UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 17, 2014

WESTERN ALLIANCE BANCORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-32550 | 88-0365922 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

One E. Washington Street, Phoenix, Arizona 85004

(Address of principal executive offices) (Zip Code)

(602) 389-3500

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

⃞ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

⃞ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

⃞ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

⃞ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On July 17, 2014, Western Alliance Bancorporation (the “Company”) issued a press release reporting results for the fiscal quarter ended June 30, 2014 and posted on its website its second quarter 2014 Earnings Conference Call Presentation, which contains certain additional historical and forward-looking information relating to the Company. Copies of the press release and presentation slides are attached hereto as Exhibits 99.1 and 99.2, respectively.

The information in this report (including Exhibits 99.1 and 99.2 hereto) is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

99.1 Press Release dated July 17, 2014.

99.2 Second Quarter 2014 Earnings Conference Call dated July 18, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| WESTERN ALLIANCE BANCORPORATION |

| (Registrant) |

| | |

| | |

| /s/ Dale Gibbons | |

|

| |

| Dale Gibbons | |

| Executive Vice President and |

| Chief Financial Officer |

| | |

| | |

| | |

Date: July 17, 2014 | |

Western Alliance Reports Second Quarter 2014 Net Income of $35.5 million, or $0.40 Per Share

PHOENIX--(BUSINESS WIRE)--July 17, 2014--Western Alliance Bancorporation (NYSE:WAL) announced today its financial results for the second quarter 2014.

Second Quarter 2014 Highlights:

| |

• | Net income of $35.5 million, compared to $31.1 million for the first quarter 2014 and $34.1 million for the second quarter 2013 |

| |

• | Earnings per share of $0.40, compared to $0.35 per share in the first quarter 2014 and $0.39 per share in the second quarter 2013 |

| |

• | Accretion of interest yield related to purchased credit impaired loan sales or payoffs increased $1.4 million, net of tax, or $0.02 per share, compared to the first quarter 2014 |

| |

• | Pre-tax, pre-provision operating earnings of $47.4 million, up from $44.4 million in the first quarter 2014 and up 18.1% from $40.1 million in the second quarter 20131 |

| |

• | Net interest margin of 4.39%, compared to 4.41% in the first quarter 2014 and 4.36% in the second quarter 2013 |

| |

• | Total loans of $7.54 billion, up $436 million from March 31, 2014 and up $1.13 billion from June 30, 2013 |

| |

• | Total deposits of $8.47 billion, up $321 million from March 31, 2014 and up $1.47 billion from June 30, 2013 |

| |

• | Nonperforming assets (nonaccrual loans and repossessed assets) decreased to 1.23% of total assets from 1.30% in the first quarter 2014 and from 1.86% in the second quarter 2013 |

| |

• | Net loan recoveries (annualized) to average loans outstanding of 0.09%, compared to 0.02% in the first quarter 2014 and net loan charge-offs to average loans of 0.17% in the second quarter 2013 |

| |

• | Tier I Leverage Capital of 10.0% and Total Risk-Based Capital ratio of 12.4%, compared to 9.9% and 12.4%, respectively, at March 31, 2014 and 9.9% and 12.0%, respectively, at June 30, 2013 |

| |

• | Total equity of $958 million, up $63 million from March 31, 2014 and up $159 million from June 30, 2013 |

| |

• | Tangible book value per share, net of tax, of $9.02, up from $8.32 at March 31, 2014 and up from $7.26 at June 30, 20131 |

Financial Performance

“Our performance momentum continued during the quarter with record organic loan growth and strong deposit growth driving record net interest income,” said Robert Sarver, Chairman and Chief Executive Officer of Western Alliance Bancorporation. “Double digit revenue growth, which was well in excess of the increase in expenses, took our efficiency ratio below 50% for the first time. On the asset quality front, Western Alliance has achieved net loan recoveries in three of the last four quarters, while gross loan losses have fallen to only 0.11% of total average loans.”

Sarver continued, “Despite our strong asset growth, our capital has climbed even faster with tangible common equity rising to 7.9% of tangible assets at June 30, 2014, and each regulatory capital ratio is higher than it was a year ago. Our tangible book value per share, net of tax, is up 24% in the past year to $9.02.”

Income Statement

Net interest income was $93.9 million in the second quarter 2014, an increase of $3.1 million, or 3.4%, from $90.8 million in the first quarter of 2014 and an increase of $11.7 million, or 14.3%, compared to the second quarter 2013. The Company’s net interest margin decreased in the second quarter 2014 to 4.39%, compared to 4.41% in the first quarter 2014, and increased compared to 4.36% in the second quarter 2013.

Operating non-interest income was $5.7 million for the second quarter 2014, compared to $5.7 million in the first quarter of 2014 and $5.0 million for the second quarter of 2013.1

Net operating revenue was $99.6 million for the second quarter 2014, an increase of 3.2% compared to $96.5 million for the first quarter of 2014 and an increase of 14.3% compared to $87.2 million for the second quarter 2013.1

Operating non-interest expense was $52.2 million for the second quarter 2014, compared to $52.1 million for the first quarter of 2014 and $47.0 million for the second quarter of 2013.1 The Company’s operating efficiency ratio1 on a tax equivalent basis was 49.4% for the second quarter 2014, compared to 51.0% for the first quarter 2014 and 52.2% for the second quarter 2013.

The Company had 1,112 full-time equivalent employees and 39 offices at June 30, 2014, compared to 1,015 full-time equivalent employees and 41 offices at June 30, 2013.

The Company views its pre-tax, pre-provision operating earnings as a key metric for assessing the Company’s earning power, which it defines as net operating revenue less operating non-interest expense. For the second quarter 2014, the Company’s pre-tax, pre-provision operating earnings were $47.4 million, up from $44.4 million in the first quarter 2014 and up 18.1% from $40.1 million in the second quarter 2013.1

Balance Sheet

Gross loans totaled $7.54 billion at June 30, 2014, an increase of $436 million from March 31, 2014 and an increase of $1.13 billion from $6.41 billion at June 30, 2013. At June 30, 2014, the allowance for credit losses was 1.40% of total loans, compared to 1.46% at March 31, 2014 and 1.50% at June 30, 2013, reflecting an improvement in the Company’s asset quality profile.

Deposits totaled $8.47 billion at June 30, 2014, an increase of $321 million from $8.15 billion at March 31, 2014 and an increase of $1.47 billion from $7.00 billion at June 30, 2013. Non-interest bearing deposits were $2.28 billion at June 30, 2014, compared to $2.09 billion at March 31, 2014 and $1.92 billion at June 30, 2013. Non-interest bearing deposits comprised 26.9% of total deposits at June 30, 2014, compared to 25.7% at March 31, 2014 and 27.4% at June 30, 2013, while the proportion of savings and money market accounts decreased to 42.9% from approximately 45.1% at March 31, 2014 and increased from 42.1% at June 30, 2013. Certificates of deposit as a percent of total deposits increased to 20.8% from 20.0% at June 30, 2014 and decreased from 21.5% at June 30, 2013. The Company’s ratio of loans to deposits was 89.1% at June 30, 2014, compared to 87.2% at March 31, 2014 and 91.6% at June 30, 2013.

Stockholders’ equity at June 30, 2014 increased to $958 million from $895 million at March 31, 2014 and increased $159 million from $799 million at June 30, 2013. To support the Company's continued growth, we raised $2.6 million in net proceeds from the issuance of 115,866 shares of common stock through our at-the-market (ATM) public offering. This was the first issuance of common stock under the $100 million ATM program. In order to increase management's flexibility regarding the Company's investment portfolio, during the quarter, the Company transferred all of its held-to-maturity securities to available-for-sale, which resulted in an increase of $7.3 million to accumulated other comprehensive income at June 30, 2014.

At June 30, 2014, tangible common equity, net of tax, was 7.9% of tangible assets1 and total risk-based capital was 12.4% of risk-weighted assets. The Company’s tangible book value per share1 was $9.02 at June 30, 2014, up 24.2% from June 30, 2013.

Total assets increased 2.8% to $10.02 billion at June 30, 2014 from $9.75 billion at March 31, 2014, and increased 16.7% from $8.59 billion at June 30, 2013.

Asset Quality

The provision for credit losses was $0.5 million for the second quarter 2014, compared to $3.5 million for the first quarter 2014 and second quarter 2013. Net loan recoveries in the second quarter 2014 were $1.5 million, or 0.09% of average loans (annualized), compared to 0.02% for the first quarter 2014. Net charge-offs for the second quarter 2013 were $2.7 million, or 0.17% of average loans (annualized).

Nonaccrual loans decreased $6.1 million to $64.3 million during the quarter. Loans past due 90 days and still accruing interest totaled $3.0 million at June 30, 2014, up from $0.2 million at March 31, 2014 and down from $3.9 million at June 30, 2013. Loans past due 30-89 days, still accruing interest totaled $5.1 million at quarter end, down from $11.1 million at March 31, 2014 and $7.3 million at June 30, 2013.

As the Company’s asset quality improved and its capital increased, the ratio of classified assets to Tier I capital plus the allowance for credit losses, a common regulatory measure of asset quality, improved to 25% at June 30, 2014 from 32% at June 30, 2013.1

Segment Highlights

On December 31, 2013, the Company consolidated its three bank subsidiaries under one charter, Western Alliance Bank. As a result, the Company has redefined its operating segments to reflect the new organizational and internal reporting structure. Prior year segment information has not been recast to conform to the new segmentation methodology due to the impracticability of restating segments because of the change in legal structure at December 31, 2013. The new operating segments are as follows: Arizona, Nevada, California, National Business Lines, and Corporate & Other.

