UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 25, 2014

| |

|

VAPOR CORP.

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

Delaware

|

|

(State or other jurisdiction of incorporation)

|

| |

|

|

|

|

|

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

|

| 3001 Griffin Road, Dania Beach, Florida |

33312 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code (888) 766-5351

| |

|

N/A

|

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

As previously reported in the Current Report on Form 8-K dated May 14, 2014 of Vapor Corp. (the “Company”), as filed with the Securities and Exchange Commission on May 15, 2014, on May 14, 2014, the Company and its newly formed wholly-owned subsidiary IVGI Acquisition, Inc., a Delaware corporation (the “Buyer”), entered into an Asset Purchase Agreement (the “Purchase Agreement”) with International Vapor Group, Inc., a Delaware corporation (“International Vapor”), certain of International Vapor’s subsidiaries (together with International Vapor, the “Sellers”) and the owners of International Vapor (the “Owners”), pursuant to which the Buyer will purchase the Sellers’ electronic cigarettes and vaporizers online, wholesale and retail operations (collectively, the “Business”) by acquiring substantially all of the Sellers’ assets and assuming certain of the Sellers’ liabilities in an asset purchase transaction (the “Transaction”).

On July 25, 2014, the Company, the Buyer and the Owners David Epstein, David Herrera and Nicolas Molina, in their capacities as the representatives of the Sellers and Owners, entered into a First Amendment to Asset Purchase Agreement (the “First Amendment), pursuant to which the Purchase Agreement was amended in certain respects including:

|

|

●

|

the termination date of the Purchase Agreement was extended to September 30, 2014 from July 31, 2014;

|

|

|

●

|

prior to closing the Transaction, the Business will cease using the Vapor Zone® brands and the Business, as necessary, will be rebranded with one or more new brands mutually agreed upon by the parties;

|

|

|

●

|

the aggregate principal amount of secured loans International Vapor may obtain from the Company prior to closing the Transaction for purchasing inventory, among other purposes, was increased to $500,000 from $300,000 (on July 28, 2014, the Company made a secured loan to International Vapor in the aggregate principal amount of $500,000);

|

|

|

●

|

prior to closing the Transaction , the Company is required to enter into up to ten (10) real estate leases for new retail stores that the Sellers desire to add to their retail operations and fund up to $41,000 of the associated lease security deposits and expenses for the build out of each such retail store;

|

|

|

●

|

The Company may issue up to $250,000 in 43,200 shares of its common stock after the closing as reimbursement for certain of the Sellers’ inventory bearing the Vapor Zone® brand that is not part of the Transaction to the extent the Sellers are not able to sell such inventory within 120 days after the closing of the Transaction; and

|

|

|

●

|

International Vapor’s and the Owners’ post-closing indemnity obligations were expanded to cover losses incurred by the Company (and other covered persons) resulting from any (i) liabilities arising from a third party finder’s fee agreement to which International Vapor is a party and (ii) liabilities arising from third party claims based on trademark infringement relating to the Business’ pre-closing use of the Vapor Zone® brands.

|

Closing of the Transaction is subject to the Company obtaining stockholder approval for issuance of the shares of its common stock that will be issued under the Purchase Agreement, as amended by the First Amendment, as well as additional customary closing conditions. The Company expects to close the Transaction as soon as possible but not later than September 30, 2014.

The foregoing description of the First Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the First Amendment, a copy of which is filed as Exhibit 10.1 to this Report and incorporated herein by reference.

On July 28, 2014, the Company issued a press release announcing the First Amendment, a copy of which is filed herewith as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| |

|

|

|

|

|

|

|

10.1

|

|

First Amendment to Asset Purchase Agreement dated July 25, 2014 by and among Vapor Corp., IVGI Acquisition, Inc. and Nicolas Molina, David Epstein and David Herrera

|

| |

|

|

|

99.1

|

|

Press Release of Vapor Corp. dated July 28, 2014

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

| |

VAPOR CORP.

|

|

| |

(Registrant) |

|

| |

|

|

| |

|

|

| |

By: |

/s/Harlan Press |

|

| |

|

Harlan Press

|

|

| |

|

Chief Financial Officer

|

|

|

Date: July 28, 2014

|

|

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

| |

|

|

|

10.1

|

|

First Amendment to Asset Purchase Agreement dated July 25, 2014 by and among Vapor Corp., IVGI Acquisition, Inc. and Nicolas Molina, David Epstein and David Herrera

|

|

99.1

|

|

Press Release of Vapor Corp. dated July 28, 2014

|

Exhibit 10.1

FIRST AMENDMENT TO ASSET PURCHASE AGREEMENT

This First Amendment to Asset Purchase Agreement (this “First Amendment”) is made and entered into this 25th day of July, 2014 by and among Vapor Corp., a Delaware corporation (“Parent”), IVGI Acquisition, Inc., a Delaware corporation (“Buyer”), and Nicolas Molina, David Epstein and David Herrera, each a Florida resident and in his capacity as one of the Sellers’ Representatives. All capitalized terms used herein, but not otherwise defined herein, shall have the meanings ascribed to them in Asset Purchase Agreement (as defined below).

RECITALS

WHEREAS, the parties hereto have entered into that certain Asset Purchase Agreement dated May 14, 2014 (the “Asset Purchase Agreement”) by and among Parent, Buyer, the Sellers and the Owners (of which the Sellers’ Representatives are part) pursuant to which Buyer desires to purchase and assume from Sellers, and Sellers desire to sell and assign to Buyer, the Acquired Assets and the Assumed Liabilities;

WHEREAS, Section 10.5 of the Asset Purchase Agreement provides that the Asset Purchase Agreement may be amended by a written instrument signed by Parent, Buyer and the Sellers’ Representatives on behalf of the Sellers and the Owners; and

WHEREAS, the parties hereto desire to amend the Asset Purchase Agreement as set forth in this First Amendment.

NOW, THEREFORE, in accordance with Section 10.5 of the Asset Purchase Agreement and in consideration of the mutual covenants contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Amendment to Section 1.1.2 of the Asset Purchase Agreement. Section 1.1.2 of the Asset Purchase Agreement is hereby amended by inserting the following clauses at the end of such section:

“(n) the trademark “VAPOR ZONE,” the domain names containing “VAPORZONE” and the trade names “VaporZone”, all of the foregoing as set forth on Schedule 2.14 (collectively, the “Discontinued Brand”);

(o) all Contractual Obligations of the Sellers specifically pertaining to Inventory bearing the Discontinued Brand and/or the development or promotion of the Discontinued Brand; and

(p) all Inventory bearing the Discontinued Brand (the “Retained Inventory”).”

and deleting the word “and” after clause (l).

