UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14F-1

Information Statement under Section 14(f)

of the Securities Exchange Act of 1934 and Rule 14f-1 thereunder

Commission File Number

001-08589

|

FCCC, Inc.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Connecticut

|

|

06-0759497

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

200 Connecticut Avenue, Norwalk, Connecticut

|

|

06854

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(203) 855-7700

|

|

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, without par value

GENERAL

This Information Statement is being provided to holders of the Common Stock, no par value (the “Common Stock”), of FCCC, Inc. (the “Company”) as of June 27, 2014, pursuant to Section 14(f) of the Securities Exchange Act, as amended, and Rule 14f-1 promulgated thereunder. You are receiving this Information statement in connection with the change in control of our Company, including a change in the composition of its Board of Directors.

This Information Statement is filed with the Securities and Exchange Commission (the “SEC”) and mailed to our stockholders on or about June 27, 2014.

WE ARE NOT SOLICITING YOUR PROXY. NO VOTE OR OTHER ACTION BY THE COMPANY’S

STOCKHOLDERS IS REQUIRED WITH RESPECT TO THE MATTERS DISCUSSED HEREIN

BACKGROUND

On June 27, 2014, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with Frederick L. Farrar, LFM Investments, Inc., Chafre, LLC, Charles E. Lanham and Daniel R. Loftus (collectively, the “Purchasers”), pursuant to which the Company agreed to sell to the Purchasers an aggregate of 1,900,000 shares (the “Shares”) of Common Stock for aggregate cash consideration equal to $380,000.00. The Shares represent approximately 54.9% of the issued and outstanding shares of the Company’s Common Stock as of the date of this Information Statement. A closing is expected to occur pursuant to the Purchase Agreement upon satisfaction of all of the conditions thereunder, which is expected to occur on or after July 7, 2014. There are no other arrangements or understandings involving control persons of the Company with respect to the election of directors.

In connection with the entry into the Purchase Agreement, on June 27, 2014, our Board of Directors elected each of Frederick L. Farrar, Daniel R. Loftus and Fred J. Merritt to serve as directors of the Company effective as of the later of (a) 10 days after the mailing of this Information Statement to our stockholders and (b) a “closing” under the Purchase Agreement (such event, the “Change of Control”). Separately, each of our current directors and officers has tendered their resignation from all positions with our Company, also effective as of the Change of Control.

VOTING SECURITIES AND PRINCIPAL HOLDERS

As of June 27, 2014, we had 1,561,022 shares of Common Stock issued and outstanding. Each share of Common Stock is entitled to one vote on matters submitted to stockholders. If the Change of Control had occurred as of the same date, we would have had 3,461,022 shares of Common Stock issued and outstanding.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of our Common Stock as of June 27, 2014 (as if all securities to be issued under the Purchase Agreement were issued as of that date) by (i) each of our executive officers; (ii) each of our directors and appointed directors; (iii) all of the executive officers, directors and directors pending appointment as a group, and (iv) other persons known by us to hold more than 5% of our outstanding shares of Common Stock.

|

Name of Beneficial Owner

|

|

Amount and Nature of Beneficial

Ownership

(1)

|

|

|

Percent of Outstanding

Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

Frederick L. Farrar

(2)

3502 Woodview Trace, Suite 200

Indianapolis, IN 46268

|

|

|

925,000

|

(3)(4)

|

|

|

26.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Michael L.

Goldman

(

5

)

11 Skytop Drive

Trumbull, CT 06611

|

|

|

16,921

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Daniel R. Loftus

(

2

)

5210 Heathrow Hill Drive

Brentwood, TN 37027

|

|

|

185,000

|

(3)

|

|

|

5.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Frederick J. Merritt

(

2

)

1650 West 106

th

Street

Carmel, IN 46032

|

|

|

500,000

|

(3)(6)

|

|

|

14.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Jay J. Miller

(

5

)

450 East 57

th

Street, Suite 5D

New York, NY 10022

|

|

|

–

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Bernard Zimmerman

(

5

)

18 High Meadow Road

Weston, CT 06833

|

|

|

241,800

|

(7)

|

|

|

7.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group (6 persons)

|

|

|

1,868,721

|

|

|

|

54.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

LFM Investments, Inc.

