UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

July 1, 2014

Date

of Report (Date of earliest event reported)

JAZZ

PHARMACEUTICALS PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Ireland |

|

001-33500 |

|

98-1032470 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File No.) |

|

(IRS Employer

Identification No.) |

Fourth Floor, Connaught House,

1 Burlington Road, Dublin 4, Ireland

(Address of principal executive offices, including zip code)

011-353-1-634-7800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On July 1, 2014, Jazz Pharmaceuticals Public Limited

Company (the “Company”), Jazz Pharmaceuticals International II Limited (“Buyer”), a wholly-owned subsidiary of the Company, and Gentium S.p.A. (“Gentium”), a majority-owned subsidiary of the Company, entered into an

Assignment Agreement (the “Assignment Agreement”) with Sigma-Tau Pharmaceuticals, Inc. (“Sigma-Tau”). Upon the closing of the transaction contemplated by the Assignment Agreement (the “Closing”), the Company would own

worldwide rights to defibrotide.

Pursuant to the terms of the Assignment Agreement, Sigma-Tau agreed to sell, transfer and assign to Buyer all of

Sigma-Tau’s right, title and interest in and to the License and Supply Agreement, dated December 7, 2011, as amended, between Gentium and Sigma-Tau (the “License Agreement”), pursuant to which Sigma-Tau has certain rights to

market defibrotide in North America, Central America and South America, and Buyer has agreed to assume certain liabilities of Sigma-Tau under the License Agreement. Sigma-Tau also agreed to sell, transfer and assign to Buyer all of Sigma-Tau’s

and its affiliates’ right, title and interest in and to certain know-how and certain other assets that, in each case, relate to defibrotide.

Upon

the Closing, Buyer will make an initial upfront payment of $75 million to Sigma-Tau (the “Initial Payment”). Buyer is also obligated to make milestone payments of up to $175 million to Sigma-Tau (the “Milestone Payments”)

comprised of: (i) $25 million upon the acceptance for filing by the U.S. Food and Drug Administration (“FDA”) of the first new drug application (“NDA”) for defibrotide for veno-occlusive disease (“VOD”); and

(ii) up to an additional $150 million based on the timing of potential FDA approval of defibrotide for VOD. The Company has guaranteed Buyer’s payment obligations under the Assignment Agreement, including to make the Initial Payment and

the Milestone Payments and to cover any indemnification claims that are Buyer’s responsibility.

Buyer and Sigma-Tau have made customary

representations and warranties and agreed to customary covenants in the Assignment Agreement, and, subject to certain limitations, each of Buyer and Sigma-Tau has also agreed to indemnify the other for breaches of representations, warranties,

covenants and other specified matters. In addition, Buyer and Sigma-Tau, on behalf of themselves and their affiliates, have agreed to release each other from certain liabilities with respect to the License Agreement or the defibrotide-related

know-how and assets. The Closing is subject to certain conditions, including expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

The foregoing description of the Assignment Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and

qualified in its entirety by reference to, the full text of the Assignment Agreement, which will be filed as an exhibit to a subsequent Current Report on Form 8-K that the Company expects to file in connection with the anticipated Closing. The

Company intends to seek confidential treatment for certain portions of the Assignment Agreement pursuant to a confidential treatment request that it intends to submit to the Securities and Exchange Commission pursuant to Rule 24b-2 under the

Securities Exchange Act of 1934, as amended.

Relationships

The Company became the indirect majority shareholder of Gentium in January 2014 pursuant to a tender offer and ultimately acquired more than 99% of the

outstanding voting securities of Gentium (the “Gentium Acquisition”). Sigma-Tau is an affiliate of Sigma-Tau Finanziaria S.p.A., which together with its affiliated entities beneficially owned, based on public filings, approximately 17% of

the outstanding voting securities of Gentium immediately prior to the Gentium Acquisition and was also represented on Gentium’s board of directors.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release, dated July 2, 2014, titled “Jazz Pharmaceuticals Announces Agreement to Acquire Rights to Defibrotide in the Americas From Sigma-Tau Pharmaceuticals, Inc.” |

Forward-Looking Statements

This Current Report on Form 8-K and the accompanying Exhibit 99.1 contain forward-looking statements, including, but not limited to, statements related to

the anticipated closing of the transaction contemplated by the Assignment Agreement and the timing and benefits thereof, the therapeutic and commercial potential of defibrotide, planned future discussions with the FDA concerning the regulatory

pathway for submission of an NDA for defibrotide, the potential acceptance for filing of and potential approval of an NDA for defibrotide, potential future development of defibrotide for approval in countries outside the European Union

