4G chipmaker Sequans Communications S.A. (NYSE: SQNS) today

announced financial results for the second quarter ended June 30,

2014.

Second Quarter 2014 Highlights:

Revenue: Revenue of $5.1 million increased 13% compared

to the first quarter of 2014, due to higher sales of chipsets and

higher other revenue. Revenue increased 116% compared to the second

quarter of 2013 due to higher sales of products for the LTE

markets.

Gross margin: Gross margin was 41.3% compared to gross

margin of 39.5% in the first quarter of 2014, and 41.1% in the

second quarter of 2013, due to a more favorable revenue mix

including more other revenue.

Operating loss: Operating loss was $8.7 million compared

to an operating loss of $8.3 million in the first quarter of 2014

and an operating loss of $9.2 million in the second quarter of

2013, due to higher operating expenses primarily related to product

development costs.

Net loss: Net loss was $8.7 million, or ($0.15) per

diluted share/ADS, compared to a net loss of $8.3 million, or

($0.14) per diluted share/ADS in the first quarter of 2014 and a

net loss of $9.1 million, or ($0.20) per diluted share/ADS in the

second quarter of 2013.

Non-IFRS Net loss: Excluding stock-based compensation,

non-IFRS net loss was $8.4 million, or ($0.14) per diluted

share/ADS, compared to a non-IFRS net loss of $7.9 million, or

($0.13) per diluted share/ADS in the first quarter of 2014, and a

non-IFRS net loss of $8.6 million, or ($0.19) per diluted

share/ADS, in the second quarter of 2013.

In millions of US$ except percentages, shares and per share

amounts

Key Metrics Q2 2014

%* Q1 2014 %* Q2 2013 %* Revenue

$5.1 $4.5 $2.3 Gross

profit

2.1 41.3% 1.8 39.5% 1.0 41.1% Operating loss

(8.7) (171.2%) (8.3) (183.6%) (9.2) (392.7%) Net loss

(8.7) (171.4%) (8.3) (183.3%) (9.1) (387.3%) Diluted EPS

($0.15) ($0.14) ($0.20) Weighted average number of diluted

shares/ADS

59,144,398 59,136,031 44,683,839 Cash flow used

in operations

(3.3) (8.4) (8.1) Cash, cash equivalents and

short-term investments at quarter-end

22.1 27.9 24.9

Additional information: Stock-based compensation included in

operating result

0.3 0.4 0.5 Non-IFRS diluted EPS (excludes

stock-based compensation)

($0.14) ($0.13) ($0.19)

* Percentage of revenue

“We have begun shipping for the build of a mobile computing

design win targeting a Q4 launch in the U.S. and our home/portable

router business is providing a growing base of revenues,” said

Georges Karam, Sequans CEO. “During Q2, we added several

new design wins for routers and M2M applications, and we are in

advanced discussions on a number of others, including several

mobile computing opportunities. The new Colibri platform introduced

in June has been gaining a lot of traction, especially among module

manufacturers. Looking ahead, we see a growing pipeline of

follow-on design wins and new carrier opportunities in the U.S.,

APAC, and the rest of the world,” concluded Dr. Karam.

Third Quarter 2014 Outlook

The following statements are based on management’s current

assumptions and expectations. These statements are forward-looking

and actual results may differ materially. Sequans undertakes no

obligation to update these statements.

Sequans expects revenue for the third quarter of 2014 to be in

the range of $6.5 to $7.5 million, with non-IFRS gross margin of

above 35%. Based on this revenue range and expected gross margin,

non-IFRS net loss per diluted share/ADS is expected to be between

($0.12) and ($0.14) for the third quarter of 2014, based on

approximately 59.1 million weighted average number of diluted

shares/ADSs. Non-IFRS EPS guidance excludes primarily the impact of

stock based compensation.