1650 W. 106

th

Street

Indianapolis, IN 46032

|

|

|

500,000

|

(3)

|

|

|

14.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Chafre, LLC

3502 Woodview Trace, Suite 200

Indianapolis, IN 46032

|

|

|

400,000

|

(3)

|

|

|

11.6

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Charles E. Lanham

7564 Silver Pine Court

Indianapolis, IN 46250

|

|

|

290,000

|

(3)

|

|

|

8.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Martin Cohen

27 E. 65

th

Street Suite 11A

New York, NY 10021

|

|

|

244,440

|

|

|

|

7.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Bernard Zimmerman & Company, Inc.

18 High Meadow Road

Weston, CT 06833

|

|

|

241,800

|

|

|

|

7.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Claudia B. Carucci

Uncle Mills Partners, LLC

17 Eagle Island Place

Sheldon, SC 29941-3017

|

|

|

193,785

|

(8)

|

|

|

5.6

|

%

|

|

(1)

|

Unless otherwise indicated in the footnotes to this table, (a) the listed beneficial owner has sole voting power and investment power with respect to the number of shares shown, and (b) no director or executive officer has pledged as security any shares shown as beneficially owned.

|

|

(2)

|

Elected to serve after closing under the Purchase Agreement.

|

|

(3)

|

To be acquired pursuant to the Purchase Agreement.

|

|

(4)

|

Includes 400,000 shares held by Chafre, LLC of which Mr. Farrar is the Managing Member.

|

|

(5)

|

Resignation tendered effective as of a closing under the Purchase Agreement.

|

|

(6)

|

All 500,000 shares are held by LFM Investments, Inc., of which Mr. Merritt serves as President.

|

|

(7)

|

Represents shares owned by Bernard Zimmerman & Company, Inc. Mr. Zimmerman serves as President and is the control shareholder of Bernard Zimmerman & Company, Inc.

|

|

(8)

|

Based upon Schedule 13G filed on February 11, 2014 providing data as of December 31, 2013. Includes 79,389 shares held by Uncle Mills Partners, LLC, of which Ms. Carucci is the Manager.

|

DIRECTORS AND EXECUTIVE OFFICERS

As of the Change of Control, our directors and executive officers will be as follows.

|

Name

|

|

Age

|

|

Position

|

|

|

|

|

|

|

|

Frederick L. Farrar

|

|

57

|

|

Chairman, President, Chief Executive Officer, Principal Financial Officer and Director

|

|

Daniel R. Loftus

|

|

63

|

|

Secretary and Director

|

|

Fred J. Merritt

|

|

46

|

|

Director

|

The following summarizes the background of each such executive officer and appointed director.

Frederick L. Farrar

will be Chairman, President, Chief Executive Officer, Principal Financial Officer and Director of FCCC, Inc. upon the Change in Control. Previously, he served as Executive Vice President and Chief Financial Officer of Klipsch Group, Inc., from 1990 to 2013. Mr. Farrar also served on its board of directors from 2002 until it was acquired by Voxx International (NASDAQ: VOXX) in March of 2011. After the acquisition, Mr. Farrar continued to serve as Executive Vice President and Chief Financial Officer of Klipsch Group, Inc. until December 2013. Mr. Farrar is a founder and served as President and Chief Operating Officer of Windrose Medical Properties Trust (NYSE:WRS) from 2002 to 2006. After its merger with Healthcare REIT, Inc. (NYSE:HCN), he served as Executive Vice President from 2006 to 2009. Other roles include President and Chief Financial Officer of Trading Company of America, LTD, a private company that operated retail jewelry locations under the business name “The Shane Company”, from 1992 to 1997; Chief Financial Officer of National Guest Homes Inc., a developer and operator of assisted living facilities, from 1990 to 1996; and Chief Financial Officer of Hospital Affiliates Development Corporation, a fee-based developer of hospitals and other medical facilities from 1990 through 2002. Prior to 1990, Mr. Farrar had an initial 10 year career as a fee-based financial advisor. Mr. Farrar has served on the board of directors of BHC LLC/Cryopoint, LLC since August 2012 and is President and founder of Chafre LLC, a private investment-focused company that will become a significant stockholder of the Company after the Change in Control, among other private entities. Mr. Farrar received a B.A. from St. Lawrence University in 1978 and a law degree from Syracuse University in 1980.

