Filed Pursuant to Rule 424(b)(3)

Registration No. 333-197285

PROSPECTUS

Gevo, Inc.

17,534,279 Shares of Common Stock

This prospectus

relates to the offer and sale from time to time by the Selling Stockholder (as defined herein) of up to 17,534,279 shares of our common stock, par value $0.01 per share (the “Common Stock”). The shares of Common Stock covered by this

prospectus include shares of Common Stock issuable upon exercise of our 10.0% Convertible Senior Secured Notes due 2017 (the “Convertible Notes”), which were issued in connection with a private placement financing, and shares of Common

Stock that may be issuable from time to time in the event that we pay a portion of the interest on the Convertible Notes in kind (by either increasing the principal amount of the Convertible Notes or issuing additional Convertible Notes) or elect to

pay make-whole payments due upon conversion of the Convertible Notes, if any, in shares of Common Stock. We are registering the resale of the shares of Common Stock underlying the Convertible Notes as required by the Registration Rights Agreement

that we entered into with the Selling Stockholder on May 9, 2014 (the “Registration Rights Agreement”).

Our registration

of the shares of Common Stock covered by this prospectus does not mean that the Selling Stockholder will offer or sell any of the shares. The Selling Stockholder may offer and sell or otherwise dispose of the shares of Common Stock described in this

prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. See “Plan of Distribution” beginning on page 17 for more

information.

We will not receive any of the proceeds from the shares of Common Stock sold by the Selling Stockholder.

The Selling Stockholder will pay all underwriting discounts and selling commissions, if any, in connection with the sale of the shares of

Common Stock. We have agreed to pay certain expenses in connection with this registration statement and to indemnify the Selling Stockholder against certain liabilities. As of the date of this prospectus, no underwriter or other person has been

engaged to facilitate the sale of shares of Common Stock in this offering.

You should read this prospectus carefully before you invest.

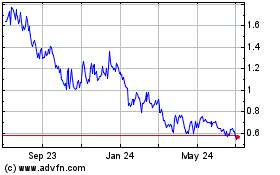

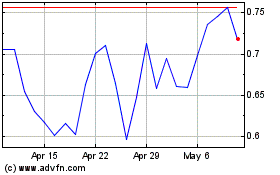

Our Common Stock is traded on the NASDAQ Global Market under the symbol “GEVO.” On July 3, 2014, the last reported sale

price of our Common Stock on the NASDAQ Global Market was $0.87. There is currently no trading market for the Convertible Notes.

Investing in

our securities involves a high degree of risk. You should carefully review the risks and uncertainties described under the heading “Risk Factors” beginning on page 10 and contained under similar headings in the other documents that we

incorporate by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 25, 2014.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

You should rely only on the information contained or incorporated by reference in this prospectus. Neither we nor the Selling Stockholder have

authorized anyone to provide you with information that is different from such information. If anyone provides you with different or inconsistent information, you should not rely on it. The Selling Stockholder is offering to sell Common Stock only in

jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on its cover page regardless of the time of delivery of this prospectus or any sale of the Common Stock. In case there

are differences or inconsistencies between this prospectus and the information incorporated by reference, you should rely on the information in the document with the latest date.

The Selling Stockholder is offering the Common Stock only in jurisdictions where such issuances are permitted. The distribution of this

prospectus and the issuance of the Common Stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to,

the issuance of the Common Stock and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the Common Stock

offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

It is important for you to read and consider all of the information contained in this prospectus in making your investment decision. To

understand the offering fully and for a more complete description of the offering you should read this entire document carefully, including particularly the “Risk Factors” section beginning on page 10. You also should read and consider the

information in the documents to which we have referred you in the sections entitled “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference”.

As used in this prospectus, unless the context requires otherwise, the terms “we”, “us”, “our”, “Gevo

®

” or “the Company” refer to Gevo, Inc., a Delaware corporation, and its wholly owned or indirect subsidiaries, and their predecessors. References to the “Selling

Stockholder” refer to the stockholder listed herein under “The Selling Stockholder” and its transferees, donees, pledgees or other successors–in–interest.

1

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

This prospectus contains estimates and other information concerning our target markets that are based on industry publications, surveys and

forecasts, including those generated by the US Energy Information Association (the “EIA”), the International Energy Agency (the “IEA”), the Renewable Fuels Association (the “RFA”) and Nexant, Inc. (“Nexant”).

Certain target market sizes presented in this prospectus have been calculated by us (as further described below) based on such information. This information involves a number of assumptions and limitations and you are cautioned not to give undue

weight to this information. Please read the section of this prospectus entitled “Cautionary Statement Regarding Forward-Looking Statements.” The industry in which we operate is subject to a high degree of uncertainty and risk due to a

variety of factors, including those described in this prospectus under the heading “Risk Factors” and those incorporated herein by reference to our most recent annual report on Form 10-K and any subsequently filed quarterly reports on Form

10-Q, as well as any amendments thereto reflected in subsequent filings with the Securities and Exchange Commission (the “SEC”). These and other factors could cause actual results to differ materially from those expressed in these

publications, surveys and forecasts.

With respect to calculation of product market volumes:

|

|

•

|

|

product market volumes are provided solely to show the magnitude of the potential markets for isobutanol and the products derived from it. They are not intended to be projections of our actual isobutanol production or

sales;

|

|

|

•

|

|

product market volume calculations for fuels markets are based on data available for the year 2011 (the most current data available from the IEA);

|

|

|

•

|

|

product market volume calculations for chemicals markets are based on data available for the year 2012 (the most current data available from Nexant); and

|

|

|

•

|

|

volume data with respect to target market sizes is derived from data included in various industry publications, surveys and forecasts generated by the EIA, the IEA and Nexant.

|

We have converted these market sizes into volumes of isobutanol as follows:

|

|

•

|

|

we calculated the size of the market for isobutanol as a gasoline blendstock and oxygenate by multiplying the world gasoline market volume by an estimated 12.5% by volume isobutanol blend ratio;

|

|

|

•

|

|

we calculated the size of the specialty chemicals markets by substituting volumes of isobutanol equivalent to the volume of products currently used to serve these markets;

|

|

|

•

|

|

we calculated the size of the petrochemicals and hydrocarbon fuels markets by calculating the amount of isobutanol that, if converted into the target products at theoretical yield, would be needed to fully serve these

markets (in substitution for the volume of products currently used to serve these markets); and

|

|

|

•

|

|

for consistency in measurement, where necessary we converted all market sizes into gallons.

|

Conversion into gallons for the fuels markets is based upon fuel densities identified by Air BP Ltd. and the American Petroleum Institute.

