UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): 06/30/2014

UMB FINANCIAL CORP

(Exact name of registrant as specified in its charter)

Commission File Number: 0-4887

|

MO

|

|

43-0903811

|

|

(State or other jurisdiction of

|

|

(IRS Employer

|

|

incorporation)

|

|

Identification No.)

|

1010 Grand Blvd, Kansas City, MO 64106

(Address of principal executive offices, including zip code)

(816) 860-7000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement

On June 30, 2014, UMB Financial Corporation (the "Company") and two of the Company's subsidiaries, Prairie Capital Management, LLC ("PCM") and UMB Merchant Banc, LLC, entered into a Settlement Agreement and Release (the "Settlement Agreement") with P-Cap Holdings LLC ("P-Cap"), P-Gen, LLC, Brian N. Kaufman, Robyn R. Schneider, Curtis A. Krizek, George K. Baum Holdings, Inc., and the Plan Committee to resolve disputes arising under the Asset Purchase Agreement dated as of June 27, 2010 (the "Asset Purchase Agreement"). The Settlement Agreement (i) includes a compromise and settlement of the disputes relating to the calculation of the earn-out payment and the incentive bonus-pool payment under the Asset Purchase Agreement for 2013 and (ii) modifies the treatment of PCM's general-partnership interests in certain private-equity funds or co-investment vehicles sponsored and advised by PCM (the "PE Interests) in determining future earn-out payments and incentive bonus-pool payments. The Settlement Agreement requires an upfront payment of $4.2 million to P-Cap and $1.8 million to the incentive bonus-pool recipients. The Settlement Agreement is attached as Exhibit 10.1.

Item 9.01. Financial Statements and Exhibits

10.1 Settlement Agreement and Release dated June 30, 2010

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

|

|

|

|

UMB FINANCIAL CORP

|

|

|

|

|

|

Date: July 03, 2014

|

|

|

|

By:

|

|

/s/ Brian J. Walker

|

|

|

|

|

|

|

|

|

|

Brian J. Walker

|

|

|

|

|

|

|

|

|

|

EVP, Chief Financial Officer and Chief Accounting Officer

|

|

|

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

EX-10.1

|

|

Settlement Agreement and Release

|

SETTLEMENT AGREEMENT AND RELEASE

This Settlement Agreement and Release (this “Agreement”) is made as of June 30, 2014 (the “Effective Date”), by and among (i) Prairie Capital Management, LLC (formerly known as UMB Advisors, LLC and referred to here as “PCM”), (ii) UMB Merchant Banc, LLC (“UMB Merchant Banc”), (iii) UMB Financial Corporation (“UMBFC”), (iv) P-Cap Holdings LLC (formerly known as Prairie Capital Management LLC and referred to here as “P-Cap”), (v) P-Gen, LLC (formerly known as PCM LLC and

referred to here as “P-Gen”), (vi) Brian N. Kaufman (“Mr. Kaufman”), (vii) Robyn R. Schneider

(“Mr. Schneider”), (viii) Curtis A. Krizek (“Mr. Krizek”), (ix) George K. Baum Holdings, Inc.

(“GKB Holdings”), and (x) the Plan Committee established under Exhibit B to the APA (as later defined) on behalf of itself and all Recipients as defined in Exhibit B to the APA

(collectively, the “Plan Committee”). PCM, UMB Merchant Banc, and UMBFC are collectively referred to here as the “UMB Entities.” P-Cap, P-Gen, Mr. Kaufman, Mr. Schneider, Mr. Krizek, and GKB Holdings are collectively referred to here as the “P-Cap Entities.” The UMB Entities, the P-Cap

Entities, and the Plan Committee are collectively referred to here as the “Parties.”

The Parties (excluding the Plan Committee) executed and delivered the Asset Purchase Agreement, dated as of June 27, 2010 (the “APA”), and related documents (collectively and together with the APA, the “Transaction Documents”) in connection with UMBFC’s acquisition of the business then

operated by P-Cap. Each capitalized term used but not otherwise defined in this Background has the meaning set forth in the APA.

On February 28, 2014, according to Exhibits A and B to the APA, the UMB Entities delivered to the P-Cap Entities and the Plan Committee (i) the Earn-Out Notice and the Draft Earn-Out Calculation for

the 2013 Earn-Out Period (collectively, the “2013 Earn-Out Notice”) and (ii) the calculation of the Incentive Bonus Pool Amount for the 2013 Plan Year (the “2013 Incentive Bonus Pool Amount”).