Conference Call and Webcast

Sequans plans to conduct a teleconference and live webcast to

discuss the financial results for the second quarter of 2014 today,

July 24, 2014, at 8:00 a.m. EDT /14:00 CEST. To participate in the

live call, analysts and investors should dial 877-260-8898 (or +1

612-332-0802 if outside the U.S.). A live and archived webcast of

the call will be available from the Investors section of the

Sequans website at www.sequans.com/investors/. A replay of the

conference call will be available until August 24, 2014, by dialing

toll free 800-475-6701 in the U.S., or +1 320-365-3844 from outside

the U.S., using the following access code: 330549.

Forward Looking Statements

This press release contains projections and other

forward-looking statements regarding future events or our future

financial performance. All statements other than present and

historical facts and conditions contained in this release,

including any statements regarding our future results of operations

and financial positions, business strategy, plans and our

objectives for future operations, are forward-looking statements

(within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of

1934, as amended). These statements are only predictions and

reflect our current beliefs and expectations with respect to future

events and are based on assumptions and subject to risk and

uncertainties and subject to change at any time. We operate in a

very competitive and rapidly changing environment. New risks emerge

from time to time. Given these risks and uncertainties, you should

not place undue reliance on these forward-looking statements.

Actual events or results may differ materially from those contained

in the projections or forward-looking statements. Some of the

factors that could cause actual results to differ materially from

the forward-looking statements contained herein include, without

limitation: (i) the contraction or lack of growth of markets in

which we compete and in which our products are sold, including

WiMAX and LTE markets, (ii) unexpected increases in our expenses,

including manufacturing expenses, (iii) our inability to adjust

spending quickly enough to offset any unexpected revenue shortfall,

(iv) delays or cancellations in spending by our customers, (v)

unexpected average selling price reductions, (vi) the significant

fluctuation to which our quarterly revenue and operating results

are subject due to cyclicality in the wireless communications

industry and transitions to new process technologies, (vii) our

inability to anticipate the future market demands and future needs

of our customers, (viii) our inability to achieve new design wins

or for design wins to result in shipments of our products at levels

and in the timeframes we currently expect, and (ix) other factors

detailed in documents we file from time to time with the Securities

and Exchange Commission. Forward-looking statements in this release

are made pursuant to the safe harbor provisions contained in the

Private Securities Litigation Reform Act of 1995.

Use of Non-IFRS/non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements

prepared in accordance with IFRS, we disclose certain non-IFRS, or

non-GAAP, financial measures. These measures exclude non-cash

charges relating to stock-based compensation. We believe that these

measures can be useful to facilitate comparisons among different

companies. These non-GAAP measures have limitations in that the

non-GAAP measures we use may not be directly comparable to those

reported by other companies. We seek to compensate for this

limitation by providing a reconciliation of the non-GAAP financial

measures to the most directly comparable IFRS measures in the table

attached to this press release.

About Sequans Communications

Sequans Communications S.A. (NYSE: SQNS) is a 4G chipmaker and

leading provider of single-mode LTE chipset solutions to wireless

device manufacturers worldwide. Founded in 2003, Sequans has

developed and delivered six generations of 4G technology and its

chips are certified and shipping in 4G networks, both LTE and

WiMAX, around the world. Today, Sequans offers two LTE product

lines: StreamrichLTE™, optimized for feature-rich mobile computing

and home/portable router devices, and StreamliteLTE™, optimized for

M2M devices and other connected devices for the Internet of Things.

Sequans is based in Paris, France with additional offices in the

United States, United Kingdom, Israel, Hong Kong, Singapore,

Taiwan, South Korea, and China. Visit Sequans online

at www.sequans.com; www.facebook.com/sequans; www.twitter.com/sequans

Condensed financial tables follow

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Three months ended (in thousands of US$, except share and

per share amounts) June 30, March 31, June

30, 2014 2014

2013

Revenue :