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements involve known and unknown risks, uncertainties and

other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the

forward-looking statements. Forward-looking statements may include, but are not limited to, statements relating to the achievement of advances in our technology platform, the success of our retrofit production model, the availability of suitable and

cost-competitive feedstocks, our ability to gain market acceptance for our products, the expected cost-competitiveness and relative performance attributes of our isobutanol and the products derived from it, additional competition and the future

price and volatility of petroleum and products derived from petroleum. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology.

Forward-looking statements reflect our current views about future events, are based on assumptions, and are subject to known and unknown risks

and uncertainties. Many important factors could cause actual results, performance or achievements to differ materially from the results, performance or achievements expressed in or implied by our forward-looking statements, including the factors

listed below. Many of the factors that will determine future results, performance or achievements are beyond our ability to control or predict. The following are important factors, among others, that could cause actual results, performance or

achievements to differ materially from the results, performance or achievements reflected in our forward-looking statements:

|

|

•

|

|

our ability to continue as a going concern;

|

|

|

•

|

|

our ability to successfully commercialize isobutanol and the products derived from it;

|

|

|

•

|

|

our ability to produce commercial quantities of isobutanol in a timely and economic manner;

|

|

|

•

|

|

unexpected delays, operational difficulties, cost-overruns or failures in the retrofit process;

|

|

|

•

|

|

our ability to successfully identify and acquire access to additional facilities suitable for efficient retrofitting;

|

|

|

•

|

|

our ability to market our isobutanol to potential customers;

|

|

|

•

|

|

fluctuations in the market price of petroleum;

|

|

|

•

|

|

fluctuations in the market price of corn and other feedstocks;

|

|

|

•

|

|

our ability to obtain regulatory approval for the use of our isobutanol in our target markets;

|

|

|

•

|

|

our ability to adequately protect our intellectual property, and prevent the loss of some of our intellectual property rights through costly litigation or administrative proceedings;

|

|

|

•

|

|

our ability to transition our preliminary commitments into definitive supply and distribution agreements or to negotiate sufficient long-term supply agreements for our production of isobutanol; and

|

|

|

•

|

|

general economic conditions and inflation, interest rate movements and access to capital.

|

The

forward-looking statements contained herein reflect our views and assumptions only as of the date such forward-looking statements are made. You should not place undue reliance on forward-looking statements. Except as required by law, we assume no

responsibility for updating any forward-looking statements nor do we

3

intend to do so. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. The risks included in this

section are not exhaustive. Additional factors that could cause actual results to differ materially from those described in the forward-looking statements are set forth in this prospectus under the heading “Risk Factors” and contained in

our most recent annual report on Form 10-K and any subsequently filed quarterly reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC. You should carefully read this prospectus, together with the

information incorporated herein by reference as described under the heading “Where You Can Find Additional Information,” completely and with the understanding that our actual future results may be materially different from what we expect.

4

PROSPECTUS SUMMARY

The following summary highlights certain information contained in this prospectus or incorporated by reference. This summary does not contain all of the

information you should consider before investing in our Common Stock. Before making an investment decision, you should read the entire prospectus carefully, including “Risk Factors,” together with the additional information described under

the headings “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

Our Company

We are a renewable chemicals and next generation biofuels company. Our strategy is to commercialize biobased alternatives to

petroleum-based products to allow for the optimization of fermentation facilities’ assets, with the ultimate goal of maximizing cash flows from the operation of those assets. Our underlying technology uses a combination of synthetic biology,

metabolic and chemical engineering and chemistry. We intend to focus primarily on the production and sale of isobutanol and related products from renewable feedstocks. Isobutanol is a four-carbon alcohol that can be sold directly for use as a

specialty chemical in the production of solvents, paints and coatings or as a value-added gasoline blendstock. Isobutanol can also be converted into butenes using dehydration chemistry deployed in the refining and petrochemicals industries today.

The convertibility of isobutanol into butenes is important because butenes are primary hydrocarbon building blocks used in the production of hydrocarbon fuels, lubricants, polyester, rubber, plastics, fibers and other polymers. We believe that the

products derived from isobutanol have potential applications in substantially all of the global hydrocarbon fuels market, representing a potential market for isobutanol of approximately 1,000 billion gallons per year (“BGPY”), and in

approximately 40% of the global petrochemicals market, representing a potential market for isobutanol of approximately 70 BGPY. When combined with a potential specialty chemical market for isobutanol of approximately 1.2 BGPY, we believe that the

potential global market for isobutanol is greater than 1,100 BGPY.

We believe that products derived from our isobutanol will be drop-in

products, which means that our customers will be able to replace petroleum-based intermediate products with renewable isobutanol-based intermediate products without modification to their equipment or production processes. The final products produced

from our renewable isobutanol-based intermediate products should be chemically and physically identical to those produced from petroleum-based intermediate products, except that they will contain carbon from renewable sources. Customer interest in

our renewable isobutanol is primarily driven by our production route, which we believe will be cost-efficient, and our renewable isobutanol’s potential to serve as a cost-effective, environmentally sensitive alternative to the petroleum-based

intermediate products that they currently use. We believe that at every step of the value chain, renewable products that are chemically identical to the incumbent petrochemical products will have lower market adoption hurdles in contrast with other

bioindustrial products because the infrastructure and applications for such products already exist. In addition, we believe that products made from biobased isobutanol will be subject to less raw material cost volatility than the petroleum-based

products in use today because of the lower historical cost volatility of agricultural feedstocks compared to oil.

In order to produce and

sell isobutanol made from renewable sources, we have developed the Gevo Integrated Fermentation Technology

®

(“GIFT

®

”), an

integrated technology platform for the efficient production and separation of renewable isobutanol. GIFT

®

consists of two components, proprietary biocatalysts that convert sugars derived from

multiple renewable feedstocks into isobutanol through fermentation, and a proprietary separation unit that is designed to continuously separate isobutanol during the fermentation process. We developed our technology platform to be compatible with

the existing approximately 23 BGPY of global operating ethanol production capacity, as estimated by the RFA.

GIFT

®

is designed to permit (i) the retrofit of existing ethanol capacity to produce either isobutanol, ethanol or both products simultaneously, or (ii) the addition of renewable isobutanol

or ethanol production capabilities to a facility’s existing ethanol production by adding additional fermentation capacity side-by-side with the facility’s existing ethanol fermentation capacity (collectively referred to as

“Retrofit”). Having the flexibility to switch between the production of isobutanol and ethanol, or produce both products simultaneously, should allow us to optimize asset utilization and cash flows at a facility by taking advantage of

fluctuations in market conditions.

5

GIFT

®

is also designed to allow relatively low capital expenditure Retrofits of existing ethanol facilities, enabling a rapid route to

isobutanol production from the fermentation of renewable feedstocks. We believe that our production route will be cost-efficient and will enable rapid deployment of our technology platform and allow our isobutanol and related renewable products to

be economically competitive with many of the petroleum-based products used in the chemicals and fuels markets today.