2. Amendment to Section 1.1.4 of the Asset Purchase Agreement. Section 1.1.4 of the Asset Purchase Agreement is hereby amended by inserting the following clauses at the end of such section:

“(k) to the extent not included in the Net Working Capital calculation set forth in Section 1.2.5, all Liabilities for the actual out of pocket costs incurred by International Vapor prior to the Closing pursuant to and as limited by Section 4.10 for rebranding with the New Brand (i) the Acquired Assets which are branded with the Discontinued Brand and (ii) any and all aspects of the Business that use the Discontinued Brand as of the date of this Agreement (the “Pre-Closing Rebranding Costs”);

(l) all Liabilities arising from or specifically relating to that Finder’s Fee Agreement entered into as of January 26, 2013 by and between International Vapor and Allan Rothstein (the “Rothstein Agreement”); and

(m) all Liabilities arising from or specifically relating to any DB Third Party Claim.”

and deleting the word “and” after clause (i).

3. Amendment to Section 1.2.2 of the Asset Purchase Agreement. Section 1.2.2 of the Asset Purchase Agreement is hereby amended by deleting the clause “$19,100,000 (the “Fixed Stock Purchase Price” and, together with the Cash Purchase Price, the “Fixed Purchase Price”) with such Cash Purchase Price being subject to adjustment as provided in Section 1.2.5.” and inserting the following new clause in place thereof:

“$19,100,000 (the “Fixed Stock Purchase Price” and, together with the Cash Purchase Price, the “Fixed Purchase Price”) with such Cash Purchase Price and Fixed Stock Purchase Price being subject to adjustment as provided in Section 1.2.5 and Section 1.2.6, respectively.”

4. Amendment to Section 1.2.4 of the Asset Purchase Agreement. Section 1.2.4 of the Asset Purchase Agreement is hereby amended by deleting paragraph (a) of such section in its entirety and inserting the following new paragraph (a):

“(a) At the Closing, Buyer shall, out of the Fixed Stock Purchase Price to be paid to International Vapor on behalf of the Sellers, deposit in the Escrow Account on behalf of International Vapor on behalf of the Sellers pursuant Section 1.3 (such deposit, the “Escrow Fund”), Two Million Seven Hundred Twenty-Four Thousand Dollars ($2,724,000) worth of the Shares (calculated in accordance with Section 1.2.2) (such Shares, the “Escrow Shares”). The Escrow Shares shall be specifically allocated to satisfy the Sellers’ and Owners’ reimbursement obligations under Section 1.2.6 and their indemnity obligations pursuant to Article 7 as follows: (i) $100,000 worth of the Escrow Shares for purposes of Section 1.2.6 (the “Rebranding Escrow Shares” and the deposit thereof pursuant to Section 1.3, the “Rebranding Escrow Fund”), (ii) $624,000 worth of the Escrow Shares for purposes of Section 7.17 (along with any additional Escrow Shares deposited pursuant to Section 1.7.7, the “Special Escrow Shares” and the deposit thereof pursuant to Section 1.3 and Section 1.7.7, the “Special Escrow Fund”)) and (iii) $2,000,000 of the Escrow Shares for purposes of Article 7 other than Section 7.17 and Section 7.18 (the “General Escrow Shares” and the deposit thereof pursuant to Section 1.3, the “General Escrow Fund”).”

5. Amendment to Section 1.2.5 of the Asset Purchase Agreement. Section 1.2.5 of the Asset Purchase Agreement is hereby amended by deleting the last sentence of paragraph (a) of such section in its entirety and replacing it with the following sentence:

“ “Target Net Working Capital” means negative Fifty Thousand Dollars (-$50,000).”

6. Amendment to Section 1.2 of the Asset Purchase Agreement. Section 1.2 of the Asset Purchase Agreement is hereby amended by inserting the following new Section 1.2.6 after Section 1.2.5:

“Section 1.2.6. Rebranding Adjustment.

(a) On or prior to the date that is one hundred twenty (120) days following the Closing Date, Buyer shall prepare, or cause to be prepared, and deliver to Sellers’ Representatives a certificate executed by the Chief Financial Officer of Buyer setting forth the Post-Closing Rebranding Costs and the calculation thereof. “Post-Closing Rebranding Costs” means the actual, required and essential out of pocket costs incurred by Buyer, with the approval of International Vapor, which approval shall not be unreasonably withheld, delayed or conditioned, after the Closing and prior to the date of such certificate, to complete the rebranding of the Acquired Assets and any and all aspects of the Business with the New Brand to the extent International Vapor does not do so to prior to the Closing in accordance with Section 4.10; provided that Post-Closing Rebranding Costs shall not include (x) advertising or brand marketing costs related to the New Brand to the extent that the aggregate amount of such costs, when added to the New Brand Marketing Expense, would exceed $50,000, (y) costs to replace inventory or packaging bearing the Discontinued Brand, or (z) costs included in the Net Working Capital calculation set forth in Section 1.2.5.

(b) Sellers’ Representatives shall complete their review of the Post-Closing Rebranding Costs within thirty (30) days after delivery thereof by Buyer. During such review period, Buyer shall provide Sellers’ Representatives with access to all books and records reasonably requested by Sellers’ Representatives to review the Post-Closing Rebranding Costs, and Buyer shall make reasonably available its representatives responsible for the preparation of the Post-Closing Rebranding Costs in order to respond to the inquiries of Sellers’ Representatives. If Sellers’ Representatives object to the Post-Closing Rebranding Costs for any reason (including, without limitation, that any such costs were not required for and essential to the rebranding), they shall, on or before the last day of such 30-day period, so inform Buyer in writing (an “IVG Objection”), setting forth a specific description of the basis of Sellers’ Representatives’ determination and the adjustments to the Post-Closing Rebranding Costs that Sellers’ Representatives believe should be made. To the extent any disagreement therewith is not described in an IVG Objection received by Buyer on or before the last day of such 30-day period, then the Post-Closing Rebranding Costs set forth on the certificate delivered by Buyer to Sellers’ Representative pursuant to Section 1.2.6(a) shall be deemed agreed, final and binding on the parties.

