UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): 7/22/2014

UMB FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

Commission

File Number : 0-4887

|

|

|

| MO |

|

43-0903811 |

| (State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

1010 Grand Blvd., Kansas City, MO 64106

(Address of principal executive offices, including zip code)

(816) 860-7000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act ( 17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition |

On July 22, 2014, UMB Financial Corporation (the

“Company”) issued a press release announcing the financial results for the Company for the quarter ending June 30, 2014. A copy of the press release is attached as Exhibit 99.1.

The information contained in Item 2.02 of this Current Report and in Exhibit 99.1 is being furnished and shall not be deemed to be “filed” with

the SEC for the purposes of Section 18 of the Exchange Act of 1934, as amended or otherwise subject to the liabilities of that section.

| Item 7.01 |

Regulation FD Disclosure |

The information provided under Item 7.01 of this Current Report on Form

8-K is being furnished and is not deemed to be “filed” with the SEC for the purposes of Section 18 of the Exchange Act of 1934, as amended or otherwise subject to the liabilities of that section.

The Company is furnishing a copy of materials that will be used in the Company’s shareholder conference call on July 23, 2014, at 9:30 a.m. (CST). A

copy of the materials is attached as Exhibit 99.2 and will be available on the Company’s website at www.umbfinancial.com. The materials are dated July 22, 2014, and the Company disclaims any obligation to correct or update any of the

materials in the future.

The Company’s July 22, 2014, press release that is attached as Exhibit 99.1 also announced that the Board of Directors

declared a regular quarterly dividend of $0.225 per share payable on October 1, 2014, to shareholders of record on September 10, 2014.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

| Exhibit 99.1 |

|

Press Release announcing financial results for quarter ending June 30, 2014, and announcing dividend declaration |

|

|

| Exhibit 99.2 |

|

Investor Presentation Materials, dated July 22, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| UMB FINANCIAL CORPORATION |

|

|

| By: |

|

/s/ Brian J. Walker |

|

|

Brian J. Walker

EVP, Chief Financial Officer And

Chief Accounting Officer |

Date: July 22, 2014

Exhibit 99.1

|

|

|

| UMB Financial Corporation 1010 Grand

Boulevard Kansas City, MO 64106 816.860.7000

umb.com |

|

News Release |

//FOR IMMEDIATE RELEASE//

Media Contact: Kelli Christman: 816.860.5088

Investor Relations

Contact: Abby Wendel: 816.860.1685

UMB Financial Corporation Reports Second Quarter 2014 Earnings of $34.7 million,

or $0.76 per Diluted Share

Selected second quarter financial highlights:

| |

• |

|

Average net loans for the three months ended June 30, 2014 increased 12.0 percent to $6.9 billion compared to the three months ended June 30, 2013; marks the

17th consecutive quarter of loan growth |

| |

• |

|

Nonperforming loans decreased to 0.39 percent of loans as of June 30, 2014, from 0.40 percent of loans as of June 30, 2013 |

| |

• |

|

Noninterest income increased 18.0 percent from the second quarter of 2013 to $134.0 million; represents 60.9 percent of total revenue |

| |

• |

|

Total company assets under management stood at a record $43.7 billion, an increase of 21.9 percent compared to the second quarter of 2013 |

| |

• |

|

Tier 1 capital ratio remains strong at 13.81 percent |

KANSAS CITY, Mo. (July 22, 2014)—UMB

Financial Corporation (Nasdaq: UMBF), a diversified financial holding company, announced earnings for the three months ended June 30, 2014 of $34.7 million or $0.77 per share ($0.76 diluted). This is an increase of $4.7 million, or 15.8

percent, compared to second quarter 2013 earnings of $29.9 million or $0.75 per share ($0.74 diluted). Earnings for the six months ended June 30, 2014, were $58.1 million or $1.30 per share ($1.28 diluted). This is a decrease of $6.8 million,

or 10.5 percent, compared to the prior year-to-date earnings of $64.9 million or $1.62 per share ($1.61 diluted).

“As our second quarter results

demonstrate, the strength of our business model relies on diverse revenue sources, high quality credit, a strong balance sheet and low-cost funding,” said Mariner Kemper, Chairman and Chief Executive Officer. “Total company assets under

management reached a record high this quarter at $43.7 million. Compared to the same period a year ago, AUM increased 21.9 percent, and over the past five years increased 34.1 percent on a compound annual growth rate basis. Loan growth continues to

be a driving force behind our success with average net loans increasing 12.0 percent during the second quarter of 2014, as compared to the second quarter of 2013. This was our 17th consecutive

quarter of loan growth. Finally, noninterest income increased 18.0 percent, compared to the second quarter 2013, led by revenue growth in our investment management and asset servicing businesses. Diverse revenue, loan growth, total cost of funds at

10 basis points, and excellent credit quality demonstrate that our business model continues to serve us well.”

Net Interest Income and Margin

Net interest income for the second quarter of 2014 increased $3.8 million, or 4.7 percent, compared to the same period in 2013. Average earning assets

increased by $749.3 million, or 5.4 percent, compared to the second quarter of 2013. This increase was due to a $739.0 million, or 12.0 percent, increase in average loans. Net interest margin decreased three basis points to 2.53 percent for the

three months ended June 30, 2014, compared to the same quarter in 2013.

Noninterest Income and Expense

Noninterest income increased $20.4 million, or 18.0 percent, for the three months ended June 30, 2014, compared to the same period in 2013. This increase

is attributable to increased trust and securities processing income of $9.9 million, or 15.6 percent, for the three months ended June 30, 2014, compared to the same period in 2013. The increase in trust and securities processing income was

primarily due to a $3.7 million, or 18.9 percent, increase in fees related to institutional and personal investment management services, a $3.1 million, or 16.3 percent, increase in fund administration and custody services, and a $2.2 million, or

10.0 percent increase, in advisory fee income from the Scout Funds. Equity earnings on alternative investments increased $3.5 million due to unrealized gains on Prairie Capital Management (“PCM”) equity method investments for the three

months ended June 30, 2014, compared to the same period in 2013. Other noninterest income increased $4.5 million primarily driven by a gain on the sale of a branch property of $2.8 million and increased fair value adjustments on interest rate

swap transactions of $0.8 million compared to the same period in 2013.