(“EU”) and in other indications, the Company’s pipeline and portfolio growth strategy, including potentially bringing new therapies to market, and other statements that are not historical facts. These forward-looking statements are

based on the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of

these risks and uncertainties, which include, without limitation, risks and uncertainties associated with the Company’s ability to complete the acquisition of defibrotide rights from Sigma-Tau pursuant to the Assignment Agreement on the

proposed terms and schedule, including risks and uncertainties related to the satisfaction of closing conditions; the Company’s ability to successfully manage the risks associated with integrating defibrotide into the Company’s product

portfolio; the possibility that the Company may fail to realize the anticipated benefits (commercial or otherwise) from the acquisition of defibrotide rights from Sigma-Tau; the inherent uncertainty associated with the regulatory approval process,

including the risks that the Company may be required to conduct additional time-consuming and costly clinical trials in order to obtain any regulatory approval of defibrotide in the United States and that the Company may otherwise be unable to

obtain or maintain any regulatory approvals for defibrotide in the United States or in other countries outside of the EU; the difficulty and uncertainty of pharmaceutical product development, including the timing and cost thereof; risks related to

effectively commercializing defibrotide, including uncertainty of the future sales of and revenue from defibrotide following regulatory approval, if any, in the United States, and in other indications; the Company’s ability to identify and

acquire, in-license or develop additional products or product candidates to grow its business; possible restrictions on the Company’s ability and flexibility to pursue certain future opportunities as a result of its substantial outstanding debt

obligations; risks related to future opportunities and plans; and those other risks detailed from time-to-time under the caption “Risk Factors” and elsewhere in the Company’s Securities and Exchange Commission filings and reports

(Commission File No. 001-33500), including the Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 and future filings and reports by the Company. The Company undertakes no duty or obligation to update any forward-looking

statements contained in this Current Report on Form 8-K and the accompanying Exhibit 99.1 as a result of new information, future events or changes in its expectations.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY |

|

|

| By: |

|

/s/ Matthew P. Young |

|

|

Name: Matthew P. Young |

|

|

Title: Senior Vice President and Chief Financial Officer |

Date: July 2, 2014

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release, dated July 2, 2014, titled “Jazz Pharmaceuticals Announces Agreement to Acquire Rights to Defibrotide in the Americas From Sigma-Tau Pharmaceuticals, Inc.” |

Exhibit 99.1

JAZZ PHARMACEUTICALS ANNOUNCES AGREEMENT TO ACQUIRE RIGHTS TO DEFIBROTIDE IN THE AMERICAS FROM SIGMA-TAU

PHARMACEUTICALS, INC.

Jazz Pharmaceuticals to own worldwide rights to defibrotide at closing

Investor conference call to be held today, July 2 at 8:30 AM EDT/1:30 PM IST

DUBLIN, July 2, 2014 — Jazz Pharmaceuticals plc (Nasdaq: JAZZ) today announced that the company has signed a definitive agreement with Sigma-Tau

Pharmaceuticals, Inc. (Sigma-Tau) under which a subsidiary of Jazz Pharmaceuticals plc (Jazz) will acquire from Sigma-Tau rights to defibrotide in the United States (U.S.) and all other countries in the Americas. Sigma-Tau holds rights to market

defibrotide in the Americas under an agreement with Gentium S.p.A., which was acquired by Jazz earlier this year. Defibrotide is a novel product that is marketed by Jazz in the European Union (EU) under the name Defitelio® for the treatment of severe hepatic veno-occlusive disease (VOD) in patients over one month of age undergoing hematopoietic stem cell transplantation (HSCT) therapy. In the U.S., Jazz is working

with the Food and Drug Administration (FDA) on the regulatory pathway for submission of a New Drug Application (NDA) for the potential approval of defibrotide to treat patients with severe VOD.

As part of the agreement, Sigma-Tau would receive an upfront payment of $75 million upon closing of the transaction. Sigma-Tau would be eligible to receive

milestone payments of $25 million upon the acceptance for filing by the FDA of the first NDA for defibrotide for VOD and up to an additional $150 million based on the timing of potential FDA approval of defibrotide for VOD. Jazz expects to fund the

transaction with cash on hand and that the transaction will close during the third quarter of 2014, subject to customary closing conditions, including expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976.

