UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

| Date

of Report (Date of earliest event reported) |

July

25, 2014 |

Tompkins Financial

Corporation

(Exact

Name of Registrant as specified in Charter)

| New

York |

1-12709 |

16-1482357 |

| (State

or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| The

Commons, PO Box 460, Ithaca, New York |

14851 |

| (Address

of Principal Executive Offices) |

(Zip

Code) |

| Registrant’s telephone number, including area code |

(607) 273-3210 |

(Former name or former address,

if changed since last report.)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

☐ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On

July 25, 2014, the Company issued a press release announcing its earnings for the calendar quarter ended June 30, 2014. A copy

of the press release is attached to this Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

Item 8.01 Other Events

On July

25, 2014, the Company issued a press release announcing that its Board of Directors approved payment of a regular quarterly cash

dividend of $0.40 per share, payable on August 15, 2014, to common shareholders of record on August 4, 2014. A copy of the press

release is attached to this Report on Form 8-K as Exhibit 99.2 and is incorporated herein by reference.

On July

25, 2014, the Company also announced that its Board of Directors has authorized the repurchase of up to 400,000 shares of the Company’s

outstanding common stock. Purchases may be made on the open market or in privately negotiated transactions over the next 24 months.

A copy of the press release is attached to this Report on Form 8-K as Exhibit 99.3 and is incorporated herein by reference.

The repurchase

program may be suspended, terminated or modified at any time for any reason, including market conditions, the cost of repurchasing

shares, the availability of alternative investment opportunities, liquidity, and other factors deemed appropriate. The information

contained in this report, including Exhibits 99.1, 99.2, and 99.3, shall not be deemed "filed" with the SEC nor incorporated

by reference in any registration statement filed by the Company under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits.

| | Exhibit No. | Description |

| | | |

| 99.1 | Press Release of Tompkins Financial Corporation dated July 25, 2014 |

| 99.2 | Press Release of Tompkins Financial Corporation dated July 25, 2014 |

| | 99.3 | Press Release of Tompkins Financial Corporation dated July 25, 2014 |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TOMPKINS FINANCIAL CORPORATION |

| |

|

|

| |

|

|

| |

|

|

| Date: July 25, 2014 |

By: |

/s/ Stephen S. Romaine |

| |

|

Stephen S. Romaine |

| |

|

President and CEO |

INDEX TO EXHIBITS

Tompkins Financial Corporation 8-K

Exhibit 99.1

| |

For more information contact:

Stephen S. Romaine, President & CEO

Francis M. Fetsko, CFO & COO

Tompkins Financial Corporation (888) 503-5753

|

For Immediate Release

Friday, July 25, 2014

Tompkins Financial Corporation Reports Record Second Quarter

Earnings

ITHACA, NY – Tompkins

Financial Corporation (NYSEMKT:TMP)

Tompkins Financial Corporation reported

net income of $13.1 million for the second quarter of 2014, an increase of 18.7% from the $11.0 million reported for the same period

in 2013. Diluted earnings per share were $0.87 for the second quarter of 2014, a 16.0% increase from $0.75 reported for the second

quarter of 2013. This represents the best second quarter in Company history.

For the year-to-date period ended June

30, 2014, net income was $25.6 million, an increase of 13.8% from the $22.5 million reported for the same period in 2013. Diluted

earnings per share were $1.72 for the year-to-date period ended June 30, 2014, up 11.0% compared to the $1.55 per share reported

for the same period last year.

Prior period results included in this press

release were impacted by certain non-recurring items, which are more fully described in the non-GAAP disclosure tables included

with this press release.

President and CEO, Stephen S. Romaine said

“We are very pleased with the earnings growth for both quarter and year to date periods. Growth in loans, securities, and

core deposits contributed to improvement in net interest income. Meanwhile, a low level of net charge-offs and reductions in nonperforming

asset levels resulted in a modest provision expense for the quarter.”

Selected

highlights FOR second QUARTER:

| § | Diluted earnings per share for the quarter and six months ended June 30, 2014, reflect the best

second quarter and year-to-date results in the Company’s history. |

| § | Net interest income of $40.5 million was up 1.7% from the same period last year. |

| § | Provision expense declined to $67,000 for the second quarter of 2014, compared to $2.5 million

for the same period in 2013. |

| § | Credit quality improved with total non-performing assets at June 30, 2014 down 18.0% from the most

recent prior quarter, and down 24.0% from the same period last year. |

| § | Total loans at June 30, 2014 were up 5.7% over the same period in 2013, and were up an annualized

2.2% over year-end 2013. |

| § | Core deposits (total deposits less time deposit greater than $250,000, brokered deposits, and municipal

money market deposits) at June 30, 2014 were up 2.0% when compared to the same period in 2013. |

| § | Tangible book value per share has increased for the fourth consecutive quarter, and is up 16.3%

from the second quarter of 2013. Refer to Non-GAAP disclosure for additional details on tangible book value per share. |

| § | Annualized return on average equity was 10.91% for the quarter ended June 30, 2014, compared to

9.87% for the same period in 2013. |

NET INTEREST INCOME

Net interest income of $40.5 million for

the second quarter of 2014 increased 1.73% compared to $39.8 million reported for the same period in 2013. The net interest margin

for the second quarter of 2014 was 3.55%, compared to 3.58% for the same period in 2013. For the year-to-date period, net interest

income of $80.5 million was up 3.2% from the prior year. The net interest margin of 3.58% for the first six months of 2014 was

relatively unchanged from the 3.59% reported in the first six months of 2013.

NONINTEREST INCOME

Noninterest income was $17.7 million for

the second quarter of 2014, up 7.1% compared to the same period last year. For the first six months of 2014, noninterest income

was up 3.6% over the same period in 2013.

Noninterest income represented 30.4% of

total revenue for the second quarter of 2014, compared to 29.3% for the same period in 2013. Fee based revenue related to wealth

management, deposit fees, and card services fees, were all up from the same period in 2013, while insurance revenues were down

1.7% compared to the same period prior year.