Noninterest expense increased $16.2 million, or 10.8 percent, for the three months

ended June 30, 2014, compared to the same period in 2013. This increase is driven by higher salary and benefits expense of $6.0 million, or 7.1 percent, an increase in the contingency reserve of $5.3 million, an increase in equipment expense of

$1.0 million, and an increase in other noninterest expense of $2.1 million. The increase in salary and benefits is due to increases in salaries and wages of $2.5 million, or 4.7 percent, a $1.2 million, or 6.7 percent, increase in commissions and

bonuses, and a $2.3 million, or 17.4 percent, increase in employee benefits expense. The increase of $2.1 million in other noninterest expense is due to a $0.8 million increase in fair value adjustments on contingent consideration liabilities and a

$0.6 million increase in fair value adjustments on interest rate swap transactions. On June 30, 2014, the Company entered into a settlement agreement to resolve objections to its calculation of the earn-out amount owed to the sellers of PCM and

a related incentive bonus calculation for the employees of PCM. As of June 30, 2014, an additional $5.3 million of contingency reserve expense was recorded during the second quarter of 2014 for a total estimated settlement liability of $20.3

million.

“Our fee-based businesses continue to perform well, resulting in noninterest income at 60.9 percent of our total revenue,” said Peter

deSilva, President and Chief Operating Officer. “Trust and securities processing revenue increased 15.6 percent to $73.4 million compared to the second quarter 2013. Scout Investments—our institutional investment management

segment—delivered nearly half of the increase with 16.6 percent growth in noninterest income year-over-year. Revenue from our asset servicing business increased 17.7 percent compared to the second quarter 2013. Assets under management within

the bank are now more than $11 billion—also a record—and asset management-related revenue within the bank increased 14.2 percent. Within our payment solutions segment, healthcare deposits increased 36.4 percent compared to the prior year

and healthcare and flexible spending accounts increased more than 45 percent year-over-year to 4.6 million total accounts.”

Balance

Sheet

Average total assets for the three months ended June 30, 2014, were $15.6 billion compared to $14.9 billion for the same period in

2013, an increase of $0.7 billion, or 5.0 percent. Average earning assets increased by $0.7 billion for the period, or 5.4 percent.

Average loan balances

for the three months ended June 30, 2014, increased $739.0 million, or 12.0 percent, to $6.9 billion compared to the same period in 2013. Actual loan balances on June 30, 2014, were $6.9 billion, an increase of $0.6 billion, or 9.2

percent, compared to June 30, 2013. This increase

was primarily driven by an increase in commercial loans of $207.5 million, or 6.2 percent, a $160.2 million, or 10.2 percent, increase in commercial real estate loans, and a $124.7 million, or

116.4 percent, increase in construction loans. Nonperforming loans increased to $27.2 million on June 30, 2014, from $25.5 million on June 30, 2013. As a percentage of loans, nonperforming loans decreased to 0.39 percent as of

June 30, 2014, compared to 0.40 percent on June 30, 2013. Nonperforming loans are defined as nonaccrual loans and restructured loans. The company’s allowance for loan losses totaled $76.8 million, or 1.11 percent of loans, as of

June 30, 2014, compared to $71.6 million, or 1.13 percent of loans, as of June 30, 2013.

For the three months ended June 30, 2014, average

securities, including trading securities, totaled $7.0 billion. This is a decrease of $180.4 million, or 2.5 percent, from the same period in 2013.

Average total deposits increased $0.7 billion, or 6.0 percent, to $12.3 billion for the three months ended June 30, 2014, compared to the same period in

2013. Average noninterest-bearing demand deposits increased $516.7 million, or 11.2 percent, compared to 2013. Average interest-bearing deposits increased by $183.2 million, or 2.6 percent, in 2014 as compared to 2013. Total deposits as of

June 30, 2014, were $12.2 billion, compared to $11.7 billion as of June 30, 2013, a 3.8 percent increase. Also, as of June 30, 2014, noninterest-bearing demand deposits were 44.4 percent of total deposits.

As of June 30, 2014, UMB had total shareholders’ equity of $1.6 billion, an increase of 30.6 percent as compared to the same period in 2013. This

increase is primarily attributable to the common stock issuance the company completed in September 2013.

“True to our strategy to rotate out of the

investment portfolio and into loans, the increase in interest income in the second quarter came from loan volume and changes to the earning asset mix,” said Brian Walker, Chief Financial Officer. “The average balance of the investment

portfolio decreased 2.1 percent year-over-year. Our bias toward shortening the duration of the portfolio, combined with the strategy to rotate into loans further demonstrates our balanced approach toward asset sensitivity while guarding against a

continued, sustained low interest rate environment. We believe we are well positioned to benefit in a rising rate environment.”

Year-to-Date

Earnings for the six months ended June 30, 2014, were $58.1 million or $1.30 per share ($1.28 diluted). This is a decrease of $6.8 million,

or 10.5 percent, compared to the prior year-to-date earnings of $64.9 million or $1.62 per share ($1.61 diluted).

Net interest income for the six months

ended June 30, 2014, increased $9.8 million, or 6.1 percent, compared to the same period in 2013. Net interest margin decreased to 2.45 percent for the six months ended June 30, 2014, as compared to 2.53 percent for the same period in

2013.