On March 28, 2014, according to Section (f) of Exhibit A to the APA, P-Cap delivered to the UMB Entities an objection (the “2013 Earn-Out Dispute”) to the treatment in the 2013 Earn-Out Notice of an unrealized gain on UMBFC’s indirect general-partnership interest in a co-investment vehicle sponsored and advised by PCM (the “2013

Unrealized Gain”).

On March 28, 2014, in connection with Exhibit B to the APA, the Plan Committee and P-Cap delivered to the UMB Entities an objection (the “2013 Incentive-Bonus

Dispute” and, together with the 2013 Earn-Out Dispute, the “2013 Disputes”) to the treatment of the 2013 Unrealized Gain in the calculation of

the 2013 Incentive Bonus Pool Amount.

The Parties wish to resolve the 2013 Disputes among themselves without involving an Earn-Out Accounting Arbitrator under Section (f) of Exhibit A to the APA.

The Parties also wish to agree on the current and future treatment of UMBFC’s direct or indirect general-partnership interests (collectively, the “PCM GP

Interests”) in all Non-Split-Interest Funds that are private-equity funds or co-investment vehicles and all similar private-equity funds or co-investment vehicles sponsored and advised by PCM from and after the

Closing Date (excluding all Split-Interest Funds and all hedge funds) (collectively, the “PCM Funds”). For the purpose of clarification, the term “PCM Funds” includes PCM Private Equity III L.P.; PCM Private Equity IV L.P.; PCM AEP Co-Invest, LP; PCM CEC Opportunity, LP; PCM Credit Opportunities, LP; PCM EMG Opportunity, LP; PCM Founders, LP; PCM

Plains Co-Invest, LP; PCM Utica Co-Invest, LP; PCM Woodford Co-Invest, LP; and PCM Permian Co-Invest, L.P. Also for the purpose of clarification, the term “PCM Funds” excludes all

Split-Interest Funds (which are, as set forth in the APA, PCM Private Equity L.P.; PCM Private Equity II L.P.; PCM Tech Investments L.P.; PCM Private Equity Co-Investment I L.P.; and PCM Spartan Co-Invest, L.P.) and all hedge funds (including PCM

Long/Short Equity L.P.; PCM Concentrated Global Long/Short Equity L.P.; and PCM Diversified Strategies L.P.).

In consideration of the Background and the mutual promises in this Agreement and for other valuable consideration, the receipt and adequacy of which are acknowledged, the Parties agree to the

following:

Section 1. Definitions and Rules of Construction

(a) Each capitalized term used but not otherwise defined in this Agreement has the meaning set forth in the APA.

(b) The term “Related Persons” means, for any Party, all of the Party’s affiliates, members, divisions, agents, directors,

officers, employees, representatives, successors, and assigns. For purposes of this Agreement, however, (i) none of any P-Cap Entity or the Plan Committee will be treated as a Related Person of any UMB Entity, and (ii) no UMB Entity will be treated

as a Related Person of any P-Cap Entity or the Plan Committee.

(c) The term “Claims” means all claims, demands, liabilities, actions, causes of action, complaints, charges, suits, proceedings,

examinations, investigations, damages, expenses, costs, and fees of attorneys or other professionals—in each case, of any kind or nature, whether known or unknown, whether absolute or contingent, and whether under contract, at common law, in

equity, under statute or regulation, or otherwise.

|

(d) |

The following rules of construction apply in this Agreement: |

| |

| |

(i) |

The term “include” introduces a nonexhaustive list. |

| |

| |

(ii) |

Unless otherwise expressly specified, the term “or” is not exclusive. |

| |

| |

(iii) |

The term “law” includes any applicable constitution, statute, regulation, |

| |

rule, ordinance, holding, order, decree, judgment, writ, injunction, stipulation, award, or

2

other legal requirement (whether arising at law, in equity, or otherwise) of a governmental authority. A reference to any law is to that law as amended or supplemented to the applicable time.

(iv) A reference to any agreement (including this Agreement), document, policy, or procedure is to that agreement, document, policy, or procedure as amended or supplemented to the applicable time to

the extent that the amendment or supplement is effected in the manner required under that agreement, document, policy, or procedure.

(v) A reference to any person or entity (including any Party) includes that person’s or entity’s successors and permitted assigns.

(vi) Words in the singular include the plural, and words in the plural include the singular.

