As filed with the Securities and Exchange Commission on June 20, 2014

File No. 333-192391

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2

TO

FORM S-1

ON

FORM S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

VAPOR CORP.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

2100

|

|

84-1070932

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

3001 Griffin Road

Dania Beach, Florida 33312

(888) 766-5351

(Address,

including zip code, and telephone number, including area code, of registrant’s principal place of business)

Jeffrey

Holman

Chief Executive Officer

Vapor Corp.

3001 Griffin

Road

Dania Beach, Florida 33312

(888) 766-5351

(Name,

address, including zip code, and telephone number, including area code, of registrant’s agent for service)

Copies of

communications to:

Andrew E. Balog, Esq.

Greenberg Traurig, P.A.

333 Avenue of the Americas

(333 S.E. 2nd Avenue)

Miami, Florida 33131

(305) 579-0642 (phone)

(305) 961-5642 (facsimile)

Approximate

date of commencement of proposed sale to the public:

From time to time after the registration statement becomes effective.

If the

only securities being registered on this Form are to be offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered in connection with a dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration Statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

¨

|

|

Accelerated filer

|

|

¨

|

|

|

|

|

|

|

Non-accelerated filer

|

|

¨

(Do not check if smaller reporting company)

|

|

Smaller reporting company

|

|

x

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective

date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the Registration Statement

shall become effective on such date as the commission, acting pursuant to section 8(a) may determine.

EXPLANATORY NOTE

This Post-Effective Amendment No. 2 relates to the registration statement on Form S-1 (File No. 333-192391) of Vapor Corp. (the

“Company”) that was declared effective by the Securities and Exchange Commission (the “SEC”) on January 27, 2014 (the “Registration Statement”). The Company filed Post-Effective No.1 to the Registration Statement

on March 5, 2014, which was declared effective by the SEC on March 11, 2014. The Company is filing this Post-Effective Amendment No. 2 to the Registration Statement to convert the Registration Statement into a Form S-3 Registration

Statement. The Company is also filing this Post-Effective Amendment No. 2 to the Registration Statement to deregister 516,545 shares of the Company’s common stock that have been sold under the Registration Statement since Post Effective

Amendment No. 1 became effective. Accordingly, the Company hereby requests that upon effectiveness of this Post-Effective Amendment No. 2 such 516,545 shares be removed from registration. For this reason, this Post-Effective Amendment

No. 2 only includes 1,856,864 of the original 3,409,141 shares of the Company’s common stock registered under the Registration Statement.

No additional securities are being registered under this Post-Effective Amendment No. 2. All applicable registration fees were paid at

the time of the original filing of the Registration Statement.

The information in this prospectus is not complete and may be changed. Our selling

stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these

securities in any jurisdiction where the offer or sale is not permitted.

|

|

|

|

|

PROSPECTUS

|

|

SUBJECT TO COMPLETION, DATED JUNE 20, 2014

|

VAPOR CORP.

1,856,864 Shares of Common Stock

This prospectus

relates to the resale, from time to time, of up to 1,856,864 shares of our common stock. These shares are held by our stockholders referred to throughout this prospectus as the “selling stockholders.” We will not receive any of the

proceeds from the sale of these shares by the selling stockholders.

The selling stockholders may sell or otherwise dispose of the shares

covered by this prospectus or interests therein on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale,

at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. Additional information about the selling stockholders, and the times and manner in which they may offer and sell shares of

our common under this prospectus, is provided in the sections entitled “

Selling Stockholders

” and “

Plan of Distribution

” of this prospectus.

Our common stock is presently listed on The NASADAQ Capital Market under the symbol “VPCO”. On June 17, 2014, the closing sale

price of our common stock was $5.36 per share.

We issued 1,810,864 of the shares covered by this prospectus in a private placement of

3,333,338 shares of our common stock at a per share price of $3.00 that we completed on October 29, 2013 with various institutional and individual accredited investors and certain of our officers and directors from which we raised gross

proceeds of $10 million (the “Private Placement”).

You should consider carefully the risks that we have described in the

section entitled “Risk Factors” beginning on page 4 of this prospectus before deciding whether to invest in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide

you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The selling stockholders are not making an offer to sell, or soliciting offers to buy, shares of our common stock in any

jurisdiction where the offer is not permitted. The information contained in this prospectus is accurate only as of date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock, and the information

incorporated by reference in this prospectus is accurate only as of the date such information is filed with the Securities and Exchange Commission (“SEC”). Our business, financial condition, results of operation and prospects may have

changed since those dates.

You should read this prospectus together with the additional information described under the headings

“Information Incorporated by Reference” and “Where You Can Find More Information.”

i

PROSPECTUS SUMMARY

The following summary provides an overview of certain information about our company and the offering and may not contain all the

information that may be important to you. This summary is qualified in its entirety by and should be read together with the information contained elsewhere or incorporated by reference in this prospectus. You should carefully read this entire

prospectus before making a decision about whether to invest in our common stock. The terms “Vapor Corp.,”, “Vapor,” “we,” “us,” “our” and the Company refer to Vapor Corp. and its consolidated

wholly-owned subsidiary Smoke Anywhere USA, Inc. and the terms “Smoke Anywhere USA” and “Smoke” refer to our wholly-owned subsidiary Smoke Anywhere USA, Inc.

Vapor Corp.

Company Overview

We design, market, and distribute electronic cigarettes, vaporizers, e-liquids and accessories under the Krave

®

, Fifty-One

®

(also known as Smoke 51), VaporX

®

, Hookah Stix

®

and Alternacig

®

brands. We also design and develop private label brands for our distribution customers. Third party manufacturers

manufacture our products to meet our design specifications. We market our electronic cigarettes as an alternative to traditional tobacco cigarettes.

Recent Developments

As has been

previously disclosed, on May 14, 2014, we entered into an asset purchase agreement with International Vapor Group, Inc. and certain of its subsidiaries (“IVG”) to purchase IVG’s e-commerce, wholesale and retail operations,

including their South Beach Smoke

®

, Ever Smoke

®

and Vapor Zone

®

brands, by

acquiring substantially all of IVG’s assets and assuming certain of its liabilities.

Under the terms of the purchase agreement, we

have agreed to pay IVG at closing approximately $20.8 million, of which approximately $1.7 million will be in cash and the remaining $19.1 million in 3,300,501 shares of our common stock (based on a price of $5.787 per share which represents the

30-trading day weighted average closing price of our common stock, as reported on the OTC Bulletin Board preceding May 14, 2014, the date of the purchase agreement). We have also agreed to pay IVG an earn-out aggregating up to $29.2 million in

shares of our common stock. Earn-out payments are contingent and based upon the post-closing performance of IVG’s e-commerce, wholesale and retail operations during the earn-out period specified in the purchase agreement.