NONINTEREST EXPENSE

Noninterest expense was $38.9 million for

the second quarter of 2014, up 3.1% compared to the second quarter of 2013. For the year-to-date period, noninterest expense was

up 2.4% from the same period in 2013. The increase in noninterest expense compared to the same period prior year is mainly a result

of higher salary and wages expense. Non-employee related expenses for the second quarter of 2014 were relatively unchanged from

the same quarter last year.

ASSET QUALITY

Asset quality trends improved in nearly

all categories during the quarter. Substandard and Special Mention loans declined by $70.3 million from the same period last year,

and by $27.6 million from the most recent prior quarter. The percentage of nonperforming loans and leases to total loans and leases

improved to 0.83% at June 30, 2014, compared to 1.28% reported at June 30, 2013. The percentage of nonperforming assets to total

assets improved to 0.66%, which is the lowest this percentage has been over the past 21 quarters, and remains well below the most

recent peer average of 1.56% by the Federal Reserve.1

Provision for loan and lease losses was

$67,000 for the second quarter of 2014, down from $2.5 million reported in the second quarter of 2013. Net loan and lease charge-offs

totaled $564,000 in the second quarter of 2014, down from $1.7 million in the second quarter of 2013.

The Company's allowance for originated

loan and lease losses totaled $26.8 million at June 30, 2014, which represented 1.02% of total originated loans, compared to $24.9

million or 1.08% at June 30, 2013 and $26.7 million or 1.04% at March 31, 2014. The increase in the allowance when compared to

the same period last year was mainly a result of loan growth and was partially offset by improved asset quality. The allowance

for loan and lease losses covered 103.08% of nonperforming loans and leases as of June 30, 2014, up from 64.99% at June 30, 2013

and 78.88% at the most recent prior quarter.

CAPITAL POSITION

Capital ratios remain well above the regulatory

well capitalized minimums. Tier 1 capital to average assets improved for the sixth consecutive quarter, to 8.79% at June 30, 2014,

and the ratio of total capital to risk-weighted assets was 13.92%, up from 13.34% at June 30, 2013.

ABOUT TOMPKINS FINANCIAL CORPORATION

Tompkins Financial Corporation is a financial

services company serving the Central, Western, and Hudson Valley regions of New York and the Southeastern region of Pennsylvania.

Headquartered in Ithaca, NY, Tompkins Financial is parent to Tompkins Trust Company, The Bank of Castile, Mahopac Bank, VIST Bank,

Tompkins Insurance Agencies, Inc., and offers wealth management services through Tompkins Financial Advisors. For more information

on Tompkins Financial, visit www.tompkinsfinancial.com.

NON-GAAP MEASURES

This press release contains financial information

determined by methods other than in accordance with accounting principles generally accepted in the United States of America (GAAP).

Where non-GAAP disclosures are used in this press release, the comparable GAAP measure, as well as reconciliation to the comparable

GAAP measure, is provided in the accompanying tables. Management believes that these non-GAAP measures provide useful information.

Non-GAAP measures should not be considered a substitute for financial measures determined in accordance with GAAP and investors

should consider the Company’s performance and financial condition as reported under GAAP and all other relevant information

when assessing the performance or financial condition of the Company. See “Tompkins Financial Corporation - Summary Financial

Data (Unaudited)” tables for Non-GAAP related calculations.

"Safe Harbor" Statement under

the Private Securities Litigation Reform of 1995:

This press release may include forward-looking

statements with respect to revenue sources, growth, market risk, and corporate objectives. The Company assumes no duty, and specifically

disclaims any obligation, to update forward-looking statements, and cautions that these statements are subject to numerous assumptions,

risks, and uncertainties, all of which could change over time. Actual results could differ materially from forward-looking statements.

| |

|

|

|

|

|

|

| TOMPKINS FINANCIAL CORPORATION |

| CONDENSED CONSOLIDATED STATEMENTS OF CONDITION |

| |

|

|

|

|

|

|

| (In thousands, except share and per share data) (Unaudited) |

|

As of |

|

As of |

| ASSETS |

|

06/30/2014 |

|

12/31/2013 |

| |

|

|

|

|

|

|

| Cash and noninterest bearing balances due from banks |

$ |

82,640 |

$ |

82,163 |

| Interest bearing balances due from banks |

|

779 |

|

721 |

| |

Cash and Cash Equivalents |

|

83,419 |

|

82,884 |

| |

|

|

|

|

|

|

| Trading securities, at fair value |

|

10,009 |

|

10,991 |

| Available-for-sale securities, at fair value (amortized cost of $1,373,243 at June 30, |

|

|

|

|

| |

2014 and $1,368,736 at December 31, 2013) |

|

1,379,254 |

|

1,354,811 |

| Held-to-maturity securities, at amortized cost (fair value of $31,629 at June 30, 2014 |

|

|

|

|

| |

and $19,625 at December 31, 2013) |

|

30,963 |

|

18,980 |

| Originated loans and leases, net of unearned income and deferred costs and fees |

|

2,610,289 |

|

2,527,244 |

| Acquired loans and leases, covered |

|

22,165 |

|

25,868 |

| Acquired loans and leases, non-covered |

|

596,514 |

|

641,172 |

| Less: Allowance for loan and lease losses |

|

27,517 |

|

27,970 |

| |

Net Loans and Leases |

|

3,201,451 |

|

3,166,314 |

| |

|

|

|

|

|

|

| FDIC Indemnification Asset |

|

3,490 |

|

4,790 |

| Federal Home Loan Bank stock |

|

21,028 |

|

25,041 |

| Bank premises and equipment, net |

|

58,808 |

|

55,932 |

| Corporate owned life insurance |

|

72,812 |

|

69,335 |

| Goodwill |

|

92,243 |

|

92,140 |

| Other intangible assets, net |

|

15,485 |

|

16,298 |

| Accrued interest and other assets |

|

88,859 |

|

105,523 |

| |

Total Assets |

$ |

5,057,821 |

$ |

5,003,039 |

| |

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

| Deposits: |

|

|

|

|

| |

Interest bearing: |

|

|

|

|

| |

Checking, savings and money market |

|

2,239,259 |

|

2,190,616 |

| |

Time |

|

901,650 |

|

865,702 |

| |

Noninterest bearing |

|

903,480 |

|

890,898 |

| |

Total Deposits |

|

4,044,389 |

|

3,947,216 |

| |

|

|

|

|

|

|

| Federal funds purchased and securities sold under agreements to repurchase |

|

144,796 |

|

167,724 |

| Other borrowings, including certain amounts at fair value of $11,164 at June 30, 2014 |