Daniel R. Loftus

will serve as a director of our company and as Secretary following the Change in Control. Mr. Loftus is currently self-employed, but previously he served as Executive Vice President, Secretary and General Counsel of Windrose Medical Properties Trust (NYSE:WRS) from 2002 to 2006. After its merger with Health Care REIT, Inc. (NYSE:HCN), he served as Senior Vice President from 2006 to December 2013. Other roles include Executive Vice President and Chief Counsel of MT Communications, Inc., a private company operating a television station, from 1994 to 1996; and Chief Manager of Emmaus Ventures, a private investment-focused company during 2000. Mr. Loftus has been engaged in the practice of law since 1976 with several law firms located in Nashville, Tennessee. Mr. Loftus received a B.A. from Wabash College in 1972 and a law degree from Vanderbilt University in 1975.

Fred J. Merritt

has served as president and sole shareholder of LFM Investments, Inc. (“LFM”) since its formation in 1999. LFM has been active in the acquisition, ownership and management of companies engaged in various industries including manufacturing, electronics, staffing, bio-tech, printing, construction, finance, parking and staffing. Mr. Merritt has also served as chief executive officer, president, vice president of finance and sole shareholder of Riverside Mfg., LLC, a private specialized military supplier focused on wheeled tire vehicles and track vehicles, since 2002. Prior to 1999, he devoted ten years of his career in the corporate banking industry with a focus on closely held business acquisitions and valuations. Mr. Merritt served as an outside director for Bloomfield State Bank from 2007 to 2014, where he was a member of the Bank’s audit and loan committees. Mr. Merritt received a B.S. degree from Indiana University in 1989.

Board of Directors and Corporate Governance

The Company’s Board of Directors is responsible for establishing broad corporate policies and for overseeing our overall management. In addition to considering various matters which require board approval, the Board provides advice and counsel to, and ultimately monitors the performance of, our executive officer(s). All directors hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified. Officers are elected to serve, subject to the discretion of the Board, until their successors are appointed. The Company has not held an annual meeting of stockholders since 2003.

Mr. Farrar will become our Chief Executive Officer and will lead our Board of Directors as Chairman. We do not intend to designate a lead independent director. We believe that this structure is appropriate for the Company at this time. Specifically, we believe that the proposed leadership structure will provide leadership and engagement while we seek and evaluate opportunities. Because we do not currently have any operations, we believe the potential risks of concentration of authority are outweighed by the efficiency of having the same person serve as Chief Executive Officer and Chairman.

One of the key functions of our Board of Directors is informed oversight of our Company’s risk management processes. Our Board administers its oversight functions primarily through monitoring and assessing risks through its full membership rather than through standing committees. Our audit committee is responsible for assessing significant financial risks and risks of compliance with legal and regulatory requirements.

Director Independence

Based upon a review of the material relationships between our directors and our Company, we have determined that none of our directors are eligible for designation as “independent” directors.

Committees of the Board

Audit Committee.

Our Board of Directors has established an Audit Committee. The Committee meets with management and our independent auditors to determine the adequacy of internal controls and other financial reporting matters. After the Change of Control we expect the Audit Committee will be composed of Daniel R. Loftus and Fred J. Merritt.

All of the members of the Audit Committee will meet the requirements for financial literacy under the applicable rules and regulations of the SEC. Our Board of Directors has determined that Mr. Merritt will be qualified to serve as an audit committee financial expert, as that term is defined under the applicable rules of the SEC.

Our Board of Directors does not have a standing compensation committee or nominating committee and it is not expected to form them in connection with the Change of Control. We believe this structure is appropriate in light of the Company’s current capital structure and level of operations.

Family Relationships

There are no family relationships among our directors and any of our executive officers.

Legal Proceedings

There are no material proceedings pursuant to which any of our directors or executive officers is a party adverse to us.