We expect that the

combination of our efficient proprietary technology, our marketing focus on providing drop-in substitutes for incumbent petrochemical products and our relatively low capital investment Retrofits will mitigate many of the historical issues associated

with the commercialization of renewable chemicals and fuels.

We were incorporated in Delaware in June 2005 under the name Methanotech,

Inc. and filed an amendment to our certificate of incorporation changing our name to Gevo, Inc. on March 29, 2006. Our principal executive offices are located at 345 Inverness Drive South, Building C, Suite 310, Englewood, CO 80112, and our

telephone number is (303) 858-8358. We maintain an Internet website at

www.gevo.com

. Information contained in or accessible through our website does not constitute part of this prospectus.

The Offering

|

|

|

|

|

Securities offered

|

|

17,534,279 shares of Common Stock, comprised of shares of Common Stock issuable upon exercise of the Convertible Notes and shares of Common Stock that may be issuable from time to time in the event that the Company pays a portion

of the interest on the Convertible Notes in kind or elects to pay make-whole payments due upon conversion of the Convertible Notes, if any, in shares of Common Stock.

|

|

|

|

|

Common Stock to be outstanding after the offering

|

|

86,638,284 shares

|

|

|

|

|

Selling Stockholder

|

|

All of the shares of Common Stock are being offered by the Selling Stockholder identified in the section titled “The Selling Stockholder” beginning on page 15 of this prospectus.

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any of the proceeds from the Common Stock sold by the Selling Stockholder.

|

|

|

|

|

NASDAQ Global Market Symbol

|

|

GEVO

|

The above information regarding the shares of Common Stock to be outstanding after the offering is based on

69,104,005 shares of Common Stock outstanding as of June 30, 2014. As discussed in “–Private Placement of Convertible Notes” below, the Selling Stockholder is subject to certain beneficial ownership limitations.

6

The following is a summary of the transactions relating to the securities being registered

hereunder:

Private Placement of Convertible Notes

To obtain funding for our ongoing obligations, we entered into a Term Loan Agreement, dated May 9, 2014, with Agri-Energy, LLC and Gevo

Development, LLC, as guarantors (the “Guarantors”), the lenders party thereto from time to time (each, a “Lender” and collectively, the “Lenders”) and WB Gevo, Ltd. (as successor in interest to Whitebox Advisors LLC),

as administrative agent (the “Whitebox Loan Agreement”), pursuant to which the Lenders committed to provide one or more senior secured term loans to the Company in an aggregate amount of up to approximately $31.1 million on the terms and

conditions set forth in the Whitebox Loan Agreement (collectively, the “Term Loan”). The first advance of the Term Loan in the amount of approximately $25.9 million was paid to the Company on May 9, 2014. In connection with the first

advance, the Lenders received a structuring fee in an amount equal to 3.5% of such advance. We also paid all reasonable out of pocket expenses, including legal fees, of the Lenders and the administrative agent in connection with the Term Loan and

have agreed to pay any such expenses associated with the Purchase Agreement (as defined below) and Registration Rights Agreement (as defined below).

On June 6, 2014, the Lenders exercised their option under that certain Exchange and Purchase Agreement, dated May 9, 2014, by and

among the Company, the Guarantors, WB Gevo, Ltd. and the other Lenders party thereto from time to time, and WB Gevo, Ltd. (as successor in interest to Whitebox Advisors LLC), in its capacity as administrative agent and representative for the Lenders

(the “Purchase Agreement”), to convert approximately $26.1 million in outstanding principal and interest under the Term Loan into Convertible Notes. In connection with the issuance of the Convertible Notes, the Company entered into an

Indenture (the “Indenture”), dated June 6, 2014, with the Guarantors and Wilmington Savings Fund Society FSB, as trustee and collateral trustee.

The Convertible Notes bear interest at a rate of 10% per annum, payable on March 31, June 30, September 30, and

December 31 of each year. Additional interest of 2% per annum may also accrue on the outstanding Convertible Notes, at the election of the holders of a majority of the outstanding Convertible Notes, during any period in which an event of

default under the Indenture has occurred and has not been cured or waived. The interest on the Convertible Notes will be payable in cash unless (i) no event of default has occurred and is continuing and (ii) the last reported sales price

of our Common Stock on the 10th trading day immediately preceding the relevant interest payment date is more than $1.10 per share, in which case 50% of the interest on the Convertible Notes will be payable in cash and 50% of the interest on the

Convertible Notes will be payable in kind. While the Convertible Notes are outstanding, we will be required to maintain an interest reserve in an amount equal to 10% of the aggregate unpaid principal amount of the Convertible Notes (including any

capitalized and uncapitalized interest that is paid in kind). The Convertible Notes will mature on March 15, 2017.

The Convertible

Notes are secured by a lien on substantially all of the assets of the Company and are guaranteed by the Guarantors. On June 6, 2014, in connection with the issuance of the Convertible Notes, the Company and the Guarantors entered into a Pledge

and Security Agreement in favor of the collateral trustee. The collateral pledged includes substantially all of the assets of the Company and the Guarantors, including intellectual property and real property. Agri-Energy, LLC has also entered into

an Amended and Restated Mortgage with respect to the real property located in Luverne, MN.

The holders of the Convertible Notes may, at

any time until the close of business on the business day immediately preceding the maturity date, convert the principal amount of the Convertible Notes, or any portion of such principal amount which is at least $1,000, into shares of our Common

Stock. Upon conversion of the Convertible Notes, we will deliver shares of our Common Stock at an initial conversion rate of 0.8633 shares of Common Stock per $1.00 principal amount of the Convertible Notes (equivalent to an initial conversion price

of approximately $1.1584 per share of Common Stock). Such conversion rate is subject to adjustment in certain circumstances, including in the event that there is a dividend or distribution paid on shares of the Common Stock or a subdivision,

combination or reclassification of the Common Stock. The Company also has the right to increase the conversion rate (i) by any amount for a period of at least 20 business days if the Company’s board of directors determines that such

increase would be in the Company’s best interest or (ii) to avoid or diminish any income tax to

7

holders of shares of Common Stock or rights to purchase shares of Common Stock in connection with any dividend or distribution. In addition, subject to certain conditions described herein, each

holder who exercises its option to voluntarily convert its Convertible Notes will receive a make-whole payment in an amount equal to any unpaid interest that would otherwise have been payable on such Convertible Notes through the maturity date (a

“Voluntary Conversion Make-Whole Payment”). Subject to certain limitations, we may pay any Voluntary Conversion Make-Whole Payments either in cash or in shares Common Stock, at our election.