(c) On the date that is one hundred twenty (120) days following the Closing Date or a date that is not less than five (5) Business Days prior to such 120th day, Sellers’ Representatives shall prepare, or cause to be prepared, and deliver to Buyer a certificate executed by the Sellers’ Representatives setting forth the value (determined by reference to the actual cost paid by Sellers for such Retained Inventory) of the Retained Inventory owned by International Vapor as of the end of the one hundred twentieth (120th) day after the Closing Date and the calculation thereof (the lesser of (x) such value and (y) Two Hundred Fifty Thousand Dollars ($250,000), the “Retained Inventory Value”).

(d) Buyer shall complete its review of the Retained Inventory Value within thirty (30) days after delivery thereof by Sellers’ Representatives. During such review period, International Vapor shall provide Buyer with the opportunity to view the Retained Inventory and access to all books and records reasonably requested by Buyer to review the Retained Inventory Value, and International Vapor shall make reasonably available its representatives responsible for the preparation of the Retained Inventory Value in order to respond to the inquiries of Buyer. If Buyer objects to the Retained Inventory Value for any reason, it shall, on or before the last day of such 30-day period, so inform the Sellers’ Representatives in writing (a “Buyer Objection”), setting forth a specific description of the basis of Buyer’s determination and the adjustments to the Retained Inventory Value that Buyer believes should be made. To the extent any disagreement therewith is not described in a Buyer Objection received by the Sellers’ Representatives on or before the last day of such 30-day period, then the Retained Inventory Value set forth on the certificate delivered by the Sellers’ Representatives to Buyer pursuant to Section 1.2.6(c) shall be deemed agreed, final and binding on the parties.

(e) If Sellers’ Representatives timely deliver an IVG Objection to Buyer and/or Buyer timely delivers a Buyer Objection to Sellers’ Representatives, and Sellers’ Representatives and Buyer are unable to resolve all of their disagreements with respect to the proposed adjustments set forth in the IVG Objection and/or the Buyer Objection within thirty (30) days after the later of the date that Buyer receives the IVG Objection and the date that the Sellers’ Representatives receive the Buyer Objection, then any such unresolved disagreement shall be submitted for resolution by arbitration in Fort Lauderdale, Florida before one arbitrator, which arbitration shall be administered by JAMS pursuant to its Comprehensive Arbitration Rules and Procedures and in accordance with the Expedited Procedures in those Rules notwithstanding anything to the contrary set forth in Section 10.14. The arbitrator shall be selected by mutual agreement of Buyer and the Sellers’ Representatives or, if the parties cannot agree, then by striking from a list of arbitrators supplied by JAMS. The arbitrator shall issue a written opinion determining the definitive amount of the Post-Closing Rebranding Costs and/or the Retained Inventory Value at issue in the arbitration, which determination shall be final and binding upon the parties. Each of Buyer and the Sellers’ Representatives, as a single party on behalf of the Sellers and Owners, shall be responsible for fifty percent (50%) of the arbitrator’s fees and expenses and each such party shall be responsible for its own attorneys’ fees and expenses for the arbitration.

(f) To the extent that the Post-Closing Rebranding Costs, as finally determined in accordance with paragraphs (b) and (e), as applicable, of this Section 1.2.6, exceed the Retained Inventory Value, as finally determined in accordance with paragraphs (d) and (e), as applicable, of this Section 1.2.6, then on or prior to the fifth (5th) Business Day following the date when the Post-Closing Rebranding Costs and the Retained Inventory Value have both been finally determined, International Vapor and Owners shall reimburse Parent for the positive difference between the Post-Closing Rebranding Costs and the Retained Inventory Value (the “Rebranding Cost Surplus”), first, from the Rebranding Escrow Shares and second, to the extent that the Rebranding Escrow Shares shall be insufficient to reimburse Parent in full for the Rebranding Cost Surplus, the Buyer will have a right of offset against any earned but unpaid portion of the Earn-Out; provided, however, if no such earned but unpaid portion of the Earn-Out Payments shall be available to satisfy such remaining Rebranding Cost Surplus or no portion of the Earn-Out Payments is then earned, the Sellers and Owners shall satisfy such reimbursement claim by, at the Sellers’ and/or Owners’ sole option, either a tender of Shares or Earn-Out Shares or a cash payment to Parent. For the avoidance of doubt and ambiguity, the Sellers and the Owners may, at their sole option, satisfy any Rebranding Cost Surplus with cash, and shall satisfy any such Rebranding Cost Surplus with a cash payment to the extent the Rebranding Escrow Shares, the Shares and Earn-Out Shares then owned by them (or earned as an Earn-Out Payment but not yet issued to them) are not sufficient to do so in full. The value ascribed to the Rebranding Escrow Shares, the Earn-Out Shares or the Shares offset or tendered (as applicable) for purposes of satisfaction of the Rebranding Cost Surplus shall be equal to the quotient of the amount of the Rebranding Cost Surplus required to be paid divided by the greater of (A) the 30-trading day weighted average closing price per share of the Parent’s common stock, as reported on the primary exchange on which the Parent’s common stock is traded or quoted, preceding the date of when the reimbursement claim is required to be paid, or (B) the Volume Weighted Average Closing Price.

(g) To the extent that the Retained Inventory Value, as finally determined in accordance with paragraphs (d) and (e), as applicable, of this Section 1.2.6, exceeds the Post-Closing Rebranding Costs, as finally determined in accordance with paragraphs (b) and (e), as applicable, of this Section 1.2.6, then on or prior to the fifth (5th) Business Day following the date when the Post-Closing Rebranding Costs and the Retained Inventory Value have both been finally determined, Parent shall issue to International Vapor, for distribution to the Owners pro rata based on each Owner’s Percentage Ownership, newly issued unregistered shares of the Parent’s common stock, the number of which would be equal to the quotient of (x) the positive difference between the Retained Inventory Value and the Post-Closing Rebranding Costs divided by (y) the Volume Weighted Average Closing Price.”

