Graystone Company Announces Copper Campaign #1 Results

June 17 2014 - 9:00AM

Business Wire

The Graystone Company (OTC:GYST) announced today that the

Company’s copper project in Peru has completed its First campaign

with the following results. The company produced 203 tons of copper

ore at a total cost of $108.37 per ton. The company sold its copper

concentrate equaling $184.72 per ton of ore. The company’s copper

campaign #1 produced a net profit of $76.35 per ton or $15,499.05.

As per the terms of the joint venture agreement, the company also

recouped its operational costs equaling $21,999.11. “Considering

this was our first venture in copper, we were pleased to turn a per

ton net profit,” said Graystone CEO. “Our goal for campaign #2 is

to reduce the amount of time it takes to produce 200 tons of ore.

We have also identified some key equipment that needs to be

replaced to reduce breakdown time, and we also plan on purchasing

essential spare parts to be stored on site. Our experience of

conducting a successful campaign has enabled us to identify areas

we can become more efficient and profitable.”

The company also announced today that 10-14 days of mine

maintenance has already commenced and we anticipate campaign #2

will start around July 1, 2014.

About The Graystone Company.

The Graystone Company, Inc. is a U.S.-based mining and exploration

company focused on acquiring and developing gold and other mineral

properties. The Company's strategy is to build value for

shareholders by the identification, acquisition and exploration of

early-stage properties that show significant potential for the

discovery of gold.

Notice Regarding Forward-Looking

Statements in this press release which are not purely

historical are forward-looking statements and include any

statements regarding beliefs, plans, expectations or intentions

regarding the future. Actual results could differ from those

projected in any forward-looking statements due to numerous

factors. These forward-looking statements are made as of the date

of this news release, and we assume no obligation to update the

forward-looking statements, or to update the reasons why actual

results could differ from those projected in the forward-looking

statements. Although we believe that any beliefs, plans,

expectations and intentions contained in this press release are

reasonable, there can be no assurance that any such beliefs, plans,

expectations or intentions will prove to be accurate. Investors

should consult all of the information set forth herein and should

also refer to the risk factors disclosure outlined in our annual

report on Form 10-K for the most recent fiscal year, our quarterly

reports on Form 10-Q and other periodic reports filed from

time-to-time with the Securities and Exchange Commission.

The Graystone Company, Inc.Joseph Wade,

702-289-4827info@graystonegold.comwww.graystone1.com

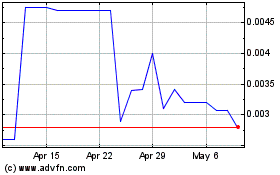

Graystone (PK) (USOTC:GYST)

Historical Stock Chart

From Mar 2024 to Apr 2024

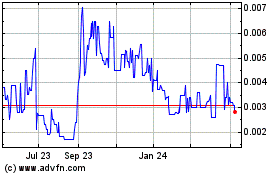

Graystone (PK) (USOTC:GYST)

Historical Stock Chart

From Apr 2023 to Apr 2024