UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

GLOBAL CLEAN ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

Maryland

|

No. 84-1522846

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

6040 Upshaw Dr. #105

Humble, Texas

|

77396

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code:

(281) 441-2538

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

None

|

Name of Each Exchange on Which Registered

None

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.001 per share

(Title of Class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

|

Large accelerated filer

o

|

Accelerated filer

o

|

|

|

|

|

Non-accelerated filer

o

|

Smaller reporting company

x

|

|

(Do not check if a smaller reporting company)

|

|

ITEM 1.

|

|

3

|

|

ITEM 2.

|

|

13

|

|

ITEM 3.

|

|

17

|

|

ITEM 4.

|

|

18

|

|

ITEM 5.

|

|

19

|

|

ITEM 6.

|

|

20

|

|

ITEM 7

|

|

21

|

|

ITEM 8.

|

|

22

|

|

ITEM 9.

|

|

23

|

|

ITEM 10.

|

|

23

|

|

ITEM 11.

|

|

25

|

|

ITEM 12.

|

|

25

|

|

ITEM 13.

|

|

F-1

|

|

ITEM 14.

|

|

26

|

|

ITEM 15.

|

|

26

|

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Global Clean Energy, Inc. (“GCE”) (the “Company”) is a Maryland corporation with offices in Houston, Texas and Montreal, Canada. The Company is a developer of waste to energy and Platinum Group Metals (“PGM”) smelting and recovery plants across North America.

OUR MISSION

GCE plans to optimize commercially available technologies to recover, reclaim and convert waste and PGM into commercially viable energy and off takes; a process the Company refers to as Reforming Environmental Salvage into Clean Usable Energy (“R.E.S.C.U.E”).

GCE was formed eight years ago focused on processing organic waste into synthetic natural gas (“syngas”). The goal was to both reduce greenhouse gas emissions and lower the dependency in North America and Europe on imported oil and natural gas. In 2012, after significant capital investment in R&D, the Company made the strategic decision to prioritize feedstock lockup and operation agreements. GCE recognized accelerating growth opportunities in the US and began to secure long term feedstock sourcing and operations agreements. To execute this strategy GCE brought in top management from the renewable energy industry.

GCE is focused on the North American markets in implementing commercially proven technologies to convert and recover end-of-life plastic, tires, biomass, ASR auto shred, and PGM. GCE plans to incorporate technologies that are presently being employed in Europe and Asia to permit faster growth, less risk and accelerated operations and investments. GCE is positioning itself as one of the most diverse feedstock integrators, differentiating itself from single source, singular platform traditional feedstock developers in the flourishing North America alternative fuel market.

Global Clean Energy plans to Build-Own-Operate (“BOO”) plants utilizing best available technologies worldwide; GCE is a leader in the Plastic and Tire Waste to Energy field with sites under contract in the Southeast and Midwestern US which will process 30-60 tons per day of each substrate. GCE is in the midst of finalizing agreements for the development of a Plasma Arch PGM recovery site in the Southern US.

The GCE management team has extensive financial and operational backgrounds in the renewable energy, manufacturing, IP, IT fields, having built and sold companies in the hundreds of million-of dollars over the last 20 years. With broad experience in many disciplines and industries, our customers have ranged from large independents through to government agencies, mass distribution entities and Fortune 1000 companies. The team’s industry background affords the Company with vital insight and a valuable network of plant construction, manufacturing and EPC resources.

GCE is uniquely positioned to become the fastest growing developer, with its aggregation model of modular waste-to-energy and recovery conversion projects in the multi-billion dollar waste to energy industry.

HIGHLIGHTS

|

·

|

GCE is focused on the build out of a hybrid Plastic and Tire W2F plant and a PGM plasma smelting operation

|

|

·

|

GCE strictly implements systems with a minimum of 10 commercialized installations in place to mitigate technology risks

|

|

·

|

GCE contracts 20 year long-term feedstock supply agreements

|

|

·

|

GCE only implements systems with performance guarantees in place from OEM

|

|

·

|

GCE follows stringent IRR criteria

|

|

·

|

GCE will acquire synergistic operations

|

|

·

|

GCE bases its investment decisions on extensive financial modeling for sites that have expansion capabilities for scalable and modular system growth and expansion, “inside the fence” of our customer’s facilities

|

|

·

|

GCE creates joint ventures with large entities, municipalities and existing operations, clearly differentiating the company from “start-up” risks

|

|

·

|

GCE controls feedstock, technology, site operations and off take sales

|

|

·

|

The Company is ready to commercialize 2 sites for 2015 operation and 2 additional sites in 2016

|

North American Market and Drivers

In the U.S., the field of solid waste management is becoming more closely aligned with resource management, and this is in large part because the way we view “waste” is dramatically shifting. New technologies are being developed that allow more materials to be recovered and new value created from those materials. Much more of our waste stream is considered to be valuable scrap material and new technologies such as automation for materials separation are allowing the industry to tap into these resources and create value out of what was previously considered non-valuable material. Conversion technologies, specifically those designed for plastics, offer the same potential to create value as landfills. Plastic to fuel (“PTF”) technologies offer the potential to manage landfill-bound plastics as a resource to create a valuable alternative fuel source. At this time, a large portion of the plastic waste stream is still treated as “waste,” and there is a large opportunity to recover more of the plastics we use in the United States.

Now, an end-of-life management option exists for non-recycled plastics: conversion of scrap plastics to either chemical feedstock or fuel. These conversion technologies rely on the processes of depolymerization and pyrolysis, respectively or PTF technologies. The technology has existed for decades, however, recent investment and innovation in pyrolytic technology has created a new generation of systems that GCE has embraced as reviewed in the technology section.

Global Clean Energy recognizes that alternative energy technologies are evolving rapidly and other technologies that are likely to emerge may provide for various applications. These technologies will allow the Company to develop projects over a wider size range and broader scope of potential feedstock.

GCE is focused on 5 key development and plant investment principles:

1. Controlling Feedstock

2. Aggregating waste-to-energy conversion technologies

3. Developing alternative fuels with F-500 EPC and O & M companies

4. Providing development capital utilizing EPC backed technologies with performance guarantees

5. Generating high IRR

System Description

Global Clean Energy plans to use proven, commercialized best available technology worldwide to convert waste into high value energy

|

1.

|

Systems break down carbon-based materials by applying extreme temperatures in an oxygen-starved environment. High temperatures in an oxygen starved environment allow gasification (pyrolysis) systems to significantly reduce harmful emissions compared to either incineration or landfills.

|

|

2.

|

Gasification has been used to generate energy for over a century and is cleaner and more efficient than traditional "burn" or combustion processes. There are gasification plants worldwide generating clean energy in 26 countries.

|

|

3.

|

Pyrolysis systems are scalable and can process as little as 25 tons per day.

|

|

4.

|

Other systems available to the Company include Anaerobic Digestion for organic waste in the agricultural sector and Plasma Arc Systems for super high heating, destruction and recovery for non-homogenous waste, E-Waste and PGM rhodium, palladium and platinum.

|

|

5.

|

Modular systems install inside the fence with technology guarantees in place.

|

Marketing Plan

GCE will focus on projects for industrial facilities where high value after life secure feedstock supplies can be converted into high value off takes to generate a high Internal Rate of Return for the company. GCE plans to operate one-stop, full-service, third-party source for generating on-site Syngas, low sulfur fuels, and/or ethanol in the waste to fuels markets, and Platinum, rhodium and palladium in the PGM commodity markets right through to refining.

