Filed

Pursuant to Rule 424(b)(3)

Under the Securities Act of

1933, as amended

Registration

No.

333 – 195952

PROSPECTUS

Up to 147,000,000 Shares of Common Stock

This prospectus relates to the offer and sale of up to 147,000,000

shares of common stock, par value $0.001, of Amarantus BioScience Holdings, Inc., a Nevada corporation, by the selling stockholders

identified on page 17 of this prospectus.

We are not selling any securities under this prospectus and

will not receive any of the proceeds from the sale of shares by the selling stockholders.

One of the selling stockholders, Lincoln Park Capital Fund,

LLC, or “Lincoln Park”, is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act

of 1933, as amended. The selling stockholders, including Lincoln Park, may sell the shares of common stock described in this prospectus

in a number of different ways and at varying prices. See “Plan of Distribution” for more information about how the

selling stockholders may sell the shares of common stock being registered pursuant to this prospectus.

We will pay the expenses incurred in registering the shares,

including legal and accounting fees. See “Plan of Distribution”.

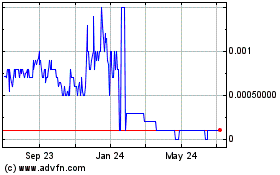

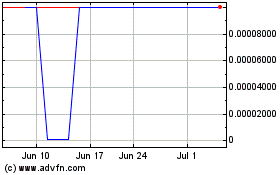

Our common stock is currently quoted on the OTC Markets under

the symbol “AMBS”. On June 2, 2014, the last reported sale price of our common stock on the OTC Markets was $0.10.

Our business and an investment in our securities involve

a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus for a discussion of information that

you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is June

17, 2014

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus

or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not authorized

anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may

authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities.

The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this

prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed

since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere

in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before

investing in our securities, you should carefully read this entire prospectus, including our financial statements and the

related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless otherwise stated all references to “us,”

“our,” “Amarantus,” “we,” the “Company” and similar designations refer to, Amarantus

Bioscience Holdings

, Inc., a Nevada corporation.

Overview

We are a California-based development-stage biopharmaceutical

company founded in January 2008. We focus on developing our intellectual property and proprietary technologies to develop drug

and diagnostic product candidates to treat human disease. We own or have exclusive licenses to various product candidates in the

biopharmaceutical and diagnostic areas of the healthcare industry, with a specific focus on bringing these candidates to market

in the areas of Alzheimer’s disease, Parkinson’s disease, Retinal Degenerative disorders, and other ailments of the

human body, with a particular focus on the nervous system. Our business model is to develop our product candidates through various

de-risking milestones that we believe will be accretive to stockholder value and strategically partner with biopharmaceutical

companies, diagnostic companies, investors, private foundations and other key stakeholders in the specific sub-sector of the healthcare

industry in which we are developing our products in order to achieve regulatory approval in key jurisdictions and thereafter successfully

market and distribute our products.

Principal Products in Development

The Company’s philosophy is to acquire, in-license, discover

and develop drug candidates and diagnostics with the potential to address critically important biological pathways involved in

human disease.

LymPro Test ®

The Lymphocyte Proliferation Test (“LymPro Test

®”, or “LymPro”) is a diagnostic blood test for Alzheimer’s disease originally developed by the University

of Leipzig in Germany. The test works by evaluating the cell surface marker CD69 on peripheral blood lymphocytes following a mitogenic

stimulation. The underlying scientific basis for LymPro is that Alzheimer’s patients have a dysfunctional cellular machinery

that inappropriately allows mature neurons in the brain to enter the mitotic process (cell division /cell cycle). When this happens

the neurons start the cell division process, but cannot complete that process. As a result, a number of cytokines and other genes

are upregulated, ultimately leading to cell death by apoptosis. This inappropriate cell division activation process is also present

in the lymphocytes of Alzheimer’s patients, as lymphocytes share a similar cellular division machinery with brain neurons.

We measure the integrity of this cellular division machinery process by measuring CD69 upregulation in response to the mitogenic

stimulation. If CD 69 is upregulated it means that the cellular division machinery process is correct and Alzheimer’s is

not present. If CD69 is not upregulated, it means there is a dysfunctional cellular division machinery process, and Alzheimer’s

is more likely. To date, data has been published in peer-reviewed publications on LymPro with 160 patients, demonstrating 92%

co-positivity and 91% co-negativity with an overall 95% accuracy rating for LymPro.

Eltoprazine

Eltoprazine is a small molecule drug candidate that is a selective

partial agonist on the 5HT1-A and 5HT1-B receptors of the serotonergic system in the brain originally discovered and developed

by Solvay Pharmaceuticals (now Abbvie). The serotonergic system has been associated with a wide range of disorders motor and behavioral

disorders including aggression, cognition, attention and control. The Company is developing Eltoprazine for the treatment of the

primary side effect of current Parkinson’s disease medication Levadopa-Induced Dyskinesia (“PD LID”), as well

as Adult Attention Deficit Hyperactivity Disorder (“Adult ADHD”). To date, over 700 patients have been dosed with

Eltoprazine at varying doses as high as 30mg; the active dose in both PD LID and Adult ADHD is 5mg. Primary and secondary endpoints

have been met for Eltoprazine in Phase 2 trials in PD LID and Adult ADHD.

MANF

Mesencephalic Astrocyte-derived Neurotrophic Factor or MANF

is an endogenous, evolutionally conserved and widely expressed protein that was discovered by the Company’s Chief Scientific

Officer Dr. John Commissiong. MANF acts on a variety of molecular functions, including as a part of the endoplasmic reticulum

stress response (“ER-SR”) system of the unfolded protein response (“UPR”). MANF has demonstrated efficacy

as a disease-modifying treatment in various animal models, including Parkinson’s disease, retinitis pigmentosa, cardiac

ischemia and stroke. The Company has made a strategic decision to focus the development of MANF in orphan indications and is currently

evaluating the most appropriate indication for development based on data currently being assembled internally, by contract research

organizations and academic collaborators.

Since inception, the Company’s research team has been

focused on developing MANF as a therapeutic for Parkinson’s disease, and other apoptosis-related disorders. The Company’s

business plans are focused in these specific areas:

Other

Exploration of our PhenoGuard platform for neurrotrophic factor

discovery and discovery and evaluation of external drug candidates for potential in-licensure or acquisition.

For the next 12 months, the Company intends to focus primarily

on the commercialization of LymPro, the further clinical development of Eltoprazine, and the preclinical development of MANF.

