As filed with the Securities and Exchange Commission on July

17, 2014

|

Registration No. 333-___________

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

________________________________

NANOVIRICIDES, INC.

(Exact name of registrant as specified in

its charter)

|

Nevada

(State or jurisdiction

of incorporation or organization)

|

8731

(Primary Standard Industrial

classification Code)

|

76-0674577

(I.R.S. Employer

Identification No.)

|

|

|

|

135 Wood Street

Suite 205

West Haven, Connecticut 06516

(Address and telephone number of registrant’s

principal executive offices and principal place of business)

|

|

|

|

|

|

Dr. Eugene Seymour

135 Wood Street

Suite 205

West Haven, Connecticut

(203) 937-6137

(Name, address and telephone number of agent

for service)

|

|

Copies to:

Peter Campitiello, Esq.

Kane Kessler, P.C.

1350 Avenue of the Americas

New York, New York 10019

Telephone (212) 519-5109

Facsimile (212) 245-3009

|

Approximate date of proposed sale to the public:

As

soon as practicable after this Registration Statement has become effective and the shares of common stock underlying the warrants

described herein have been purchased by the respective warrant-holders.

If the securities being registered on this Form are being offered

in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box.

¨

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (Check one):

|

Large accelerated filer

|

¨

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

|

x

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

¨

|

|

CALCULATION OF REGISTRATION FEE

|

|

|

Title of each class of

Securities to be registered

|

|

Amount to be

Registered

|

|

|

Proposed maximum

Offering price per

unit(1)

|

|

|

Proposed maximum

aggregate

offering price(1)

|

|

|

Amount of

registration fee(1)

|

|

|

Common Stock, $0.001 par value, underlying certain existing Warrants

(3)

|

|

|

3,071,986 (2)(3)

|

|

|

$

|

3.50

|

|

|

$

|

10,751,951

|

|

|

$

|

1,384.85

|

|

|

TOTAL

|

|

|

|

|

|

|

|

|

|

$

|

10,751,951

|

|

|

$

|

1,384.85

|

|

|

(1)

|

Calculated pursuant to Rule 457(i) of the Securities Act of 1933, as amended, based upon the per share exercise price of $3.50 for the common stock underlying previously issued warrants (the “Warrants”).

|

|

(2)

|

Represents the maximum number of shares of common stock to be

issued to the holders of: (i) warrants to purchase 100,000 shares of common stock originally issued in connection with a

private placement in November 2005; (ii) warrants to purchases 84,572 shares of common stock issued on June 15, 2006 in a

private placement offering, (iii) warrants to purchase 421,429 shares of common stock issued on October 1, 2007 in

connection with a private placement offering, (iv) warrants to purchase 466,486 shares of common stock issued on August 22,

2008 in a private placement offering, (v) warrants to purchase 561,628 shares of common stock issued on June 30, 2009 in a

private placement offering, (vi) warrants to purchase 377,297 shares of common stock issued on September 30, 2009 in a

private placement offering and (vii) warrants to purchase 1,060,574 shares of common stock issued on September 30, 2009 in a

private offering (collectively, the “Warrant Shares”).

|

|

(3)

|

Pursuant to Rule 416, the number of shares of common stock being registered shall include an indeterminate

number of shares of common stock that may be issued pursuant to stock splits, stock dividends, recapitalizations or certain other

capital adjustments.

|

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. The selling stockholders named in this prospectus may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities

and the selling stockholders named in this prospectus are not soliciting offers to buy these securities in any jurisdiction where

the offer or sale is not permitted.

Subject to completion, dated

July 17, 2014

________________

3,071,986 Shares of Common Stock

___________

This prospectus relates

to the offer and sale by the holders of various classes of our warrants identified in this prospectus (the “Warrantholders”),

and any of their respective pledgees, donees, transferees or other successors in interest, of up to 3,071,986 shares (the “Warrant

Shares”) of common stock of NanoViricides, Inc., a Nevada corporation (“we”, “us”, or the “Company”).

The number of shares the Warrantholders may sell includes shares of the Company’s common stock, par value $0.001 per share

(the “Common Stock”) that they may receive if they exercise their warrants or that may potentially be issuable to them

in connection with an adjustment due to stock splits, stock dividends, recapitalizations or certain other capital adjustments.

We are filing the registration statement (of which this prospectus is a part) at this time so that Warrantholders exercise such

Warrants to purchase the Warrant Shares, however, we are unsure how many of the Warrants, if any, will be exercised. We will not

receive any of the proceeds from the sale of the common stock by the selling stockholders, but we will receive all of the proceeds

of the exercise price of the Warrants ($3.50 per share) only if they are exercised by the warrantholders.

The Warrant Shares

This Prospectus relates

to the offer and sale by the Warrantholders of up to 3,071,986 shares of Common Stock (the “Warrant Shares”) issuable

upon the exercise of: (i) warrants that were issued to investors in connection with the Registrant’s private placement of

common stock and warrants to purchase common stock in November 2005 (the “2005 Warrants”); (ii) warrants that were

issued to investors in connection with the registrant’s private placement of common stock and warrants to purchase common

stock on June 15, 2006 (the “2006 Warrants”); (iii) warrants to purchase common stock on October 1, 2007 (the “2007

Warrants”); (iv) warrants to purchase common stock on August 22, 2008 (the “2008 Warrants”); (v) warrants to

purchase Common Stock on June 30, 2009 (the “2009A Warrants”); (vi) warrants to purchase common stock issued on September

30, 2009 (the “2009B Warrants”); and (vii) warrants to purchase shares of common stock issued on September 30, 2009

(the “2009C Warrants”).

The 2005 Warrants were

issued in connection with a private placement of the Company’s Common Stock and Warrants from November 28, 2005 through December

30, 2005. The Company sold 782,858 shares of Common Stock and Warrants to purchase an additional 391,429 shares Common Stock at

an exercise price of $3.50 (the “2005 Warrants”) for an aggregate offering of $1,370,000. The original expiration date

of the 2005 Warrants was December 2008, which was extended to August 15, 2014. 100,000 of the 2005 Warrants remain unexercised.