The Company's reportable segments are aggregated primarily based on geographic location, services offered and markets served. The Arizona, Nevada and California segments provide full service banking and related services to their respective regions. The Company's National Business Lines segment provides banking services to niche markets. These National Business Lines are broader in geographic scope and are managed centrally. Corporate & Other consists of corporate-related items, income and expense items not allocated to our other reportable segments and inter-segment eliminations.

Key management metrics for evaluating the performance of the Company's Arizona, Nevada, California and National Business Lines segments include loan and deposit growth, asset quality and pre-tax income.

Arizona reported a gross loan balance of $2.13 billion at June 30, 2014, an increase of $99 million during the quarter, and an increase of $106 million during the year. Deposits were $2.12 billion at June 30, 2014, an increase of $53 million during the quarter, and an increase of $115 million during the year. Pre-tax income was $17.3 million and $29.9 million for the three and six months ended June 30, 2014, respectively.

Nevada reported a gross loan balance of $1.68 billion at June 30, 2014, a decrease of $41 million during the quarter, and a decrease of $72 million during the year. Deposits were $3.19 billion at June 30, 2014, an increase of $136 million during the quarter, and an increase of $265 million during the year. Pre-tax income was $17.7 million and $34.2 million for the three and six months ended June 30, 2014, respectively.

California reported a gross loan balance of $1.69 billion at June 30, 2014, an increase of $32 million during the quarter, and an increase of $80 million during the year. Deposits were $2.06 billion at June 30, 2014, an increase of $145 million during the quarter, and an increase of $116 million during the year. Pre-tax income was $14.0 million and $24.3 million for the three and six months ended June 30, 2014, respectively.

National Business Lines reported a gross loan balance of $1.95 billion at June 30, 2014, an increase of $330 million during the quarter, and an increase of $601 million during the year. Deposits were $886 million at June 30, 2014, an increase of $14 million during the quarter, and an increase of $118 million during the year. Pre-tax income was $6.8 million and $12.1 million for the three and six months ended June 30, 2014, respectively.

Attached to this press release is summarized financial information for the quarter ended June 30, 2014.

Conference Call and Webcast

Western Alliance Bancorporation will host a conference call and live webcast to discuss its second quarter 2014 financial results at 12:00 p.m. ET on Friday, July 18, 2014. Participants may access the call by dialing 1-888-317-6003 and using passcode: 8153733 or via live audio webcast using the website link: http://services.choruscall.com/links/wal140718.html. The webcast is also available via the Company’s website at www.westernalliancebancorp.com. Participants should log in at least 15 minutes early to receive instructions. The call will be recorded and made available for replay after 2:00 p.m. ET July 18th through July 31st at 9:00 a.m. ET by dialing 1-877-344-7529 passcode: 10048463.

About Western Alliance Bancorporation

Western Alliance Bancorporation (NYSE:WAL) is a leading bank holding company providing comprehensive business banking and related financial services through its wholly-owned banking subsidiary, Western Alliance Bank (the "Bank"). With local teams of experienced bankers, the Bank provides a superior level of capabilities, products and services, to assist the growth of local businesses and the quality of life in the markets it serves. In addition to a national platform of specialized financial service units, the Bank operates full service banking divisions in its local markets as Alliance Bank of Arizona, Bank of Nevada, First Independent Bank and Torrey Pines Bank. Western Alliance Bancorporation is publicly traded on the New York Stock Exchange. Additional investor information can be accessed on the Investor Relations page of the Company's website, www.westernalliancebancorp.com.

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Examples of forward-looking statements include, among others, statements we make regarding guidance, outlook or expectations relating to our business, financial and operating results, and future economic performance. The forward-looking statements contained herein reflect our current views about future events and financial performance and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ materially from historical or expected results include, among others: the risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 as filed with the Securities and Exchange Commission; changes in general economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; inflation, interest rate, market and monetary fluctuations; increases in competitive pressures among financial institutions and businesses offering similar products and services; higher defaults on our loan portfolio than we expect; changes in management’s estimate of the adequacy of the allowance for credit losses; legislative or regulatory changes or changes in accounting principles, policies or guidelines; supervisory actions by regulatory agencies which may limit our ability to pursue certain growth opportunities; management’s estimates and projections of interest rates and interest rate policy; the execution of our business plan; and other factors affecting the financial services industry generally or the banking industry in particular.

Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only as of the date on which it is made. We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements, whether written or oral, that may be made from time to time, set forth in this press release to reflect new information, future events or otherwise.

Use of Non-GAAP Financial Information

This press release contains both financial measures based on accounting principles generally accepted in the United States (“GAAP”) and non-GAAP based financial measures, which are used where management believes it to be helpful in understanding Western Alliance Bancorporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in this press release. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

Early Adoption of Accounting Standards

Effective as of the first quarter 2014, the Company elected early adoption of Accounting Standards Codification 323-740, an amended Financial Accounting Standards Board standard related to accounting for low income housing tax credit investments. Under this amended standard, the amortization of the investment may now be calculated under the proportional amortization method and is included in income tax expense rather than as a separate line item in non-interest income. Prior period amounts have been adjusted to reflect the adoption of this new accounting guidance, which has resulted in an increase in non-interest income and income tax expense. See the supplemental schedule at the end of the Q1 2014 press release for additional detail on the impact that adoption of this standard has had on prior period financial information.

1 See Reconciliation of Non-GAAP Financial Measures beginning on page 15.

|

| | | | | | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | | | | |

Summary Consolidated Financial Data | | | | | | | | | | | | |

Unaudited | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | At or for the Three Months Ended June 30, | | At or for the Six Months Ended June 30, |

| | 2014 | | 2013 | | Change % | | 2014 | | 2013 | | Change % |

| | | | | | | | | | | | |

Selected Balance Sheet Data: | | | | | | | | | | | | |

(dollars in millions) | | | | | | | | | | | | |

Total assets | | $ | 10,023.6 |

| | $ | 8,592.7 |

| | 16.7 | % | | | | | | |

Loans, net of deferred fees | | 7,544.5 |

| | 6,411.5 |

| | 17.7 |

| | | | | | |

Securities and money market investments | | 1,606.7 |

| | 1,313.1 |

| | 22.4 |

| | | | | | |

Securities purchased under agreement to resell | | — |

| | 134.0 |

| | (100.0 | ) | | | | | | |

Total deposits | | 8,469.5 |

| | 7,001.3 |

| | 21.0 |

| | | | | | |

Borrowings | | 337.5 |

| | 418.6 |

| | (19.4 | ) | | | | | | |

Junior subordinated debt | | 42.7 |

| | 39.9 |

| | 7.0 |

| | | | | | |

Stockholders' equity | | 957.7 |

| | 799.3 |

| | 19.8 |

| | | | | | |

| | | | | | | | | | | | |

Selected Income Statement Data: | | | | | | | | | | | | |

(dollars in thousands) | | | | | | | | | | | | |

Interest income | | $ | 101,973 |

| | $ | 89,285 |

| | 14.2 | % | | $ | 200,674 |

| | $ | 172,393 |

| | 16.4 | % |

Interest expense | | 8,075 |

| | 7,133 |

| | 13.2 |

| | 15,999 |

| | 14,038 |

| | 14.0 |

|

Net interest income | | 93,898 |

| | 82,152 |

| | 14.3 |

| | 184,675 |

| | 158,355 |

| | 16.6 |

|

Provision for loan losses | | 507 |

| | 3,481 |

| | (85.4 | ) | | 4,007 |

| | 8,920 |

| | (55.1 | ) |

Net interest income after provision for credit losses | | 93,391 |

| | 78,671 |

| | 18.7 |

| | 180,668 |

| | 149,435 |

| | 20.9 |

|

Non-interest income | | 5,773 |

| | 11,762 |

| | (50.9 | ) | | 10,608 |

| | 16,561 |

| | (35.9 | ) |

Non-interest expense | | 52,416 |

| | 48,531 |

| | 8.0 |

| | 102,165 |

| | 95,460 |

| | 7.0 |

|

Income from continuing operations, before income tax expense | | 46,748 |

| | 41,902 |

| | 11.6 |

| | 89,111 |

| | 70,536 |

| | 26.3 |

|

Income tax expense | | 10,706 |

| | 7,661 |

| | 39.7 |

| | 21,330 |

| | 15,448 |

| | 38.1 |

|

Income from continuing operations | | 36,042 |

| | 34,241 |

| | 5.3 |

| | 67,781 |

| | 55,088 |

| | 23.0 |

|

Loss on discontinued operations, net | | (504 | ) | | (169 | ) | | 198.2 |

| | (1,158 | ) | | (131 | ) | | 784.0 |

|

Net income | | $ | 35,538 |

| | $ | 34,072 |

| | 4.3 | % | | $ | 66,623 |

| | $ | 54,957 |

| | 21.2 | % |

Diluted net income per common share from continuing operations | | $ | 0.41 |

| | $ | 0.39 |

| | 5.1 | % | | $ | 0.77 |

| | $ | 0.63 |

| | 22.2 | % |

Diluted net loss per common share from discontinued operations, net of tax | | $ | (0.01 | ) | | $ | — |

| | | | $ | (0.01 | ) | | $ | — |

| | |

Diluted net income per common share | | $ | 0.40 |

| | $ | 0.39 |

| | 2.6 | % | | $ | 0.76 |

| | $ | 0.63 |

| | 20.6 | % |

| | | | | | | | | | | | |

Common Share Data: | | | | | | | | | | | | |

Diluted net income per common share | | $ | 0.40 |

| | $ | 0.39 |

| | 2.6 | % | | $ | 0.76 |

| | $ | 0.63 |

| | 20.6 | % |

Book value per common share | | $ | 9.30 |

| | $ | 7.57 |

| | 22.9 | % | | | | | | |

Tangible book value per share, net of tax (1) | | $ | 9.02 |

| | $ | 7.26 |

| | 24.2 | % | | | | | | |

Average shares outstanding (in thousands): | | | | | | | | | | | | |

Basic | | 86,501 |

| | 85,659 |

| | 1.0 |

| | 86,379 |

| | 85,493 |

| | 1.0 |

|

Diluted | | 87,333 |

| | 86,524 |

| | 0.9 |

| | 87,229 |

| | 86,254 |

| | 1.1 |

|

Common shares outstanding | | 87,774 |

| | 86,997 |

| | 0.9 |

| |

| |

| | |

| | | | | | | | | | | | |

(1) See Reconciliation of Non-GAAP Financial Measures. | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | | | | |

Summary Consolidated Financial Data (continued) | | | | | | | | | | | | |

Unaudited | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | At or for the Three Months Ended June 30, | | At or for the Six Months Ended June 30, |

| | 2014 | | 2013 | | Change % | | 2014 | | 2013 | | Change % |

| | (in thousands, except per share data) |

Selected Performance Ratios: | | | | | | | | | | | | |

Return on average assets (1) | | 1.46 | % | | 1.62 | % | | (9.9 | )% | | 1.39 | % | | 1.35 | % | | 3.0 | % |

Return on average tangible common equity (2) | | 17.41 |

| | 21.41 |

| | (18.7 | ) | | 16.77 |

| | 17.66 |

| | (5.0 | ) |

Net interest margin (1) | | 4.39 |

| | 4.36 |

| | 0.7 |

| | 4.40 |

| | 4.36 |

| | 0.9 |

|

Net interest spread | | 4.26 |

| | 4.22 |

| | 0.9 |

| | 4.27 |

| | 4.21 |

| | 1.4 |

|

Efficiency ratio - tax equivalent basis (2) | | 49.42 |

| | 52.21 |

| | (5.3 | ) | | | | | | |

Loan to deposit ratio | | 89.08 |

| | 91.58 |

| | (2.7 | ) | | | | | | |

| |

| |

| |

| | | | | | |

Capital Ratios: | |

| |

| |

| | | | | | |

Tangible equity (2) | | 9.3 | % | | 9.0 | % | | 3.3 | % | | | | | | |

Tangible common equity (2) | | 7.9 |

| | 7.4 |

| | 6.8 |

| | | | | | |

Tier 1 common equity (2) | | 9.0 |

| | 8.3 |

| | 8.4 |

| | | | | | |

Tier 1 Leverage ratio (3) | | 10.0 |

| | 9.9 |

| | 1.0 |

| | | | | | |

Tier 1 Risk Based Capital (3) | | 11.2 |

| | 10.8 |

| | 3.7 |

| | | | | | |

Total Risk Based Capital (3) | | 12.4 |

| | 12.0 |

| | 3.3 |

| | | | | | |

| |

| |

| |

| | | | | | |

Asset Quality Ratios: | |

| |

| |

| | | | | | |

Net (recoveries) charge-offs to average loans outstanding (1) | | (0.09 | )% | | 0.17 | % | | (152.9 | )% | | (0.05 | )% | | 0.27 | % | | (118.5 | )% |

Nonaccrual loans to gross loans | | 0.85 |

| | 1.29 |

| | (34.1 | ) | | | | | | |

Nonaccrual loans and repossessed assets to total assets | | 1.23 |

| | 1.86 |

| | (33.9 | ) | | | | | | |

Loans past due 90 days and still accruing to total loans | | 0.04 |

| | 0.06 |

| | (33.3 | ) | | | | | | |

Allowance for credit losses to loans | | 1.40 |

| | 1.50 |

| | (6.7 | ) | | | | | | |

Allowance for credit losses to nonaccrual loans | | 164.64 |

| | 116.19 |

| | 41.7 |

| | | | | | |

| |

| |

| |

| | | | | | |

(1) Annualized for the three and six month periods ended June 30, 2014 and 2013. | | | | | | |

(2) See Reconciliation of Non-GAAP Financial Measures. | | | | | | |

(3) Capital ratios are preliminary until the Call Reports are filed. | | | | | | |

|

| | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | |

Condensed Consolidated Income Statements | | | | | | | | |

Unaudited | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2014 | | 2013 | | 2014 | | 2013 |

Interest income: | | (dollars in thousands) |

Loans | | $ | 90,583 |

| | $ | 81,093 |

| | $ | 177,387 |

| | $ | 155,818 |

|

Investment securities | | 10,894 |

| | 7,822 |

| | 22,219 |

| | 15,980 |

|

Federal funds sold and other | | 496 |

| | 370 |

| | 1,068 |

| | 595 |

|

Total interest income | | 101,973 |

| | 89,285 |

| | 200,674 |

| | 172,393 |

|

Interest expense: | |

| |

| |

| |

|

Deposits | | 4,930 |

| | 3,929 |

| | 9,595 |

| | 7,661 |

|

Borrowings | | 2,702 |

| | 2,749 |

| | 5,540 |

| | 5,456 |

|

Junior subordinated debt | | 443 |

| | 455 |

| | 864 |

| | 921 |

|

Total interest expense | | 8,075 |

| | 7,133 |

| | 15,999 |

| | 14,038 |

|

Net interest income | | 93,898 |

| | 82,152 |

| | 184,675 |

| | 158,355 |

|

Provision for credit losses | | 507 |

| | 3,481 |

| | 4,007 |

| | 8,920 |

|

Net interest income after provision for credit losses | | 93,391 |

| | 78,671 |

| | 180,668 |

| | 149,435 |

|

Non-interest income: | |

| |

| |

| |

|

Service charges | | 2,737 |

| | 2,449 |

| | 5,267 |

| | 4,983 |

|

Bank owned life insurance | | 959 |

| | 1,036 |

| | 1,908 |

| | 2,072 |

|

(Losses) gains on sales of investment securities, net | | (163 | ) | | (5 | ) | | 203 |

| | 143 |

|

Unrealized gains (losses) on assets/liabilities measured at fair value, net | | 235 |

| | (3,290 | ) | | (1,041 | ) | | (3,761 | ) |

Bargain purchase gain from acquisition | | — |

| | 10,044 |

| | — |

| | 10,044 |

|

Other | | 2,005 |

| | 1,528 |

| | 4,271 |

| | 3,080 |

|

Total non-interest income | | 5,773 |

| | 11,762 |

| | 10,608 |

| | 16,561 |

|

Non-interest expenses: | |

| |

| |

| |

|

Salaries and employee benefits | | 31,751 |

| | 28,100 |

| | 61,306 |

| | 54,675 |

|

Occupancy | | 4,328 |

| | 4,753 |

| | 9,010 |

| | 9,599 |

|

Legal, professional and directors' fees | | 4,192 |

| | 2,549 |

| | 7,831 |

| | 5,572 |

|

Insurance | | 2,087 |

| | 2,096 |

| | 4,480 |

| | 4,466 |

|

Data processing | | 2,401 |

| | 2,175 |

| | 5,075 |

| | 4,040 |

|

Marketing | | 506 |

| | 710 |

| | 1,065 |

| | 1,378 |

|

Loan and repossessed asset expenses | | 927 |

| | 721 |

| | 2,161 |

| | 2,317 |

|

Customer service | | 708 |

| | 717 |

| | 1,328 |

| | 1,360 |

|

Net loss (gain) on sales and valuations of repossessed and other assets | | 184 |

| | (1,124 | ) | | (2,363 | ) | | (605 | ) |

Intangible amortization | | 302 |

| | 597 |

| | 899 |

| | 1,194 |

|

Merger / restructure expense | | 26 |

| | 2,620 |

| | 183 |

| | 2,815 |

|

Other | | 5,004 |

| | 4,617 |

| | 11,190 |

| | 8,649 |

|

Total non-interest expense | | 52,416 |

| | 48,531 |

| | 102,165 |

| | 95,460 |

|

Income from continuing operations before income taxes | | 46,748 |

| | 41,902 |

| | 89,111 |

| | 70,536 |

|

Income tax expense | | 10,706 |

| | 7,661 |

| | 21,330 |

| | 15,448 |

|

Income from continuing operations | | $ | 36,042 |

| | $ | 34,241 |

| | $ | 67,781 |

| | $ | 55,088 |

|

Loss from discontinued operations net of tax benefit | | (504 | ) | | (169 | ) | | (1,158 | ) | | (131 | ) |