The Transactions under which the shares included in this

Prospectus may be or were issued

Lincoln Park

On March 7, 2014, we entered into a purchase agreement with

Lincoln Park, which we refer to in this prospectus as the “Purchase Agreement”, pursuant to which Lincoln Park has

agreed to purchase from us up to $20,000,000 of our common stock (subject to certain limitations) from time to time over a 30-month

period. Also on March 7, 2014, we entered into a registration rights agreement, or the “Registration Rights Agreement”,

with Lincoln Park, pursuant to which we have filed with the SEC the registration statement that includes this prospectus to register

for resale under the Securities Act of 1933, as amended, or the Securities Act, 90,000,000 of the shares that have been or may

be issued to Lincoln Park under the Purchase Agreement.

This prospectus covers the 4,000,000 shares of our common stock

that we have already issued to Lincoln Park for a total purchase price of $400,000 as an initial purchase under the Purchase Agreement

(the “Initial Purchase”) and 6,000,000 shares of our common stock, which we refer to in this prospectus as the “Initial

Commitment Shares”, as consideration for Lincoln Park’s commitment to purchase additional shares of our common stock

pursuant to the Purchase Agreement. This prospectus also covers an additional 76,500,000 shares of our common stock which may

be issued to Lincoln Park in the future pursuant to the Purchase Agreement and 3,500,000 shares of our common stock, which we

refer to in this prospectus as the “Additional Commitment Shares”, that we are required to issue proportionally in

the future, as an additional commitment fee, if and when we sell shares to Lincoln Park pursuant to the Purchase Agreement. The

Additional Commitment Shares are issued pro rata as Lincoln Park purchases up to the additional $19,600,000 of our common stock

as directed by us. For example, if we elect, at our sole discretion, to require Lincoln Park to purchase $100,000 of our stock

then we would issue 17,857 Additional Commitment Shares, which is the product of $100,000 (the amount we have elected to sell)

divided by $19,600,000 (the remaining total amount we can sell Lincoln Park pursuant to the Purchase Agreement multiplied by 3,500,000

(the total number of Additional Commitment Shares). The Additional Commitment Shares will only be issued pursuant to this formula

as and when we elect at our discretion to sell stock to Lincoln Park.

We do not have the right to commence any further sales to Lincoln

Park under the Purchase Agreement until the SEC has declared effective the registration statement of which this prospectus forms

a part. Thereafter, we may, from time to time and at our sole discretion, direct Lincoln Park to purchase up to 1,000,000 shares

of our common stock on any business day, which amount may be increased to up to 2,500,000 shares, provided the closing price of

our common stock exceeds certain thresholds set forth in the Purchase Agreement, with a maximum limit of up to $500,000 worth

of our common stock on any single business day. Additionally, we may direct Lincoln Park to purchase an additional “accelerated

amount” under certain circumstances set forth in the Purchase Agreement. Except as described in this prospectus, there are

no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any

sales of our common stock to Lincoln Park. The purchase price of the shares that may be sold to Lincoln Park pursuant to the Purchase

Agreement will be based on the market price of our common stock immediately preceding the time of sale as computed pursuant to

the Purchase Agreement without any fixed discount; provided that in no event will such shares be sold to Lincoln Park when our

closing sale price is less than $0.04 per share, subject to adjustment as provided in the Purchase Agreement. The purchase price

per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, or other similar

transaction occurring during the business days used to compute such price. We may at any time in our sole discretion terminate

the Purchase Agreement without fee, penalty or cost upon one business days’ notice. Lincoln Park may not assign or transfer

its rights and obligations under the Purchase Agreement.

As of May 29, 2014, there were 734,130,341 shares of our common

stock outstanding, of which 685,299,044 shares were held by non-affiliates, excluding the 10,000,000 shares that we have already

issued to Lincoln Park under the Purchase Agreement. Although the Purchase Agreement provides that we may sell up to $20,000,000

of our common stock to Lincoln Park, only 90,000,000 shares of our common stock that may be issued and sold to Lincoln Park under

the Purchase Agreement are being offered under this prospectus, which represents (i) 4,000,000 shares that we issued to Lincoln

Park in the Initial Purchase, (ii) 6,000,000 Initial Commitment Shares that we issued to Lincoln Park as a commitment fee, (iii)

an additional 76,500,000 shares which may be issued to Lincoln Park in the future under the Purchase Agreement, and (iv) 3,500,000

Additional Commitment Shares that we are required to issue proportionally in the future, as an additional commitment fee, if and

when we sell shares to Lincoln Park under the Purchase Agreement. If all of the 90,000,000 shares (inclusive of the 4,000,000

shares issued to Lincoln Park in the Initial Purchase and 6,000,000 Initial Commitment Shares issued to Lincoln Park), offered

by Lincoln Park under this prospectus were issued and outstanding as of the date hereof, such shares would represent 11.6% of

the total number of shares of our common stock outstanding and 11% of the total number of outstanding shares held by non-affiliates,

in each case as of the date hereof. If we elect to issue and sell more than the 90,000,000 shares offered under this prospectus

to Lincoln Park, which we have the right, but not the obligation, to do, we must first register for resale under the Securities

Act any such additional shares, which could cause additional substantial dilution to our stockholders. The number of shares ultimately

offered for resale by Lincoln Park is dependent upon the number of shares we sell to Lincoln Park under the Purchase Agreement.

Issuances of our common stock in this offering will not affect

the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders

will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing stockholders

own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage of our total outstanding

shares after any such issuance to Lincoln Park.

Memory Dx

On April 29, 2014, we entered into an asset purchase agreement

with Memory Dx, LLC, pursuant to which we purchased all of the assets of Memory Dx, including all right, title and interest in certain

cell-based technique for the detection, diagnosis or prognostic testing related to any neurodegenerative disorder, including,

Alzheimer’s disease, which is referred to as the LymPro Technology. The assets acquired include all intellectual property,

goodwill, patents and all copyrights owned by MDx, subject to certain exclusions and further described in the asset purchase agreement.

As consideration for transfer of the assets pursuant to the

asset purchase agreement, we agreed to pay to Memory Dx (i) $50,000 upon execution of the asset purchase agreement, (ii) $50,000

upon the date 60 days after execution of the asset purchase agreement, and (iii) $50,000 on the date 120 days after execution

of the asset purchase agreement. Additionally, we agreed to issue to Memory Dx upon delivery of the assets, 1,500,000 shares of

our common stock, which stock will have piggy-back registration rights.

Contingent upon (i) the Company entering into a direct licensing

agreement with the University of Leipzig or Leipzig, pursuant to which Leipzig would grant the Company a direct license to certain

assets now licensed to Memory Dx by Leipzig, and (ii) MDx terminating the license agreement it currently holds with Leipzig as

it relates to such licensed assets with the Company’s prior written consent, we shall issue to Memory Dx, upon the date

10 days after the execution of a direct license agreement between the Company and Leipzig, 6,500,000 shares of the Company’s

common stock and shall provide Memory Dx with piggy-back registration rights as it related to such shares.