IVG’s principal owners and operators Nicolas Molina and David Epstein have agreed to become part of our management team responsible for

IVG’S continuing e-commerce, wholesale and retail operations. Mr. Molina will serve as Senior Vice President of Retail & e-Commerce and Mr. Epstein will serve as Vice President of Wholesale.

Completion of the acquisition is subject to our obtaining stockholder approval for issuance of the shares of our common stock that will be

issued at closing as part of the purchase price and thereafter as earn-out payments, as well as additional customary closing conditions. We expect to complete the acquisition as soon as possible but not later than July 31, 2014.

We refer to this pending acquisition in this prospectus as the “IVG Acquisition.”

Electronic Cigarettes

“Electronic cigarettes” or “e-cigarettes” and “vaporizers” are battery-powered products that enable users to

inhale nicotine vapor without smoke, tar, ash, or carbon monoxide. Electronic cigarettes look like traditional cigarettes and, regardless of their construction are comprised of three functional components:

|

|

•

|

|

a mouthpiece, which is a small plastic cartridge that contains a liquid nicotine solution;

|

|

|

•

|

|

the heating element that vaporizes the liquid nicotine so that it can be inhaled; and

|

1

|

|

•

|

|

the electronics, which include: a lithium-ion battery, an airflow sensor, a microchip controller and an LED, which illuminates to indicate use.

|

When a user draws air through the electronic cigarette and/or vaporizer, the air flow is detected by a sensor, which activates a heating

element that vaporizes the solution stored in the mouthpiece/cartridge, the solution is then vaporized and it is this vapor that is inhaled by the user. The cartridge contains either a nicotine solution or a nicotine free solution, either of which

may be flavored.

Our Electronic Cigarettes

We offer disposable electronic cigarettes in multiple sizes, puff counts, styles, flavors and nicotine strengths; rechargeable electronic

cigarettes that use replaceable cartridges (also known as “atomizers or cartomizers”); and rechargeable vaporizers for use with either electronic cigarette solution (“e-liquid”) or dry herbs or leaf.

Disposable electronic cigarettes feature a one-piece construction that houses all the components and is

utilized until the nicotine or nicotine free solution is depleted.

Rechargeable electronic cigarettes feature a rechargeable battery and replaceable cartridge (also known as

a “atomizer or cartomizer”). The atomizers or cartomizers are changed when the solution is depleted from use.

Vaporizers feature a tank or chamber, a heating element and a battery. The vaporizer user fills the tank

with e-liquid or the chamber with dry herb or leaf. The vaporizer battery can be recharged and the tank and chamber can be refilled.

2

Our Brands

We sell our electronic cigarettes, vaporizers and e-liquids under several different brands, including Krave

®

, Fifty-One

®

(also known as Smoke 51), VaporX

®

, Stix

®

and Alternacig

®

brands. We also design and develop private label brands for our distribution customers. Our in-house engineering and

graphic design teams work to provide aesthetically pleasing, technologically advanced affordable e-cigarette options. We have developed and trademarked or are preparing to commercialize additional brands which we currently and will market to new

customers and demographics.

Corporate Information

We were originally incorporated as Consolidated Mining International, Inc. in 1985 as a Nevada corporation, and changed our name in 1987 to

Miller Diversified Corporation whereupon we operated in the commercial cattle feeding business until October 31, 2003 when the company sold substantially all of its assets and became a discontinued operation. On November 5, 2009, we

acquired Smoke Anywhere USA, Inc., a distributor of electronic cigarettes, in a reverse triangular merger. As a result of the merger, Smoke Anywhere USA, Inc. became our sole operating business. On January 7, 2010, we changed our name to Vapor

Corp. Our fiscal year is a calendar year ending December 31. Effective December 31, 2013, we reincorporated to the State of Delaware from the State of Nevada.

Our principal executive offices are located at 3001 Griffin Road, Dania Beach, Florida 33312, and our telephone number is (888) 766-5351.

Our website is located at www.vapor-corp.com. Information on our website is not, and should not be considered, part of this prospectus.

The Offering

|

|

|

|

|

Common stock offered by selling stockholders:

|

|

1,856,864 shares.

|

|

|

|

|

Common stock offered by us

|

|

None.

|

|

|

|

|

Common stock outstanding before this

offering

|

|

16,456,911 shares as of June 19, 2014.

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any of the proceeds from the sale or other disposition of the shares of our common stock covered by this prospectus by the selling stockholders.

|

|

|

|

|

The NASDAQ Capital Market symbol for our Common Stock

|

|

VPCO

|

|

|

|

|

Risk Factors

|

|

Investing in our common stock involves a high degree of risk. You should carefully review and consider the section entitled “

Risk Factors

” of this prospectus for a discussion of factors to consider before deciding

to invest in our common stock.

|

3

RISK FACTORS

Investing in our common stock has a high degree of risk. Before making an investment in our common stock, you should carefully consider the

following risks, as well as the other information contained and incorporated by reference in this prospectus. The risk factors described below are those that we believe are the material risks we face. These risk factors are not presented in the

order of importance or probability of occurrence. Any of the risk factors described below, as well as any others in our future filings with the SEC, could significantly and adversely affect our business, prospects, financial condition and results of

operations. In that case, the market price of our common stock could decline, and you may lose all or a part of your investment.

Risks Relating to

Our Business

We have incurred losses and cannot assure you that we will achieve or maintain profitable operations.

As of March 31, 2014, we had an accumulated deficit of $2,832,413 compared to an accumulated deficit of $1,379,654 as of December 31,

2013. Our accumulated deficit is primarily due to, among other reasons, the establishment of our business infrastructure and operations, stock-based compensation expenses and increases in our marketing expenditures to grow sales of our electronic

cigarettes and vaporizers. For the quarterly period ended March 31, 2014, we had a net loss of $1,452,759 compared to net income of $123,544 for the quarterly period ended March 31, 2013. For the year ended December 31, 2013, we had

net income of $801,352 compared to a net loss of $1,920,972 for the year ended December 31, 2012. We cannot assure you that we will generate operating profits on a sustainable basis as we continue to expand our infrastructure, further develop

our marketing efforts and otherwise implement our growth initiatives.

We have and may continue to experience liquidity and capital resources

constraints because of our significant operating losses.

