.

Asset Management

The balance of cash and cash equivalents was $92 million at June

30, 2014. For the year-to-date period of 2014, the company reported

cash provided by operating activities of approximately $73 million.

Asset management metrics for the quarter were strong with

consolidated days sales outstanding (DSO) of 20.6 days as of June

30, 2014, compared to DSO of 20.8 days as of June 30, 2013.

Consolidated inventory turns were 10.2 for the second quarter of

2014, comparable to inventory turns for the same period last

year.

Segment Results

Domestic segment revenues for the second quarter of 2014 were

$2.19 billion, an increase of 2% when compared to the prior year’s

second quarter revenue of $2.14 billion. The increase in second

quarter Domestic segment revenues resulted primarily from growth

among larger healthcare provider customer accounts, partially

offset by declines in revenue from smaller provider customers. For

the year-to-date period, Domestic segment revenues were $4.34

billion, an increase of approximately 1% when compared to the same

period last year.

For the second quarter of 2014, Domestic segment operating

earnings were $48.3 million, or 2.21% of segment revenues, a

decline of approximately $2.9 million, when compared to the same

period of 2013. For the year-to-date period, Domestic segment

operating earnings were $101.1 million, or 2.33% of segment

revenues, a decline of $3.1 million, when compared to operating

earnings for the same period in the prior year. For both the

quarter and the year-to-date periods, the decline in Domestic

segment operating earnings reflected lower benefits from supplier

price changes, as well as lower margin on new and renewed customer

contracts. Offsetting these negative factors were cost benefits

realized from ongoing strategic initiatives designed to improve

productivity and efficiency.

The International segment contributed revenue of $118 million

for the second quarter of 2014 and had an operating loss of $3.6

million. For the year-to-date period, the International segment

reported $226 million in revenues, and an operating loss of $6.8

million. For both the quarter and the year-to-date periods, the

company attributed the International segment operating losses to

operations in the United Kingdom, including increased costs

associated with integrating a significant new customer and reduced

customer activity.

2014 Outlook

Based on operating and financial results for the first half of

2014 and expectations for the remainder of the year, the company

revised its financial guidance for the year as follows:

For 2014, the company now expects revenue growth to exceed 2%

and adjusted net income per diluted share to be within a range of

$1.80 to $1.90 for the year, excluding acquisition-related and exit

and realignment activities.

The 2014 outlook is based on certain assumptions that are

subject to the risk factors discussed in the company’s filings with

the Securities & Exchange Commission.

Investor Events

Owens & Minor is scheduled to participate in investor

conferences in second half of 2014; webcasts of the company’s

formal presentations will be posted on the company’s corporate

website:

- R.W. Baird 2014 Healthcare Conference,

New York – September 3, 2014

- 2014 Morgan Stanley Global Healthcare

Conference, New York – September 8-10, 2014

- 2014 Credit Suisse Healthcare

Conference, Phoenix – November 11-13, 2014

Investors Conference Call &

Supplemental Material

Conference Call: Owens & Minor will conduct a conference

call for investors on Tuesday, July 29, 2014, at 8:00 a.m. EDT. The

access code for the conference call, international dial-in and

replay is #70234446. Participants may access the call at

866-393-1604. The international dial-in number is 224-357-2191.

Replay: A replay of the call will be available for one week by

dialing 855-859-2056. Webcast: A listen-only webcast of the call,

along with supplemental information, will be available on

www.owens-minor.com under “Investor Relations.”

Owens & Minor uses its website as a channel of distribution

for material company information, including news releases, investor

presentations and financial information. This information is

routinely posted and accessible under Investor Relations at

www.owens-minor.com.

Included with the press release financial tables are

reconciliations of the differences between the non-GAAP financial

measures presented in this news release, which exclude

acquisition-related and exit and realignment charges, and their

most directly comparable GAAP financial measures.

Safe Harbor Statement

Except for historical information, the matters discussed in this

press release may constitute forward-looking statements that

involve risks and uncertainties that could cause actual results to

differ materially from those projected. These risk factors are

discussed in reports filed by the company with the Securities &

Exchange Commission. All of this information is available at

www.owens-minor.com.

The company assumes no obligation, and expressly disclaims any

such obligation, to update or alter information, whether as a

result of new information, future events, or otherwise.

Owens & Minor, Inc.

