Current Report Filing (8-k)

July 21 2014 - 1:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 21, 2014

PetMed Express, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

Florida

| | 000-28827

| | 65-0680967

|

(State or other jurisdiction

of incorporation)

| | (Commission

File Number)

| | (I.R.S. Employer

Identification No.)

|

1441 S.W. 29th Avenue, Pompano Beach, FL 33069

(Address of principal executive offices) (Zip Code)

(954) 979-5995

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01 Other Events.

On July 21, 2014, PetMed Express, Inc. issued a press release announcing its June 30, 2014 quarter end financial results. Additionally, PetMed Express, Inc. announced that its Board of Directors declared a quarterly dividend of $0.17 per share on its common stock. The dividend will be payable on August 15, 2014, to shareholders of record at the close of business on August 4, 2014. The Company intends to continue to pay regular quarterly dividends; however the declaration and payment of future dividends is discretionary and will be subject to a determination by the Board of Directors each quarter following its review of the Company’s financial performance. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

| | |

| (d)

| Exhibits.

|

|

|

|

|

| 99.1 – Press release dated July 21, 2014

|

EXHIBIT INDEX

| | |

Exhibit No.

|

| Description

|

|

| |

99.1

|

| Press release dated July 21, 2014

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 21, 2014

| | |

| PETMED EXPRESS, INC.

|

|

|

|

| By:

| /s/ Bruce S. Rosenbloom

|

| Name:

| Bruce S. Rosenbloom

|

| Title:

| Chief Financial Officer

|

|

|

|

2

|

Exhibit 99.1

|

PETMED EXPRESS D/B/A 1-800-PETMEDS ANNOUNCES ITS FIRST QUARTER FINANCIAL RESULTS

AND ITS $0.17 PER SHARE QUARTERLY DIVIDEND

|

Pompano Beach, Florida, July 21, 2014 - PetMed Express, Inc. (NASDAQ: PETS) today announced its financial results for the quarter ended June 30, 2014. Net income was $5.0 million, or $0.25 diluted per share, for the quarter ended June 30, 2014, compared to net income of $4.8 million, or $0.24 diluted per share, for the quarter ended June 30, 2013, a 4.6% increase to net income. Net sales for the quarter ended June 30, 2014 were $72.5 million, compared to $74.2 million for the quarter ended June 30, 2013, a decrease of 2.2%. The Company’s online sales for the quarter ended June 30, 2014 were approximately 80% of all sales, compared to 79% for the same quarter the prior year.

Menderes Akdag, CEO and President, commented: “We were able to increase our gross margins for the second consecutive quarter and decrease our operational expenses to improve our bottom line results for the quarter ended June 30, 2014. For the quarter ended June 30, 2014 our gross profit increased by 40 basis points, which can be attributed to a cost reduction in certain brands. For the quarter ended June 30, 2014 our operational expenses decreased by 30 basis points, mainly due to a reduction in advertising spending. Despite our sales decrease for the quarter we were able to increase our average order size to $78 for the quarter ended June 30, 2014, compared to $77 for the same quarter in the prior year. For the remainder of Fiscal 2015 we are focusing on improving our marketing efforts to increase sales.”

The Board of Directors declared a quarterly dividend of $0.17 per share on the Company’s common stock. The dividend will be payable on August 15, 2014, to shareholders of record at the close of business on August 4, 2014. The Company intends to continue to pay regular quarterly dividends; however the declaration and payment of future dividends is discretionary and will be subject to a determination by the Board of Directors each quarter following its review of the Company’s financial performance.

This morning at 8:30 A.M. Eastern Time, Mr. Akdag will host a conference call to review the quarter’s financial results. To access the call, which is open to the public, please dial (888) 455-1758 (toll free) or (203) 827-7025. Callers will be required to supply PETMEDS as the passcode. For those unable to participate in the live event, the call will be available for replay from 10:00 A.M. on July 21, 2014 until August 4, 2014 at 11:59 P.M. To access the replay, call (866) 509-3896 (toll free) or (203) 369-1915, and enter passcode 5500.

Founded in 1996, PetMed Express is America’s Largest Pet Pharmacy, delivering prescription and non-prescription pet medications and other health products for dogs and cats at competitive prices direct to the consumer through its 1-800-PetMeds toll free number and on the Internet through its website at www.1800petmeds.com.