The 2006 Warrants were

issued in connection with a private placement of the Company’s Common Stock and Warrants on June 15, 2006. The Company sold

535,715 shares of Common Stock and Warrants to purchase an additional 535,715 shares at an original exercise price of $8.75 per

share (the “2006 Warrants”) for an aggregate purchase price of $1,875,000. The original expiration date of the 2006

Warrants was June 2009, the expiration date was extended to August 15, 2014 and the exercise price was revised to $3.50. 84,572

of the 2006 Warrants remain unexercised.

The 2007 Warrants were

issued in connection with a private placement of the Company’s Common Stock and Warrants in October 2007. The Company sold

1,428,571 shares of Common Stock and Warrants to purchase an additional 428,571 shares of Common Stock at the exercise price of

$3.50 per share (the “2007 Warrants”) for an aggregate price of $2,500,000. The expiration date was extended to August

15, 2014. 421,429 of the 2007 Warrants remain unexercised.

The 2008 Warrants were

issued in connection with a private placement of the Company’s Common Stock and Warrants on August 22, 2008. The Company

sold 938,858 shares of Common Stock and Warrants to purchase an additional 469,429 shares of Common Stock at an original exercise

price of $7.00 per share (the “2008 Warrants”) for an aggregate purchase price of $ 3,286,000. The original expiration

date was extended to August 15, 2014 and the exercise price was revised to $3.50. 466,486 of the 2008 Warrants remain unexercised.

The 2009A Warrants

were issued in connection with a private placement of the Company’s Common Stock and Warrants on June 30, 2009. The Company

sold an aggregate of 628,772 shares of Common Stock and Warrants to purchase an additional 607,343 shares of Common Stock at an

exercise price of $3.50 per share (the “2009A Warrants) for an aggregate purchase price of $1,100,350. The original expiration

date was extended to August 15, 2014. 561,628 of the 2009A Warrants remain unexercised.

The 2009B Warrants

were issued in connection with a private placement of the Company’s Common Stock and Warrants on September 30, 2009. The

Company sold an aggregate of 764,286 shares of Common Stock and Warrants to purchase an additional 382,143 shares of Common Stock

at an exercise price of $3.50 per share (the “2009B Warrants) for an aggregate purchase price of $1,337,500. The original

expiration date was extended to August 15, 2014. 377,297 of the 2009B Warrants remain unexercised.

The 2009C Warrants

were issued in connection with a private offering of the Company’s Common Stock and Warrants to its Warrantholders on September

30, 2009. The Company sold an aggregate of 1,074,229 shares of Common Stock and Warrants to purchase an additional 1,074,229 shares

of Common Stock at an exercise price of $3.50 per share (the “2009C Warrants”) for an aggregate offering price of $1,879,900.

The original expiration date of the 2009C Warrants was extended to August 15, 2014, 1,060,574 of the 2009C Warrants remain unexercised.

We will to pay all

legal, accounting, registration and related fees and expenses in connection with the registration of these shares. The selling

stockholders will pay all underwriting discounts and selling commissions, if any, in connection with the sale of their shares.

The Warrantholders,

after they have exercised the Warrants and paid the exercise price of $3.50 per share to the Company, may offer the shares from

time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices

or at privately negotiated prices.

Our common stock is traded on the NYSE MKT

under the symbol “NNVC.” On July 16, 2014, the closing price of the common stock on NYSE MKT was $4.57 per share. We

urge you to obtain current market quotations for our common stock.

___________

Pursuant to Rule 416

under the Securities Act of 1933, as amended, this registration statement also covers an indeterminate number of additional shares

as may hereafter be offered or issued with respect to the shares registered hereby resulting from stock splits, stock dividends,

recapitalizations or certain other capital adjustments.

If you have any questions

or need assistance, you should contact the Company. All questions and requests should be directed to Eugene Seymour, NanoViricides,

Inc., 135 Wood Street, Suite 205, West Haven, Connecticut 06516, telephone (203) 937-6137, email:

info@NanoViricides.com

.

The securities offered by this Prospectus

involve a high degree of risk.

See “Risk Factors” beginning

on page 5.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved these securities or determined that this prospectus

is truthful or complete. A representation to the contrary is a criminal offense.

The date of this prospectus is July 17,

2014.

Table of Contents

We have not authorized anyone to provide you with information

different from that contained or incorporated by reference in this prospectus.

PROSPECTUS SUMMARY

This summary highlights

important features of this offering and the information included or incorporated by reference in this prospectus. This summary

does not contain all of the information that you should consider before investing in our common stock. You should read the entire

prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.”

Unless the context

otherwise requires, references in this prospectus to “NanoViricides,” “we,” “us” and “our”

refer to NanoViricides, Inc.

Summary of the Offer

|

The Company

|

|

NanoViricides, Inc., a Nevada corporation, is a leading company in the application of nanomedicine technologies to the complex issues of viral diseases. The nanoviricides® class of drug is designed to specifically attack virus particles and dismantle them.

|

|

|

|

|

|

Corporate Contact Information

|

|

Our principal executive offices are located at 135 Wood Street, Suite 205, West Haven, Connecticut 06516, telephone (203) 937-6137.

|

|

|

|

|

|

Common Stock offered by Warrantholders

|

|

3,071,986 Shares

|

|

|

|

|

|

Common Stock Outstanding

|

|

54,614,930 shares as of July 17, 2014

|

|

|

|

|

|

Offered Warrants that qualify for the Offer

|

|

“2005 Warrants”

|

|

|

|

|

|

|

|

As of July 17, 2014, we had outstanding warrants to purchase an aggregate of 100,000 shares of Common Stock, which were issued in November and December 2005 pursuant to the closing of a private placement offering of Units. Each Unit consisted of two shares of Common Stock and one warrant to purchase one share of Common Stock. We are offering pursuant to this Prospectus 100,000 shares of our Common Stock for issuance upon exercise of the 2005 Warrants. The shares issued upon exercise of the 2005 Warrants will be unrestricted and freely transferable. The 2005 Warrants will expire on August 15, 2014, unless sooner exercised.