Target Clients

GCE will target industries such as the automotive, chemical, plastic, paper and tire industries, all of which have substantial demand for GCE off takes for internal power or fuel needs or repurposing byproducts back into industry as is the case auto and truck catalyst and carbon markets.

Priority will be given to those companies that are in a position to enter into both feedstock supply and energy off-take agreements either on a fixed-price or toll-processing basis. In this way, GCE will insulate itself from feedstock and energy market price fluctuations for its first plants.

Due to the fact that GCE will be depending primarily on the security of the long-term feedstock supply and energy off-take agreements, it will give priority to companies with strong balance sheets and good out-year prospects. It is currently intended that companies with less secure business prospects will generally be served only if they can post performance bonds or provide other assurances that minimize the risks of their non-performance.

Employees

The Company at present has 8 full time employees, 20 consultants engaged on a project basis and an operations network built by the Company throughout North America.

Corporate History

Global Clean Energy, Inc., a Maryland corporation, was incorporated on November 8, 2007. GCE is successor to Newsearch, Inc. (“Newsearch”), a Colorado corporation, which was incorporated on December 3, 1999. Newsearch was dormant until August 20, 2002, when it acquired Panache, Inc. (“Panache”), a Colorado corporation, and Panache became a wholly-owned subsidiary of Newsearch. Panache ceased operations in June 2004, when it determined that its business plan could not be executed due to a lack of operating capital and prospects for raising adequate funding, and was dissolved in January 2005. Newsearch was dormant from July 2004 through July 2006 when it began operating in furtherance of its current business plan.

On November 13, 2007, Newsearch was reincorporated in the State of Maryland and, at the same time, changed its name to Global Clean Energy, Inc.

Internet Web Site

www.globalcleanenergy.net

RISK FACTORS

If any of the following risks actually occur, our business could be harmed.

We have an immediate need for capital and this capital could significantly dilute shareholders or otherwise expose us to creditor risk

Currently, we do not have any financing arrangements in place. We need to raise additional capital through the issuance of equity and/or debt to provide financing to execute our long-term strategic plan. Our ability to obtain additional funding will be subject to a number of factors, including market conditions, our operating performance and investor sentiment. These factors may make the timing, amount, terms and conditions of additional funding unattractive.

If we issue additional equity securities, our existing stockholders may experience dilution or be subordinated to any rights, preferences or privileges granted to the new equity holders. If we raise additional financing through the issuance of equity or equity-related, those securities may have rights, preferences or privileges senior to those of the rights of our common stock and our stockholders may experience dilution of their ownership interests. Similarly, the incurrence of additional debt would increase our interest expense and other debt service obligations and could result in the imposition of covenants that restrict our operational and financial flexibility. If financing is not available or obtainable within the next six months, our ability to meet our financial obligations and pursue our plan of operation will be substantially limited and investors may lose a substantial portion or all of their investment.

Pyrolytic Steam Reforming (“PSR”) technology may not gain broad commercial acceptance.

Commercial applications of PSR technology are at an early stage of development, and the extent to which PSR power generation will be commercially viable is uncertain. Many factors may affect the commercial acceptance of PSR technology, including the following:

|

·

|

performance, reliability and cost-effectiveness of PSR technology compared to conventional and other alternative energy sources and products;

|

|

·

|

developments relating to other alternative energy generation technologies;

|

|

·

|

fluctuations in economic and market conditions that affect the cost or viability of conventional and alternative energy sources, such as increases or decreases in the prices of oil and other fossil fuels;

|

|

·

|

overall growth in the alternative energy equipment market;

|

|

·

|

availability and terms of government subsidies and incentives to support the development of alternative energy sources, including PSR;

|

|

·

|

fluctuations in capital expenditures by utilities and independent power producers, which tend to decrease when the economy slows and interest rates increase; and

|

|

·

|

the development of new and profitable applications requiring the type of energy supply provided by our autonomous PSR systems.

|

If PSR technology does not gain broad commercial acceptance, our business will be materially harmed and we may need to curtail or cease operations.

If sufficient demand for our BOO on-site alternative energy plants does not develop or takes longer to develop than we anticipate, our revenues may decline, and we may be unable to achieve and then sustain profitability.

Our facilities might not be commercially viable even if gasification technologies gain commercial acceptance.

Even if PSR technology achieves broad commercial acceptance, our BOO plants may not prove to be commercially viable for generating electricity from low-cost sources of feedstock. We expect to invest a significant portion of our time and financial resources in the development of our BOO plants. As we begin to market, sell and construct our BOO plants, unforeseen hurdles may be encountered that would limit the commercial viability of our BOO plants, including unanticipated construction, operating, maintenance and other costs. Our target customers and we may also encounter technical obstacles to construction, constructing and maintaining BOO plants with sufficient capacity to generate competitively-priced alternative fuels.

If demand for our BOO plants fails to develop sufficiently, we may be unable to grow our business or generate sufficient revenues to achieve and then sustain profitability

.

Demand for BOO plants in our presently targeted markets may not develop or may develop to a lesser extent than we anticipate. If we are not successful in commercializing our BOO plants, or are significantly delayed in doing so, our business, financial condition and results of operations could be adversely affected.

Our targeted markets are highly competitive. We expect to compete with other alternative energy companies and may have to compete with larger companies that enter into the alternative energy business.

The Alternative Energy and PGM Recovery industry, particularly in North America, is highly competitive and continually evolving as participants strive to distinguish themselves and compete with the larger electric power industry. Competition in the renewable energy industry is likely to continue to increase with the advent of dozens of new alternative energy technologies. If we are not successful in constructing systems that generate competitively priced alternative fuels, we will not be able to respond effectively to competitive pressures from other alternative energy technologies.

Moreover, the success of alternative energy generation technologies may cause larger electric utility and other energy companies with substantial financial resources to enter into the alternative energy industry. These companies, due to their greater capital resources and substantial technical expertise, may be better positioned to develop new technologies. Our inability to respond effectively to such competition could adversely affect our business, financial condition and results of operations.