7. Amendment to Section 1.3 of the Asset Purchase Agreement. Section 1.3 of the Asset Purchase Agreement is hereby amended by deleting such section in its entirety and inserting the following new section:

“Section 1.3 Escrow. To provide for an escrow account or accounts to secure and to serve as a fund in respect of the indemnification obligations of the Sellers and Owners under this Agreement, Buyer, the Sellers’ Representatives and the Escrow Agent at Closing shall enter into an Escrow Agreement substantially in the form of Exhibit B (the “Escrow Agreement”). At Closing, the Buyer shall deposit the Escrow Shares with the Escrow Agent to be held in an account or accounts (the “Escrow Account”) pursuant to the terms of the Escrow Agreement. All Rebranding Escrow Shares remaining in the Escrow Account after the Rebranding Cost Reimbursement shall be distributed to the Owners in accordance with the Escrow Agreement on the third Business Day after the Rebranding Cost Reimbursement. Except with respect to Special Escrow Shares retained to fund Buyer Indemnified Persons’ indemnity claims made in accordance with Article 7 on or before the twenty-seventh (27th) month anniversary following the Closing Date (the “Escrow Period”), all Special Escrow Shares then remaining in the Escrow Account shall be distributed to the Owners in accordance with the Escrow Agreement on the third Business Day after the earlier of (a) the final resolution, by settlement, litigation or otherwise, of the dispute between International Vapor and Allan Rothstein regarding the Rothstein Agreement (the “Rothstein Resolution”) and (b) the expiration of the Escrow Period; provided that, the portion of the Special Escrow Shares deposited in the Escrow Account pursuant to Section 1.7.7 shall be distributed to the Owners in accordance with the proportions set forth in Section 1.7.7. Except with respect to General Escrow Shares retained to fund Buyer Indemnified Persons’ indemnity claims made in accordance with Article 7 prior to the expiration of the Escrow Period, all General Escrow Shares in the Escrow Account shall be distributed to the Owners in accordance with the Escrow Agreement on the third Business Day after the expiration of the Escrow Period. With respect to any pending claim, promptly following resolution of such pending claim, the Special Escrow Shares or the General Escrow Shares, as applicable and if any, retained to fund such pending claim which have not been paid, which are not payable to any Buyer Indemnified Person pursuant to Article 7 in connection with such resolution, and which are not required to remain in the Escrow Account to satisfy other pending claims, shall be distributed to the Owners.”

8. Amendment to Section 1.7.7 of the Asset Purchase Agreement. Section 1.7.7 of the Asset Purchase Agreement is hereby amended by deleting such section in its entirety and inserting the following new section:

“ 1.7.7 Manner of Payment. The Earn-Out, if any, shall be payable to the Owners, in part as stockholders of International Vapor and in part, as to Molina and Epstein, as employees of the Buyer, in newly issued unregistered shares of the Parent’s common stock (“Earn-Out Shares”), the number of which would be equal to the quotient of such earned portion of the Earn-Out Payment divided by the Volume Weighted Average Closing Price. The Earn-Out, if any, shall be paid directly to the Owners by Buyer. 43.17% of the Earn-Out shall be paid to the Owners pro rata based upon their respective Ownership Percentages (the aggregate of all such payments, the “Equity Earn-Out”), 40.28% of the Earn-Out shall be paid to Molina pursuant to the terms of his Employment Agreement and 16.55% of the Earn-Out shall be paid to Epstein pursuant to the terms of his Employment Agreement (the aggregate portion of the Earn-Out payable to Epstein and Molina pursuant to their respective Employment Agreements, the “Employment Earn-Out”), provided that prior to the Rothstein Resolution, 3% of the aggregate number of Earn-Out Shares constituting each Earn-Out Payment that would otherwise be paid by Buyer to the Owners shall instead be deposited by the Buyer in the Escrow Account as Special Escrow Shares. Subject to Section 1.7.10, Section 1.7.11 and Section 1.7.12, any Earn-Out Payments made by Buyer pursuant to this Section 1.7 shall be apportioned among the Owners as set forth in the preceding sentence. Any payments owed by an Owner to the Buyer pursuant to Sections 1.7.6(a) or 1.7.6(c) shall be paid to the Buyer from the Shares and/or Earn-Out Shares received by such Owner prior to the date thereof, the number of which would be equal to the quotient of such payment divided by the Volume Weighted Average Closing Price.”

9. Amendment of Section 4.8.2 of the Asset Purchase Agreement. Section 4.8.2 of the Asset Purchase Agreement is hereby amended by deleting the first and second sentences of such section and inserting the following new sentences in place thereof:

“If International Vapor presents Parent with a valid invoice for expenses incurred for (i) new E-Cig Products comprising Inventory other than with the Discontinued Brand, (ii) attendance at trade shows or (iii) capital expenditures for the Retail Operations and Parent approves such invoice in whole or in part, which approval shall not be unreasonably withheld, delayed or conditioned, Parent shall pay such approved portion of such invoice and such payment shall be deemed to be a loan from Parent to International Vapor (each, a “Capex Loan”). Capex Loans may not exceed $500,000 in the aggregate, provided that no more than $200,000 of the Capex Loans shall be for expenses incurred under clauses (ii) and (iii) of the preceding sentence.”

10. Amendment of Section 4 of the Asset Purchase Agreement. Article 4 of the Asset Purchase Agreement is hereby amended by inserting the following new Sections 4.10 and 4.11 after Section 4.9:

“4.10 Rebranding.

International Vapor shall use commercially reasonable efforts to resolve, through settlement, litigation or otherwise, any and all third party claims filed in court and still prosecutable (whether or not pending before any such court) against any Seller at or prior to the Closing arising from a claim that the Business’ use of the Discontinued Brand infringes on or is likely to cause confusion with another’s mark or trade name (each a “DB Third Party Claim”), at International Vapor’s sole cost and expense, provided that any such settlement of a DB Third Party Claim that does not include a full and general release of all Buyer Indemnified Persons from all Liabilities arising or relating to, or in connection with, each such DB Third Party Claim shall be subject to Parent’s prior written approval, which shall not be unreasonably withheld or delayed. Subject to the last sentence of this Section 4.10, Sellers and Owners agree that International Vapor shall use commercially reasonable efforts to cease using the Discontinued Brand as soon as reasonably practicable and, at its sole cost and expense, shall rebrand (i) the Acquired Assets which are branded with the Discontinued Brand (including, without limitation, Vapor Zone Franchising) and (ii) any and all aspects of the Business (including, without limitation, the company-owned and franchised retail store line of business) using the Discontinued Brand as of the date of this Agreement with one or more new brands, which shall be mutually agreed upon by Parent and the Sellers’ Representatives in writing no later than August 15, 2014 (collectively, the “New Brand”), provided that International Vapor shall not implement any aspect of such rebranding of the Acquired Assets and the Business prior to the Closing without the prior written approval of Parent, which approval shall not be unreasonably delayed, conditioned or withheld, and provided, further, that, prior to Closing, International Vapor shall be obligated, at its sole cost and expense, to advertise and brand market the New Brand in the ordinary course of business consistent with its past practice of advertising and brand marketing the Discontinued Brand, and in addition to such ordinary course advertising and brand marketing, International Vapor shall be obligated, at its sole cost and expense, to actively advertise and brand market the New Brand by incurring costs and expenses up to, but not in excess of, $50,000 (such costs, in excess of the ordinary course advertising and brand marketing expenses, the “New Brand Marketing Expense”). For the avoidance of doubt, International Vapor shall be permitted to continue to sell, prior to Closing, Inventory bearing the Discontinued Brand, provided that any such sale will be independent of, and shall not involve, Parent, Buyer or their respective businesses and/or operations. International Vapor shall be responsible for all the Pre-Closing Rebranding Costs and such Pre-Closing Rebranding Costs shall be included as current liabilities, to the extent required to be accrued pursuant to GAAP at Closing, of the Companies on a consolidated basis, and any Inventory bearing the Discontinued Brand shall not be included as current assets of the Companies on a consolidated basis, in the determination of Net Working Capital as of the Closing Date notwithstanding anything to the contrary set forth in Section 1.2.5. From and after the time, as contemplated under this Section 4.10, that International Vapor ceases to use the Discontinued Brand, the Sellers and Owners, severally and not jointly, hereby acknowledge and agree that no Seller or Owner will ever use or allow the use of, directly or indirectly, the Discontinued Brand in connection with any Competitive Business except that (x) the Sellers and Owners may allow the use of the Discontinued Brand by any third party with which none of them have an affiliation as a part of the settlement of a DB Third Party Claim in accordance with the first sentence of this Section 4.10 and (y) during the period beginning on the Closing Date and ending one hundred and twenty (120) days thereafter, International Vapor may, in its sole discretion, sell any Retained Inventory, provided that any such sale will be independent of, and shall not involve, Parent, Buyer or their respective businesses and/or operations.