At March 31, 2014, we had working capital of $10,680,259 compared to

$11,657,615 at December 31, 2013, a decrease of $977,356. At December 31, 2013, we had working capital of $11,657,615 compared to $325,836 at December 31, 2012, an increase of $11,331,779. The increase in working capital is primarily

attributable to the net proceeds of approximately $9.1 million from the Private Placement and the conversion of approximately $1.7 million of senior convertible notes on October 29, 2013. Although our working capital was $10,680,259 as of

March 31, 2014, there is no assurance we will have sufficient liquidity and capital resources to fund our business. In the event we experience liquidity and capital resources constraints because of operating losses, greater than anticipated

sales growth or otherwise, we may need to raise additional capital in the form of equity and/or debt financing. If such additional capital is not available on terms acceptable to us or at all then we may need to curtail our operations and/or take

additional measures to conserve and manage our liquidity and capital resources, any of which would have a material adverse effect on our business, results of operations and financial condition.

Our five years of operating history, makes it difficult to accurately predict our future sales and appropriately budget our expenses.

We acquired Smoke Anywhere USA, Inc., a distributor of electronic cigarettes, on November 5, 2009. Smoke Anywhere USA, Inc. commenced its

business in March 2008. Because we have only five years of operating history, and our business is still evolving, it is difficult to accurately predict our future sales and appropriately budget our expenses. Additionally, our operations will be

subject to risks inherent in the establishment of a developing new business, including, among other things, efficiently deploying our capital, developing our products, developing and implementing our marketing campaigns and strategies and developing

brand awareness and acceptance of our products. Our ability to generate future sales will be dependent on a number of factors, many of which are beyond our control, including the pricing of competing products, overall demand for our products,

changes in consumer preferences, market competition, government regulation and the completion of the IVG Acquisition. We are currently evaluating the expansion of our staffing, advertising campaigns and operational expenditures in anticipation of

future sales growth. If our sales do not increase as anticipated, we could incur significant losses due to our higher infrastructure expense levels if we are not able to decrease our advertising and operating expenses in a timely manner to offset

any shortfall in future sales.

4

The potential regulation of electronic cigarettes by the United States Food and Drug Administration may

materially adversely affect our business.

On April 24, 2014, the United States Food and Drug Administration (the

“FDA”) released proposed rules that would extend its regulatory authority to electronic cigarettes and certain other tobacco products under the Family Smoking Prevention and Tobacco Control Act (the “Tobacco Control Act”). We are

in the process of reviewing and analyzing the proposed rules and their impact on our business. We preliminarily note that the proposed rules would require that electronic cigarette manufacturers (i) register with the FDA and report electronic

cigarette product and ingredient listings; (ii) market new electronic cigarette products only after FDA review; (iii) only make direct and implied claims of reduced risk if the FDA confirms that scientific evidence supports the claim and

that marketing the electronic cigarette product will benefit public health as a whole; (iv) not distribute free samples; (v) implement minimum age and identification restrictions to prevent sales to individuals under age 18;

(vi) include a health warning; and (vii) not sell electronic cigarettes in vending machines, unless in a facility that never admits youth. The proposed regulation is subject

to a 75-day

public comment period, following which the FDA will finalize the proposed regulation. It is not known how long this regulatory process to finalize and implement the rules may take. Accordingly, although we cannot predict the content of any final

rules from the proposed rules or the impact they may have, we believe that if the final rules enacted are materially more stringent then the proposed rules they could have a material adverse effect on our business, results of operations and

financial condition.

The recent development of electronic cigarettes has not allowed the medical profession to study the long-term health effects

of electronic cigarette use.

Because electronic cigarettes were recently developed the medical profession has not had a sufficient

period of time to study the long-term health effects of electronic cigarette use. Currently, therefore, there is no way of knowing whether or not electronic cigarettes are safe for their intended use. If the medical profession were to determine

conclusively that electronic cigarette usage poses long-term health risks, electronic cigarette usage could decline, which could have a material adverse effect on our business, results of operations and financial condition.

Our business, results of operations and financial condition could be adversely affected if we are taxed like other tobacco products or if we are

required to collect and remit sales tax on certain of our internet sales.

Presently the sale of electronic cigarettes is not

subject to federal, state and local excise taxes like the sale of conventional cigarettes or other tobacco products, all of which have faced significant increases in the amount of taxes collected on their sales. Should federal, state and local

governments and or other taxing authorities impose excise taxes similar to those levied against conventional cigarettes and tobacco products on our products, it may have a material adverse effect on the demand for our products, as consumers may be

unwilling to pay the increased costs for our products.

We may be unable to establish the systems and processes needed to track and submit

the excise and sales taxes we collect through Internet sales, which would limit our ability to market our products through our websites which would have a material adverse effect on our business, results of operations and financial condition. States

such as New York, Hawaii, Rhode Island and North Carolina have begun collecting sales taxes on Internet sales where companies have used independent contractors in those states to solicit sales from residents of that state. The requirement to

collect, track and remit sales taxes based on independent affiliate sales may require us to increase our prices, which may affect demand for our products or conversely reduce our net profit margin, either of which would have a material adverse

effect on our business, results of operations and financial condition.

The market for electronic cigarettes is a niche market, subject to a great

deal of uncertainty and is still evolving.

Electronic cigarettes, having recently been introduced to market, are at an early stage

of development, represent a niche market and are evolving rapidly and are characterized by an increasing number of market entrants. Our future sales and any future profits are substantially dependent upon the widespread acceptance and use of

5

electronic cigarettes. Rapid growth in the use of, and interest in, electronic cigarettes is recent, and may not continue on a lasting basis. The demand and market acceptance for these products

is subject to a high level of uncertainty. Therefore, we are subject to all of the business risks associated with a new enterprise in a niche market, including risks of unforeseen capital requirements, failure of widespread market acceptance of

electronic cigarettes, in general or, specifically our products, failure to establish business relationships and competitive disadvantages as against larger and more established competitors.

We face intense competition and our failure to compete effectively could have a material adverse effect on our business, results of operations and

financial condition.

Competition in the electronic cigarette industry is intense. We compete with other sellers of electronic

cigarettes, most notably Lorillard, Inc., Altria Group, Inc. and Reynolds American Inc., big tobacco companies, through their electronic cigarettes business segments; the nature of our competitors is varied as the market is highly fragmented and the

barriers to entry into the business are low.

We compete primarily on the basis of product quality, brand recognition, brand loyalty,

service, marketing, advertising and price. We are subject to highly competitive conditions in all aspects of our business. The competitive environment and our competitive position can be significantly influenced by weak economic conditions, erosion

of consumer confidence, competitors’ introduction of low-priced products or innovative products, cigarette excise taxes, higher absolute prices and larger gaps between price categories, and product regulation that diminishes the ability to

differentiate tobacco products.