The Company’s competition in the PGM recovery industry are the likes of Techemet, Johnson Matthey and BASF. For pyrolysis GCE will be competing against companies such as Enerkem Inc and Kleanindustries.

We may be unable to manage the expansion of our operations effectively.

We intend to expand our business significantly. However, to date the scope of our operations has been limited, and we do not have experience operating on the scale that we believe will be necessary to achieve profitable operations. Our current personnel, facilities, systems and internal procedures and controls are not adequate to support our anticipated future growth. We plan to add sales, marketing and engineering offices in additional locations throughout North America.

To manage the expansion of our operations, we will be required to improve our operational and financial systems, procedures and controls, increase our construction operating capacity and expand, train and manage our employee base, which must increase significantly if we are to fulfill our current construction, operation and growth plans. Our management will also be required to maintain and expand our relationships with customers, suppliers and other third parties, as well as attract new customers and suppliers. If we do not meet these challenges, we may be unable to take advantage of market opportunities, execute our business strategies or respond to competitive pressures.

We may be unable to successfully negotiate and enter into operations and maintenance contracts with potential customers.

An important element of our business strategy is to maximize our revenue opportunities with any potential future customers by seeking to enter into operations and maintenance contracts with them under which we would be paid fees for operating and maintaining the BOO plants that they have purchased from us. Even if customers purchase our BOO plants, they may not enter into operations and maintenance contracts with us. Even if we successfully negotiate and enter into such operations and maintenance contracts, our customers may terminate them prematurely or they may not be profitable for a variety of reasons, including the presence of unforeseen hurdles or costs. In addition, our inability to perform adequately under such operations and maintenance contracts could impair our efforts to successfully market the BOO plants. Any one of these outcomes could have a material adverse effect on our business, financial condition and results of operations.

Problems with the quality or performance of our BOO plants could adversely affect our business, financial condition and results of operations.

We anticipate that our agreements with customers will generally include guarantees with respect to the quality and performance of our BOO plants. Because of the limited operating history of our BOO plants, we will be required to make assumptions regarding the durability, reliability and performance of the systems, and we cannot predict whether and to what extent we may be required to perform under the guarantees that we expect to give our customers. Our assumptions could prove to be materially different from the actual performance of our BOO plants, causing us to incur substantial expense to repair or replace defective systems in the future. We will bear the risk of claims long after we have sold our BOO plants and recognized revenue. Moreover, any widespread technology failures could adversely affect our business, financial condition and results of operations.

Currency translation and transaction risk may adversely affect our business, financial condition and results of operations.

Although our reporting currency is the US dollar, we expect to conduct our business and incur costs in the local currency of most countries in which we operate. As a result, we will be subject to currency translation risk. We expect a large percentage of our revenues to be generated outside the United States and denominated in foreign currencies in the future. Changes in exchange rates between foreign currencies and the US dollar could affect our revenues and cost of revenues, and could result in exchange losses. We cannot accurately predict the impact of future exchange rate fluctuations on our results of operations.

We may not be able to continue as a going concern.

The Company’s financial statements have been prepared assuming that it will continue as a going concern. Such assumption contemplates the realization of assets and satisfaction of liabilities in the normal course of business. However, we have incurred continued losses, have a net working capital deficiency, and have an accumulated deficit of $10,820,002 as of December 31, 2013. These factors among others create a substantial doubt about our ability to continue as a going concern. The Company is dependent upon sufficient future revenues, additional sales of our securities or obtaining debt financing in order to meet our operating cash requirements. Barring the Company’s generation of revenues in excess of its costs and expenses or its obtaining additional funds from equity or debt financing, or receipt of significant licensing prepayments, the Company will not have sufficient cash to continue to fund the operations of the Company through June 30, 2014. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Although we are actively pursuing financing opportunities, we may not be able to raise cash on terms acceptable to us or at all. There can be no assurance that we will be successful in obtaining additional funding. Financings, if available, may be on terms that are dilutive to our shareholders, and the prices at which new investors would be willing to purchase our securities may be lower than the current price of our ordinary shares. If additional financing is not available or is not available on acceptable terms, we will have to curtail our operations in the short term.

Our business uses non-exclusive licensed technology, which may be difficult to protect and may infringe on the intellectual property rights of third parties.

It is possible that we may need to acquire other licenses to, or to contest the validity of, issued or pending patents or claims of third parties. We cannot assure you that any license would be made available to us on acceptable terms, if at all, or that we would prevail in any such contest. In addition, we could incur substantial costs in defending ourselves in suits brought against us for alleged infringement of another party’s patents in bringing patent infringement suits against other parties based on our licensed patents.

In addition to licensed patent protection, we also rely on trade secrets, proprietary know-how and technology that we will seek to protect, in part, by confidentiality agreements with our prospective joint venture partners, employees and consultants. We cannot assure you that these agreements will not be breached, that we will have adequate remedies for any breach, or that our trade secrets and proprietary know-how will not otherwise become known or be independently discovered by others.

Our financial results may fluctuate from quarter to quarter, which may make it difficult to predict our future performance.

Our financial results may fluctuate as a result of a number of factors, many of which are outside of our control. For these reasons, comparing our financial results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our future quarterly and annual expenses as a percentage of our revenues may be significantly different from those we expect for the future. Our financial results in some quarters may fall below expectations. Any of these events could cause our stock price to fall. Each of the risk factors listed in this “Risk Factors” section, including the following factors, may adversely affect our business, financial condition and results of operations:

|

·

|

delays in permitting or acquiring necessary regulatory consents;

|

|

·

|

delays in the timing of contract awards and determinations of work scope;

|

|

·

|

delays in funding for or construction of BOO plants;

|

|

·

|

changes in cost estimates relating to BOO plant completion, which under percentage of completion accounting principles could lead to significant charges to previously recognized revenue or to changes in the timing of our recognition of revenue from those projects;

|

|

·

|

delays in meeting specified contractual milestones or other performance criteria under project contracts or in completing project contracts that could delay the recognition of revenue that would otherwise be earned;

|

|

·

|

reductions in the availability or level of subsidies and incentives for alternative energy sources;

|

|

·

|

decisions made by parties with whom we have commercial relationships not to proceed with anticipated projects;

|

|

·

|

increases in the length of our sales cycle; and

|

|

·

|

reductions in the efficiency of our construction and/or operations processes.

|

If prices for alternative energy or fuels drop significantly, we will also be forced to reduce our prices, which potentially may lead to losses.

Prices for alternative energy or fuels can vary significantly over time and decreases in price levels could adversely affect our profitability and viability. We cannot assure you that we will be able to sell any alternative energy or fuels we produce.

Price increases or interruptions in needed energy supplies could cause loss of customers and impair our profitability.