Net income | | $ | 35,538 |

| | $ | 34,072 |

| | $ | 66,623 |

| | $ | 54,957 |

|

Preferred stock dividends | | 352 |

| | 353 |

| | 705 |

| | 705 |

|

Net income available to common stockholders | | $ | 35,186 |

| | $ | 33,719 |

| | $ | 65,918 |

| | $ | 54,252 |

|

Diluted net income per share | | $ | 0.40 |

| | $ | 0.39 |

| | $ | 0.76 |

| | $ | 0.63 |

|

|

| | | | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | | |

Five Quarter Condensed Consolidated Income Statements | | | | | | | | | | |

Unaudited | | | | | | | | | | |

| | Three Months Ended |

| | Jun 30, 2014 | | Mar 31, 2014 | | Dec 31, 2013 | | Sep 30, 2013 | | Jun 30, 2013 |

| | (in thousands, except per share data) |

Interest income: | | | | | | | | | | |

Loans | | $ | 90,583 |

| | $ | 86,804 |

| | $ | 86,902 |

| | $ | 83,994 |

| | $ | 81,093 |

|

Investment securities | | 10,894 |

| | 11,325 |

| | 10,137 |

| | 8,286 |

| | 7,822 |

|

Federal funds sold and other | | 496 |

| | 572 |

| | 543 |

| | 400 |

| | 370 |

|

Total interest income | | 101,973 |

| | 98,701 |

| | 97,582 |

| | 92,680 |

| | 89,285 |

|

Interest expense: | | | |

| |

| |

| |

|

Deposits | | 4,930 |

| | 4,665 |

| | 4,442 |

| | 4,232 |

| | 3,929 |

|

Borrowings | | 2,702 |

| | 2,838 |

| | 2,717 |

| | 3,429 |

| | 2,749 |

|

Junior subordinated debt | | 443 |

| | 421 |

| | 442 |

| | 460 |

| | 455 |

|

Total interest expense | | 8,075 |

| | 7,924 |

| | 7,601 |

| | 8,121 |

| | 7,133 |

|

Net interest income | | 93,898 |

| | 90,777 |

| | 89,981 |

| | 84,559 |

| | 82,152 |

|

Provision for credit losses | | 507 |

| | 3,500 |

| | 4,300 |

| | — |

| | 3,481 |

|

Net interest income after provision for credit losses | | 93,391 |

| | 87,277 |

| | 85,681 |

| | 84,559 |

| | 78,671 |

|

Non-interest income: | | | |

| |

| |

| |

|

Service charges | | 2,737 |

| | 2,530 |

| | 2,512 |

| | 2,425 |

| | 2,449 |

|

Bank owned life insurance | | 959 |

| | 949 |

| | 905 |

| | 1,832 |

| | 1,036 |

|

(Losses) gains on sales of investment securities, net | | (163 | ) | | 366 |

| | 342 |

| | (1,679 | ) | | (5 | ) |

Unrealized gains (losses) on assets/liabilities measured at fair value, net | | 235 |

| | (1,276 | ) | | (2,618 | ) | | (7 | ) | | (3,290 | ) |

Loss on extinguishment of debt | | — |

| | — |

| | (1,387 | ) | | — |

| | — |

|

Bargain purchase gain from acquisition | | — |

| | — |

| | — |

| | — |

| | 10,044 |

|

Other | | 2,005 |

| | 2,266 |

| | 1,803 |

| | 1,558 |

| | 1,528 |

|

Total non-interest income | | 5,773 |

| | 4,835 |

| | 1,557 |

| | 4,129 |

| | 11,762 |

|

Non-interest expenses: | | | | | | | | | | |

Salaries and employee benefits | | 31,751 |

| | 29,555 |

| | 30,071 |

| | 28,689 |

| | 28,100 |

|

Occupancy | | 4,328 |

| | 4,682 |

| | 4,626 |

| | 4,901 |

| | 4,753 |

|

Legal, professional and directors' fees | | 4,192 |

| | 3,639 |

| | 4,623 |

| | 3,438 |

| | 2,549 |

|

Insurance | | 2,087 |

| | 2,393 |

| | 1,744 |

| | 1,884 |

| | 2,096 |

|

Data processing | | 2,401 |

| | 2,674 |

| | 2,040 |

| | 1,872 |

| | 2,175 |

|

Marketing | | 506 |

| | 559 |

| | 619 |

| | 585 |

| | 710 |

|

Loan and repossessed asset expenses | | 927 |

| | 1,234 |

| | 793 |

| | 1,136 |

| | 721 |

|

Customer service | | 708 |

| | 620 |

| | 860 |

| | 677 |

| | 717 |

|

Net loss (gain) on sales and valuations of repossessed and other assets | | 184 |

| | (2,547 | ) | | (2,153 | ) | | 371 |

| | (1,124 | ) |

Intangible amortization | | 302 |

| | 597 |

| | 597 |

| | 597 |

| | 597 |

|

Merger / restructure expense | | 26 |

| | 157 |

| | 1,919 |

| | 1,018 |

| | 2,620 |

|

Other | | 5,004 |

| | 6,186 |

| | 5,392 |

| | 4,507 |

| | 4,617 |

|

Total non-interest expense | | 52,416 |

| | 49,749 |

| | 51,131 |

| | 49,675 |

| | 48,531 |

|

Income from continuing operations before income taxes | | 46,748 |

| | 42,363 |

| | 36,107 |

| | 39,013 |

| | 41,902 |

|

Income tax expense | | 10,706 |

| | 10,624 |

| | 3,992 |

| | 10,390 |

| | 7,661 |

|

Income from continuing operations | | $ | 36,042 |

| | $ | 31,739 |

| | $ | 32,115 |

| | $ | 28,623 |

| | $ | 34,241 |

|

Loss from discontinued operations, net of tax | | (504 | ) | | (654 | ) | | (701 | ) | | (29 | ) | | (169 | ) |

Net income | | $ | 35,538 |

| | $ | 31,085 |

| | $ | 31,414 |

| | $ | 28,594 |

| | $ | 34,072 |

|

Preferred stock dividends | | 352 |

| | 353 |

| | 352 |

| | 352 |

| | 353 |

|

Net income available to common stockholders | | $ | 35,186 |

| | $ | 30,732 |

| | $ | 31,062 |

| | $ | 28,242 |

| | $ | 33,719 |

|

| | | | | | | | | | |

Diluted net income per share | | $ | 0.40 |

| | $ | 0.35 |

| | $ | 0.36 |

| | $ | 0.33 |

| | $ | 0.39 |

|

|

| | | | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | | |

Five Quarter Condensed Consolidated Balance Sheets | | | | | | | | | | |

Unaudited | | | | | | | | | | |

| | Jun 30, 2014 | | Mar 31, 2014 | | Dec 31, 2013 | | Sep 30, 2013 | | Jun 30, 2013 |

| | (in millions) |

Assets: | | | | | | | | | | |

Cash and due from banks | | $ | 379.3 |

| | $ | 354.8 |

| | $ | 305.5 |

| | $ | 380.9 |

| | $ | 248.9 |

|

Securities purchased under agreement to resell | | — |

| | 111.1 |

| | — |

| | 128.1 |

| | 134.0 |

|

Cash and cash equivalents | | 379.3 |

| | 465.9 |

| | 305.5 |

| | 509.0 |

| | 382.9 |

|

| | | |

| |

| |

| |

|

Securities and money market investments | | 1,606.7 |

| | 1,671.2 |

| | 1,689.6 |

| | 1,370.8 |

| | 1,313.1 |

|

Loans held for sale | | — |

| | — |

| | — |

| | 25.4 |

| | 27.6 |

|

Loans held for investment: | | | |

| |

| |

| |

|

Commercial | | 3,027.7 |

| | 2,723.4 |

| | 2,478.2 |

| | 2,234.9 |

| | 2,174.1 |

|

Commercial real estate - non-owner occupied | | 1,940.0 |

| | 1,849.2 |

| | 1,841.1 |

| | 1,864.3 |

| | 1,839.7 |

|

Commercial real estate - owner occupied | | 1,605.0 |

| | 1,606.2 |

| | 1,561.9 |

| | 1,551.2 |

| | 1,550.0 |

|

Construction and land development | | 612.4 |

| | 553.7 |

| | 535.7 |

| | 459.8 |

| | 416.7 |

|

Residential real estate | | 328.1 |

| | 344.9 |

| | 350.3 |

| | 359.0 |

| | 381.7 |

|

Consumer | | 40.9 |

| | 38.3 |

| | 43.1 |

| | 29.8 |

| | 28.5 |

|

Deferred fees, net | | (9.6 | ) | | (7.1 | ) | | (8.9 | ) | | (8.1 | ) | | (6.8 | ) |

Gross loans and deferred fees, net | | 7,544.5 |

| | 7,108.6 |

| | 6,801.4 |

| | 6,490.9 |

| | 6,383.9 |

|

Allowance for credit losses | | (105.9 | ) | | (103.9 | ) | | (100.1 | ) | | (97.9 | ) | | (96.3 | ) |