Our principal competitors are “big tobacco”, U.S. cigarette manufacturers of both conventional

tobacco cigarettes and electronic cigarettes like Altria Group, Inc., Lorillard, Inc. and Reynolds American Inc. We compete against “big tobacco” who offers not only conventional tobacco cigarettes and electronic cigarettes but also

smokeless tobacco products such as “snus” (a form of moist ground smokeless tobacco that is usually sold in sachet form that resembles small tea bags), chewing tobacco and snuff. Furthermore, we believe that “big tobacco” will

devote more attention and resources to developing and offering electronic cigarettes as the market for electronic cigarettes grows. Because of their well-established sales and distribution channels, marketing expertise and significant resources,

“big tobacco” is better positioned than small competitors like us to capture a larger share of the electronic cigarette market. We also compete against numerous other smaller manufacturers or importers of cigarettes. There can be no

assurance that we will be able to compete successfully against any of our competitors, some of whom have far greater resources, capital, experience, market penetration, sales and distribution channels than us. If our major competitors were, for

example, to significantly increase the level of price discounts offered to consumers, we could respond by offering price discounts, which could have a materially adverse effect on our business, results of operations and financial condition.

Sales of conventional tobacco cigarettes have been declining, which could have a material adverse effect on our business.

The overall U.S. market for conventional tobacco cigarettes has generally been declining in terms of volume of sales, as a result of

restrictions on advertising and promotions, funding of smoking prevention campaigns, increases in regulation and excise taxes, a decline in the social acceptability of smoking, and other factors, and such sales are expected to continue to decline.

Recently, a national drug store chain announced that it would cease selling tobacco products by October 1, 2014. If other national drug store chains also decide to cease selling tobacco products, cigarette sales could decline further. While the

sales of electronic cigarettes have been increasing over the last several years, the electronic cigarette market is only developing and is a fraction of the size of the conventional tobacco cigarette market. A continual decline in cigarette sales

may adversely affect the growth of the electronic cigarette market, which could have a material adverse effect on our business, results of operations and financial condition.

Third party assertions of our infringement of their intellectual property rights could result in our having to incur significant costs and modify the

way in which we currently operate our business.

Although we have filed patent applications, we do not own any domestic or foreign

patents relating to our electronic cigarettes. The electronic cigarette industry is nascent and third parties may claim patent rights over one

6

or more types of electronic cigarettes. For example, Ruyan Investment (Holdings) Limited (“Ruyan”), a Chinese company, has made certain public claims as to its ownership of patents

relating to an “Atomizing Electronic Cigarette” and has filed two separate lawsuits against us. We and Ruyan settled the first lawsuit on March 1, 2013, while the other lawsuit has been stayed along with other patent infringement

lawsuits filed by Ruyan against other defendants pending the results of an inter partes reexamination requested by one of the defendants in the other lawsuits. Further, on March 5, 2014, Fontem Ventures, B.V. and Fontem Holdings 1 B.V. (the

successors to Ruyan, collectively “Fontem”) filed a lawsuit against us alleging infringement of, among others, an “Aerosol Electronic Cigarette” and an “Electronic Atomization Cigarette.” We currently purchase our

products from Chinese manufacturers other than Ruyan and Fontem.

Ruyan’s and Fontem’s lawsuits as well as any other third party

lawsuits alleging our infringement of patents, trade secrets or other intellectual property rights could cause us to do one or more of the following:

|

|

•

|

|

stop selling products or using technology that contains the allegedly infringing intellectual property;

|

|

|

•

|

|

incur significant legal expenses;

|

|

|

•

|

|

pay substantial damages to the party whose intellectual property rights we may be found to be infringing;

|

|

|

•

|

|

redesign those products that contain the allegedly infringing intellectual property; or

|

|

|

•

|

|

attempt to obtain a license to the relevant intellectual property from third parties, which may not be available to us on reasonable terms or at all.

|

There is no assurance that third party lawsuits alleging our infringement of patents, trade secrets or other intellectual property rights

could not have a material adverse effect on our business, results of operations and financial condition.

We may not be able to adequately protect

our intellectual property rights in China or elsewhere, which could harm our business and competitive position.

We believe that

patents, trademarks, trade secrets and other intellectual property we use and are developing are important to sustaining and growing our business. We utilize third party manufacturers to manufacture our products in China, where the validity,

enforceability and scope of protection available under intellectual property laws are uncertain and still evolving. Implementation and enforcement of Chinese intellectual property-related laws have historically been deficient, ineffective and

hampered by corruption and local protectionism. Accordingly, we may not be able to adequately protect our intellectual property in China, which could have a material adverse effect on our business, results of operations and financial condition.

Furthermore, policing unauthorized use of our intellectual property in China and elsewhere is difficult and expensive, and we may need to resort to litigation to enforce or defend our intellectual property or to determine the enforceability, scope

and validity of our proprietary rights or those of others. Such litigation and an adverse determination in any such litigation, if any, could result in substantial costs and diversion of resources and management attention, which could harm our

business and competitive position.

Electronic cigarettes face intense media attention and public pressure.

Electronic cigarettes are new to the marketplace and since their introduction certain members of the media, politicians, government regulators

and advocate groups, including independent medical physicians have called for an outright ban of all electronic cigarettes, pending regulatory review and a demonstration of safety. A partial or outright ban would have a material adverse effect on

our business, results of operations and financial condition.

7

Acquisitions could result in operating difficulties, dilution, and other harmful consequences that may

adversely impact our business, results of operations and financial condition.

Acquisitions are an important element of our

corporate strategy, and we expect to pursue acquisitions in addition to the IVG Acquisition. These transactions are expected to be material to our financial condition and results of operations. We also expect to continue to evaluate and enter into

discussions regarding a wide array of potential strategic transactions. The process of integrating an acquired company or business can create unforeseen operating difficulties and expenditures, including, diversion of management time and focus from

operating our business to acquisition integration challenges, failure to successfully develop the acquired business, liabilities for activities of the acquired company or business before the acquisition, including patent and trademark infringement

claims, violations of laws, commercial disputes, tax liabilities and other known and unknown liabilities, litigation or other claims in connection with the acquired company or business.

Our failure to address these risks or other problems encountered in connection with acquisitions could cause us to fail to realize the

anticipated benefits of such acquisitions, incur unanticipated liabilities, and harm our business generally.

Acquisitions could also

result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, or amortization expenses, or impairment of goodwill, and restructuring charges, any of which could harm our financial condition or results.

We rely on a limited number of key employees and may experience difficulty in attracting and hiring qualified new personnel in some areas of our

business.