PGI Drug Discovery

Effective January 14, 2014, we entered into a License Agreement

with PGI Drug Discovery, LLC or PGI, pursuant to which we were granted an exclusive license (with a right to sublicense) to certain

intellectual property, including clinical and pre-clinical data concerning licensed compounds for CNS related therapeutic applications,

referred to as the Eltoprozine Program covering the use of Eltoprazine and certain of its related compounds in all therapeutic

indications.

Pursuant to the terms of the License Agreement, we agreed to:

(i) pay PGI $100,000 in cash for the license within 20 days of the execution of the License Agreement, (ii) pay PGI up to an aggregate

of $4 million in development milestones through NDA submission, (iii) pay a research support payment to PGI as partial reimbursement

for costs incurred for earlier research and management of CIAS, ADHD and levodopa induced dyskinesia (LID) clinical trials totaling

up to $650,000 to be paid in a mixture of cash and shares of our common stock, and (iv) reimburse PGI for the Eltoprazine clinical

supply inventory up to $500,000 payable upon the earlier of the initiation of a Phase IIb clinical study or 6 months after the

date of the License Agreement. As further consideration for the license, we will pay a single digit royalty to PGI of the annual

worldwide aggregate net sales by the Company.

Simultaneous with the execution of the License Agreement, the

Company and PGI entered into a Services Agreement pursuant to which PGI will provide certain services to us related to PGI’s

proprietary analytical systems as will be set forth in certain study plans. We agreed to a payment commitment of $450,000 at a

minimum annual rate of $150,000 for each of three years. The Services Agreement is for a term of the later of 3 years or the completion

of any study plan accepted by the parties under the Services Agreement.

As partial consideration of the research support payment by

the Company to PGI, the Company entered into a Securities Purchase Agreement with PGI, pursuant to which PGI subscribed for 4,000,000

shares of our common stock. Pursuant to the SPA, the Company granted PGI certain piggy-back registration rights.

Warrants

On March 7, 2014, we accepted elections to exercise certain

warrants in the aggregate amount of 60,000,000 shares of common stock for gross proceeds of $3,600,000. Pursuant to the offer

to exercise dated February 13, 2014 as supplemented on March 6, 2014, the holders of outstanding warrants to purchase shares of

our common stock at a price of $0.06, the “Original Warrants,” were offered the opportunity to exercise their Original

Warrants and receive warrants (the “New Warrants”) to purchase three (3) shares of our common stock for every four

(4) Original Warrants exercised. The New Warrants are exercisable at a price of $0.12 for a term of five (5) years. The New Warrants

are callable by the Company if the volume weighted average price of our common stock for each of 20 consecutive trading days exceeds

$0.18 and certain equity conditions are met. We may also call the New Warrants if the closing price of the Company’s common

stock exceeds $0.18 on the date that is the earlier of the receipt by the Company of an approval letter for listing of our common

stock on an exchange or listing of our common stock on an exchange. The holders of the New Warrants were also granted piggyback

registration rights.

Risks Associated With Our Business

Our business is subject to numerous risks described in the

section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before

making an investment. Some of these risks include:

|

|

·

|

We are largely dependent

on the success of our lead product candidates, Eltoprazine, LymPro and MANF, and we may not be able to successfully commercialize

these products;

|

|

|

·

|

If we fail to obtain U.S. regulatory

approval of LymPro, Eltoprazine, MANF or any of our other current or future product candidates, we will be unable to commercialize

these potential products in the United States;

|

|

|

·

|

Our proprietary rights

may not adequately protect our intellectual property and product candidates and if we cannot obtain adequate protection of

our intellectual property and product candidates, we may not be able to successfully market our product candidates.;

|

|

|

·

|

If our product candidates,

including LymPro, Eltoprazine, MANF, do not gain market acceptance among physicians, patients and the medical community, we

will be unable to generate significant revenue, if any.;

|

|

|

·

|

We are at an early stage

of development as a company and currently have no source of revenue and may never become profitable;

|

|

|

·

|

We do not have any products that are

approved for commercial sale and therefore do not expect to generate any revenues from product sales in the foreseeable future,

if ever;

|

|

|

·

|

We have incurred significant losses

since inception and anticipate that we will incur continued losses for the foreseeable future;

|

|

|

·

|

We will need to raise substantial additional

capital to fund our operations, and our failure to obtain funding when needed may force us to delay, reduce or eliminate certain

product development programs;

|

|

|

·

|

If we are unable to hire and retain

key personnel, we may not be able to implement our business plan.;

|

|

|

·

|

Our stock price may be volatile;

|

|

|

·

|

We have not and do not anticipate paying

any dividends on our common stock;

|

|

|

·

|

We have a potential issuance of additional

common shares from the conversion of our promissory note;

|

|

|

·

|

If we fail to establish and maintain

an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any

inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the

trading price of our common stock;

|

|

|

·

|

Offers or availability for sale of

a substantial number of shares of our common stock may cause the price of our common stock to decline;

|

|

|

·

|

Our certificate of incorporation allows for our board to create

new series of preferred stock without further approval by our stockholders, which could adversely affect the rights of the

holders of our common stock;

|

|

|

·

|

We improperly classified certain unpaid

bonuses to senior management and may need to restate Form 10-K for the year ended December 31, 2012 and Forms 10-Q for the

quarters ended March 31, 2013, June 30, 2013 and September 30, 2013;

|

Corporate Information

We were incorporated on January 14, 2008 in the state

of Delaware and were reincorporated in Nevada on March 22, 2013. The Company is a development stage biopharmaceutical drug development

holding company dedicated to sourcing high-potential therapeutic and diagnostic platform technologies and aligning their development

with complementary biopharmaceutical assets to reduce overall enterprise risk. Our principal executive offices are located at c/o

Janssen Labs@QB3, 953 Indiana Street San Francisco, CA 94107

and our telephone number is (408) 737-2734. Our website

address is http:// http://www.amarantus.com/. The information on, or that can be accessed through, our website is not part of

this prospectus.

