- 126 consecutive quarters of

profitability

- Net income per diluted share for

three months ended June 30, 2014 was $0.13, an increase of 30%

compared to $0.10 for the second quarter, 2013

- Efficiency ratio for the second

quarter improved to 69.68%, compared to 77.16% for the same quarter

in 2013

- Loans increased 6.9% since June 30,

2013

- Non-performing assets to total

assets remain at low levels, 0.75% at June 30, 2014

Farmers National Banc Corp. (Farmers) (NASDAQ: FMNB) today

reported financial results for the three and six months ended June

30, 2014.

Net income for the three months ended June 30, 2014 was $2.4

million, or $0.13 per diluted share, which compares favorably to

$1.9 million, or $0.10 per diluted share for the second quarter

ended June 30, 2013. Net income for the six months ended June 30,

2014 was $4.5 million, a 17.3% increase compared to $3.9 million

for the same period in 2013. On a per share basis, net income for

the six months ended June 30, 2014 was $0.24, an increase of 14.3%

compared to the six month period ended June 30, 2013.

Kevin J. Helmick, President and CEO, stated, “Our improvement in

net income for the six months ended June 30, 2014 and the second

quarter of 2014 is a result of our continued focus on increasing

fee income and control of noninterest expenses. The continued focus

on increasing fee-based revenues and reducing expenses has also

contributed to an improvement in our efficiency ratio to 69.8% from

74.9% during the first six months of 2014 compared to the same

period in 2013. It is important to note that noninterest income has

increased 17.7% in comparing the second quarter of 2014 to the

second quarter of 2013, while noninterest expenses decreased 4.5%.

We are also pleased to report that loans increased 6.9% in the past

twelve months.”

2014 Second Quarter Financial Highlights

- Loan growth Total loans were

$637.8 million at June 30, 2014, compared to $596.8 million at June

30, 2013. This represents an increase of 6.9%. The increase in

loans is a direct result of Farmers’ focus on loan growth utilizing

a talented lending and credit team while adhering to a sound

underwriting discipline. Most of the increase in loans has occurred

in the commercial real estate, commercial and industrial and

residential real estate loan portfolios. Loans comprised 58.8% of

the Bank's average earning assets in 2014, an improvement compared

to 56.1% in 2013.

- Loan quality Non-performing

assets to total assets remain at a safe level, currently at 0.75%.

Early stage delinquencies also continue to remain at low levels, at

$3.5 million or 0.54% of total loans at June 30, 2014.

- Net interest marginThe net

interest margin for the quarter ended June 30, 2014 was 3.54%, a

decrease of 2 basis points from 3.56% reported for the quarter

ended March 31, 2014. Asset yields decreased 5 basis points, while

the cost of interest-bearing liabilities decreased 2 basis

points.

- Noninterest incomeNoninterest

income was $3.8 million for the second quarter of 2014, a 17.7%

improvement compared to the same quarter in 2013. Trust fees

increased $161 thousand or 11.6% and service charges on deposit

accounts also increased $90 thousand or 17.2%. The company also

added $272 thousand in retirement plan consulting fees earned from

the entity acquired in July 2013, National Associates, Inc.

- Noninterest expensesThe Company

underwent a cost reduction program in 2013 that included the

closure of two retail branch locations and the elimination of

several full time positions. During the first six months of 2014,

the company has remained committed to keeping noninterest expenses

at a more manageable level. As a result of these actions, the

Company’s noninterest expenses decreased to $9.4 million for the

quarter ended June 30, 2014, compared to the $9.8 million reported

in the second quarter in 2013.

2014 Outlook

Mr. Helmick continued: “Following a slow first quarter in terms

of loan growth and fee income, we were pleased with improvements in

both of these areas during the second quarter. We continue to look

forward to the ensuing quarters as the economic outlook begins to

improve. We also continue our discipline of closely monitoring

levels of non-interest expense while growing non-interest

revenues.”

Farmers National Banc Corp. is the bank holding company for the

Farmers National Bank of Canfield, Farmers National Insurance, LLC,

Farmers Trust Company and National Associates, Inc. Farmers’

operates eighteen banking offices throughout Mahoning, Trumbull,

Columbiana and Stark Counties and two trust offices located in

Boardman and Howland. Farmers offers a wide range of banking and

investment services to companies and individuals, and maintains a

website at www.farmersbankgroup.com.