|

|

|

|

| |

and $11,292 at December 31, 2013 |

|

287,158 |

|

331,531 |

| Trust preferred debentures |

|

37,254 |

|

37,169 |

| Other liabilities |

|

54,987 |

|

61,460 |

| |

Total Liabilities |

$ |

4,568,584 |

$ |

4,545,100 |

| |

|

|

|

|

|

|

| EQUITY |

|

|

|

|

| Tompkins Financial Corporation shareholders' equity: |

|

|

|

|

| |

Common Stock - par value $.10 per share: Authorized 25,000,000 shares; Issued: |

|

|

|

|

| |

|

14,889,349 at June 30, 2014; and 14,785,007 at December 31, 2013 |

|

1,489 |

|

1,479 |

| |

Additional paid-in capital |

|

351,324 |

|

346,096 |

| |

Retained earnings |

|

150,893 |

|

137,102 |

| |

Accumulated other comprehensive loss |

|

(12,835) |

|

(25,119) |

| |

Treasury stock, at cost – 106,129 shares at June 30, 2014, and 105,449 shares |

|

|

|

|

| |

|

at December 31, 2013 |

|

(3,151) |

|

(3,071) |

| |

|

|

|

|

|

|

| |

Total Tompkins Financial Corporation Shareholders’ Equity |

|

487,720 |

|

456,487 |

| Noncontrolling interests |

|

1,517 |

|

1,452 |

| |

Total Equity |

$ |

489,237 |

$ |

457,939 |

| |

Total Liabilities and Equity |

$ |

5,057,821 |

$ |

5,003,039 |

| |

|

|

|

|

|

|

| See notes to consolidated financial statements |

| TOMPKINS FINANCIAL CORPORATION |

CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| |

| |

|

|

Three Months Ended |

|

Six Months Ended |

| (In thousands, except per share data) (Unaudited) |

|

|

06/30/2014 |

|

06/30/2013 |

|

06/30/2014 |

|

06/30/2013 |

| INTEREST AND DIVIDEND INCOME |

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

37,348 |

$ |

37,550 |

$ |

74,302 |

$ |

73,979 |

| Due from banks |

|

|

0 |

|

1 |

|

1 |

|

8 |

| Trading securities |

|

|

107 |

|

160 |

|

219 |

|

325 |

| Available-for-sale securities |

|

|

7,984 |

|

7,912 |

|

15,920 |

|

15,392 |

| Held-to-maturity securities |

|

|

186 |

|

177 |

|

338 |

|

368 |

| Federal Home Loan Bank stock and Federal Reserve Bank stock |

|

|

194 |

|

160 |

|

404 |

|

345 |

| Total Interest and Dividend Income |

|

|

45,819 |

|

45,960 |

|

91,184 |

|

90,417 |

| INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

| Time certificates of deposits of $100,000 or more |

|

|

951 |

|

1,239 |

|

1,903 |

|

2,443 |

| Other deposits |

|

|

1,826 |

|

2,016 |

|

3,616 |

|

4,198 |

| Federal funds purchased and securities sold under agreements to |

|

|

|

|

|

|

|

|

|

| repurchase |

|

|

763 |

|

966 |

|

1,580 |

|

1,976 |

| Trust preferred debentures |

|

|

571 |

|

690 |

|

1,141 |

|

1,377 |

| Other borrowings |

|

|

1,192 |

|

1,223 |

|

2,401 |

|

2,391 |

| Total Interest Expense |

|

|

5,303 |

|

6,134 |

|

10,641 |

|

12,385 |

| Net Interest Income |

|

|

40,516 |

|

39,826 |

|

80,543 |

|

78,032 |

| Less: Provision for loan and lease losses |

|

|

67 |

|

2,489 |

|

810 |

|

3,527 |

| Net Interest Income After Provision for Loan and Lease Losses |

|

|

40,449 |

|

37,337 |

|

79,733 |

|

74,505 |

| NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

| Insurance commissions and fees |

|

|

7,046 |

|

7,167 |

|

14,303 |

|

14,428 |

| Investment services income |

|

|

3,902 |

|

3,698 |

|

7,912 |

|

7,486 |

| Service charges on deposit accounts |

|

|

2,388 |

|

2,024 |

|

4,504 |

|

3,932 |

| Card services income |

|

|

1,920 |

|

1,690 |

|

4,032 |

|

3,428 |

| Mark-to-market loss on trading securities |

|

|

(34) |

|

(270) |

|

(93) |

|

(385) |

| Mark-to-market gain on liabilities held at fair value |

|

|

63 |

|

347 |

|

128 |

|

424 |

| Other income |

|

|

2,399 |

|

1,810 |

|

4,238 |

|

4,176 |

| Gain on sale of available-for-sale securities |

|

|

36 |

|

75 |

|

130 |

|

442 |

| Total Noninterest Income |

|

|

17,720 |

|

16,541 |

|

35,154 |

|

33,931 |

| NONINTEREST EXPENSES |

|

|

|

|

|

|

|

|

|

| Salaries and wages |

|

|

17,660 |

|

16,291 |

|

34,306 |

|

31,863 |

| Pension and other employee benefits |

|

|

4,978 |

|

5,338 |

|

11,023 |

|

11,408 |

| Net occupancy expense of premises |

|

|

3,066 |

|

2,954 |

|

6,326 |

|

6,015 |

| Furniture and fixture expense |

|

|

1,459 |

|

1,462 |

|

2,796 |

|

2,919 |

| FDIC insurance |

|

|

735 |

|

821 |

|

1,546 |

|

1,593 |

| Amortization of intangible assets |

|

|

525 |

|

547 |

|

1,052 |

|

1,104 |

| Merger related expenses |

|

|

0 |

|

37 |

|

0 |

|

233 |

| Other operating expense |

|

|

10,505 |

|

10,327 |

|

20,089 |

|

20,163 |

| Total Noninterest Expenses |

|

|

38,928 |

|

37,777 |

|

77,138 |

|

75,298 |

| Income Before Income Tax Expense |

|

|

19,241 |

|

16,101 |

|

37,749 |

|

33,138 |

| Income Tax Expense |

|

|

6,148 |

|

5,061 |

|

12,054 |

|

10,557 |

| Net Income attributable to Noncontrolling Interests and Tompkins Financial Corporation |