Production of alternative fuel sources requires a constant and consistent supply of energy. If there is any interruption in our supply of energy for whatever reason, such as availability, delivery or mechanical problems, we may be required to halt any production we may have. If we halt production for any extended period of time, it will have a material adverse effect on our business. Natural gas and electricity prices have historically fluctuated significantly. We expect to purchase significant amounts of these resources as part of our pyrolysis process. Increases in the price of natural gas or electricity would harm our business and financial results by increasing our energy costs.

We may be unable to attract and retain management and other personnel we need to succeed.

Our success depends on the skills, experience and efforts of our senior management and other key development, manufacturing, construction and sales and marketing employees. We cannot be certain that we will be able to attract, retain and motivate such employees. The loss of the services of one or more of these employees could have a material adverse effect on our business. There is a risk that we will not be able to retain or replace these key employees.

In addition, our anticipated growth will require us to hire a significant number of qualified technical, commercial and administrative personnel. The majority of our new hires will be engineers, project managers and operations personnel. There is intense competition from other companies and research and academic institutions for qualified personnel in the areas of our activities. If we cannot continue to attract and retain, on acceptable terms, the qualified personnel necessary for the continued development of our business, we may not be able to sustain our operations or grow at a competitive pace.

The reduction or elimination of government subsidies and economic incentives for alternative energy sources could prevent demand for our BOO plants from developing, which in turn would adversely affect our business, financial condition and results of operations.

Federal, state and local governmental bodies in many countries, most notably the United Kingdom, Canada and the United States, have provided subsidies in the form of tariff subsidies, rebates, tax credits and other incentives to utilities, power generators and distributors using alternative energy. However, these incentives and subsidies generally decline over time, and many incentive and subsidy programs have specific expiration dates. Moreover, because the market for electricity generated from gasification is at an early stage of development, some of the programs may not include gasification as an alternative energy source eligible for the incentives and subsidies.

Currently, the cost of alternative fuels generated from gasification, without the benefit of subsidies or other economic incentives, substantially exceeds the price of alternative fuels from our BOO plants, which are designed to feed alternative fuels to an on-site end-user, depends significantly on the availability and size of government incentives and subsidies for gasification. As alternative energy becomes more of a competitive threat to conventional energy providers, companies active in the conventional energy business may increase their lobbying efforts in order to encourage governments to stop providing subsidies for alternative energy, including gasification. We cannot predict the level of any such efforts, or how governments may react to such efforts. The reduction, elimination or expiration of government incentives and subsidies, or the exclusion of PSR technology from those incentives and subsidies, may result in the diminished competitiveness of gasification relative to conventional and non-gasification alternative sources of energy. Such diminished competitiveness could materially and adversely affect the growth of the gasification industry, which could in turn adversely affect our business, financial condition and results of operations.

Lax enforcement of environmental and energy policy regulations may adversely affect demand for alternative energy.

Our success will depend in part on effective enforcement of existing environmental and energy policy regulations. Many of our potential customers are unlikely to switch from the use of conventional fuels unless compliance with applicable regulatory requirements leads, directly or indirectly, to the use of alternative energy sources. Both additional regulation and enforcement of such regulatory provisions are likely to be vigorously opposed by the entities affected by such requirements. If existing emissions-reducing standards are weakened, or if governments are not active and effective in enforcing such standards, our business and results of operations could be adversely affected. Even if the current trend toward more stringent emissions standards continues, we will depend on the ability of alternative energy sources to satisfy these emissions standards. Certain standards imposed by regulatory programs may limit or preclude the use of our products to comply with environmental or energy requirements. Any decrease in the emission standards or the failure to enforce existing emission standards and other regulations could result in a reduced demand for any alternative energy we produce.

Costs of compliance with burdensome or changing environmental and operational safety regulations could cause our focus to be diverted away from our business and our results of operations to suffer.

The production of many alternative energy fuels still involves the emission of various airborne pollutants, including particulate matter, carbon monoxide, carbon dioxide, nitrous oxide, volatile organic compounds and sulfur dioxide. The production facilities that we will build may discharge water or other matters into the environment. As a result, we are subject to complicated environmental regulations of the countries we are in or the U.S. Environmental Protection Agency and regulations and permitting requirements of the states where our plants are to be located. These regulations are subject to change and such changes may require additional capital expenditures or increased operating costs. Consequently, considerable resources may be required to comply with future environmental regulations. In addition, our BOO plants could be subject to environmental nuisance or related claims by employees, property owners or residents near the plants arising from air or water discharges. Environmental and public nuisance claims, or tort claims based on emissions, or increased environmental compliance costs could significantly increase our operating costs.

Implementation of our planned projects is dependent upon receipt of all necessary regulatory permits and approvals.

Development of power generation is heavily regulated. Each of our planned projects is subject to multiple permitting and approval requirements. In many cases we expect to be dependent on a regional government agency for such permits and approvals. Due to the unique nature of alternative fuels systems, we would expect our projects to receive close scrutiny by permitting agencies, approval authorities and the public, which could result in substantial delay in the permitting process. Successful challenges by any parties opposed to our planned projects could result in conditions limiting the project size or in the denial of necessary permits and approvals.

If we are unable to obtain necessary permits and approvals in connection with any or all of our projects, those projects would not be implemented and our business, financial condition and results of operations would be adversely affected. Further, we cannot assure you that we have been or will be at all times in complete compliance with all such permits and approvals. If we violate or fail to comply with these permits and approvals, we could be fined or otherwise sanctioned by regulators.

Our directors and officers as a group have significant voting power and may take actions that may not be in the best interest of all other stockholders.

Our directors and officers, as a group, control approximately 40% of the Company’s current outstanding shares of common stock. These directors and executive officers may be able to exert significant control over our management and affairs requiring stockholder approval, including approval of significant corporate transactions. This concentration of ownership may expedite approvals of Company decisions, or have the effect of delaying or preventing corporate actions that may be in the best interests of all our stockholders.

Our common stock is traded on the OTC: Pink market and may fluctuate significantly.

Our common stock is currently traded and quoted on the OTC: Pink market. The quotation of our common stock on a securities market or exchange does not assure that a meaningful, consistent and liquid trading market will ever exist. Our stock is a penny stock and there are significant risks.

Stockholders should be aware that, according to the SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. These patterns include:

|

·

|

Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

|

|

·

|

Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

|

|

·

|

“Boiler room” practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons;

|

|

·

|

Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and

|

|

·

|

The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses.

|

Furthermore, the “penny stock” designation may adversely affect the development of any public market for our shares or, if such a market develops, its continuation. Broker-dealers are required to personally determine whether an investment in “penny stock” is suitable for customers.