Non-GAAP Disclosure

This press release includes disclosures of Farmers tangible

common equity ratio and pre-tax, pre-provision income, which are

financial measures not prepared in accordance with generally

accepted accounting principles in the United States (GAAP). A

non-GAAP financial measure is a numerical measure of historical or

future financial performance, financial position or cash flows that

excludes or includes amounts that are required to be disclosed by

GAAP. Farmers believes that these non-GAAP financial measures

provide both management and investors a more complete understanding

of the underlying operational results and trends and Farmers’

marketplace performance. The presentation of this additional

information is not meant to be considered in isolation or as a

substitute for the numbers prepared in accordance with GAAP. The

reconciliations of non-GAAP financial measures are included in the

tables following Consolidated Financial Highlights below.

Forward-Looking Statements

This earnings release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements about Farmers’ financial condition,

results of operations, asset quality trends and profitability.

Forward-looking statements are not historical facts but instead

represent only management’s current expectations and forecasts

regarding future events, many of which, by their nature, are

inherently uncertain and outside of Farmers’ control. Farmers’

actual results and financial condition may differ, possibly

materially, from the anticipated results and financial condition

indicated in these forward-looking statements. Factors that could

cause Farmers’ actual results to differ materially from those

described in the forward-looking statements can be found in

Farmers’ Annual Report on Form 10-K for the year ended December 31,

2013, which has been filed with the Securities and Exchange

Commission and is available on Farmers’ website

(www.farmersbankgroup.com) and on the Securities and Exchange

Commission’s website (www.sec.gov). Forward-looking statements are

not guarantees of future performance and should not be relied upon

as representing management’s views as of any subsequent date.

Farmers does not undertake any obligation to update the

forward-looking statements to reflect the impact of circumstances

or events that may arise after the date of the forward-looking

statements.