|

|

13,093 |

|

11,040 |

|

25,695 |

|

22,581 |

| Less: Net income attributable to noncontrolling interests |

|

|

32 |

|

33 |

|

65 |

|

65 |

| Net Income Attributable to Tompkins Financial Corporation |

|

$ |

13,061 |

$ |

11,007 |

$ |

25,630 |

$ |

22,516 |

| Basic Earnings Per Share |

|

$ |

0.88 |

$ |

0.76 |

$ |

1.73 |

$ |

1.55 |

| Diluted Earnings Per Share |

|

$ |

0.87 |

$ |

0.75 |

$ |

1.72 |

$ |

1.55 |

| |

|

|

|

|

|

|

|

|

|

| See notes to consolidated financial statements |

| |

| Average Consolidated Statements of Condition and Net Interest Analysis (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Quarter Ended |

|

Year to Date Period Ended |

|

Year to Date Period Ended |

| |

|

|

|

June 30, 2014 |

|

June 30, 2014 |

|

June 30, 2013 |

| |

|

|

|

Average |

|

|

|

|

Average |

|

|

|

|

Average |

|

|

|

| |

|

|

|

Balance |

|

|

Average |

|

Balance |

|

|

Average |

|

Balance |

|

|

Average |

| (Dollar amounts in thousands) |

|

(QTD) |

|

Interest |

Yield/Rate |

|

(YTD) |

|

Interest |

Yield/Rate |

|

(YTD) |

|

Interest |

Yield/Rate |

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest-bearing balances due from banks |

$ |

746 |

$ |

— |

0.00% |

$ |

885 |

$ |

1 |

0.23% |

$ |

2,760 |

$ |

8 |

0.58% |

| |

Securities (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

U.S. Government securities |

|

1,317,080 |

|

7,504 |

2.29% |

|

1,301,015 |

|

14,877 |

2.31% |

|

1,342,524 |

|

14,060 |

2.11% |

| |

|

Trading securities |

|

10,338 |

|

107 |

4.15% |

|

10,584 |

|

219 |

4.17% |

|

15,732 |

|

325 |

4.17% |

| |

|

State and municipal (5) |

|

91,870 |

|

1,017 |

4.44% |

|

89,964 |

|

2,127 |

4.77% |

|

99,179 |

|

2,558 |

5.20% |

| |

|

Other securities (5) |

|

4,269 |

|

32 |

3.01% |

|

4,729 |

|

76 |

3.24% |

|

8,295 |

|

150 |

3.65% |

| |

|

Total securities |

|

1,423,557 |

|

8,660 |

2.44% |

|

1,406,292 |

|

17,299 |

2.48% |

|

1,465,730 |

|

17,093 |

2.35% |

| |

FHLBNY and FRB stock |

|

21,196 |

|

194 |

3.67% |

|

20,670 |

|

404 |

3.94% |

|

20,942 |

|

345 |

3.32% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total loans and leases, net of unearned income (5)(6) |

|

3,221,223 |

|

37,762 |

4.70% |

|

3,206,950 |

|

75,161 |

4.73% |

|

3,001,458 |

|

74,906 |

5.03% |

| |

Total interest-earning assets |

|

4,666,722 |

|

46,616 |

4.01% |

|

4,634,797 |

|

92,865 |

4.04% |

|

4,490,890 |

|

92,352 |

4.15% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other assets |

|

363,673 |

|

|

|

|

371,552 |

|

|

|

|

442,103 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

5,030,395 |

|

|

|

|

5,006,349 |

|

|

|

|

4,932,993 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES & EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest-bearing deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Interest bearing checking, savings, & money market |

|

2,257,254 |

|

1,114 |

0.20% |

|

2,272,478 |

|

2,211 |

0.20% |

|

2,255,128 |

|

2,682 |

0.24% |

| |

|

Time deposits |

|

901,602 |

|

1,663 |

0.74% |

|

895,073 |

|

3,308 |

0.75% |

|

970,239 |

|

3,959 |

0.82% |

| |

|

Total interest-bearing deposits |

|

3,158,856 |

|

2,777 |

0.35% |

|

3,167,551 |

|

5,519 |

0.35% |

|

3,225,367 |

|

6,641 |

0.42% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Federal funds purchased & securities sold under |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

agreements to repurchase |

|

145,623 |

|

763 |

2.10% |

|

153,939 |

|

1,580 |

2.07% |

|

187,289 |

|

1,976 |

2.13% |

| Other borrowings |

|

278,424 |

|

1,192 |

1.72% |

|

263,633 |

|

2,401 |

1.84% |

|

181,292 |

|

2,391 |

2.66% |

| Trust preferred debentures |

|

37,227 |

|

571 |

6.15% |

|

37,205 |

|

1,141 |

6.18% |

|

43,683 |

|

1,377 |

6.36% |

| |

Total interest-bearing liabilities |

|

3,620,130 |

|

5,303 |

0.59% |

|

3,622,328 |

|

10,641 |

0.59% |

|

3,637,631 |

|

12,385 |

0.69% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest bearing deposits |

|

877,219 |

|

|

|

|

856,161 |

|

|

|

|

778,201 |

|

|

|

| Accrued expenses and other liabilities |

|

52,983 |

|

|

|

|

53,539 |

|

|

|

|

71,969 |

|

|

|

| |

Total liabilities |

|

4,550,332 |

|

|

|

|

4,532,028 |

|

|

|

|

4,487,801 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tompkins Financial Corporation Shareholders’ equity |

|

478,561 |

|

|

|

|

472,836 |

|

|

|

|

443,708 |

|

|

|

| Noncontrolling interest |

|

1,502 |

|

|

|

|

1,485 |

|

|

|

|

1,484 |

|

|

|

| |

Total equity |

|

480,063 |

|

|

|

|

474,321 |

|

|

|

|

445,192 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total liabilities and equity |