Summary of the Offering

|

Common stock to be offered by the selling stockholders

|

|

147,000,000 shares including (i)

90,000,000 shares, 10,000,000 which have been issued, and 80,000,000 which we may issue under the Purchase Agreement with

Lincoln Park; (ii) 12,000,000 shares of common stock which have been issued or maybe issued to PGI Drug Discovery or Memory

Dx, and (iii) 45,000,000 shares issuable upon exercise of warrants.

|

|

|

|

|

|

|

|

|

|

Common stock outstanding prior to this offering

|

|

734,130,341 shares

|

|

|

|

|

|

Common stock to be outstanding after this offering (1)

|

|

865,989,339 shares

|

|

|

|

|

|

Use of Proceeds

|

|

We will receive no proceeds from the sale of shares of common stock

by the selling stockholders in this offering. However, we may receive up to $20,000,000 under the Purchase Agreement

with Lincoln Park, of which we have already received $400,000. Also, we may receive the exercise price of any common stock

we issue to the selling stockholders who hold the warrants included in this prospectus, upon exercise of their outstanding

warrants. However, the holders may exercise their warrants on a cashless basis if at any time after the six months anniversary

there is no effective registration statement or current prospectus available for the resale of the shares underlying the Warrants,

in which case we will not receive any proceeds from such exercise.

|

|

|

|

|

|

|

|

Any proceeds that we receive from sales to Lincoln Park under the

Purchase Agreement and exercise of the warrants will be used for research and development, product acquisition and general

corporate purposes. See “Use of Proceeds.”

|

|

|

|

|

|

Risk factors

|

|

This investment involves a high degree of risk. See “Risk

Factors” for a discussion of factors you should consider carefully before making an investment decision.

|

|

|

|

|

|

Symbol on OTC Markets

|

|

AMBS

|

|

|

(1)

|

Assumes the issuance and sale of the 80,000,000 shares

that may be issued and sold to Lincoln Park pursuant to the Purchase Agreement and the

exercise of the warrants by the holders of the warrants that are offered in this prospectus.

|

RISK FACTORS

Any investment in our securities involves

a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this

prospectus before deciding whether to purchase our securities. Our business, financial condition and results of operations could

be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements

that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking

statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Related to Our Product Candidates

and Operations

We are largely dependent on the

success of our lead product candidates, Eltoprazine, LymPro and MANF, and we may not be able to successfully commercialize these

products.

We have incurred and will continue to

incur significant costs relating to the development of our lead product candidates, LymPro, Eltoprazine and MANF. We have not

obtained approval to commercialize LymPro, Eltoprazine and MANF in any jurisdiction and we may never be able to obtain approval

or, if approvals are obtained, to commercialize LymPro, Eltoprazine and MANF successfully.

If we fail to successfully commercialize

our products, we may be unable to generate sufficient revenue to sustain and grow our business, and our business, financial condition

and results of operations will be adversely affected.

If we fail to obtain U.S. regulatory

approval of LymPro, Eltoprazine, MANF or any of our other current or future product candidates, we will be unable to commercialize

these potential products in the United States.

The development, testing, manufacturing

and marketing of our product candidates are subject to extensive regulation by governmental authorities in the United States.

In particular, the process of obtaining FDA approval is costly and time consuming, and the time required for such approval is

uncertain. Our product candidates must undergo rigorous preclinical and clinical testing and an extensive regulatory approval

process mandated by the FDA. Such regulatory review includes the determination of manufacturing capability and product performance.

Generally, only a small percentage of pharmaceutical products are ultimately approved for commercial sale.

We can give no assurance that our current

or future product candidates will be approved by the FDA or any other governmental body. In addition, there can be no assurance

that all necessary approvals will be granted for future product candidates or that FDA review or actions will not involve delays

caused by requests for additional information or testing that could adversely affect the time to market for and sale of our product

candidates. Further failure to comply with applicable regulatory requirements can, among other things, result in the suspension

of regulatory approval as well as possible civil and criminal sanctions.

Our proprietary rights may not adequately

protect our intellectual property and product candidates and if we cannot obtain adequate protection of our intellectual property

and product candidates, we may not be able to successfully market our product candidates.

Our commercial success will depend in

part on obtaining and maintaining intellectual property protection for our technologies and product candidates. We will only be

able to protect our technologies and product candidates from unauthorized use by third parties to the extent that valid and enforceable

patents cover them, or that other market exclusionary rights apply.

While we have issued enforceable patents

covering our product candidates, the patent positions of life sciences companies, like ours, can be highly uncertain and involve

complex legal and factual questions for which important legal principles remain unresolved. No consistent policy regarding the

breadth of claims allowed in such companies' patents has emerged to date in the United States. The general patent environment

outside the United States also involves significant uncertainty. Accordingly, we cannot predict the breadth of claims that may

be allowed or that the scope of these patent rights would provide a sufficient degree of future protection that would permit us

to gain or keep our competitive advantage with respect to these products and technology.

Our issued patents may be subject to challenge

and possibly invalidated by third parties. Changes in either the patent laws or in the interpretations of patent laws in the United

States or other countries may diminish the market exclusionary ability of our intellectual property.

In addition, others may independently

develop similar or alternative compounds and technologies that may be outside the scope of our intellectual property. Should third

parties obtain patent rights to similar compounds or radiolabeling technology, this may have an adverse effect on our business.

To the extent that consultants or key

employees apply technological information independently developed by them or by others to our product candidates, disputes may

arise as to the proprietary rights of the information, which may not be resolved in our favor. Consultants and key employees that

work with our confidential and proprietary technologies are required to assign all intellectual property rights in their discoveries

to us. However, these consultants or key employees may terminate their relationship with us, and we cannot preclude them indefinitely

from dealing with our competitors. If our trade secrets become known to competitors with greater experience and financial resources,

the competitors may copy or use our trade secrets and other proprietary information in the advancement of their products, methods

or technologies. If we were to prosecute a claim that a third party had illegally obtained and was using our trade secrets, it

would be expensive and time consuming and the outcome would be unpredictable. In addition, courts outside the United States are

sometimes less willing to protect trade secrets than courts in the United States. Moreover, if our competitors independently develop

equivalent knowledge, we would lack any contractual claim to this information, and our business could be harmed.

If our product candidates, including

LymPro, Eltoprazine, MANF, do not gain market acceptance among physicians, patients and the medical community, we will be unable

to generate significant revenue, if any.

The products that we develop may not achieve

market acceptance among physicians, patients, third-party payers and others in the medical community. If we, or any of our partners,

receive the regulatory approvals necessary for commercialization, the degree of market acceptance will depend upon a number of

factors, including:

|

|

-

|

limited indications of

regulatory approvals;

|

|

|

-

|

the establishment and demonstration

in the medical community of the clinical efficacy and safety of our product candidates and their potential advantages over

existing diagnostic compounds;

|

|

|

-

|

the prevalence and severity of any

side effects;

|

|

|

-

|

our ability to offer our product candidates

at an acceptable price;

|

|

|

-

|

the relative convenience and ease of

administration of our products;

|

|

|

-

|

the strength of marketing and distribution

support; and

|

|

|

-

|

sufficient third-party coverage or

reimbursement.

|

The market may not accept LymPro, Eltoprazine

or MANF based products based on any number of the above factors. The market may choose to continue utilizing the existing products

for any number of reasons, including familiarity with or pricing of these existing products. The failure of any of our product

candidates to gain market acceptance could impair our ability to generate revenue, which could have a material adverse effect

on our future business and prevent us from obtaining the necessary partnerships to further our business strategy.