Section 2. Nature of This Agreement

|

(a) This Agreement includes a compromise and settlement of the 2013 Disputes. None of this Agreement, any negotiation or communication in connection with the 2013 Disputes or this Agreement, any

performance under this Agreement, or any other matter or other thing arising under, relating to, or resulting from any of the foregoing constitutes, implies, or may be construed as an admission by any Party in connection with the 2013 Disputes or

any other dispute that may arise under or in connection with a Transaction Document.

(b) This Agreement modifies the APA and the other Transaction Documents with respect to the current and future treatment of all PCM GP Interests under the Transaction Documents. If any provision of

this Agreement conflicts or is inconsistent with any provision of the APA or any other Transaction Document, the provision of this Agreement will prevail. For the purpose of clarification, nothing in this Agreement modifies (i) the

general-partnership duties and obligations of a UMB Entity in connection with any PCM Fund, (ii) the advisory duties and obligations of PCM (as well as the related duties and obligations of Mr. Kaufman, Mr. Schneider, and Mr. Krizek under their

employment or registered-representative agreements) in connection with any PCM Fund, or (iii) the compliance duties and obligations of Mr. Kaufman, Mr. Schneider, and Mr. Krizek (including those arising under UMBFC’s Code of Ethics or Code of

Conduct as described in their employment or registered-representative agreements).

Section 3. Resolution of the 2013 Disputes

|

(a) As a result of this Agreement, the Parties do not dispute that the UMB Entities (i) on March 17, 2014, fully and timely paid to all Recipients for the 2013 Plan Year the applicable portions of the

2013 Incentive Bonus Pool Amount and (ii) otherwise have fully satisfied all of their obligations to the P-Cap Entities and the Plan Committee in connection with the 2013 Plan Year.

(b) As a result of this Agreement, the Parties do not dispute that the UMB Entities (i) on April 28, 2014, fully and timely paid to P-Cap the Earn-Out Amount for the 2013 Earn-Out Period (the

“2013 Earn-Out Amount”) and (ii) otherwise have fully satisfied all of their

3

obligations to the P-Cap Entities and the Plan Committee in connection with the 2013 Earn-Out Period.

(c) The P-Cap Entities and the Plan Committee withdraw the 2013 Disputes in full and accept in their entirety the 2013 Earn-Out Notice and the calculation of the 2013 Incentive Bonus Pool Amount, in

each case, as delivered by the UMB Entities on February 28, 2014.

(d) The Parties agree and acknowledge that, as a result of this Agreement, none of any P-Cap Entity, the Plan Committee, or any of their Related Persons has any further right, claim, or interest of

any kind or nature in connection with the 2013 Earn-Out Amount, the 2013 Earn-Out Period, the 2013 Incentive Bonus Pool Amount, or the 2013 Plan Year.

Section 4. Treatment of the PCM GP Interests

(a) Except as described in the next sentence and Section 4(f), no revenue, income, distributions, payments, carried interest, incentives, gains, losses, changes in value or valuation, or other amounts

of any kind or nature—in each case whether realized or unrealized—that are realized or received from, are realizable or receivable on account of, are allocated or attributable to, or otherwise arise out of, relate to, or result from any

PCM GP Interest (collectively, the “PCM GP Amounts”) will be included in any calculation, determination, allocation, distribution, or payment of or on account of any Net Income,

any Pre-Bonus, Pre-Tax Income, any Adjusted Pre-Bonus, Pre-Tax Income, any Adjusted Pre-Tax Income, any Earn-Out Amount, or any Incentive Bonus Pool Amount under any Transaction Document (including Exhibits A and B to the APA). Allowable Corporate

Expenses and other expenses arising out of, relating to, or resulting from the PCM GP Interests will continue to be included in calculations, determinations, and allocations under and as set forth in the Transaction Documents.

(b) Section (a)(xviii)(C) of Exhibit A to the APA is amended by deleting “ending as of the anniversary of the Closing Date in 2015” and substituting in its place “ending on and

inclusive of July 31, 2015 (the “Final Anniversary Date”).”

(c) The following calculations, determinations, allocations, distributions, and payments must be made under this Agreement in connection with the PCM GP Interests:

(i) On the Effective Date, the UMB Entities must (A) pay to P-Cap an amount (the “Advanced P-Cap Amount”) equal to $4,200,000

and (B) allocate and pay portions of an aggregate amount (the “Advanced Recipient Amount,” and together with the Advanced P-Cap Amount, the “Advanced Amount”) equal to $1,800,000 to Recipients in amounts that have been specified by the Plan Committee in a separate document, the receipt of which is acknowledged by the UMB

Entities.