(NYSE: OMI) is a leading healthcare logistics company dedicated to

Connecting the World of Medical Products to the Point of CareTM by

providing vital supply chain services to healthcare providers and

manufacturers of healthcare products. Owens & Minor provides

logistics services across the spectrum of medical products from

disposable medical supplies to devices and implants. With logistics

platforms strategically located in the United States and Europe,

Owens & Minor serves markets where three quarters of global

healthcare spending occurs. Owens & Minor’s customers span the

healthcare market from independent hospitals to large integrated

healthcare networks, as well as group purchasing organizations,

healthcare products manufacturers, and the federal government. A

FORTUNE 500 company, Owens & Minor is headquartered in

Richmond, Virginia, and has annualized revenues exceeding $9

billion. For more information about Owens & Minor, visit the

company website at www.owens-minor.com.

Owens & Minor, Inc.

Consolidated Statements of Income

(unaudited)

(in thousands, except per share data)

Three Months Ended June 30, 2014

2013 Net revenue

$ 2,305,858 $ 2,236,077 Cost

of goods sold

2,023,586 1,962,646 Gross margin

282,272 273,431 Selling, general and administrative expenses

225,838 212,548 Acquisition-related and exit and realignment

charges

7,593 638 Depreciation and amortization

13,892 12,276 Other operating income, net

(2,152

) (2,081 ) Operating earnings

37,101 50,050 Interest

expense, net

3,342 3,248 Income before income

taxes

33,759 46,802 Income tax provision

13,883

17,930

Net income $ 19,876

$ 28,872

Net income per common share:

Basic $ 0.32 $ 0.46

Diluted $

0.32 $ 0.46

Six Months Ended June 30,

2014 2013 Net revenue

$

4,562,239 $ 4,482,461 Cost of goods sold

3,998,771

3,929,979 Gross margin

563,468 552,482

Selling, general and administrative expenses

451,448 430,269

Acquisition-related and exit and realignment charges

10,855

2,648 Depreciation and amortization

27,756 24,905 Other

operating income, net

(9,978 ) (3,274 ) Operating

earnings

83,387 97,934 Interest expense, net

6,589

6,446 Income before income taxes

76,798 91,488

Income tax provision

31,436 36,518

Net

income $ 45,362 $ 54,970

Net income per common share: Basic $

0.72 $ 0.87

Diluted $ 0.72 $ 0.87

Owens & Minor, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

(in thousands)

June 30, 2014 December 31, 2013

Assets Current assets Cash and cash

equivalents

$ 92,027 $ 101,905 Accounts and notes

receivable, net

545,179 572,854 Merchandise inventories

820,882 771,663 Other current assets

287,844

279,510

Total current assets 1,745,932

1,725,932 Property and equipment, net

207,140 191,961

Goodwill, net

275,975 275,439 Intangible assets, net

38,679 40,406 Other assets, net

96,085

90,304

Total assets $ 2,363,811

$ 2,324,042

Liabilities and equity Current

liabilities Accounts payable

$ 698,648 $ 643,872

Accrued payroll and related liabilities

29,691 23,296

Deferred income taxes

38,951 41,613 Other current

liabilities

251,015 280,398

Total

current liabilities 1,018,305 989,179 Long-term debt,

excluding current portion

219,098 213,815 Deferred income

taxes

42,080 43,727 Other liabilities

52,943

52,278

Total liabilities 1,332,426

1,298,999

Total equity 1,031,385

1,025,043

Total liabilities and equity $

2,363,811 $ 2,324,042

Owens & Minor, Inc.

Consolidated Statements of Cash

Flows (unaudited)

(in thousands)

Six Months Ended June 30, 2014

2013 Operating activities: Net income

$ 45,362 $ 54,970 Adjustments to reconcile net income

to cash provided by operating activities: Depreciation and

amortization

27,756 24,905 Share-based compensation expense

4,190 3,449 Provision for losses on accounts and notes

receivable

334 315 Deferred income tax (benefit) expense

(5,151 ) 5,777 Changes in operating assets and

liabilities: Accounts and notes receivable

28,477 1,789

Merchandise inventories

(48,575 ) (31,176 ) Accounts

payable

54,922 191,406 Net change in other assets and

liabilities

(32,765 ) (69,462 ) Other, net

(1,078 ) (2,794 )

Cash provided by

operating activities 73,472 179,179

Investing activities: Additions to property

and equipment

(25,657 ) (16,221 ) Additions to

computer software and intangible assets

(13,166 )

(14,826 ) Proceeds from sale of investment

1,937 — Proceeds

from sale of property and equipment

45

68

Cash used for investing activities

(36,841 ) (30,979 )

Financing

activities: Cash dividends paid

(31,564 ) (30,411

) Repurchases of common stock

(9,448 ) (8,297 )

Excess tax benefits related to share-based compensation

444

550 Proceeds from exercise of stock options

1,180 4,195

Purchase of noncontrolling interest

(1,500 ) — Other,

net

(4,441 ) (5,167 )

Cash used for

financing activities (45,329 )

(39,130 )

Effect of exchange rate changes on cash and cash

equivalents (1,180 ) 868

Net increase (decrease) in cash and cash equivalents

(9,878 ) 109,938

Cash and cash equivalents at

beginning of period 101,905 97,888

Cash and cash equivalents at end of period

$ 92,027 $ 207,826

Owens & Minor, Inc.