“The acquisition of the remaining worldwide rights to defibrotide is a strong strategic fit with our specialty focus and would continue

the momentum of our recent launch of Defitelio in the EU, further leveraging our global clinical and commercial expertise in hematology/oncology,” said Bruce Cozadd, chairman and chief executive officer of Jazz Pharmaceuticals plc. “This

transaction supports our mission to improve care for patients with serious medical conditions, and we remain committed to making targeted investments to develop and bring to market differentiated treatments for patients.”

“This transaction would not only strengthen our global presence, but also demonstrate our commitment to diversify and expand our U.S. commercial

portfolio with meaningful new therapies,” said Russell Cox, executive vice president and chief operating officer of Jazz Pharmaceuticals plc. “We look forward to ongoing discussions with the FDA as we continue our efforts toward submission

of an NDA for defibrotide in the U.S. Patients in the U.S. with severe VOD have a critical unmet medical need, and we believe that defibrotide has the potential to become an important treatment option for these patients.”

About Defitelio®q (defibrotide)

In October 2013, the European Commission granted marketing authorization under exceptional circumstances for Defitelio®q (defibrotide) for the treatment of severe VOD in HSCT therapy. It is indicated in

patients over one month of age. Defitelio is not indicated in patients with hypersensitivity to defibrotide or any of its excipients or with concomitant use of thrombolytic therapy.

In addition to its existing approved indication in the EU, defibrotide has the potential to be developed for approval in countries outside the EU and in other

indications. Defibrotide has been granted orphan drug designation to treat and prevent VOD by the FDA, by the European Medicines Agency (EMA) and by the Korean Ministry of Food and Drug Safety (MFDS), orphan drug designation for the treatment of VOD

by the Commonwealth of Australia-Department of Health, and Fast Track designation to treat severe VOD by the FDA.

In the EU, please consult the Defitelio

summary of product characteristics before prescribing, particularly in relation to use of medicinal products that increase the risk of hemorrhage, concomitant systemic anticoagulant therapy, medicinal products that affect platelet aggregation, use

in patients who have or develop clinically significant acute bleeding requiring blood transfusion, and patients who have hemodynamic instability.

| q |

This medicinal product is subject to additional monitoring. |

About VOD

Hepatic veno-occlusive disease (VOD) is an early complication in patients undergoing HSCT therapy. In its severe form, VOD can be life-threatening and is

associated with multi-organ failure and is fatal in over 80% of patients.1,2 HSCTs are performed with curative intent in patients with hematological malignancies, selected solid tumors and some

non-malignant disorders, such as serious hemoglobinopathies.3,4 Studies have reported a wide range of incidence rates for VOD, suggesting that 5-15% of patients undergoing HSCT develop VOD.2,5,6

Conference Call Information

Jazz Pharmaceuticals will host a conference call and live audio webcast today at 8:30 a.m. EDT/1:30 p.m. IST to discuss this transaction and related matters.

Interested parties may access the live audio webcast and slide presentation via the Investors & Media section of the Jazz Pharmaceuticals website at www.jazzpharmaceuticals.com. Please connect to the website prior to the start of the

conference call to ensure adequate time for any software downloads that may be necessary to listen to the webcast. A replay of the webcast will be archived on the website for one week.

Audio Webcast/Conference Call:

U.S. Dial-In Number: +1

866 543 6403

Outside the U.S. Dial-In Number: +1 617 213 8896

Passcode: 11784518

A replay of the conference call will be

available through July 9, 2014 and accessible through one of the following telephone numbers and entering the passcode:

Replay U.S. Dial-In Number:

+1 888 286 8010

Replay Outside the U.S. Dial-In Number: +1 617 801 6888

Passcode: 47229125

About Jazz Pharmaceuticals plc

Jazz Pharmaceuticals plc (Nasdaq: JAZZ) is a specialty biopharmaceutical company focused on improving patients’ lives by identifying, developing and

commercializing differentiated products that address unmet medical needs. The company has a diverse portfolio of products and/or product candidates in the areas of sleep, hematology/oncology, pain and psychiatry. The company’s U.S. marketed

products in these areas include: Xyrem® (sodium oxybate) oral solution, Erwinaze® (asparaginase Erwinia chrysanthemi), Prialt® (ziconotide) intrathecal infusion, Versacloz® (clozapine) oral suspension,