(ii) Promptly following receipt by the UMB Entities of all information necessary to take the actions described in this clause (ii), but in any event on the 90th day after the Final Anniversary Date

with the most current information reasonably available to PCM and UMBFC on that day, the UMB Entities must in the following order:

4

(A) calculate the aggregate realized gain on the PCM GP Interests that is received free and clear by a UMB Entity on or before the Final Anniversary Date (the “Aggregate Realized Gain”),

(B) calculate the aggregate unrealized gain on the PCM GP Interests as of the Final Anniversary Date (I) after taking into account any Aggregate Realized Gain (including any Aggregate Realized Gain

received on the Final Anniversary Date), (II) consistent with the valuation methodologies for the PCM GP Interests used by UMBFC for its December 31, 2013, and March 31, 2014, financial statements, recognizing that methodologies may differ when a

PCM Fund owns publicly traded securities or other securities for which publicly traded securities may provide a proxy, and (III) using the most current information reasonably available to PCM and UMBFC on the date of the calculation (which, for the

purpose of clarification, must occur by the 90th day after the Final Anniversary Date as specified in the introductory language in this clause (ii)) (the “Aggregate Unrealized Gain”), and

(C) deliver to P-Cap and the Plan Committee a written statement describing the calculations that were made in determining the Aggregate Realized Gain and the Aggregate Unrealized Gain.

(iii) The UMB Entities must give P-Cap and the Plan Committee reasonable access, during normal business hours, to the books and records of the UMB Entities that support the written statement described

in Section 4(c)(ii)(C). The calculations by the UMB Entities of the Aggregate Realized Gain and the Aggregate Unrealized Gain will be treated as conclusive and accepted by the P-Cap Entities and the Plan Committee unless, within 10 days after the

date of delivery of the written statement described in Section 4(c)(ii)(C), P-Cap or the Plan Committee delivers to the UMB Entities a written statement detailing its objections to the calculations. If a written statement of objections is delivered,

the Parties must negotiate in good faith to resolve each objection for a period of not less than 30 days after the date of delivery of that written statement. Unless the Parties agree otherwise, if any objection remains unresolved after the

mandatory 30-day negotiation period, that objection must be settled by arbitration administered by the American Arbitration Association (“AAA”) and governed by the AAA Commercial

Arbitration Rules. Judgment on any award rendered by an arbitrator under this Section 4(c)(iii) may be entered in any court with jurisdiction.

(iv) Within 10 days after the acceptance of all calculations or the resolution of all objections (as applicable) under Section 4(c)(iii), the UMB Entities must in the following order:

(A) calculate an amount (the “Final Amount”) equal to the sum of

|

(I) |

the Aggregate Unrealized Gain and (II) the Aggregate Realized Gain, |

| |

| |

(B) if the Final Amount is zero (with the understanding that the |

| |

amount calculated in clause (A) is not capable of being a negative amount under any circumstance), notify P-Cap and the Plan Committee in writing that no

5

payment is due to any P-Cap Entity or the Plan Committee under this Section 4(c)(iv), and

(C) if the Final Amount is a positive amount, make the following calculations, determinations, allocations, payments, and distributions in the following order:

(I) calculate and retain an amount (the “Final UMB Entity

Allocation”) equal to the product of (1) the Final Amount times

|

(2) |

10.0%, |

| |

| |

(II) calculate an amount (the “Final P-Cap Entity |

| |

Allocation”) equal to the difference of (1) the Final Amount minus (2) the Final UMB Entity Allocation minus (3) the Advanced Amount,

(III) if the Final P-Cap Entity Allocation is a positive amount, (1) calculate an amount (the “Final P-Cap Allocation”) equal to

the product of (a) the Final P-Cap Entity Allocation times (b) 70.0%, (2) notify P-Cap in writing of the Final P-Cap Allocation, and (3) pay to P-Cap the Final P-Cap Allocation,

and

(IV) if the Final P-Cap Entity Allocation is a positive amount, (1) calculate an amount (the “Final Plan Committee Allocation”)

equal to the product of (a) the Final P-Cap Entity Allocation times (b) 30.0%, (2) notify the Plan Committee in writing of the Final Plan Committee Allocation, and (3) within 15 days after

this notice is delivered, allocate and pay portions of the Final Plan Committee Allocation (a) if any of Mr. Kaufman, Mr. Schneider, or Mr. Krizek then serve on the Plan Committee and if the Plan Committee within 5 days after this notice is

delivered has notified the UMB Entities in writing of the Recipients of the Final Plan Committee Allocation and each of their portions, to those Recipients as so notified by the Plan Committee or (b) if none of Mr. Kaufman, Mr. Schneider, or Mr.