4.11 Leases. If not later than ten (10) Business Days prior to the Closing International Vapor presents Parent with a real estate lease for a new retail store on terms and conditions reasonably satisfactory to Parent then Parent shall, directly or indirectly, enter into such real estate lease subject to the counterparty landlord’s consent and fund all associated lease security deposits and expenses for the build out and opening of such store, provided, however, that prior to the Closing (a) Parent shall not be required enter into more than ten (10) such real estate leases (each a “Store Lease”) and fund more than $41,000 per Store Lease for the associated security deposits and expenses for the build out of the applicable store and (b) Parent shall make no expenditure pursuant to this sentence without the prior approval of International Vapor, which approval shall not be unreasonably withheld, delayed or conditioned. Should the Closing occur, any Store Lease then in effect shall be included in the Acquired Assets and Assumed Liabilities, and notwithstanding any language in the Agreement to the contrary, each store for which a Store Lease is then in effect shall be deemed a Retail Store opened during the Measurement Period for purposes of the calculation of the Retail Earn-Out whether opened before or after the Closing Date. In the event this Agreement is terminated for any reason then Parent shall retain each such Store Lease then in effect and operate the retail store thereunder, in its sole and absolute discretion, either as (x) a franchised store of International Vapor pursuant to the franchise agreement then in use by International Vapor or (y) a non-franchised store, independent from International Vapor and which store shall not use the Discontinued Brand or the New Brand, and in any manner Parent deems appropriate in its sole and absolute discretion subject to the permitted use specified in the applicable Store Lease.”

11. Amendment to Section 6.7 of the Asset Purchase Agreement. Section 6.7 of the Asset Purchase Agreement is hereby amended by deleting such section in its entirety and inserting the following new section:

“6.7 Use

of Name. The Sellers and the Owners, severally and not jointly, hereby acknowledge and agree that, upon the consummation of

the Contemplated Transactions, the Buyer shall have the sole right to use the names “International Vapor”, “South

Beach Smoke”, “Beach Wellness”, the New Brand or any service marks, trademarks, trade names, identifying symbols,

logos, emblems, signs or insignia related thereto or containing or comprising the foregoing, including any name or mark confusingly

similar thereto. Following the Closing, no Seller or any Owner or any of their Affiliates will use the names “International

Vapor”, “South Beach Smoke”, “Beach Wellness”, the New Brand or any confusingly similar names and

each Seller shall at Closing terminate such names or assumed names by making all necessary filings with the appropriate Governmental

Authorities. In addition, no Seller or Owner will ever use or allow the use of, directly or indirectly, the names “International

Vapor”, “South Beach Smoke”, “Beach Wellness”, or the New Brand in connection with any

Competitive Business.”

12. Amendment to Section 7.1.1 of the Asset Purchase Agreement.

|

a.

|

Section 7.1.1 of the Asset Purchase Agreement is hereby amended by deleting clauses (b), (c) and (d) of such section in its entirety and inserting the following new clauses (b), (c), (d) and (e):

|

“(b) any breach or violation of any covenant or agreement of any Seller and/or Owner contained in this Agreement or any Company Agreement (other than the Employment Agreements) that is to be performed either prior to, on or after Closing other than as specified in clause (e) of this Section 7.1.1;

(c) any Retained Liabilities other than the Retained Liabilities specified in Section 1.1.4 (l) (which shall be subject to the indemnity obligations of the Sellers and Owners set forth in Section 7.17) and the Retained Liabilities specified in Section 1.1.4 (m) (which shall be subject to the indemnity obligations of the Sellers and Owners set forth in Section 7.18);

(d) any Liabilities associated with the (x) pre-Closing operations of Vapor Zone Franchising that are not Retained Liabilities under Section 1.1.4(k), (y) the pre and post-Closing operations of Nutricigs and/or (z) the pre-Closing actions of any Seller or Owner under Section 4.10 that are not Retained Liabilities under Section 1.1.4(m); or

(e) any breach or violation of any covenant or agreement of any Seller or Owner under Section 4.10 (for the avoidance of doubt, any Liabilities relating to any DB Third Party Claim shall be subject to the indemnity obligations of the Sellers and Owners set forth in Section 7.18).”

b. Section 7.1.1 of the Asset Purchase Agreement is hereby amended by adding the following sentence:

“Notwithstanding anything to the contrary contained in this Agreement, International Vapor and the Owners shall have no indemnification obligation with respect to the Post-Closing Rebranding Costs other than with respect to the breach of a covenant or agreement of Sellers and/or Owners under Section 1.2.6.”