|

|

|

|

|

|

|

|

“2006 Warrants”

|

|

|

|

|

|

|

|

As of July 17, 2014, we had outstanding warrants to purchase an aggregate of 84,572 shares of Common Stock, which were issued on June 15, 2006 pursuant to the closing of our private placement offering of Units. Each Unit consisted of one share of Common Stock and one warrant to purchase one share of Common Stock. We are offering pursuant to this Prospectus 84,572 shares of our Common Stock for issuance upon exercise of the 2006 Warrants. The shares issued upon exercise of the 2006 Warrants will be unrestricted and freely transferable. The 2006 Warrants will expire on August 15, 2014, unless sooner exercised.

|

|

|

|

|

|

|

|

“2007 Warrants”

|

|

|

|

|

|

|

|

As of July 17, 2014, we had outstanding warrants to purchase an aggregate of 421,429 shares of Common Stock, which were issued on October 1, 2007 pursuant to the closing of our private placement offering of Units. Each Unit consisted of one share of Common Stock and one warrant to purchase one share of Common Stock. We are offering pursuant to this Prospectus 421,429 shares of our Common Stock for issuance upon exercise of the 2007 Warrants. The shares issued upon exercise of the 2007 Warrants will be unrestricted and freely transferable. The 2007 Warrants will expire on August 15, 2014, unless sooner exercised.

|

|

|

|

|

|

|

|

“2008 Warrants”

|

|

|

|

|

|

|

|

As of July 17, 2014, we had outstanding warrants to purchase an aggregate of 466,486 shares of Common Stock, which were issued on August 22, 2008 pursuant to the closing of our private placement offering of Units. Each Unit consisted of one share of Common Stock and one warrant to purchase one share of Common Stock. We are offering pursuant to this Prospectus 466,486 shares of our Common Stock for issuance upon exercise of the 2008 Warrants. The shares issued upon exercise of the 2008 Warrants will be unrestricted and freely transferable. The 2008 Warrants will expire on August 15, 2014, unless sooner exercised.

|

|

|

|

|

|

|

|

“2009A Warrants”

|

|

|

|

|

|

|

|

As of July 17, 2014, we had outstanding warrants to purchase an aggregate of 561,628 shares of Common Stock, which were issued on June 30, 2009 pursuant to the closing of our private placement offering of Units. Each Unit consisted of one share of Common Stock and one warrant to purchase one share of Common Stock. We are offering pursuant to this Prospectus 561,628 share of our Common Stock for issuance upon exercise of the 2009A Warrants. The shares issued upon exercise of the 2009A Warrants will be unrestricted and freely transferable. The 2009A Warrants will expire on August 15, 2014, unless sooner exercised.

|

|

|

|

|

|

|

|

“2009B Warrants”

|

|

|

|

|

|

|

|

As of July 17, 2014, we had outstanding warrants to purchase an aggregate of 377,297 shares of Common Stock, which were issued on September 30, 2009 pursuant to the closing of our private placement offering of Units. Each Unit consisted of one share of Common Stock and one warrant to purchase one share of Common Stock. We are offering pursuant to this Prospectus 377,297 shares of our Common Stock for issuance upon exercise of the 2009B Warrants. The shares issued upon exercise of the 2009B Warrants will be unrestricted and freely transferable. The 2009B Warrants will expire on August 15, 2014, unless sooner exercised.

|

|

|

|

|

|

|

|

“2009C Warrants”

|

|

|

|

|

|

|

|

As of July 17, 2014, we had outstanding warrants to purchase an aggregate of 1,060,574 shares of Common Stock, which were issued on September 30, 2009 pursuant to the closing of our private placement offering of Units. Each Unit consisted of one share of Common Stock and one warrant to purchase one share of Common Stock. We are offering pursuant to this Prospectus 1,060,574 shares of our Common Stock for issuance upon exercise of the 2009C Warrants. The shares issued upon exercise of the 2009C Warrants will be unrestricted and freely transferable. The 2009C Warrants will expire on August 15, 2014, unless sooner exercised.

|

|

Market Price of the Common Stock

|

|

Our Common Stock is quoted on the NYSE MKT under the symbol “NNVC”. On July 16, 2014, the last reported sale price of our Common Stock was $4.57. There is no public market for any of the Warrants.

|

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the sale of the Shares in this offering, but we will receive the exercise price of the warrants in the Warrants are exercised. See “Use of Proceeds”.

|

|

|

|

|

|

Risk Factors

|

|

There are risks associated with participating in the Offer. For a discussion of some of the risks you should consider before deciding whether to participate in the Offer, you are urged to carefully review and consider the information in the section entitled “Risk Factors” starting on page 5.

|

|

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING

INFORMATION

This prospectus includes

and incorporates forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

All statements, other than statements of historical facts, included or incorporated in this prospectus regarding our strategy,

future operations, financial position, future revenues, projected costs, prospects, plans and objectives of management are forward-looking

statements. When used in this prospectus or in any other presentation, statements which are not historical in nature, including

the words “anticipate,” “estimate,” “could,” “should,” “may,” “plan,”

“seek,” “expect,” “believe,” “intend,” “target,” “project”

and similar expressions are intended to identify forward-looking statements. They also include statements regarding:

|

|

•

|

our future growth and profitability;

|

|

|

•

|

our competitive strengths; and

|

|

|

•

|

our business strategy and the trends we anticipate in the industries and economies in which we operate.

|

These forward-looking

statements are based on our current expectations and are subject to a number of risks, uncertainties and assumptions. These statements

are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our

control, are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the

forward-looking statements. Important factors that could cause actual results to differ materially from those in forward-looking

statements include:

|

|

•

|

economic downturns, reduced capital expenditures, consolidation and technological and regulatory changes in our industry;

|

|

|

•

|

the highly competitive nature of our industry;

|

|

|

•

|

our ability to attract and retain qualified managers and skilled employees;

|

|

|

•

|

the outcome of our plans for future operations and growth; and

|

|

|

•

|

the other factors referenced in this prospectus, including, without limitation, under “Risk Factors.”

