As filed with the Securities and Exchange Commission on July 17, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 17, 2014

B&G Foods, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

001-32316 |

|

13-3918742 |

|

(State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of Incorporation) |

|

File Number) |

|

Identification No.) |

|

Four Gatehall Drive, Parsippany, New Jersey |

|

07054 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (973) 401-6500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

Item 7.01. Regulation FD Disclosure.

On July 17, 2014, B&G Foods, Inc. issued a press release announcing its financial results for the quarter ended June 28, 2014. The information contained in the press release, which is attached to this report as Exhibit 99.1, is incorporated by reference herein and is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition” and Item 7.01, “Regulation FD Disclosure.”

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

99.1 |

|

Press Release dated July 17, 2014, furnished pursuant to Item 2.02 and Item 7.01 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

B&G FOODS, INC. |

|

|

|

|

|

|

|

|

Dated: July 17, 2014 |

By: |

/s/ Robert C. Cantwell |

|

|

|

Robert C. Cantwell

Executive Vice President of Finance and

Chief Financial Officer |

3

Exhibit 99.1

B&G Foods Reports Second Quarter 2014 Financial Results

— Base Business Net Sales Increased 1.1% —

— Company Updates 2014 Guidance —

Parsippany, N.J., July 17, 2014—B&G Foods, Inc. (NYSE: BGS) today announced financial results for the second quarter and first two quarters of 2014.

Highlights (vs. year-ago quarter where applicable):

· Net sales increased 26.1% to $202.9 million

· Base business net sales volume increased $4.4 million, or 2.8%

· Net income increased over 100% to $16.1 million

· Adjusted net income* increased 1.4% to $17.5 million

· Diluted earnings per share increased over 100% to $0.30

· Adjusted diluted earnings per share* remained consistent at $0.33

· Adjusted EBITDA* increased 8.8% to $46.1 million

· Decreased guidance for fiscal year 2014:

· Adjusted EBITDA guidance decreased approximately 2.4% to a range of $204.0 million to $209.0 million

· Adjusted diluted earnings per share guidance decreased approximately 3.1% to a range of approximately $1.54 to $1.60

Commenting on the results, David L. Wenner, President and Chief Executive Officer of B&G Foods, stated, “The Company achieved very substantial growth in the second quarter, with overall net sales increasing by 26.1%. While substantially all of the increase came from acquisitions, we were encouraged by a base business volume increase of 2.8%. The fact that we gave back 1.7% of that increase in pricing indicates that we must continue to adjust our promotional activity to a more appropriate balance of volume and price. And while adjusted EBITDA increased by 8.8%, we expected better. We continue to see added expenses due to our rapid growth over the past year. As we work through these issues we are reducing our adjusted EBITDA guidance for fiscal 2014 to a range of $204.0 million to $209.0 million, which at the mid-point of the range represents a 12.2% increase over 2013.”

* Please see “About Non-GAAP Financial Measures and Items Affecting Comparability” below for the definition of the terms adjusted net income, adjusted diluted earnings per share, EBITDA and adjusted EBITDA, as well as information concerning certain items affecting comparability and reconciliations of the non-GAAP terms adjusted net income, adjusted diluted earnings per share, EBITDA and adjusted EBITDA to the most comparable GAAP financial measures.

Financial Results for the Second Quarter of 2014

Net sales for the second quarter of 2014 increased $42.0 million or 26.1% to $202.9 million from $160.9 million for the second quarter of 2013. Net sales of Pirate Brands, which B&G Foods acquired in July 2013, contributed $20.3 million to the overall increase, net sales of Specialty Brands, acquired in April 2014, contributed $11.5 million to the overall increase, net sales of the Rickland Orchards brand, acquired in October 2013, contributed $7.1 million to the overall increase and an additional month of net sales of the TrueNorth brand, acquired in May 2013, contributed $1.4 million to the overall increase. Net sales for B&G Foods’ base business increased $1.7 million, or 1.1%, attributable to a unit volume increase of $4.4 million, or 2.8%, partially offset by a net price decrease of $2.7 million, or 1.7%.