Pursuant to the terms of the Indenture, a holder may not convert the Convertible Notes into shares of our Common Stock to the extent that,

after giving effect to such conversion, the number of shares of our Common Stock beneficially owned by such holder and its affiliates would exceed 4.99% of our Common Stock outstanding at the time of such conversion; provided that a holder may, at

its option and upon not less than 61 days’ prior notice, increase such threshold to an amount not in excess of 9.99%. Subject to the foregoing limitations, the Convertible Notes are convertible into shares of our Common Stock at any time.

The Indenture also contains limitations on the ability of certain holders to assign or otherwise transfer their interests in the Convertible

Notes.

Beginning on December 6, 2014, we will have the right to require holders of the Convertible Notes to convert all or part of

the Convertible Notes into shares of our Common Stock if the last reported sale price of our Common Stock over any 10 consecutive trading days equals or exceeds 150% of the applicable conversion price (a “Mandatory Conversion”). Each

holder whose Convertible Notes are converted in a Mandatory Conversion will receive a make-whole payment for the converted notes in an amount equal to any unpaid interest that would have otherwise been payable on such Convertible Notes through the

maturity date (a “Mandatory Conversion Make-Whole Payment”). Subject to certain limitations, we may pay any Mandatory Conversion Make-Whole Payments either in cash or in shares of Common Stock, at our election.

If a fundamental change of the Company occurs, the holders of Convertible Notes may require us to repurchase all or a portion of the

Convertible Notes at a cash repurchase price equal to 100% of the principal amount of such Convertible Notes, plus accrued and unpaid interest, if any, to, but excluding, the repurchase date, plus a cash make-whole payment for the repurchased

Convertible Notes in an amount equal to any unpaid interest that would otherwise have been payable on such Convertible Notes through the maturity date.

Pursuant to the terms of the Purchase Agreement, we have an option, subject to certain conditions and for a limited period of time following

the date of the Purchase Agreement, to require the Lenders to provide the Company with an additional $5.2 million (subject to a structuring fee in an amount equal to 3.5% ) by means of (i) a second advance under the Term Loan, which would also

be exchangeable into Convertible Notes, (ii) the purchase by the Lenders of additional Convertible Notes or (iii) a combination thereof (the allocation to be determined by the administrative agent). The Purchase Agreement also provides the

Lenders with an option, subject to certain conditions, to purchase up to an additional $32.0 million aggregate principal amount of Convertible Notes.

The potential issuance of more than 19.99% of our Common Stock upon conversion of the Convertible Notes was approved by our stockholders at

the annual meeting held on July 3, 2014.

In connection with the transactions described above, we also entered into a Registration

Rights Agreement, dated May 9, 2014 (the “Registration Rights Agreement”) with WB Gevo, Ltd. and the other parties thereto from time to time, pursuant to which we have agreed to, among other things, file a registration statement on

Form S-3 registering the resale of the shares of our Common Stock underlying the Convertible Notes.

We are obligated to cause the

registration statement to be filed no later than July 11, 2014 and declared effective no later than October 4, 2014. We are also obligated to use our reasonable best efforts to ensure that the registration statement remains in effect until

all of the securities covered by the registration statement have been sold or may be sold without volume restrictions and without the need for current public information pursuant to Rule 144 promulgated by the SEC under the Securities Act. The

registration statement to which this prospectus relates is intended to fulfill, in part, our obligations under the Registration Rights Agreement with respect the Convertible Notes issued by the Company on June 6, 2014.

8

In accordance with the terms of the Registration Rights Agreement, we will be required to file

another registration statement with respect to the remaining shares of Common Stock underlying the outstanding Convertible Notes and any other shares of Common Stock that may be issuable from time to time in the event that the Company pays a portion

of the interest on the Convertible Notes in kind or elects to pay make-whole payments due upon conversion of the Convertible Notes, if any, in shares of Common Stock, as well as the shares of Common Stock underlying any additional Convertible Notes

that may be issued pursuant to the terms of the Purchase Agreement.

In the event of a default of our obligations under the Registration

Rights Agreement, we will be required to pay an increased interest rate of 0.50% on the principal amount of any Convertible Notes that are effected by such default for each month that the registration statement has not been filed or declared

effective, as the case may be.

9

RISK FACTORS

An investment in our Common Stock involves a substantial risk of loss. You should carefully consider these risk factors, together with all

of the other information included or incorporated by reference in this prospectus and any accompanying prospectus supplement, as modified and superseded pursuant to Rule 412 under the Securities Act, before you decide to invest in our Common Stock.

The occurrence of any of the following risks could harm our business. In that case, the trading price of our Common Stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or

that we currently believe are immaterial may also impair our business operations and our liquidity. You should also refer to the other information contained in this prospectus and any accompanying prospectus supplement or incorporated by reference

herein or therein, including our financial statements and the notes to those statements and the information set forth under the heading “Cautionary Note Regarding Forward-Looking Statements.”

Our auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain

further financing.

Our audited financial statements for the year ended December 31, 2013, were prepared under the assumption

that we would continue our operations as a going concern. Our independent registered public accounting firm has included a “going concern” explanatory paragraph in its report on our financial statements for the year ended December 31,

2013, indicating that the amount of working capital at December 31, 2013 was not sufficient to meet the cash requirements to fund planned operations through December 31, 2014 without additional sources of cash, which raises substantial

doubt about our ability to continue as a going concern. Uncertainty concerning our ability to continue as a going concern may hinder our ability to obtain future financing. Continued operations and our ability to continue as a going concern are

dependent on our ability to obtain additional funding in the near future and thereafter, and there are no assurances that such funding will be available to us at all or will be available in sufficient amounts or on reasonable terms. Our financial

statements do not include any adjustments that may result from the outcome of this uncertainty. Without additional funds from private and/or public offerings of debt or equity securities, sales of assets, sales or out-licenses of intellectual

property or technologies, or other transactions, we will exhaust our resources and will be unable to continue operations. If we cannot continue as a viable entity, our stockholders would likely lose most or all of their investment in us.

We may incur additional indebtedness in the future. Any future indebtedness we incur exposes us to risks that could adversely affect our

business, financial condition and results of operations.