13. Amendment to Section 7.1.2 of the Asset Purchase Agreement. Section 7.1.2 of the Asset Purchase Agreement is hereby amended by inserting at the end of the last sentence of such section the following phrase:

“and Section 7.1.1(e);”

14. Amendment to Section 7.1.3 of the Asset Purchase Agreement. Section 7.1.3 of the Asset Purchase Agreement is hereby amended by inserting at the end of the last sentence of such section the following:

“and Section 7.1.1(e);”

15. Amendment to Section 7.7.1 of the Asset Purchase Agreement. Section 7.7.1 of the Asset Purchase Agreement is hereby amended by inserting the phrases “General Escrow Fund” and “General Escrow Shares” in place of the phrases “Escrow Fund” and “Escrow Shares”, respectively, throughout such section.

16. Amendment to Article 7 of the Asset Purchase Agreement. Article 7 of the Asset Purchase Agreement is hereby amended by inserting the following new Sections 7.17 and 7.18 after Section 7.16:

“7.17 Special Indemnification.

7.17.1 From and after Closing, International Vapor and the Owners will indemnify and hold harmless the Buyer Indemnified Persons from, against and in respect of any and all Losses incurred or suffered by Buyer Indemnified Persons or any of them (including any Losses sustained or incurred after the end of the survival period specified in Section 7.17.2, provided that a claim is made in writing to Sellers’ Representatives prior to the end of the survival period in accordance with the terms of this Agreement) as a result of, arising out of or directly or indirectly relating to all Liabilities arising from or relating to the Rothstein Agreement.

7.17.2 International Vapor’s and the Owners’ aggregate indemnification obligation pursuant to Section 7.17.1 shall be uncapped and their indemnification obligations pursuant to Section 7.17.1 shall survive until expiration of the applicable statute of limitations for Losses under Section 7.17.1. Section 7.4.3, Section 7.5, and Section 7.8 through Section 7.16 shall apply to this Section 7.17. For the avoidance of doubt, Sections 7.1, 7.3, 7.4 (other than 7.4.3), 7.6, and 7.7 shall not apply to this Section 7.17.

7.17.3 Notwithstanding anything to the contrary contained herein, all of Sellers’ and Owners’ indemnification obligations (including attorneys’ fees and costs) pursuant to this Section 7.17 will be satisfied, first, from the Special Escrow Shares except to the extent that a Seller and/or Owner shall elect, at his/its sole option, to satisfy their respective portion with cash. To the extent that the Special Escrow Shares shall have been fully exhausted and, therefore, shall be insufficient to satisfy a properly asserted indemnification claim the Buyer would have (except to the extent that any Seller and/or Owner shall elect to satisfy the same with cash) a right of offset against any earned but unpaid portion of the Earn-Out, however, if no such earned but unpaid portion of the Earn-Out Payments shall be available to satisfy such claim or no portion of the Earn-Out Payments is then earned, the Sellers and Owners shall satisfy such indemnification claim by, at the Sellers’ and/or Owners’ sole option, either a tender of Shares or Earn-Out Shares or a cash payment to the Buyer. For the avoidance of doubt and ambiguity, the Sellers and the Owners shall satisfy any indemnity claim with a cash payment to the extent the Shares and Earn-Out Shares then owned by them (or earned as an Earn-Out Payment but not yet issued to them) are not sufficient to do so in full. The value ascribed to the Special Escrow Shares, the Earn-Out Shares or the Shares to be released from the Special Escrow Fund, offset or tendered (as applicable) for purposes of satisfaction of any Buyer Indemnified Person’s indemnification claim under this Section 7.17 shall be equal to the quotient of the amount of the claims required to be paid divided by the greater of (A) the 30-trading day weighted average closing price per share of the Parent’s common stock, as reported on the primary exchange on which the Parent’s common stock is traded or quoted, preceding the date of when the claim is required to be paid, or (B) the Volume Weighted Average Closing Price. For the avoidance of doubt, in the event that a Seller or Owner is obligated to pay legal fees, costs and expenses, whether of the Sellers and/or Owners or any Buyer Indemnified Person, pursuant to the Sellers’ or Owners’ indemnification obligations as set forth in this Section 7.17, then upon the request of the Sellers’ Representative, a sufficient number of Special Escrow Shares then in the Special Escrow Fund shall be released to such Sellers and/or Owners to fund the amount of such obligation based on the value ascribed to such Special Escrow Shares as set forth in the preceding sentence; provided, however, that not more than an aggregate of 50% of the Special Escrow Shares held in the Special Escrow Fund on the Closing Date shall be released to fund such obligations. Further, in the event that International Vapor enters into a settlement agreement with Allan Rothstein regarding the Rothstein Agreement that involves a payment to Allan Rothstein of Shares, a sufficient number of Special Escrow Shares then in the Special Escrow Fund shall be released to International Vapor to fund the amount of such obligation based on the value ascribed to such Special Escrow Shares as set forth two sentences above. Buyer consents to Kozyak Tropin & Throckmorton serving as counsel to International Vapor with respect to the Rothstein Resolution, and consents to International Vapor and Owners assuming the defense of, and engaging Kozyak Tropin & Throckmorton to serve as counsel to the Buyer Indemnified Persons with respect to, any third party claim against which International Vapor and the Owners are obligated to indemnify the Buyer Indemnified Persons pursuant to Section 7.17.1; provided, however, the Buyer Indemnified Persons shall be entitled to separate counsel, at the expense of the Sellers and Owners, in the event a conflict of interest arises by virtue of such joint legal representation under the Florida Rules of Professional Conduct and Buyer’s foregoing consent for Kozyak Tropin & Throckmorton to serve as joint counsel shall not be deemed to constitute a waiver by it or any other Buyer Indemnified Person of any such conflict of interest.”

“7.18 DB Third Party Claim Indemnification.

7.18.1 From and after Closing, International Vapor and the Owners will indemnify and hold harmless the Buyer Indemnified Persons from, against and in respect of any and all Losses incurred or suffered by Buyer Indemnified Persons or any of them (including any Losses sustained or incurred after the end of the survival period specified in Section 7.18.2, provided that a claim is made in writing to Sellers’ Representatives prior to the end of the survival period in accordance with the terms of this Agreement) as a result of, arising out of or directly or indirectly relating to all Liabilities arising from or relating to any DB Third Party Claim.

7.18.2 International Vapor’s and the Owners’ aggregate indemnification obligation pursuant to Section 7.18.1 shall be uncapped and their indemnification obligations pursuant to Section 7.18.1 shall survive until expiration of the applicable statute of limitations for Losses under Section 7.18.1. Section 7.4.3, Section 7.5, and Section 7.8 through Section 7.16 shall apply to this Section 7.17. For the avoidance of doubt, Sections 7.1, 7.3, 7.4 (other than 7.4.3), 7.6, and 7.7 shall not apply to this Section 7.18.