Gross profit for the second quarter of 2014 increased $7.3 million, or 13.2%, to $63.0 million from $55.7 million for the second quarter of 2013. Gross profit expressed as a percentage of net sales decreased to 31.1% for the second quarter of 2014 from 34.6% in the second quarter of 2013. The 3.5 percentage point decrease was primarily attributable to an increase in distribution costs, the base business net price decrease described above and a sales mix shift to lower margin products, which reduced gross profit margin by approximately 1.1 percentage points, 0.9 percentage points and 1.5 percentage points, respectively.

Selling, general and administrative expenses increased $8.0 million, or 46.0%, to $25.3 million for the second quarter of 2014 from $17.3 million for the second quarter of 2013. This increase was primarily due to increases in acquisition-related transaction costs of $4.1 million, selling expenses of $2.1 million (including increases of $1.3 million for brokerage expenses and $0.5 million for salesperson compensation), consumer marketing of $1.5 million and warehousing expenses of $0.5 million, partially offset by a decrease in all other expenses of $0.2 million. Expressed as a percentage of net sales, selling, general and administrative expenses increased 1.7 percentage points to 12.5% for the second quarter of 2014 from 10.8% for the second quarter of 2013.

Net interest expense for the second quarter of 2014 increased $1.8 million or 17.7% to $11.8 million from $10.0 million for the second quarter of 2013. The increase was primarily attributable to an increase in the Company’s average debt outstanding.

The Company’s reported net income under U.S. generally accepted accounting principles (GAAP) was $16.1 million, or $0.30 per diluted share, for the second quarter of 2014, as compared to a net loss of $1.4 million, or $0.03 per share, for the second quarter of 2013. The Company’s adjusted net income for the second quarter of 2014, which excludes the after tax impact of refinancing charges, acquisition-related transaction costs and a non-cash gain relating to the Rickland Orchards earn-out, was $17.5 million, or $0.33 per adjusted diluted share. The Company’s adjusted net income for the second quarter of 2013, which excludes the after tax impact of refinancing charges and acquisition-related transaction costs, was $17.3 million, or $0.33 per adjusted diluted share.

For the second quarter of 2014, adjusted EBITDA, which excludes the impact of acquisition-related transaction costs and the non-cash gain relating to the Rickland Orchards earn-out, increased 8.8% to $46.1 million from $42.4 million for the second quarter of 2013.

Financial Results for the First Two Quarters of 2014

Net sales for the first two quarters of 2014 increased $69.0 million or 20.8% to $401.0 million from $332.0 million for the first two quarters of 2013. Net sales of Pirate Brands, which B&G Foods acquired in July 2013, contributed $40.7 million to the overall increase, net sales of the Rickland Orchards brand, acquired in October 2013, contributed $15.8 million to the overall increase, net sales of Specialty Brands, acquired in April 2014, contributed $11.5 million to the overall increase and an additional four months of net sales of the TrueNorth brand, acquired in May 2013, contributed $7.2 million to the overall increase. Net sales from the Company’s base business decreased $6.2 million, or 1.8%, attributable to a net price decrease of $5.4 million, or 1.6% and a unit volume decrease of $0.8 million, or 0.2%.

2

Gross profit for the first two quarters of 2014 increased $13.2 million, or 11.5%, to $127.7 million from $114.5 million for the first two quarters of 2013. Gross profit expressed as a percentage of net sales decreased to 31.8% in the first two quarters of 2014 from 34.5% in the first two quarters of 2013. The 2.7 percentage point decrease was primarily attributable to the base business net price decrease described above, an increase in distribution costs and a sales mix shift to lower margin products, which reduced gross profit margin by approximately 0.9 percentage points, 0.7 percentage points and 1.1 percentage points, respectively.

Selling, general and administrative expenses increased $14.1 million, or 41.6%, to $47.9 million for the first two quarters of 2014 from $33.8 million for the first two quarters of 2013. This increase was primarily due to increases in consumer marketing of $5.3 million, acquisition-related transaction costs of $4.8 million, selling expenses of $3.4 million (including increases of $1.9 million for brokerage expenses and $0.8 million for salesperson compensation) and warehousing expenses of $1.1 million, offset by a decrease in all other expenses of $0.5 million. Expressed as a percentage of net sales, our selling, general and administrative expenses increased 1.7 percentage points to 11.9% for the first two quarters of 2014 from 10.2% for the first two quarters of 2013.