As of June 30, 2014, the aggregate amount of the outstanding

principal and final payments under our amended and restated loan and security agreement with TriplePoint Capital LLC (“TriplePoint”) was approximately $1 million and we had $26.1 million in outstanding Convertible Notes and $26.9 million

in outstanding 7.5% Convertible Senior Notes due 2022 which were issued by the Company in July 2012 (the “July Notes” and, together with the Convertible Notes, the “Notes”). Our indebtedness could have significant negative

consequences for our business, results of operations and financial condition, including:

|

|

•

|

|

increasing our vulnerability to adverse economic and industry conditions;

|

|

|

•

|

|

limiting our ability to obtain additional financing;

|

|

|

•

|

|

requiring the dedication of a substantial portion of our cash flow from operations to service our indebtedness, thereby reducing the amount of our cash flow available for other purposes;

|

|

|

•

|

|

limiting our flexibility in planning for, or reacting to, changes in our business; and

|

|

|

•

|

|

placing us at a possible competitive disadvantage with less leveraged competitors and competitors that may have better access to capital resources.

|

We cannot assure you that we will continue to maintain sufficient cash reserves or that our business will generate cash flow from operations

at levels sufficient to permit us to pay principal, premium, if any, and interest on our indebtedness, or that our cash needs will not increase. If we are unable to generate sufficient cash flow or

10

otherwise obtain funds necessary to make required payments, or if we fail to comply with the various requirements of our existing indebtedness or any other indebtedness which we may incur in the

future, we would be in default, which would permit the holders of the Notes and such other indebtedness to accelerate the maturity of the Notes and such other indebtedness and could cause defaults under the Notes and such other indebtedness. Any

default under the Notes or such other indebtedness could have a material adverse effect on our business, results of operations and financial condition.

In particular, the Convertible Notes and our indebtedness with TriplePoint are secured by liens on substantially all of our assets, including

our intellectual property. If we are unable to satisfy our obligations under such instruments, the holders of the Convertible Notes or TriplePoint, as applicable, could foreclose on our assets, including our intellectual property. Any such

foreclosure could force us to substantially curtail or cease our operations which could have a material adverse effect on our business, financial condition and results of operations.

Future issuances of our Common Stock or instruments convertible or exercisable into our Common Stock, including in connection with

conversions of Notes or exercises of Warrants (as defined below), may materially and adversely affect the price of our Common Stock and cause dilution to our existing stockholders.

We may obtain additional funds through public or private debt or equity financings in the near future, subject to certain limitations in the

agreements governing our indebtedness, including our secured indebtedness with Whitebox and/or TriplePoint. If we issue additional shares of Common Stock or instruments convertible into Common Stock, it may materially and adversely affect the price

of our Common Stock. In addition, the conversion of some or all of the Notes and/or the exercise of some or all of the warrants to purchase 21,303,750 shares of Common Stock that were issued by the Company in December 2013 (the “Warrants”)

may dilute the ownership interests of our stockholders, and any sales in the public market of any of our Common Stock issuable upon such conversion or exercise could adversely affect prevailing market prices of our Common Stock. Additionally, under

the terms of the Warrants, in the event that a Warrant is exercised at a time when we do not have an effective registration statement covering the underlying shares of Common Stock on file with the SEC, such Warrant must be net exercised, which will

dilute the ownership interests of existing stockholders without any corresponding benefit to the Company of a cash payment for the exercise price of such Warrant.

As of June 30, 2014, we had $26.9 million in outstanding July Notes, which were convertible into 10,682,401 shares of Common Stock at the

conversion rate in effect on June 30, 2014 (which amount includes 5,956,887 shares of Common Stock issuable in full satisfaction of the coupon make-whole payments due in connection therewith). The anticipated conversion of the $26.9 million in

outstanding July Notes into shares of our Common Stock could depress the trading price of our Common Stock. In addition, we have the option to issue Common Stock to any converting holder in lieu of making any required coupon make-whole payment in

cash. If we elect to issue our Common Stock for such payment, the stock will be valued at 90% of the simple average of the daily volume weighted average prices of our Common Stock for the 10 trading days ending on and including the trading day

immediately preceding the conversion date. If our stock price decreases, the number of shares we would be required to deliver in connection with the coupon make-whole payments would increase. Given that the agreements governing our indebtedness,

including our secured indebtedness with Whitebox and/or TriplePoint, may prohibit us from paying, repurchasing or redeeming the July Notes or making cash payments in respect of the coupon make-whole payments due upon a conversion, we may be unable

to make such payment in cash. If we issue additional shares of our Common Stock in satisfaction of such payments, this may cause significant additional dilution to our existing stockholders.

As of June 30, 2014, we had $26.1 million in outstanding Convertible Notes, which were convertible into 29,024,778 shares of our Common

Stock at the conversion rate in effect on June 30, 2014, as described above under the heading “Prospectus Summary—Private Placement of Convertible Notes.” The 29,024,778 shares includes 6,486,795 shares of Common Stock that may

be issuable from time to time in the event that the Company pays a portion of the interest on the Convertible Notes in kind or elects to pay

make-whole

payments due upon conversion of the Convertible Notes, if

any, in shares of Common Stock. The anticipated conversion of the principal amount of the Convertible Notes (including any interest that is paid in kind) into shares of our Common Stock could depress the trading price of our Common Stock. In

addition, subject to certain restrictions, we have the option to issue

11

Common Stock to any converting holder in lieu of making any required make-whole payment in cash. If we elect to issue our Common Stock for such payment, it will be at the same conversion rate

that is applicable to conversions of the principal amount of the Convertible Notes. If we elect to issue additional shares of our Common Stock for such payments, this may cause significant additional dilution to our existing stockholders.

The terms of the agreements governing our indebtedness, including our secured indebtedness with Whitebox and/or TriplePoint and the

indentures governing the Notes, may restrict our ability to engage in certain transactions.

The terms of the agreements governing

our indebtedness, including our secured indebtedness with Whitebox and/or TriplePoint and the indentures governing the Notes, may prohibit us from engaging in certain actions, including disposing of certain assets, granting or otherwise allowing the

imposition of a lien against certain assets, incurring certain kinds of additional indebtedness or acquiring or merging with other entities unless we receive the prior approval of the applicable lender or the requisite holders of the Notes. If we

are unable to obtain such approval, we could be prohibited from engaging in transactions which could be beneficial to our business and our stockholders or could be forced to repay such indebtedness in full.

The indentures governing the Notes may prohibit us from engaging in certain mergers or acquisitions and if a fundamental change of the Company

occurs prior to the maturity date of the Notes, holders of the Notes will have the right, at their option, to require us to repurchase all or a portion of their Notes and, in certain circumstances, to pay the holders of Convertible Notes a

make-whole payment equal to the aggregate amount of interest that would have been payable on such Convertible Notes from the repurchase date through the maturity date of such Convertible Notes. With respect to the July Notes, if a fundamental change

occurs prior to the maturity date of the July Notes, we will in some cases be required to increase the conversion rate for a holder that elects to convert its July Notes in connection with such fundamental change. With the respect to the Convertible

Notes, the Company has the right to increase the conversion rate of the Convertible Notes by any amount for a period of at least 20 business days if the Company’s board of directors determines that such increase would be in the Company’s

best interest. In addition, if an extraordinary transaction occurs, holders of Warrants will have the right, at their option, to require us to repurchase the unexercised portion of such Warrants for an amount in cash equal to the value of the

Warrants, as determined in accordance with the Black Scholes option pricing model and the terms of the Warrants. These and other provisions could prevent or deter a third party from acquiring us, even where the acquisition could be beneficial to

you.

