UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 13, 2014

CANNAVEST CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation) |

333-173215

(Commission File Number) |

80-0944970

(I.R.S. Employer Identification No.) |

2688 South Rainbow Avenue, Suite B

Las Vegas, Nevada 89146

(Address of principal executive offices)

(866) 290-2157

(Registrant’s telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[_] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-(b))

[_] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-(c))

Item 1.01 Entry into a Material

Definitive Agreement

On June 13, 2014, CannaVEST Corp. (the

“Company”) entered into a Stock Purchase and Transfer Agreement (the “Agreement”) with PhytoSPHERE Systems,

LLC (“PhytoSPHERE”), a stockholder of the Company, pursuant to which the Company disposed of 3,059,439 shares of the

Series A Preferred Stock and 24,623,000 shares of the common stock of KannaLife Sciences, Inc. (the “KannaLife Stock”)

in exchange for 500,000 shares of the Company’s common stock which had previously been issued to PhytoSPHERE. The KannaLife

Stock represents 100% of the Company’s ownership in KannaLife Sciences, Inc.

The disclosure set forth below under

paragraph 4 of Item 5.02 regarding the Offer Letter (as defined below) is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of

Assets.

The disclosure set forth above under paragraph 1 of Item 1.01

above is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 16, 2014, the Board of Directors

of the Company appointed Joseph Dowling as the Chief Financial Officer of the Company. The Company did not have a Chief Financial

Officer prior to Mr. Dowling’s appointment.

Prior to his appointment, Mr. Dowling,

age 57, held the position of Senior Consultant with RGP, a global consulting firm, providing finance, internal and external regulatory

reporting expertise to a range of clients. From 2005 to 2012, Mr. Dowling held the position of chief financial officer of MediVas,

LLC, a life science company, and from 1998 to 2005 served as a Managing Director at Citigroup, a global financial services firm.

Earlier in his career, Mr. Dowling served in various finance and accounting roles in both public accounting and in the banking

industry. Mr. Dowling holds a Bachelor of Arts from the University of California, Los Angeles in Economics and is a certified public

accountant.

There is no arrangement or understanding

between Mr. Dowling and any other person pursuant to which he was selected as an executive officer. There are no family relationships

between Mr. Dowling and any of the Company’s directors, executive officers or persons nominated or chosen by the Company

to become a director or executive officer and the Company has not entered into any transactions with Mr. Dowling that are reportable

pursuant to Item 404(a) of Regulation S-X.

In connection with the commencement of

Mr. Dowling’s employment, Mr. Dowling accepted an Offer Letter presented by the Company, effective as of June 16, 2014 (the

“Offer Letter”). The Offer Letter provides that Mr. Dowling will report to the Chief Executive Officer of the Company,

enter into a customary confidentiality and invention assignment agreement with the Company and his compensation will consist of

the following components:

| · | A base salary at an annualized rate of $200,000; |

| · | An equity issuance of 200,000 shares of restricted common stock of the Company, which will be issued

in four equal installments beginning June 16, 2015 and continuing annually thereafter, subject to approval by the Company’s

Board of Directors and Mr. Dowling’s continued employment; |

| · | Group health insurance coverage and other employment benefits on the same terms as other employees

of the Company; and |

| · | A severance package on terms to be determined pursuant to the terms of a separate agreement with

the Company. |

As an officer of the Company, Mr. Dowling

will be eligible to participate in the Company’s 2013 Equity Incentive Plan.

Item 9.01 Financial Statements and Exhibits.

| (d) |

Exhibits |

| |

|

| 1.01 |

Offer Letter, effective as of June

16, 2014, by and between the Company and Joseph Dowling. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 19, 2014

| |

CANNAVEST CORP. |

| |

|

| |

By: |

/s/ Michael Mona, Jr. |

| |

|

Michael Mona, Jr.

President and Chief Executive Officer |

Exhibit 1.01

June 5, 2014

Mr. Joseph D. Dowling

6556 Windward Ridge Way

San Diego, CA 92121

RE: Offer of Employment

Dear Joseph:

CannaVest Corp is pleased to extend an offer of employment

to you for the position of Chief Financial Officer (CFO) with a hire date of June 16, 2014. You will report to Michael Mona, Jr.,

President and CEO and will work in the San Diego, CA office. We are excited about the potential that you bring to our company.