ITEM

2. FINANCIAL INFORMATION

For the years ended December 31, 2013 and 2012:

During the years ended December 31, 2013 and 2012 we did not earn any revenue. Our net loss for the year ended December 31, 2013 was $3,007,942, an increase of $1,383,759 as compared to the net loss for the year ended December 31, 2012 of $1,624,183. Our ability to use consultants and operate with as little overhead has allowed us to minimize operating losses. Cash used in operations during the year ended December 31, 2013 was $391,154 whereas during the year ended December 31, 2012, there was $27,966 in cash provided by operations. This was primarily due to the utilization of our stock to compensate consultants instead of cash which has reduced our need for cash.

For the three months ended March 31, 2014 and 2013:

During the three months ended March 31, 2014 and 2013 we did not earn any revenue. Our net loss for the three months ended March 31, 2014 was $533,148, a decrease of $148,107 as compared to the net loss for the three months ended March 31, 2013 of $681,255. Our ability to use consultants and operate with as little overhead has allowed us to minimize operating losses. Cash used in operations during the three months ended March 31, 2014 was $362,721 whereas during the three months ended March 31, 2013, there was $90,709 in cash used in operations. This was primarily due to the utilization of our stock to compensate consultants instead of cash which has reduced our need for cash.

Liquidity and Capital Resources

Our cash on hand totaled $4,589 and $122 at March 31, 2014 and December 31, 2013, respectively, and our working capital deficit was $3,028,955 and $2,844,471, respectively. These deficits resulted from ongoing expenses related to implementing our business plan with limited revenues to date. The stockholders’ deficit was $3,028,955 and $2,844,470 at March 31, 2014 and December 31, 2013, respectively.

To date, we have financed our operations through the combination of equity and debt financing, loans from related parties, and the use of shares of our common stock issued as payment for services rendered to us by third parties. In the future we may have to issue shares of our common stock and warrants in private placement transactions to help finance our operations, and to pay for professional services (such as financial consulting, market development, legal services, and public relations services). We do not intend to pay dividends to shareholders in the foreseeable future.

In order for our operations to continue, we will need to generate revenues from our intended operations sufficient to meet our anticipated cost structure. We may encounter difficulties in establishing these operations due to the time frame of developing, constructing and ultimately operating the planned BOO plants and bio-refinery projects.

To ensure sufficient funds to meet our future needs for capital, we will from time to time, evaluate opportunities to generate financing through some combination of the private sale of equity, or issuance of convertible debt securities. However, future equity or debt financing may not be available to us at all, or if available, may not be on terms acceptable to us. We have estimated our operating expenses for the period from April 2014 to December 2014 will approximate roughly $1,400,000.

If we do not raise additional capital, or we are unable to obtain additional financing, or begin to generate revenues from our intended operations, we may have to scale back or postpone the preliminary engineering design and permitting for our initial facility until such financing is available.

Critical Accounting Policies and Estimates

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reporting amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the periods. Management makes these estimates using the best information available at the time the estimates are made; however, actual results could differ materially from these estimates.

Cash and Cash Equivalents

The Company minimizes its credit risk associated with cash by periodically evaluating the credit quality of its primary financial institution. The balance at times may exceed federally insured limits. The Company has not experienced any losses on such accounts. The Company had no cash equivalents at March 31, 2014 or December 31, 2013.

Fair Value of Financial Instruments

The Company adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 820 on January 1, 2011. Under this standard, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). The standard outlines a valuation framework and creates a fair value hierarchy in order to increase the consistency and comparability of fair value measurements and the related disclosures. Under GAAP, certain assets and liabilities must be measured at fair value, and FASB ASC 820-10-50 details the disclosures that are required for items measured at fair value.

Income Taxes

In assessing the realization of deferred tax assets, the Company considers whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. The Company considers the scheduled reversal of deferred tax liabilities, projected future taxable income, and tax planning strategies in making this assessment. Based on the level of historical operating results and the uncertainty of the economic conditions, the Company has recorded a full valuation allowance against its deferred tax assets at March 31, 2014 and December 31, 2013 where it cannot conclude that it is more likely than not that those assets will be realized.

Revenue Recognition

The Company’s business is to recover and reform environmental salvage into clean usable energy. When a contract is signed to perform services the Company will develop a recovery plan which the customer reviews. Once the final plan is accepted the Company will complete the order, according to the completed plan. At the completion of each phase of the plan, an invoice is prepared itemizing the portions completed. The invoice is entered into our accounting system and is recognized as revenue at that time. Our invoices are paid by the customer within 30 days of receipt.

As described above, in accordance with the requirements of ASC 605-10-599, the Company recognizes revenue when (1) persuasive evidence of an arrangement exists (contracts); (2) delivery has occurred; (3) the seller’s price is fixed or determinable (per the customer’s contract); and (4) collectability is reasonably assured.

Beneficial Conversion Features

From time to time, the Company may issue convertible notes that contain an imbedded beneficial conversion feature. A beneficial conversion feature exists on the date a convertible note is issued when the fair value of the underlying common stock to which the note is convertible into is in excess of the remaining unallocated proceeds of the note after first considering the allocation of a portion of the note proceeds to the fair value of warrants, if related warrants have been granted. The intrinsic value of the beneficial conversion feature is recorded as a debt discount with a corresponding amount to additional paid in capital. The debt discount is amortized to interest expense over the life of the note using the effective interest method.

Stock-Based Compensation

Global Clean Energy accounts for stock-based compensation in accordance with ASC 718. Under the fair value recognition provisions of this statement, stock-based compensation cost is measured at the grant date based on the fair value of the award and is recognized as expense on a straight-line basis over the requisite service period, which is the vesting period. The Company elected the modified-prospective method, under which prior periods are not revised for comparative purposes. The valuation provisions of ASC 718 apply to new grants and to grants that were outstanding as of the effective date and subsequently modified.

During the three months ended March 31, 2014 and 2013, there were no stock options granted or outstanding.

Comprehensive Income

ASC 220-10-45-10A establishes requirements for inclusion of foreign currency translation adjustments in the disclosure of comprehensive income (loss). During the three months ended March 31, 2014 and 2013, the Company reported foreign currency translation adjustments of $276,798 and $46,275, respectively, as part of other comprehensive income (loss), due to the Canadian dollar being the functional currency, but the American dollar being the reporting currency.

Comprehensive income (loss) is defined as the change in equity during a period from transactions and other events and circumstances from non-owner sources. The Company is required to record all components of comprehensive income (loss) in the financial statements in the period in which they are recognized. Net income (loss) and other comprehensive income (loss), including foreign currency translation adjustments and unrealized gains and losses on investments, are reported, net of their related tax effect, to arrive at comprehensive income (loss).