The loss of any of our key employees could adversely affect our business. As a member of the tobacco industry, we may

experience difficulty in identifying and hiring qualified executives and other personnel in some areas of our business. This difficulty is primarily attributable to the health and social issues associated with the tobacco industry. The loss of

services of any key employees or our inability to attract, hire and retain personnel with requisite skills could restrict our ability to develop new products, enhance existing products in a timely manner, sell products or manage our business

effectively. These factors could have a material adverse effect on our business, results of operations and financial condition.

We may experience

product liability claims in our business, which could adversely affect our business.

The tobacco industry in general has

historically been subject to frequent product liability claims. As a result, we may experience product liability claims from the marketing and sale of electronic cigarettes. Any product liability claim brought against us, with or without merit,

could result in:

|

|

•

|

|

liabilities that substantially exceed our product liability insurance, which we would then be required to pay from other sources, if available;

|

|

|

•

|

|

an increase of our product liability insurance rates or the inability to maintain insurance coverage in the future on acceptable terms, or at all;

|

|

|

•

|

|

damage to our reputation and the reputation of our products, resulting in lower sales;

|

|

|

•

|

|

regulatory investigations that could require costly recalls or product modifications;

|

|

|

•

|

|

the diversion of management’s attention from managing our business.

|

Any one or more of the foregoing

could have a material adverse effect on our business, results of operations and financial condition.

8

If we experience product recalls, we may incur significant and unexpected costs and our business reputation

could be adversely affected.

We may be exposed to product recalls and adverse public relations if our products are alleged to

cause illness or injury, or if we are alleged to have violated governmental regulations. A product recall could result in substantial and unexpected expenditures that could exceed our product recall insurance coverage limits and harm to our

reputation, which could have a material adverse effect on our business, results of operations and financial condition. In addition, a product recall may require significant management time and attention and may adversely impact on the value of our

brands. Product recalls may lead to greater scrutiny by federal or state regulatory agencies and increased litigation, which could have a material adverse effect on our business, results of operations and financial condition.

Product exchanges, returns and warranty claims may adversely affect our business.

If we are unable to maintain an acceptable degree of quality control of our products we will incur costs associated with the exchange and

return of our products as well as servicing our customers for warranty claims. Any of the foregoing on a significant scale may have a material adverse effect on our business, results of operations and financial condition.

Adverse economic conditions may adversely affect the demand for our products.

Electronic cigarettes are new to market and may be regarded by users as a novelty item and expendable as such demand for our products may be

extra sensitive to economic conditions. When economic conditions are prosperous, discretionary spending typically increases; conversely, when economic conditions are unfavorable, discretionary spending often declines. Any significant decline in

economic conditions that affects consumer spending could have a material adverse effect on our business, results of operations and financial condition.

Generating foreign sales will result in additional costs and expenses and may expose us to a variety of risks.

In the first quarter of 2012, we began selling our electronic cigarettes in the country of Canada through a Canadian distributor. Generating

sales of our products in Canada as well as other foreign jurisdictions will require us to incur additional costs and expenses. Furthermore, our entry into foreign jurisdictions may expose us to various risks, which differ in each jurisdiction, and

any of such risks may have a material adverse effect on our business, financial condition and results of operations. Such risks include the degree of competition, fluctuations in currency exchange rates, difficulty and costs relating to compliance

with different commercial, legal, regulatory and tax regimes and political and economic instability.

Our success is dependent upon our marketing

efforts.

We intend to undertake extensive marketing activities to promote brand awareness and our portfolio of products. If we are

unable to generate significant market awareness for our products and our brands at the consumer level or unable to capitalize on significant marketing, advertising or promotional campaigns we undertake, our business, financial condition and results

of operations could be adversely affected.

We rely, significantly, on the efforts of third party agents to generate sales of our products.

We rely, significantly, on the efforts of independent distributors to purchase and distribute our products to wholesalers and

retailers. No single distributor currently accounts for a material percentage of our sales and we believe that should any of these relationships terminate we would be able to find suitable replacements and do so on a timely basis. However, any loss

of distributors or our ability to timely replace any given distributor could have a material adverse effect on our business, financial condition and results of operations.

We rely, in part, on the efforts of independent salespersons who sell our products to distributors and major retailers and Internet sales

affiliates to generate sales of products. No single independent salesperson or Internet affiliate currently accounts for a material percentage of our sales and we believe that should any of these

9

relationships terminate we would be able to find suitable replacements and do so on a timely basis. However, any loss of independent sales persons or Internet sales affiliates or our ability to

timely replace any one of them could have a material adverse effect on our business, financial condition and results of operations.

We may not be

able to establish sustainable relationships with large retailers or national chains.

We believe the best way to develop brand and

product recognition and increase sales volume is to establish relationships with large retailers and national chains. We currently have established relationships with five large retailers and national chains and in connection therewith we have

agreed to pay such retailers and chains fees, known as “slotting fees”, to carry and offer our products for sale based on the number of stores our products will be carried in. These existing relationships are “at-will” meaning

that either party may terminate the relationship for any reason or no reason at all. We may not be able to sustain these relationships or establish other relationships with large retailers or national chains or, even if we do so, sustain such other

relationships. Our inability to develop and sustain relationships with large retailers and national chains will impede our ability to develop brand and product recognition and increase sales volume and, ultimately, require us to pursue and rely on

local and more fragmented sales channels, which will have a material adverse effect on our business, results of operations and financial condition.

We may not be able to adapt to trends in our industry.

We may not be able to adapt as the electronic cigarette industry and customer demand evolves, whether attributable to regulatory constraints or

requirements, a lack of financial resources or our failure to respond in a timely and/or effective manner to new technologies, customer preferences, changing market conditions or new developments in our industry. Any of the failures to adapt for the

reasons cited herein or otherwise could make our products obsolete and would have a material adverse effect on our business, financial condition and results of operations.

We depend on third party manufacturers for our products.

We depend on third party manufacturers for our electronic cigarettes, vaporizers and accessories. Our customers associate certain

characteristics of our products including the weight, feel, draw, unique flavor, packaging and other attributes of our products to the brands we market, distribute and sell. Any interruption in supply and/or consistency of our products may adversely

impact our ability to deliver our products to our wholesalers, distributors and customers and otherwise harm our relationships and reputation with customers, and have a materially adverse effect on our business, results of operations and financial

condition.

Although we believe that several alternative sources for the components, chemical constituents and manufacturing services

necessary for the production of our products are available, any failure to obtain any of the foregoing would have a material adverse effect on our business, results of operations and financial condition.

We rely on Chinese manufacturers to produce our products.