Noninterest income increased $22.4 million, or 9.5 percent, to $257.0 million for the six months ended June 30, 2014, as compared to the same

period in 2013. The increase in noninterest income is primarily driven by increased trust and securities processing income of $19.1 million, or 15.2 percent. The increase in trust and securities processing income was primarily due to a $6.7 million,

or 17.2 percent, increase in fees related to institutional and personal investment management services, a $6.5 million, or 15.0 percent, increase in advisory fee income from the Scout Funds, and a $4.5 million, or 11.6 percent, increase in fund

administration and custody services. Additional increases in noninterest income include a $6.0 million increase in equity earnings on alternative investments due to unrealized gains on PCM equity method investments and a $4.1 million, or 69.0

percent increase in other noninterest income. The increase in other noninterest income is driven by $2.8 million gain on the sale of a branch property and a $1.4 million increase in fair value adjustments on interest rate swap transactions during

the first six months of 2014 compared to the same period in 2013. These increases were offset by a decrease in trading and investment banking income of $1.8 million and a decrease in gains on securities available for sale of $3.4 million in the

first six months of 2014 compared to the same period in 2013.

Noninterest expense increased $38.1 million, or 12.7 percent, for the six months ended June 30, 2014,

compared to the same period in 2013. This increase is driven by an increase in salary and employee benefit expense of $11.1 million, or 6.7 percent, and a $20.3 million increase in the contingency reserve. As noted above, $20.3 million of

contingency reserve has been recognized in 2014 in conjunction with the settlement agreement entered into on June 30, 2014, to resolve the PCM dispute. Of this amount $15.0 million was recognized in the first quarter of 2014 and $5.3 million

was recognized in the second quarter of 2014.

Dividend Declaration

The Board of Directors declared during the company’s quarterly board meeting a $0.225 quarterly cash dividend, payable on October 1, 2014, to

shareholders of record at the close of business on September 10, 2014.

Conference Call

The company plans to host a conference call to discuss its 2014 second quarter earnings results on July 23, 2014, at 9:30 a.m. (CDT).

Interested parties may access the call by dialing (toll-free) 800-524-8950 or (U.S.) 416-260-0113. The live call can also be accessed by visiting the investor

relations area of umbfinancial.com or by using the following the link:

http://event.on24.com/r.htm?e=816187&s=1&k=2C36A678B70F9F90A5C30FBBFC76E890

A replay of the conference call may be heard until August 8, 2014, by calling (toll-free) 888-203-1112 or (U.S.) 719-457-0820. The replay pass code

required for playback is conference identification number 5599321. The call replay may also be accessed via the company’s website umb.com by visiting the investor relations area.

Forward-Looking Statements:

This release

contains, and our other communications may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical

or current facts. All forward-looking statements are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or

guarantee about the future. Our actual future objectives, strategies, plans, prospects, performance, condition, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results

or other future events, circumstances, or aspirations to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2013, our subsequent Quarterly Reports on Form 10-Q or

Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the SEC. Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any

forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we

may make in any subsequent Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other applicable document that is filed or furnished with the SEC.

About UMB:

UMB Financial Corporation (Nasdaq: UMBF) is a diversified financial holding company headquartered in Kansas City, Mo., offering complete banking services,

payment solutions, asset servicing and institutional investment management to customers. UMB operates banking and wealth management centers throughout Missouri, Illinois, Colorado, Kansas, Oklahoma, Nebraska, Arizona and Texas. Subsidiaries of the

holding company include companies that offer services to mutual funds and alternative-investment entities and registered investment advisors that offer equity and fixed income strategies to institutions and individual investors. For more

information, visit umb.com, umbfinancial.com, blog.umb.com or follow us on Twitter at @UMBBank, Facebook at facebook.com/UMBBank and LinkedIn at linkedin.com/company/umb-bank.