|

We believe these forward-looking

statements are reasonable; however, you should not place undue reliance on any forward-looking statements, which are based on current

expectations. Furthermore, forward-looking statements speak only as of the date they are made. If any of these risks or uncertainties

materialize, or if any of our underlying assumptions are incorrect, our actual results may differ significantly from the results

that we express in or imply by any of our forward-looking statements. These and other risks are detailed in this prospectus, in

any supplements to this prospectus, in the documents that we incorporate by reference into this prospectus and in other documents

that we file with the SEC. See “Risk Factors”. We do not undertake any obligation to publicly update or revise these

forward-looking statements after the date of this prospectus to reflect future events or circumstances. We qualify any and all

of our forward-looking statements by these cautionary factors.

ABOUT NANOVIRICIDES, INC.

This summary highlights

selected information and does not contain all the information that is important to you. You should carefully read this prospectus,

any applicable prospectus supplement and the documents we have referred you to in “Incorporation of Certain Documents by

Reference” on page 9 of this prospectus for information about us and our financial statements as well as “Where You

Can Find More Information” on page 9.

Except where the

context otherwise requires, the terms “we,” “us,” “our” or “Nanoviricides” refer

to NanoViricides, Inc.

Our Business

We are an early developmental

stage nano-biopharmaceutical company engaged in the discovery, development and commercialization of anti-viral therapeutics. We

have no customers, products or revenues to date, and may never achieve revenues or profitable operations. Our drugs are based on

several patents, patent applications, provisional patent applications, and other proprietary intellectual property held by TheraCour

Pharma, Inc., one of our principal shareholders, to which we have the licenses in perpetuity for the treatment of the following

human viral diseases:

|

|

·

|

Influenza, Asian Bird Flu, and H1N1 “Swine Flu” Viruses;

|

|

|

·

|

Herpes Simplex Virus (HSV);

|

|

|

·

|

Human Immunodeficiency Virus (HIV/AIDS);

|

|

|

·

|

Adenoviral Conjunctivitis and Keratitis, and Ocular Indications of Herpes Simplex Types 1 & 2.

|

|

|

·

|

Dengue Fever types I, II, III, & IV;

|

|

|

·

|

Hepatitis B Virus (HBV);

|

|

|

·

|

Hepatitis C Virus (HCV);

|

|

|

·

|

Rabies;

|

|

|

·

|

Ebola and Marburg Viruses;

|

|

|

·

|

Japanese Encephalitis; and

|

|

|

·

|

West Nile Virus.

|

We focus our laboratory

research and pre-clinical programs on specific anti-viral solutions. We are seeking to add to our pipeline of drug candidates through

our internal discovery pre-clinical development programs and through an in-licensing strategy.

Company Information

Our principal executive

offices are located at 135 Wood Street, Suite 205, West Haven, Connecticut 06516. Our telephone number is (203) 937-6137. You may

also contact us or obtain additional information through our internet website address at www.nanoviricides.com. Information contained

on our website is not incorporated into this prospectus and is not a part of this prospectus.

RISK FACTORS

Investing in our common stock involves

significant risks and uncertainties. Please see the risk factors under the heading “Risk Factors” in our most recent

Annual Report on Form 10-K, and revised or supplemented by our Quarterly Report on Form 10-Q filed with the SEC since the filing

of our most recent Annual Report on Form 10-K, each of which is on file with the SEC and is incorporated by reference in this prospectus.

The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not

presently known to us or that we currently deem immaterial may also affect our business operations.

USE OF PROCEEDS

We will not receive

any proceeds from the sale of shares by the Warrantholders. The exercise price of the outstanding Warrants is $3.50 per share,

subject to adjustment under specified circumstances. If all of the warrants are exercised for cash (assuming no price adjustment),

we will receive proceeds of $10,751,951, which we will use for general corporate purposes. The allocation of proceeds toward any

of these purposes will depend upon the amount of net proceeds received.

The selling stockholders

will pay all underwriting discounts, selling commissions and expenses incurred by them for brokerage, accounting, tax or legal

services or any other expenses incurred by the selling stockholders in connection with the sale of the shares, if any. We will

bear all other costs, fees and expenses incurred in effecting the registration of the shares covered by this prospectus, including,

without limitation, all registration and filing fees, NYSE MKT listing fees and fees and expenses of our counsel and our accountants.

DESCRIPTION OF THE TRANSACTIONS

From November 28, 2005

through December 30, 2005, the Company sold 782,858 shares of Common Stock and Warrants to purchase an additional 391,429 shares

Common Stock at an exercise price of $3.50 (the “2005 Warrants”) for an aggregate offering of $1,370,000. The original

expiration date of the 2005 Warrants was December 2008, which has been extended to August 15, 2014. 100,000 of the 2005 Warrants

remain unexercised.

On June 15, 2006, the

Company sold 535,715 shares of Common Stock and Warrants to purchase an additional 535,715 shares at an original exercise price

of $8.75 per share (the “2006 Warrants”) for an aggregate purchase price of $1,875,000. The original expiration date

of the 2006 Warrants was June 2009, which has been extended to August 15, 2014 and the exercise price was revised to $3.50. 84,572

of the 2006 Warrants remain unexercised.

In October 2007, the

Company sold 1,428,571 shares of Common Stock and Warrants to purchase an additional 428,571 shares of Common Stock at the exercise

price of $3.50 per share (the “2007 Warrants”) for an aggregate price of $1,750,000. The expiration date has been extended

to August 15, 2014. 421,429 of the 2007 Warrants remain unexercised.