Financial Statistics and GAAP/Non-GAAP

Reconciliations (unaudited)

(in thousands, except per share data)

Quarter Ended (in thousands, except

ratios and per share data)

6/30/2014 3/31/2014

12/31/2013 9/30/2013 6/30/2013

Consolidated operating results: Domestic

$ 2,187,535 $ 2,148,915 $ 2,213,949 $ 2,175,663 $

2,143,691 International

118,323 107,465

104,575 94,884 92,386

Net revenue

$ 2,305,858 $

2,256,380 $ 2,318,524 $ 2,270,547

$ 2,236,077 Gross margin

$

282,272 $ 281,195 $ 291,263 $ 273,329 $ 273,431 Gross margin

as a percent of revenue

12.24 % 12.46 %

12.56 % 12.04 % 12.23 % SG&A

expenses

$ 225,838 $ 225,610 $ 222,043 $ 211,344 $

212,548 SG&A expenses as a percent of revenue

9.79 % 10.00 % 9.58 % 9.31 %

9.51 % Operating earnings, as reported (GAAP)

$ 37,101 $ 46,284 $ 50,934 $ 49,215 $ 50,050

Acquisition-related and exit and realignment charges

7,593 3,262 7,049

2,747 638 Operating earnings, adjusted

(Non-GAAP)

$ 44,694 $ 49,546 $ 57,983 $ 51,962 $

50,688 Operating earnings as a percent of revenue, adjusted

(Non-GAAP)

1.94 % 2.20 % 2.50 %

2.29 % 2.27 % Net income, as reported (GAAP)

$ 19,876 $ 25,485 $ 27,942 $ 27,970 $ 28,872

Acquisition-related and exit and realignment charges, after-tax

5,095 2,222 5,024

1,899 412 Net income, adjusted (Non-GAAP)

$ 24,971 $ 27,707

$ 32,966 $ 29,869 $ 29,284

Net income per diluted common share, as reported (GAAP)

$ 0.32 $ 0.41 $ 0.44 $ 0.44 $ 0.46

Acquisition-related and exit and realignment charges

0.08 0.03 0.08

0.03 — Net income per diluted common

share, adjusted (Non-GAAP)

$ 0.40

$ 0.44 $ 0.52 $ 0.47

$ 0.46

Financing: Cash and cash

equivalents

$ 92,027 $ 182,373 $ 101,905 $ 153,789 $

207,826 Total interest-bearing debt

$ 221,496

$ 217,261 $ 216,243 $

216,850 $ 216,994

Stock

information: Cash dividends per common share

$

0.25 $ 0.25 $ 0.24

$ 0.24 $ 0.24 Stock price at quarter-end

$ 33.98 $ 35.03 $

36.56 $ 34.59 $ 33.83

Use of Non-GAAP

Measures

This earnings release contains financial measures that are not

calculated in accordance with U.S. generally accepted accounting

principles ("GAAP"). In general, the measures exclude items and

charges that (i) management does not believe reflect Owens &

Minor, Inc.'s (the "Company") core business and relate more to

strategic, multi-year corporate activities; or (ii) relate to

activities or actions that may have occurred over multiple or in

prior periods without predictable trends. Management uses these

non-GAAP financial measures internally to evaluate the Company's

performance, evaluate the balance sheet, engage in financial and

operational planning and determine incentive compensation.

Management provides these non-GAAP financial measures to

investors as supplemental metrics to assist readers in assessing

the effects of items and events on its financial and operating

results and in comparing the Company's performance to that of its

competitors. However, the non-GAAP financial measures used by the

Company may be calculated differently from, and therefore may not

be comparable to, similarly titled measures used by other

companies.

The non-GAAP financial measures disclosed by the Company should

not be considered a substitute for, or superior to, financial

measures calculated in accordance with GAAP, and the financial

results calculated in accordance with GAAP and reconciliations to

those financial statements set forth above should be carefully

evaluated.

Owens & Minor, Inc.