|

|

|

| CONSOLIDATED BALANCE SHEETS |

|

UMB Financial Corporation |

| (unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

| Assets |

|

|

|

|

|

|

|

|

| Loans |

|

$ |

6,920,683 |

|

|

$ |

6,338,921 |

|

| Allowance for loan losses |

|

|

(76,802 |

) |

|

|

(71,647 |

) |

|

|

|

|

|

|

|

|

|

| Net loans |

|

|

6,843,881 |

|

|

|

6,267,274 |

|

|

|

|

|

|

|

|

|

|

| Loans held for sale |

|

|

3,156 |

|

|

|

6,693 |

|

| Investment securities: |

|

|

|

|

|

|

|

|

| Available for sale |

|

|

6,700,623 |

|

|

|

6,944,358 |

|

| Held to maturity |

|

|

238,799 |

|

|

|

160,328 |

|

| Trading securities |

|

|

26,484 |

|

|

|

47,996 |

|

| Federal Reserve Bank Stock and other |

|

|

67,527 |

|

|

|

25,955 |

|

|

|

|

|

|

|

|

|

|

| Total investment securities |

|

|

7,033,433 |

|

|

|

7,178,637 |

|

|

|

|

|

|

|

|

|

|

| Federal funds and resell agreements |

|

|

82,652 |

|

|

|

66,973 |

|

| Interest-bearing due from banks |

|

|

255,453 |

|

|

|

607,470 |

|

| Cash and due from banks |

|

|

639,878 |

|

|

|

415,489 |

|

| Bank premises and equipment, net |

|

|

250,655 |

|

|

|

246,300 |

|

| Accrued income |

|

|

73,805 |

|

|

|

71,817 |

|

| Goodwill |

|

|

209,758 |

|

|

|

209,758 |

|

| Other intangibles |

|

|

49,888 |

|

|

|

61,994 |

|

| Other assets |

|

|

120,131 |

|

|

|

120,812 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

15,562,690 |

|

|

$ |

15,253,217 |

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

| Noninterest-bearing demand |

|

$ |

5,399,733 |

|

|

$ |

4,887,643 |

|

| Interest-bearing demand and savings |

|

|

5,754,573 |

|

|

|

5,801,388 |

|

| Time deposits under $100,000 |

|

|

442,361 |

|

|

|

509,412 |

|

| Time deposits of $100,000 or more |

|

|

577,622 |

|

|

|

531,307 |

|

|

|

|

|

|

|

|

|

|

| Total deposits |

|

|

12,174,289 |

|

|

|

11,729,750 |

|

|

|

|

|

|

|

|

|

|

| Federal funds and repurchase agreements |

|

|

1,607,294 |

|

|

|

2,157,979 |

|

| Short-term debt |

|

|

— |

|

|

|

514 |

|

| Long-term debt |

|

|

5,745 |

|

|

|

4,063 |

|

| Accrued expenses and taxes |

|

|

131,996 |

|

|

|

117,916 |

|

| Other liabilities |

|

|

42,024 |

|

|

|

16,523 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

13,961,348 |

|

|

|

14,026,745 |

|

|

|

|

|

|

|

|

|

|

| Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Common stock |

|

|

55,057 |

|

|

|

55,057 |

|

| Capital surplus |

|

|

887,086 |

|

|

|

736,456 |

|

| Retained earnings |

|

|

922,268 |

|

|

|

834,445 |

|

| Accumulated other comprehensive income (loss) |

|

|

16,901 |

|

|

|

(22,227 |

) |

| Treasury stock |

|

|

(279,970 |

) |

|

|

(377,259 |

) |

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity |

|

|

1,601,342 |

|

|

|

1,226,472 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

15,562,690 |

|

|

$ |

15,253,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Statements of Income |

|

UMB Financial Corporation |

| (unaudited, dollars in thousands except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Interest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

60,309 |

|

|

$ |

56,615 |

|

|

$ |

119,209 |

|

|

$ |

111,335 |

|

| Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable interest |

|

|

19,021 |

|

|

|

18,841 |

|

|

|

37,982 |

|

|

|

37,305 |

|

| Tax-exempt interest |

|

|

9,798 |

|

|

|

10,118 |

|

|

|

19,705 |

|

|

|

19,877 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total securities income |

|

|

28,819 |

|

|

|

28,959 |

|

|

|

57,687 |

|

|

|

57,182 |

|

| Federal funds and resell agreements |

|

|

46 |

|

|

|

40 |

|

|

|

79 |

|

|

|

64 |

|

| Interest-bearing due from banks |

|

|

466 |

|

|

|

330 |

|

|

|

1,589 |

|

|

|

1,000 |

|

| Trading securities |

|

|

149 |

|

|

|

268 |

|

|

|

272 |

|

|

|

533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest income |

|

|

89,789 |

|

|

|

86,212 |

|

|

|

178,836 |

|

|

|

170,114 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

3,092 |

|

|

|

3,333 |

|

|

|

6,151 |

|

|

|

7,125 |

|

| Federal funds and repurchase agreements |

|

|

454 |

|

|

|

491 |

|

|

|

935 |

|

|

|

1,058 |

|

| Other |

|

|

73 |

|

|

|

61 |

|

|

|

135 |

|

|

|

121 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest expense |

|

|

3,619 |

|

|

|

3,885 |

|

|

|

7,221 |

|

|

|

8,304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

86,170 |

|

|

|

82,327 |

|

|

|

171,615 |

|

|

|

161,810 |

|

| Provision for loan losses |

|

|

5,000 |

|

|

|

5,000 |

|

|

|

9,500 |

|

|

|

7,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income after provision for loan losses |

|

|

81,170 |

|

|

|

77,327 |

|

|

|

162,115 |

|

|

|

154,810 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Trust and securities processing |

|

|

73,357 |

|

|

|

63,486 |

|

|

|

144,920 |

|

|

|

125,798 |

|

| Trading and investment banking |

|

|

6,409 |

|

|

|

5,423 |

|

|

|

10,732 |

|

|

|

12,532 |

|

| Service charges on deposits |

|

|

20,627 |

|

|

|

20,882 |

|

|

|

42,185 |

|

|

|

42,405 |

|

| Insurance fees and commissions |

|

|

732 |

|

|

|

1,236 |

|

|

|

1,335 |

|

|

|

2,198 |

|

| Brokerage fees |

|

|

3,075 |

|

|

|

2,886 |

|

|

|

4,890 |

|

|

|

5,832 |

|

| Bankcard fees |

|

|

17,185 |

|

|

|

16,032 |

|

|

|

32,808 |

|

|

|

32,470 |

|

| Gains on sale of securities available for sale, net |

|

|

2,569 |

|

|

|

1,519 |

|

|

|

4,039 |

|

|

|

7,412 |

|

| Equity earnings on alternative investments |

|

|

3,462 |

|

|

|

— |

|

|

|

5,992 |

|

|

|

— |

|

| Other |

|

|

6,585 |

|

|

|

2,121 |

|

|

|

10,064 |

|

|

|

5,954 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total noninterest income |

|

|

134,001 |

|

|

|

113,585 |

|

|

|

256,965 |

|

|

|

234,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

|

89,532 |

|

|

|

83,566 |

|

|

|

178,413 |

|

|

|

167,268 |

|

| Occupancy, net |

|

|

9,705 |

|

|

|

9,273 |

|

|

|

19,410 |

|

|

|

19,160 |

|

| Equipment |

|

|

12,920 |

|

|

|

11,873 |

|

|

|

25,583 |

|

|

|

23,807 |

|

| Supplies and services |

|

|

5,554 |

|

|

|

5,362 |

|

|

|

10,191 |

|

|

|

9,849 |

|

| Marketing and business development |

|

|

6,307 |

|

|

|

5,705 |

|

|

|

10,909 |

|

|

|

9,977 |

|

| Processing fees |

|

|

14,817 |

|

|

|

14,293 |

|

|

|

28,468 |

|

|

|

28,383 |

|

| Legal and consulting |

|

|

4,632 |

|

|

|

4,844 |

|

|

|

8,004 |

|

|

|

8,445 |

|

| Bankcard |

|

|

4,997 |

|

|

|

4,709 |

|

|

|

8,685 |

|

|

|

9,257 |

|

| Amortization of intangible assets |

|

|

3,074 |

|

|

|

3,354 |

|

|

|

6,176 |

|

|

|

6,809 |

|

| Regulatory fees |

|

|

2,709 |

|

|

|

2,484 |

|

|

|

5,225 |

|

|

|

4,395 |

|

| Contingency reserve |

|

|

5,272 |

|

|

|

— |

|

|

|

20,272 |

|

|

|

— |

|

| Other |

|

|

6,992 |

|

|

|

4,848 |

|

|

|

17,416 |

|

|

|

13,339 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total noninterest expense |