The majority of our manufacturers are based in China. Certain Chinese factories and the products they export have recently been the source of

safety concerns and recalls, which is generally attributed to lax regulatory, quality control and safety standards. Should Chinese factories continue to draw public criticism for exporting unsafe products, whether those products relate to our

products or not we may be adversely affected by the stigma associated with Chinese production, which could have a material adverse effect on our business, results of operations and financial condition.

We may be unable to promote and maintain our brands.

We believe that establishing and maintaining the brand identities of our products is a critical aspect of attracting and expanding a large

customer base. Promotion and enhancement of our brands will depend largely on our success in continuing to provide high quality products. If our customers and end users do not perceive our products to be of high quality, or if we introduce new

products or enter into new business ventures that are not favorably received by our customers and end users, we will risk diluting our brand identities and decreasing their attractiveness to existing and potential customers.

10

Moreover, in order to attract and retain customers and to promote and maintain our brand equity

in response to competitive pressures, we may have to increase substantially our financial commitment to creating and maintaining a distinct brand loyalty among our customers. If we incur significant expenses in an attempt to promote and maintain our

brands, our business, results of operations and financial condition could be adversely affected.

We expect that new products and/or brands we

develop will expose us to risks that may be difficult to identify until such products and/or brands are commercially available.

We

are currently developing, and in the future will continue to develop, new products and brands, the risks of which will be difficult to ascertain until these products and/or brands are commercially available. For example, we are developing new

formulations, packaging and distribution channels. Any negative events or results that may arise as we develop new products or brands may adversely affect our business, financial condition and results of operations.

If we are unable to manage our anticipated future growth, our business and results of operations could suffer materially.

Our business has grown rapidly during our limited operating history. Our future operating results depend to a large extent on our ability to

successfully manage our anticipated growth. To manage our anticipated growth, we believe we must effectively, among other things:

|

|

•

|

|

hire, train, and manage additional employees;

|

|

|

•

|

|

expand our marketing and distribution capabilities;

|

|

|

•

|

|

increase our product development activities;

|

|

|

•

|

|

add additional qualified finance and accounting personnel; and

|

|

|

•

|

|

implement and improve our administrative, financial and operational systems, procedures and controls.

|

We are increasing our investment in marketing and distribution channels and other functions to grow our business. We are likely to incur the

costs associated with these increased investments earlier than some of the anticipated benefits and the return on these investments, if any, may be lower, may develop more slowly than we expect or may not materialize.

If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities or develop new products, and

we may fail to satisfy product requirements, maintain product quality, execute our business plan or respond to competitive pressures, any of which could have a material adverse effect on our business, results of operations and financial condition.

We face competition from foreign importers who do not comply with government regulation.

We face competition from foreign sellers of electronic cigarettes that may illegally ship their products into the United States for direct

delivery to customers. These market participants will not have the added cost and expense of complying with U.S. regulations and taxes and as a result will be able to offer their product at a more competitive price than us and potentially capture

market share. Moreover, should we be unable to sell certain of our products during any regulatory approval process we have no assurances that we will be able to recapture those customers that we lost to our foreign domiciled competitors during any

“blackout” periods, during which we are not permitted to sell our products. This competitive disadvantage may have a material adverse effect on our business, results of operations and our financial condition.

11

Internet security poses a risk to our e-commerce sales.

At present we generate a portion of our sales through e-commerce sales on our websites. We manage our websites and

e-commerce

platform internally and as a result any compromise of our security or misappropriation of proprietary information could have a material adverse effect on our business, financial condition and results of

operations. We rely on encryption and authentication technology licensed from third parties to provide the security and authentication necessary to effect secure Internet transmission of confidential information, such as credit and other proprietary

information. Advances in computer capabilities, new discoveries in the field of cryptography or other events or developments may result in a compromise or breach of the technology used by us to protect client transaction data. Anyone who is able to

circumvent our security measures could misappropriate proprietary information or cause material interruptions in our operations. We may be required to expend significant capital and other resources to protect against security breaches or to minimize

problems caused by security breaches. To the extent that our activities or the activities of others involve the storage and transmission of proprietary information, security breaches could damage our reputation and expose us to a risk of loss and/or

litigation. Our security measures may not prevent security breaches. Our failure to prevent these security breaches may result in consumer distrust and may adversely affect our business, results of operations and financial condition.

Our results of operations could be adversely affected by currency exchange rates and currency devaluations.

Our functional currency is the U.S. dollar; substantially all of our purchases and sales are currently generated in U.S. dollars. However, our

manufacturers and suppliers are located in China. The Chinese currency, the renminbi, has appreciated significantly against the U.S. dollar in recent years. Fluctuations in exchange rates between our respective currencies could result in higher

production and supply costs to us which would have a material adverse effect on our results of operations if we are not willing or able to pass those costs on to our customers.

If we fail to satisfy our registration obligations under the registration rights agreement for the shares of our common stock issued in the Private

Placement, we would be required to make certain cash payments to certain of the holders of such shares.

Under the registration

rights agreement for the Private Placement, we filed an initial registration statement to register for resale the 3,216,171 shares of our common stock purchased by the investors (other than our participating officers and directors). The initial

registration statement was declared effective by the SEC on January 27, 2014. On March 5, 2014, we filed a post-effective amendment to the initial registration statement. The post-effective amendment to the initial registration statement

was declared effective by the SEC on March 11, 2014. On June 20, 2014, we filed a second post-effective amendment to the initial registration statement of which this prospectus is a part. The second post-effective amendment to the initial

registration statement was declared effective by the SEC on , 2014. As a result of the second post-effective amendment, this prospectus does not include 1,552,277 shares of our

common stock that were previously sold under the initial registration statement. If the second post-effective amendment to the initial registration statement after being declared effective by the SEC is not effective for resales for more than 20

consecutive days or more than 45 days in any 12 month period during the registration period (

i.e.

, the earlier of the date on which the shares have been sold or are eligible for sale under SEC Rule 144 without restriction), we are required to

pay the investors (other than our participating officers and directors) liquidated damages in cash equal to 1.5% of the aggregate purchase price paid by the investors (other than our participating officers and directors) for the shares for every 30

days or portion thereof until the default is cured. Such cash payments, which could be as much as $81,489 for every 30 days, could significantly reduce our working capital and liquidity and could adversely affect our business, results of operations

and financial condition.

Risks Related to Government Regulation

Changes in laws, regulations and other requirements could adversely affect our business, results of operations or financial condition.