Basic and Diluted Net Earnings (Loss) per Share

Basic net earnings (loss) per common share is computed by dividing net earnings (loss) applicable to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted net earnings (loss) per common share is determined using the weighted-average number of common shares outstanding during the period, adjusted for the dilutive effect of common stock equivalents, consisting of shares that might be issued upon exercise of common stock options. In periods where losses are reported, the weighted-average number of common shares outstanding excludes common stock equivalents, because their inclusion would be anti-dilutive. There were no outstanding potential common stock equivalents for the periods presented. As such, basic and diluted earnings per share resulted in the same figures for the three months ended March 31, 2014 and 2013.

Recently Issued Accounting Pronouncements

In June 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-10, “Development Stage Entities”. The amendments in this update remove the definition of a development stage entity from the Master Glossary of the ASC thereby removing the financial reporting distinction between development stage entities and other reporting entities from U.S. GAAP. In addition, the amendments eliminate the requirements for development stage entities to (1) present inception-to-date information in the statements of income, cash flows, and shareholder equity, (2) label the financial statements as those of a development stage entity, (3) disclose a description of the development stage activities in which the entity is engaged, and (4) disclose in the first year in which the entity is no longer a development stage entity that in prior years it had been in the development stage. The amendments in this update are applied retrospectively. The adoption of ASU 2014-10 removed the development stage entity financial reporting requirements from the Company.

In July 2013, the FASB issued ASU No. 2013-11: Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carry forward, a Similar Tax Loss, or a Tax Credit Carry forward Exists. The new guidance requires that unrecognized tax benefits be presented on a net basis with the deferred tax assets for such carry forwards. This new guidance is effective for fiscal years and interim periods within those years beginning after December 15, 2013. We do not expect the adoption of the new provisions to have a material impact on our financial condition or results of operations.

In February 2013, FASB issued ASU No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income, to improve the transparency of reporting these reclassifications. Other comprehensive income includes gains and losses that are initially excluded from net income for an accounting period. Those gains and losses are later reclassified out of accumulated other comprehensive income into net income. The amendments in the ASU do not change the current requirements for reporting net income or other comprehensive income in financial statements. All of the information that this ASU requires already is required to be disclosed elsewhere in the financial statements under U.S. GAAP. The new amendments will require an organization to:

|

·

|

Present (either on the face of the statement where net income is presented or in the notes) the effects on the line items of net income of significant amounts reclassified out of accumulated other comprehensive income - but only if the item reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting period; and

|

|

·

|

Cross-reference to other disclosures currently required under U.S. GAAP for other reclassification items (that are not required under U.S. GAAP) to be reclassified directly to net income in their entirety in the same reporting period. This would be the case when a portion of the amount reclassified out of accumulated other comprehensive income is initially transferred to a balance sheet account (e.g., inventory for pension-related amounts) instead of directly to income or expense.

|

The amendments apply to all public and private companies that report items of other comprehensive income. Public companies are required to comply with these amendments for all reporting periods (interim and annual). The amendments are effective for reporting periods beginning after December 15, 2012, for public companies. Early adoption is permitted. The adoption of ASU No. 2013-02 did not have a material impact on our financial position or results of operations.

In January 2013, the FASB issued ASU No. 2013-01, Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities, which clarifies which instruments and transactions are subject to the offsetting disclosure requirements originally established by ASU 2011-11. The new ASU addresses preparer concerns that the scope of the disclosure requirements under ASU 2011-11 was overly broad and imposed unintended costs that were not commensurate with estimated benefits to financial statement users. In choosing to narrow the scope of the offsetting disclosures, the Board determined that it could make them more operable and cost effective for preparers while still giving financial statement users sufficient information to analyze the most significant presentation differences between financial statements prepared in accordance with U.S. GAAP and those prepared under IFRSs. Like ASU 2011-11, the amendments in this update will be effective for fiscal periods beginning on, or after January 1, 2013. The adoption of ASU 2013-01 did not have a material impact on our financial position or results of operations.

In October 2012, the FASB issued ASU 2012-04, “Technical Corrections and Improvements” in Accounting Standards Update No. 2012-04. The amendments in this update cover a wide range of Topics in the Accounting Standards Codification. These amendments include technical corrections and improvements to the Accounting Standards Codification and conforming amendments related to fair value measurements. The amendments in this update will be effective for fiscal periods beginning after December 15, 2012. The adoption of ASU 2012-04 did not have a material impact on our financial position or results of operations.

In August 2012, the FASB issued ASU 2012-03, “Technical Amendments and Corrections to SEC Sections: Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin (SAB) No. 114, Technical Amendments Pursuant to SEC Release No. 33-9250, and Corrections Related to FASB Accounting Standards Update 2010-22 (SEC Update)” in Accounting Standards Update No. 2012-03. This update amends various SEC paragraphs pursuant to the issuance of SAB No. 114. The adoption of ASU 2012-03 did not have a material impact on our financial position or results of operations.

In July 2012, the FASB issued ASU 2012-02, “Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment” in Accounting Standards Update No. 2012-02. This update amends ASU 2011-08, Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment and permits an entity first to assess qualitative factors to determine whether it is more likely than not that an indefinite-lived intangible asset is impaired as a basis for determining whether it is necessary to perform the quantitative impairment test in accordance with Subtopic 350-30, Intangibles - Goodwill and Other - General Intangibles Other than Goodwill. The amendments are effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012. Early adoption is permitted, including for annual and interim impairment tests performed as of a date before July 27, 2012, if a public entity’s financial statements for the most recent annual or interim period have not yet been issued or, for nonpublic entities, have not yet been made available for issuance. The adoption of ASU 2012-02 did not have a material impact on our financial position or results of operations.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Our principal executive offices are situated at 6040 Upshaw Dr. #105, Humble, Texas 77396. The space is being sublet from Houston Industrial Materials which is owned by our Chairman, Gerald Enloe. This space is temporary until actual space needs for the Texas office are determined.

Our Company’s operational offices are at 4150 St Catherine Street West, Suite 525, Montreal, Quebec H3Z 2Y5. The space is being sublet from Kenneth Adessky, Attorneys. Mr. Adessky is a director and acts as our CFO.

We believe our existing facilities are adequate to meet our current needs and we can renew our existing subleases or obtain alternative space on terms that would not have a material impact on our financial results.