|

|

166,511 |

|

|

|

150,311 |

|

|

|

338,752 |

|

|

|

300,689 |

|

| Income before income taxes |

|

|

48,660 |

|

|

|

40,601 |

|

|

|

80,328 |

|

|

|

88,722 |

|

| Income tax provision |

|

|

13,988 |

|

|

|

10,672 |

|

|

|

22,243 |

|

|

|

23,852 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

34,672 |

|

|

$ |

29,929 |

|

|

$ |

58,085 |

|

|

$ |

64,870 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income—basic |

|

$ |

0.77 |

|

|

$ |

0.75 |

|

|

$ |

1.30 |

|

|

$ |

1.62 |

|

| Net income—diluted |

|

|

0.76 |

|

|

|

0.74 |

|

|

|

1.28 |

|

|

|

1.61 |

|

| Dividends |

|

|

0.225 |

|

|

|

0.215 |

|

|

|

0.450 |

|

|

|

0.430 |

|

| Weighted average shares outstanding |

|

|

44,823,370 |

|

|

|

39,966,869 |

|

|

|

44,782,944 |

|

|

|

39,924,423 |

|

|

|

|

| Statements of Consolidated Comprehensive Income (Loss) |

|

UMB Financial Corporation |

| (unaudited, dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Net Income |

|

$ |

34,672 |

|

|

$ |

29,929 |

|

|

$ |

58,085 |

|

|

$ |

64,870 |

|

| Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized gains (losses) on securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in unrealized holding gains (losses), net |

|

|

50,910 |

|

|

|

(136,367 |

) |

|

|

83,369 |

|

|

|

(163,415 |

) |

| Less: Reclassifications adjustment for gains included in net income |

|

|

(2,569 |

) |

|

|

(1,519 |

) |

|

|

(4,039 |

) |

|

|

(7,412 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in unrealized gains (losses) on securities during the period |

|

|

48,341 |

|

|

|

(137,886 |

) |

|

|

79,330 |

|

|

|

(170,827 |

) |

| Income tax (benefit) expense |

|

|

(18,143 |

) |

|

|

52,087 |

|

|

|

(29,789 |

) |

|

|

63,012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

30,198 |

|

|

|

(85,799 |

) |

|

|

49,541 |

|

|

|

(107,815 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income (loss) |

|

$ |

64,870 |

|

|

$ |

(55,870 |

) |

|

$ |

107,626 |

|

|

$ |

(42,945 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Statements of |

|

|

| Shareholders’ Equity |

|

UMB Financial Corporation |

| (unaudited, dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

| |

|

Common |

|

|

Capital |

|

|

Retained |

|

|

Comprehensive |

|

|

Treasury |

|

|

|

|

| |

|

Stock |

|

|

Surplus |

|

|

Earnings |

|

|

Income (Loss) |

|

|

Stock |

|

|

Total |

|

| Balance—January 1, 2013 |

|

$ |

55,057 |

|

|

$ |

732,069 |

|

|

$ |

787,015 |

|

|

$ |

85,588 |

|

|

$ |

(380,384 |

) |

|

$ |

1,279,345 |

|

| Total comprehensive income (loss) |

|

|

— |

|

|

|

— |

|

|

|

64,870 |

|

|

|

(107,815 |

) |

|

|

— |

|

|

|

(42,945 |

) |

| Cash dividends ($0.43 per share) |

|

|

— |

|

|

|

— |

|

|

|

(17,440 |

) |

|

|

— |

|

|

|

— |

|

|

|

(17,440 |

) |

| Purchase of treasury stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,750 |

) |

|

|

(1,750 |

) |

| Issuance of equity awards |

|

|

— |

|

|

|

(2,466 |

) |

|

|

— |

|

|

|

— |

|

|

|

2,916 |

|

|

|

450 |

|

| Recognition of equity based compensation |

|

|

— |

|

|

|

4,096 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,096 |

|

| Net tax benefit related to equity compensation plans |

|

|

— |

|

|

|

503 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

503 |

|

| Sale of treasury stock |

|

|

— |

|

|

|

198 |

|

|

|

— |

|

|

|

— |

|

|

|

104 |

|

|

|

302 |

|

| Exercise of stock options |

|

|

— |

|

|

|

2,056 |

|

|

|

— |

|

|

|

— |

|

|

|

1,855 |

|

|

|

3,911 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance—June 30, 2013 |

|

$ |

55,057 |

|

|

$ |

736,456 |

|

|

$ |

834,445 |

|

|

$ |

(22,227 |

) |

|

$ |

(377,259 |

) |

|

$ |

1,226,472 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance—January 1, 2014 |

|

$ |

55,057 |

|

|

$ |

882,407 |

|

|

$ |

884,630 |

|

|

$ |

(32,640 |

) |

|

$ |

(283,389 |

) |

|

$ |

1,506,065 |

|

| Total comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

58,085 |

|

|

|

49,541 |

|

|

|

— |

|

|

|

107,626 |

|

| Cash dividends ($0.45 per share) |

|

|

— |

|

|

|

— |

|

|

|

(20,447 |

) |

|

|

— |

|

|

|

— |

|

|

|

(20,447 |

) |

| Purchase of treasury stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,165 |

