UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 31, 2014

3DIcon Corporation

(Exact name of

registrant as specified in charter)

|

Oklahoma

(State or other jurisdiction of

incorporation) |

000-54697

(Commission

File Number) |

73-1479206

(IRS Employer

Identification No.) |

|

6804 South Canton Avenue, Suite

150

Tulsa, OK

(Address of principal executive

offices) |

74136

(Zip Code) |

Registrant’s telephone number, including

area code: (918) 494-0505

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

FORWARD-LOOKING

STATEMENTS

This Current Report on Form 8-K contains

forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future

events or performance, and underlying assumptions and other statements that are other than statements of historical facts. These

statements are subject to uncertainties and risks including, but not limited to (i) securing capital for general working purposes,

and (ii) other risks and in statements filed from time to time with the Securities and Exchange Commission (the “SEC”).

All such forward-looking statements, whether written or oral, and whether made by or on behalf of the Company, are expressly qualified

by the cautionary statements and any other cautionary statements which may accompany the forward-looking statements. In addition,

the Company disclaims any obligation to, and will not, update any forward-looking statements to reflect events or circumstances

after the date hereof.

Item 7.01 Regulation

FD Disclosure

On June 19, 2014,

the 3DIcon Corporation (the “Company”) held a management briefing for its shareholders. The Company’s presentation

is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information

contained in this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities

Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as shall be expressly set forth by

specific reference in such a filing. The furnishing of the information in this Current Report on Form 8-K is not intended to, and

does not, constitute a representation that such furnishing is required by Regulation FD or that the information contained in this

Current Report on Form 8-K constitutes material investor information that is not otherwise publicly available.

The Securities

and Exchange Commission encourages registrants to disclose forward-looking information so that investors can better understand

the future prospects of a registrant and make informed investment decisions. This Current Report on Form 8-K and exhibits may contain

these types of statements, which are “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, and which involve risks, uncertainties and reflect the Registrant’s judgment as of the date of this Current

Report on Form 8-K. Forward-looking statements may relate to, among other things, operating results and are indicated by words

or phrases such as “expects,” “should,” “will,” and similar words or phrases. These statements

are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at

the date of this Current Report on Form 8-K. Investors are cautioned not to rely unduly on forward-looking statements when evaluating

the information presented within.

| Item

9.01 | Financial

Statements and Exhibits |

| |

Exhibit No. |

Description |

| |

99.1 |

Corporate Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: June 20, 2014 |

3DICON CORPORATION |

|

| |

|

|

|

|

By: |

/s/ Victor Keen |

|

| |

Name: |

Victor Keen |

|

| |

Position: |

Chief Executive Officer |

|

3DIcon Corporation Management Briefing June 19, 2014

Disclaimer Certain information or statements in this presentation constitute “forward - looking statements” and as an early stage development company, such forward looking statements made by 3 DIcon are speculative and not observable historically . All statements other than statements of historical facts included in this presentation, including those regarding 3 DIcon’s future financial position and results, business strategy, plans and objectives of management for future operations, including development plans, potential financial results, and statements on industry growth are forward - looking statements . These forward - looking statements involve known and unknown risks, uncertainties and other factors which may cause 3 DIcon’s actual results, performance or achievements, to be materially different from any future results, performance or achievements expressed or implied by such forward - looking statements . These forward - looking statements are based on numerous assumptions regarding 3 DIcon’s present and future business strategies and the environment in which 3 DIcon will operate in the future, including capital to be raised by or on behalf of 3 DIcon . Factors that could cause 3 DIcon’s actual results, performance or achievements to differ materially from those in the forward - looking statements include, among others, changes in the Company’s business plan, manufacturing capabilities, political, economic or regulatory conditions in the markets in which 3 DIcon anticipates operating and supplies of materials . 3 DIcon does not guarantee future results, levels of activity, performance or achievements . 3 DIcon, its employees, affiliates and representatives make no representations or warranties, express or implied, as to the accuracy or completeness of any of the information contained herein or any other written or oral communication transmitted or made available to any recipients, and each of such parties expressly disclaims any and all liability relating to or resulting from the use of such information and communications by the recipients or any of its affiliates or representatives . Only those particular representations and warranties, if any, which may be made to the recipients in one or more definitive written agreements when, as and if executed, and subject to such limitations and restrictions as may be specified in such definitive written agreements, shall have any legal effect . The information provided in this presentation does not constitute any offer or solicitation of securities of any kind . The information contained herein does not constitute investment, legal or tax advice . The summary information contained herein does not purport to represent all relevant information regarding 3 DIcon . Any forecasts herein are provided by management in this presentation for illustrative purposes only and are based on information available to us at this time . Management expects that internal forecasts and expectations may change over time . 1