This press release may contain “forward-looking” statements, as defined in the Private Securities Litigation Reform Act of 1995 or by the Securities and Exchange Commission, that involve a number of risks and uncertainties, including the Company’s ability to meet the objectives included in its business plan. Important factors that could cause results to differ materially from those indicated by such “forward-looking” statements are set forth in Management’s Discussion and Analysis of Financial Condition and Results of Operations in the PetMed Express Annual Report on Form 10-K for the year ended March 31, 2014. The Company’s future results may also be impacted by other risk factors listed from time to time in its SEC filings, including, but not limited to, the Company's Form 10-Q and its Annual Report on Form 10-K.

For investment relations contact PetMed Express, Inc., Bruce S. Rosenbloom, CFO, 954-979-5995.

###

Exhibit 99.1 Page 1 of 4

|

PETMED EXPRESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| | | | | | | | |

| | June 30,

| | | March 31,

| |

| | 2014

| | | 2014

| |

ASSETS

| | | | | | |

| | | | | | |

Current assets:

| | | | | | |

Cash and cash equivalents

| | $

| 29,141

| | | $

| 18,305

| |

Short term investments - available for sale

| | | 15,567

| | | | 15,539

| |

Accounts receivable, less allowance for doubtful accounts of $6 and $7, respectively

| | | 1,598

| | | | 1,761

| |

Inventories - finished goods

| | | 32,887

| | | | 35,727

| |

Prepaid expenses and other current assets

| | | 1,516

| | | | 1,761

| |

Deferred tax assets

| | | 1,087

| | | | 1,062

| |

Prepaid income taxes

| | | -

| | | | 54

| |

Total current assets

| | | 81,796

| | | | 74,209

| |

| | | | | | | | |

Noncurrent assets:

| | | | | | | | |

Prepaid expenses

| | | 2,214

| | | | 1,996

| |

Property and equipment, net

| | | 1,153

| | | | 1,310

| |

Intangible assets

| | | 860

| | | | 860

| |

| | | | | | | | |

Total assets

| | $

| 86,023

| | | $

| 78,375

| |

| | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY

| | | | | | | | |

| | | | | | | | |

Current liabilities:

| | | | | | | | |

Accounts payable

| | $

| 8,589

| | | $

| 5,768

| |

Accrued expenses and other current liabilities

| | | 2,406

| | | | 2,325

| |

Income taxes payable

| | | 2,889

| | | | -

| |

Total current liabilities

| | | 13,884

| | | | 8,093

| |

| | | | | | | | |

Deferred tax liabilities

| | | -

| | | | 65

| |

| | | | | | | | |

Total liabilities:

| | | 13,884

| | | | 8,158

| |

| | | | | | | | |

Commitments and contingencies

| | | | | | | | |

| | | | | | | | |

Shareholders' equity:

| | | | | | | | |

Preferred stock, $.001 par value, 5,000 shares authorized; 3 convertible shares issued and outstanding with a liquidation preference of $4 per share

| | | 9

| | | | 9

| |

Common stock, $.001 par value, 40,000 shares authorized; 20,189 and 21,190 shares issued and outstanding, respectively

| | | 20

| | | | 20

| |

Additional paid-in capital

| | | 1,950

| | | | 1,578

| |

Retained earnings

| | | 70,189

| | | | 68,647

| |

Accumulated other comprehensive loss

| | | (29

| )

| | | (37

| )

|

| | | | | | | | |

Total shareholders' equity

| | | 72,139

| | | | 70,217

| |

| | | | | | | | |

Total liabilities and shareholders' equity

| | $

| 86,023

| | | $

| 78,375

| |

Exhibit 99.1 Page 2 of 4

PETMED EXPRESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands, except for per share amounts) (Unaudited)

| | | | | | | | |

| | Three Months Ended

| |

| | June 30,

| |

| | 2014

| | | 2013

| |

| | | | | | |

Sales

| | $

| 72,541

| | | $

| 74,194

| |

Cost of sales

| | | 48,769

| | | | 50,181

| |

| | | | | | | | |

Gross profit

| | | 23,772

| | | | 24,013

| |

| | | | | | | | |

Operating expenses:

| | | | | | | | |

General and administrative

| | | 5,875

| | | | 5,873

| |

Advertising

| | | 9,896

| | | | 10,395

| |

Depreciation

| | | 163

| | | | 248

| |

Total operating expenses

| | | 15,934

| | | | 16,516

| |

| | | | | | | | |

Income from operations

| | | 7,838

| | | | 7,497

| |

| | | | | | | | |

Other income (expense):