ITEM

4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of July 7, 2014, the stock ownership of (i) each of our named executive officers and directors, (ii) all executive officers and directors as a group, and (iii) each person known by us to be a beneficial owner of 5% or more of our common stock. No person listed below has any option, warrant or other right to acquire additional securities from us, except as may be otherwise noted. We believe that all persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them except as stated therein.

|

Name and Address

|

|

Amount & Nature

|

|

|

|

|

|

of Beneficial

|

|

of Beneficial

|

|

|

Percent

|

|

|

Owner (1)

|

|

Ownership

|

|

|

of Class (2)

|

|

|

|

|

|

Kenneth Adessky

4150 Sainte-Catherine Street W.

Suite 525

Montreal, Quebec H3Z 2Y5

|

|

|

55,087,500

|

|

|

|

22.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Dr. Earl Azimov

5737 Blossom

Cote St Luc, Quebec H4W 2T2

|

|

|

54,500,000

|

|

|

|

22.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Gerald Enloe

7777 Plum Grove Road

Cleveland, Texas 77371

|

|

|

103,920

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paul Whitton

2415 Shakespeare #3

Houston, Texas 77936

|

|

|

50,000

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Brian Levine

134 Tobago.

Dollard des Ormeaux, Quebec H9G 2X5

|

|

|

13,400,000

|

|

|

|

5.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Steven Mann

10720 New Berd

Las Vegas, NV 89144

|

|

|

13,400,000

|

|

|

|

5.5

|

%

|

|

|

|

|

|

|

|

|

|

|

** All officers and directors

as a group (6 persons)

|

|

|

136,541,400

|

|

|

|

56.43

|

%

|

*Less than 1%.

|

(1)

|

Beneficial ownership is determined in accordance with the Rule 13d-3(a) of the Securities Exchange Act of 1934, as amended, and generally includes voting or investment power with respect to securities. Except as subject to community property laws, where applicable, the person named above has sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by him.

|

|

(2)

|

The beneficial ownership percent in the table is calculated with respect to the number of outstanding shares 241,968,911 of the Company’s common stock as of December 31, 2013, and each stockholder’s ownership is calculated as the number of shares of common stock owned plus the number of shares of common stock into which any preferred stock, warrants, options or other convertible securities owned by that stockholder can be converted within 60 days.

|

Beneficial Ownership Reporting Compliance

No parties except for our President and Principal Financial officer own more than ten percent (10%) of the Company’s common stock.

ITEM

5. DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the names, ages, years elected and principal offices and positions of our current directors and executive officers as of June 10, 2014

|

Name

|

|

Age

|

|

Position(s) with the Company

|

|

|

|

|

|

|

|

Gerald Enloe

|

|

65

|

|

Chairman of the Board, Director

|

|

|

|

|

|

|

|

Earl Azimov

|

|

52

|

|

President, Chief Executive Officer and Director

|

|

|

|

|

|

|

|

Kenneth Adessky

|

|

50

|

|

Chief Financial Officer, Secretary and Director

|

|

|

|

|

|

|

|

Paul Whitton

|

|

67

|

|

Director

|

|

|

|

|

|

|

|

Brian Levine

|

|

53

|

|

Chief Operating Officer,

|

|

|

|

|

|

|

|

Steven Mann

|

|

56

|

|

Chief Development Officer,

|

Gerald Enloe:

Mr. Enloe has served as a director and as Chairman of the Board since April 30, 2009. Since 1991, Mr. Enloe has served as President and CEO of Houston Industrial Materials, Inc., a construction materials supplier. He has 25 years of experience in the environmental remediation business. He has also served as Chairman and a Director of Element 21 Golf, Inc. from 2002-2006.

Dr. Earl Azimov:

Dr. Azimov has served as a Director and Chairman of our Board since August 2006. Mr. Azimov has served as Chief Executive Officer and President since 2009. Dr. Azimov is currently the Chief Executive Officer of Miazzi Ventures Inc., a merchant bank that he co-founded that has assumed leadership roles in early stage companies since 1996, including Mamma.com, which was sold in 1999 for an eight-figure valuation. In addition, from 2003-2007, Dr. Azimov was the co-founder and Director of GospelCity.Com, Inc., a world leader of on-line faith-based gospel entertainment. From 1992 through 1995, Dr. Azimov was the President of Zellers Optical Centers, a company he co-founded that employed over 70 optometrists and 200 support personnel that was later sold to National Vision Associates of Atlanta, who operate the Wal-Mart Vision Centers. Dr. Azimov brings 20 years of private equity experience, focusing on seed capital investments in startup companies. He has a Bachelor of Science from the University of South Carolina and a Doctorate of Optometry from the University of Montreal — School of Optometry, in Montreal, Quebec, Canada.

Kenneth Adessky:

Mr. Adessky has been our Chief Financial Officer, Secretary and a Director since August 2006. Mr. Adessky is currently a Senior Partner of Adessky Lesage, a corporate commercial law firm located in Montreal, Canada that he co-founded in 1995. As a Senior Partner, Mr. Adessky focuses his legal practice on private and public financings, mergers and acquisitions and public offerings of small capital public companies. Over the past decade, Mr. Adessky has completed in excess of $100 million dollars of financing. Mr. Adessky received his Bachelor of Civil Law from McGill University in Montreal, Quebec, Canada in 1990.

Paul Whitton:

Mr. Whitton currently serves as our Vice-President, and he has served as a Director since June 2007. Since 1998, Mr. Whitton has been the owner of JK, Inc., an environmental consulting company based in Houston, Texas. Mr. Whitton holds numerous patents relating to industrial environmental quality and is a nationally recognized speaker on abatement. Prior to 1988, he spent 22 years with Brown & Root Construction Company where he was an area superintendent for construction and maintenance of oil and gas refineries, nuclear power plants, and paper mills throughout the world but primarily the Mideast and United Kingdom. He was also a construction supervisor with Boeing Air and in the United States Navy for four years. Mr. Whitton brings industrial plant management and construction experience as well as his environmental expertise to the Company.

Brian Levine

: Mr. Levine joined GCE as its Chief Operating on December 1, 2012. Mr. Levine’s last five years were spent in the wind energy industry where he was responsible for global marketing and new application development. He is recognized for pioneering and developing new wind energy recovery platforms F.A.R. (forced air recovery based on the constant flow for in the air handling and evaporative cooling equipment) that is revolutionizing the industry. Brian has a diverse background in manufacturing, private equity, global marketing, media and M&A. Levine maintains regular deal flow in renewable technologies, focus on wind, bio fuels, diesel reduction and hybrid charging and technology incubators.

Mr. Steven Mann

:

Mr. Mann

joined GCE as its Chief Development on April 1, 2013. Mr. Mann has a background in operating and manufacturing the fourth largest cabinet company in North America. Mr. Mann was instrumental in growing the company and selling it to a private equity firm. Mr. Mann

gives GCE the added oversight for current and future projects to allow GCE to fully vet and evaluate site feasibility studies, to design sites and systems and to aggregate property owners, manufacturers, installation companies, and O&M’s to build, own and operate waste to energy sites that are scalable and repeatabl

e.