Farmers National Banc

Corp. and Subsidiaries Consolidated Financial Highlights

(Amounts in thousands, except per share results) Unaudited

Consolidated Statements of Income For the Three Months

Ended For the Six Months Ended June 30, March

31, Dec. 30, Sept 30, June 30, June

30, June 30, Percent 2014

2014 2013 2013

2013 2014 2013

Change Total interest income $10,118 $10,063 $10,298 $10,122

$10,273 $20,181 $20,539 -1.7% Total interest expense 1,166

1,207 1,257 1,274 1,234 2,373

2,532 -6.3%

Net interest income 8,952 8,856 9,041

8,848 9,039 17,808 18,007 -1.1% Provision for loan losses 300 330

525 340 170 630 425 48.2% Other income 3,797 3,433 3,641 4,173

3,225 7,230 6,100 18.5% Other expense 9,378 9,141

9,221 10,926 9,822 18,519 18,910

-2.1%

Income before income taxes 3,071 2,818 2,936 1,755

2,272 5,889 4,772 23.4% Income taxes 720 627 641

143 404 1,347 899 49.8%

Net

income $2,351 $2,191 $2,295 $1,612

$1,868 $4,542 $3,873 17.3% Average

shares outstanding 18,781 18,778 18,776 18,776 18,747 18,780 18,771

Pre-tax pre-provision income $3,371 $3,148 $3,461 $2,095 $2,442

$6,519 $5,197 Basic and diluted earnings per share 0.13 0.12 0.12

0.09 0.10 0.24 0.21 Cash dividends 563 563 563 563 557 1,127 1,121

Cash dividends per share 0.03 0.03 0.03 0.03 0.03 0.06 0.06

Performance Ratios Net Interest Margin (Annualized) 3.54%

3.56% 3.53% 3.47% 3.63% 3.55% 3.65% Efficiency Ratio (Tax

equivalent basis) 69.68% 69.87% 67.96% 81.64% 77.16% 69.77% 74.88%

Return on Average Assets (Annualized) 0.83% 0.78% 0.78% 0.56% 0.66%

0.80% 0.69% Return on Average Equity (Annualized) 7.85% 7.65% 7.23%

5.60% 6.21% 7.74% 6.48% Dividends to Net Income 23.95% 25.70%

24.53% 34.93% 29.82% 24.81% 28.94%

Consolidated

Statements of Financial Condition June 30, March

31, Dec. 30, Sept 30, June 30, 2014

2014 2013 2013 2013 Assets Cash

and cash equivalents $28,070 $29,333 $27,513 $40,303 $26,587

Securities available for sale 409,285 427,625 422,985 438,127

443,833 Loans held for sale 275 1,026 158 1,016 4,612 Loans

637,774 626,186 630,684 611,349 596,838 Less allowance for loan

losses 7,356 7,387 7,568 7,369 7,590

Net Loans 630,418 618,799 623,116 603,980

589,248 Other assets 65,238 64,217

63,554 64,693 59,209

Total Assets $1,133,286

$1,141,000 $1,137,326 $1,148,119

$1,123,489

Liabilities and Stockholders' Equity

Deposits $907,443 $923,033 $915,216 $903,410 $901,886 Other

interest-bearing liabilities 93,807 92,815 101,439 118,322 101,589

Other liabilities 11,016 7,829 7,664 13,863

5,698 Total liabilities 1,012,266 1,023,677 1,024,319

1,035,595 1,009,173 Stockholders' Equity 121,020 117,323

113,007 112,524 114,316

Total

Liabilities and Stockholders' Equity $1,133,286

$1,141,000 $1,137,326 $1,148,119 $1,123,489

Period-end shares outstanding 18,781 18,781 18,776 18,776

18,547 Book value per share $6.44 $6.25 $6.02 $5.99 $6.16 Tangible

book value per share 5.91 5.71 5.47 5.43 5.85

Capital and

Liquidity Total Capital to Risk Weighted Assets (a) 16.71%

16.51% 16.26% 16.28% 17.25% Tier 1 Capital to Risk Weighted Assets

(a) 15.67% 15.47% 15.19% 15.22% 16.08% Tier 1 Capital to Average

Assets (a) 9.89% 9.73% 9.36% 9.29% 9.64% Equity to Asset Ratio

10.68% 10.28% 9.94% 9.80% 10.18% Tangible Common Equity Ratio 9.89%

9.48% 9.11% 8.96% 9.71% Net Loans to Assets 55.63% 54.23% 54.79%

52.61% 52.45% Loans to Deposits 70.28% 67.84% 68.91% 67.67% 66.18%

Asset Quality Non-performing loans (b) $8,140 $8,494 $9,091

$9,124 $8,079 Other Real Estate Owned 352 174 171 208 295

Non-performing assets 8,492 8,668 9,262 9,332 8,374 Loans 30 - 89

days delinquent (b) 3,460 2,473 3,600 2,348 2,497 Charged-off loans

650 836 620 915 456 Recoveries 319 325 294 354 367 Net Charge-offs

331 511 326 561 89 Annualized Net Charge-offs to Average Net Loans

Outstanding 0.21% 0.34% 0.22% 0.38% 0.06% Allowance for Loan Losses

to Total Loans 1.15% 1.18% 1.20% 1.21% 1.27% Non-performing Loans

to Total Loans 1.28% 1.36% 1.44% 1.49% 1.35% Allowance to

Non-performing Loans 90.37% 86.97% 83.25% 80.77% 93.95%

Non-performing Assets to Total Assets 0.75% 0.76% 0.81% 0.81% 0.75%

(a) June

30, 2014 ratio is estimated (b) Amounts reported are unpaid

principal balance

Reconciliation of Common

Stockholders' Equity to Tangible Common Equity June 30,

March 31, Dec. 30, Sept 30, June 30,

2014 2014 2013 2013 2013

Stockholders' Equity $121,020 $117,323 $113,007 $112,524 $114,316

Less Goodwill and other intangibles 9,960 10,151

10,343 10,546 5,836 Tangible Common Equity $111,060

$107,172 $102,664 $101,978 $108,480

Reconciliation of Total Assets to Tangible Assets

June 30, March 31, Dec. 30, Sept 30,

June 30, 2014 2014 2013 2013

2013 Total Assets $1,133,286 $1,141,000 $1,137,326

$1,148,119 $1,123,489 Less Goodwill and other intangibles 9,960

10,151 10,343 10,546 5,836 Tangible

Assets $1,123,326 $1,130,849 $1,126,983

$1,137,573 $1,117,653

Reconciliation of Income

Before Taxes to Pre-Tax, Pre-Provision Income For the Three

Months Ended For the Six Months Ended June 30,

March 31, Dec. 30, Sept 30, June 30,

June 30, June 30, 2014 2014 2013

2013 2013 2014 2013 Income before

income taxes $3,071 $2,818 $2,936 $1,755 $2,272 $5,889 $4,772

Provision for loan losses 300 330 525 340

170 630 425 Pre-tax, pre-provision income

$3,371 $3,148 $3,461 $2,095 $2,442

$6,519 $5,197

Farmers National Banc Corp.Kevin J. Helmick, President and CEO,

330-533-3341Email: exec@farmersbankgroup.com

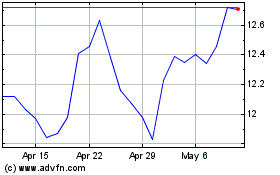

Farmers National Banc (NASDAQ:FMNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

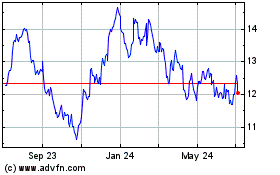

Farmers National Banc (NASDAQ:FMNB)

Historical Stock Chart

From Apr 2023 to Apr 2024