$ |

5,030,395 |

|

|

|

$ |

5,006,349 |

|

|

|

$ |

4,932,993 |

|

|

|

| Interest rate spread |

|

|

|

|

3.42% |

|

|

|

|

3.45% |

|

|

|

|

3.46% |

| |

Net interest income/margin on earning assets |

|

|

|

41,313 |

3.55% |

|

|

|

82,224 |

3.58% |

|

|

|

79,967 |

3.59% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax Equivalent Adjustment |

|

|

|

(797) |

|

|

|

|

(1,681) |

|

|

|

|

(1,935) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net interest income per consolidated financial statements |

|

|

$ |

40,516 |

|

|

|

$ |

80,543 |

|

|

|

$ |

78,032 |

|

| Tompkins Financial Corporation - Summary Financial Data (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands, except per share data) |

|

Quarter-Ended |

Year-Ended |

| |

|

Jun-14 |

|

Mar-14 |

|

Dec-13 |

|

Sep-13 |

|

Jun-13 |

|

Dec-13 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Period End Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

| Securities |

$ |

1,420,226 |

$ |

1,408,918 |

$ |

1,384,782 |

$ |

1,390,233 |

$ |

1,469,315 |

$ |

1,384,782 |

| Originated loans and leases, net of unearned income and deferred costs and fees (2) |

|

2,610,289 |

|

2,555,522 |

|

2,527,244 |

|

2,420,695 |

|

2,309,232 |

|

2,527,244 |

| Acquired loans and leases (3) |

|

618,679 |

|

648,690 |

|

667,040 |

|

698,617 |

|

745,951 |

|

667,040 |

| Allowance for loan and lease losses |

|

27,517 |

|

28,014 |

|

27,970 |

|

26,408 |

|

25,458 |

|

27,970 |

| Total assets |

|

5,057,821 |

|

5,041,800 |

|

5,003,039 |

|

4,932,428 |

|

4,931,883 |

|

5,003,039 |

| Total deposits |

|

4,044,389 |

|

4,105,170 |

|

3,947,216 |

|

3,972,756 |

|

3,912,910 |

|

3,947,216 |

| Federal funds purchased and securities sold under agreements to repurchase |

|

144,796 |

|

158,794 |

|

167,724 |

|

162,117 |

|

171,498 |

|

167,724 |

| Other borrowings |

|

287,158 |

|

214,616 |

|

331,531 |

|

242,177 |

|

299,098 |

|

331,531 |

| Trust preferred debentures |

|

37,254 |

|

37,211 |

|

37,169 |

|

37,127 |

|

43,703 |

|

37,169 |

| Shareholders' equity |

|

489,237 |

|

473,822 |

|

457,939 |

|

444,276 |

|

431,894 |

|

457,939 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

| Average earning assets |

$ |

4,666,722 |

$ |

4,602,517 |

$ |

4,571,099 |

$ |

4,533,603 |

$ |

4,571,428 |

$ |

4,521,873 |

| Average assets |

|

5,030,395 |

|

4,982,033 |

|

4,950,476 |

|

4,897,678 |

|

4,965,895 |

|

4,928,499 |

| Average interest-bearing liabilities |

|

3,620,130 |

|

3,624,555 |

|

3,574,803 |

|

3,572,708 |

|

3,663,230 |

|

3,605,430 |

| Average equity |

|

480,063 |

|

468,515 |

|

449,445 |

|

434,482 |

|

447,088 |

|

443,565 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Share data |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding (basic) |

|

14,709,881 |

|

14,644,548 |

|

14,589,120 |

|

14,515,053 |

|

14,427,838 |

|

14,477,617 |

| Weighted average shares outstanding (diluted) |

|

14,821,191 |

|

14,775,386 |

|

14,731,786 |

|

14,622,512 |

|

14,496,859 |

|

14,573,919 |

| Period-end shares outstanding |

|

14,853,439 |

|

14,829,007 |

|

14,749,097 |

|

14,692,671 |

|

14,599,558 |

|

14,749,097 |

| Book value per share |

|

32.94 |

|

31.95 |

|

31.05 |

|

30.24 |

|

29.58 |

|

31.05 |

| Tangible book value per share (Non-GAAP) |

|

25.68 |

|

24.65 |

|

23.70 |

|

22.82 |

|

22.08 |

|

23.70 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

$ |

40,516 |

$ |

40,027 |

$ |

42,624 |

$ |

40,473 |

$ |

39,826 |

$ |

161,129 |

| Provision for loan/lease losses |

|

67 |

|

743 |

|

585 |

|

2,049 |

|

2,489 |

|

6,161 |

| Noninterest income |

|

17,720 |

|

17,434 |

|

17,439 |

|

18,528 |

|

16,541 |

|

69,898 |

| Noninterest expense |

|

38,928 |

|

38,210 |

|

40,251 |

|

37,554 |

|

37,777 |

|

153,102 |

| Income tax expense |

|

6,148 |

|

5,906 |

|

4,905 |

|

5,316 |

|

5,061 |

|

20,777 |

| Net income attributable to Tompkins Financial Corporation |

|

13,061 |

|

12,602 |

|

14,290 |

|

14,049 |

|

11,007 |

|

50,856 |

| Noncontrolling interests |

|

32 |

|

33 |

|

32 |

|

33 |

|

33 |

|

131 |

| Basic earnings per share (9) |

$ |

0.88 |

$ |

0.85 |

$ |

0.97 |

$ |

0.96 |

$ |

0.76 |

$ |

3.48 |

| Diluted earnings per share (9) |

$ |

0.87 |

$ |

0.84 |

$ |

0.96 |

$ |

0.95 |

$ |

0.75 |

$ |

3.46 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Originated nonaccrual loans and leases |