ITEM

6. EXECUTIVE COMPENSATION

Summary Compensation Table

The following Summary Compensation Table sets forth, for the years indicated, all cash compensation paid, distributed or accrued for services, including salary and bonus amounts, rendered in all capacities by our Executive Officers. No other executive officer or other employee received or is entitled to receive remuneration in excess of $100,000 during the stated periods.

|

Name and Principal

|

|

Year

|

|

Salary (1)

|

|

|

Option Grants

|

|

|

All Other

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earl Azimov, Chief Executive Officer

|

|

2012

|

|

$

|

120,000

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

120,000

|

|

|

|

|

2013

|

|

$

|

180,000

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

180,000

|

|

|

Kenneth Adessky, Chief Financial Officer

|

|

2012

|

|

$

|

120,000

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

120,000

|

|

|

|

|

2013

|

|

$

|

180,000

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

180,000

|

|

|

Brian Levine, Chief Operating Officer

|

|

2013

|

|

$

|

120,000

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

120,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steven Mann, Chief Development Officer

|

|

2013

|

|

$

|

120,000

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

120,000

|

|

_____________

(1) Salary consists of compensation fees.

Employment Agreements

We do not have employment agreements with any of our executive officers or directors. We have verbal understandings with our executive officers regarding monthly retainers and reimbursement for actual out-of-pocket expenses.

Termination of Employment

There are no compensatory plans or arrangements, including payments to be received from the Company, with respect to any person named in the Summary Compensation Table set forth above that would in any way result in payments to any such person because of his or her resignation, retirement or other termination of such person’s employment with us.

ITEM

7.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Related Party Transaction Procedures.

The Board reviews and approves all transactions between us and any director or executive officer that will, or is reasonably likely to require disclosure under the SEC’s rules. In determining whether to approve any transaction with any of our directors or executive officers, the Board will consider the following factors, among others, to the extent relevant to the transaction:

|

·

|

whether the terms of the transaction are fair to us and on the same basis as would apply if the transaction did not involve a related person;

|

|

·

|

whether there are business reasons for us to enter into the transaction;

|

|

·

|

whether the transaction would impair the independence of an outside director; and

|

|

·

|

whether the transaction would present an improper conflict of interest for a director or executive officer, taking into consideration such factors as the Board deems relevant, such as the size of the transaction, the overall financial position of the individual, the direct or indirect nature of the individual’s interest in the transaction and the ongoing nature of any proposed relationship.

|

Related Party Transactions

.

Promissory Notes – Related Party

On August 15, 2008, the Company obtained an $80,000 loan from Vision Capital Partners (a related party) due in one year, bearing interest at 7.5% per year. Accrued interest at March 31, 2014 and December 31, 2013 was $32,408 and $32,032, respectively. Currently in default.

On May 1, 2013, the Company obtained a $15,000 loan, in Canadian dollars, from Ken Adessky due in one year, bearing interest at 7.5% per year. Accrued interest at March 31, 2014 and December 31, 2013 was $932 and $701, respectively.

Rent Payable

The Company has signed a lease commitment with Ken Adessky (a related party), on a month-to-month basis, for office space payable monthly at a rate of $5,000; the amount of rent payable on the lease was $354,960 and $351,540 as of March 31, 2014 and December 31, 2013, respectively.

Common Stock

On August 15, 2012, Ken Adessky (a related party) converted $50,000 of accrued compensation into 10,000,000 shares of common stock, valued at $600,000 based on the closing market price on the date of grant. As the value of the common stock granted exceeds the value of the liabilities relieved, a loss on conversion of $550,000 was recognized.

On August 15, 2012, Earl Azimov (a related party) converted $50,000 of accrued compensation into 10,000,000 shares of common stock, valued at $600,000 based on the market price on the date of grant. As the value of the common stock granted exceeds the value of the liabilities relieved, a loss on conversion of $550,000 was recognized.

On February 12, 2013, Ken Adessky (a related party) converted $50,000 of accrued compensation into 9,600,000 shares of common stock, valued at $270,720 based on the closing market price on the date of grant. As the value of the common stock granted exceeds the value of the liabilities relieved, a loss on conversion of $150,720 was recognized.

On February 12, 2013, Earl Azimov (a related party) converted $50,000 of accrued compensation into 9,600,000 shares of common stock, valued at $270,720 based on the closing market price on the date of grant. As the value of the common stock granted exceeds the value of the liabilities relieved, a loss on conversion of $150,720 was recognized.

On June 10, 2013, Ken Adessky and Earl Azimov converted $50,000 of accrued compensation each into 6,250,000 shares of common stock each, the total of the two grants was valued at $262,500 based on the closing market price on the date of grant. As the value of the common stock granted exceeds the value of the liabilities relieved, a loss on conversion of $162,500 was recognized.

On August 19, 2013, Ken Adessky (a related party) converted $60,000 of accrued compensation into 4,800,000 shares of common stock, valued at $86,400 based on the closing market price on the date of grant. As the value of the common stock granted exceeds the value of the liabilities relieved, a loss on conversion of $26,400 was recognized.

On August 19, 2013, Earl Azimov (a related party) converted $60,000 of accrued compensation into 4,800,000 shares of common stock, valued at $86,400 based on the closing market price on the date of grant. As the value of the common stock granted exceeds the value of the liabilities relieved, a loss on conversion of $26,400 was recognized.

Consulting Agreements

On January 2, 2013, the Company agreed to engage Kenneth Adessky and Earl Azimov as consultants earning the monthly amounts of $18,000 and $18,000, respectively for their services rendered each month until further changed or repealed.

Director Independence

Our current directors are Gerald Enloe, Dr. Earl Azimov, Paul Whitton, and Kenneth Adessky. We are not currently subject to corporate governance standards defining the independence of our directors. We have not yet adopted an independence standard or policy, although we intend to do so in the near future. Accordingly, the Company’s Board currently determines the independence of each Director and nominee for election as a Director. The Board has determined that none of the Company’s directors currently qualifies as an independent director.

Family Relationships

There are no family relationships among our officers and directors.

ITEM

8. LEGAL PROCEEDINGS

We currently have no legal proceedings pending nor have any legal proceeding been threatened against us or any of our officers, directors or control persons of which we are aware.

Involvement in Certain Legal Proceedings

None of our directors or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates that are required to be disclosed pursuant to the rules and regulations of the SEC. None of the directors or executive officers to our knowledge has been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, or has been a party to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws, except for matters that were dismissed without sanction or settlement.

ITEM

9. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS MARKET INFORMATION

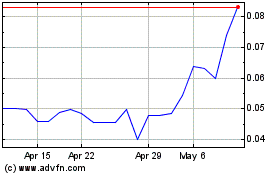

The Company’s common stock began trading on the OTC Bulletin Board (“OTCBB”) on October 3, 2008 under the trading symbol “GCEI”.

The following table shows the high and low bid prices of our common stock by quarter since January 1, 2012 and for each quarter thereafter through December 31, 2013. These quotes reflect inter-dealer prices, without retail markup, markdown or commissions and may not represent actual transactions.

|