Meeting Agenda Meeting Objectives & Introductions Victor Keen, CEO 3D Display Industry Overview Mark Willner, 3DIcon Business Advisory Board 3DIcon’s Plan For Success Plan Overview – Victor Keen, CEO Schott Defense / 3Dicon Partnership – Jim Stein, Schott Systems Engineering Update – Hakki Refai, CTO CEO Observation from a Shareholder Perspective Questions & Answers John O’Connor, Chairman of the Board 2

Meeting Objectives Provide our shareholders with an update on 3DIcon’s strategies & plans for success Presentations by 3DIcon management, partners, consultants and advisors Provide our shareholders with an opportunity to interact with 3DIcon management Question & answer session via live meeting and online webinar 3

3D DISPLAY INDUSTRY OVERVIEW Mark Willner, Chairman, 3DIcon Business Advisory Board 4

The 3D Display Opportunity The near term opportunity for 3D is in professional applications and not consumer TV makers & movie / gaming companies were burned by glasses - based 3DTV failure Less than 1% of all movies are made in 3D Consumers want to multi - task / interact at home Glasses - free 3DTV is 5 - 7 years away Adoption curve will be similar to HDTV & Color TV Lack of content vs. installed base, lack of industry standards, cost of converting infrastructure barriers 5

Professional Vs. Consumer Professional 3D Applications Focus on decision making speed & accuracy at work Visualization of real world data (all possible views) User needs to decide what they see Collaboration based on multiple views important Consumer 3D Applications Focus on home / mobile entertainment Visualization of movies shot in 3D (stereo camera) or 3D console / PC games rendered in stereo Director gets to decide what user sees 6

The Problem & The Solution 7 Hang on while I convert the 3D radar data I see on this 2D display back into a 3D mental model so I can make a good decision quickly THE SOLUTION – Show 3D data on a 3D display (eliminate the double 3D - to - 2D and 2D - to - 3D conversion) THE PROBLEM…

Professional 3D Applications Where 3D Data I s B eing C aptured T oday Via radar, sonar, laser, seismic, satellite, and other imaging technologies Government / Military Air Traffic Control, UAV Piloting Passenger, Luggage & Cargo Screening Battle Space V isualization Underwater Targeting & Navigation Simulation & Training Industrial / Medical Medical Imaging – MRI, CT, Ultrasound Oil & Gas Exploration – Seismic Weather Assessment & Forecasting Automotive & Aerospace Design 8

A Professional Application

CSpace Vs. Other 3D Displays 10

CSpace Vs. O culus Rift 3DIcon CSpace Oculus Rift User Experience Real World Interaction Fully Immersive Key Application Professional – Decision Support Entertainment – Gaming Number of Users Multiple One Simultaneous Views Infinite 360 ° One Stereo Depth Cues Real World (All 4) Disparity Only (1 of 4) Potential Issues NONE Nausea, Loss of Balance, Eye Strain, Headache, … 11

Glasses - Free 3D Displays 12 Glasses - Free 3D Displays Flat Surface 3D Displays Volumetric 3D Displays Horizontal Parallax Only Full Parallax Multiview Holoform Light Field Holographic Stereo Swept Volume Static Volume 3DIcon 3DTL Actuality Xigen , USC Zebra Ostendo MIT, … Philips, … MANY Holografika , … Note: • Simplified & Not Exhaustive (does not include eye/head tracked technologies)

Flat Projection 3D Displays Light Field Displays – Every 2D pixel is divided into 1,000s or more subpixels . Each subpixel is steered / projected in a slightly different direction using optics to show a different image for each pixel in each direction. 3D HDTV = 131 billion subpixels ; 3 of 4 vision depth cues True* Holographic Displays – Every 2D pixel is divided into 100,000s or more of subpixels smaller than the wavelength of light (<500 nm) that manipulate both the amplitude and phase of light . 3D HDTV = 500 billion subpixels ( ± 30 ° FOV); all depth cues 13 * Many technologies claim to be holographic but are not