7.18.3 Buyer consents to Gallivan, White & Boyd P.A. serving as counsel to International Vapor with respect to any DB Third Party Claim, and consents to International Vapor and Owners assuming the defense of, and engaging Gallivan, White & Boyd P.A. to serve as counsel to the Buyer Indemnified Persons with respect to, any DB Third Party Claim against which International Vapor and the Owners are obligated to indemnify the Buyer Indemnified Persons pursuant to Section 7.18.1; provided, however, the Buyer Indemnified Persons shall be entitled to separate counsel, at the expense of the Sellers and Owners, in the event a conflict of interest arises by virtue of such joint legal representation under the Florida Rules of Professional Conduct or the South Carolina Rules of Professional Conduct and Buyer’s foregoing consent for Gallivan, White & Boyd P.A. to serve as joint counsel shall not be deemed to constitute a waiver by it or any other Buyer Indemnified Person of any such conflict of interest. Notwithstanding anything to the contrary contained herein, all of Sellers’ and Owners’ indemnification obligations (including attorneys’ fees and costs) pursuant to this Section 7.18 will be satisfied with cash payments.”

17. Amendment of Section 9.1.2 of the Asset Purchase Agreement. Section 9.1.2 of the Asset Purchase Agreement is hereby amended by deleting the date “July 31, 2014” contained in such section with the following new date:

“September 30, 2014;”

18. Joint and Several Obligations. All payment and indemnification obligations of Owners set forth in this First Amendment shall be several (but not joint), pro rata based on the formula set forth in the last paragraph of Section 7.1.1.

19. Amendment to Section 11.2 of the Asset Purchase Agreement. Section 11.2 of the Asset Purchase Agreement is hereby amended by inserting the following new defined terms in the correct alphabetical order within Section 11.2:

|

|

|

|

| |

|

|

|

“Buyer Objection”

|

|

Section 1.2.6(d)

|

|

“DB Third Party Claim”

|

|

Section 4.10

|

|

“Discontinued Brand”

|

|

Section 1.1.2

|

|

“General Escrow Shares”

|

|

Section 1.2.4(a)

|

|

“General Escrow Fund”

|

|

Section 1.2.4(a)

|

|

“IVG Objection”

|

|

Section 1.2.6(b)

|

|

“New Brand”

|

|

Section 4.10

|

|

“New Brand Marketing Expense”

|

|

Section 4.10

|

|

“Pre-Closing Rebranding Costs”

|

|

Section 1.1.4(k)

|

|

“Post-Closing Rebranding Costs”

|

|

Section 1.2.6(a)

|

|

“Rebranding Cost Reimbursement”

|

|

Section 1.2.6(d)

|

|

“Rebranding Cost Surplus”

|

|

Section 1.2.6(f)

|

|

“Rebranding Escrow Shares”

|

|

Section 1.2.4(a)

|

|

“Rebranding Escrow Fund”

|

|

Section 1.2.4(a)

|

|

“Retained Inventory”

|

|

Section 1.1.2

|

|

“Retained Inventory Value”

|

|

Section 1.2.6(d)

|

|

“Rothstein Agreement”

|

|

Section 1.1.4(l)

|

|

“Rothstein Resolution”

|

|

Section 1.3

|

|

“Special Escrow Shares”

|

|

Section 1.2.4(a)

|

|

“Special Escrow Fund”

|

|

Section 1.2.4(a)

|

|

“Store Lease”

|

|

Section 4.11

|

20. Consent to Transfer. Each of Parent and Buyer consents to the transfer by Molina prior to the Closing Date of all of the Equity Securities of International Vapor held by Molina as of the date of the Agreement to Pegasus Real Estate Investment Group, LLC, a Florida limited liability company (“Pegasus”), which is owned in its entirety by the 2009 Pegasus Trust dated 2/25/2009 and the Nicolas Molina Revocable Trust dated 11/13/2009 (as amended from time to time). Each of Parent and Buyer acknowledges that Pegasus is not an “accredited investor” as such term is defined in Regulation D of the 1933 Act. From and after the completion of such transfer (the “Transfer Effective Date”), for purposes of the Agreement, “Owner” shall be deemed to refer to Pegasus rather than Molina and Molina shall be deemed an “Affiliate” of Pegasus, and on or prior to the Transfer Effective Date Pegasus shall deliver to Buyer and Parent a letter wherein, as an “Owner”, it shall make as of the Transfer Effective Date the representations and warranties set forth in Section 2.2.2, Section 2.2.5, Section 2.3, Section 2.4, Section 2.5, Section 2.15.4, Section 2.20, Section 2.25.1, Section 2.29 and Section 2.32 (other than Section 2.32.8) (provided, for the avoidance of doubt, that Pegasus shall make only the representations and warranties in such sections that specifically relate to itself as an “Owner”) and agree to perform the covenants and agreements set forth in the Agreement that an “Owner” is required to perform before and after the Closing and such letter shall be deemed a part of and incorporated by reference into the Agreement as if fully set forth therein; provided, however, that the representations and warranties made by Molina in the Agreement as an “Owner” shall be deemed to survive and continue in full force and effect notwithstanding the transfer of his Equity Securities of International Vapor to Pegasus in accordance herewith; and provided, further, that Molina and Pegasus shall be jointly and severally liable with respect to any indemnification obligations of Pegasus as an “Owner” pursuant to Article 7 (and, for the avoidance of doubt, the transfer of Molina’s Equity Securities of International Vapor to Pegasus in accordance herewith shall not relieve Molina of his obligations to perform the covenants and agreements set forth in the Agreement that apply to him in a capacity other than as an “Owner”, including those set forth in Section 4.8.2 and Section 6.2).

21. Transfer of Earn-Out Payments. Each of Parent and Buyer consents to the transfer by Molina to Pegasus of Molina’s right, pursuant to Section 1.7.7, to receive 40.28% of the Earn-Out in accordance with the terms of his Employment Agreement. Each of Parent, Buyer and Molina acknowledges and agrees that from and after the Transfer Effective Date, any Earn-Out Payment that would otherwise have been paid to Molina pursuant to Section 1.7.7 shall instead be paid directly to Pegasus. For the avoidance of doubt, from and after the Transfer Effective Date, the portion of the 43.17% of the Earn-Out that would otherwise have been paid to Molina as an “Owner” pursuant to Section 1.7.7 shall also be paid directly to Pegasus in its capacity as an “Owner.”