On August 22, 2008,

the Company sold 938,858 shares of Common Stock and Warrants to purchase an additional 469,429 shares of Common Stock at an original

exercise price of $7.00 per share (the “2008 Warrants”) for an aggregate purchase price of $3,286,000. The original

expiration date has been extended to August 15, 2014 and the exercise price was revised to $3.50. 466,486 of the 2008 Warrants

remain unexercised.

On June 30, 2009, the

Company sold an aggregate of 628,772 shares of Common Stock and Warrants to purchase an additional 607,343 shares of Common Stock

at an exercise price of $3.50 per share (the “2009A Warrants) for an aggregate purchase price of $1,100,350. The original

expiration date has been extended to August 15, 2014. 561,628 of the 2009A Warrants remain unexercised.

On September 30, 2009,

the Company sold an aggregate of 764,286 shares of Common Stock and Warrants to purchase an additional 382,143 shares of Common

Stock at an exercise price of $3.50 per share (the “2009B Warrants) for an aggregate purchase price of $1,337,500. The original

expiration date has been extended to August 15, 2014. 377,297 of the 2009B Warrants remain unexercised.

Also on September 30,

2009, the Company sold an aggregate of 1,074,229 shares of Common Stock and Warrants to purchase an additional 1,074,229 shares

of Common Stock at an exercise price of $3.50 per share (the “2009C Warrants) for an aggregate offering price of $1,879,900.

The original expiration date of the 2009C Warrants was extended to August 15, 2014, 1,060,574 of the 2009C Warrants remain unexercised.

SELLING STOCKHOLDERS

This prospectus relates

to the resale from time to time of up to 3,071,986 shares of our common stock by the Warrantholders which is comprised of shares

of Common Stock that they may receive if they exercise their Warrants and pay the warrant exercise price.

In lieu of providing

a table of the selling stockholders setting forth: (i) the number of shares held of record or beneficially by the selling stockholders

and (ii) the number of shares that may be offered under this prospectus by the selling stockholders, the Registrant will include

the names of the selling stockholders and the number of shares each selling stockholder is eligible to sell in a prospectus filed

pursuant to rule 424(b)(7) or a post-effective amendment to this registration statement.

None of the selling

stockholders has held any position or office, or has otherwise had a material relationship, with us or any of our subsidiaries

within the past three years. The persons named in the table below have sole or shared voting and investment power with respect

to the number of shares indicated as beneficially owned by them.

PLAN OF DISTRIBUTION

We are registering

the shares of common stock issuable upon exercise of the warrants to permit the resale of these shares of common stock by the holders

of the warrants from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the

selling stockholders of the shares of common stock. We will bear all fees and expenses incident to our obligation to register the

shares of common stock.

The selling stockholders

may sell all or a portion of the shares of common stock beneficially owned by them and offered hereby from time to time directly

or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers,

the selling stockholders will be responsible for underwriting discounts or commissions or agent's commissions. The shares of common

stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying

prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may involve

crosses or block transactions,

|

|

·

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

|

|

·

|

in the over-the-counter market;

|

|

|

·

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

·

|

through the writing of options, whether such options are listed on an options exchange or otherwise;

|

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

short sales;

|

|

|

·

|

sales pursuant to Rule 144;

|

|

|

·

|

broker-dealers may agree with the selling securityholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

If the selling stockholders

effect such transactions by selling shares of common stock to or through underwriters, broker-dealers or agents, such underwriters,

broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders

or commissions from purchasers of the shares of common stock for whom they may act as agent or to whom they may sell as principal

(which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those

customary in the types of transactions involved). In connection with sales of the shares of common stock or otherwise, the selling

stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the shares of

common stock in the course of hedging in positions they assume. The selling stockholders may also sell shares of common stock short

and deliver shares of common stock covered by this prospectus to close out short positions and to return borrowed shares in connection

with such short sales. The selling stockholders may also loan or pledge shares of common stock to broker-dealers that in turn may

sell such shares.

The selling stockholders

may pledge or grant a security interest in some or all of the warrants or shares of common stock owned by them and, if

they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of

common stock from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable

provision of the Securities Act of 1933, as amended, amending, if necessary, the list of selling stockholders to include the pledgee,

transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer

and donate the shares of common stock in other circumstances in which case the transferees, donees, pledgees or other successors

in interest will be the selling beneficial owners for purposes of this prospectus.

The selling stockholders

and any broker-dealer participating in the distribution of the shares of common stock may be deemed to be "underwriters"

within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer

may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares

of common stock is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of

shares of common stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents,

any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions

or concessions allowed or reallowed or paid to broker-dealers.

Under the securities

laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers or dealers.

In addition, in some states the shares of common stock may not be sold unless such shares have been registered or qualified for

sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance

that any selling stockholder will sell any or all of the shares of common stock registered pursuant to the registration statement,

of which this prospectus forms a part.

The selling stockholders

and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act

of 1934, as amended, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act,

which may limit the timing of purchases and sales of any of the shares of common stock by the selling stockholders and any other

participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common

stock to engage in market-making activities with respect to the shares of common stock. All of the foregoing may affect the marketability

of the shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the

shares of common stock.

Once sold under the

registration statement, of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands

of persons other than our affiliates.

DESCRIPTION OF SECURITIES TO BE REGISTERED

General

Our Amended and Restated Articles of Incorporation authorize us to issue up to 85,714,286 shares of common

stock par value of $0.001 per share, and 5,714,286 shares of preferred stock, par value $0.001 per share. As of July 17, 2014,

we had 54,614,930 shares of common stock issued and outstanding, 3,249,665 shares of preferred stock issued and outstanding, and

an aggregate of 11,484,878 shares of common stock issuable upon exercise of currently exercisable options, warrants and convertible

notes. The transfer agent and registrar for our common stock is Corporate Stock Transfer, Denver, Colorado 80209, (303) 282-4800.

Description of Common Stock

Voting Rights

Each holder of common stock is entitled to

one vote for each share held on all matters submitted to a vote of the stockholders.