Net interest expense for the first two quarters of 2014 increased $3.1 million or 15.9% to $22.9 million from $19.8 million in the first two quarters of 2013. The increase was primarily attributable to the increase in the Company’s average debt outstanding.

The Company’s reported net income under GAAP was $33.9 million, or $0.63 per diluted share, for the first two quarters of 2014, as compared to $18.2 million, or $0.34 per diluted share, for the first two quarters of 2013. The Company’s adjusted net income for the first two quarters of 2014, which excludes the after tax impact of refinancing charges, acquisition-related transaction costs and the non-cash gain relating to the Rickland Orchards earn-out, was $35.8 million, or $0.67 per adjusted diluted share. The Company’s adjusted net income for the first two quarters of 2013, which excludes the after tax impact of refinancing charges and acquisition-related transaction costs, was $36.9 million, and adjusted diluted earnings per share was $0.70.

For the first two quarters of 2014, adjusted EBITDA, which excludes the impact of acquisition-related transaction costs and the non-cash gain relating to the Rickland Orchards earn-out, increased 5.1% to $92.5 million from $88.0 million for the first two quarters of 2013.

Guidance

B&G Foods decreased its adjusted EBITDA guidance for fiscal 2014 by approximately 2.4% to a range of $204.0 million to $209.0 million. B&G Foods also decreased its adjusted diluted earnings per share guidance for fiscal 2014 by approximately 3.1% to a range of $1.54 to $1.60.

Conference Call

B&G Foods will hold a conference call at 4:30 p.m. ET today, July 17, 2014. The call will be webcast live from B&G Foods’ website at www.bgfoods.com under “Investor Relations—Company Overview.” The call can also be accessed live over the phone by dialing (888) 539-3679 for U.S. callers or (719) 457-2634 for international callers.

A replay of the call will be available one hour after the call and can be accessed by dialing (877) 870-5176 or (858) 384-5517 for international callers; the password is 5016612. The replay will be available from July 17, 2014 through July 31, 2014. Investors may also access a web-based replay of the call at the Investor Relations section of B&G Foods’ website, www.bgfoods.com.

3

About Non-GAAP Financial Measures and Items Affecting Comparability

“Adjusted net income,” “adjusted diluted earnings per share,” “EBITDA” (net income (loss) before net interest expense, income taxes, depreciation and amortization and loss on extinguishment of debt) and “adjusted EBITDA” (EBITDA as adjusted for cash and non-cash acquisition-related expenses, gains and losses, which may include third party fees and expenses, integration, restructuring and consolidation expenses, and gains or losses related to changes in the fair value of contingent liabilities from earn-outs) are “non-GAAP financial measures.” A non-GAAP financial measure is a numerical measure of financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in B&G Foods’ consolidated balance sheets and related consolidated statements of operations, comprehensive income, changes in stockholders’ equity and cash flows. Non-GAAP financial measures should not be considered in isolation or as a substitute for the most directly comparable GAAP measures. The Company’s non-GAAP financial measures may be different from non-GAAP financial measures used by other companies.

The Company uses “adjusted net income” and “adjusted diluted earnings per share,” which are calculated as reported net income (loss) and reported diluted earnings (loss) per share adjusted for certain items that affect comparability. These non-GAAP financial measures reflect adjustments to reported net income (loss) and diluted earnings (loss) per share to eliminate the items identified below. This information is provided in order to allow investors to make meaningful comparisons of the Company’s operating performance between periods and to view the Company’s business from the same perspective as the Company’s management. Because the Company cannot predict the timing and amount of acquisition-related transaction costs, non-cash gains or losses on contingent earn-out consideration and gains or losses on extinguishment of debt, management does not consider these costs when evaluating the Company’s performance or when making decisions regarding allocation of resources.