Krizek then serve on the Plan Committee or if the Plan Committee within 5 days after this notice is delivered has not notified the UMB Entities in writing of the Recipients of the Final Plan Committee Allocation and each of their portions, to the

Recipients of the Advanced Recipient Amount in the same proportions as the Advanced Recipient Amount was allocated and paid under Section 4(c)(i)(B).

(v) The following hypothetical example is set forth here for purposes of interpreting and construing the calculations, determinations, allocations, distributions, and payments required under Sections

4(c)(ii) and (iv).

The facts of this hypothetical example follow:

6

PCM GP Interest #1 resulted in a distribution of $20,000,000 free and clear to a UMB Entity on or before the Final Anniversary Date and had a valuation equal to $0 on the Final Anniversary

Date.

PCM GP Interest #2 resulted in no distribution to a UMB Entity on or before the Final Anniversary Date and had a valuation equal to $5,000,000 on the Final Anniversary Date.

PCM GP Interest #3 resulted in a distribution of $1,000,000 free and clear to a UMB Entity on or before the Final Anniversary Date and had a valuation equal to $2,000,000 on the Final

Anniversary Date.

In this hypothetical example, Sections 4(c)(ii) and (iv) would operate as follows:

(ii)(A) the Aggregate Realized Gain equals $21,000,000—$20,000,000 for PCM GP Interest #1 plus $0 for PCM GP Interest #2

plus $1,000,000 for PCM GP Interest #3,

(ii)(B) the Aggregate Unrealized Gain equals $7,000,000—$0 for PCM GP Interest #1 plus $5,000,000 for PCM GP Interest #2

plus $2,000,000 for PCM GP Interest #3,

(iv)(A) the Final Amount equals $28,000,000—(I) $21,000,000 plus (II) $7,000,000,

(iv)(B) not applicable because the Final Amount is a positive amount, and

(iv)(C) because the Final Amount is a positive amount:

(I) the Final UMB Entity Allocation equals $2,800,000—

|

(1) |

$28,000,000 times (2) 10.0%, |

| |

| |

(II) |

the Final P-Cap Entity Allocation equals $19,200,000— |

| |

|

(1) |

$28,000,000 minus (2) $2,800,000 minus (3) $6,000,000, |

| |

| |

(III) |

the Final P-Cap Allocation equals $13,440,000— |

| |

| |

(1)(a) $19,200,000 times (b) 70.0%, and

|

(IV) the Final Plan Committee Allocation equals $5,760,000—(1)(a) $19,200,000 times (b) 30.0%.

(vi) The following hypothetical example is also set forth here for purposes of interpreting and construing the calculations, determinations, allocations, distributions, and payments required under

Sections 4(c)(ii) and (iv).

The facts of this hypothetical example follow:

7

PCM GP Interest #1 resulted in a distribution of $2,000,000 free and clear to a UMB Entity on or before the Final Anniversary Date and had a valuation equal to $0 on the Final Anniversary

Date.

PCM GP Interest #2 resulted in no distribution to a UMB Entity on or before the Final Anniversary Date and had a valuation equal to $0 on the Final Anniversary Date.

PCM GP Interest #3 resulted in a distribution of $1,000,000 free and clear to a UMB Entity on or before the Final Anniversary Date and had a valuation equal to $1,000,000 on the Final

Anniversary Date.

In this hypothetical example, Sections 4(c)(ii) and (iv) would operate as follows:

(ii)(A) the Aggregate Realized Gain equals $3,000,000—$2,000,000 for PCM GP Interest #1 plus $0 for PCM GP Interest #2

plus $1,000,000 for PCM GP Interest #3,

(ii)(B) the Aggregate Unrealized Gain equals $1,000,000—$0 for PCM GP Interest #1 plus $0 for PCM GP Interest #2

plus $1,000,000 for PCM GP Interest #3,

(iv)(A) the Final Amount equals $4,000,000—(I) $3,000,000 plus (II) $1,000,000,

(iv)(B) not applicable because the Final Amount is a positive amount, and

(iv)(C) because the Final Amount is a positive amount:

(I) the Final UMB Entity Allocation equals $400,000—

|

(1) |

$4,000,000 times (2) 10.0%, |

| |

| |

(II) |

the Final P-Cap Entity Allocation equals ($2,400,000)— |

| |

|

(1) |

$4,000,000 minus (2) $400,000 minus (3) $6,000,000, |

| |

| |

(III) |

the Final P-Cap Allocation is a negative amount and no |

| |

(IV) the Final Plan Committee Allocation is a negative amount and no payment is due.