Product revenue 4,404 4,100 1,799 Other revenue 664

404 548

Total revenue 5,068

4,504 2,347 Cost of revenue Cost

of product revenue 2,932 2,643 1,332 Cost of other revenue

44 82 51

Total cost of revenue

2,976 2,725 1,383 Gross

profit 2,092 1,779

964 Operating expenses : Research and development

7,518 6,918 7,248 Sales and marketing 1,454 1,179 1,135 General and

administrative 1,796 1,953 1,798

Total operating expenses

10,768 10,050 10,181

Operating loss (8,676) (8,271)

(9,217) Financial income (expense): Interest

income (expense), net (1) 11 10 Foreign exchange gain

30 44 167

Loss before income taxes

(8,647) (8,216) (9,040)

Income tax expense 41 42 51

Loss

(8,688) (8,258) (9,091) Attributable to

: Shareholders of the parent (8,688) (8,258) (9,091)

Minority interests - - - Basic loss per share

($0.15) ($0.14) ($0.20) Diluted loss per share

($0.15) ($0.14) ($0.20) Weighted average

number of shares used for computing: — Basic 59,144,398 59,136,031

44,683,839 — Diluted 59,144,398 59,136,031

44,683,839

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

Six months ended June 30, (in thousands of US$, except

share and per share amounts) 2014 2013

Revenue : Product revenue 8,504 2,895 Other

revenue 1,068 1,754

Total revenue

9,572 4,649 Cost of revenue Cost of

product revenue 5,575 2,594 Cost of other revenue 126

371

Total cost of revenue 5,701

2,965 Gross profit 3,871

1,684 Operating expenses : Research and development

14,436 13,762 Sales and marketing 2,633 2,274 General and

administrative 3,749 4,119

Total operating expenses 20,818

20,155 Operating loss (16,947)

(18,471) Financial income (expense): Interest

income, net 10 29 Foreign exchange gain 74 35

Loss before income taxes (16,863)

(18,407) Income tax expense (benefit) 83 88

Loss (16,946) (18,495) Attributable to

: Shareholders of the parent (16,946) (18,495) Minority

interests - - Basic loss per share ($0.29)

($0.44) Diluted loss per share ($0.29) ($0.44)

Weighted average number of shares used for

computing:

— Basic 59,138,642 41,810,911 — Diluted 59,138,642

41,810,911

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION

At June 30, At December 31, (in thousands of

US$) 2014 2013 ASSETS

Non-current assets Property, plant and equipment 8,734 6,622

Intangible assets 3,859 4,679 Deposits and other receivables 349

471 Available for sale assets 269 1,098

Total

non-current assets 13,211 12,870

Current

assets Inventories 5,947 6,582 Trade receivables 6,425 5,486

Prepaid expenses and other receivables 2,655 2,832 Recoverable

value added tax 734 508 Research tax credit receivable 5,618 8,006

Cash and cash equivalents 22,114 37,244

Total

current assets 43,493 60,658

Total assets

56,704 73,528 EQUITY AND LIABILITIES

Equity Issued capital, euro 0.02 nominal value, 59,144,741

shares authorized, issued and outstanding at June 30, 2014 (

59,129,639 at December 31, 2013) 1,568 1,567 Share premium 165,510

165,785 Other capital reserves 15,447 14,721 Accumulated deficit

(140,185) (123,239) Other components of equity 114 95

Total equity 42,454 58,929

Non-current

liabilities Government grant advances and interest-free loans

478 604 Finance lease obligations 104 240 Provisions 608 460

Deferred tax liabilities 38 37

Total non-current

liabilities 1,228 1,341

Current

liabilities Trade payables 7,774 7,252 Government grant

advances and interest-free loans 372 435 Finance lease obligations

264 261 Other current liabilities 4,178 4,384 Deferred revenue 388

343 Provisions 46 583

Total current

liabilities 13,022 13,258

Total equity and

liabilities 56,704 73,528

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS Six months ended June 30, (in thousands