Additional information regarding EBITDA and adjusted EBITDA, and a reconciliation of EBITDA and adjusted EBITDA to net income (loss) and to net cash provided by operating activities is included below for the second quarter and first two quarters of 2014 and 2013, along with the components of EBITDA and adjusted EBITDA. Also included below are reconciliations of the non-GAAP terms adjusted net income and adjusted diluted earnings per share to reported net income (loss) and reported diluted earnings (loss) per share.

About B&G Foods, Inc.

B&G Foods and its subsidiaries manufacture, sell and distribute a diversified portfolio of high-quality, branded shelf-stable foods across the United States, Canada and Puerto Rico. Based in Parsippany, New Jersey, B&G Foods’ products are marketed under many recognized brands, including Ac’cent, B&G, B&M, Baker’s Joy, Bear Creek Country Kitchens, Brer Rabbit, Canoleo, Cary’s, Cream of Rice, Cream of Wheat, Devonsheer, Don Pepino, Emeril’s, Grandma’s Molasses, JJ Flats, Joan of Arc, Las Palmas, MacDonald’s, Maple Grove Farms, Molly McButter, Mrs. Dash, New York Flatbreads, New York Style, Old London, Original Tings, Ortega, Pirate’s Booty, Polaner, Red Devil, Regina, Rickland Orchards, Sa-són, Sclafani, Smart Puffs, Spring Tree, Sugar Twin, Trappey’s, TrueNorth, Underwood, Vermont Maid and Wright’s. B&G Foods also sells and distributes two branded household products, Static Guard and Kleen Guard.

Forward-Looking Statements

Statements in this press release that are not statements of historical or current fact constitute “forward-looking statements.” The forward-looking statements contained in this press release include, without limitation, statements related to B&G Foods’ adjusted EBITDA and adjusted diluted earnings per share expectations for fiscal 2014. Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the actual results of B&G Foods to be materially different from the historical results or from any future results expressed or implied by such forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties readers are urged to consider statements labeled with the terms “believes,” “belief,” “expects,”

4

“projects,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in B&G Foods’ filings with the Securities and Exchange Commission, including under Item 1A, “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and in its subsequent reports on Forms 10-Q and 8-K. Investors are cautioned not to place undue reliance on any such forward looking statements, which speak only as of the date they are made. B&G Foods undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Contacts:

|

Investor Relations:

ICR, Inc.

Don Duffy

866-211-8151 |

Media Relations:

ICR, Inc.

Matt Lindberg

203-682-8214 |

5

B&G Foods, Inc. and Subsidiaries

Consolidated Balance Sheets

(In thousands, except share and per share data)

(Unaudited)

|

|

|

June 28, 2014 |

|

December 28, 2013 |

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,010 |

|

$ |

4,107 |

|

|

Trade accounts receivable, net |

|

58,352 |

|

62,763 |

|

|

Inventories |

|

119,748 |

|

101,251 |

|

|

Prepaid expenses and other current assets |

|

8,314 |

|

8,079 |

|

|

Income tax receivable |

|

11,255 |

|

3,422 |

|

|

Deferred income taxes |

|

3,113 |

|

2,115 |

|

|

Total current assets |

|

204,792 |

|

181,737 |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net of accumulated depreciation of $121,996 and $114,685 |

|

113,671 |

|

110,374 |

|

|

Goodwill |

|

371,954 |

|

319,292 |

|

|

Other intangibles, net |

|

985,546 |

|

844,141 |

|

|

Other assets |

|

31,350 |

|

28,799 |

|

|

Total assets |

|

$ |

1,707,313 |

|

$ |

1,484,343 |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Trade accounts payable |

|

$ |

42,623 |

|

$ |

42,638 |

|

|

Accrued expenses |

|

19,080 |

|

19,189 |

|

|

Current portion of long-term debt |

|

45,000 |

|

26,250 |

|

|

Dividends payable |

|

18,246 |

|

17,637 |

|

|

Total current liabilities |

|

124,949 |

|

105,714 |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

1,000,265 |

|

844,635 |

|

|

Other liabilities |

|

2,131 |

|

8,692 |

|

|

Deferred income taxes |

|

204,416 |

|

146,939 |

|

|

Total liabilities |

|

1,331,761 |

|

1,105,980 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value per share. Authorized 1,000,000 shares; no shares issued or outstanding |