) |

|

|

(3,165 |

) |

| Issuance of equity awards |

|

|

— |

|

|

|

(3,395 |

) |

|

|

— |

|

|

|

— |

|

|

|

3,865 |

|

|

|

470 |

|

| Recognition of equity based compensation |

|

|

— |

|

|

|

4,733 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,733 |

|

| Net tax benefit related to equity compensation plans |

|

|

— |

|

|

|

1,202 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,202 |

|

| Sale of treasury stock |

|

|

— |

|

|

|

300 |

|

|

|

— |

|

|

|

— |

|

|

|

159 |

|

|

|

459 |

|

| Exercise of stock options |

|

|

— |

|

|

|

1,839 |

|

|

|

— |

|

|

|

— |

|

|

|

2,560 |

|

|

|

4,399 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance—June 30, 2014 |

|

$ |

55,057 |

|

|

$ |

887,086 |

|

|

$ |

922,268 |

|

|

$ |

16,901 |

|

|

$ |

(279,970 |

) |

|

$ |

1,601,342 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Balances / Yields and Rates |

|

UMB Financial Corporation |

| (tax—equivalent basis) |

|

|

| (unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

| |

|

Average |

|

|

Average |

|

|

Average |

|

|

Average |

|

| |

|

Balance |

|

|

Yield/Rate |

|

|

Balance |

|

|

Yield/Rate |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, net of unearned interest |

|

$ |

6,897,840 |

|

|

|

3.51 |

% |

|

$ |

6,158,821 |

|

|

|

3.69 |

% |

| Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

|

4,836,080 |

|

|

|

1.58 |

|

|

|

4,978,109 |

|

|

|

1.52 |

|

| Tax-exempt |

|

|

2,104,368 |

|

|

|

2.88 |

|

|

|

2,113,009 |

|

|

|

2.97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total securities |

|

|

6,940,448 |

|

|

|

1.97 |

|

|

|

7,091,118 |

|

|

|

1.95 |

|

| Federal funds and resell agreements |

|

|

32,692 |

|

|

|

0.56 |

|

|

|

28,524 |

|

|

|

0.56 |

|

| Interest-bearing due from banks |

|

|

619,094 |

|

|

|

0.30 |

|

|

|

432,588 |

|

|

|

0.31 |

|

| Trading securities |

|

|

36,785 |

|

|

|

1.80 |

|

|

|

66,482 |

|

|

|

1.79 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total earning assets |

|

|

14,526,859 |

|

|

|

2.63 |

|

|

|

13,777,533 |

|

|

|

2.67 |

|

| Allowance for loan losses |

|

|

(75,929 |

) |

|

|

|

|

|

|

(70,004 |

) |

|

|

|

|

| Other assets |

|

|

1,167,262 |

|

|

|

|

|

|

|

1,167,899 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

15,618,192 |

|

|

|

|

|

|

$ |

14,875,428 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

$ |

7,126,614 |

|

|

|

0.17 |

% |

|

$ |

6,943,399 |

|

|

|

0.19 |

% |

| Federal funds and repurchase agreements |

|

|

1,592,986 |

|

|

|

0.11 |

|

|

|

1,848,118 |

|

|

|

0.11 |

|

| Borrowed funds |

|

|

5,771 |

|

|

|

5.07 |

|

|

|

4,592 |

|

|

|

5.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing liabilities |

|

|

8,725,371 |

|

|

|

0.17 |

|

|

|

8,796,109 |

|

|

|

0.18 |

|

| Noninterest-bearing demand deposits |

|

|

5,152,980 |

|

|

|

|

|

|

|

4,636,240 |

|

|

|

|

|

| Other liabilities |

|

|

154,229 |

|

|

|

|

|

|

|

153,227 |

|

|

|

|

|

| Shareholders’ equity |

|

|

1,585,612 |

|

|

|

|

|

|

|

1,289,852 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

15,618,192 |

|

|

|

|

|

|

$ |

14,875,428 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest spread |

|

|

|

|

|

|

2.46 |

% |

|

|

|

|

|

|

2.49 |

% |

| Net interest margin |

|

|

|

|

|

|

2.53 |

|

|

|

|

|

|

|

2.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

| |

|

Average |

|

|

Average |

|

|

Average |

|

|

Average |

|

| |

|

Balance |

|

|

Yield/Rate |

|

|

Balance |

|

|

Yield/Rate |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, net of unearned interest |

