Osisko Gold Royalties Announces Flow Through Private Placement Into NioGold Mining

July 25 2014 - 1:15PM

Marketwired Canada

Osisko Gold Royalties (the "Company" or "Osisko") (TSX:OR) is pleased to

announce that it has signed a letter of intent with NioGold Mining Corporation

("NioGold") pursuant to which Osisko will acquire 14 million flow-through common

shares of NioGold at a price of $0.35 per share by way of private placement. In

addition, Osisko will purchase from NioGold the right to repurchase certain

royalties on its claims for an aggregate purchase price $150,000. Details of the

transaction are as follows:

Private placement

Osisko will acquire 14 million flow-through common shares of NioGold for total

proceeds of $4.9 million to NioGold, which will be listed for trading on the TSX

Venture Exchange under the symbol "NOX" on closing.

Osisko will acquire these 14 million flow-through common shares of NioGold for

investment purposes and other than these shares, Osisko has no current intention

to increase the beneficial ownership of, or control or direction over,

additional securities of NioGold. These shares are being acquired by Osisko

pursuant to applicable exemptions from the prospectus requirements and will be

subject to a four-month hold period.

Purchase of Right to Repurchase Marban and Malartic Hygrade-NSM Royalties

Osisko to pay $150,000 to purchase the rights held by NioGold to repurchase half

of the existing net smelter return royalties on the Marban block and Malartic

Hygrade-NSM block, consisting of:

a. The right to repurchase for the price of $1,000,000:

i. 0.25% NSR on the Marban claims

ii. 0.5% NSR on the First Canadian claims

iii.1.0% NSR on the Norlartic claims

b. The right to repurchase for the price of $1,000,000:

i. 1.0% NSR on the Malartic Hygrade-NSM claims

Upon closing of the transaction, Osisko will own 23,598,500 common shares of

NioGold, or approximately 19.5% of NioGold's issued and outstanding common

shares. The definitive agreement for the transaction will also include the

following key terms:

1. NioGold to relocate its head office to Montreal, Quebec

2. NioGold board to be reconstituted to include two Osisko nominees, two

NioGold nominees and one nominee to be jointly determined by Osisko and

NioGold, for a total of five directors.

The transaction is subject to customary conditions, including the satisfactory

completion of Osisko's due diligence on NioGold's assets, the negotiation and

entering into by both parties of a definitive agreement and regulatory approval

from the TSX Venture Exchange.

About NioGold Mining Corporation

NioGold is a mineral exploration company focused on gold. Its flagship projects

are located in the Cadillac - Malartic - Val-d'Or region of the prolific Abitibi

gold mining district, Quebec. The Cadillac, Malartic and Val-d'Or mining camps

have produced over 45 million ounces of gold since the 1930s and presently

encompasses six producing gold mines including the Canadian Malartic Mine.

NioGold's land holdings within the Abitibi presently cover 130km2 and encompass

four former gold producers, namely the Norlartic, Kierens (First Canadian),

Marban and Malartic Hygrade mines that collectively produced 640,000 ounces of

gold.

About Osisko Gold Royalties Ltd

Osisko is a gold-focused royalty and stream company whose cornerstone asset is a

5% NSR royalty on the Canadian Malartic Gold Mine, located in Malartic, Quebec.

The Company also holds a 2% NSR royalty on the Upper Beaver, Kirkland Lake and

Hammond Reef gold exploration projects in Northern Ontario.

Osisko's head office is located at 1100 Avenue des Canadiens-de-Montreal, Suite

300, Montreal, Quebec, H3B 2S2.

Forward-looking statements

Certain statements contained in this press release may be deemed

"forward-looking statements". All statements in this release, other than

statements of historical fact, that address events or developments that Osisko

expects to occur, are forward looking statements. Forward looking statements are

statements that are not historical facts and are generally, but not always,

identified by the words "expects", "plans", "anticipates", "believes",

"intends", "estimates", "projects", "potential", "scheduled" and similar

expressions, or that events or conditions "will", "would", "may", "could" or

"should" occur including, without limitation, the satisfaction of conditions to

the completion of this transaction, the realization of the anticipated benefits

of this transaction, the performance of the assets of Osisko and any acquired

assets the potential of Osisko. Although Osisko believes the expectations

expressed in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future performance and actual

results may differ materially from those in forward looking statements. Factors

that could cause the actual results to differ materially from those in

forward-looking statements include, the results of efforts to satisfy the

conditions, including regulatory approvals, gold prices, Osisko's royalty

interest, access to skilled consultants, results of mining operation,

exploration and development activities, with production and development stage

mining operations, uninsured risks, regulatory changes, defects in title,

availability of personnel, materials and equipment, timeliness of government or

court approvals, actual performance of facilities, equipment and processes

relative to specifications and expectations, unanticipated environmental impacts

on operations market prices, continued availability of capital and financing and

general economic, market or business conditions.

These factors are discussed in greater detail in Schedule I to the management

information circular of Osisko Mining Corporation which created Osisko and which

is filed on SEDAR and also provide additional general assumptions in connection

with these statements. Osisko cautions that the foregoing list of important

factors is not exhaustive. Investors and others who base themselves on the

forward looking statements contained herein should carefully consider the above

factors as well as the uncertainties they represent and the risk they entail.

Osisko believes that the expectations reflected in those forward-looking

statements are reasonable, but no assurance can be given that these expectations

will prove to be correct and such forward-looking statements included in this

press release should not be unduly relied upon. These statements speak only as

of the date of this press release. Osisko undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise, other than as required by applicable

law.

FOR FURTHER INFORMATION PLEASE CONTACT:

John Burzynski

Senior Vice President New Business Development

(416) 363-8653

jburzynski@osiskogr.com

Sylvie Prud'homme

Director of Investor Relations

(514) 940-0670

sprudhomme@osiskogr.com

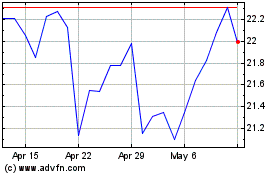

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

From Mar 2024 to Apr 2024

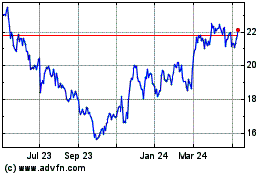

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

From Apr 2023 to Apr 2024