In addition to the FDA’s proposed regulations, our business, results of operations or financial condition could be adversely affected by

new or future legal requirements imposed by legislative or regulatory initiatives, including, but not limited to, those relating to health care, public health and welfare and environmental matters. For

12

example, in recent years, states and many local and municipal governments and agencies, as well as private businesses, have adopted legislation, regulations or policies which prohibit, restrict,

or discourage smoking; smoking in public buildings and facilities, stores, restaurants and bars; and smoking on airline flights and in the workplace. Furthermore, some states prohibit and others are considering prohibiting the sales of electronic

cigarettes to minors. Other similar laws and regulations are currently under consideration and may be enacted by state and local governments in the future. At present, it is not clear if electronic cigarettes, which omit no smoke or noxious odors,

are subject to such restrictions. If electronic cigarettes are subject to restrictions on smoking in public and other places, our business, operating results and financial condition could be materially and adversely affected. New legislation or

regulations may result in increased costs directly for our compliance or indirectly to the extent such requirements increase the prices of goods and services because of increased costs or reduced availability. We cannot predict whether such

legislative or regulatory initiatives will result in significant changes to existing laws and regulations and/or whether any changes in such laws or regulations will have a material adverse effect on our business, results of operations or financial

condition.

Restrictions on the public use of electronic cigarettes may reduce the attractiveness and demand for our electronic cigarettes.

Certain states, cities, businesses, providers of transportation and public venues in the U.S. have already banned the use of

electronic cigarettes, while others are considering banning the use of electronic cigarettes. If the use of electronic cigarettes is banned anywhere the use of traditional tobacco burning cigarettes is banned, electronic cigarettes may lose their

appeal as an alternative to traditional tobacco burning cigarettes, which may reduce the demand for our products and, thus, have a material adverse effect on our business, results of operations and financial condition.

Limitation by states on sales of electronic cigarettes may have a material adverse effect on our ability to sell our products.

On February 15, 2010, in response to a civil investigative demand from the Office of the Attorney General of the State of Maine, we

voluntarily executed an assurance of discontinuance with the State of Maine, which prohibits us from selling electronic cigarettes in the State of Maine until such time as we obtain a retail tobacco license in the state. While suspending sales to

residents of Maine is not material to our operations, other electronic cigarette companies have entered into similar agreements with other states, such as the State of Oregon. If one or more states from which we generate or anticipate generating

significant sales bring actions to prevent us from selling our products unless we obtain certain licenses, approvals or permits and if we are not able to obtain the necessary licenses, approvals or permits for financial reasons or otherwise and/or

any such license, approval or permit is determined to be overly burdensome to us then we may be required to cease sales and distribution of our products to those states, which would have a material adverse effect on our business, results of

operations and financial condition.

The FDA has issued an import alert which has limited our ability to import certain of our products.

As a result of FDA import alert 66-41 (which allows the detention of unapproved drugs promoted in the U.S.), U.S. Customs has from

time to time temporarily and in some instances indefinitely detained products sent to us by our Chinese suppliers. If the FDA modifies the import alert from its current form which allows U.S. Customs discretion to release our products to us, to a

mandatory and definitive hold we will no longer be able to ensure a supply of saleable product, which will have a material adverse effect on our business, results of operations and financial condition. We believe this FDA import alert will become

less relevant to us as and when the FDA regulates electronic cigarettes under the Tobacco Control Act.

The application of the Prevent All Cigarette

Trafficking Act and/or the Federal Cigarette Labeling and Advertising Act to electronic cigarettes would have a material adverse affect on our business.

At present, neither the Prevent All Cigarette Trafficking Act (which prohibits the use of the U.S. Postal Service to mail most tobacco products

and which amends the Jenkins Act, which would require individuals and businesses that make interstate sales of cigarettes or smokeless tobacco to comply with state tax laws) nor the Federal Cigarette Labeling and Advertising Act (which governs how

cigarettes can be advertised and marketed)

13

apply to electronic cigarettes. The application of either or both of these federal laws to electronic cigarettes could result in additional expenses, could prohibit us from selling products

through the internet and require us to change our advertising and labeling and method of marketing our products, any of which would have a material adverse effect on our business, results of operations and financial condition.

We may face the same governmental actions aimed at conventional cigarettes and other tobacco products.

Tobacco industry expects significant regulatory developments to take place over the next few years, driven principally by the World Health

Organization’s Framework Convention on Tobacco Control (“FCTC”). The FCTC is the first international public health treaty on tobacco, and its objective is to establish a global agenda for tobacco regulation with the purpose of

reducing initiation of tobacco use and encouraging cessation. Regulatory initiatives that have been proposed, introduced or enacted include:

|

|

•

|

|

the levying of substantial and increasing tax and duty charges;

|

|

|

•

|

|

restrictions or bans on advertising, marketing and sponsorship;

|

|

|

•

|

|

the display of larger health warnings, graphic health warnings and other labeling requirements;

|

|

|

•

|

|

restrictions on packaging design, including the use of colors and generic packaging;

|

|

|

•

|

|

restrictions or bans on the display of tobacco product packaging at the point of sale, and restrictions or bans on cigarette vending machines;

|

|

|

•

|

|

requirements regarding testing, disclosure and performance standards for tar, nicotine, carbon monoxide and other smoke constituents levels;

|

|

|

•

|

|

requirements regarding testing, disclosure and use of tobacco product ingredients;

|

|

|

•

|

|

increased restrictions on smoking in public and work places and, in some instances, in private places and outdoors;

|

|

|

•

|

|

elimination of duty free allowances for travelers; and

|

|

|

•

|

|

encouraging litigation against tobacco companies.

|

If electronic cigarettes are subject to one

or more significant regulatory initiates enacted under the FCTC, our business, results of operations and financial condition could be materially and adversely affected.

Risks Related to Our Common Stock

Our common stock

has historically been thinly traded and you may be unable to sell at or near ask prices or at all if you desire to liquidate your shares.

Effective May 30, 2014, we listed our common stock on The NASDAQ Capital Market. Although our common stock is listed on The NASDAQ Capital

Market, there is no assurance that an active public market for our common stock will develop or be sustained.

A number of factors may

limit the development or sustainability of an active public market for our common stock, including the fact that we are a small company which has incurred significant operating losses and is relatively unknown to stock analysts, stock brokers,

institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such

as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable.

14

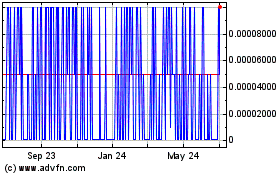

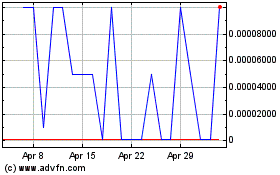

The market price of our common stock has been and may continue to be volatile.