of US$) 2014 2013

Operating activities Loss before income taxes

(16,863) (18,407) Non-cash adjustment to reconcile

income before tax to net cash from (used in) operating activities

Amortization and impairment of property, plant and equipment 1,742

2,055 Amortization and impairment of intangible assets 916 954

Share-based payment expense 726 1,050 Increase (decrease) in

provisions (389) (71) Financial income (10) (29) Foreign exchange

loss (gain) (20) 60 Loss (Gain) on disposal of property, plant and

equipment 27 - Working capital adjustments Decrease (Increase) in

trade receivables and other receivables (1,312) 1,059 Decrease

(Increase) in inventories 635 (455) Decrease (Increase) in research

tax credit receivable 2,388 (1,577) Increase (Decrease) in trade

payables and other liabilities 418 900 Increase (Decrease) in

deferred revenue 45 281 Increase (Decrease) in government grant

advances 135 (180) Income tax paid (165) (210)

Net cash flow

used in operating activities (11,727) (14,570)

Investing activities Purchase of intangible assets

and property, plant and equipment (3,962) (2,623) Sale (purchase)

of financial assets 951 (103) Interest received 79 82

Net cash

flow used in investments activities (2,932)

(2,644) Financing activities Initial Public

Offer, net of costs (298) 13,548 Proceeds from issue of warrants

and exercise of stock options/warrants 22 - Repayment of borrowings

and finance lease liabilities (128) (122) Interest paid (69) (54)

Net cash flows from (used in) financing activities

(473) 13,372 Net increase (decrease) in cash

and cash equivalents (15,132) (3,842) Net foreign exchange

difference 2 (3) Cash and cash equivalent at January 1 37,244

28,751

Cash and cash equivalents at end of the period

22,114 24,906 SEQUANS COMMUNICATIONS

S.A. UNAUDITED

RECONCILIATION OF NON-IFRS FINANCIAL RESULTS

Three months

ended (in thousands of US$, except share and per share

amounts) June 30, March 31, June 30,

2014 2014

2013 Net IFRS loss as reported (8,688)

(8,258) (9,091) Add back Stock-based

compensation expense according to IFRS 2 331 395 488

Non-IFRS

loss adjusted (8,357) (7,863)

(8,603) IFRS basic loss per share as reported

($0.15) ($0.14) ($0.20) Add back Stock-based compensation

expense according to IFRS 2 $0.01 $0.01 $0.01

Non-IFRS basic loss per share ($0.14) ($0.13)

($0.19) IFRS diluted loss per share ($0.15) ($0.14) ($0.20) Add

back Stock-based compensation expense according to IFRS 2

$0.01 $0.01 $0.01 Non-IFRS diluted loss per

share ($0.14) ($0.13) ($0.19)

SEQUANS COMMUNICATIONS S.A.

UNAUDITED RECONCILIATION OF NON-IFRS FINANCIAL RESULTS

Six months

ended (in thousands of US$, except share and per share

amounts) June 30, June 30,

2014 2013 Net IFRS loss as

reported (16,946) (18,495) Add back

Stock-based compensation expense according to IFRS 2 727 1,050

Non-IFRS loss adjusted (16,219)

(17,445) IFRS basic loss per share as reported

($0.29) ($0.44) Add back Stock-based compensation expense

according to IFRS 2 $0.02 $0.02 Non-IFRS basic loss

per share ($0.27) ($0.42) IFRS diluted loss per share

($0.29) ($0.44) Add back Stock-based compensation expense

according to IFRS 2 $0.02 $0.02 Non-IFRS diluted loss

per share ($0.27) ($0.42)

Sequans Communications S.A.Media Relations: Kimberly Tassin,

+1.425.736.0569, Kimberly@sequans.comInvestor Relations: Claudia

Gatlin, +1 212.830.9080, Claudia@sequans.com

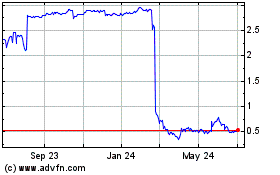

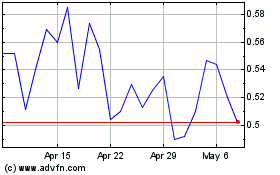

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Apr 2023 to Apr 2024