22. No Breach, No Delay. No claim, event, matter or occurrence, the existence of which is directly or indirectly addressed in this First Amendment shall be deemed a breach of the Agreement or a basis by any party to terminate the Agreement under Section 9.1 after the entering into of this First Amendment, nor shall such claim, event, matter or occurrence, or the action or inaction of any affected party in connection therewith, be deemed to have been the cause of, or resulted in, the failure of the Closing to occur on or before the date set forth in Section 9.1.2.

23. Effect of First Amendment. This First Amendment is not and shall not be construed as an amendment, modification or waiver of any provision of the Asset Purchase Agreement except as expressly provided herein, and in all other respects the Asset Purchase Agreement remains in full force and effect in accordance with its terms as of the date hereof. To the extent that any term or provision of this First Amendment conflicts with any term or provision of the Asset Purchase Agreement or any of the Company Agreements, such term or provision of this First Amendment shall govern.

24. Entire Agreement. This First Amendment constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior oral or written understandings and agreements between the parties hereto with respect to the subject matter hereof.

25. Counterparts; General. This First Amendment may be executed and delivered (by facsimile, e-mail or other electronic transmission) in any number of counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. Sections 10.10 (Severability), 10.11 (Headings), Section 10.12 (Construction), 10.13 (Governing Law), 10.14 (Jurisdiction; Venue; Service of Process) and 10.15 (Wavier of Jury Trial) of the Asset Purchase Agreement are hereby incorporated by reference herein and made a part hereof as if fully set forth herein.

[Intentionally Left Blank; Signature Page Follows]

IN WITNESS WHEREOF, the undersigned have executed and delivered this First Amendment as of the date first above written.

| |

|

|

|

|

|

PARENT

|

|

|

| |

|

|

|

Vapor Corp.

|

|

|

| |

|

|

| By: |

/s/ Harlan Press |

|

|

| Name: |

Harlan Press |

|

|

|

Title:

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

| |

|

|

|

|

| BUYER |

|

|

| |

|

|

| IVGI Acquisition, Inc. |

|

|

| |

|

|

|

|

| By: |

/s/ Harlan Press |

|

|

|

Name:

|

Harlan Press |

|

|

| Title: |

President |

|

|

| |

|

|

| |

SELLERS’ REPRESENTATIVES

|

| |

|

|

| |

|

|

| |

/s/ David Epstein |

|

| |

DAVID EPSTEIN |

|

| |

|

|

| |

|

|

| |

/s/ David Herrera |

|

| |

DAVID HERRERA |

|

| |

|

|

| |

|

|

| |

/s/ Nicolas Molina |

|

| |

NICOLAS MOLINA |

|

Exhibit 99.1

Vapor Corp. and International Vapor Group, a Multi-brand e-

Cigarette and Vaporizer Company, enter into First Amendment to

Asset Purchase Agreement

DANIA BEACH, Fla., July 28, 2014 – Vapor Corp. (NASDAQCM: VPCO; “Vapor” or “the Company”), a leading U.S.-based electronic cigarette and vaporizer company, today announced that on July 25, 2014 the Company and International Vapor Group, Inc. and certain of its subsidiaries (“IVG”) amended their previously announced asset purchase agreement entered into on May 14, 2014, pursuant to which the Company will purchase IVG’s e-cigarettes and vaporizers e-commerce, wholesale and retail operations (the “IVG business”) by acquiring substantially all of IVG’s assets and assuming certain of its liabilities.

The parties amended the asset purchase agreement by entering into a first amendment to asset purchase agreement. The first amendment extends the termination date of the asset purchase agreement to September 30, 2014, requires IVG’s business prior to completing the acquisition to cease using the VAPOR ZONE® brands and to rebrand the IVG business, as necessary, with one or more new brands mutually agreed upon by the parties and expands and modifies IVG’s and the International Vapor Group, Inc. owners’ indemnity obligations, among other modifications to the asset purchase agreement.

Completion of the acquisition is subject to Vapor obtaining stockholder approval for issuance of the shares of its common stock that will be issued under the asset purchase agreement, as amended by the first amendment, as well as additional customary closing conditions. Vapor expects to complete the acquisition as soon as possible but not later than September 30, 2014.

Additional information about the first amendment to the asset purchase agreement has been filed by Vapor with the Securities and Exchange Commission in a Current Report on Form 8-K and investors are encouraged to read the filing for a better understanding of the terms and conditions of the asset purchase agreement, as amended by the first amendment.

About Vapor Corp.

Vapor Corp., a publicly traded company, is a leading U.S. based electronic cigarette company, whose brands include Krave®, VaporX®, Hookah Stix®, Alternacig®, Fifty-One®, EZ Smoker®, Green Puffer®, Americig®, Fumare™ and Smoke Star®. We also design and develop private label brands for some of our distribution customers. “Electronic cigarettes” or “e-cigarettes,” are battery-powered products that enable users to inhale nicotine vapor without smoke, tar, ash or carbon monoxide. Vapor’s electronic cigarettes and accessories are available online, through direct response to our television advertisements and through retail locations throughout the United States. For more information on Vapor Corp. and its e-cigarette brands, please visit us at www.vapor-corp.com.

Safe Harbor Statement

This press release contains certain forward-looking statements that are made pursuant to the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Words such as “expects,” “anticipates,” “plans,” “believes,” “scheduled,” “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These forward-looking statements concern Vapor’s operations, economic performance, financial condition and pending acquisition of IVG’s online, wholesale and retail operations and are based largely on Vapor’s beliefs and expectations. These statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Vapor to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Certain of these factors and risks, as well as other risks and uncertainties are stated in Vapor’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and in Vapor’s subsequent filings with the U.S. Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Vapor assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Contacts:

Media:

Caitlin Kasunich

KCSA Strategic Communications

ckasunich@kcsa.com

(212) 896-1241

Investors:

Jeffrey Goldberger / Garth Russell

KCSA Strategic Communications

jgoldberger@kcsa.com / grussell@kcsa.com

(212) 896-1249 / (212) 896-1250

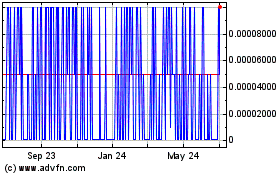

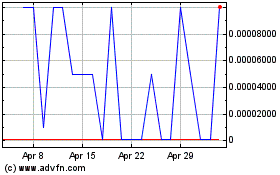

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024