Code of Ethics

We do not currently have a code of ethics. We believe this approach is appropriate in light of the Company’s current capital structure and level of operations, but we expect to continue to evaluate the appropriateness of adopting a code of ethics as our Company continues to develop.

Communication to the Board of Directors

You may contact our Board of Directors or any director by mail addressed to the attention of our entire Board or the specific director identified by name or title, at FCCC, Inc., 200 Connecticut Avenue, Norwalk, Connecticut 06854. All communications will be submitted to our Board or the specified director on a periodic basis.

For the fiscal years ended March 21, 2014 and March 31, 2013 there was no direct compensation awarded to, earned by or paid by us to our President and Chief Executive Officer, Bernard Zimmerman. No other persons served as executive officers during those periods. See

Related Party Transactions

below for a discussion of payments made to Bernard Zimmerman & Company, Inc., an affiliate of Mr. Zimmerman.

Related Party Transactions

On July 1, 2003, we entered into a consulting agreement with Bernard Zimmerman & Company, Inc. (the “Original Consulting Agreement"), whose President and controlling shareholder is Bernard Zimmerman, a current member of our Board of Directors and our current Chief Executive Officer and President. Under the Original Consulting Agreement Mr. Zimmerman’s company provided consulting services with respect to the business and finances of the Company in exchange for monthly payments of $2,000.00 plus reasonable and necessary out-of-pocket expenses. The Original Consulting Agreement would have expired by its terms on July 1, 2006, but has been authorized by our Board of Directors to continue on a month to month basis since that time. Effective August 1, 2011, the monthly fee payable under the Original Consulting Agreement was reduced to $1,500 per month. Effective April 1, 2012, the monthly fee was eliminated.

In connection with the Purchase Agreement and subject to a closing thereunder, we have agreed to enter into a new consulting agreement with Bernard Zimmerman & Company, Inc., which will be effective as of July 1, 2014 and which will supersede the Original Consulting Agreement. The new consulting agreement will have a twelve-month term and Bernard Zimmerman & Company, Inc. will provide similar services as under the Original Consulting Agreement in exchange for monthly payments of $2,000, with the right of the Company to terminate the agreement prior to the sixth month of the term for an early termination fee of $12,000 less payments made prior to termination.

Compensation of Directors

After the Change of Control, all directors, other than Mr. Farrar and Mr. Loftus, initially will be eligible to receive a fee of $100 for each Board of Directors meeting attended. Audit Committee members receive a fee of $100 per Audit Committee meeting held on a day when a meeting of the Board is not also scheduled to occur.

The members of the Board of Directors, as a group excluding Mr. Zimmerman, received an aggregate total of $1,800 of director fees during the most recent completed fiscal year ended March 31, 2014.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934 and the regulations promulgated thereunder require directors and certain officers and persons who own more than 10% of our common stock to file reports of their ownership of our common stock and changes in their ownership with the SEC. None of our officers or directors failed to file any required report on a timely basis during our Company’s most recent fiscal year.

LEGAL PROCEEDINGS

We are not aware of any legal proceeding to which any director or officer or any of their affiliates is a party adverse to our Company or in which such persons have a material interest adverse to our Company.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are required to file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC’s public reference rooms at 100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information on the operation of the public reference rooms. Copies of our SEC filing are also available to the public from the SEC’s website at

www.sec.gov

.

SIGNATURE

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized, on June 27, 2014.

|

|

FCCC, INC.

|

|

|

|

|

|

|

By:

|

/s/ Bernard Zimmerman

|

|

|

|

Bernard Zimmerman

President and Chief Executive Officer

|

|

8

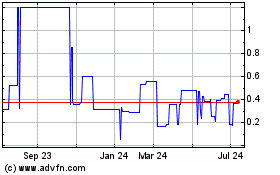

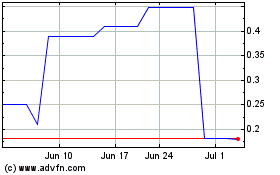

FCCC (PK) (USOTC:FCIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

FCCC (PK) (USOTC:FCIC)

Historical Stock Chart

From Apr 2023 to Apr 2024