Loans, net | | 7,438.6 |

| | 7,004.7 |

| | 6,701.3 |

| | 6,393.0 |

| | 6,287.6 |

|

| | | |

| |

| |

| |

|

Premises and equipment, net | | 109.6 |

| | 106.6 |

| | 105.6 |

| | 105.9 |

| | 106.1 |

|

Other repossessed assets | | 59.3 |

| | 56.5 |

| | 66.7 |

| | 76.5 |

| | 76.5 |

|

Bank owned life insurance | | 142.5 |

| | 141.5 |

| | 140.6 |

| | 139.7 |

| | 140.4 |

|

Goodwill and other intangibles, net | | 26.5 |

| | 26.8 |

| | 27.4 |

| | 28.0 |

| | 28.6 |

|

Other assets | | 261.1 |

| | 273.4 |

| | 270.7 |

| | 272.2 |

| | 229.9 |

|

Total assets | | $ | 10,023.6 |

| | $ | 9,746.6 |

| | $ | 9,307.4 |

| | $ | 8,920.5 |

| | $ | 8,592.7 |

|

Liabilities and Stockholders' Equity: | | | | | | | | | | |

Liabilities: | | | | | | | | | | |

Deposits: | | | | | | | | | | |

Non-interest bearing demand deposits | | $ | 2,278.8 |

| | $ | 2,093.6 |

| | $ | 2,200.0 |

| | $ | 1,972.5 |

| | $ | 1,919.6 |

|

Interest bearing: | | | |

| |

| |

| |

|

Demand | | 794.8 |

| | 750.4 |

| | 709.8 |

| | 673.7 |

| | 631.3 |

|

Savings and money market | | 3,637.4 |

| | 3,672.3 |

| | 3,310.4 |

| | 3,050.0 |

| | 2,945.1 |

|

Time certificates | | 1,758.5 |

| | 1,632.7 |

| | 1,618.0 |

| | 1,579.1 |

| | 1,505.3 |

|

Total deposits | | 8,469.5 |

| | 8,149.0 |

| | 7,838.2 |

| | 7,275.3 |

| | 7,001.3 |

|

Customer repurchase agreements | | 53.7 |

| | 57.4 |

| | 71.2 |

| | 55.5 |

| | 51.9 |

|

Total customer funds | | 8,523.2 |

| | 8,206.4 |

| | 7,909.4 |

| | 7,330.8 |

| | 7,053.2 |

|

Securities sold short | | — |

| | 109.8 |

| | — |

| | 126.6 |

| | 129.5 |

|

Borrowings | | 337.5 |

| | 342.8 |

| | 341.1 |

| | 394.1 |

| | 418.6 |

|

Junior subordinated debt | | 42.7 |

| | 42.8 |

| | 41.9 |

| | 39.4 |

| | 39.9 |

|

Accrued interest payable and other liabilities | | 162.5 |

| | 150.0 |

| | 159.5 |

| | 203.1 |

| | 152.2 |

|

Total liabilities | | 9,065.9 |

| | 8,851.8 |

| | 8,451.9 |

| | 8,094.0 |

| | 7,793.4 |

|

Stockholders' Equity | | | |

| |

| |

| |

|

Common stock and additional paid-in capital | | 803.4 |

| | 795.3 |

| | 797.2 |

| | 792.2 |

| | 789.5 |

|

Preferred stock | | 141.0 |

| | 141.0 |

| | 141.0 |

| | 141.0 |

| | 141.0 |

|

Retained earnings (accumulated deficit) | | 4.8 |

| | (30.4 | ) | | (61.2 | ) | | (92.2 | ) | | (120.4 | ) |

Accumulated other comprehensive income (loss) | | 8.5 |

| | (11.1 | ) | | (21.5 | ) | | (14.5 | ) | | (10.8 | ) |

Total stockholders' equity | | 957.7 |

| | 894.8 |

| | 855.5 |

| | 826.5 |

| | 799.3 |

|

Total liabilities and stockholders' equity | | $ | 10,023.6 |

| | $ | 9,746.6 |

| | $ | 9,307.4 |

| | $ | 8,920.5 |

| | $ | 8,592.7 |

|

|

| | | | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | | |

Changes in the Allowance For Credit Losses | | | | | | | | | | |

Unaudited | | | | | | | | | | |

| | Three Months Ended |

| | Jun 30, 2014 | | Mar 31, 2014 | | Dec 31, 2013 | | Sep 30, 2013 | | Jun 30, 2013 |

| | (in thousands) |

Balance, beginning of period | | $ | 103,899 |

| | $ | 100,050 |

| | $ | 97,851 |

| | $ | 96,323 |

| | $ | 95,494 |

|

Provision for credit losses | | 507 |

| | 3,500 |

| | 4,300 |

| | — |

| | 3,481 |

|

Recoveries of loans previously charged-off: | | | | | | | | | | |

Commercial and industrial | | 1,254 |

| | 922 |

| | 666 |

| | 2,242 |

| | 1,757 |

|

Commercial real estate - non-owner occupied | | 1,052 |

| | 83 |

| | 395 |

| | 273 |

| | 154 |

|

Commercial real estate - owner occupied | | 196 |

| | 477 |

| | 297 |

| | 149 |

| | 479 |

|

Construction and land development | | 498 |

| | 211 |

| | 273 |

| | 966 |

| | 120 |

|

Residential real estate | | 314 |

| | 553 |

| | 549 |

| | 430 |

| | 549 |

|

Consumer | | 191 |

| | 170 |

| | 179 |

| | 726 |

| | 11 |

|

Total recoveries | | 3,505 |

| | 2,416 |

| | 2,359 |

| | 4,786 |

| | 3,070 |

|

Loans charged-off: | | | | | | | | | | |

Commercial and industrial | | 1,039 |

| | 1,478 |

| | 621 |

| | 544 |

| | 1,065 |

|

Commercial real estate - non-owner occupied | | 99 |

| | 160 |

| | 2,268 |

| | 466 |

| | 1,000 |

|

Commercial real estate - owner occupied | | 230 |

| | 11 |

| | 238 |

| | 398 |

| | 1,391 |

|

Construction and land development | | 78 |

| | — |

| | 686 |

| | — |

| | 238 |

|

Residential real estate | | 523 |

| | 406 |

| | 281 |

| | 1,138 |

| | 2,010 |

|

Consumer | | 5 |

| | 12 |

| | 366 |

| | 712 |

| | 18 |

|

Total loans charged-off | | 1,974 |

| | 2,067 |

| | 4,460 |

| | 3,258 |

| | 5,722 |

|

Net loan (recoveries) charge-offs | | (1,531 | ) | | (349 | ) | | 2,101 |

| | (1,528 | ) | | 2,652 |

|

Balance, end of period | | $ | 105,937 |

| | $ | 103,899 |

| | $ | 100,050 |

| | $ | 97,851 |

| | $ | 96,323 |

|

| | | | | | | | | | |

Net (recoveries) charge-offs to average loans outstanding - annualized | | (0.09 | )% | | (0.02 | )% | | 0.13 | % | | (0.10 | )% | | 0.17 | % |

Allowance for credit losses to gross loans | | 1.40 |

| | 1.46 |

| | 1.47 |

| | 1.50 |

| | 1.50 |

|

Nonaccrual loans | | $ | 64,343 |

| | $ | 70,401 |

| | $ | 75,681 |

| | $ | 76,641 |

| | $ | 82,899 |

|

Repossessed assets | | 59,292 |

| | 56,450 |

| | 66,719 |

| | 76,475 |

| | 76,499 |

|

Loans past due 90 days, still accruing | | 3,001 |

| | 167 |

| | 1,534 |

| | 5,456 |

| | 3,893 |

|

Loans past due 30 to 89 days, still accruing | | 5,123 |

| | 11,087 |

| | 13,425 |

| | 8,689 |

| | 7,341 |

|

Classified loans on accrual | | 133,220 |

| | 125,903 |

| | 128,586 |

| | 144,041 |

| | 140,192 |

|

Special mention loans | | 90,534 |

| | 117,540 |

| | 129,965 |

| | 137,247 |

| | 162,482 |

|

|

| | | | | | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | | |

Analysis of Average Balances, Yields and Rates | | | | | | | | | | |

Unaudited | | | | | | | | | | | | |

| | Three Months Ended June 30, |

| | 2014 | | 2013 |

| | Average Balance | | Interest | | Average Yield/ Cost | | Average Balance | | Interest | | Average Yield/ Cost |

| | ($ in millions) | | ($ in thousands) | | | | ($ in millions) | | ($ in thousands) | | |

Interest earning assets | | | | | | | | | | | | |

Loans (1) | | $ | 7,178.3 |

| | $ | 90,583 |

| | 5.29 | % | | $ | 6,100.8 |

| | $ | 81,093 |

| | 5.40 | % |

Securities (1) | | 1,629.9 |

| | 10,894 |

| | 3.08 |

| | 1,295.9 |

| | 7,822 |

| | 2.92 |

|

Federal funds sold and other | | 292.4 |

| | 496 |

| | 0.68 |

| | 407.7 |

| | 370 |

| | 0.36 |

|

Total interest earning assets | | 9,100.6 |

| | 101,973 |

| | 4.75 |

| | 7,804.4 |

| | 89,285 |

| | 4.73 |

|

Non-interest earning assets | | | | | | | | | | | | |

Cash and due from banks | | 138.7 |

| | | | | | 119.2 |

| | | | |

Allowance for credit losses | | (105.0 | ) | | | | | | (96.6 | ) | | | | |

Bank owned life insurance | | 141.8 |

| | | | | | 139.7 |

| | | | |

Other assets | | 462.0 |

| | | | | | 432.7 |

| | | | |

Total assets | | $ | 9,738.1 |

| | | | | | $ | 8,399.4 |

| | | | |

Interest-bearing liabilities | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | |

Interest-bearing transaction accounts | | $ | 791.5 |

| | $ | 385 |

| | 0.19 | % | | $ | 626.8 |

| | $ | 370 |

| | 0.24 | % |

Savings and money market | | 3,583.5 |

| | 2,691 |

| | 0.30 |

| | 2,768.7 |

| | 2,007 |

| | 0.29 |

|

Time certificates of deposit | | 1,700.4 |

| | 1,854 |

| | 0.44 |

| | 1,584.0 |

| | 1,552 |

| | 0.39 |

|

Total interest-bearing deposits | | 6,075.4 |

| | 4,930 |

| | 0.32 |

| | 4,979.5 |

| | 3,929 |

| | 0.32 |

|

Short-term borrowings | | 236.2 |

| | 216 |

| | 0.37 |

| | 188.8 |

| | 214 |

| | 0.45 |

|

Long-term debt | | 280.4 |

| | 2,486 |

| | 3.55 |

| | 365.2 |

| | 2,535 |

| | 2.78 |

|

Junior subordinated debt | | 42.8 |

| | 443 |

| | 4.14 |

| | 36.7 |

| | 455 |

| | 4.96 |

|

Total interest-bearing liabilities | | 6,634.8 |

| | 8,075 |

| | 0.49 |

| | 5,570.2 |

| | 7,133 |

| | 0.51 |

|

Non-interest-bearing liabilities | | | | | | | | | | | | |

Non-interest-bearing demand deposits | | 2,045.5 |

| | | | | | 1,898.2 |

| | | | |

Other liabilities | | 126.7 |

| | | | | | 124.6 |

| | | | |

Stockholders’ equity | | 931.1 |

| | | | | | 806.4 |

| | | | |

Total liabilities and stockholders' equity | | $ | 9,738.1 |

| | | | | | $ | 8,399.4 |

| | | | |

Net interest income and margin | | | | $ | 93,898 |

| | 4.39 | % | | | | $ | 82,152 |

| | 4.36 | % |

Net interest spread | | | | | | 4.26 | % | | | | | | 4.22 | % |

| | | | | | | | | | | | |

(1) Yields on loans and securities have been adjusted to a tax equivalent basis. The taxable-equivalent adjustment was $6,029 and $2,929 for the three months ended June 30, 2014 and 2013, respectively. |

|

| | | | | | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | | |

Analysis of Average Balances, Yields and Rates | | | | | | | | | | |

Unaudited | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2014 | | 2013 |

| | Average Balance | | Interest | | Average Yield/ Cost | | Average Balance | | Interest | | Average Yield/ Cost |

| | ($ in millions) | | ($ in thousands) | |

| | ($ in millions) | | ($ in thousands) | |

|

Interest earning assets | |

| |

| |

| |

|

| |

| |

|

Loans (1) | | $ | 7,036.5 |

| | $ | 177,387 |

| | 5.28 | % | | $ | 5,857.0 |

| | $ | 155,818 |

| | 5.41 | % |

Securities (1) | | 1,640.8 |

| | 22,219 |

| | 3.11 |

| | 1,289.7 |

| | 15,980 |

| | 3.06 |

|

Federal funds sold & other | | 251.6 |

| | 1,068 |

| | 0.85 |

| | 406.2 |

| | 595 |

| | 0.29 |

|

Total interest earnings assets | | 8,928.9 |

| | 200,674 |

| | 4.76 |

| | 7,552.9 |

| | 172,393 |

| | 4.73 |

|

Non-interest earning assets | |

| | | | | |

| | | | |

Cash and due from banks | | 138.1 |

| | | | | | 122.9 |

| | | | |

Allowance for credit losses | | (103.1 | ) | | | | | | (96.8 | ) | | | | |

Bank owned life insurance | | 141.4 |

| | | | | | 139.2 |

| | | | |

Other assets | | 447.6 |

| | | | | | 427.3 |

| | | | |

Total assets | | $ | 9,552.9 |

| | | | | | $ | 8,145.5 |

| | | | |

Interest-bearing liabilities | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | |

Interest bearing transaction accounts | | $ | 778.3 |

| | $ | 768 |

| | 0.20 | % | | $ | 617.8 |

| | $ | 671 |

| | 0.22 | % |

Savings and money market | | 3,518.3 |

| | 5,254 |

| | 0.30 |

| | 2,695.2 |

| | 3,918 |

| | 0.29 |

|

Time certificates of deposits | | 1,660.2 |

| | 3,573 |

| | 0.43 |

| | 1,517.1 |

| | 3,072 |

| | 0.40 |

|

Total interest-bearing deposits | | 5,956.8 |

| | 9,595 |

| | 0.32 |

| | 4,830.1 |

| | 7,661 |

| | 0.32 |

|

Short-term borrowings | | 201.8 |

| | 345 |

| | 0.34 |

| | 183.0 |

| | 428 |

| | 0.47 |

|

Long-term debt | | 291.0 |

| | 5,195 |

| | 3.57 |

| | 319.2 |

| | 5,028 |

| | 3.15 |

|

Junior subordinated debt | | 42.4 |

| | 864 |

| | 4.08 |

| | 36.5 |

| | 921 |

| | 5.05 |

|

Total interest-bearing liabilities | | 6,492.0 |

| | 15,999 |

| | 0.49 |

| | 5,368.8 |

| | 14,038 |

| | 0.52 |

|

Non-interest-bearing liabilities | |

| |

| | | |

| |

| | |

Non-interest-bearing demand deposits | | 2,049.8 |

| |

| | | | 1,876.8 |

| |

| | |

Other liabilities | | 102.3 |

| |

| | | | 107.4 |

| |

| | |

Stockholders’ equity | | 908.8 |

| |

| | | | 792.5 |

| |

| | |

Total liabilities and stockholders' equity | | $ | 9,552.9 |

| |

| | | | $ | 8,145.5 |

| |

| | |

Net interest income and margin | |

| | $ | 184,675 |

| | 4.40 | % | |

| | $ | 158,355 |

| | 4.36 | % |

Net interest spread | | | | | | 4.27 | % | |

| | | | 4.21 | % |

| | | | | | | | | | | | |

(1) Yields on loans and securities have been adjusted to a tax equivalent basis. The taxable-equivalent adjustment was $11,734 and $6,311 for the six months ended June 30, 2014 and 2013, respectively. |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | | |

Operating Segment Results | | | | | | | | | | | | |

Unaudited | | | | | | | | | | | | |

| | Arizona | | Nevada | | California | | National Business Lines | | Corporate & Other | | Consolidated Company |

| | (dollars in millions) |

As of June 30, 2014: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Assets: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Cash, cash equivalents and investment securities | | $ | 3.0 |

| | $ | 7.0 |

| | $ | 2.4 |

| | $ | — |

| | $ | 1,973.6 |

| | $ | 1,986.0 |

|

Gross loans and deferred fees, net | | 2,131.0 |

| | 1,682.6 |

| | 1,694.8 |

| | 1,951.5 |

| | 84.6 |

| | 7,544.5 |

|

Less: allowance for credit losses | | (29.9 | ) | | (23.6 | ) | | (23.8 | ) | | (27.4 | ) | | (1.2 | ) | | (105.9 | ) |

Loans, net | | 2,101.1 |

| | 1,659.0 |

| | 1,671.0 |

| | 1,924.1 |

| | 83.4 |

| | 7,438.6 |

|

Other repossessed assets | | 13.1 |

| | 24.1 |

| | — |

| | — |

| | 22.1 |

| | 59.3 |

|

Goodwill and intangible assets, net | | — |

| | 26.5 |

| | — |

| | — |

| | — |

| | 26.5 |

|

Other assets | | 42.2 |

| | 62.7 |

| | 26.2 |

| | 21.1 |

| | 361.0 |

| | 513.2 |

|

Total assets | | $ | 2,159.4 |

| | $ | 1,779.3 |

| | $ | 1,699.6 |

| | $ | 1,945.2 |

| | $ | 2,440.1 |

| | $ | 10,023.6 |

|

Liabilities: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Deposits (1) | | $ | 2,115.4 |

| | $ | 3,187.8 |

| | $ | 2,061.1 |

| | $ | 886.3 |

| | $ | 218.9 |

| | $ | 8,469.5 |

|

Borrowings | | — |

| | — |

| | — |

| | — |

| | 337.5 |

| | 337.5 |

|

Other liabilities | | 20.9 |

| | 46.8 |

| | 4.8 |

| | 24.7 |

| | 161.7 |

| | 258.9 |

|

Total liabilities | | 2,136.3 |

| | 3,234.6 |

| | 2,065.9 |

| | 911.0 |

| | 718.1 |

| | 9,065.9 |

|

Allocated equity | | 233.7 |

| | 212.5 |

| | 188.7 |

| | 152.3 |

| | 170.5 |

| | 957.7 |

|

Liabilities and stockholders' equity | | $ | 2,370.0 |

| | $ | 3,447.1 |

| | $ | 2,254.6 |

| | $ | 1,063.3 |

| | $ | 888.6 |

| | $ | 10,023.6 |

|

Excess funds provided (used) | | 208.6 |

| | 1,670.0 |

| | 555.1 |

| | (882.2 | ) | | (1,551.5 | ) | | — |

|

| |

| |

| |

| |

| |

| |

|

No. of branches | | 10 |

| | 18 |

| | 11 |

| | — |

| | — |

| | 39 |

|

No. of full-time equivalent employees | | 212 |

| | 305 |

| | 218 |

| | 92 |

| | 285 |

| | 1,112 |

|

| | | | | | | | | | | | |

| | (in thousands) |

Three Months Ended June 30, 2014: | | | | | | | | | | | | |

Net interest income (expense) | | $ | 29,211 |

| | $ | 29,359 |

| | $ | 24,702 |

| | $ | 16,226 |

| | $ | (5,600 | ) | | $ | 93,898 |

|

Provision for (recovery of) credit losses | | 3 |

| | (2,011 | ) | | (1,672 | ) | | 3,467 |

| | 720 |

| | 507 |

|

Net interest income (expense) after provision for credit losses | | 29,208 |

| | 31,370 |

| | 26,374 |

| | 12,759 |

| | (6,320 | ) | | 93,391 |

|

Non-interest income | | 934 |

| | 2,352 |

| | 970 |

| | 643 |

| | 874 |

| | 5,773 |

|

Non-interest expense | | (12,793 | ) | | (16,026 | ) | | (13,342 | ) | | (6,640 | ) | | (3,615 | ) | | (52,416 | ) |