|

$ |

6,788,991 |

|

|

|

3.54 |

% |

|

$ |

5,987,788 |

|

|

|

3.75 |

% |

| Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

|

4,861,475 |

|

|

|

1.58 |

|

|

|

4,925,312 |

|

|

|

1.53 |

|

| Tax-exempt |

|

|

2,107,119 |

|

|

|

2.90 |

|

|

|

2,054,141 |

|

|

|

3.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total securities |

|

|

6,968,594 |

|

|

|

1.98 |

|

|

|

6,979,453 |

|

|

|

1.97 |

|

| Federal funds and resell agreements |

|

|

29,939 |

|

|

|

0.53 |

|

|

|

23,858 |

|

|

|

0.54 |

|

| Interest-bearing due from banks |

|

|

1,154,811 |

|

|

|

0.28 |

|

|

|

701,282 |

|

|

|

0.29 |

|

| Trading securities |

|

|

37,682 |

|

|

|

1.63 |

|

|

|

62,048 |

|

|

|

1.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total earning assets |

|

|

14,980,017 |

|

|

|

2.55 |

|

|

|

13,754,429 |

|

|

|

2.65 |

|

| Allowance for loan losses |

|

|

(75,466 |

) |

|

|

|

|

|

|

(70,750 |

) |

|

|

|

|

| Other assets |

|

|

1,160,124 |

|

|

|

|

|

|

|

1,145,799 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

16,064,675 |

|

|

|

|

|

|

$ |

14,829,478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

$ |

7,545,182 |

|

|

|

0.16 |

% |

|

$ |

6,980,728 |

|

|

|

0.21 |

% |

| Federal funds and repurchase agreements |

|

|

1,630,169 |

|

|

|

0.12 |

|

|

|

1,761,074 |

|

|

|

0.12 |

|

| Borrowed funds |

|

|

5,738 |

|

|

|

4.74 |

|

|

|

4,989 |

|

|

|

4.89 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing liabilities |

|

|

9,181,089 |

|

|

|

0.16 |

|

|

|

8,746,791 |

|

|

|

0.19 |

|

| Noninterest-bearing demand deposits |

|

|

5,160,206 |

|

|

|

|

|

|

|

4,631,425 |

|

|

|

|

|

| Other liabilities |

|

|

156,608 |

|

|

|

|

|

|

|

165,117 |

|

|

|

|

|

| Shareholders’ equity |

|

|

1,566,772 |

|

|

|

|

|

|

|

1,286,145 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

16,064,675 |

|

|

|

|

|

|

$ |

14,829,478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest spread |

|

|

|

|

|

|

2.39 |

% |

|

|

|

|

|

|

2.46 |

% |

| Net interest margin |

|

|

|

|

|

|

2.45 |

|

|

|

|

|

|

|

2.53 |

|

|

|

|

| SECOND QUARTER 2014 |

|

|

| FINANCIAL HIGHLIGHTS |

|

UMB Financial Corporation |

| (unaudited, dollars in thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

| Six Months Ended June 30 |

|

2014 |

|

|

2013 |

|

| Net interest income |

|

$ |

171,615 |

|

|

$ |

161,810 |

|

| Provision for loan losses |

|

|

9,500 |

|

|

|

7,000 |

|

| Noninterest income |

|

|

256,965 |

|

|

|

234,601 |

|

| Noninterest expense |

|

|

338,752 |

|

|

|

300,689 |

|

| Income before income taxes |

|

|

80,328 |

|

|

|

88,722 |

|

| Net income |

|

|

58,085 |

|

|

|

64,870 |

|

| Net income per share—Basic |

|

|

1.30 |

|

|

|

1.62 |

|

| Net income per share—Diluted |

|

|

1.28 |

|

|

|

1.61 |

|

| Return on average assets |

|

|

0.73 |

% |

|

|

0.88 |

% |

| Return on average equity |

|

|

7.48 |

% |

|

|

10.17 |

% |

|

|

|

| Three Months Ended June 30 |

|

|

|

|

|

|

| Net interest income |

|

$ |

86,170 |

|

|

$ |

82,327 |

|

| Provision for loan losses |

|

|

5,000 |

|

|

|

5,000 |

|

| Noninterest income |

|

|

134,001 |

|

|

|

113,585 |

|

| Noninterest expense |

|

|

166,511 |

|

|

|

150,311 |

|

| Income before income taxes |

|

|

48,660 |

|

|

|

40,601 |

|

| Net income |

|

|

34,672 |

|

|

|

29,929 |

|

| Net income per share—Basic |

|

|

0.77 |

|

|

|

0.75 |

|

| Net income per share—Diluted |

|

|

0.76 |

|

|

|

0.74 |

|

| Return on average assets |

|

|

0.89 |

% |

|

|

0.81 |

% |

| Return on average equity |

|

|

8.77 |

% |

|

|

9.31 |

% |

|

|

|

| At June 30 |

|

|

|

|

|

|

| Assets |

|

$ |

15,562,690 |

|

|

$ |

15,253,217 |

|

| Loans, net of unearned interest |

|

|

6,920,683 |

|

|

|

6,338,921 |

|

| Securities |

|

|

7,033,433 |

|

|

|

7,178,637 |

|

| Deposits |

|

|

12,174,289 |

|

|

|

11,729,750 |

|

| Shareholders’ equity |

|

|

1,601,342 |

|

|

|

1,226,472 |

|

| Book value per share |

|

|

35.21 |

|

|

|

30.20 |

|

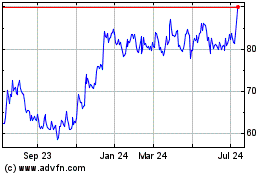

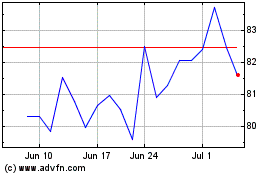

| Market price per share |

|

|

63.39 |

|

|

|

55.67 |

|

| Equity to assets |

|

|

10.29 |

% |

|

|

8.04 |

% |

| Allowance for loan losses |

|

$ |

76,802 |

|

|

$ |

71,647 |

|

| As a % of loans |

|

|

1.11 |

% |

|

|

1.13 |

% |

| Nonaccrual and restructured loans |

|

$ |

27,175 |

|

|

$ |

25,489 |

|

| As a % of loans |

|

|

0.39 |

% |

|

|

0.40 |

% |

| Loans over 90 days past due |

|

$ |

4,522 |

|

|

$ |

4,013 |

|

| As a % of loans |

|

|

0.07 |

% |

|

|

0.06 |

% |

| Other real estate owned |

|

$ |

1,455 |

|

|

$ |

3,573 |

|

| Net loan charge-offs quarter-to-date |