Risks Associated with Our Financial Condition

Our independent registered public accounting firm has

expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our consolidated financial statements as of December 31,

2013 were prepared under the assumption that we will continue as a going concern for the next twelve months. Our independent registered

public accounting firm has issued a report that included an explanatory paragraph referring to our projected future losses along

with recurring losses from operations and expressing substantial doubt in our ability to continue as a going concern without additional

capital becoming available. Our ability to continue as a going concern is dependent upon our ability to obtain additional equity

or debt financing, attain further operating efficiencies, reduce expenditures, and, ultimately, to generate revenue. The financial

statements do not include any adjustments that might result from the outcome of this uncertainty.

We are at an early stage of development as a company

and currently have no source of revenue and may never become profitable.

We are a development stage biopharmaceutical company. Currently,

we have no products approved for commercial sale and, to date, we have not generated any revenue. Our ability to generate revenue

depends heavily on:

|

|

-

|

demonstration in future

clinical trials that our product candidate, MANF for the treatment of PD is safe and effective;

|

|

|

-

|

our ability to seek and obtain regulatory

approvals, including with respect to the indications we are seeking;

|

|

|

-

|

successful manufacture and commercialization

of our product candidates; and

|

|

|

-

|

market acceptance of our products.

|

All of our existing product candidates are in various stages

of development and will require extensive additional preclinical and clinical evaluation, regulatory review and approval, significant

marketing efforts and substantial investment before they could provide us with any revenue. As a result, if we do not successfully

develop, achieve regulatory approval and commercialize LymPro, Eltoprazine and/or MANF, we will be unable to generate any revenue

for many years, if at all. We do not anticipate that we will generate revenue for several years, at the earliest, or that we will

achieve profitability for at least several years after generating material revenue, if at all. If we are unable to generate revenue,

we will not become profitable, and we may be unable to continue our operations.

We do not have any products that are approved for commercial

sale and therefore do not expect to generate any revenues from product sales in the foreseeable future, if ever.

We currently do not have any products that are approved for

commercial sale. To date, we have funded our operations primarily from grants and sales of our securities. We have not received,

and do not expect to receive for at least the next several years in the case of Eltoprazine and MANF and until the 2

nd

half

of 2014 in the case of LymPro, if at all, any revenues from the commercialization of our product candidates. To obtain revenues

from sales of our product candidates, we must succeed, either alone or with third parties, in developing, obtaining regulatory

approval for, manufacturing and marketing drugs with commercial potential. We may never succeed in these activities, and may not

generate sufficient revenues to continue our business operations or achieve profitability.

We have incurred significant losses since inception and

anticipate that we will incur continued losses for the foreseeable future.

As of December 31, 2013, we had an accumulated deficit of approximately

$27.0 million. We expect to incur significant and increasing operating losses for the next several years as we expand our research

and development, advance product candidates into clinical development, complete clinical trials, seek regulatory approval and,

if we receive FDA approval, commercialize our products. Because of the numerous risks and uncertainties associated with product

development efforts, we are unable to predict the extent of any future losses or when we will become profitable, if at all. If

we are unable to achieve and then maintain profitability, the market value of our common stock will likely decline.

We will need to raise substantial additional capital

to fund our operations, and our failure to obtain funding when needed may force us to delay, reduce or eliminate certain product

development programs.

We expect to continue to spend substantial amounts to:

|

|

-

|

continue development of

our product candidates;

|

|

|

-

|

finance our general and administrative

expenses;

|

|

|

-

|

license or acquire additional technologies;

|

|

|

-

|

manufacture product for clinical trials;

|

|

|

-

|

launch and commercialize our product

candidates, if any such product candidates receive regulatory approval; and

|

|

|

-

|

develop and implement sales,

marketing and distribution capabilities.

|

We will be required to raise additional capital to complete

the development and commercialization of our product candidates and to continue to fund operations at the current cash expenditure

levels. Our future funding requirements will depend on many factors, including, but not limited to:

|

|

-

|

the rate of progress and

cost of our clinical trials and other development activities;

|

|

|

-

|

any future decisions we may make about

the scope and prioritization of the programs we pursue;

|

|

|

-

|

the costs of filing, prosecuting, defending

and enforcing any patent claims and other intellectual property rights;

|

|

|

-

|

the costs of manufacturing product;

|

|

|

-

|

the costs and timing of regulatory

approval;

|

|

|

-

|

the costs of establishing sales, marketing

and distribution capabilities;

|

|

|

-

|

the effect of competing technological

and market developments;

|

|

|

-

|

the terms and timing of any collaborative,

licensing and other arrangements that we may establish; and

|

|

|

-

|

general market conditions for offerings

from biopharmaceutical companies.

|

Worldwide economic conditions and the international equity

and credit markets have recently significantly deteriorated and may remain depressed for the foreseeable future. These developments

could make it more difficult for us to obtain additional equity or credit financing, when needed.

We cannot be certain that funding will be available on acceptable

terms, or at all. To the extent that we raise additional funds by issuing equity securities, our stockholders may experience significant

dilution. Any debt financing, if available, may involve restrictive covenants that impact our ability to conduct our business.

If we are unable to raise additional capital when required or on acceptable terms, we may have to significantly delay, scale back

or discontinue the development and/or commercialization of one or more of our product candidates. We also may be required to:

|

|

-

|

seek collaborators for

our product candidates at an earlier stage than otherwise would be desirable and on terms that are less favorable than might

otherwise be available; and/or

|

|

|

-

|

relinquish license or otherwise dispose

of rights to technologies, product candidates or products that we would otherwise seek to develop or commercialize ourselves

on unfavorable terms.

|

We may require additional financing to sustain our operations

and without it we may not be able to continue operations.

At December 31, 2013 we had a working capital deficit of $7,291,370.

We have an operating cash flow deficit of $8,206,256 for the period January 14, 2008 (date of inception) through December 31,

2013, an operating cash flow deficit of $1,154,126 for the fiscal year ended December 31, 2012 and for the year ended December

31, 2013, an operating cash flow deficit of $3,473,237. We do not currently have sufficient financial resources to fund our operations

or those of our subsidiaries. Therefore, we need additional funds to continue these operations.