Income (loss) from continuing operations before income taxes | | 17,349 |

| | 17,696 |

| | 14,002 |

| | 6,762 |

| | (9,061 | ) | | 46,748 |

|

Income tax expense (benefit) | | 6,805 |

| | 6,194 |

| | 5,887 |

| | 2,536 |

| | (10,716 | ) | | 10,706 |

|

Income from continuing operations | | 10,544 |

| | 11,502 |

| | 8,115 |

| | 4,226 |

| | 1,655 |

| | 36,042 |

|

Loss from discontinued operations, net | | — |

| | — |

| | — |

| | — |

| | (504 | ) | | (504 | ) |

Net income | | $ | 10,544 |

| | $ | 11,502 |

| | $ | 8,115 |

| | $ | 4,226 |

| | $ | 1,151 |

| | $ | 35,538 |

|

| | | | | | | | | | | | |

| | (in thousands) |

Six Months Ended June 30, 2014: | |

| |

|

| |

|

| |

| |

|

| |

|

|

Net interest income (expense) | | $ | 55,819 |

| | $ | 57,954 |

| | $ | 47,494 |

| | $ | 30,190 |

| | $ | (6,782 | ) | | $ | 184,675 |

|

Provision for (recovery of) credit losses | | 1,561 |

| | (2,895 | ) | | (1,017 | ) | | 5,637 |

| | 721 |

| | 4,007 |

|

Net interest income (expense) after provision for credit losses | | 54,258 |

| | 60,849 |

| | 48,511 |

| | 24,553 |

| | (7,503 | ) | | 180,668 |

|

Non-interest income | | 1,754 |

| | 4,641 |

| | 2,220 |

| | 725 |

| | 1,268 |

| | 10,608 |

|

Non-interest expense | | (26,097 | ) | | (31,262 | ) | | (26,385 | ) | | (13,148 | ) | | (5,273 | ) | | (102,165 | ) |

Income (loss) from continuing operations before income taxes | | 29,915 |

| | 34,228 |

| | 24,346 |

| | 12,130 |

| | (11,508 | ) | | 89,111 |

|

Income tax expense (benefit) | | 11,734 |

| | 11,981 |

| | 10,237 |

| | 4,549 |

| | (17,171 | ) | | 21,330 |

|

Income from continuing operations | | 18,181 |

| | 22,247 |

| | 14,109 |

| | 7,581 |

| | 5,663 |

| | 67,781 |

|

Loss from discontinued operations, net | | — |

| | — |

| | — |

| | — |

| | (1,158 | ) | | (1,158 | ) |

Net income | | $ | 18,181 |

| | $ | 22,247 |

| | $ | 14,109 |

| | $ | 7,581 |

| | $ | 4,505 |

| | $ | 66,623 |

|

| | | | | | | | | | | | |

(1) Certain centrally-managed deposits from prior periods were re-allocated to specific regions to conform to current presentation. |

|

| | | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | |

Reconciliation of Non-GAAP Financial Measures (Unaudited) | | | | | | | | | |

| | | | | | | | | |

Pre-Tax, Pre-Provision Operating Earnings by Quarter | | | | | | | | | |

| Three Months Ended |

| Jun 30, 2014 | | Mar 31, 2014 | | Dec 31, 2013 | | Sep 30, 2013 | | Jun 30, 2013 |

| (in thousands) |

Total non-interest income | $ | 5,773 |

| | $ | 4,835 |

| | $ | 1,557 |

| | $ | 4,129 |

| | $ | 11,762 |

|

Less: |

| | | | | | | | |

(Losses) gains on sales of investment securities, net | (163 | ) | | 366 |

| | 342 |

| | (1,679 | ) | | (5 | ) |

Unrealized losses on assets/liabilities measured at fair value, net | 235 |

| | (1,276 | ) | | (2,618 | ) | | (7 | ) | | (3,290 | ) |

Loss on extinguishment of debt | — |

| | — |

| | (1,387 | ) | | — |

| | — |

|

Bargain purchase gain from acquisition | — |

| | — |

| | — |

| | — |

| | 10,044 |

|

Total operating non-interest income | 5,701 |

| | 5,745 |

| | 5,220 |

| | 5,815 |

| | 5,013 |

|

Add: net interest income | 93,898 |

| | 90,777 |

| | 89,981 |

| | 84,559 |

| | 82,152 |

|

Net operating revenue (1) | $ | 99,599 |

| | $ | 96,522 |

| | $ | 95,201 |

| | $ | 90,374 |

| | $ | 87,165 |

|

| | | | | | | | | |

Total non-interest expense | $ | 52,416 |

| | $ | 49,749 |

| | $ | 51,131 |

| | $ | 49,675 |

| | $ | 48,531 |

|

Less: |

| | | | | | | | |

Net loss (gain) on sales and valuations of repossessed and other assets | 184 |

| | (2,547 | ) | | (2,153 | ) | | 371 |

| | (1,124 | ) |

Merger / restructure expense | 26 |

| | 157 |

| | 1,919 |

| | 1,018 |

| | 2,620 |

|

Total operating non-interest expense (1) | $ | 52,206 |

| | $ | 52,139 |

| | $ | 51,365 |

| | $ | 48,286 |

| | $ | 47,035 |

|

| | | | | | | | | |

Pre-tax, pre-provision operating earnings (2) | $ | 47,393 |

| | $ | 44,383 |

| | $ | 43,836 |

| | $ | 42,088 |

| | $ | 40,130 |

|

|

| | | | | | | | | | | | | | | | | | | |

Tangible Common Equity | | | | | | | | | |

| Jun 30, 2014 | | Mar 31, 2014 | | Dec 31, 2013 | | Sep 30, 2013 | | Jun 30, 2013 |

| (dollars and shares in thousands) |

Total stockholders' equity | $ | 957,664 |

| | $ | 894,804 |

| | $ | 855,498 |

| | $ | 826,472 |

| | $ | 799,307 |

|

Less: | | | | | | | | | |

Goodwill and intangible assets, net | 26,475 |

| | 26,777 |

| | 27,374 |

| | 27,970 |

| | 28,568 |

|

Total tangible stockholders' equity | 931,189 |

| | 868,027 |

| | 828,124 |

| | 798,502 |

| | 770,739 |

|

Less: | | | | | | | | | |

Preferred stock | 141,000 |

| | 141,000 |

| | 141,000 |

| | 141,000 |

| | 141,000 |

|

Total tangible common equity | 790,189 |

| | 727,027 |

| | 687,124 |

| | 657,502 |

| | 629,739 |

|

Add: | | | | | | | | | |

Deferred tax - attributed to intangible assets | 1,138 |

| | 1,243 |

| | 1,452 |

| | 1,661 |

| | 1,870 |

|

Total tangible common equity, net of tax | $ | 791,327 |

| | $ | 728,270 |

| | $ | 688,576 |

| | $ | 659,163 |

| | $ | 631,609 |

|

Total assets | $ | 10,023,587 |

| | $ | 9,746,623 |

| | $ | 9,307,342 |

| | $ | 8,920,449 |

| | $ | 8,592,692 |

|

Less: | | | | | | | | | |

Goodwill and intangible assets, net | 26,475 |

| | 26,777 |

| | 27,374 |

| | 27,970 |

| | 28,568 |

|

Tangible assets | 9,997,112 |

| | 9,719,846 |

| | 9,279,968 |

| | 8,892,479 |

| | 8,564,124 |

|

Add: | | | | | | | | | |

Deferred tax - attributed to intangible assets | 1,138 |

| | 1,243 |

| | 1,452 |

| | 1,661 |

| | 1,870 |

|

Total tangible assets, net of tax | $ | 9,998,250 |

| | $ | 9,721,089 |

| | $ | 9,281,420 |

| | $ | 8,894,140 |

| | $ | 8,565,994 |

|

Tangible equity ratio (3) | 9.3 | % | | 8.9 | % | | 8.9 | % | | 9.0 | % | | 9.0 | % |

Tangible common equity ratio (3) | 7.9 | % | | 7.5 | % | | 7.4 | % | | 7.4 | % | | 7.4 | % |

Common shares outstanding | 87,774 |

| | 87,554 |

| | 87,186 |

| | 87,099 |

| | 86,997 |

|

Tangible book value per share, net of tax (4) | $ | 9.02 |

| | $ | 8.32 |

| | $ | 7.90 |

| | $ | 7.57 |

| | $ | 7.26 |

|

|

| | | | | | | | | | | | | | | | | | | |

Western Alliance Bancorporation and Subsidiaries | | | | | | | | | |

Reconciliation of Non-GAAP Financial Measures (Unaudited) | | | | | | | | | |

| | | | | | | | | |

Efficiency Ratio | | | | | | | | | |

| Three Months Ended |

| Jun 30, 2014 | | Mar 31, 2014 | | Dec 31, 2013 | | Sep 30, 2013 | | Jun 30, 2013 |

| (in thousands) |

Total operating non-interest expense | $ | 52,206 |

| | $ | 52,139 |

| | $ | 51,365 |

| | $ | 48,286 |

| | $ | 47,035 |

|

Divided by: | | | | | | | | | |

Total net interest income | $ | 93,898 |

| | $ | 90,777 |

| | $ | 89,981 |

| | $ | 84,559 |

| | $ | 82,152 |

|

Add: | | | | | | | | | |

Tax equivalent adjustment | 6,029 |

| | 5,705 |

| | 3,728 |

| | 3,272 |

| | 2,929 |

|

Operating non-interest income | 5,701 |

| | 5,745 |

| | 5,220 |

| | 5,815 |

| | 5,013 |

|

| $ | 105,628 |

| | $ | 102,227 |

| | $ | 98,929 |

| | $ | 93,646 |

| | $ | 90,094 |

|

Efficiency ratio - tax equivalent basis (5) | 49.4 | % | | 51.0 | % | | 51.9 | % | | 51.6 | % | | 52.2 | % |