Your initial compensation package includes an annual

salary of $200,000 (payable biweekly) and will be reviewed after the first six months of employment. A severance package will be

discussed and agreed upon prior to your start date of June 16th, 2014. In addition, you will be eligible to receive

up to 200,000 shares of common stock of the company, subject to approval of the Board of Directors and pursuant to the terms of

the company’s equity incentive plan. Subject to your continued employment, you will be issued 50,000 shares of stock on the

first anniversary of your employment, with the remaining 150,000 shares issuable in three equal installments of 50,000 shares on

each of the second, third and fourth anniversaries of your employment.

You will be classified as a salaried, exempt employee.

You will be required to work with other members of the team in the performance of your duties as needed. As an employee, you will

be expected to adhere to the company’s standards of professionalism, loyalty, integrity, honesty, reliability and respect

for all. Please note that the company is an equal opportunity employer. The company does not permit, and will not tolerate the

unlawful discrimination or harassment of any employees, consultants, or related third parties on the basis of sex, race, color,

religion, age, national origin or ancestry, marital stats, veteran status, mental or physical disability or medical condition,

sexual orientation, pregnancy, childbirth or related medical condition, or any other status protected by applicable law.

You will be required to devote your full professional

time and attention to the performance of your obligations to the company, and will at all times faithfully, industriously and to

the best of your ability, experience and talent, perform all of the duties and responsibilities of your position. In furtherance

of, and not in limitation of the foregoing, during the term of your employment, (a) you further agree that the company will be

entitled to all of the benefits and profits arising from or incident to all such work, services and advice provided to the company

(except as otherwise may be provided in the Confidentiality Agreement, as hereinafter defined), and (b) you shall not engage or

participate in any business that is in competition in any manner whatsoever with the current or anticipated business of the company.

After an initial 90 day period, you will be eligible

for participation in our employee benefits program which includes paid time off, holidays, and other benefits which are generally

applicable to an exempt employee. These benefits may change from time to time, and you will be eligible to participate in such

employee benefits as are hereafter provided generally to all of the company’s employees, including, if applicable, a 401k

benefit plan. You will be covered by workers’ compensation insurance and State Disability Insurance, as required by law.

In accepting our offer of employment, you certify

your understanding that your employment will be on an at-will basis, and that neither you nor any Company representative have entered

into a contract regarding the terms or the duration of your employment. As an at-will employee, you will be free to terminate your

employment with the Company at any time, with or without cause or advance notice. Likewise, the Company will have the right to

reassign you, or to terminate your employment at any time, with or without cause or advance notice.

Your employment with the company on the terms and

conditions set forth herein is contingent upon your execution and delivery of the Company’s Proprietary Information and Inventions

Assignment Agreement (“Confidentiality Agreement”), a copy of which has been delivered to you.

We look forward to your arrival at our company and

are confident that you will play a key role in contributing to CannaVest becoming a world-class organization. Please let me know

if you have any questions or if I can do anything to make your arrival easier.

Sincerely,

Michael J. Mona, Jr.

President & Chief Executive Officer

CannaVest Corp.

This offer will remain open until Wednesday, June 10, 2014.

If you decide to accept this offer based on the terms and conditions set forth above, and we hope you will, please sign the enclosed

copy of this letter in the space indicated below and return it to me.

I hereby acknowledge, accept and agree to the terms as set forth

above and further acknowledge that no other commitments were made to me as part of my employment offer except as specifically set

forth herein.:

| June 16, 2014 |

|

/s/ Joseph D. Dowling |

| Date |

|

Signature |

| |

|

|

| |

|

Joseph D. Dowling |

| |

|

Employee name (Printed) |

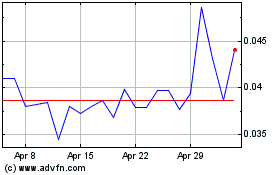

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Apr 2023 to Apr 2024