3DIcon Vs. Ostendo 3DIcon CSpace Ostendo QPI Approach Volumetric - Infrared Phosphors & Lasers Light Field - Flat Projection Multi - year Goal ~ 800M 3D pixels, 2 colors Large array of multiple chips with 256 x 256 2D pixels each, colors TBD (1024 x 640 3D pixels) Current Capability > 1M 3D green pixels Small array of six chip “projectors” with 16 x 20 2D green pixels each Path To Full Color Red - green - blue phosphors & 3 lasers Stacked red - green - blue LED emitters 14

CSpace Vs. Other 3D Displays CSpace ® will deliver both A real - time 360 ° viewing experience and Large high quality images & high reliability Stacked LCD & Stacked Shutter Not 360 ° view, limited depth & image size Image must be rotated on - screen Multiview & Holoform Not 360 ° view, not real t ime, horizontal 3D only Sweet - spots & repeating views (multi - view) Light Field & Holographic Low resolution & limited depth (light field) 100B+ sub - micron pixels feasibility ( holo ) 15

3DICON PLAN GOING FORWARD Victor Keen, CEO 16

Our Plan Going Forward Target High Value Professional Applications Model is Development Technology & Licensing or Other Joint Ventures Model We will not be manufacturing Utilize Non - dilutive US Federal Funding Principally to fund development of image space material Led by our partner Schott Defense and Doug Freitag One of world’s largest and most successful companies in developing and implementing sophisticated glass solutions for Government and industry Highly experienced in obtaining Government funding Goal is for Schott to be the first of other strategic partners for the Company 17

Operating Plan Overview 18 2014 2015 2016 2017 2018 2019 Secure Federal Funding (12 - 24 months) Development Of Image Chamber Materials (24 - 36 months) Development Of Optics, Electronics & Software (24 months) 3DIcon Revenue Stream - License Fees & Royalties

Plan Components 3DIcon Federal Funding Overview Doug Freitag , Bayside Materials Technologies Schott Defense / 3DIcon Partnership & Image Chamber Materials Development Jim Stein, VP of Government Affairs, Schott Defense Systems Engineering / OCAST Update Dr. Hakki Refai , CTO, 3DIcon 19

3DICON FEDERAL FUNDING OVERVIEW Doug Freitag , Bayside Materials Technologies 20

Federal R&D Funding Overview FY14 R&D Funding Available $140B available across 11 Agencies. 95% controlled by 6 Agencies (DOD, DHHS, NASA, DOE, NSF, USDA) Investment Criteria Supports agency mission (e.g., national security, energy security, public health) Beyond the risk tolera nce of industry Meritorious project selection Key Benefits to 3DIcon V alidation of the business idea Retain IP Foster partnerships 21 DOD: Dept. of Defense DHHS: Health & Human Services NASA: Aeronautics and Space DOE: Dept. of Energy NSF: Science Foundation USDA: Agriculture

Mechanics of Federal R&D Funding Not a loan program; no requirement to repay Reimburses direct and indirect (overhead) costs. Funding used to increase the maturity of the technology with follow - on funding based on milestones. Timing is key due to Governmentt funding cycles Approximately $2B set aside for small business - Small Business Innovation (SBIR) 22

Historical Investment in 3D Displays Federal R&D Company Agency Amount Timing Ostendo Air Force IARPA (Air Force) $0.1M(SBIR) $58M (BAA) 2010 2012 - 2016 Xigen NASA, HHS, NSF $5.5M (SBIR) 2007 - 2013 Zebra Imaging Air Force, Army DARPA (Army) Navy $1M (SBIR) $19M (BAA) $10M (BAA) 2010 - 2013 2007 - 2012 2007 - 2009 Holochip Corp Navy, DARPA $0.5M (SBIR) 2008 - 2013 Third Dimen Tech Air Force, HHS, DOE $1.9M (SBIR) 2007 - 2013 Dimension Tech NASA, DOE, Navy, NSF, HHS $5.6M (SBIR) 1991 - 2011 Actuality Army $0.1M (SBIR) 2004 Zaxel Systems DARPA, NSF $1.25M (SBIR) 1999 - 2003 3D Tech Labs NIST, DARPA, NASA , NSF, MDA, HHS $1.4M (SBIR) 1996 - 2002 23