|

— |

|

— |

|

|

Common stock, $0.01 par value per share. Authorized 125,000,000 shares; 53,663,697 and 53,445,910 shares issued and outstanding as of June 28, 2014 and December 28, 2013 |

|

537 |

|

534 |

|

|

Additional paid-in capital |

|

146,374 |

|

183,113 |

|

|

Accumulated other comprehensive loss |

|

(2,461 |

) |

(2,471 |

) |

|

Retained earnings |

|

231,102 |

|

197,187 |

|

|

Total stockholders’ equity |

|

375,552 |

|

378,363 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

1,707,313 |

|

$ |

1,484,343 |

|

6

B&G Foods, Inc. and Subsidiaries

Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

|

|

|

Second Quarter Ended |

|

First Two Quarters Ended |

|

|

|

|

June 28, 2014 |

|

June 29, 2013 |

|

June 28, 2014 |

|

June 29, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

202,889 |

|

$ |

160,882 |

|

$ |

401,029 |

|

$ |

332,076 |

|

|

Cost of goods sold |

|

139,862 |

|

105,185 |

|

273,333 |

|

217,567 |

|

|

Gross profit |

|

63,027 |

|

55,697 |

|

127,696 |

|

114,509 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

25,289 |

|

17,318 |

|

47,892 |

|

33,826 |

|

|

Amortization expense |

|

3,348 |

|

2,156 |

|

6,595 |

|

4,223 |

|

|

Gain on change in fair value of contingent consideration |

|

(8,206 |

) |

— |

|

(8,206 |

) |

— |

|

|

Operating income |

|

42,596 |

|

36,223 |

|

81,415 |

|

76,460 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expenses: |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

11,803 |

|

10,030 |

|

22,945 |

|

19,803 |

|

|

Loss on extinguishment of debt |

|

5,748 |

|

28,478 |

|

5,748 |

|

28,478 |

|

|

Income (loss) before income tax expense (benefit) |

|

25,045 |

|

(2,285 |

) |

52,722 |

|

28,179 |

|

|

Income tax expense (benefit) |

|

8,907 |

|

(852 |

) |

18,807 |

|

9,978 |

|

|

Net income (loss) |

|

$ |

16,138 |

|

$ |

(1,433 |

) |

$ |

33,915 |

|

$ |

18,201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

53,654 |

|

52,863 |

|

53,652 |

|

52,789 |

|

|

Diluted |

|

53,719 |

|

52,863 |

|

53,713 |

|

52,902 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings (loss) per share |

|

$ |

0.30 |

|

$ |

(0.03 |

) |

$ |

0.63 |

|

$ |

0.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share |

|

$ |

0.34 |

|

$ |

0.29 |

|

$ |

0.68 |

|

$ |

0.58 |

|

7

B&G Foods, Inc. and Subsidiaries

Reconciliation of EBITDA and Adjusted EBITDA to Net Income (Loss) and to Net Cash Provided by Operating Activities

(In thousands)

(Unaudited)