The conversion or exercise prices, as applicable, of the Notes and Warrants can fluctuate under certain circumstances which,

if triggered, can result in potentially material further dilution to our stockholders.

The conversion price of the July Notes can

fluctuate in certain circumstances, including in the event that we undertake certain stock dividends, splits, combinations or distributions or if there is a fundamental change prior to the maturity date of the July Notes. In such instances, the

conversion price of the July Notes can fluctuate materially lower than the initial conversion price of $5.69 per share. The conversion price of the Convertible Notes can fluctuate in certain circumstances, including in the event that there is a

dividend or distribution paid on shares of our Common Stock or a subdivision, combination or reclassification of our Common Stock. In such instances, the conversion price of the Convertible Notes can fluctuate materially lower than the initial

conversion price of $1.1584 per share. The number of shares of Common Stock for which the Warrants are exercisable and the price at which such shares of Common Stock may be purchased upon exercise of the Warrants may be adjusted in the event that

(i) we undertake certain stock dividends, splits, combinations, distributions, or (ii) we undertake certain issuances of Common Stock or convertible securities at prices lower than the then–current exercise price for the Warrants.

These provisions could result in substantial dilution to investors in our Common Stock.

12

The interest rates of the Notes can fluctuate under certain circumstances which, if

triggered, can result in potentially material further dilution to our stockholders.

The interest rates of the Notes can fluctuate

in certain circumstances, including in the event of a default of our obligations under the indentures governing the Notes or the Registration Rights Agreement as described above under the heading “Prospectus Summary—Private Placement of

Convertible Notes.” In addition, the interest on the Convertible Notes will be payable 50% in cash and 50% in kind if (i) no event of default has occurred and is continuing under the indenture governing the Convertible Notes and

(ii) the last reported sales price of our Common Stock on the 10th trading day immediately preceding the relevant interest payment date is more than $1.10 per share. As the Company may be required to pay a portion of the interest on the

Convertible Notes in kind, by either increasing the principal amount of the outstanding Convertible Notes or issuing additional Convertible Notes, any increase to the interest rate applicable to the Convertible Notes could result in additional

dilution to investors in our Common Stock.

Our Common Stock may be delisted from The NASDAQ Global Market, which could affect its

market price and liquidity.

We are required to continually meet the listing requirements of The NASDAQ Global Market (including a

minimum bid price for our common stock of $1.00 per share) to maintain the listing of our common stock on The NASDAQ Global Market. On June 30, 2014, we received a deficiency letter from The NASDAQ Global Market indicating that for 30

consecutive trading days our common stock had a closing bid price below the $1.00 per share minimum. In accordance with NASDAQ Listing Rules, we were provided a compliance period of 180 calendar days, or until December 29, 2014, to regain

compliance with this requirement. We can regain compliance with the minimum closing bid price requirement if the bid price of our Common Stock closes at $1.00 per share or higher for a minimum of 10 consecutive business days. If we do not regain

compliance with the minimum closing bid price requirement during the initial 180-day compliance period, we may be eligible for an additional 180-day compliance period if we transfer the listing of our Common Stock to The NASDAQ Capital Market,

provided that we meet the continued listing requirement for market value of publicly held shares and all other initial listing standards, with the exception of the bid price requirement. If we do not regain compliance with the minimum closing bid

price requirement during this second 180-day compliance period, NASDAQ will provide written notice that our securities are subject to delisting. At such time, we would be entitled to appeal the delisting determination to a NASDAQ Listing

Qualifications Panel. We cannot provide any assurance that our stock price will recover within the permitted grace period. If our Common Stock is delisted, it could be more difficult to buy or sell our Common Stock and to obtain accurate quotations,

and the price of our stock could suffer a material decline. Delisting would constitute a fundamental change under the indenture governing the Convertible Notes and we could be required to repurchase all or a portion of the Convertible Notes.

Delisting may also impair our ability to raise capital.

13

USE OF PROCEEDS

This prospectus relates to shares of our Common Stock that may be offered and sold from time to time by the Selling Stockholder. We will not

receive any of the proceeds resulting from the sale of Common Stock by the Selling Stockholder.

14

THE SELLING STOCKHOLDER

This prospectus relates to the resale by the Selling Stockholder named below, from time to time, of up to 17,534,279 shares of our Common

Stock issued or issuable to the Selling Stockholder upon the conversion of the Convertible Notes, as described above under the heading “Prospectus Summary—Private Placement of Convertible Notes.” The 17,534,279 shares includes shares

of our Common Stock issuable upon conversion of the Convertible Notes and shares of Common Stock that may be issuable from time to time in the event that the Company pays a portion of the interest on the Convertible Notes in kind or elects to pay

make-whole payments due upon conversion of the Convertible Notes, if any, in shares of Common Stock.

We do not know when or in what

amounts the Selling Stockholder may sell or otherwise dispose of the shares covered hereby. The Selling Stockholder might not sell any or all of the shares covered by this prospectus or may sell or dispose of some or all of the shares other than

pursuant to this prospectus. Because the Selling Stockholder may not sell or otherwise dispose of some or all of the shares covered by this prospectus and because there are currently no agreements, arrangements or understandings with respect to the

sale or other disposition of any of the shares, we cannot estimate the number of the shares that will be held by the Selling Stockholder after completion of the offering. For purposes of the table below, we have assumed that the Selling Stockholder

will have sold all of the shares covered by this prospectus upon completion of the applicable offering.

WB Gevo, Ltd., is currently the

sole Selling Stockholder and, to date, is the sole Lender under the Whitebox Loan Agreement and the Purchase Agreement described above under the heading “Prospectus Summary—Private Placement of Convertible Notes.” Pursuant to the

terms of the Purchase Agreement, we have an option, subject to certain conditions and for a limited period of time following the date of the Purchase Agreement, to require the Lenders to provide the Company with an additional $5.2 million (subject

to a structuring fee in an amount equal to 3.5% ) by means of (i) a second advance under the Term Loan, which would also be exchangeable into Convertible Notes, (ii) the purchase by the Lenders of additional Convertible Notes or

(iii) a combination thereof (the allocation to be determined by the administrative agent). The Purchase Agreement also provides the Lenders with an option, subject to certain conditions, to purchase up to an additional $32.0 million aggregate

principal amount of Convertible Notes.

Except for the lending relationship described above, the Selling Stockholder has not held any

position or office or had any other material relationship with us or any of our predecessors or affiliates within the past three years other than as a result of the ownership of our securities. In addition, unless otherwise indicated in the

footnotes below, we believe that: (i) the Selling Stockholder is not a broker-dealer or an affiliate of a broker-dealer, (ii) the Selling Stockholder does not have any direct or indirect agreements or understandings with any person to

distribute its shares, and (iii) the Selling Stockholder has sole voting and investment power with respect to all shares beneficially owned, subject to applicable community property laws.