$ |

16,918 |

$ |

26,974 |

$ |

29,875 |

$ |

33,881 |

$ |

32,100 |

$ |

29,875 |

| Acquired nonaccrual loans and leases |

|

5,907 |

|

6,936 |

|

8,508 |

|

8,008 |

|

6,916 |

|

8,508 |

| Originated loans and leases 90 days past due and accruing |

|

543 |

|

339 |

|

607 |

|

1,217 |

|

156 |

|

607 |

| Troubled debt restructurings not included above |

|

3,327 |

|

1,266 |

|

45 |

|

46 |

|

0 |

|

45 |

| Total nonperforming loans and leases |

|

26,695 |

|

35,515 |

|

39,035 |

|

43,152 |

|

39,172 |

|

39,035 |

| OREO (8) |

|

6,795 |

|

5,351 |

|

4,253 |

|

6,264 |

|

4,918 |

|

4,253 |

| Total nonperforming assets |

|

33,490 |

|

40,866 |

|

43,288 |

|

49,416 |

|

44,090 |

|

43,288 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Tompkins Financial Corporation - Summary Financial Data (Unaudited) - continued |

| |

|

Quarter-Ended |

Year-Ended |

| Delinquency - Originated loan and lease portfolio |

|

Jun-14 |

|

Mar-14 |

|

Dec-13 |

|

Sep-13 |

|

Jun-13 |

|

Dec-13 |

| Loans and leases 30-89 days past due and |

|

|

|

|

|

|

|

|

|

|

|

|

| accruing (2) |

$ |

5,221 |

$ |

5,660 |

$ |

5,762 |

$ |

12,193 |

$ |

9,597 |

$ |

5,762 |

| Loans and leases 90 days past due and accruing (2) |

|

543 |

|

339 |

|

607 |

|

1,217 |

|

156 |

|

607 |

| Total originated loans and leases past due and accruing (2) |

|

5,764 |

|

5,999 |

|

6,369 |

|

13,410 |

|

9,753 |

|

6,369 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Delinquency - Acquired loan and lease portfolio |

| Covered loans and leases 30-89 days past due and accruing (3)(7) |

|

0 |

|

635 |

|

0 |

|

1,132 |

|

1,613 |

|

0 |

| Covered loans and leases 90 days or more past |

|

|

|

|

|

|

|

|

|

|

|

|

| due and accruing (3)(7) |

|

904 |

|

1,135 |

|

2,416 |

|

2,980 |

|

3,091 |

|

2,416 |

| Non-covered loans and leases 30-89 days past |

|

|

|

|

|

|

|

|

|

|

|

|

| due and accruing (3)(7) |

|

1,620 |

|

2,293 |

|

1,532 |

|

6,887 |

|

5,591 |

|

1,532 |

| Non-covered loans and leases 90 days past |

|

|

|

|

|

|

|

|

|

|

|

|

| due and accruing (3)(7) |

|

3,048 |

|

3,746 |

|

4,557 |

|

10,521 |

|

13,324 |

|

4,557 |

| Total acquired loans and leases past due and accruing |

|

5,572 |

|

7,809 |

|

8,505 |

|

21,520 |

|

23,619 |

|

8,505 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total loans and leases past due and accruing |

$ |

11,336 |

$ |

13,808 |

$ |

14,874 |

$ |

34,930 |

$ |

33,372 |

$ |

14,874 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for Loan Losses - Originated loan and lease portfolio |

| Balance at beginning of period |

$ |

26,661 |

$ |

26,700 |

$ |

25,722 |

$ |

24,853 |

$ |

24,598 |

$ |

24,643 |

| Provision for loan and lease losses |

|

(56) |

|

511 |

|

(325) |

|

1,499 |

|

(994) |

|

1,000 |

| Net loan and lease (recoveries) charge-offs |

|

(147) |

|

550 |

|

(1,303) |

|

630 |

|

(1,249) |

|

(1,057) |

| Allowance for loan and lease losses (originated |

|

26,752 |

|

26,661 |

|

26,700 |

|

25,722 |

|

24,853 |

|

26,700 |

| loan portfolio) - balance at end of period |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for Loan Losses - Acquired loan and lease portfolio |

| Balance at beginning of period |

$ |

1,353 |

$ |

1,270 |

$ |

686 |

$ |

605 |

$ |

63 |

$ |

0 |

| Provision for loan and lease losses |

|

123 |

|

232 |

|

910 |

|

549 |

|

3,483 |

|

5,161 |

| Net loan and lease charge-offs |

|

711 |

|

149 |

|

326 |

|

468 |

|

2,941 |

|

3,891 |

| Allowance for loan and lease losses (acquired |

|

|

|

|

|

|

|

|

|

|

|

|

| loan portfolio) - balance at end of period |

|

765 |

|

1,353 |

|

1,270 |

|

686 |

|

605 |

|

1,270 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total allowance for loan and lease losses |

|

27,517 |

|

28,014 |

|

27,970 |

|

26,408 |

|

25,458 |

|

27,970 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loan Classification - Originated Portfolio |

|

|

|

|

|

|

|

|

|

|

|

|

| Special Mention |

$ |

35,484 |

$ |

44,725 |

$ |

42,365 |

$ |

42,975 |

$ |

43,099 |

$ |

42,365 |

| Substandard |

|

21,253 |

|

32,917 |

|

35,022 |

|

37,004 |

|

41,969 |

|

35,022 |

| Loan Classification - Acquired Portfolio |

|

|

|

|

|

|

|

|

|

|

|

|

| Special Mention |

|

12,124 |

|

14,936 |

|

17,322 |

|

23,939 |

|

29,300 |

|

17,322 |

| Substandard |

|

30,273 |

|

34,137 |

|

33,561 |

|

42,433 |

|

55,079 |

|

33,561 |

| Loan Classifications - Total Portfolio |

|

|

|

|

|

|

|

|

|

|

|

|

| Special Mention |

|

47,608 |

|

59,661 |

|

59,687 |

|

66,914 |

|

72,399 |

|

59,687 |

| Substandard |

|

51,526 |

|

67,054 |

|

68,583 |

|

79,437 |

|

97,048 |

|

68,583 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Tompkins Financial Corporation - Summary Financial Data (Unaudited) - continued |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| RATIO ANALYSIS |