(d) The Parties agree and acknowledge that (i) no Acceleration Event under the APA has occurred on or prior to the Effective Date, (ii) no event has occurred on or prior to the Effective Date that

would give rise to an Acceleration Event under the APA, and (iii) any future occurrence of an Acceleration Event under the APA will not affect the obligation of any UMB Entity to pay the Advanced P-Cap Amount, the Advanced Recipient Amount, any

Final P-Cap Allocation, or any Final Plan Committee Allocation.

8

(e) Except as described in this Agreement, no UMB Entity and none of its Related Persons has any liability or obligation of any kind or nature to any P-Cap Entity or the Plan Committee arising out of,

relating to, or resulting from any PCM GP Interest or any PCM GP Amount. Except as described in this Agreement, none of any P-Cap Entity, the Plan Committee, or any of their Related Persons has any liability or obligation of any kind or nature to

any UMB Entity arising out of, relating to, or resulting from any PCM GP Interest or any PCM GP Amount.

(f) If a realized gain on a PCM GP Interest is received free and clear by a UMB Entity before the Final Anniversary Date in the form of cash or liquid securities that at the time are traded on a

public market, an amount equal to that realized gain—with the value of liquid securities determined at the market close on the date of receipt—will be added to Adjusted Pre-bonus, Pre-tax Income for the Earn-Out Period in which the cash or

liquid securities were received for the sole purpose of determining the Growth Multiplier for that Earn-Out Period under Exhibit A to the APA and not for the purpose of determining the applicable Earn-Out Amount or Incentive Bonus Pool Amount or any

other purpose.

Section 5. Waivers and Releases

|

(a) The P-Cap Entities and the Plan Committee, on behalf of themselves and their Related Persons, knowingly, voluntarily, irrevocably, unconditionally, and fully release the UMB Entities and their

Related Persons from any and all Claims arising out of, relating to, or resulting from any 2013 Dispute, any matter or other thing underlying a 2013 Dispute, or any matter or other thing that could have been alleged or asserted in connection with a

2013 Dispute (including any related private or public disclosures, filings, or representations made by any P-Cap Entity or the Plan Committee). The P-Cap Entities and the Plan Committee, on behalf of themselves and their Related Persons, also

knowingly, voluntarily, irrevocably, unconditionally, and fully waive all rights, claims, and interests—in each case, of any kind or nature, whether known or unknown, whether absolute or contingent, and whether under contract, at common law, in

equity, under statute or regulation, or otherwise—arising out of, relating to, or resulting from any PCM GP Interest or any PCM GP Amount after the Final Anniversary Date. For the purpose of clarification, this Section 5(a) does not operate to

amend, waive, or release any obligation of the UMB Entities that may exist under any and all other applicable agreements (including Transaction Documents) to indemnify the P-Cap Entities, the Plan Committee, or their Related Persons against

third-party Claims.

(b) The UMB Entities, on behalf of themselves and their Related Persons, knowingly, voluntarily, irrevocably, unconditionally, and fully release the P-Cap Entities, the Plan Committee, and their

Related Persons from any and all Claims arising out of, relating to, or resulting from any 2013 Dispute, any matter or other thing underlying a 2013 Dispute, or any matter or other thing that could have been alleged or asserted in connection with a

2013 Dispute (including any related private or public disclosures, filings, or representations made by any UMB Entity). For the purpose of clarification, this Section 5(b) does not operate to amend, waive, or release any obligation of the P-Cap

Entities or the Plan Committee that may exist under any and all other applicable agreements (including Transaction Documents) to indemnify the UMB Entities or their Related Persons against third-party Claims.

9

(c) The Parties, on behalf of themselves and all of their Related Persons, agree and acknowledge that no demand, action, cause of action, complaint, charge, suit, or other dispute currently exists

between or among the Parties except for the 2013 Disputes.

(d) As described more fully in Section 3, this Agreement constitutes a complete and final resolution of the 2013 Disputes as between and among the Parties. But for the purpose of clarification,

nothing in this Agreement (including any waiver or release in this Section 5) constrains any Party in enforcing this Agreement.