We may direct Lincoln Park to purchase up to an additional

$19,600,000 worth of shares of our common stock under our agreement over a 30 month period generally in amounts up to 1,000,000

shares of our common stock on any such business day, which amounts may be increased to up to 2,500,000, provided the closing price

of our common stock exceeds a certain threshold with a maximum limit of up to $500,000 worth of our common stock on any single

business day, plus an additional “accelerated amount” under certain circumstances. However, Lincoln Park shall not

purchase any shares of our common stock on any business day that the closing sale price of our common stock is less than $0.04

per share, subject to adjustment as set forth in the Purchase Agreement. Assuming a purchase price of $0.10 per share (the closing

sale price of the common stock on June 2, 2014) and the purchase by Lincoln Park of the full 76,500,000 purchase shares under

the purchase agreement, proceeds to us would only be $7,650,000.

The extent we rely on Lincoln Park as a source of funding will

depend on a number of factors including, the prevailing market price of our common stock and the extent to which we are able to

secure working capital from other sources. If obtaining sufficient funding from Lincoln Park were to prove unavailable or prohibitively

dilutive, we will need to secure another source of funding in order to satisfy our working capital needs. Even if we sell all

$20,000,000 under the Purchase Agreement to Lincoln Park, we may still need additional capital to fully implement our business,

operating and development plans. Should the financing we require to sustain our working capital needs be unavailable or prohibitively

expensive when we require it, the consequences could be a material adverse effect on our business, operating results, financial

condition and prospects.

Risks Associated with Management

If we are unable to hire and retain key personnel,

we may not be able to implement our business plan.

Due to the specified nature of our business, having certain

key personnel is essential to the development and marketing of the products we plan to sell and thus to the entire business itself.

Consequently, the loss of any of those individuals may have a substantial effect on our future success or failure. We may have

to recruit qualified personnel with competitive compensation packages, equity participation, and other benefits that may affect

the working capital available for our operations. Management may have to seek to obtain outside independent professionals to assist

them in assessing the merits and risks of any business proposals as well as assisting in the development and operation of many

company projects. No assurance can be given that we will be able to obtain such needed assistance on terms acceptable to us. Our

failure to attract additional qualified employees or to retain the services of key personnel could have a material adverse effect

on our operating results and financial condition.

Risks Related to Our Common Stock

Our stock price may be volatile.

The stock market, particularly in recent

years, has experienced significant volatility particularly with respect to pharmaceutical, biotechnology and other life sciences

company stocks. The volatility of pharmaceutical, biotechnology and other life sciences company stocks often does not relate to

the operating performance of the companies represented by the stock. Factors that could cause this volatility in the market price

of our common stock include:

|

|

-

|

results from and any delays

in our clinical trials;

|

|

|

-

|

failure or delays in entering additional

product candidates into clinical trials;

|

|

|

-

|

failure or discontinuation of any of

our research programs;

|

|

|

-

|

research publications that are unfavorable;

|

|

|

-

|

delays in establishing new strategic

relationships;

|

|

|

-

|

delays in the development or commercialization

of our potential products;

|

|

|

-

|

market conditions in the pharmaceutical

and biotechnology sectors and issuance of new or changed securities analysts' reports or recommendations;

|

|

|

-

|

actual and anticipated fluctuations

in our financial and operating results;

|

|

|

-

|

developments or disputes concerning

our intellectual property or other proprietary rights;

|

|

|

-

|

introduction of technological innovations

or new commercial products by us or our competitors;

|

|

|

-

|

issues in manufacturing our potential

products;

|

|

|

-

|

market acceptance of our potential

products;

|

|

|

-

|

third-party healthcare reimbursement

policies;

|

|

|

-

|

FDA or other domestic or foreign regulatory

actions affecting us or our industry;

|

|

|

-

|

litigation or public concern about

the safety of our product candidates; and

|

|

|

-

|

additions or departures of key personnel.

|

These and other external factors may cause

the market price and demand for our common stock to fluctuate substantially, which may limit or prevent investors from readily

selling their shares of common stock and may otherwise negatively affect the liquidity of our common stock. In the past, when

the market price of a stock has been volatile, holders of that stock have instituted securities class action litigation against

the company that issued the stock. If any of our stockholders brought a lawsuit against us, we could incur substantial costs defending

the lawsuit. Such a lawsuit could also divert the time and attention of our management.

We have not and do not anticipate

paying any dividends on our common stock.

We have paid no dividends on our common

stock to date and it is not anticipated that any dividends will be paid to holders of our common stock in the foreseeable future.

While our future dividend policy will be based on the operating results and capital needs of the business, it is currently anticipated

that any earnings will be retained to finance our future expansion and for the implementation of our business plan. As an investor,

you should take note of the fact that a lack of a dividend can further affect the market value of our stock, and could significantly

affect the value of any investment in our Company.

We have a potential issuance of

additional common shares from the conversion of our promissory note.

The promissory note dated March 5, 2008 can be converted at

the option of the Company based upon the FMV of common stock as of the date of issuance at the closing price quoted on the exchange

on which the Company’s common stock is listed. The conversion price as at December is $0.0798, and would convert to 3,107,356

shares.

If we fail to establish and maintain

an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any

inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading

price of our common stock.

Effective internal control is necessary

for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or

prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed,

and our business and reputation with investors may be harmed. As a result, our small size and any current internal

control deficiencies may adversely affect our financial condition, results of operation and access to capital. We have

not performed an in-depth analysis to determine if historical un-discovered failures of internal controls exist, and may in the

future discover areas of our internal control that need improvement.

Our common stock is currently deemed

a “penny stock,” which makes it more difficult for our investors to sell their shares.

Our common stock is subject to the “penny stock”

rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common

stock is not listed on The Nasdaq Stock Market or other national securities exchange and trades at less than $4.00 per share,

other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth

of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require,

among other things, that brokers who trade penny stock to persons other than “established customers” complete certain

documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the

security, including a risk disclosure document and quote information under certain circumstances. Many brokers have

decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers

willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any

significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are

subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

Offers or availability for sale of a substantial number

of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common

stock in the public market upon the expiration of any statutory holding period, under Rule 144, or issued upon the exercise of

outstanding options or warrants, it could create a circumstance commonly referred to as an “overhang” and in anticipation

of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred

or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related

securities in the future at a time and price that we deem reasonable or appropriate.

Our certificate of incorporation allows for our board

to create new series of preferred stock without further approval by our stockholders, which could adversely affect the rights

of the holders of our common stock.

Our board of directors has the authority to fix and determine

the relative rights and preferences of preferred stock and has designated 250,000 preferred shares as Series A Convertible Preferred

Stock, 2,500,000 as Series B Convertible Preferred Stock, 750,000 as Series C Convertible Preferred Stock, and 1,300 as Series

D Convertible Preferred Stock. Our board of directors also has the authority to issue additional shares of our preferred stock

without further stockholder approval. As a result, our board of directors could authorize the issuance of a series of preferred

stock that would grant to holders the preferred right to our assets upon liquidation, the right to receive dividend payments before

dividends are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium,

prior to the redemption of our common stock. In addition, our board of directors could authorize the issuance of a series of preferred

stock that has greater voting power than our common stock or that is convertible into our common stock, which could decrease the

relative voting power of our common stock or result in dilution to our existing stockholders.