| | | | | | | | |

Interest income, net

| | | 44

| | | | 47

| |

Other, net

| | | 9

| | | | (2

| )

|

Total other income

| | | 53

| | | | 45

| |

| | | | | | | | |

Income before provision for income taxes

| | | 7,891

| | | | 7,542

| |

| | | | | | | | |

Provision for income taxes

| | | 2,918

| | | | 2,787

| |

| | | | | | | | |

Net income

| | $

| 4,973

| | | $

| 4,755

| |

| | | | | | | | |

Net change in unrealized gain (loss) on short

| | | | | | | | |

term investments

| | | 8

| | | | (46

| )

|

| | | | | | | | |

Comprehensive income

| | $

| 4,981

| | | $

| 4,709

| |

| | | | | | | | |

Net income per common share:

| | | | | | | | |

Basic

| | $

| 0.25

| | | $

| 0.24

| |

Diluted

| | $

| 0.25

| | | $

| 0.24

| |

| | | | | | | | |

Weighted average number of common shares outstanding:

| | | | | | | | |

Basic

| | | 19,961

| | | | 19,848

| |

Diluted

| | | 20,092

| | | | 20,004

| |

| | | | | | | | |

Cash dividends declared per common share

| | $

| 0.17

| | | $

| 0.15

| |

Exhibit 99.1 Page 3 of 4

PETMED EXPRESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited)

| | | | | | | | |

| | Three Months Ended

| |

| | June 30,

| |

| | 2014

| | | 2013

| |

Cash flows from operating activities:

| | | | | | |

Net income

| | $

| 4,973

| | | $

| 4,755

| |

Adjustments to reconcile net income to net cash provided by operating activities:

| | | | | | | | |

Depreciation

| | | 163

| | | | 248

| |

Share based compensation

| | | 373

| | | | 362

| |

Deferred income taxes

| | | (90

| )

| | | 35

| |

Bad debt expense

| | | 17

| | | | 24

| |

(Increase) decrease in operating assets and increase (decrease) in liabilities:

| | | | | | | | |

Accounts receivable

| | | 146

| | | | (1,112

| )

|

Inventories - finished goods

| | | 2,840

| | | | 10,025

| |

Prepaid income taxes

| | | 54

| | | | -

| |

Prepaid expenses and other current assets

| | | 27

| | | | (609

| )

|

Accounts payable

| | | 2,821

| | | | 3,818

| |

Income taxes payable

| | | 2,889

| | | | 2,474

| |

Accrued expenses and other current liabilities

| | | 44

| | | | (175

| )

|

Net cash provided by operating activities

| | | 14,257

| | | | 19,845

| |

| | | | | | | | |

Cash flows from investing activities:

| | | | | | | | |

Net change in investments

| | | (20

| )

| | | (21

| )

|

Purchases of property and equipment

| | | (6

| )

| | | (4

| )

|

Net cash used in investing activities

| | | (26

| )

| | | (25

| )

|

| | | | | | | | |

Cash flows from financing activities:

| | | | | | | | |

Dividends paid

| | | (3,395

| )

| | | (2,977

| )

|

Net cash used in financing activities

| | | (3,395

| )

| | | (2,977

| )

|

| | | | | | | | |

Net increase in cash and cash equivalents

| | | 10,836

| | | | 16,843

| |

Cash and cash equivalents, at beginning of period

| | | 18,305

| | | | 18,155

| |

| | | | | | | | |

Cash and cash equivalents, at end of period

| | $

| 29,141

| | | $

| 34,998

| |

| | | | | | | | |

Supplemental disclosure of cash flow information:

| | | | | | | | |

| | | | | | | | |

Cash paid for income taxes

| | $

| 66

| | | $

| 279

| |

| | | | | | | | |

Dividends payable in accrued expenses

| | $

| 300

| | | $

| 315

| |

Exhibit 99.1 Page 4 of 4

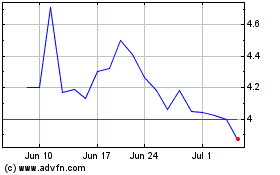

PetMed Express (NASDAQ:PETS)

Historical Stock Chart

From Mar 2024 to Apr 2024

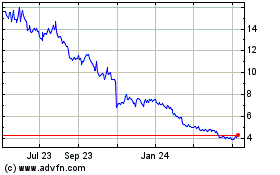

PetMed Express (NASDAQ:PETS)

Historical Stock Chart

From Apr 2023 to Apr 2024