Section 6. Confidentiality

|

(a) Except as otherwise set forth in this Section 6 or as otherwise permitted by all Parties, no Party may directly or indirectly disclose to any person or entity any negotiation, any communication,

or any disagreement arising under, relating to, or resulting from this Agreement (the “Confidential Information”). The term “Confidential

Information” excludes, however, information that has been, is, or becomes generally known or generally available to the public other than as a result of a breach of this Agreement. Each Party must take reasonably

appropriate steps (i) to prevent or stop the prohibited disclosure of Confidential Information by the Party and (ii) to cause any partner, insider, director, officer, employee, agent, representative, or advisor (including any attorney, accountant,

consultant, or banker) of the Party (each a “Representative”) to comply with the provisions of this Section 6.

(b) This Agreement may be publicly filed with or furnished to the Securities and Exchange Commission, any exchange, or any other governmental entity or self-regulatory organization by the UMB Entities

and, in that case, would become generally available to the public without any breach of this Agreement.

(c) Each Party may disclose Confidential Information to any of its Representatives who has agreed or is required by internal policies or fiduciary or other legal obligations to keep the Confidential

Information confidential.

(d) If a Party or any of its Representatives is requested or required (including by oral questions, interrogatories, requests for information or documents in legal proceedings, subpoena, civil

investigative demand, or other process) to disclose any Confidential Information, the Party must provide the other Parties with prompt written notice of the request or requirement, to the extent permitted by applicable law, so that the other Parties

(at their sole expense) may seek a protective order or other appropriate remedy or waive compliance with this Agreement. If the Party or Representative so requested or required is compelled—in the absence of an applicable protective order or

other remedy or the receipt of an applicable waiver from the other Parties—to disclose Confidential Information, the Party or Representative so compelled may without liability disclose the Confidential Information that is required but must

exercise commercially reasonable efforts (at the sole expense of the other Parties that continue to object to the disclosure) to preserve the confidential treatment of the Confidential Information. Despite the foregoing, however, nothing in this

Agreement prohibits, prevents, or limits any Party or any of its Representatives from disclosing any Confidential Information, without notice to or consent of the other Parties, if the disclosure is made (i) to a supervisory or governmental

authority, a self-regulatory organization, or a standard-setting organization in the course of any examination,

10

inquiry, or audit of the Party or any of its Representatives or any business or operations of the Party or any of its Representatives or (ii) to comply with applicable securities, tax, banking, or other laws.

Section 7. Representations and Warranties

|

Each Party represents and warrants the following to the other Parties as of the Effective

(a) The Party is (i) a natural person, (ii) an unincorporated association, or (iii) a person or entity duly organized and validly existing in good standing under the laws of its jurisdiction of

organization. The Party has full power and authority, in all material respects, to execute, deliver, and perform its obligations under this Agreement.

(b) The Party has duly authorized its execution and delivery of this Agreement and its performance of this Agreement.

(c) This Agreement is the legal, valid, and binding obligation of the Party and is enforceable against the Party according to its terms, except as enforceability may be limited by bankruptcy or other

insolvency laws applicable to creditors generally or general principles of equity.

(d) The Party is the full, complete, and sole owner of all rights, interests, claims, demands, obligations, liabilities, actions, causes of action, complaints, charges, suits, damages, expenses,

costs, and fees being released or waived in this Agreement and has not sold, transferred, assigned, pledged, hypothecated, encumbered, or otherwise conveyed any of them or any part of any of them.

(e) The Party (i) has completely read this Agreement, (ii) is represented by an attorney of the Party’s own choice who has explained this Agreement to the Party, (iii) completely understands this

Agreement and its effects, and (iv) has executed and accepted this Agreement as a free and voluntary act of the Party’s own free will without any threat, force, duress, or coercion of any kind.

(f) The Party has not relied and is not relying on any statement, representation, or other communication by any other Party or any other Party’s Representative in connection with any actual or

potential liability, obligation, claim, or damage relating to the subject matter of this Agreement.

If a Party discovers or otherwise obtains knowledge of a breach of any of these representations and warranties, that Party must give prompt written notice of the breach to the other Parties.

(a) Except as otherwise expressly provided in this Agreement, all notices and other communications by a Party under this Agreement must be in writing and will be considered effective when delivered by

hand, by courier, by facsimile, by overnight delivery service, or by

11

certified mail, return receipt requested and postage prepaid, to the other Parties at the most recent addresses provided by the other Parties under the APA.

|

|

|

(b)

|

|

This Agreement can only be modified in a written document executed by the

|

|

Parties.

|

|

|

|

|

|

|

|

|

|

(c)

|

|

This Agreement is governed by and must be construed according to the laws of

|

the State of Missouri, without reference to its conflict-of-law provisions. EACH PARTY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, THE RIGHT TO TRIAL BY JURY IN ANY PROCEEDING ARISING OUT OF, RELATING TO, OR

RESULTING FROM THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT.