We improperly classified certain unpaid bonuses to senior

management and may need to restate Form 10-K for the year ended December 31, 2012 and Forms 10-Q for the quarters ended March

31, 2013, June 30, 2013 and September 30, 2013.

Unpaid bonuses to

Gerald E. Commissiong, President

and Chief Executive Officer and Dr. John W. Commissiong, Chief Scientific, Officer earned in fiscal years 2012 and 2013, were

improperly reflected as prepaid expenses and other current assets in form 10-K filed with the Security and Exchange Commission

on 4/17/2013, and forms 10-Q filed with the Security and Exchange Commission on May 12, 2013, August 19, 2013 and November 14,

2013. This improper classification was not in conformity with the financial policies of the Company. In the fourth quarter 2013

were paid and thereby eliminating this improper classification. A total bonus of $443,874 was paid in 2014, $230,222 for Gerald

E. Commissiong, and $213,763 for Dr. John W. Commissiong. The Company is continuing its review of this improper classification

and may determine that a restatement of its Form 10-K for the year ended December 31, 2012 and Forms 10-Q for the quarters ended

March 31, 2013, June 30, 2013 and September 30, 2013 is necessary.

The sale or issuance of our common stock to Lincoln Park

may cause dilution and the sale of the shares of common stock acquired by Lincoln Park, or the perception that such sales may

occur, could cause the price of our common stock to fall

On March 7, 2014, we entered into the Purchase Agreement with

Lincoln Park, pursuant to which Lincoln Park has committed to purchase up to $20,000,000 of our common stock. Concurrently with

the execution of the Purchase Agreement on March 7, 2014, we issued 4,000,000 shares of our common stock to Lincoln Park for a

total purchase price of $400,000 in the Initial Purchase under the Purchase Agreement and 6,000,000 Initial Commitment Shares

to Lincoln Park as a fee for its commitment to purchase additional shares of our common stock under the Purchase Agreement. The

additional shares that may be sold pursuant to the Purchase Agreement may be sold by us to Lincoln Park at our discretion from

time to time over a 30-month period commencing after the SEC has declared effective the registration statement that includes this

prospectus.

Other than with respect to the Initial Purchase by Lincoln

Park under the Purchase Agreement, the purchase price for the shares that we may sell to Lincoln Park under the Purchase Agreement

will fluctuate based on the market price of our common stock. Depending on market liquidity at the time, sales of such shares

may cause the market price of our common stock to fall.

We generally have the right to control the timing and amount

of any sales of our shares to Lincoln Park, except that, pursuant to the terms of our agreements with Lincoln Park, we would be

unable to sell shares to Lincoln Park if and when the closing sale price of our common stock is below $0.04 per share, subject

to adjustment as set forth in the Purchase Agreement. Additional sales of our common stock, if any, to Lincoln Park will depend

upon market conditions and other factors to be determined by us. As such, other than the Initial Purchase, Lincoln Park may ultimately

purchase all, some or none of the shares of our common stock that may be sold pursuant to the Purchase Agreement and, after it

has acquired shares, Lincoln Park may sell all, some or none of those shares. Therefore, sales to Lincoln Park by us could result

in substantial dilution to the interests of other holders of our common stock. Additionally, the sale of a substantial number

of shares of our common stock to Lincoln Park, or the anticipation of such sales, could make it more difficult for us to sell

equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This prospectus contains forward-looking statements. Such forward-looking

statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise

are not statements of historical fact. These forward-looking statements are based on our current expectations and projections

about future events and they are subject to risks and uncertainties known and unknown that could cause actual results and developments

to differ materially from those expressed or implied in such statements.

In some cases, you can identify forward-looking statements

by terminology, such as “expects”, “anticipates”, “intends”, “estimates”, “plans”,

“potential”, “possible”, “probable”, “believes”, “seeks”, “may”,

“will”, “should”, “could” or the negative of such terms or other similar expressions. Accordingly,

these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those

expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout

this prospectus.

You should read this prospectus and the documents that we reference

herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and

with the understanding that our actual future results may be materially different from what we expect. You should assume

that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Because

the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking

statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. These risks

and uncertainties, along with others, are described above under the heading “Risk Factors” beginning on page 8 of

this prospectus. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation

to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to

reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict

which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor,

or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

We qualify all of the information presented in this prospectus, and particularly our forward-looking statements, by these cautionary

statements.

This prospectus also includes estimates of market size and

industry data that we obtained from industry publications and surveys and internal company sources. The industry publications

and surveys used by management to determine market size and industry data contained in this prospectus have been obtained from

sources believed to be reliable.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that

may be offered and sold from time to time by the selling stockholders. We will receive no proceeds from the sale of shares of

common stock by the selling stockholders in this offering. The proceeds from the sales will belong to the selling stockholders.

However, we may receive up to $20,000,000 under the Purchase Agreement with Lincoln Park, of which we have already received $400,000.

Also, we may receive the exercise price of any common stock we issue to the selling stockholders who hold the warrants included

in this prospectus, upon exercise of their outstanding warrants. However, the holders may exercise the warrants on a cashless

basis if at any time after the six months anniversary, there is no effective registration statement or current prospectus available

for the resale of the shares underlying the warrants, in which case we will not receive any proceeds from such exercise.

We estimate that the net proceeds to us from the sale of our

common stock to Lincoln Park pursuant to the Purchase Agreement will be up to $19,600,000 over an approximately 30-month period,

assuming that we sell the full amount of our common stock that we have the right, but not the obligation, to sell to Lincoln Park

under that agreement and other estimated fees and expenses. However, we are registering for resale under this prospectus, only

a portion of the shares we may sell to Lincoln Park under the Purchase Agreement and anticipate that based upon the closing price

of the Company’s common stock on June 2, 2014, that we will receive up to a maximum of $9,000,000 from the sale of those

shares. Since proceeds from the sale of the shares to Lincoln Park are based on the trading price of our common stock on the date

the sales are made under the Purchase Agreement, we may receive less than the $9,000,000 from the sale of the shares included

in this prospectus. Factors which might negatively impact the price we receive also include the possibility of: general negative

market reaction to the presence of a large selling shareholder; and many other tangible and intangible factors regarding acceptance

of our products by consumers and our ability to execute our business plan. We may also receive proceeds of $5,400,000 upon the

exercise of the warrants included in this prospectus, assuming the warrants are not exercised on cash-less basis. See “Plan

of Distribution” elsewhere in this prospectus for more information.