3DIcon Federal R&D Funding Forecast 24 0 2 4 6 8 10 12 14 16 18 GFY14 GFY15 GFY16 TITLE III MANTECH BAA SBIR Projected Award Timing $ Millions Title III: Create production capability Mantech : Cost reduction BAA: Mission need innovation SBIR: Small Business set - aside Innovation

3DIcon Federal R&D Opportunity Pipeline Organization Interest Engagement Start Intel Com (CIA, IARPA) Data Analyst tool July ARPA - E Manufact and design tool July Army ( ARL) Autonomous System operations, Situational awareness, Training June Air Force (AFRL) May Navy (ONR) June DARPA May DOD June, Oct FAA May DARPA Materials Science June NIH Medical imaging Aug NSF Materials Science June NASA Autonomous operations Jan 25

Value Chain Partnership Candidates 26 Software, Hardware, Materials Display Integration System Integration End Users • Schott (materials) • TBA (lasers) • TBD (other) • Rockwell Collins • Honeywell • Lockheed • Raytheon • Boeing • ITT • L - 3 • DOD • NASA • DOT (FAA) • Intel (CIA, etc.) Goals Develop strategic partnerships for complementary technologies (e.g. materials) & value added integration Jointly pursue significant federal funding with and through these strategic partners.

SCHOTT DEFENSE - 3DICON PARTNERSHIP IMAGE CHAMBER MATERIALS DEVELOPMENT Jim Stein, VP of Government Affairs, Schott Defense 27

© SCHOTT North America, Inc. SCHOTT AG – global presence Global technology group, founded in Jena, Germany in 1884 ▪ Established as Private Foundation out of partnership between Carl Zeiss and Otto Schott ▪ Carl Zeiss Foundation now sole shareholder (2004) ▪ Production and sales in 35 countries ▪ Over 16,000 employees North American Headquarters in Elmsford, New York Established materials/glass development and manufacturing in America 44 years ago at request of DOD ▪ 8 US Manufacturing sites ▪ Over 1500 US employees Over $2.5 Billion in annual Sales 28

SCHOTT is a diversified high - tech manufacturing group Electronic Packaging Pharma Systems Home Tech Flat Glass Advanced Materials Fiber Optics Energy SCHOTT Products are found: - On the Moon - In planetary orbits - In National Labs - In your automobile - In your kitchen - In museums - On your roof - Protecting our Troops

© SCHOTT North America, Inc. R&D: Innovation Leadership the Key to Maintaining Our Lead Materials Development Expertise: Development and innovation of glass and glass ceramic materials ▪ Invented the glass ceramic cooktop ( Ceran ) – eco friendly ▪ Transparent armor window systems ( DoD M - AT V) Manufacture of high technology custom materials Melting and Hot forming process development Coating Technologies Coefficient of thermal expansion matching between dissimilar materials Hermetically Sealed Electronic Packaging (EPA’s) Specialize in Products that Can Not Fail Fusion – laser glass for world’s most powerful lasers Fission – P roven 60 year life in reactor pressure vessel feedthroughs Renewables – Proven 25 year life on PV modules and CSP receiver tubes Oil and Gas – Down well sensor connectors – Liquid Natural Gas Tanker Feed through assemblies Survivability – Advanced Glass Ceramic Armor Systems for US M - ATV – Ejection seat and auto air bag initiators Pharma – Epi - pen auto - injectors 30 Global network with more than 600 R&D employees all over the world ▪ The Otto Schott Research Center in Mainz ▪ The Development Center in Duryea, Pennsylvania (USA) ▪ Technical Support Centers in Europe, North America and Asia

© SCHOTT North America, Inc. 3 1 SCHOTT and the USG - a long and successful track record >9,000 laser glass slabs for Lawrence Livermore`s National Ignition Facility delivered OEM for Transparent Armor for M - ATV Supplier of fiber optic components for night vision devices used by the U.S. military Security cleared staff for ITAR and classified projects in defense office in Crystal City, Arlington, VA and other sites Federal and Prime Contractor grants and support for numerous R&D projects in the U.S Exawatt Laser Material High Homogeneity Optical Glass Advanced Armor Chemical Strengthening SCHOTT is a core component supplier and reliable partner to the U.S . military and the U.S. Government