|

Quarter-Ended |

Year-Ended |

| Credit Quality |

|

Jun-14 |

|

Mar-14 |

|

Dec-13 |

|

Sep-13 |

|

Jun-13 |

|

Dec-13 |

| Nonperforming loans and leases/total loans and leases (7) |

|

0.83% |

|

1.11% |

|

1.22% |

|

1.38% |

|

1.28% |

|

1.22% |

| Nonperforming assets/total assets |

|

0.66% |

|

0.81% |

|

0.87% |

|

1.00% |

|

0.89% |

|

0.87% |

| Allowance for originated loan and lease losses/total originated loans and leases |

|

1.02% |

|

1.04% |

|

1.06% |

|

1.06% |

|

1.08% |

|

1.06% |

| Allowance/nonperforming loans and leases |

|

103.08% |

|

78.88% |

|

71.65% |

|

61.20% |

|

64.99% |

|

71.65% |

| Net loan and lease losses (recoveries) annualized/total average loans and leases |

|

0.07% |

|

0.09% |

|

(0.12%) |

|

0.14% |

|

0.22% |

|

0.09% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Adequacy (period-end) |

|

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 capital / average assets |

|

8.79% |

|

8.68% |

|

8.52% |

|

8.37% |

|

8.16% |

|

8.52% |

| Total capital / risk-weighted assets |

|

13.92% |

|

13.67% |

|

13.42% |

|

13.32% |

|

13.34% |

|

13.42% |

| Tangible common equity / tangible assets |

|

7.68% |

|

7.38% |

|

7.11% |

|

6.92% |

|

6.65% |

|

7.11% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Profitability |

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets * |

|

1.04% |

|

1.02% |

|

1.15% |

|

1.10% |

|

0.89% |

|

1.03% |

| Return on average equity * |

|

10.91% |

|

10.88% |

|

12.62% |

|

12.83% |

|

9.87% |

|

11.47% |

| Net interest margin (TE) * |

|

3.55% |

|

3.60% |

|

3.78% |

|

3.63% |

|

3.58% |

|

3.65% |

| * Quarterly ratios have been annualized |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Disclosure |

|

|

|

|

|

|

|

|

|

|

|

|

| Reported noninterest income (GAAP) |

$ |

17,720 |

$ |

17,434 |

$ |

17,439 |

$ |

18,528 |

$ |

16,541 |

$ |

69,898 |

| Adjustments (pre-tax): |

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on redemption of trust preferred |

|

0 |

|

0 |

|

0 |

|

(1,410) |

|

0 |

|

(1,410) |

| Gain on deposit conversion |

|

0 |

|

0 |

|

(1,285) |

|

0 |

|

0 |

|

(1,285) |

| Noninterest income (Non-GAAP) |

$ |

17,720 |

$ |

17,434 |

$ |

16,154 |

$ |

17,118 |

$ |

16,541 |

$ |

67,203 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Disclosure |

|

|

|

|

|

|

|

|

|

|

|

|

| Reported net income (GAAP) |

$ |

13,061 |

$ |

12,569 |

$ |

14,290 |

$ |

14,049 |

$ |

11,007 |

$ |

50,856 |

| Adjustments (net of tax): |

|

|

|

|

|

|

|

|

|

|

|

|

| Merger related expenses |

|

0 |

|

0 |

|

0 |

|

0 |

|

22 |

|

140 |

| Gain on redemption of trust preferred |

|

0 |

|

0 |

|

0 |

|

(846) |

|

0 |

|

(846) |

| Gain on deposit conversion |

|

0 |

|

0 |

|

(771) |

|

0 |

|

0 |

|

(771) |

| Subtotal adjustments |

|

0 |

|

0 |

|

(771) |

|

(846) |

|

22 |

|

(1,477) |

| Net operating income (Non-GAAP) |

|

13,061 |

|

12,569 |

|

13,519 |

|

13,203 |

|

11,029 |

|

49,379 |

| Adjusted diluted earnings per share (Non-GAAP) (9) |

$ |

0.87 |

$ |

0.84 |

$ |

0.91 |

$ |

0.89 |

$ |

0.75 |

$ |

3.36 |

|

Tompkins Financial Corporation - Summary Financial Data (Unaudited)

- continued

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Disclosure |

|

Quarter-Ended |

Year-Ended |

| |

|

Jun-14 |

|

Mar-14 |

|

Dec-13 |

|

Sep-13 |

|

Jun-13 |

|

Dec-13 |

| Reported net income (GAAP) |

$ |

13,061 |

$ |

12,569 |

$ |

14,290 |

$ |

14,049 |

$ |

11,007 |

$ |

50,856 |

| Merger related expenses (net of tax) |

|

0 |

|

0 |

|

0 |

|

0 |

|

22 |

|

140 |

| Gain on redemption of trust preferred (net of tax) |

|

0 |

|

0 |

|

0 |

|

(846) |

|

0 |

|

(846) |

| Gain on deposit conversion |

|

0 |

|

0 |

|

(771) |

|

0 |

|

0 |

|

(771) |

| Net operating income (Non-GAAP) |

$ |

13,061 |

$ |

12,569 |

$ |

13,519 |

$ |

13,203 |

$ |

11,029 |

$ |

49,379 |

| Amortization of intangibles (net of tax) |

|

315 |

|

316 |

|

329 |

|

327 |

|

328 |

|

1,318 |

| Adjusted net operating income (Non-GAAP) |

|

13,376 |

|

12,885 |

|

13,848 |

|

13,530 |

|

11,357 |

|

50,697 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average total shareholders' equity |

|

480,063 |

|

468,515 |

|

449,445 |

|

434,482 |

|

447,088 |

|

443,565 |

| Less: Average goodwill and intangibles |

|

108,019 |

|

108,437 |

|

108,729 |

|

109,277 |

|

110,037 |

|

109,676 |

| Average tangible shareholders' equity (Non-GAAP) |

|

372,044 |

|

360,078 |

|

340,716 |

|

325,205 |

|

337,051 |

|

333,889 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating return on shareholders' tangible equity (annualized) (Non-GAAP) |

|

14.42% |

|

14.51% |

|

16.13% |

|

16.51% |

|

13.52% |

|

15.18% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Disclosure |

|

|

|

| Total shareholders' equity (GAAP) |

$ |

489,237 |

$ |

473,822 |

$ |

457,939 |

$ |

444,276 |

$ |

431,894 |

$ |

457,939 |

| Less: goodwill and intangibles |

|

107,728 |

|

108,250 |

|

108,438 |

|

108,981 |

|

109,540 |

|

108,438 |

| Tangible shareholders' equity |

|

381,509 |

|

365,572 |

|

349,501 |

|

335,295 |

|

322,354 |

|

349,501 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Ending shares outstanding |