We expect to use any proceeds that we receive under the Purchase

Agreement and the exercise of the Warrants for research and development, product acquisition and for general corporate purposes.

The amounts and timing of our actual expenditures will depend on numerous factors, including the status of our product sales and

marketing efforts, the amount of proceeds actually raised from sales under the Purchase Agreement, upon exercise of the Warrants

and the amount of cash generated through our existing strategic collaborations and any additional strategic collaborations into

which we may enter. Accordingly, our management will have significant flexibility in applying any net proceeds that we receive

pursuant to the Purchase Agreement.

SELLING STOCKHOLDERS

This prospectus relates to the possible

resale by the selling stockholders. We are filing the registration statement of which this prospectus forms a part pursuant to

(i) the provisions of the Registration Rights Agreement, which we entered into with Lincoln Park on March 7, 2014 concurrently

with our execution of the Purchase Agreement, in which we agreed to provide certain registration rights with respect to sales

by Lincoln Park of the shares of our common stock that have been or may be issued to Lincoln Park under the Purchase Agreement;

and (ii) piggy-back registration rights granted to the other selling stockholders. The selling stockholders, may, from time to

time, offer and sell pursuant to this prospectus any or all of the shares that they holder or that may be acquired by them from

the Company. The selling stockholders may sell some, all or none of their shares. We do not know how long the selling stockholders

will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling

stockholders regarding the sale of any of the shares.

The following table presents information regarding the selling

stockholders and the shares that they may offer and sell from time to time under this prospectus. The table is prepared based

on information supplied to us by the selling stockholders, and reflects their holdings as of May 29, 2014. None of the selling

stockholders nor any of their affiliates has held a position or office, or had any other material relationship, with us or any

of our predecessors or affiliates. As used in this prospectus, the term “selling stockholders” includes each of the

selling stockholder s and any donees, pledgees, transferees or other successors in interest selling shares received after the

date of this prospectus from the selling stockholders as a gift, pledge or other non-sale related transfer. Beneficial ownership

is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act. The percentage of shares beneficially

owned prior to the offering is based on 734,130,341 shares of our common stock actually outstanding as of May 29, 2014.

|

Selling Stockholder

|

|

Shares

Beneficially

Owned

Before this

Offering

|

|

|

Percentage of

Outstanding

Shares

Beneficially

Owned Before

this

Offering(1)

|

|

|

Shares to be

Sold in this

Offering

|

|

|

Percentage of

Outstanding

Shares

Beneficially

Owned After

this Offering

(2)

|

|

|

Lincoln Park Capital Fund, LLC (3)

|

|

|

10,000,000

|

|

|

|

1.36

|

|

|

|

90,000,000

|

|

|

|

0

|

|

|

Memory Dx, LLC (4)

|

|

|

1,500,000

|

|

|

|

*

|

|

|

|

8,000,000

|

|

|

|

0

|

|

|

PGI Drug Discovery, LLC (5)

|

|

|

3,641,002

|

|

|

|

*

|

|

|

|

4,000,000

|

|

|

|

0

|

|

|

Dominion Capital, LLC (6)

|

|

|

36,454,306

|

|

|

|

4.99

|

%

|

|

|

20,833,312

|

|

|

|

*

|

|

|

Dustin Ray Johns (7)

|

|

|

8,072,910

|

|

|

|

1.09

|

%

|

|

|

3,072,910

|

|

|

|

*

|

|

|

International Infusion, Inc. (8)

|

|

|

24,745,627

|

|

|

|

3.37

|

%

|

|

|

8,177,123

|

|

|

|

*

|

|

|

Joseph Rubinfeld (9)

|

|

|

1,663,890

|

|

|

|

*

|

|

|

|

208,334

|

|

|

|

*

|

|

|

Nicholas Nurse (10)

|

|

|

1,249,999

|

|

|

|

*

|

|

|

|

1,249,999

|

|

|

|

*

|

|

|

Robert F. Johnston Living Trust (11)

|

|

|

7,291,660

|

|

|

|

*

|

|

|

|

3,124,997

|

|

|

|

*

|

|

|

Gemini Master Fund, Ltd. (12)

|

|

|

11,944,425

|

|

|

|

1.63

|

%

|

|

|

8,333,325

|

|

|

|

*

|

|

|

TOTAL

|

|

|

|

|

|

|

|

|

|

|

147,000,000

|

|

|

|

|

|

* Less than 1%

|

|

(1)

|

Based on 734,130,341 outstanding shares of our common stock

as of May 29, 2014, which includes (i) 4,000,000 shares of our common stock issued to

Lincoln Park on March 7, 2014 for a total purchase price of $400,000 in the Initial Purchase

under the Purchase Agreement and (ii) 6,000,000 shares of our common stock issued to

Lincoln Park on March 7, 2014 as a fee for its commitment to purchase additional shares

of our common stock under the Purchase Agreement, all of which shares are covered by

the registration statement that includes this prospectus.

|

|

|

(2)

|

Assumes the sale of all the shares offered by the selling

stockholders.

|

|

|

(3)

|

The selling stockholder is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended. Josh

Scheinfeld and Jonathan Cope, the Managing Members of Lincoln Park Capital, LLC, are

deemed to be beneficial owners of all of the shares of common stock owned by Lincoln

Park Capital Fund, LLC. Messrs. Cope and Scheinfeld have shared voting and investment

power over the shares being offered under the prospectus filed with the SEC in connection

with the transactions contemplated under the Purchase Agreement. Lincoln Park Capital,

LLC is not a licensed broker dealer or an affiliate of a licensed broker dealer.

|

|

|

(4)

|

William Gartner has

voting and investment power over the shares being offered by the selling stockholder. The shares beneficially owned prior

to the offering represent 1,500,000 shares which have been issued pursuant to the asset purchase agreement with memory DX,

LLC. The shares offered represent the shares required to be issued to the selling stockholder pursuant to the asset purchase

agreement with Memory DX, LLC, including the 1,500,000 shares which have been previously issued.

|

|

|

(5)

|

Emer Leahy has voting and investment power over the shares

being offered by the selling stockholder. The shares beneficially owned prior to the

offering represent 3,641,002 shares which have been issued pursuant to the license agreement

with PGI Drug Discovery, LLC. The shares offered represent the shares required to be

issued to the selling stockholder pursuant to the license agreement with PGI Drug Discovery,

LLC, including the 3,641,002 shares which have been previously issued.

|

|

|

(6)

|

Mikhail Gurevich is the Managing Member of Dominion Capital

Holdings LLC, the investment manager of Dominion Capital LLC, and as such has voting

and investment power over the securities owned by Dominion Capital LLC. The shares offered

by the selling stockholder represent shares that may be acquired upon exercise of warrants

held by the selling stockholder.

|

|