Summary Segment Information

(unaudited)

(in thousands)

Three Months Ended June 30, 2014 2013

% of % of consolidated consolidated

Amount net

revenue Amount net revenue

Net revenue: Domestic

$

2,187,535 94.87 % $ 2,143,691 95.87 %

International

118,323 5.13 % 92,386

4.13 % Consolidated net revenue

$ 2,305,858

100.00 % $ 2,236,077 100.00 %

% of segment % of segment

Operating earnings (loss):

net revenue net revenue Domestic

$ 48,317 2.21

% $ 51,245 2.39 % International

(3,623 )

(3.06

)%

(557 ) (0.60 )% Acquisition-related and exit and realignment

charges

(7,593 ) N/A (638 ) N/A Consolidated

operating earnings

$ 37,101 1.61

% $ 50,050 2.24 %

Depreciation and

amortization: Domestic

$ 8,812 $ 8,887

International

5,080 3,389 Consolidated

depreciation and amortization

$ 13,892 $

12,276

Capital expenditures: (1)

Domestic

$ 18,858 $ 12,872 International

5,737

3,398 Consolidated capital expenditures

$

24,595 $ 16,270 (1) Represents

additions to property and equipment and additions to computer

software and separately acquired intangible assets.

Owens & Minor, Inc.

Summary Segment Information

(unaudited)

(in thousands)

Six Months Ended June 30, 2014 2013

% of % of consolidated consolidated

Amount net

revenue Amount net revenue

Net revenue: Domestic

$

4,336,451 95.05 % $ 4,298,406 95.89 %

International

225,788 4.95 % 184,055

4.11 % Consolidated net revenue

$ 4,562,239

100.00 % $ 4,482,461 100.00 %

% of segment % of segment

Operating earnings (loss):

net revenue net revenue Domestic

$ 101,053

2.33 % $ 104,151 2.42 % International

(6,811

) (3.02

)%

(3,569 ) (1.94 )% Acquisition-related and exit and realignment

charges

(10,855 ) N/A (2,648 ) N/A

Consolidated operating earnings

$ 83,387

1.83 % $ 97,934 2.18 %

Depreciation and amortization: Domestic

$

17,787 $ 17,969 International

9,969 6,936

Consolidated depreciation and amortization

$

27,756 $ 24,905

Capital

expenditures: (1) Domestic

$ 29,033 $ 24,474

International

9,790 6,573 Consolidated capital

expenditures

$ 38,823 $ 31,047

June 30, 2014 December 31, 2013

Total assets:

Domestic

$ 1,787,026 $ 1,747,572 International

484,758 474,565 Segment assets

2,271,784 2,222,137 Cash and cash equivalents

92,027

101,905 Consolidated total assets

$

2,363,811 $ 2,324,042

Owens & Minor, Inc.

Net Income Per Common Share

(unaudited)

(in thousands, except per share data)

Three Months Ended June 30, Six Months Ended June

30, 2014 2013 2014

2013 Numerator: Net income

$ 19,876 $ 28,872

$ 45,362 $ 54,970 Less: income allocated to unvested

restricted shares

(159 ) (156 )

(345 )

(351 ) Net income attributable to common shareholders - basic

19,717 28,716

45,017 54,619 Add: undistributed income

attributable to unvested restricted shares -basic

19 64

68 122 Less: undistributed income attributable to unvested

restricted shares -diluted

(19 ) (64 )

(68

) (122 )

Net income attributable to common shareholders -

diluted $ 19,717 $ 28,716

$

45,017 $ 54,619 Denominator: Weighted average

shares outstanding — basic

62,311 62,707

62,271

62,695 Dilutive shares - stock options

5 45

9 51

Weighted average shares outstanding —

diluted 62,316 62,752

62,280

62,746 Net income per share attributable to

common shareholders: Basic

$ 0.32 $ 0.46

$

0.72 $ 0.87 Diluted

$ 0.32 $ 0.46

$

0.72 $ 0.87

Owens & Minor, Inc.Trudi Allcott, Director, Investor &

Media Relations, 804-723-7555truitt.allcott@owens-minor.comorChuck

Graves, Director, Finance & Investor Relations,

804-723-7556chuck.graves@owens-minor.com

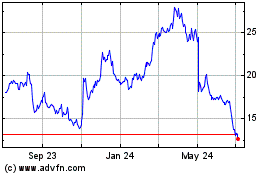

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

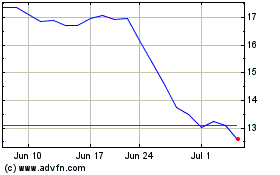

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Apr 2023 to Apr 2024