|

|

|

Second Quarter Ended |

|

First Two Quarters Ended |

|

|

|

|

June 28, 2014 |

|

June 29, 2013 |

|

June 28, 2014 |

|

June 29, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

16,138 |

|

$ |

(1,433 |

) |

$ |

33,915 |

|

$ |

18,201 |

|

|

Income tax expense (benefit) |

|

8,907 |

|

(852 |

) |

18,807 |

|

9,978 |

|

|

Interest expense, net |

|

11,803 |

|

10,030 |

|

22,945 |

|

19,803 |

|

|

Depreciation and amortization |

|

7,050 |

|

5,599 |

|

13,945 |

|

11,019 |

|

|

Loss on extinguishment of debt |

|

5,748 |

|

28,478 |

|

5,748 |

|

28,478 |

|

|

EBITDA(1) |

|

49,646 |

|

41,822 |

|

95,360 |

|

87,479 |

|

|

Acquisition-related transaction costs |

|

4,642 |

|

534 |

|

5,383 |

|

534 |

|

|

Gain on change in fair value of contingent consideration |

|

(8,206 |

) |

— |

|

(8,206 |

) |

— |

|

|

Adjusted EBITDA |

|

46,082 |

|

42,356 |

|

92,537 |

|

88,013 |

|

|

Income tax (expense) benefit |

|

(8,907 |

) |

852 |

|

(18,807 |

) |

(9,978 |

) |

|

Interest expense, net |

|

(11,803 |

) |

(10,030 |

) |

(22,945 |

) |

(19,803 |

) |

|

Deferred income taxes |

|

4,500 |

|

1,452 |

|

8,594 |

|

6,194 |

|

|

Amortization of deferred financing costs and bond discount |

|

984 |

|

1,118 |

|

2,028 |

|

2,293 |

|

|

Acquisition-related transaction costs |

|

(4,642 |

) |

(534 |

) |

(5,383 |

) |

(534 |

) |

|

Acquisition-related contingent consideration expense, including interest accretion |

|

200 |

|

— |

|

432 |

|

— |

|

|

Share-based compensation expense |

|

1,177 |

|

1,490 |

|

1,742 |

|

2,160 |

|

|

Excess tax benefits from share-based compensation |

|

— |

|

151 |

|

(2,383 |

) |

(4,198 |

) |

|

Changes in assets and liabilities |

|

(21,287 |

) |

(18,286 |

) |

(18,508 |

) |

(22,471 |

) |

|

Net cash provided by operating activities |

|

$ |

6,304 |

|

$ |

18,569 |

|

$ |

37,307 |

|

$ |

41,676 |

|

(1) EBITDA and adjusted EBITDA are non-GAAP financial measures used by management to measure operating performance. A non-GAAP financial measure is defined as a numerical measure of our financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in our consolidated balance sheets and related consolidated statements of operations, comprehensive income, changes in stockholders’ equity and cash flows. We define EBITDA as net income (loss) before net interest expense, income taxes, depreciation and amortization and loss on extinguishment of debt. We define adjusted EBITDA as EBITDA adjusted for cash and non-cash acquisition-related expenses, gains and losses, which may include third party fees and expenses, integration, restructuring and consolidation expenses, and gains or losses related to changes in the fair value of contingent liabilities from earn-outs. Management believes that it is useful to eliminate net interest expense, income taxes, depreciation and amortization, loss on extinguishment of debt and acquisition-related expenses, gains and losses because it allows management to focus on what it deems to be a more reliable indicator of ongoing operating performance and our ability to generate cash flow from operations. We use EBITDA and adjusted EBITDA in our business operations to, among other things, evaluate our operating performance, develop budgets and measure our performance against those budgets, determine employee bonuses and evaluate our cash flows in terms of cash needs. We also present EBITDA and adjusted EBITDA because we believe they are useful indicators of our historical debt capacity and ability to service debt and because covenants in our credit agreement and our senior notes indenture contain ratios based on these measures. As a result, internal management reports used during monthly operating reviews feature the EBITDA and adjusted EBITDA metrics. However, management uses these metrics in conjunction with traditional GAAP operating performance and liquidity measures as part of its overall assessment of company performance and liquidity and therefore does not place undue reliance on these measures as its only measures of operating performance and liquidity.

EBITDA and adjusted EBITDA are not recognized terms under GAAP and do not purport to be an alternative to operating income or net income (loss) as an indicator of operating performance or any other GAAP measure.

8

EBITDA and adjusted EBITDA are not complete net cash flow measures because EBITDA and adjusted EBITDA are measures of liquidity that do not include reductions for cash payments for an entity’s obligation to service its debt, fund its working capital, capital expenditures and acquisitions and pay its income taxes and dividends. Rather, EBITDA and adjusted EBITDA are two potential indicators of an entity’s ability to fund these cash requirements. EBITDA and adjusted EBITDA are not complete measures of an entity’s profitability because they do not include costs and expenses for depreciation and amortization, interest and related expenses, loss on extinguishment of debt, acquisition-related expenses, gains and losses and income taxes. Because not all companies use identical calculations, this presentation of EBITDA and adjusted EBITDA may not be comparable to other similarly titled measures of other companies. However, EBITDA and adjusted EBITDA can still be useful in evaluating our performance against our peer companies because management believes these measures provide users with valuable insight into key components of GAAP amounts.