The Selling Stockholder has represented to us in writing that it acquired the securities or will acquire the underlying securities for its own

account and not with a view to or for distributing or reselling such securities. In recognition of the fact that the Selling Stockholder, even though purchasing the shares for its own account, may wish to be legally permitted to sell its securities

when it deems appropriate, we agreed with the Selling Stockholder to file a registration statement to register the resale of the securities. We also have agreed to use reasonable best efforts to keep the registration statement, of which this

prospectus constitutes a part, effective until all of the securities covered by the registration statement have been sold or may be sold without volume restrictions and without the need for current public information pursuant to Rule 144 promulgated

by the SEC under the Securities Act.

The table below presents information regarding the Selling Stockholder and the shares of our Common

Stock that it may sell or otherwise dispose of from time to time under this prospectus. The percentage of beneficial ownership is based upon 69,104,005 shares of Common Stock issued and outstanding as of June 30, 2014. Beneficial ownership is

determined under Section 13(d) of the Exchange Act and generally includes voting or investment power with respect to securities and includes any securities that grant the Selling Stockholder the right to acquire Common Stock within 60 days of

June 30, 2014. The number of shares in the column “Common Stock Owned Prior to

15

Offering” assumes that: (i) the full principal amount of the Convertible Notes (including all interest that is payable in kind) is converted into shares of Common Stock, and

(ii) the Company pays all make-whole payments, if any, that are due upon such conversion in shares of Common Stock. The information in the table below is based on information provided by or on behalf of the Selling Stockholder. Since the date

on which it provided us with the information below, the Selling Stockholder may have sold, transferred or otherwise disposed of some or all of its shares in transactions exempt from the registration requirements of the Securities Act.

Pursuant to the terms of the Indenture, a holder may not convert the Convertible Notes into shares of our Common Stock to the extent that,

after giving effect to such conversion, the number of shares of our Common Stock beneficially owned by such holder and its affiliates would exceed 4.99% of our Common Stock outstanding at the time of such conversion; provided that a holder may, at

its option and upon not less than 61 days’ prior notice, increase such threshold to an amount not in excess of 9.99%. Subject to the foregoing limitations, the Convertible Notes are convertible into shares of our Common Stock at any time.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Selling Stockholder

|

|

Common Stock Owned

Prior to Offering

(1)

|

|

|

Maximum Number

of Shares of

Common Stock to be

Offered Pursuant to

this Prospectus

|

|

|

Common Stock Owned After

Offering

(2)

|

|

|

|

|

Number

|

|

|

Number

|

|

|

Number

|

|

|

Percent

|

|

|

WB Gevo, Ltd.

(3)

|

|

|

29,024,778

|

|

|

|

17,534,279

|

|

|

|

11,490,499

|

|

|

|

11.7

|

%

|

|

(1)

|

The number of shares consists of the aggregate of the number of shares of Common Stock held by the Selling Stockholder and shares of Common Stock issuable upon exercise of Convertible Notes held by such Selling

Stockholder. These figures do not take into account any restrictions on the Selling Stockholder’s ability to exercise its conversion rights to the extent that, after giving effect to such conversion, the number of shares of our Common Stock

beneficially owned by the Selling Stockholder and its affiliates would exceed 4.99% or 9.99% of our Common Stock outstanding at the time of such conversion. In addition to the shares set forth in the table, the number of shares to be sold includes

an indeterminate number of shares issuable upon conversion of the Convertible Notes, as such number may be adjusted as a result of stock splits, stock dividends and similar transactions in accordance with Rule 416 under the Securities Act.

|

|

(2)

|

For purposes of this table, the Company assumes that all of the shares covered by this prospectus will be sold by the Selling Stockholder.

|

|

(3)

|

Andrew Redleaf exercises voting and dispositive power over the securities owned by WB Gevo, Ltd., all of which were acquired in the private placement described above under the heading “Prospectus

Summary—Private Placement of Convertible Notes.”

|

Each time the Selling Stockholder sells

any shares of Common Stock offered by this prospectus, it is required to provide you with this prospectus and the related prospectus supplement, if any, containing specific information about the Selling Stockholder and

the terms of the shares of Common Stock being offered in the manner required by the Securities Act.

No offer or sale

may occur unless the registration statement that includes this prospectus has been declared effective by the SEC and remains effective at the time the Selling Stockholder offers or sells shares of Common Stock. We are

required, under certain circumstances, to update, supplement or amend this prospectus to reflect material developments in our business, financial position and results of operations and may do so by an amendment to this prospectus, a prospectus

supplement or a future filing with the SEC incorporated by reference in this prospectus.

16

PLAN OF DISTRIBUTION

We are registering the shares of Common Stock on behalf of the Selling Stockholder to permit resales of the Common Stock by the holder from

time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the Selling Stockholder of the Common Stock. Sales of shares may be made by the Selling Stockholder, including its transferees, donees, pledgees

or other successors–in–interest directly to purchasers or to or through underwriters, broker–dealers or through agents. Sales may be made from time to time on the NASDAQ Global Market, any other exchange or market upon which our

shares may trade in the future, in the over–the–counter market, in private transactions or otherwise, at market prices prevailing at the time of sale, at prices related to market prices, or at negotiated or fixed prices. The shares may be

sold by one or more of, or a combination of, the following and these sales may be effected in transactions that may involve crosses or block transactions:

|

|

•

|

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

|

|

•

|

|

in the over-the-counter market;

|

|

|

•

|

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

•

|

|

through the writing or settlement of options or other hedging transactions, whether such options are listed on an options exchange or otherwise;

|

|

|

•

|

|

in ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

in block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

through purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

in an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

in privately negotiated transactions;

|

|

|

•

|

|

in sales pursuant to Rule 144;

|

|

|

•

|

|

whereby broker-dealers may agree with the Selling Stockholder to sell a specified number of such shares at a stipulated price per share;

|

|

|

•

|

|

in a combination of any such methods of sale; and

|

|

|

•

|

|

in any other method permitted pursuant to applicable law.

|

If the Selling Stockholder effects

such transactions by selling shares of Common Stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the Selling

Stockholder or commissions from purchasers of the shares of Common Stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be

in excess of those customary in the types of transactions involved). In connection with sales of the shares of Common Stock or otherwise, the Selling Stockholder may enter into hedging transactions with broker-dealers, which may in turn engage in

short sales of the shares of Common Stock in the course of hedging in positions they assume. The Selling Stockholder may also sell shares of Common Stock short and deliver shares of Common Stock covered by

17

this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The Selling Stockholder may also loan or pledge shares of Common Stock to

broker-dealers that in turn may sell such shares.