Dividends

Subject to the rights of the holders of any

preferred stock, the holders of common stock are entitled to receive ratably such dividends as may be declared by our board of

directors out of funds legally available for dividends. We have not historically declared or paid cash dividends on

our common stock.

Other Rights

In the event of a liquidation,

dissolution or winding up of us, holders of our common stock are entitled to share ratably in all assets remaining after payment

of liabilities and the liquidation preference, if any, of any then outstanding preferred stock. Holders of our common

stock are not entitled to preemptive rights and have no subscription, redemption or conversion privileges. All outstanding

shares of common stock are, and all shares of common stock issued by us in an offering under this prospectus and the applicable

prospectus supplement will be, fully paid and nonassessable. The rights, preferences and privileges of holders of common

stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock which

our board of directors may designate and that we may issue in one or more offerings under this prospectus or at other times in

the future.

Transfer Agent and Registrar

The transfer agent and registrar for our

common stock is Corporate Stock Transfer, Inc., 3200 Cherry Creek Drive South, Suite 430, Denver, Colorado 80209, (303) 282-4800.

Holders of our common

stock are entitled to one vote for each share on all matters to be voted on by our stockholders. Holders of our common stock do

not have any cumulative voting rights. Common stockholders are entitled to share ratably in any dividends that may be declared

from time to time on the common stock by our board of directors from funds legally available therefor. Holders of common stock

do not have any preemptive right to purchase shares of common stock. There are no conversion rights or sinking-fund provisions

for or applicable to our common stock.

LEGAL MATTERS

Legal matters in connection

with the validity of the shares offered by this prospectus will be passed upon by Kane Kessler, P.C., New York, New York.

EXPERTS

The consolidated financial

statements as of June 30, 2013 included herein have been included in reliance on the report of Li & Company, P.C., an independent

registered public accounting firm, which is included herein and given on the authority of said firm as experts in auditing and

accounting.

We have had no changes

in our independent registered public accounting firm through the date of this Prospectus or during our preceding two fiscal years,

nor have we had any disagreements with our independent registered public accounting firm on any matter of accounting principles

or practices, financial statement disclosure, or auditing scope or procedure during such time.

WHERE YOU CAN

FIND MORE INFORMATION

Before you decide whether

to invest in our common stock, you should read this prospectus and the information we otherwise file with the SEC. We are a reporting

company and file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy

these reports, proxy statements and other information at the SEC’s Public Reference Room at 100 F Street, N.E., Washington,

D.C. 20549 or at the SEC’s other public reference facilities. Please call the SEC at 1-800-SEC-0330 for more information

about the operation of the public reference rooms. You can request copies of these documents by writing to the SEC and paying a

fee for the copying costs. Our SEC filings are also available at the SEC’s website at http://www.sec.gov.

INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE

We are incorporating

certain information about us that we have filed with the SEC by reference in this prospectus, which means that we are disclosing

important information to you by referring you to those documents. We are also incorporating by reference in this prospectus information

that we file with the SEC after this date. The information we incorporate by reference is an important part of this prospectus,

and later information that we file with the SEC automatically will update and supersede the information we have included in or

incorporated into this prospectus.

We incorporate by reference

the following documents we have filed, or may file, with the SEC:

|

|

•

|

|

Our Annual Report on Form 10-K for the fiscal year ended June 30, 2013, filed on September 30, 2013 and amended on October 8, 2013;

|

|

|

•

|

|

Our Quarterly Reports on Form 10-Q for the quarter ended September 30, 2013 as filed on November 14, 2013 and amended November 18, 2013, for the quarter ended December 31, 2013 as filed on February 14, 2014, and for the quarter ended March 31, 2014 filed on May 15, 2014 ;

|

|

|

•

|

|

Our Current Reports on Form 8-K filed on December 13, 2013, January 24, 2014, February 26, 2014, February 28, 2014 and amended March 19, 2014, June 2, 2014, June 25, 2014 and July 9, 2014;

|

|

|

•

|

|

The description of capital stock contained in our Form 8-A filed on September 23, 2013, including any amendments or reports filed for the purpose of updating the description;

|

|

|

•

|

|

All documents filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and before termination of this offering. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed above or filed in the future, that are not deemed “filed” with the SEC, including our compensation committee report and performance graph or any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or certain exhibits furnished pursuant to Item 9.01 of Form 8-K.

|

This prospectus is

part of a registration statement we have filed with the SEC on Form S-3 relating to the common stock. As permitted by SEC rules,

this prospectus does not contain all of the information included in the registration statement and the accompanying exhibits and

schedules we file with the SEC. We have filed certain legal documents that control the terms of the common stock offered by this

prospectus as exhibits to the registration statement. You may refer to the registration statement and the exhibits for more information

about us and our common stock. The registration statement and exhibits are also available at the SEC’s Public Reference Room

or through its web site.

You may request a copy of these filings,

at no cost, by writing or telephoning us at the following addresses:

NanoViricides, Inc.

135 Wood Street, Suite 205

West Haven, CT 06516

Attn: Investor Relations

(203) 937-6137

Exhibits to the filings will not be sent,

however, unless those exhibits have specifically been incorporated by reference.

You should rely only

on the information contained in this prospectus, including information incorporated by reference as described above, or any prospectus

supplement that we have specifically referred you to. We have not authorized anyone else to provide you with different information.

You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than

the date on the front of those documents or that any document incorporated by reference is accurate as of any date other than its

filing date. You should not consider this prospectus to be an offer or solicitation relating to the securities in any jurisdiction

in which such an offer or solicitation relating to the securities is not authorized. Furthermore, you should not consider this

prospectus to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified

to do so, or if it is unlawful for you to receive such an offer or solicitation.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses Of Issuance And Distribution.

The Registrant estimates

that expenses payable by the Registrant in connection with the offering described in this Registration Statement will be as follows:

|

SEC registration fee

|

|

$

|

1,384.85

|

|

|

Legal fees and expenses

|

|

|

50,000.00

|

|

|

Accounting fees and expenses

|

|

|

5,000.00

|

|

|

Printing and engraving expenses

|

|

|

5,000.00

|

|

|

Transfer agent fees

|

|

|

5,000.00

|

|

|

Miscellaneous

|

|

|

5,000.00

|

|

|

|

|

$

|

71,384.85

|

|

Item 15. Indemnification of Directors and Officers.