(d) Each Party must execute and deliver any further document, perform any further act, and otherwise do any further thing that, in each case, may be reasonably necessary to carry out the provisions of

this Agreement.

(e) If one or more of the covenants, agreements, provisions, or terms of this Agreement are held invalid for any reason whatsoever, those covenants, agreements, provisions, and terms will be treated

as severable from the remaining covenants, agreements, provisions, and terms of this Agreement and will in no way affect the validity or enforceability of the remaining covenants, agreements, provisions, and terms of this Agreement. If the

invalidity of any covenant, agreement, provision, or term of this Agreement deprives any Party of the economic benefit intended to be conferred by this Agreement, the Parties must negotiate in good faith to develop and substitute a replacement

covenant, agreement, provision, or term having an economic effect that is as nearly as possible the same as the economic effect of this Agreement as intended.

(f) The headings of sections are for reference only and may not affect the interpretation or construction of this Agreement.

(g) No Party may assign all or any part of its rights or obligations under this Agreement without the prior written consent of the other Parties, except that an assignment resulting from a merger or

acquisition of or by a Party does not require consent if the assignee of the Party provides reasonable assurance of its ability to fully and timely perform under this Agreement. Any assignment in contravention of this provision is null and

void.

(h) This Agreement may be executed in any number of counterparts, each of which will be considered an original but all of which together will constitute one agreement. Any execution and delivery of an

electronic version of this Agreement—whether executed manually or electronically and whether delivered by e-mail, facsimile, or otherwise—will constitute the execution and delivery of this Agreement for all legal and other

purposes.

(i) No failure to exercise or delay in exercising any right or remedy under this Agreement will effect a waiver of that right or remedy. No single or partial exercise of any right or remedy under this

Agreement will preclude any other or further exercise of that right or

12

remedy or any other right or remedy. Except as otherwise expressly provided, the rights and remedies under this Agreement are cumulative and not exhaustive.

(j) This Agreement benefits and is binding on the Parties and their respective successors and permitted assigns. This Agreement is made for the sole benefit of the Parties and their respective

successors and permitted assigns. Nothing in this Agreement creates or may be construed as creating any right or benefit in favor of any third party.

(k) This Agreement contains all of the covenants, agreements, provisions, terms, and conditions relating to its subject matter to which the Parties have agreed. All prior understandings of any kind

are superseded by this Agreement.

(l) Sections 2 through 8 of this Agreement will survive the execution, delivery, and performance of this Agreement.

(m) Each Party must bear its own fees, expenses, and costs (including fees of attorneys or other professionals) in connection with this Agreement.

(n) This Agreement has been negotiated and jointly prepared by all Parties. No ambiguity or other uncertainty arising under, relating to, or resulting from this Agreement may be interpreted or

construed in favor of or against any Party on the basis that one or more Parties first or primarily drafted any provision of this Agreement.

[The rest of this page is left blank intentionally.]

|

13

THIS AGREEMENT CONTAINS A BINDING ARBITRATION PROVISION WHICH MAY BE ENFORCED BY THE PARTIES.

Executed as of the Effective Date.

|

PRAIRIE CAPITAL MANAGEMENT, LLC

|

/s/ John C. Pauls

Name: John C. Pauls

Title: Secretary

|

/s/ Brian J. Walker

Name: Brian J. Walker

Title: Vice President

|

UMB FINANCIAL CORPORATION

|

|

Name:

|

|

Brian J. Walker

|

|

Title:

|

|

EVP, CFO and CAO

|

/s/ Brian Kaufman

Name: Brian N. Kaufman

Title: Member

|

14

THIS AGREEMENT CONTAINS A BINDING ARBITRATION PROVISION WHICH MAY BE ENFORCED BY THE PARTIES.

/s/ Brian N. Kaufman

Name: Brian N. Kaufman

Title: Member

|

GEORGE K. BAUM HOLDINGS, INC.

|

/s/ Jonathan E Baum

Name: Jonathan E. Baum

Title: President

|

15

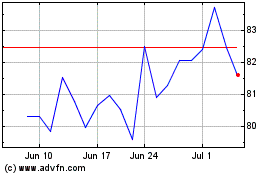

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From Mar 2024 to Apr 2024

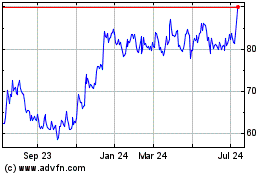

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From Apr 2023 to Apr 2024