The market price of our common stock has been volatile, and fluctuates widely in price in response to various factors, which are beyond our

control. The price of our common stock is not necessarily indicative of our operating performance or long-term business prospects. In addition, the securities markets have from time to time experienced significant price and volume fluctuations that

are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock. Factors such as the following could cause the market price of our common

stock to fluctuate substantially:

|

|

•

|

|

the introduction of new products by our competitors;

|

|

|

•

|

|

government regulation of our industry;

|

|

|

•

|

|

our quarterly operating and financial results;

|

|

|

•

|

|

conditions in the electronic cigarette and tobacco industries;

|

|

|

•

|

|

developments concerning proprietary rights; or

|

|

|

•

|

|

litigation or public concern about the safety of our products.

|

The stock market in general

experiences from time to time extreme price and volume fluctuations. Periodic and/or continuous market fluctuations could result in extreme volatility in the price of our common stock, which could cause a decline in the value of our common stock.

Price volatility may be worse if the trading volume of our common stock is low.

Volatility in our common stock price may subject us to securities

litigation.

The market for our common stock is characterized by significant price volatility when compared to seasoned issuers,

and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility

in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities to us and could divert our management’s attention and resources from

managing our operations and business.

Future sales of our common stock may depress our stock price.

As of June 19, 2014, we had 16,456,911 shares of our common stock outstanding, and warrants and options that are exercisable into

1,011,821 shares of our common stock. Approximately 10,144,041 of the 16,456,911 outstanding shares are eligible for resale without restriction in the public market. If any significant number of the 10,144,041 shares are sold, such sales could have

a depressive effect on the market price of our stock. The remaining shares are eligible, and some of the shares underlying the warrants and options upon issuance will be eligible, to be offered from time to time in the public market pursuant to Rule

144 of the Securities Act, and any such sale of these shares may have a depressive effect as well. We are unable to predict the effect, if any, that the sale of shares, or the availability of shares for future sale, will have on the market price of

the shares prevailing from time to time. Sales of substantial amounts of shares in the public market, or the perception that such sales could occur, could depress prevailing market prices for the shares. Such sales may also make it more difficult

for us to sell equity securities or equity-related securities in the future at a time and price, which we deem appropriate.

15

If we fail to maintain an effective system of internal control over financial reporting, we may not be able

to accurately report our financial results. As a result, we could become subject to sanctions or investigations by regulatory authorities and/or stockholder litigation, which could harm our business and have an adverse effect on our stock price.

As a public reporting company, we are required to comply with the Sarbanes-Oxley Act of 2002 and the related rules and regulations

of the SEC, including periodic reports, disclosures and more complex accounting rules. As directed by Section 404 of Sarbanes-Oxley, the SEC adopted rules requiring public companies to include a report of management on a company’s internal

control over financial reporting in their Annual Report on Form 10-K. Based on current rules, we are required to report under Section 404(a) of Sarbanes-Oxley regarding the effectiveness of our internal control over financial reporting. During

the fourth quarter of 2011, we remediated our previously disclosed material weaknesses in our internal control over financial reporting and disclosure controls as of March 31, 2011 and that persisted during 2011 until remediation. If we

determine that we have other material weaknesses, it may be necessary to make further restatements of our consolidated financial statements and investors will not be able to rely on the completeness and accuracy of the financial information

contained in our filings with the SEC and this could potentially subject us to sanctions or investigations by the SEC or other regulatory authorities or stockholder litigation.

Our board could issue “blank check” preferred stock without stockholder approval with the effect of diluting existing stockholders and

impairing their voting rights, and provisions in our charter documents could discourage a takeover that stockholders may consider favorable.

Our certificate of incorporation authorize the issuance of up to 1,000,000 shares of “blank check” preferred stock with designations,

rights and preferences as may be determined from time to time by our board of directors. Our board is empowered, without stockholder approval, to issue a series of preferred stock with dividend, liquidation, conversion, voting or other rights which

could dilute the interest of, or impair the voting power of, our common stockholders. The issuance of a series of preferred stock could be used as a method of discouraging, delaying or preventing a change in control. For example, it would be

possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to effect a change in control of our company.

Our bylaws also allow our board of directors to fix the number of directors. Our stockholders do not have cumulative voting in the election of

directors.

Any aspect of the foregoing, alone or together, could delay or prevent unsolicited takeovers and changes in control or changes

in our management.

The former stockholders of our operating subsidiary Smoke Anywhere USA, Inc. are our largest stockholders and, as such, they can

exert significant influence over us and make decisions that are not in the best interests of all stockholders.

Former stockholders

of our operating subsidiary Smoke Anywhere USA, Inc., including one who serves as our Chief Executive Officer and President, one who serves as our director of licensing and business development and one who serves as a member of the board of

directors of Smoke Anywhere USA, Inc., beneficially own in excess of 30% of our outstanding shares of common stock. As a result, these stockholders are able to assert significant influence over all matters requiring stockholder approval, including

the election and removal of directors and any change in control. In particular, this concentration of ownership of our outstanding shares of common stock could have the effect of delaying or preventing a change in control, or otherwise discouraging

or preventing a potential acquirer from attempting to obtain control. This, in turn, could have a negative effect on the market price of our common stock. It could also prevent our stockholders from realizing a premium over the market prices for

their shares of common stock. Moreover, the interests of the owners of this concentration of ownership may not always coincide with our interests or the interests of other stockholders and, accordingly, could cause us to enter into transactions or

agreements that we would not otherwise consider.

16

We do not anticipate paying cash dividends for the foreseeable future, and therefore investors should not

buy our stock if they wish to receive cash dividends.

We have never declared or paid any cash dividends or distributions on our

common stock. We currently intend to retain our future earnings to support operations and to finance expansion and, therefore, we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements that relate to future events or our future financial performance and involve known and

unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by

these forward-looking statements. Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “targets,” “likely,”

“will,” “would,” “could,” and similar expressions or phrases, or the negative of those expressions or phrases, identify forward-looking statements.

Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus, we caution you that these

statements are based on our projections of the future that are subject to known and unknown risks and uncertainties and other factors that may cause our actual results, level of activity, performance or achievements expressed or implied by these

forward-looking statements, to differ. The section in this prospectus entitled

“Risk Factors”

discuss some of the factors that could contribute to these differences.

Other unknown or unpredictable factors could also harm our results. Consequently, actual results or developments anticipated by us may not be

realized or, even if substantially realized, may not have the expected consequences to, or effects on, us. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements.

You may rely only on the information contained in this prospectus. Neither we nor any of the selling stockholders have authorized anyone to