|

| | | | | | | |

Tier 1 Common Equity | | | |

| June 30, |

| 2014 | | 2013 |

| (in thousands) |

Stockholders' equity | $ | 957,664 |

| | $ | 799,307 |

|

Less: | | | |

Accumulated other comprehensive income (loss) | 8,472 |

| | (10,750 | ) |

Non-qualifying goodwill and intangibles | 25,707 |

| | 26,756 |

|

Other non-qualifying assets | — |

| | 2 |

|

Disallowed unrealized losses on equity securities | — |

| | 103 |

|

Add: | | | |

Qualifying trust preferred securities | 49,039 |

| | 47,228 |

|

Tier 1 capital (regulatory) (6) (9) | 972,524 |

| | 830,424 |

|

Less: | | | |

Qualifying trust preferred securities | 49,039 |

| | 47,228 |

|

Preferred stock | 141,000 |

| | 141,000 |

|

Estimated Tier 1 common equity (7) (9) | $ | 782,485 |

| | $ | 642,196 |

|

Divided by: | | | |

Estimated risk-weighted assets (regulatory) (7) (9) | $ | 8,684,802 |

| | $ | 7,698,091 |

|

Tier 1 common equity ratio (7) (9) | 9.0 | % | | 8.3 | % |

| | | |

Tier 1 Capital | | | |

| June 30, |

| 2014 | | 2013 |

| (in thousands) |

Classified assets | $ | 264,766 |

| | $ | 298,887 |

|

Divide: | | | |

Tier 1 capital (regulatory) (6) (9) | 972,524 |

| | 830,424 |

|

Plus: Allowance for credit losses | 105,937 |

| | 96,323 |

|

Total Tier 1 capital plus allowance for credit losses | $ | 1,078,461 |

| | $ | 926,747 |

|

Classified assets to Tier 1 capital plus allowance (8) (9) | 25 | % | | 32 | % |

|

| | | | | | | |

(1) We believe these non-GAAP measurements provide a useful indication of the cash generating capacity of the Company. |

(2) We believe this non-GAAP measurement is a key indicator of the earnings power of the Company. |

(3) We believe this non-GAAP ratio provides a critical metric with which to analyze and evaluate financial condition and capital strength. |

(4) We believe this non-GAAP ratio improves the comparability to other institutions that have not engaged in acquisitions that resulted in recorded goodwill and other intangibles. |

(5) We believe this non-GAAP ratio provides a useful metric to measure the operating efficiency of the Company. |

(6) Under the guidelines of the Federal Reserve and the Federal Deposit Insurance Corporation in effect, Tier 1 capital consisted of common stock, retained earnings, non-cumulative perpetual preferred stock, trust preferred securities up to a certain limit, and minority interests in certain subsidiaries, less most other intangible assets. |

(7) Tier 1 common equity is often expressed as a percentage of risk-weighted assets. Under the risk-based capital framework, a bank's balance sheet assets and credit equivalent amounts of off-balance sheet items are assigned to one of four broad risk categories. The aggregated dollar amount in each category is then multiplied by the risk weighting assigned to that category. The resulting weighted values from each of the four categories are added together and this sum is the risk-weighted assets total that, as adjusted, comprises the denominator (risk-weighted assets) to determine the Tier 1 capital ratio. Adjustments are made to Tier 1 capital to arrive at Tier 1 common equity. Tier 1 common equity is divided by the risk-weighted assets to determine the Tier 1 common equity ratio. We believe this non-GAAP ratio provides a critical metric with which to analyze and evaluate financial condition and capital strength. |

(8) We believe this non-GAAP ratio provides a critical regulatory metric in which to analyze asset quality. |

(9) Current quarter is preliminary until Call Reports are filed. |

CONTACT:

Western Alliance Bancorporation

Dale Gibbons, 602-952-5476

(NYSE: WAL) July 18, 2014 Western Alliance Bancorporation 2nd Quarter Earnings Call

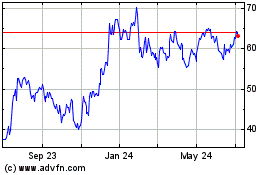

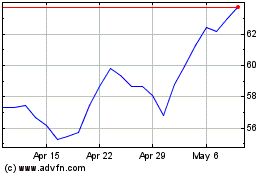

Q2 2014 Financial Highlights Q2 2014 net income of $35.5 million, EPS of $0.40, net operating revenue of $99.6 million Loan growth of $436 million to $7.54 billion, deposit growth of $321 million to $8.47 billion, and asset growth of $277 million to $10.02 billion Performance includes $1.4 million (after tax) for additional purchased credit impaired payoffs and/or sale with EPS impact of $0.02 compared to prior quarter Q2 2014 tangible book value per share growth, net of tax, of $0.70 from $8.32 to $9.02 Nonperforming assets (nonaccrual loans and repossessed assets) to total assets of 1.23%, net loan recoveries to average loans outstanding of 0.09% (annualized) Tier 1 Leverage Capital ratio of 10.0% and Total Risk Based Capital ratio of 12.4% ROA of 1.46% and ROTCE of 17.41% 2

$2,174 $2,235 $2,478 $2,723 $3,028 $1,550 $1,551 $1,562 $1,606 $1,603 $1,833 $1,856 $1,832 $1,842 $1,934 $438 $414 $393 $383 $370 $417 $460 $536 $554 Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Loan Growth and Portfolio Composition $ in millions Commercial & Industrial CRE, Owner Occupied CRE, Non- Owner Occupied Construction & Land Residential and Consumer Highlights Total loans increased 17.7%, or $1.13 billion year over year, led by C&I (39.3%, or $854 million) and Construction & Land (46.0%, or $192 million) Quarter over quarter loan growth driven by C&I (11.2%, or $305 million) and Construction & Land (9.9%, or $55 million), while Residential and Consumer continues to roll off in accordance with management plan 8.1% 4.9% 25.6% 40.1% 21.3% 6.5% 6.8% 28.6% 33.9% 24.2% $1.13 Billion Year Over Year Growth 3 $6,412 $6,516 $6,801 $7,108 $7,544 Growth: +557* +104 +285 +307 +436 $609 * Includes Centennial acquisition

Deposit Growth and Composition $ in millions Savings & MMDA NOW CDs Non-Int Bearing DDA $1,920 $1,972 $2,200 $2,094 $2,279 $2,945 $3,050 $3,310 $3,672 $3,637 $631 $674 $710 $750 $795 $1,505 $1,579 $1,618 $1,633 $1,759 Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 $7,001 $7,275 $7,838 $8,149 $8,470 Growth: +266* +274 +563 +311 +321 Highlights Total deposits increased 21.0% (or $1.47 billion year over year), led by Savings & MMDA (23.5%, or $692 million) and DDA (18.7%, or $359 million) Deposits grew $321 million quarter over quarter driven by DDA (8.8% or $185 million) and CDs (7.7%, or $126 million) 21.5% 9.0% 42.1% 27.4% 20.8% 9.4% 42.9% 26.9% $1.47 Billion Year Over Year Growth 4 * Includes Centennial acquisition

Consolidated Balance Sheet $ in millions Decrease in Investments & Cash as a result of discontinuing securities sold short ($110 million) during the quarter Loan/deposit ratio decreased slightly year over year from 91.6% to 89.1% Shareholders’ Equity increased $63 million during the quarter: $35 million due to earnings and $20 million due to OCI improvement including transfer of HTM to AFS 5 Highlights Q2-14 Q1-14 Q2-13 Investments & Cash 1,986$ 2,137$ 1,696$ Total Loans 7,544 7,108 6,412 Allowance for Credit Losses (106) (104) (96) Other Assets 600 606 581 Total Assets 10,024$ 9,747$ 8,593$ Deposits 8,470$ 8,149$ 7,001$ Other Liabilities 596 703 793 Total Liabilities 9,066$ 8,852$ 7,794$ Shareholders' Equity 958 895 799 Total Liabilities a d Equity 10,024$ 9,747$ 8,593$

Consolidated Financial Results Highlights Year over year, total revenue increased 14.2% (17.2% on tax-equivalent basis) while expenses only rose 10.8% Net income rose $4.4 million quarter over quarter as assets rose and asset quality improved $ in millions, except EPS 6 Q2-14 Q1-14 Q2-13 Net Interest Income 93.9$ 90.8$ 82.2$ Operating Non Interest Income 5.7 5.7 5.0 Total Revenue 99.6$ 96.5$ 87.2$ Operating Expenses (52.2) (52.1) (47.1) Pre-Tax, Pre-Provision Income 47.4$ 44.4$ 40.1$ Provision for Credit Losses (0.5) (3.5) (3.5) OREO (Losses) Gains and Gain on Sale of Equity Investment (0.2) 2.5 1.1 Debt Valuation Adjustments and Securities Gains/Losses 0.0 (0.9) (3.3) Bargain Purchase Gain 0.0 0.0 10.0 Other 0.0 (0.2) (2.5) Pre-Tax Income 46.7$ 42.4$ 41.9$ Inc me Tax (10.7) (10.6) (7.6) Discontinued Operations (0.5) (0.7) (0.2) Net Income 35.5 31.1 34.1 Preferred Divid d (0.4) (0.4) (0.4) Net Income Avail ble to Common 35.2$ 30.7$ 33.7$ Earnings Per Share 0.40$ 0.35$ 0.39$

Segment Reporting1: Loans and Deposits Q2 2014 7 Loans by Segment - $7.45 billion $ in billions California $2.06 25.0% Nevada $3.19 38.7% Arizona $2.12 25.7% National Business Lines $0.88 10.6% Deposits by Segment - $8.25 billion California $1.69 22.7% Nevada $1.68 22.6% Arizona $2.13 28.6% National Business Lines 2 $1.95 26.1% 1) Excludes corporate and other segment 2) Centrally managed business lines includes loans/deposits generated in AZ, CA and NV