|

$ |

3,713 |

|

|

$ |

3,234 |

|

| As a % of average loans |

|

|

0.22 |

% |

|

|

0.21 |

% |

| Net loan charge-offs year-to-date |

|

$ |

7,449 |

|

|

$ |

6,779 |

|

| As a % of average loans |

|

|

0.22 |

% |

|

|

0.23 |

% |

| Common shares outstanding |

|

|

45,475,197 |

|

|

|

40,610,316 |

|

|

|

|

| Average Balances |

|

|

|

|

|

|

| Six Months Ended June 30 |

|

|

|

|

|

|

| Assets |

|

$ |

16,064,675 |

|

|

$ |

14,829,478 |

|

| Loans, net of unearned interest |

|

|

6,788,991 |

|

|

|

5,987,788 |

|

| Securities |

|

|

7,006,276 |

|

|

|

7,041,501 |

|

| Deposits |

|

|

12,705,388 |

|

|

|

11,612,153 |

|

| Shareholders’ equity |

|

|

1,566,772 |

|

|

|

1,286,145 |

|

|

|

|

| Business Segment Information |

|

UMB Financial Corporation |

| (unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, 2014 |

|

| |

|

Bank |

|

|

Payment

Solutions |

|

|

Institutional

Investment

Management |

|

|

Asset

Servicing |

|

|

Total |

|

| Net interest income |

|

$ |

72,481 |

|

|

$ |

12,390 |

|

|

$ |

(1 |

) |

|

$ |

1,300 |

|

|

$ |

86,170 |

|

| Provision for loan losses |

|

|

2,686 |

|

|

|

2,314 |

|

|

|

— |

|

|

|

— |

|

|

|

5,000 |

|

| Noninterest income |

|

|

56,006 |

|

|

|

21,219 |

|

|

|

33,999 |

|

|

|

22,777 |

|

|

|

134,001 |

|

| Noninterest expense |

|

|

100,928 |

|

|

|

24,603 |

|

|

|

22,111 |

|

|

|

18,869 |

|

|

|

166,511 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

|

24,873 |

|

|

|

6,692 |

|

|

|

11,887 |

|

|

|

5,208 |

|

|

|

48,660 |

|

| Income tax expense |

|

|

7,211 |

|

|

|

1,910 |

|

|

|

3,375 |

|

|

|

1,492 |

|

|

|

13,988 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

17,662 |

|

|

$ |

4,782 |

|

|

$ |

8,512 |

|

|

$ |

3,716 |

|

|

$ |

34,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average assets |

|

$ |

12,008,000 |

|

|

$ |

2,148,000 |

|

|

$ |

69,000 |

|

|

$ |

1,393,000 |

|

|

$ |

15,618,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, 2013 |

|

| |

|

Bank |

|

|

Payment

Solutions |

|

|

Institutional

Investment

Management |

|

|

Asset

Servicing |

|

|

Total |

|

| Net interest income |

|

$ |

70,558 |

|

|

$ |

11,192 |

|

|

$ |

(10 |

) |

|

$ |

587 |

|

|

$ |

82,327 |

|

| Provision for loan losses |

|

|

1,628 |

|

|

|

3,372 |

|

|

|

— |

|

|

|

— |

|

|

|

5,000 |

|

| Noninterest income |

|

|

46,436 |

|

|

|

18,640 |

|

|

|

29,155 |

|

|

|

19,354 |

|

|

|

113,585 |

|

| Noninterest expense |

|

|

92,540 |

|

|

|

21,850 |

|

|

|

18,856 |

|

|

|

17,065 |

|

|

|

150,311 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

|

22,826 |

|

|

|

4,610 |

|

|

|

10,289 |

|

|

|

2,876 |

|

|

|

40,601 |

|

| Income tax expense |

|

|

6,035 |

|

|

|

1,203 |

|

|

|

2,708 |

|

|

|

726 |

|

|

|

10,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

16,791 |

|

|

$ |

3,407 |

|

|

$ |

7,581 |

|

|

$ |

2,150 |

|

|

$ |

29,929 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average assets |

|

$ |

11,201,000 |

|

|

$ |

1,793,000 |

|

|

$ |

80,000 |

|

|

$ |

1,801,000 |

|

|

$ |

14,875,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, 2014 |

|

| |

|

Bank |

|

|

Payment

Solutions |

|

|

Institutional

Investment

Management |

|

|

Asset

Servicing |

|

|

Total |

|

| Net interest income |

|

$ |

143,602 |

|

|

$ |

24,778 |

|

|

$ |

(3 |

) |

|

$ |

3,238 |

|

|

$ |

171,615 |

|

| Provision for loan losses |

|

|

5,112 |

|

|

|

4,388 |

|

|

|

— |

|

|

|

— |

|

|

|

9,500 |

|

| Noninterest income |

|

|

103,425 |

|

|

|

41,453 |

|

|

|

68,094 |

|

|

|

43,993 |

|

|

|

256,965 |

|

| Noninterest expense |

|

|

208,671 |

|

|

|

45,631 |

|

|

|

47,998 |

|

|

|

36,452 |

|

|

|

338,752 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

|

33,244 |

|

|

|

16,212 |

|

|

|

20,093 |

|

|

|

10,779 |

|

|

|

80,328 |

|

| Income tax expense |

|

|

9,242 |

|

|

|

4,485 |

|

|

|

5,523 |

|

|

|

2,993 |

|

|

|

22,243 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

24,002 |

|

|

$ |

11,727 |

|

|

$ |

14,570 |

|

|

$ |

7,786 |

|

|

$ |

58,085 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average assets |

|

$ |

12,204,000 |

|

|

$ |

2,023,000 |

|

|

$ |

71,000 |

|

|

$ |

1,767,000 |

|

|

$ |

16,065,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, 2013 |

|

| |

|

Bank |

|

|

Payment

Solutions |

|

|

Institutional

Investment

Management |

|

|

Asset

Servicing |

|

|

Total |

|

| Net interest income |

|

$ |

137,818 |

|

|

$ |

22,740 |

|

|

$ |

(10 |

) |

|

$ |

1,262 |

|

|

$ |

161,810 |

|

| Provision for loan losses |

|

|

1,937 |

|

|

|

5,063 |

|

|

|

— |

|

|

|

— |

|

|

|

7,000 |