9

B&G Foods, Inc. and Subsidiaries

Items Affecting Comparability — Reconciliation of Adjusted Information to GAAP Information

(In thousands)

(Unaudited)

|

|

|

Second Quarter Ended |

|

First Two Quarters Ended |

|

|

|

|

June 28, 2014 |

|

June 29, 2013 |

|

June 28, 2014 |

|

June 29, 2013 |

|

|

Reported net income (loss) |

|

$ |

16,138 |

|

$ |

(1,433 |

) |

$ |

33,915 |

|

$ |

18,201 |

|

|

Loss on extinguishment of debt, net of tax(1) |

|

3,702 |

|

18,397 |

|

3,702 |

|

18,397 |

|

|

Acquisition-related transaction costs, net of tax |

|

2,989 |

|

345 |

|

3,467 |

|

345 |

|

|

Gain on contingent consideration, net of tax(2) |

|

(5,285 |

) |

— |

|

(5,285 |

) |

— |

|

|

Adjusted net income |

|

$ |

17,544 |

|

$ |

17,309 |

|

$ |

35,799 |

|

$ |

36,943 |

|

|

Adjusted diluted earnings per share (3) |

|

$ |

0.33 |

|

$ |

0.33 |

|

$ |

0.67 |

|

$ |

0.70 |

|

(1) Loss on extinguishment of debt for the second quarter of 2014 includes costs relating to the termination of our prior credit agreement, which included the repayment of $121.9 million aggregate principal amount of tranche A term loans and $215.0 million aggregate principal amount of revolving loans, and the write-off of deferred debt financing costs and unamortized discount of $5.4 million and $0.3 million, respectively. Loss on extinguishment of debt for the second quarter of 2013 includes costs relating to our repurchase of $218.3 million aggregate principal amount of 7.625% senior notes and our repayment of $222.2 million aggregate principal amount of tranche B term loans, including the repurchase premium and other expenses of $17.9 million, the write-off of deferred debt financing costs of $7.9 million and the write-off of unamortized discount of $2.6 million.

(2) On October 7, 2013, we completed the Rickland Orchards acquisition for a base purchase price of $57.5 million, of which $37.4 million was paid in cash and approximately $20.1 million was paid in shares of B&G Foods common stock. The purchase agreement also provided that the purchase price could be increased by contingent earn-out consideration of up to $15.0 million in the aggregate based upon the achievement of revenue growth targets during fiscal 2014, 2015 and 2016 meant to achieve operating results in excess of base purchase price acquisition model assumptions.

As of the date of acquisition we estimated the original fair value of the contingent consideration to be approximately $7.6 million. During the remainder of fiscal 2013 and the first two quarters of 2014, we recorded interest accretion expense on the contingent consideration liability of $0.2 million and $0.4 million, respectively. At June 28, 2014, we remeasured the fair value of the contingent consideration using actual operating results through June 28, 2014 and revised forecasted operating results for the remainder of fiscal 2014, 2015 and 2016. As a result of lower than expected net sales results for Rickland Orchards and the unlikelihood of Rickland Orchards achieving the revenue growth targets, the fair value of the contingent consideration was reduced to zero, resulting in a non-cash gain of $8.2 million that is included in gain on change in fair value of contingent consideration in the accompanying unaudited consolidated statements of operations for the second quarter and first two quarters of 2014. We did not have any contingent earn-out obligations during 2013.

(3) For the second quarter of 2013, 238,931 shares of common stock issuable upon the achievement of performance goals in connection with share-based compensation awards have not been included in the calculation of diluted weighted average shares because the effect would be antidilutive on diluted loss per share.

10

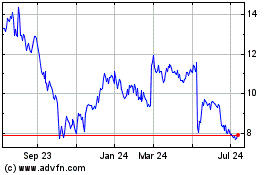

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

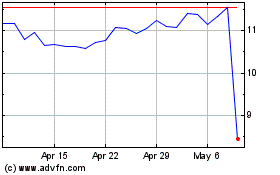

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2023 to Apr 2024