FazaClo® (clozapine, USP) HD and FazaClo LD. Jazz Pharmaceuticals also has a number of products marketed outside the U.S., including

Erwinase® and Defitelio® (defibrotide). For more information, please visit www.jazzpharmaceuticals.com.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

This press release contains forward-looking statements, including, but not limited to, statements related to the anticipated closing of the acquisition of

rights to defibrotide in the U.S. and all other countries in the Americas and the timing and benefits thereof, the therapeutic and commercial potential of defibrotide, planned future discussions with the FDA concerning the regulatory pathway for

submission of an NDA for defibrotide, the potential acceptance for filing of and potential approval of an NDA for defibrotide, potential future development of defibrotide for approval in countries outside the EU and in other indications, the

company’s pipeline and portfolio growth strategy, including potentially bringing new therapies to market, and other statements that are not historical facts. These forward-looking statements are based on Jazz Pharmaceuticals’ current

expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which

include, without limitation, risks and uncertainties associated with the company’s ability to complete the acquisition of defibrotide rights from Sigma-Tau on the proposed terms and schedule, including risks and uncertainties related to the

satisfaction of closing conditions; the company’s ability to successfully manage the risks associated with integrating defibrotide into the company’s product portfolio; the possibility that Jazz Pharmaceuticals may fail to realize the

anticipated benefits (commercial or otherwise) from the acquisition of defibrotide rights from Sigma-Tau; the inherent uncertainty associated with the regulatory approval process, including the risks that Jazz Pharmaceuticals may be required to

conduct additional time-consuming and costly clinical trials in order to obtain any regulatory approval of defibrotide in the U.S. and that Jazz Pharmaceuticals may otherwise be unable to obtain or maintain any regulatory approvals for defibrotide

in the U.S. or in other countries outside of the EU; the difficulty and uncertainty of pharmaceutical product development, including the timing and cost thereof; risks related to effectively commercializing defibrotide, including uncertainty of the

future sales of and revenue from defibrotide following regulatory approval, if any, in the U.S., and in other indications; the company’s ability to identify and acquire, in-license or develop additional products or product candidates to grow

its business; possible restrictions on the company’s ability and flexibility to pursue certain future opportunities as a result of its substantial outstanding debt obligations; other risks related to future opportunities and plans; and those

other risks detailed from time-to-time under the caption “Risk Factors” and elsewhere in Jazz Pharmaceuticals plc’s Securities and Exchange Commission filings and reports (Commission File No. 001-33500), including the Quarterly

Report on Form 10-Q for the quarter ended March 31, 2014 and future filings and reports by the company. Jazz Pharmaceuticals undertakes no duty or obligation to update any forward-looking statements contained in this press release as a result

of new information, future events or changes in its expectations.

References:

| 1. |

Carreras E. Chapter 11: Early complications after HSCT. EBMT-ESH Handbook 2012 |

| 2. |

Coppell JA et al. Biol Blood Marrow Transplant. 2010;16:157–168 |

| 3. |

Tsakiris DA & Tichelli A. Best Pract Res Clin Haematol. 2009;22:137–145 |

| 4. |

Majhail NS et al. Bone Marrow Transplant. 2013;48:294–300 |

| 5. |

Carreras E et al. Blood. 1998;92(10)3599-604 |

| 6. |

Corbaciouglu S et al. Lancet. 2012;379(9823):131-9. |

Contact Information

Investors

Kathee Littrell

Vice President, Investor Relations

Jazz Pharmaceuticals plc

Ireland, + 353 1 634 7887

U.S., + 1 650 496 2717

Media

Laurie Hurley

Vice President, Corporate Affairs

Jazz Pharmaceuticals plc

Ireland, + 353 1 634 7894

U.S., + 1 650 496 2796

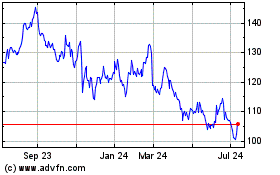

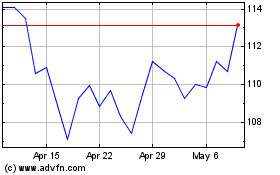

Jazz Pharmaceuticals (NASDAQ:JAZZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jazz Pharmaceuticals (NASDAQ:JAZZ)

Historical Stock Chart

From Apr 2023 to Apr 2024