Subsection 1 of Section

78.7502 of the Nevada Revised Statutes (the “NRS”), empowers a corporation to indemnify any person who was or is a

party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal,

administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that such person

is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as

a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses,

including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by such person

in connection with the action, suit or proceeding if that person acted in good faith and in a manner that he or she reasonably

believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding,

had no reasonable cause to believe his or her conduct was unlawful. The termination of any action, suit or proceeding by judgment,

order, settlement, conviction or upon a plea of nolo contendere or its equivalent, does not, of itself, create a presumption that

the person did not act in good faith and in a manner that he or she reasonably believed to be in or not opposed to the best interests

of the corporation, or that, with respect to any criminal action or proceeding, he or she had reasonable cause to believe that

his or her conduct was unlawful.

Subsection 2 of Section

78.7502 of the NRS empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to

any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by

reason of the fact that such person is or was a director, officer, employee or agent of the corporation, or is or was serving at

the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust

or other enterprise against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred

by such person in connection with the defense or settlement of the action or suit if he or she acted in good faith and in a manner

that he or she reasonably believed to be in or not opposed to the best interests of the corporation. Indemnification may not be

made for any claim, issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion

of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only

to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application

that in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses

as the court deems proper.

Section 78.7502 of the

NRS further provides that to the extent a director, officer, employee or agent of a corporation has been successful on the merits

or otherwise in defense of any action, suit or proceeding referred to in subsections 1 and 2 of Section 78.7502, or in defense

of any claim, issue or matter therein, a corporation shall indemnify him or her against expenses, including attorneys’ fees,

actually and reasonably incurred by such person in connection with the defense.

Section 78.751 of the

NRS provides that any discretionary indemnification under Section 78.7502, unless ordered by a court or advanced, may be made by

a corporation only as authorized in the specific case upon a determination that indemnification of the director, officer, employee

or agent is proper in the circumstances. The determination must be made: (a) by the stockholders; (b) by the board of directors

by majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding; (c) if a majority

vote of a quorum consisting of directors who were not parties to the action, suit or proceeding so orders, by independent legal

counsel in a written opinion; or (d) if a quorum consisting of directors who were not parties to the action, suit or proceeding

cannot be obtained, by independent legal counsel in a written opinion.

Section 78.751 of the

NRS further provides that the indemnification provided for by Section 78.7502 shall not be deemed exclusive or exclude any other

rights to which the indemnified party may be entitled and that the scope of indemnification shall continue as to directors, officers,

employees or agents who have ceased to hold such positions, and to their heirs, executors and administrators. Section 78.752 of

the NRS empowers a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee

or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of

another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person or

incurred by him or her in any such capacity or arising out of his or her status as such whether or not the corporation would have

the power to indemnify such person against such liabilities under Section 78.7502.

Pursuant to the Registrant’s

Amended and Restated Articles of Incorporation, the personal liability of its directors to the Registrant or its stockholders for

monetary damages for breach of fiduciary duty as a director is eliminated to the fullest extent permitted by law. In

addition, the Registrant will indemnify its directors and officers to the fullest extent permitted by law. In certain

cases, the Registrant may also advance expenses incurred by any director or officer in defending any proceeding brought against

him because of his position as such.

Item 16. Exhibits.

The exhibits listed

in the Exhibit Index immediately preceding the exhibits are filed as part of this Registration Statement Form S-3.

Item 17. Undertakings.

(a) The undersigned Registrant

hereby undertakes:

(1) To file, during any period

in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in this registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation

from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the

maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration

statement; and

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such

information in this registration statement;

Provided, however,

That:

(A) Paragraphs (a)(1)(i)

and (a)(1)(ii) of this section do not apply if the registration statement is on Form S–8, and the information required to

be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission

by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference

in the registration statement; and

(B) Paragraphs (a)(1)(i),

(a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form S–3 or Form F–3 and

the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or

furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that

are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b)

that is part of the registration statement.

(C)

Provided further,

however

, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the registration statement is for an offering of asset-backed

securities on Form S–1 or Form S–3, and the information required to be included in a post-effective amendment is provided

pursuant to Item 1100(c) of Regulation AB.

(2) That, for the purpose of

determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial

bona fide

offering thereof.

(3) To remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) If the registrant is a foreign private

issuer, to file a post-effective amendment to the registration statement to include any financial statements required by “Item

8.A. of Form 20–F” at the start of any delayed offering or throughout a continuous offering. Financial statements and

information otherwise required by Section 10(a)(3) of the Act need not be furnished,

provided

that the registrant includes

in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and

other information necessary to ensure that all other information in the prospectus is at least as current as the date of those

financial statements. Notwithstanding the foregoing, with respect to registration statements on Form F–3, a post-effective

amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Act if such financial

statements and information are contained in periodic reports filed with or furnished to the Commission by the registrant pursuant

to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Form F–3.

(5) That, for the purpose of determining

liability under the Securities Act of 1933 to any purchaser:

(i) If the registrant is relying on Rule

430B:

(A) Each prospectus filed by the registrant

pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed

part of and included in the registration statement; and

(B) Each prospectus required to be filed

pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering

made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the

Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such

form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described

in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter,

such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration

statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

Provided, however,

that no statement made in a registration statement or prospectus that

is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior

to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part

of the registration statement or made in any such document immediately prior to such effective date; or

(ii) If the registrant is subject to Rule

430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration

statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included

in the registration statement as of the date it is first used after effectiveness.

Provided, however,

that no statement

made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or

deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will,

as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the

registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such date of first use.