The Selling Stockholder may pledge or grant a security interest in some or all of the

Convertible Notes or shares of Common Stock owned by it and, if it defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock from time to time pursuant to this prospectus or

any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act. In such a case, we will amend, if necessary, the list of selling stockholders to include each transferee, donee, pledgee or other successor in

interest as a selling stockholder under this prospectus. The Selling Stockholder also may transfer and donate the shares of Common Stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be

the selling beneficial owners for purposes of this prospectus.

The Selling Stockholder and any broker-dealers participating in the

distribution of the shares of Common Stock may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be

underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares of Common Stock is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of shares of

Common Stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the Selling Stockholder and any discounts, commissions

or concessions allowed or reallowed or paid to broker-dealers. If the Selling Stockholder is deemed to be an “underwriter” within the meaning of the Securities Act, it will be subject to the prospectus delivery requirements of the

Securities Act and may be subject to certain statutory and regulatory liabilities, including liabilities imposed pursuant to Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange Act. We will make copies of this prospectus

(as it may be supplemented or amended from time to time) available to the Selling Stockholder for the purpose of satisfying the prospectus delivery requirements of the Securities Act.

Under the securities laws of some states, the shares of Common Stock may be sold in such states only through registered or licensed brokers or

dealers. In addition, in some states the shares of Common Stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that the Selling Stockholder will sell any or all of the shares of Common Stock registered pursuant to the

registration statement, of which this prospectus forms a part.

The Selling Stockholder and any other person participating in such

distribution will be subject to applicable provisions of the Exchange Act or the Securities Act, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and

sales of any of the shares of Common Stock by the Selling Stockholder and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of Common Stock to engage in market-making

activities with respect to the shares of Common Stock. All of the foregoing may affect the marketability of the shares of Common Stock and the ability of any person or entity to engage in market-making activities with respect to the shares of Common

Stock.

We have agreed to use reasonable best efforts to keep the registration statement, of which this prospectus constitutes a part,

effective until all of the securities covered by the registration statement have been sold or may be sold without volume restrictions and without the need for current public information pursuant to Rule 144 promulgated by the SEC under the

Securities Act. We will pay all expenses of the registration of the shares of Common Stock pursuant to the Registration Rights Agreement, including, without limitation, SEC filing fees and expenses of compliance with state securities or “Blue

Sky” laws; provided, however, that the Selling Stockholder will pay all underwriting fees, discounts and selling commissions, if any. We will indemnify the Selling Stockholder against liabilities, including some liabilities under the Securities

Act, in accordance with the Registration Rights Agreement, or the Selling Stockholder will be entitled to contribution. We may be indemnified

18

by the Selling Stockholder against civil liabilities, including liabilities under the Securities Act, that may arise from any written information furnished to us by the Selling Stockholder

specifically for use in this prospectus, in accordance with the Registration Rights Agreement, or we may be entitled to contribution.

19

DESCRIPTION OF COMMON STOCK

Authorized and Outstanding Capital Stock

Our authorized capital stock consists of 250,000,000 shares of Common Stock, par value $0.01 per share, and 10,000,000 shares of preferred

stock, par value $0.01 per share, issuable in one or more series designated by our board of directors. As of June 30, 2014, there were 69,104,005 shares of Common Stock and no shares of preferred stock outstanding.

Common Stock

The holders of our Common

Stock have one vote per share. Holders of Common Stock are not entitled to vote cumulatively for the election of directors. Generally, all matters to be voted on by stockholders must be approved by a majority, or, in the case of election of

directors, by a plurality, of the votes cast at a meeting at which a quorum is present, voting together as a single class, subject to any voting rights granted to holders of any then outstanding preferred stock. Subject to preferences that may be

applicable to any then outstanding preferred stock, holders of our Common Stock are entitled to participate equally in dividends when and as dividends may be declared by our board of directors out of funds legally available for the payment of

dividends. In the event of our voluntary or involuntary liquidation, dissolution or winding up, the prior rights of our creditors and the liquidation preference of any preferred stock then outstanding must first be satisfied. The holders of Common

Stock will be entitled to share in the remaining assets on a pro rata basis. No shares of Common Stock are subject to redemption or have redemptive rights to purchase additional shares of Common Stock.

Our Common Stock is listed on the NASDAQ Global Market under the symbol “GEVO.”

Anti-Takeover Provisions

The provisions

of the Delaware General Corporation Law (the “DGCL”), our amended and restated certificate of incorporation, and our amended and restated bylaws contain provisions that could discourage or make more difficult a change in control of Gevo

®

, including an acquisition of Gevo

®

by means of a tender offer, a proxy contest and removal of our incumbent officers and directors,

without the support of our board of directors. A summary of these provisions follows.

Statutory Business Combination Provision

We are subject to Section 203 of the DGCL (“Section 203”), which, subject to certain exceptions, prohibits a Delaware

corporation from engaging in any “business combination” with an “interested stockholder” for a period of three years following the time that such stockholder became an interested stockholder, unless:

|

|

•

|

|

the board of directors of the corporation approves either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder, prior to the time the interested stockholder

attained that status;

|

|

|

•

|

|

upon the closing of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the

transaction commenced, excluding, for purposes of determining the number of shares outstanding, those shares owned by persons who are directors and also officers and by employee stock plans in which employee participants do not have the right to

determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

•

|

|

at or subsequent to such time, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at

least 66-2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

20

With certain exceptions, an “interested stockholder” is a person or group who or which

owns 15% or more of the corporation’s outstanding voting stock (including any rights to acquire stock pursuant to an option, warrant, agreement, arrangement or understanding, or upon the exercise of conversion or exchange rights, and stock with

respect to which the person has voting rights only), or is an affiliate or associate of the corporation and was the owner of 15% or more of such voting stock at any time within the previous three years.

In general, Section 203 defines a business combination to include:

|

|

•

|

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

•

|

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

|

|

•

|

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

•

|

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

A Delaware corporation may “opt out” of this provision with an express provision in its original certificate of incorporation or an

express provision in its amended and restated certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. However, Gevo

®

has not “opted out” of this provision. Section 203 could prohibit or delay mergers or other takeover or change-in-control attempts and, accordingly, may discourage attempts to

acquire Gevo

®

.

Election and Removal of Directors

Our amended and restated certificate of incorporation provides for our board of directors to be divided into three classes, with staggered

three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Because our stockholders do not have cumulative voting

rights, our stockholders holding a majority of the shares of Common Stock outstanding are able to elect all of our directors. Directors may be removed only with cause by the affirmative vote of the holders of at least a majority of the outstanding

shares entitled to vote on such removal.

No Stockholder Action by Written Consent

Our amended and restated certificate of incorporation and our amended and restated bylaws provide that any action required or permitted to be