SYSTEMS ENGINEERING / OCAST UPDATE Dr. Hakki Refai , CTO 32

Product Prototype Goals (OCAST) The targeted image chamber size is 26 cm x 26 cm x 26 cm The target resolution for the optimized device is nearly 800 million voxels, consisting of 0 . 25 x 0 . 25 x 0 . 25 mm 3 voxels arranged in 1000 slices of 1024 x 768 voxels per slice 3 D Animation capabilities will be added to CSpace® display The created 3 D images will be viewed under normal room illumination The display will have a refresh rate of 30 Hz to provide flicker free images

Optics, Electronics, and Software Developments Wide Angle Projection Lens Line Generator Optics 3D Animation Software Development PLC Synchronization and Touch Screen Control To reach these goals

Wide Angle Projection Lens The design of the wide angle projection lens has begun, with the intent of replacing the current imaging projector with a new projector that can deliver the large 2 D images needed to address the larger image chamber that will be constructed during the project .

Laser Line Generator Optics The target design has three direct benefits for the display operation : 1. T he increased line length allows a larger area slice to be generated, allowing a larger image to be addressed and displayed 2. The narrower width provides greater voxel resolution in the depth dimension 3. The total area of the new line is very close to that of the current line area for the majority of voxels, and thus the power available to the upconversion process remains the same as the current system, and will therefore produce images of brightness that can be seen under normal room illumination

Programmable Logic Controller (PLC) control Software to be developed that will add a Programmable Logic Controller (PLC) control panel that will allow significant control over the display from the touch screen panel .

3D Animations Additional software development has focused on adding animation to the display by modifying the main CSpace® display program.

Victor Keen, CEO CEO OBSERVATIONS FROM A SHAREHOLDER PERSPECTIVE 39

CEO OBSERVATIONS FROM A SHAREHOLDER PERSPECTIVE Investor Goal: Appreciation in share value Principal factors governing value of the Company (and its stock price) Ability to adequately fund the R&D, particularly the development of the image space material Ability to minimize the dilution of the Company stock Time it takes to commercialize the technology or make demonstrable progress in doing so 40

CEO OBSERVATIONS – CON’T The Value Proposition What will the Company be worth when our technology is incorporated into a product? What is the Company worth now? The stock market seems to be betting that our chance for success may be remote . Factors that suggest that the current market valuation ($4 - 5 million) is appropriate Financial limitations have severely constrained our R&D capability We have been utilizing dilutive financing Investment from venture sources not readily available and would be equally dilutive The time and investment required to reach or approach commercialization is daunting 41

CEO OBSERVATIONS – CON’T Factors that suggest that our Company may be undervalued by the market ▪ Strong patent protection of IP ▪ Strong partner in Schott ▪ Favorable prospect for non - dilutive funding ▪ Doug Freitag and Schott project Government funding of $20 - 25 million over 3 years ▪ Others have received similar or greater government funding – Ostendo , Zebra ▪ Prior to DTC “chill” and the consequent onerous financing, now extinguished, market valued the Company at $74 million vs $2 - 5 million in last 6 months ▪ Substantial companies/potential partners (e.g., Boeing, Lockheed, Raytheon, SAC, etc.) have examined our technology – interested and supportive 42

CEO OBSERVATIONS – CON’T Success does not necessarily await CSpace being fully commercialized Could secure lucrative license deal with prepayments Could be acquired by, or partner with, another company Many non - revenue companies have been acquired or gone public at substantial valuations The stock market should ultimately reflect our progress toward commercialization, creating a favorable exit for individual shareholders 43

QUESTIONS & ANSWERS John O’Connor, Chairman Of The Board 44

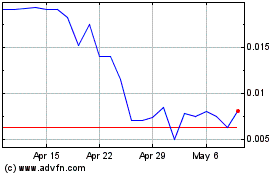

Coretec (QB) (USOTC:CRTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coretec (QB) (USOTC:CRTG)

Historical Stock Chart

From Apr 2023 to Apr 2024