(6) That, for the purpose of

determining liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities,

the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or

sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser

and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus

or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus

relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) The portion of any other

free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities

provided by or on behalf of the undersigned Registrant; and

(iv) Any other communication

that is an offer in the offering made by the undersigned Registrant to the purchaser.

(c) Insofar as indemnification

for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers or controlling persons of the

Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant

of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered,

the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities

Act and will be governed by the final adjudication of such issue.

(d) The undersigned Registrant hereby undertakes

to respond to requests for information that is incorporated by reference into the prospectus pursuant to Items 4, 10(b), 11, or

13 of this Form, within one business day of receipt of such request, and to send the incorporated documents by first class mail

or other equally prompt means. This includes information contained in documents filed subsequent to the effective date of the registration

statement through the date of responding to the request.

(e) The undersigned Registrant hereby undertakes

to supply by means of a post-effective amendment all information concerning a transaction, and the company being acquired involved

therein, that was not the subject of and included in the registration statement when it became effective.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this Registration Statement on Form S-3 to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of West Haven, State of Connecticut, on July 17, 2014.

|

|

NANOVIRICIDES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Eugene Seymour

|

|

|

|

|

Eugene Seymour

|

|

|

|

|

Chief Executive Officer

|

|

POWER OF ATTORNEY

Each person whose signature

appears below hereby constitutes and appoints Eugene Seymour his or her true and lawful attorney-in-fact and agent, with full power

of substitution, to do any and all acts and things in our name and on our behalf in our capacities as directors and officers and

to execute any and all instruments for us and in our names in the capacities indicated below, which said attorney and agent may

deem necessary or advisable to enable said registrant to comply with the Securities Act of 1933, as amended, and any rules, regulations

and requirements of the Securities and Exchange Commission, in connection with this Registration Statement on Form S-3 (including

post-effective amendments and any related registration statement pursuant to Rule 462(b) under the Securities Act of 1933,

as amended) hereto and we do hereby ratify and confirm that said attorneys and agents, or any of them, shall do or cause to be

done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed below by the following persons in the capacities indicated on July 17, 2014.

|

Name

|

|

Title

|

|

|

|

|

|

/s/ Eugene Seymour

|

|

Chairman and Chief Executive Officer

|

|

Eugene Seymour

|

|

(Principal Executive Officer)

|

|

|

|

|

|

/s/ Meeta Vyas

|

|

Chief Financial Officer

|

|

Meeta Vyas

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

/s/ Anil Diwan

|

|

President, Director

|

|

Anil Diwan

|

|

|

|

|

|

|

|

/s/ Stanley Glick

|

|

Director

|

|

Stanley Glick

|

|

|

|

|

|

|

|

/s/ Milton Boniuk

|

|

Director

|

|

Milton Boniuk

|

|

|

|

|

|

|

|

/s/ Mukund Kulkarni

|

|

Director

|

|

Mukund Kulkarni

|

|

|

EXHIBIT INDEX

|

3.1*

|

|

Articles of Incorporation, as amended, of the Registrant

|

|

3.2

|

|

Articles of Amendment to Amended and Restated Articles of Incorporation (incorporated by reference to Exhibit 3.1 to the Current Report on Form 8-K filed on September 3, 2013).

|

|

3.3*

|

|

By-laws of the Registrant

|

|

4.1*

|

|

Specimen Stock Certificate of the Registrant

|

|

4.2

|

|

Certificate of Designation of Rights and Preferences of Series B Convertible Preferred Stock (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed on May 12, 2010).

|

|

4.3

|

|

Certificate of Amendment to Certificate of Designation of Rights and Preferences of Series B Convertible Preferred Stock (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed on September 22, 2010).

|

|

4.4

|

|

Certificate of Amendment to Certificate of Designation of Rights and Preferences of Series B Convertible Preferred Stock (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed on April 19, 2010).

|

|

4.5

|

|

Certificate of Designation of Rights and Preferences of Series C Convertible Preferred Stock (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K/A filed on July 2, 2012).

|

|

5.1

|

|

Opinion of Kane Kessler, P.C.

|

|

10.1*

|

|

Share Exchange Agreement between NanoViricide, Inc. and the Registrant

|

|

10.2*

|

|

Form of Subscription Agreement for 2005 Private Placement.

|

|

10.3*

|

|

Form of Common Stock Purchase Warrant for 2006 Private Placement.

|

|

10.4

|

|

Form of Subscription Agreement for 2007 Private Placement (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed on October 18, 2007).

|

|

10.5

|

|

Form of Common Stock Purchase Warrant for 2007 Private Placement (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed on October 18, 2007).

|

|

10.6

|

|

Form of Subscription Agreement for 2008 Private Placement (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed on August 27, 2008).

|

|

10.7

|

|

Form of Common Stock Purchase Warrant for 2008 Private Placement (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed on August 27, 2008).

|

|

10.8

|

|

Form of Subscription Agreement of June 2009 Unit Offering (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed on July 7, 2009).

|

|

10.9

|

|

Form of Warrant of June 2009 Unit Offering (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed on July 7, 2009).

|

|

10.10

|

|

Form of Subscription Agreement for June 2009 Offering (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed on October 5, 2009).

|

|

10.11

|

|

Form of Subscription Agreement for June 2009 Warrant Exercise Offering (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed on October 5, 2009).

|

|

23.1

|

|

Consent of Kane Kessler, P.C. (included in Exhibit 5.1).

|

|

23.2

|

|

Consent of Li and Company, PC.

|

|

|

|

|

|

*

|

Incorporated by reference to the Company’s registration statement on Form 10-SB, filed with the Securities Commission on November 14, 2006, as amended.

|

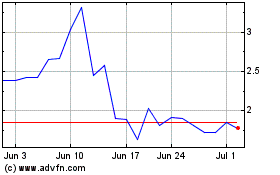

NanoViricides (AMEX:NNVC)

Historical Stock Chart

From Mar 2024 to Apr 2024

NanoViricides (AMEX:NNVC)

Historical Stock Chart

From Apr 2023 to Apr 2024