GrowBLOX Sciences, Inc. has been garnering the attention of the investment community.

July 21 2014 - 9:41AM

InvestorsHub NewsWire

With four separate revenue drivers,

a unique first-of-its-kind technology, an individual proprietary

cannabis strains and a presence within a growing list of states,

GrowBLOX Sciences, Inc. has been garnering the attention of the

investment community over the last few months. Not only has

GBLX seen explosive highs nearly $3.50, but the recent pullback to

lows of $1 may have opened an opportunity for new investment.

After watching the trading from Friday’s afternoon session, a

deeper look at the company and the current industry climate are the

main reasons for wanting to keep an eye on this company heading

into the rest of the month.

The company's technology has been

built to set the standard for manufacturing and medical cannabis

producing technology, and has it positioned to become a key player

in the industry. Back in May, GBLX identified one of its

major revenue drivers would be partnering with in-state growers to

help them cultivate cannabis that meets patients' needs. To this

point, the company has entered into several key markets:

Nevada

GBLX became one of the "chosen 18" that were granted

special use permit licenses for medical marijuana dispensaries

through its local partnership, GBS NEVADA, LLC. The Company's

Fort Apache location is the only dispensary to service the needs of

patients in that area, giving GBLX a major advantage in the Nevada

market.

Florida

Mid July marked GBLX’s entry into

the Florida market through its wholly owned subsidiary, GB Sciences

Florida, LLC. The National Cannabis Industry Association

estimates medical marijuana will be a $785 million industry in

Florida with multiple economic opportunities. Governor Rick Scott

signed a law on June 16 allowing for

the limited use of a special strain of marijuana called

“Charlotte’s Web” to treat those suffering from epilepsy, cancer

and amyotrophic lateral sclerosis (ALS), known as Lou Gehrig’s

disease and this is just the first step for the state.

Florida will have the opportunity to enact a comprehensive,

workable medical marijuana law this November by voting yes

on Amendment Two.

Illinois

GrowBLOX is currently involved in

the application process for licensing in Illinois. As far as

timing goes, GBLX has acted quickly in preparation of the potential

move as state lawmakers have set final rules to allow medical

marijuana in Illinois. Door would be open for patients to

apply for ID cards this fall and to start purchasing legal cannabis

by next spring. The state intends to approve a total of 21 licenses

for cultivation and 60 for dispensaries by September.

According to the Marijuana Business Factbook, the IL market hosts

some 10,000 patients and will generate anywhere from $25 million to

$45 million in cannabis sales.

Puerto

Rico

The Company opened its subsidiary GB

Sciences Puerto Rico, Inc. and is monitoring the island's pending

legislation to legalize medical marijuana. The Puerto Rican

Senate is currently discussing the legalization of marijuana for

medical use and its cultivation and so far SB 517 has passed senate

in a 14-12 vote now moving on to the House; it would decriminalize

up to 14 grams of marijuana. As far as legalization of

medical, Representative Carlos Vargas introduced House Bill 1362 to

legalize medical marijuana and regulate its sale, possession and

consumption. During the public hearings on House Bill 1362, most

groups testified in favor of medical marijuana and argued similar

cases as other states moving forward with a motion to legalize the

medical use of the drug identifying that reform is needed to tackle

drug addiction and high incarceration rates.

With GBLX already set up in Nevada

and already establishing a presence in 3 more areas positioned for

some type of legalization, the company has significantly entrenched

itself as a driving force within the industry as a whole. Beyond

the cultivation aspect, the company has also put into place, key

relationships with banking and inside investment. Lazarus

Investment Partners LLLP, has acquired an additional 269,632 shares

in the open market for an additional $322,000 investment. Lazarus,

which already holds a 3,000,000-share investment, which actually

averaged UP their position in GrowBLOX. I’m sure it’s not

hard to see that by averaging up, the firm believes that this is an

undervalued investment under the $1.20 mark.

Furthermore, and quite possibly even

more important is a two-fold chain of events: 1. GBLX secured a

letter of intent with First Security Bank of Nevada for the purpose

of managing the currency and banking flow of The Company's

operating facilities and 2. The House voted Wednesday (7/16) in

a 236-186 win in support of making it easier for banks to do

business with legal pot shops and providers of medical marijuana.

This was a decision that rejected a move by Rep. John Fleming,

R-La., to block the Treasury Department from implementing guidance

it issued in February telling banks how to report on their dealings

with marijuana-related businesses without running afoul of federal

money-laundering laws. The Treasury guidance was intended to give

banks confidence that they can deal with marijuana businesses in

states where they're legal. For marijuana cultivation companies

like GrowBLOX in connection with its LOI puts GBLX in place to

immediately benefit from the previously signed LOI moving forward

with full access to banking operations as it stands

today.

There’s no doubt that the US is

moving toward a new industry explosion. Sentiment from the

quickly growing millennial generation is in clear support for full

legalization. Americans age 18 to 29 oppose the federal

prohibition of marijuana, according to national polling data compiled by the Reason

Foundation. In addition to this, of those polled, only 14 percent

said that someone who consumes marijuana should go to jail.

So as more states continue to move toward some form of legalization

not only has GBLX positioned itself ahead of these motions through

subsidiaries and partnerships, but it has also been incredibly

active in providing the necessary quality that many medical

programs are looking for.

Although GBLX has gone through a

consolidation over the past week, it looks like interest has built

once again following announcements from Capitol Hill in addition to

the companies continued growth in additional markets like Illinois

and Florida so heading into the week ahead, this is going to be a

stock that I will be watching very closely especially after the

late afternoon activity from Friday.

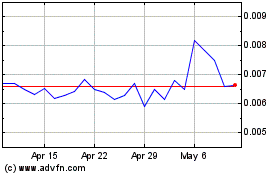

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

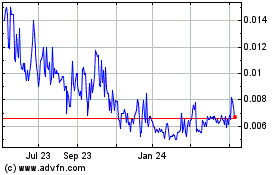

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Apr 2023 to Apr 2024