|

14,853,439 |

|

14,829,007 |

|

14,749,097 |

|

14,692,671 |

|

14,599,558 |

|

14,749,097 |

| Tangible book value per share (Non-GAAP) |

|

25.68 |

|

24.65 |

|

23.70 |

|

22.82 |

|

22.08 |

|

23.70 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Disclosure |

Year-to-date period ended |

|

|

|

|

|

|

|

|

| |

Jun-14 |

Jun-13 |

|

|

|

|

|

|

|

|

| Net income attributable to Tompkins Financial |

|

|

$ |

|

|

|

|

|

|

|

|

|

| Corporation |

|

25,630 |

|

22,516 |

|

|

|

|

|

|

|

|

| Adjustments (net of tax): |

|

|

|

|

|

|

|

|

|

|

|

|

| Merger related expenses |

|

0 |

|

155 |

|

|

|

|

|

|

|

|

| Subtotal adjustments |

|

0 |

|

155 |

|

|

|

|

|

|

|

|

| Net operating income (Non-GAAP) |

|

25,630 |

|

22,671 |

|

|

|

|

|

|

|

|

| Adjusted diluted earnings per share |

$ |

1.72 |

$ |

1.56 |

|

|

|

|

|

|

|

|

| (1) Federal Reserve peer ratio as of March 31, 2014, includes banks and bank holding companies with consolidated assets between $3 billion and $10 billion. |

| (2) "Originated" equals loans and leases not included by definition in "acquired loans" |

| (3)"Acquired Loans and Leases" equals loans and leases acquired at fair value, accounted for in accordance with FASB ASC Topic 805. "Covered Loans" are loans for which the Company will share losses with the FDIC and consist of loans VIST Bank acquired as part of an FDIC-assisted transaction during the fourth quarter of 2010. |

| (4) Average balances and yields on available-for-sale securities are based on historical amortized cost. |

| (5) Interest income includes the tax effects of taxable-equivalent basis. |

| (6) Nonaccrual loans are included in the average asset totals presented above. Payments received on nonaccrual loans have been recognized as disclosed in Note 1 of the Company's consolidated financial statements included in Part I of the Company's annual report on Form 10-K for the fiscal year ended December 31, 2013. |

| (7) Certain acquired loans and leases that are past due are not on nonaccrual and are not included in nonperforming loans. The risk of credit loss on these loans has been considered by virtue of the Corporation's estimate of acquisition-date fair value and these loans are considered accruing as the Corporation primarily recognizes interest income through accretion of the difference between the carrying value of these loans and their expected cash flows. |

| (8) Includes all other real estate owned, including those balances acquired through business combinations. |

| (9)Earnings per share year-to-date may not equal the sum of the quarterly earnings per share as a result of rounding of average shares. |

Tompkins Financial Corporation 8-K

Exhibit 99.2

| |

For more information contact:

Stephen S. Romaine, President & CEO

Francis M. Fetsko, CFO & COO

Tompkins Financial Corporation (888) 503-5753

|

For Immediate Release

Friday, July 25, 2014

Tompkins Financial Corporation Declares Cash Dividend

ITHACA, NY - Tompkins

Financial Corporation (NYSEMKT:TMP)

Tompkins Financial Corporation announced

today that its Board of Directors approved payment of a regular quarterly cash dividend of $0.40 per share, payable on August 15,

2014, to common shareholders of record on August 4, 2014.

Tompkins Financial Corporation is a financial

services company serving the Central, Western, and Hudson Valley regions of New York and the Southeastern region of Pennsylvania.

Headquartered in Ithaca, NY, Tompkins Financial is parent to Tompkins Trust Company, The Bank of Castile, Mahopac Bank, VIST Bank,

Tompkins Insurance Agencies, Inc., and offers wealth management services through Tompkins Financial Advisors. For more information

on Tompkins Financial, visit www.tompkinsfinancial.com.

Tompkins Financial Corporation 8-K

Exhibit 99.3

| |

For more information contact:

Stephen S. Romaine, President & CEO

Francis M. Fetsko, CFO & COO

Tompkins Financial Corporation (888) 503-5753

|

For Immediate Release

Friday, July 25, 2014

Tompkins Financial Corporation

Announces Approval of Stock Repurchase

Program

ITHACA, NY – Tompkins Financial Corporation (NYSEMKT:TMP)

Tompkins Financial Corporation announced

today that its Board of Directors has authorized, at the discretion of Senior Management, the repurchase of up to 400,000 shares

of the Company’s outstanding common stock. Purchases may be made on the open market or in privately negotiated transactions

over the next 24 months.

Tompkins Financial Corporation is a financial

services company serving the Central, Western, and Hudson Valley regions of New York and the Southeastern region of Pennsylvania.

Headquartered in Ithaca, NY, Tompkins Financial is parent to Tompkins Trust Company, The Bank of Castile, Mahopac Bank, VIST Bank,

Tompkins Insurance Agencies, Inc., and offers wealth management services through Tompkins Financial Advisors. For more information

on Tompkins Financial, visit www.tompkinsfinancial.com.

"Safe Harbor" Statement under

the Private Securities Litigation Reform of 1995:

This press release may include forward-looking

statements with respect to revenue sources, growth, market risk, and corporate objectives. The Company assumes no duty, and specifically

disclaims any obligation, to update forward-looking statements, and cautions that these statements are subject to numerous assumptions,

risks, and uncertainties, all of which could change over time. Actual results could differ materially from forward-looking statements.

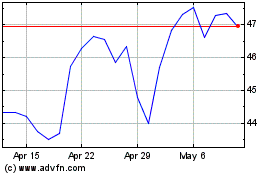

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

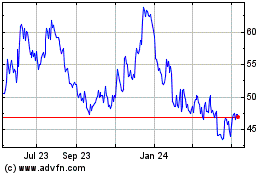

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Apr 2023 to Apr 2024