Current Report Filing (8-k)

July 22 2014 - 8:28AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities and Exchange Act of 1934

Date of Report (Date of earliest event reported): July 2, 2014

CARDIFF INTERNATIONAL,

INC.

(Exact name of Registrant

as specified in its charter)

| Florida |

000-49709 |

84-1044583 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

411 N New River Drive

E, Unit 2202

Ft. Lauderdale, FL 33301

(Address of principal

executive offices, including zip code)

(818) 783-2100

(Registrant's telephone

number, including area code)

411 N New River Drive E

Suite 2202

Ft. Lauderdale, FL 33301

(Former name or former address, if

changed since last report)

Check the appropriate box below if the 8-K filing

is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| o | Written communication pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)). |

Completion of Acquisition or Disposition of Assets, Change

in Directors

Item 2.01 Completion of Acquisition or Disposition of Assets

Cardiff International, Inc. (CDIF) completed the acquisition

of Edge View Properties, Inc. The acquisition became effective (the "Effective Time") at 3pm, July 16, 2014.

CDIF issued 300,000 shares of CDIF Preferred Class “E”

Shares as consideration for the Acquisition, derived by an independent appraisal of the land assets. Based on the price of $2.50

per Preferred “E” Class of stock the acquisition represents a $750,000 evaluation. In addition to CDIF will issue 1

Preferred “C” Share.

The Preferred “E” share of stock was adjusted as

a result of the authorization and declaration of a special distribution with a conversion rate of 1 Preferred to 5 Common Stock.

The Conversion right is granted as a result of a Lock-Up/Leak-Out clause designated by CDIF pursuant to the terms of the Acquisition.

Each new acquisition is also granted 1 “C” Preferred Share with the conversion rate of 1 Preferred to 100,000 Common

Shares. The “C” Share can only be converted if the Company files an S1 Registration Statement.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

No. Document

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Cardiff International, Inc.

By: /s/ Daniel Thompson

Daniel Thompson

Title: Chairman

Dated: July

17, 2014

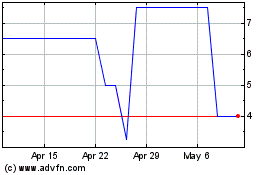

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

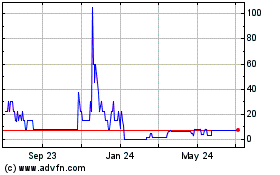

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024